Professional Documents

Culture Documents

Chapter 6-Service DPT Cost Allocation 2010

Uploaded by

Kiya AbdiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6-Service DPT Cost Allocation 2010

Uploaded by

Kiya AbdiCopyright:

Available Formats

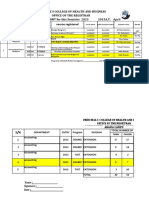

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

CHAPTER SIX

SERVICE DEPARTMENT COST ALLOCATION

- OH refers to the operating costs other than direct labor and direct material. It includes all

costs with an indirect relationship to the cost object. Thus OH can be associated with the cost

object only through a process of allocation. Before being allocated to products/jobs, OH is

distributed to the various departments; after being allocated, it is applied to the products.

- In other words, three steps are required for recording OH:

1. Costs are first distributed to the corresponding departments, hence establishing

responsibility.

2. The service departments’ costs then are allocated to various operating departments,

thereby ensuring proper matching of costs and cost objects.

3. Finally, the costs are applied to the product, which ensures product costing, inventory

valuation, and income determination.

- Applying OH to jobs and products (step 3) was discussed in the previous chapters using actual

or POR. In this chapter we will see how costs are first distributed to departments (briefly)

(step 1) and then reallocation of service department costs to other departments (step 2) in

detail.

Step 1: OH Distribution to Departments

- The goal of cost accounting is to obtain specific, precise product/job cost information. The

OH costs must be associated with products or jobs. Distributing OH costs to each department

is the first step in this overall allocation process.

- There are two categories of department: Producing departments and Support departments.

• Producing (Operating) departments are directly responsible for creating the products

or services sold to customers. E.g Machining, Assembly, Finishing

• A support (Service) department provides the services that assist other operating and

support departments in the organization. They are indirectly connected with an

organization’s services or products. Products do not pass through a support department.

Examples are: Purchasing, Materials storeroom, Maintenance, Inspection and quality

control. Engineering, Personnel, Cafeteria, Cost accounting etc

- Once the producing and support departments have been identified, the OH incurred by each

department is determined. This requires identifying direct and indirect department costs.

- It is important to keep in mind that departments tend to be relatively larger areas within a

company. As a result, many FOH costs are traceable to a specific department; these costs are

called direct departmental costs. Examples are: supervisory salary, and depreciation on

equipment used in that department only, utilities(if measured in that department), indirect

labor, indirect material etc

- In most cases, however, indirect costs are incurred to benefit more than one department and

should be distributed in proportion to the service used. The selection of the distribution base

is important. Among the more likely choices for a distribution base are the following

Cost Accounting, AAUCC, 2011 Page 1 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

Type of OH Distribution base

Power, Heat, and Cooling Square footage, rated horsepower hours, cubic

of space used

Factory rent Square footage

Inspection Number of units completed

Deprecation-building Square footage

Superintendents Number of employees

Lighting Kilowatt hours or number of bulbs

Telephone and telegraph Number of telephones or number of employee

Depreciation – Eqt. Number of operating hours

Property tax Square footage

Worker’s compensation insurance Departmental payroll

Freight in Material used

Building repairs Square footage

Note that other alternatives may exist and should be considered to ensure equity and

fairness throughout the allocation.

- The distribution of OH to departments is recorded using both the general and subsidiary

ledger. Accordingly, OH distribution takes place using, first, the subsidiary ledger accounts

(which may take the form of departmental OH analysis sheet) and, second, the general ledger

accounts.

- The subsidiary ledgers (departmental OH analysis sheets) are set up for each department and

include as many columns as the number of detailed OH accounts required. Each departmental

cost ledger includes a column for allocation from other departments, whether producing or

service departments, and other columns for the other possible OH items such as depreciation,

repairs, and so forth.

- Departmentalizing OH costs has the advantages of improving product costing by allowing

different department to have different OH rate and promoting responsibility accounting and

control of OH costs by making costs a responsibility of each department’s manager.

- FOH Control, a general ledger account, is debited summarizing actual OH costs of each

department with a credit to various accounts.

Step 2: Distribution of Service Department Costs

- Once the company has been departmentalized and all OH costs have been determined for all

departments, support department costs are redistributed to producing department in

proportion to the amount of services rendered to these departments.

- What happens to service department costs after they are allocated to production departments?

Allocated service department costs become a part of the FOH in each production

department that is applied to products with a predetermined OH rate (if departmental

OH rates are computed). If a plant-wide rate is used the distinction between service

areas and producing areas is ignored and the entire plant is treated as a single

department.

Cost Accounting, AAUCC, 2011 Page 2 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

Since the amounts allocated are presumed to represent each department’s “fair share”

of the cost of services provided for it, the allocation are included in performance

evaluations of the operating departments and also included in determining their

individual profitability.

- A service department cannot have an OH rate that assigns OH costs to units produced,

because goods do not pass through the service department.

- How are service department costs allocated?

First, we identify the factor that drives costs in the service department. This cost

driver is called the allocation base.

Second, we measure the consumption of the allocation base in the production

departments.

Third, we allocate the service department cost based on the relative amount of the

allocation base consumed in ach production department.

Selecting Allocation Base

- Costs of a service department are allocated to other departments using an allocation base. The

allocation base should be a measure of whatever activity causes variations in the costs of the

service department; it should drive the service department’s costs.

- Using causal factors results in product costs being more accurate. Furthermore, if the casual

factors are known, managers are more able to control the consumption of services.

- Examples of commonly used cost allocation bases are the following.

