Professional Documents

Culture Documents

A Win-Win-Win Scenario in The Gaming Industry Amidst The Pandemic: Evidence From The Philippines

Uploaded by

clarencrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Win-Win-Win Scenario in The Gaming Industry Amidst The Pandemic: Evidence From The Philippines

Uploaded by

clarencrCopyright:

Available Formats

© APR 2021 | IRE Journals | Volume 4 Issue 10 | ISSN: 2456-8880

A Win-Win-Win Scenario in The Gaming Industry

Amidst the Pandemic: Evidence from The Philippines

DANIEL I. MORAN

Institute of Graduate Studies, San Sebastian College - Recoletos Manila, Philippines

Abstract- The gaming industry in the Philippines gaming. Philippine law and gambling regulators

took a hit with the COVID-19 pandemic, maybe even continued to prohibit on-line casino for local patrons

the worst hit industry along with other leisurely and not until lately when the pandemic shuts off land-

tourism related businesses such as hotels, airlines, based gaming, and also with the sudden arrival of

and other tourist destinations. When the Philippine Philippine Offshore Gaming Operation (POGO).

government declared the Enhanced Community

Quarantine (ECQ), all leisurely activities and POGO is an online gambling services which caters to

businesses were prohibited from operating, and only markets outside the Philippines. It operates similar to

allowing businesses engaged in essential needs such a Business Process Outsourcing (BPO) and its major

as hospitals, medicine, food, logistics to continue its customers are from China. Technically speaking, these

operation. POGOs are illegal both in the Philippines & China in

absence of enabling law and government regulating

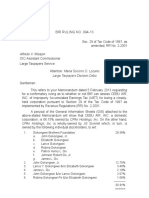

Illustration 1 body. The Philippine Amusement and Gaming

Corporation (PAGCOR) the Philippine government’s

gambling regulating body is in an obscure situation as

it can only regulate gambling activities within the

territorial jurisdiction of the Republic of the

Philippines.

This does not stop the Philippine government

however, to reap some benefit on the POGO operation.

At its peak pre-pandemic, POGO was a bustling sector

disrupting the gaming industry. From 2016 to 2018, it

grows from $657 million to $6 billion annual revenue.

As shown in the Illustration 1 above, the industry

suffered a drastic drop of its total gaming revenue

when compared year on year. This resulted and put

a stop on the steady growth year on year of the whole

industry. Earlier years prior to the pandemic, the

gaming industry showed a robust double-digit

industry wide growth, outgrowing its neighbor

gaming hub Macau, and was even once considered

to grow faster than Las Vegas, Macau, and

Singapore by an analyst from Morgan Stanley,

Praveen Choudhary.

Source:

I. INTRODUCTION https://www.statista.com/statistics/1017254/revenues

-philippine-online-gambling-operations-philippines/

While there was robust growth for land-based gaming

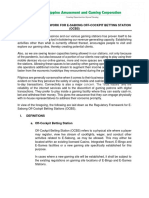

establishment, the Philippines had virtually zero For its part, Bureau of Internal Revenue (BIR)

initiative, much more so growth on the on-line reported a P7.18 billion tax collection for the year of

IRE 1702657 ICONIC RESEARCH AND ENGINEERING JOURNALS 34

© APR 2021 | IRE Journals | Volume 4 Issue 10 | ISSN: 2456-8880

2020 from the POGO operators. The BIR a thriving sector as well estimated to have an annual

commissioner further added that they have been revenue of $1B.

slapping 5% franchise tax to POGO operators since

2017. Below are the table of tax collection from this With all this in mind, there is one clear challenge both

sector: to the gambling operators and PAGCOR: how do we

adapt to this new normal while maintaining revenue

generation?

III. CAUSE OF THE PROBLEM

It will be an understatement to say that the global

pandemic caused by COVID-19 disrupted the gaming

industry not only in the Philippines but the whole

world. The effect on gaming industry is even worse

than other industries given the fact that this industry is

a leisurely, tourism geared industry and not

necessarily an essential one for human kind survival.