Service Department Allocation base

Power Kilowatt-hours, Machine hours

Cafeteria Number of employees, DL hours worked, Meals served

Personnel Number of employees, labor turnover (no. of new

hires), direct labor cost

Purchasing Number of orders, Cost of orders

Shipping Number of orders

Showroom Weight, units, size

Maintenance Number of machines, machine hours

Engineering Number of change orders, number of hours

Material handling Number of material moves, hours of material

handling used, the pounds of material moved

Medical Number of cases, number of employees

Cost accounting Number of transactions, labor hours

Production planning

and control Machine hours, labor hours

When competing activity drivers exist, managers need to assess which factor provides the

most convincing relationship.

Purpose of Service Department Cost Allocations

- Companies that allocate service department costs do so for one or more of the following

reasons:

Cost Accounting, AAUCC, 2011 Page 3 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

1. To provide more accurate product cost information― Allocating service department

costs to production departments, and then to products, recognizes that these services

constitute an input in the production process. This improves decision-making within the

organization, the quality of external financial reporting, or to comply with contractual

agreements in regulatory settings where cost-based pricing is used.

2. To improve decisions about resource utilization― By imposing on division managers

the cost of the service department resources that they use, division managers are

encouraged to use these resources only to the extent that their benefit exceeds their cost.

This is particularly related to variable costs of service departments which directly vary in

proportion of the activity of the production departments. But note that the service

department’s fixed costs will not be affected by the manager’s decision.

3. To ration limited resources― When production departments have some discretion over

their utilization of a service department resource, charging production departments for

the resource usually results in less demand for it than if the resource were “free” to the

production departments. In connection with this, to ration a scarce resource, if the

service department controls a fixed asset, and if demand for the asset exceeds capacity,

charging users a fee for the asset allows the service department to balance demand with

supply.

- The validity of these reasons depends, however, on the accuracy and fairness of the cost

assignments made. Although it may not be possible to identify a single method of allocation

that simultaneously satisfies all these objectives, several guidelines have been developed to

assist in determining the best allocation method. These guidelines are:

• Cause and effect― Using this criterion, managers identify the variable or variables

that cause resources to be consumed. Causal factors are variables or activities within

a producing department that provoke the incurrence of support costs. For example,

hours of testing may be used as the variable when allocating the costs of quality-

testing areas to products. Allocation based on this criterion is likely to be the most

credible to operating personnel.

• Benefits received― allocate costs among the beneficiaries in proportion of the

benefits each receive. This is the most frequently used criterion when cause and

effect cannot be determined.

• Fairness or equity― allocate costs in such a manner as to be “fair” or “reasonable”

for al parties. It is less frequently used because fairness is an especially difficult

criterion to obtain agreement on. What one party views as fair, another party may

view as unfair.

• Ability to bear― allocates cost based on who can best absorb them. It is less

frequently used as it tends to penalize the most profitable division by allocating to it

the largest proportion of a support department cost. This raises issues related to

cross subsidization across users of resources in an organization. As a result, no

motivational benefits of allocation are realized.

- In determining how to allocate support department costs, the guideline of cost-benefit must

be considered. In other words, the costs of implementing a particular allocation scheme must

Cost Accounting, AAUCC, 2011 Page 4 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

be compared to the benefits expected to be derived. As a result, companies try to use easily

measured and understood bases for allocation.

- Accountants universally agree that a cost allocation method is neither right nor wrong but

rather reasonable or unreasonable. For example, if all costs of maintenance were allocated to

one of the three products that a company produced, this would generally be deemed

inappropriate and misleading but not wrong. If this product were more valuable than the other

two products, then it would be reasonable to allocate more than one third of those costs to the

product. However, if the cost accountant nevertheless for simplicity and convenience allocated

exactly one third of the cost to the more valuable product, we would say that this was poor

choice and might lead to incorrect decision making rather than asserting that it was wrong.

Methods of Support Department Cost Allocation

- Historically, there have been three alternative methods of allocating service department costs:

the direct method, the step (step-down) method, the reciprocal method. The methods differ

in the extent to which they account for the fact that service departments provide services to

other department as well as to production departments.

- The following data shows the budgeted activity and budgeted costs for two support

departments and two producing department of ABC Company.

Support Departments Producing Departments

Power Maintenance Grinding Assembly

Costs $250,000 $160,000 $100,000 $60,000

Normal activity:

Kilowatt-hours ------ 200,000 600,000 200,000

Maintenance hrs 1,000 ------ 4,500 4,500

Assume that the casual factor for power costs is kilowatt-hours and the causal factor for

maintenance costs is maintenance hours. These causal factors are used as the bases for

allocation. To simplify the illustration, no distinction is made between fixed and variable

costs. (i.e., use single rate). Now let us illustrate the three methods using this data.

Direct Method

- The direct method, which is the simplest and most widely used allocation method, allocates

each service department’s costs directly to the production departments, ignoring services

rendered to other service departments. No costs are allocated from one service department to

another. This method would be appropriate when there is no possibility of interaction among

support departments.

- The result of this procedure using our data for ABC Co. is as follows:

Step 1: The power department costs are allocated on the basis of kilowatt-hours used in

both producing departments only. 75% (600,000/800,000) for Grinding and

25%(200,000/800,000) for Assembly department. i.e., Rate(power) =

$250,000/800,000kw hrs = $0.3125 per kw hr.

Step 2: The Maintenance department costs are allocated on the basis of the number of

maintenance hours used in both producing departments only. 50% (4,5400/9,000)

Cost Accounting, AAUCC, 2011 Page 5 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

for Grinding and 50% (4,500/9,000) for Assembly department. i.e., Rate (Maint.)

= $160,000/9,000 Mhrs = $17.7777 per Maint. Hour.

Support Departments Producing Departments

Power Maintenance Grinding Assembly

Costs $250,000 $160,000 $100,000 $60,000

Power Allocation

(0.75, 0.25) (250,000) ----- 187,500 62,500

Maint. Allocation

(0. 05, 0.50) ----- (160,000) 80,000 80,000

Total $0 $0 $367,500 $202,500

NB.

The service departments must be excluded from the allocation base under the direct

method. Why? If service departments are included in the allocation base, less than 100%

of the service department costs will be allocated to the operating departments.

Ignoring interactions among support departments and allocating support costs directly to

producing departments may produce unfair and inaccurate cost assignments.

Step-Down Method

- The step-down (or sequential ) method allocates the costs of some service departments to

producing and service departments in a sequential manner, but once a service department’s

costs have been allocated, no subsequent service department costs are allocated back to it.

Thus it partially recognizes interdepartmental interactions.

- The choice of which department to start with is important. The sequence typically begins with

the service department that provides the highest percentage of its total service to other service

departments, or the service department that provides to the most number of service

departments, or the service department with the highest costs, or some similar criterion and

continue the sequence in a step-by-step fashion.

- The results of this procedure using our data for ABC Co. is as follows:

Step 1: Rank support departments. Based on either the percentage or total dollars of

service provided to other support departments, Power is ranked first.

Step 2: Allocate the first -ranked support department (Power) costs to other support and

operating departments based on kw hours used. 20% (200,000/1mill.) to

Maintenance, 60% (600,000/1mill.) to Grinding, 20%(200,000/1mill.) to Assembly.

Rate (Power) = $250,000.1million kw hrs = $0.25 per kw hr.

Step 3: Allocate the second-ranked support department cost(Maintenance) which includes

costs that have been allocated to it from the first department to Producing

departments (Grinding and Assembly) based on maintenance hours used. 50%

(4,500/9,000) to Grinding, 50% (4,500/9,000) to Assembly.

Rate (Maint.) = $160,000 + $50,000/9,000 Mhrs = $23.3333 per Maint. Hr.

Support Departments Producing Departments

Power Maintenance Grinding Assembly

Cost Accounting, AAUCC, 2011 Page 6 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

Costs $250,000 $160,000 $100,000 $60,000

Power Allocation

(0.20, 0.60, 0.20) (250,000) 50,000 150,000 50,000

Maint. Allocation

(0. 05, 0.50) ----- (210,000) 105,000 105,000

Total $0 $0 $355,000 $215,000

Never include in the allocation base the service department whose cost is being allocated

and once a service department’s cost has been allocated, pretend that the department

doesn’t exist anymore.

- The strength of this method is it reduces the subsidization of service department use of other

service departments. Its weaknesses are some service departments are not charged for the use

of other service departments and selection of which department is allocated first results in

different cost allocations.

Reciprocal Method

- The reciprocal method is the most accurate of the three methods for allocating service

department costs, because it recognizes reciprocal services among service departments. It is

also the most complicated method, because it requires solving a set of simultaneous linear

equations and is seldom used in practice.

- Total cost that participates in the cost allocation exceeds the cost of the department. This total

costs is identified as reciprocated total cost.

- The results of this procedure using our data for ABC Co. is as follows:

Step 1: Express support department costs and reciprocal relationships in linear equation

form.

Let P be Reallocated cost of the Power department

Let M be Reallocated cost of the Maintenance department

Reallocated cost = basic cost + Share of the reallocated cost of the other

service department

The cost equation is:

P = $250,000 + 0.1M

M = $160,000 + 0.2P

Step 2: Solve these two simultaneous equations to obtain the complete reciprocated costs

of each support departments.

Substitute the Power cost equation into the Maintenance cost equation

M = $160,000 + 0.2 ($250,000 + 0.1 M)

M = $160,000 + $50,000 + 0.02M

0.98M = $210,000

M = $214,286

Substitute the value for M into the Power cost equation:

Cost Accounting, AAUCC, 2011 Page 7 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

P = $250,000 + 0.1($214,286)

= $250,000 + $21,429

= $271,429

Rate (Power) = $271,429/1million kw hrs = $0.271429 per kw hr.

Rate (Maint.) = $214,286/10,000 M hrs = $21.4286 per Maint. hr.

Step 3: Allocate the complete reciprocate costs of each support department to all other

departments (both support departments and operating departments):

Note that unlike the step-down method, service provided by Maintenance to Power

is recognized. From the total maintenance hour of 10,000 Power used 1,000 (10%),

Grinding used 4,500 (45%), and Assembly used 4,500 (45%).

Support Departments Producing Departments

Power Maintenance Grinding Assembly

Costs $250,000 $160,000 $100,000 $60,000

Power Allocation

(0.20, 0.60, 0.20) (271,429) 54,286 162,857 54,285*

Maint. Allocation

(0. 10, 0.45,0.45) 21,428 (214,286) 96,429 96,429

Total $1* $0 $359,286 $210,714

* rounding effects

NB.

Notice that the total costs allocated to the producing department equals $410,000

(259,286 + $150,714), the total direct costs of the two support departments ($250,000 +

$160,000).

To save our time it will be wise to allocate the reciprocated costs to producing

department only using in fact the appropriate ratios.

Since the relative difficulty of solving simultaneous equations expands rapidly when

additional service departments are involved, solutions to simultaneous equations are

usually obtained using computer software designed for this purpose.