The 30% capacity only required by PAGCOR will

These collection revenues were earmarked via the drastically reduce the revenue generation of these

Bayanihan Act: “All revenues from POGO will be operators.

used to fund the various types of assistance laid out in

the Bayanihan 2 for all sectors affected by the IV. COURSE OF ACTION

pandemic.” – Sen. Franklin Drilon.

This situation requires action from all stakeholders for

II. Statement of the Problem the industry to thrive and tide away this pandemic.

Needless to say, that both the government of the

The Philippine Amusement and Gaming Corporation Philippines and the gaming operators have already

(PAGCOR) have recently approved resumption of implemented measures to curve the spread of the virus.

gaming operation of all licensed operators but on a Preventive and reactive measures to help safeguard the

30% operational capacity only. This will hurt the health of its patron. These measures that are already in

industry, on top of the prohibition of senior citizens place however are not sufficient enough to ensure

(which belongs to the demographically major patrons profitability or even survival of the industry. There are

for casinos). recommended actions however that are outlined as

follows:

On-line gaming license to the two (2) major land-

based casino operators, Casino A and Casino B. A. PAGCOR and Philippine Government

According to the PAGCOR chair, this is their way of

combatting the effect of the pandemic, by allowing The Philippine government is pressured to look for

select patrons to enjoy gaming via on-line. alternative revenue sources after most if not all

surprisingly, there was no on-line license yet for the industries were affected by the pandemic, thereby

Casino C, despite being the recognized pioneer of drastically reducing tax collection for the government.

integrated gaming, hospitality & leisure in the This results to scarce government fund that is badly

Philippines. needed to support its population.

On top of it, here we have POGOs that are being The good news however, is that there are sectors that

allowed to operate in the Philippines without the government can tap to generate funds through

regulatory law. We also have on-line sabong which is taxation. The same system that the government did to

implement 5% tax on POGO operators, can in fact be

also implemented to on-line cock fighting or e-sabong.

IRE 1702657 ICONIC RESEARCH AND ENGINEERING JOURNALS 35

© APR 2021 | IRE Journals | Volume 4 Issue 10 | ISSN: 2456-8880

In fact, there’s a bill filed already in the house of CONCLUSION

representative calling for this taxation. Should this be

passed into law, this will generate an additional The Philippine government needs fund for its

approximately P1.25B tax collection on its first year pandemic initiatives and projects. PAGCOR, is one of

of implementation. This is according to Cong. the government agencies badly affected, as the

Salceda, Chair of Ways & Means Committee. This bill licensed gaming operators suffered drastically due to

once passed, will not only add funds to the government stoppage or imposed limit on its operation. Pandemic

coffins but will also regulate the sector. put a stop on the year-on-year steady growth of the

gaming industry in the Philippines and it calls for a

PAGCOR for its part, must immediately implement quick and effective measure in order for it to survive.

guidelines on the on-line gaming, and allow or issue It is with PAGCOR and the whole gaming industry

on-line licenses to the current pool of land-based however, where the government can find its needed

gaming operators. By allowing the operators to offer additional fund source. It is in this industry as well,

on-line gaming or casino operation, will result to a where we can find a win-win-win scenario for all

win-win-win scenario for all stakeholders of the stakeholders, and yes it includes the gaming patrons

industry. The patrons can enjoy their favorite game at and the public in general.

the comfort of their homes, away from the risk of

contacting the virus. The gaming operators will RECOMMENDATION

continue to have its revenue to survive and support its

employees, and the government through PAGCOR This pandemic made the gambling operators to adapt

will have its share of the revenue to implement and innovate based on their respective resources and

government projects. according to regulatory guidelines. Some of the

mandatory requirements for example are the strict

B. Gaming Operators health declaration upon entry, temperature, and at

times even on the spot swab test of guests prior to

For the gaming operators, the casino business is a entry. Some casinos too installed barriers to gaming

capital-intensive investment already as it is. Majority tables which has multiple players playing at the same

of the investment would normally go to physical time. This is on top of the reduction of seating capacity

structures like buildings, hotels, gaming areas, of each tables.