Comparing the Three Methods

- Does it really matter which method is used? Yes. Depending on the degree of interaction of

the support departments, the allocation methods can give radically different results. Because

allocation methods do affect the cost responsibilities of managers, it is important for the

accountant to understand the consequences of the different methods and to have a good

reason for the eventual choice.

- A different OH allocation rate in the producing department will result under each of the three

methods. Note that OH rates used in producing departments to cost products/jobs include

OH costs allocated from support departments resulting in different cost for a product

depending on which of the three methods is used.

Cost Accounting, AAUCC, 2011 Page 8 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

- For example, assume OH costs are allocated in Grinding and Assembly department using

machine hours and labor hours respectively with the following budgeted data:

Grinding Assembly

Direct labor hours: 45,000 107,500

Machine-hours 71,000 30,000

The various overhead rates using the three methods are the following:

Grinding Assembly

i) Direct Method $367,500 = $5.17 $202,500 = $1.88/Lhr

71,000 mhrs 107,500 Lhrs

ii) Step-down Method $355,000 = $5.00 $215,000 = $2.00/Lhr

71,000 mhrs 107,500 Lhrs

iii) Reciprocal Method $359,286 = $5.17 $210,714 = $1.96/Lhr

71,000 mhrs 107,500 Lhrs

- Like any accounting method, the cost–benefit guideline should also be considered in the

selection of a method of support department cost allocation.

- Note that even though most service departments are cost centers and therefore generate no

revenues, a few service departments such as the cafeteria may charge for the services they

perform. If a service department generates revenue, these revenues should be offset against

the department’s costs, and only the net amount of cost remaining after this offset should be

allocated to other departments within the organization. In this manner, the other departments

will not be required to bear costs fro which the service department has already been

reimbursed.

Additional Guidelines

- Additional guidelines that should be followed in allocating service department costs are

discussed in the following sections.

- Support department costs are allocated through the use of an allocation rate. Considerations

that go into determining an appropriate allocation rate include (1) the choice of a single or a

dual rate and (2) the use of budgeted versus actual support department costs.

Dual Rate vs. Single Rate

Single Rate

- A single rate allocates costs in each cost pool (i.e., each support department) to cost objects

(i.e., operating departments) using the same rate per unit of a cost-allocation base. No

distinction is made between fixed and variable costs in this method. In the previous examples

we used a single allocation rate.

- The advantage of this method is its low cost of implementation. It avoids the often expensive

analysis to classify costs as fixed and variable.

- The problem with the single rate method is that it treats the fixed cost as if it were variable. It

ignores the differential impact of changes in usage on costs. Fixed costs do not vary with the

level of services. This could lead operating department manager to make outsourcing decision

Cost Accounting, AAUCC, 2011 Page 9 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

that are in their own best interest but are not in the best interest of the organization as a

whole.

- The allocation of service department cost to operating department is as follows:

1) The budgeted service department costs are established for each service department.

2) Allocation base is determined

3) Allocation rate is computed:

Allocation rate = budgeted service dept cost/ allocation base

4) The service department costs are allocated to each producing department on the

basis of their proportional use of the service provided, as measured in terms of the

allocation base.

Budgeted rate × Actual usage of the allocation base

Example:

Suppose a firm’s medical services are allocated to the two production departments on the

basis of the number of their employees. The budgeted cost behavior pattern of the service

department is $20,000 plus $1 per employee operating in department I and II. In January,

the firm has 2,000 employees, three-fourth of them employed in department I and one-

fourth in department II. Allocate the service department cost to the two operating

departments based on number of employees.

1) The budgeted service department costs = $20,000 + ($1 × 2000 employees)

= $22,000

2) Allocation base is equivalent of 2,000 employees

3) The budgeted allocation rate is:

= $22,000/ 2000 = $11 per employee

Not that the budgeted rate of $11 per employee includes an allocated amount

of $10 per employee for fixed costs.

4) The service department costs are reallocated as follows:

Department I: 1,500 employees x $11 = $16,500

Department II: 500 employees x $11 = 5,500

Total Service Department. Costs = $22,000

Although straightforward, this principle of allocating service department costs is subject

to improvements described in the following sections.

Dual Rate:

- Whenever possible, service department costs should be separated into variable and fixed

classifications and allocated separately. This approach is necessary to avoid possible

inequities in allocation, as well as to provide more useful data for planning and control of

departmental operations.

Developing a Variable Rate:

Cost Accounting, AAUCC, 2011 Page 10 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

Variable costs represent direct costs of providing services and will generally vary in

total in proportion to fluctuations in the level of service consumed.

As a general rule, variable costs should be charged to producing departments

according to whatever activity (miles driven, direct labor-hours, number of employees

etc) causes the incurrence of the costs involved. For example, variable maintenance

cost of a maintenance department may be allocated (better called charged) to

producing departments on machine hour basis.

a) If the allocations are being made at the beginning of the year, they should be

based on the budgeted activity level planned for the consuming departments.

The allocation formula would be:

Cost allocated = Budgeted rate × Budgeted activity(allocation base)

b) If the allocations are being made at the end of the year, they should be based on

the actual activity level that has occurred during the year. The allocation formula

would be:

Cost allocated = Budgeted rate × Actual activity (allocation base used)

Developing a Fixed Rate:

Fixed costs can be considered capacity costs; they are incurred to provide the capacity

necessary to deliver the service units required by the producing departments. This

capacity may reflect the peak period needs of the other department, or it may reflect

their long-run average or “normal” servicing needs.

Thus the cost driver of the fixed-cost pool is the amount of capacity required when the

support department facilities were acquired and it seems reasonable to allocate fixed

costs based on those needs (capacity) as follows:

Budgeted fraction of capacity available for use × total budgeted fixed costs

Once set, allocation should not vary from period to period, since they represent each

consuming department’s “fair share” of having a certain level of service capacity

available.

Example:

Assume in the previous example the service department had provided a basic maximum

capacity to serve other departments with the assumption that department I would employ

1,600 employees and department II 400 employees.

The fixed costs would have been allocated to the two departments on the basis of the capacity

to serve, as follows:

Department I: 1,600/2000 × $20,000 = $16,000

Department II: 400/2000 × $20,000 = $4,000

The variable cost would have been allocated to the two departments on the basis of the

services utilized:

Department I: $1 × 1,500 = $1,500

Department II: $1 × 500 = $500

Cost Accounting, AAUCC, 2011 Page 11 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

The total cost allocated would have been:

Department I: $16,000 + $1,500 = $17,500

Department II: $4,000 + $500 = 4,500

Total service department costs = $22,000

Pitfalls in Allocating Fixed Costs

- Generally, it is found to be preferable to allocate fixed costs based on capacity available,

under the approach that fixed costs provide capacity and variable costs allocated based on

actual usage.

- In developing the fixed cost rate some companies choose to allocate fixed costs in

proportion to actual usage or budgeted usage.

- Since usage may vary from year to year, allocation of fixed costs would then use a variable

base. Variable bases, however, have a significant drawback: they allow the actions of one

department to affect the amount of fixed cost allocated to another department. The result is

that it distorts decisions and creates serious inequities between departments. This will not

bring the desired motivational effects with respect to the ordering of services in both the short

run and the long run.

Actual usage:

- Actual usage should not be used to allocate fixed costs. Why? Because

Fixed costs would be treated as if they were variable costs, so

The allocation wouldn’t capture the cause and effect of cost incurrence (fixed costs are

“caused” by long-run expected usage and

Changes in one division’s usage would affect another division’s allocation

Example:

Suppose department I has actually used 850 employees and department II 400 employees.

Based on actual capacity used, total fixed cost would be allocated as follows:

Department I: 850/1,250 × $20,000 = $13,600

Department II: 400/1,250 × $20,000 = $6,400

Department II has done nothing differently, but it must bear higher costs of $2,400 because of

the action of Department I. This weakness is avoided by using a predetermined lump-sum

allocation of fixed costs, based on capacity available, not capacity used. Such a budgeted

lump-sum approach is more likely to have the desired motivational effects with respect to the

ordering of services in both the short run and the long run.

Note that as long as the capacities of the producing departments remain at the level originally

anticipated, there is no reason to change the allocation ratio for fixed cost.

Budgeted usage:

- Budgeted usage can also be used as an allocation base for fixed costs. When budgeted usage is

the allocation base, user division will know in advance their allocated costs regardless of actual

usage. This information helps the user divisions with both short-run and long-run planning.

Cost Accounting, AAUCC, 2011 Page 12 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

- But allocating fixed costs on the basis of budgeted long-run usage may tempt some managers

to deliberately underestimate their planned usage. This will result in their department bearing a

lower percentage of fixed costs (assuming all other managers do not act similarly). To

discourage such underestimates, some companies offer rewards and bonuses-the carrot

approach-to managers who make accurate forecasts of long-run usage. Other companies

impose cost penalties-the stick approach-for underestimating long-run usage. For instance, a

higher cost rate is charged after a division exceeds its budgeted usage.

Note: If capacity costs are the result of a long-term decision by top management, it may be

desirable to allocate to each department the cost of capacity used based on actual usage. The

users are then not allocated the costs of unused capacity.

Should Actual or Budgeted Costs Be Allocated?

- Should a service department allocate its actual costs to operating department, or should it

allocate its budgeted costs? The answer is that budgeted costs (whenever possible) should

be allocated. In developing the allocation rates (both variable and fixed) in the previous

example we used the budgeted cost.

- The use of budgeted cost rate rather than actual cost rates for allocating variable cost of

service department has several attractive features to the manager of a user department:

Budgeted rates let the user department know in advance the cost rates they will be

charged. User department managers face no uncertainness about the rates to be used in

that budget period. Users can then determine the amount of the service to request and-if

the option exists-whether to use the internal department source or an external vendor.

The cost allocated to a particular user department does not depend on the amount of

resources used by other user departments, and

Inefficiencies/efficiencies at the department providing the service do not affect the costs

allocated to the user department. During the budget period, the supplier department, not

the user departments, bears the risk of any unfavorable cost variances. Why? Because the

user departments do not pay for any costs that exceed the budgeted rates. This will help

motivate the manager of the supplier (support) department to improve efficiency.

Budgeted rates are also needed to have timely job/product cost information.

- What is wrong with allocating actual costs?

Allocating actual costs burdens the operating departments with the inefficiencies of the

service department managers. If actual costs are allocated, then any lack of cost control

on the part of the service department manager is simply buried in a routine allocation to

other departments. Actual rate holds user-department managers responsible for costs

beyond their control and provides less incentive for service department to be efficient.

The actions of other departments affect the cost allocated to another department. i.e.,

One department may be heavily penalized for greater use of the services.

Cost Accounting, AAUCC, 2011 Page 13 of 14

PRINCIPAL’S COLLEGE OF HEALTH AND BUSINESS

ADAMA 022-2114-688, A.A 0911-061389, 522 code 1033 A.A Ethiopia

ADAMA CAMPUS 2ND YEAR 3rd semester for Degree Students

When actual rates are used for cost allocation, managers do not know the rates to be

used until the end of the budget period. i.e., rate affects the level of uncertainty user

department face.