restaurants, and facilities to accommodate its loyal

patrons. With the pandemic however, it is but timely It is obvious however, that for this Win-Win-Win

for these operators to adapt and realign a portion of its scenario to work, all the recommended courses of

CAPEX budget to build infrastructure to bolster their action from all stakeholders must be implemented with

on-line gaming capability. IT infrastructure, immediate effect.

connectivity, software & hardware, and security

should be among the capital expenditure for the REFERENCES

operators. These should be prioritized over building

the hard structures that are currently on-going [1] VENZON, CLIFF (December 2020) ‘Philippines

construction. In fact, this pandemic could even be bets on online casinos, e-cockfights as Chinese

considered as an opportunity for these operators to flee’. Retrieved from

cash in on the on-line casino since prior to pandemic, https://asia.nikkei.com/Business/Media-

these operators are only allowed to operate land-based Entertainment/Philippines-bets-on-online-

casino operation. This pandemic opens the opportunity casinos-e-cockfights-as-Chinese-flee

for the operators to expand its revenue generation to

[2] AGBrief Editorial, (January 2021) ‘Competition

multiple channels.

adds to Covid woes in the Philippines’. Retrieved

from https://agbrief.com/headline/competition-

adds-to-covid-woes-in-the-philippines/

IRE 1702657 ICONIC RESEARCH AND ENGINEERING JOURNALS 36

© APR 2021 | IRE Journals | Volume 4 Issue 10 | ISSN: 2456-8880

[3] NG, FELIX (January 2021) ‘Philippines

legislature working on new bill for taxing POGO

workers. Retrieved from

https://agbrief.com/headline/philippines-

legislature-working-on-new-bill-for-taxing-

pogo-workers/

[4] NG, FELIX (November 2020) ‘Resorts World

Manila loses US$35 million in Q3’ Retrieved

from https://agbrief.com/headline/resorts-

world-manila-loses-us35-million-in-q3/

[5] CONNELLER, PHILIP (November 2020)

‘Philippines Regulator Greenlights Online

Gambling Lifeline for Pandemic-Stricken

Casinos’. Retrieved from

https://www.casino.org/news/philippines-

regulator-pagcor-greenlights-online-gaming-

lifeline-for-casinos/

[6] OLDROYD, KEVIN (May 2019) ‘Casino

Revenue in the Philippines Is Surging’.

Retrieved from

https://www.gamblingsites.org/news/casino-

revenue-in-the-philippines-is-surging/

[7] CARPIO, ANTONIO T. (May 2020) ‘The

Invisible Hands in POGOs’. retrieved from

https://opinion.inquirer.net/129572/the-

invisible-hands-in-pogos

[8] SANCHEZ, MARTHA JEAN (December 2020)

‘Annual revenues of Philippine online gambling

operations in the Philippines from 2016 to 2018’.

Retrieved from

https://www.statista.com/statistics/1017254/reve

nues-philippine-online-gambling-operations-

philippines/

[9] DE VERA, BEN O. (January 2021) ‘BIR

collected P 7.18B from Pogo sector in 2020’.