Example:

Referring to the previous example, assume that the actual variable costs in the service

department were $10,000 because of inefficiencies instead of $2,000 ($1x2,000 employees)

budgeted. Reallocating the actual costs on the basis of the actual usage would lead to the

following results:

Department I: 1,500/2,000 × $10,000 = $7,500

Department II: 500/2,000 × $10,000 = $2,500

Actual variable cost allocated = $10,000

A good cost-accounting scheme would charge only the $2,000 to the user departments and

would let the $8,000 remain as an unfavorable budget variance of the support department.

This scheme holds support department managers responsible for the $8,000 variance and

reduces the resentment of user manages.

- Any variance over budgeted costs should be retained in the service department and closed

out at year-end against the company’s revenues or against cost of goods sold, along with

other variances. Operating department managers rarely complain about being allocated a

portion of service department costs, but they complain bitterly if they are forced to absorb

service department inefficiencies.

- If it is not feasible to maintain a distinction between variable and fixed costs in a service

department, then the costs of the department should be allocated to consuming

departments according to the base that appears to provide the best measure of benefits

received.

Cost Accounting, AAUCC, 2011 Page 14 of 14

You might also like

- Service Department Cost Allocation MethodsDocument13 pagesService Department Cost Allocation MethodsKiya AbdiNo ratings yet

- Chapter 3Document11 pagesChapter 3Arun Kumar SatapathyNo ratings yet

- Overheads CostingDocument10 pagesOverheads CostingOlivier IrengeNo ratings yet

- Costing Machine Hour RateDocument27 pagesCosting Machine Hour RateAjay SahooNo ratings yet

- Accounting For Overhead BanderveckDocument4 pagesAccounting For Overhead BanderveckFrences PascuaNo ratings yet

- Accountancy ProjectDocument15 pagesAccountancy ProjectShruti GargNo ratings yet

- Cost & Management Accounting: Overhead Allocation and Marginal vs Absorption CostingDocument10 pagesCost & Management Accounting: Overhead Allocation and Marginal vs Absorption CostingNageshwar SinghNo ratings yet

- Test Bank-Cost Concepts, Job Order, Materials, Service CostsDocument100 pagesTest Bank-Cost Concepts, Job Order, Materials, Service CostsKatrina Peralta FabianNo ratings yet

- Accounting For Factory OverheadDocument27 pagesAccounting For Factory Overheadspectrum_480% (1)

- Ca 2Document37 pagesCa 2bm36omdNo ratings yet

- CH 13 SMDocument31 pagesCH 13 SMapi-267019092No ratings yet

- Topic 3 Cost AssignmentDocument10 pagesTopic 3 Cost AssignmentEvelyn B NinsiimaNo ratings yet

- Product/Service Costing: Prof. Shailesh Gandhi IIM, AhmedabadDocument27 pagesProduct/Service Costing: Prof. Shailesh Gandhi IIM, AhmedabadNeha BhayaniNo ratings yet

- CH 13 SMDocument31 pagesCH 13 SMwaqtawanNo ratings yet

- OverheadsDocument32 pagesOverheadsLay TekchhayNo ratings yet

- CMA Chapter FiveDocument19 pagesCMA Chapter FivenganduNo ratings yet

- Departmentalization of Factory OverheadDocument3 pagesDepartmentalization of Factory OverheadPaolo Immanuel OlanoNo ratings yet

- Lecture 3-Accounting For OverheadsDocument10 pagesLecture 3-Accounting For OverheadsddmaheshslNo ratings yet

- ABC System Provides More Accurate Costing Than Traditional MethodsDocument6 pagesABC System Provides More Accurate Costing Than Traditional MethodsZoya KhanNo ratings yet

- ACCT1033 - Week 5 Accounting For Cost FlowDocument10 pagesACCT1033 - Week 5 Accounting For Cost FlowRoshane Deil PascualNo ratings yet

- Jijiga, Ethiopia: Title: Overhead AllocationDocument10 pagesJijiga, Ethiopia: Title: Overhead AllocationKader EzmailNo ratings yet

- ACC116 - Chapter 4Document19 pagesACC116 - Chapter 4Fierza NazirNo ratings yet

- Research Paper On Factory OverheadDocument8 pagesResearch Paper On Factory Overheadafmcitjzc100% (1)

- Operating Costing GuideDocument45 pagesOperating Costing GuideVivek Tiwari100% (1)

- Cost Chapter ThreeDocument24 pagesCost Chapter ThreeDEREJENo ratings yet

- Accounting for Factory Overhead CostsDocument31 pagesAccounting for Factory Overhead CostsMtshidi KewagamangNo ratings yet

- CH 06Document6 pagesCH 06Kanbiro OrkaidoNo ratings yet

- Overheads: Allocation, Apportionment & AbsorptionDocument39 pagesOverheads: Allocation, Apportionment & AbsorptionManju DoreNo ratings yet

- CA5 Accounting For Factory OverheadDocument15 pagesCA5 Accounting For Factory OverheadhellokittysaranghaeNo ratings yet

- Lesson 8 Overhead CostsDocument14 pagesLesson 8 Overhead CostsstcatherinehighmentorsNo ratings yet

- Determine Product Costs with Costing Systems (39Document11 pagesDetermine Product Costs with Costing Systems (39Cherwin bentulanNo ratings yet

- ABC Costing 12 NewDocument20 pagesABC Costing 12 Newsyed khaleel0% (1)

- Process Costing TermsDocument27 pagesProcess Costing TermsJon Jan CronicoNo ratings yet

- Service and Operation CostingDocument9 pagesService and Operation CostingUnique GadtaulaNo ratings yet

- FACTORY OVERHEAD COSTSDocument10 pagesFACTORY OVERHEAD COSTSZaheer SwatiNo ratings yet

- CH 13 SMDocument31 pagesCH 13 SMNafisah MambuayNo ratings yet

- Manufacturing Overheads - MonaDocument3 pagesManufacturing Overheads - MonaToni-Ann WillisNo ratings yet

- UEU Akuntansi Biaya Pertemuan 8910Document84 pagesUEU Akuntansi Biaya Pertemuan 8910hardyputra46No ratings yet

- Overhead and AbsorptionDocument22 pagesOverhead and AbsorptionJaokumar JaoNo ratings yet

- Cost Accounting Standard 3Document12 pagesCost Accounting Standard 3keyurNo ratings yet

- Lecture-7 Overhead (Part 4)Document38 pagesLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNo ratings yet

- SAP CO MODULE IMPLEMENTATION AT TATA BEARINGSDocument48 pagesSAP CO MODULE IMPLEMENTATION AT TATA BEARINGSYugandhar KolliNo ratings yet

- Unit 6 PDFDocument10 pagesUnit 6 PDFpayal sachdevNo ratings yet

- Operating CostingDocument22 pagesOperating CostingGauri Doke67% (3)

- Chapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostDocument3 pagesChapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostApril Joy InductaNo ratings yet

- Chapter 3 Job CostingDocument9 pagesChapter 3 Job CostingMuzey KassaNo ratings yet

- Assignment No 4-1Document3 pagesAssignment No 4-1irfan ahmedNo ratings yet

- Chap 4 CMADocument18 pagesChap 4 CMAsolomonaauNo ratings yet

- Chapter04 000 PDFDocument27 pagesChapter04 000 PDFgracel angela tolejanoNo ratings yet

- Job Costing: 1. Whether Actual or Estimated Costs Are UsedDocument16 pagesJob Costing: 1. Whether Actual or Estimated Costs Are UsedalemayehuNo ratings yet

- Overheads Allocation and ApportionmentDocument60 pagesOverheads Allocation and ApportionmentNesto Yohana SadukaNo ratings yet

- Mod 05Document29 pagesMod 05Anuj DubeyNo ratings yet

- Operating CostingDocument37 pagesOperating CostingkhairejoNo ratings yet

- Theory and ObjectivesDocument63 pagesTheory and ObjectivesSora 1211No ratings yet

- CAS 3 OverheadsDocument12 pagesCAS 3 OverheadsVivekanandNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- Registration_for_Sene_2016_E_C_Exit_Exam[1]Document2 pagesRegistration_for_Sene_2016_E_C_Exit_Exam[1]Kiya AbdiNo ratings yet

- Auditing 2 - Chapter FiveDocument10 pagesAuditing 2 - Chapter Fivehabtamu tadesseNo ratings yet

- Unit-2 Audit of Cash and Marketable SecuritiesDocument6 pagesUnit-2 Audit of Cash and Marketable SecuritiesKiya AbdiNo ratings yet

- comasionated part I and Part IIDocument32 pagescomasionated part I and Part IIKiya AbdiNo ratings yet

- Chapter 3Document7 pagesChapter 3Jarra AbdurahmanNo ratings yet

- Auditing 2 - Chapter SixDocument6 pagesAuditing 2 - Chapter SixPatrick MachiridzaNo ratings yet

- Auditing 2 - Chapter SevenDocument10 pagesAuditing 2 - Chapter SevenPatrick MachiridzaNo ratings yet

- March Report FinalDocument3 pagesMarch Report FinalKiya AbdiNo ratings yet

- Law of Business OrganizationsDocument26 pagesLaw of Business OrganizationsKiya AbdiNo ratings yet

- MARCH 2023 Adama Staff SalaryDocument24 pagesMARCH 2023 Adama Staff SalaryKiya AbdiNo ratings yet

- Law of ContractsDocument59 pagesLaw of ContractsKiya AbdiNo ratings yet

- New Doc 2022-10-29 14.46.56Document2 pagesNew Doc 2022-10-29 14.46.56Kiya AbdiNo ratings yet

- Law, Business Law, and Law of PersonDocument14 pagesLaw, Business Law, and Law of PersonKiya AbdiNo ratings yet

- 2023 Degree Regestration Format-1Document3 pages2023 Degree Regestration Format-1Kiya AbdiNo ratings yet

- Law, Business Law, and Law of PersonDocument14 pagesLaw, Business Law, and Law of PersonKiya AbdiNo ratings yet

- 2023 Degree Regestration Format-1Document3 pages2023 Degree Regestration Format-1Kiya AbdiNo ratings yet

- Law of SalesDocument16 pagesLaw of SalesKiya AbdiNo ratings yet

- PHBC Nursing CurriculumDocument260 pagesPHBC Nursing CurriculumKiya AbdiNo ratings yet

- Instructor ChecklistDocument1 pageInstructor ChecklistKiya AbdiNo ratings yet

- Law of AgencyDocument17 pagesLaw of AgencyKiya AbdiNo ratings yet

- Schedule PlannedDocument21 pagesSchedule PlannedKiya AbdiNo ratings yet

- Crane Depreciation Methods and Inventory CalculationsDocument1 pageCrane Depreciation Methods and Inventory CalculationsKiya AbdiNo ratings yet