Retrieved from

https://business.inquirer.net/316515/bir-

collected-p-7-18b-from-pogo-sector-in-2020

IRE 1702657 ICONIC RESEARCH AND ENGINEERING JOURNALS 37

You might also like

- IT-BPO and POGO Industries Drive Philippine Real Estate GrowthDocument20 pagesIT-BPO and POGO Industries Drive Philippine Real Estate GrowthFLORENCE MAY SUMINDOLNo ratings yet

- House of RepresentativesDocument5 pagesHouse of RepresentativesColeenNo ratings yet

- Offshore Gaming Regulatory ManualDocument61 pagesOffshore Gaming Regulatory ManualChristy Sanguyu100% (3)

- Philippine City Approves Cockfighting OrdinanceDocument4 pagesPhilippine City Approves Cockfighting OrdinanceDenni Dominic Martinez LeponNo ratings yet

- SPA Jess Joy Autor BlankDocument1 pageSPA Jess Joy Autor BlankMichie BeeNo ratings yet

- Request Letter For Data AcquisitionDocument1 pageRequest Letter For Data Acquisitiondll registrarNo ratings yet

- Marine Park Redevelopment Boosts Philippine TourismDocument60 pagesMarine Park Redevelopment Boosts Philippine TourismMarie Carh CabingasNo ratings yet

- FINAL PPT FPIC PROCESS Orientation On Processing of CP Applic For Govt ProjectsDocument23 pagesFINAL PPT FPIC PROCESS Orientation On Processing of CP Applic For Govt Projectsangelita dapigNo ratings yet

- Doj Ncip Moa 001-2005Document2 pagesDoj Ncip Moa 001-2005knowingthevoid100% (2)

- PD 449 - Kenneth Only!Document3 pagesPD 449 - Kenneth Only!YagamiPerezNo ratings yet

- Demand Letter (Mano Biboy)Document1 pageDemand Letter (Mano Biboy)v_sharonNo ratings yet

- ESA - Project SPLIT - DAR Version 17 March 2020Document53 pagesESA - Project SPLIT - DAR Version 17 March 2020Venus Zcxiv AquinoNo ratings yet

- ENS 201 Paper (Mining Issues in The Philippines) - Naungayan, Marianne Jane E PDFDocument16 pagesENS 201 Paper (Mining Issues in The Philippines) - Naungayan, Marianne Jane E PDFMarianne Jane NaungayanNo ratings yet

- Ormoc Cockpit OrdinanceDocument9 pagesOrmoc Cockpit OrdinanceBordibordNo ratings yet

- Affidavit of ServiceDocument12 pagesAffidavit of ServiceFiels De Guzman GamboaNo ratings yet

- The Revised Forestry Code Power PointDocument15 pagesThe Revised Forestry Code Power PointCglu NemNo ratings yet

- Bprog Learning Center Inc.: Articles of Incorporation and By-Laws - Non Stock CorporationDocument9 pagesBprog Learning Center Inc.: Articles of Incorporation and By-Laws - Non Stock CorporationVanessa May Caseres GaNo ratings yet

- Affidavit SpaDocument4 pagesAffidavit SpadoloresNo ratings yet

- Amended By-Laws of the Philippine Canine ClubDocument38 pagesAmended By-Laws of the Philippine Canine ClubmaryjovanNo ratings yet

- Regulation of Cockfighting in Eastern SamarDocument3 pagesRegulation of Cockfighting in Eastern SamarRiel VillalonNo ratings yet

- Executive Order 79Document5 pagesExecutive Order 79Anonymous Hxk3xenNo ratings yet

- Cockfighting LawDocument5 pagesCockfighting LawJayr CagasNo ratings yet

- YFreLegForms - Deed of SaleDocument2 pagesYFreLegForms - Deed of SaleJan Uriel DavidNo ratings yet

- BIR Ruling Determines CEBU Air Inc Subject to IAETDocument4 pagesBIR Ruling Determines CEBU Air Inc Subject to IAETseraphinajewelineNo ratings yet

- Ched Unifast ORIENTATIONDocument18 pagesChed Unifast ORIENTATIONChristian RiveraNo ratings yet

- Mining LawsDocument40 pagesMining LawsMatthew RayNo ratings yet

- ONGCUANGCO Law Firm Billing StatementDocument2 pagesONGCUANGCO Law Firm Billing StatementACT-CIS Party listNo ratings yet

- HR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsDocument2 pagesHR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsKabataan Party-ListNo ratings yet