- Principals College TVET Program Admission GuideDocument4 pagesPrincipals College TVET Program Admission GuideKiya AbdiNo ratings yet

- Lecturenote - 115731550cost and Managerial Accounting IIDocument131 pagesLecturenote - 115731550cost and Managerial Accounting IITadesse MolaNo ratings yet

- Cost IIiiiiiDocument77 pagesCost IIiiiiiKiya AbdiNo ratings yet

- Cma - Chapter OneDocument19 pagesCma - Chapter OneKiya AbdiNo ratings yet

- Benefits of Mobility for Older Adults & Factors Affecting BP & PulsesDocument1 pageBenefits of Mobility for Older Adults & Factors Affecting BP & PulsesKiya AbdiNo ratings yet

- TM-Entrepreneurship and Employabilityskill - TwoDocument227 pagesTM-Entrepreneurship and Employabilityskill - TwoKiya Abdi100% (2)

- Write Your Positive or Negative Thoughts About The Picture.Document6 pagesWrite Your Positive or Negative Thoughts About The Picture.YVONE MAE MAYORNo ratings yet

- Additional Problems (PRESENT ECONOMY)Document2 pagesAdditional Problems (PRESENT ECONOMY)Kristy SalmingoNo ratings yet

- 3036 7838 1 PBDocument17 pages3036 7838 1 PBAmandaNo ratings yet

- The Immortal v2Document2 pagesThe Immortal v2NihilisticWhimNo ratings yet

- YOU ReadingDocument2 pagesYOU ReadingedithNo ratings yet

- HolaDocument5 pagesHolaioritzNo ratings yet

- 5 Characteristics-Defined ProjectDocument1 page5 Characteristics-Defined ProjectHarpreet SinghNo ratings yet

- Christmas School TripDocument4 pagesChristmas School TripLã Quốc TrườngNo ratings yet

- QuizDocument18 pagesQuizParul AbrolNo ratings yet

- How To Activate Wondershare For Lifetime With Key and 127.0.0.1 Platform - Wondershare.com - 2019.mp4Document5 pagesHow To Activate Wondershare For Lifetime With Key and 127.0.0.1 Platform - Wondershare.com - 2019.mp4Rashid MahmoodNo ratings yet

- Mobility Consulting Engineer - Job DescriptionDocument2 pagesMobility Consulting Engineer - Job DescriptionEdwin BrandNo ratings yet

- Employee Stock Option SchemeDocument6 pagesEmployee Stock Option Schemezenith chhablaniNo ratings yet

- Lopez (Bussiness Meeting)Document2 pagesLopez (Bussiness Meeting)Ella Marie LopezNo ratings yet

- Aqeelcv New For Print2Document6 pagesAqeelcv New For Print2Jawad KhawajaNo ratings yet

- Zacks Marijuana Innovators GuideDocument13 pagesZacks Marijuana Innovators GuideEugene GalaktionovNo ratings yet

- CyberOps Associate - CA - Lab Answers Archives - InfraExam 2022Document4 pagesCyberOps Associate - CA - Lab Answers Archives - InfraExam 2022arunshanNo ratings yet

- TA2 FeriasDocument5 pagesTA2 FeriasRodrigo Escobedo ValdiviaNo ratings yet

- Life of a Prostitute in South Asian CinemaDocument18 pagesLife of a Prostitute in South Asian CinemaSyeda AbidiNo ratings yet

- The Science of Cop Watching Volume 004Document1,353 pagesThe Science of Cop Watching Volume 004fuckoffanddie23579No ratings yet

- Complaint For Maintenance of Possession and of Agricultural LeaseholdDocument12 pagesComplaint For Maintenance of Possession and of Agricultural LeaseholdluckyNo ratings yet

- Ssoar-2011-Afzini Et Al-Occupational Health and Safety inDocument39 pagesSsoar-2011-Afzini Et Al-Occupational Health and Safety inShan YasirNo ratings yet

- TNNLU National Med-Arb CompetitionDocument12 pagesTNNLU National Med-Arb CompetitionAkhil SreenadhNo ratings yet

- The Tallinn Manual 2.0Document44 pagesThe Tallinn Manual 2.0Arief PrihantoroNo ratings yet

- Aws D14.4 D14.4MDocument134 pagesAws D14.4 D14.4Mgeorgadam198380% (5)

- Vda de Esconde Vs CADocument1 pageVda de Esconde Vs CAMay Marie Ann Aragon-Jimenez WESTERN MINDANAO STATE UNIVERSITY, COLLEGE OF LAWNo ratings yet

- Complete The Sentences Using Connectors of Sequence and The Past Form of The VerbDocument2 pagesComplete The Sentences Using Connectors of Sequence and The Past Form of The VerbLilibeth Aparicio MontesNo ratings yet

- Case StudyDocument3 pagesCase StudyCrystal HolgadoNo ratings yet

- Asd Asda Sdfs AsdasDocument13 pagesAsd Asda Sdfs AsdasLabi SaeedNo ratings yet

- Empiricism, Sensationalism, and PositivismDocument43 pagesEmpiricism, Sensationalism, and PositivismJohn Kevin NocheNo ratings yet

- Fabrication Procedure FlowDocument3 pagesFabrication Procedure FlowtrikjohNo ratings yet

![Registration_for_Sene_2016_E_C_Exit_Exam[1]](https://imgv2-2-f.scribdassets.com/img/document/726592491/149x198/a8486da097/1714053847?v=1)