- Memorandum of Agreement For The Establishment of Negosyo CenterDocument5 pagesMemorandum of Agreement For The Establishment of Negosyo CenterNEGOSYO CENTER ESTANCIANo ratings yet

- Contract of Loan and Promissory NoteDocument2 pagesContract of Loan and Promissory NoteZor Ro100% (1)

- Affidavit of Undertaking For Promotion of Pltcol: National Headquarters, Philippine National PoliceDocument3 pagesAffidavit of Undertaking For Promotion of Pltcol: National Headquarters, Philippine National PoliceGIDEON, JR. INESNo ratings yet

- 100 Days of PNoyDocument45 pages100 Days of PNoymis_administratorNo ratings yet

- Solo Parent - ManelDocument1 pageSolo Parent - ManelA Paula Cruz FranciscoNo ratings yet

- Official List of Students First Sem 201-2019Document5 pagesOfficial List of Students First Sem 201-2019Orline C. MelendezNo ratings yet

- Proclamation No. 423 S. 1957Document7 pagesProclamation No. 423 S. 1957JeffreyReyesNo ratings yet

- ACFrOgBZoog7RQhR5KTE711dt7FXg 4OVS4bp5rLbz6tK5mUhc5PmLCGoCXBrZz dLnCmIAjzKl7AqT0gSiVgLc - GUsUnIZLEMIXdj-f4hWKoE9mnGtcbjY-8pIYLwDocument49 pagesACFrOgBZoog7RQhR5KTE711dt7FXg 4OVS4bp5rLbz6tK5mUhc5PmLCGoCXBrZz dLnCmIAjzKl7AqT0gSiVgLc - GUsUnIZLEMIXdj-f4hWKoE9mnGtcbjY-8pIYLwClaudio Dela cruzNo ratings yet

- NCIP en Banc Resolution 145 S. 2009Document2 pagesNCIP en Banc Resolution 145 S. 2009Ernest Aton100% (1)

- Review of Utilization of ENR Revenues and Application of Media StrategiesDocument160 pagesReview of Utilization of ENR Revenues and Application of Media StrategiesMark Lester Lee AureNo ratings yet

- Renewal of Domain and Web Hosting for IBPCebu.comDocument1 pageRenewal of Domain and Web Hosting for IBPCebu.comRheneir MoraNo ratings yet

- Formal Invitation LetterDocument1 pageFormal Invitation LetterTriyono SoepardiNo ratings yet

- Regulatory Framework For E-Sabong Off-Cockpit Betting Station (OCBS)Document3 pagesRegulatory Framework For E-Sabong Off-Cockpit Betting Station (OCBS)Charisse Ayra ClamosaNo ratings yet

- RA 10354 Petition SC James ImbongDocument25 pagesRA 10354 Petition SC James ImbongCBCP for LifeNo ratings yet

- Solo ParentDocument1 pageSolo ParentA Paula Cruz FranciscoNo ratings yet

- Class Activity: Sample Letter To PresidentDocument1 pageClass Activity: Sample Letter To PresidentRabindranathNo ratings yet

- Iloilo City Regulation Ordinance 2005-072Document5 pagesIloilo City Regulation Ordinance 2005-072Iloilo City CouncilNo ratings yet

- ComplaintDocument4 pagesComplaintAmado Vallejo IIINo ratings yet

- DENR Tarlac ReportsDocument74 pagesDENR Tarlac ReportsAvelino M BacalloNo ratings yet

- Complaint - Edba V, Quilon1Document3 pagesComplaint - Edba V, Quilon1ElijahBactolNo ratings yet

- Motion to Reduce BailDocument3 pagesMotion to Reduce BailIsay Lim-BorjaNo ratings yet

- Lecture On PROTECTED AREAS and The Salient Points of ENIPAS and Its IRRDocument75 pagesLecture On PROTECTED AREAS and The Salient Points of ENIPAS and Its IRRJohn Mark ParacadNo ratings yet

- PDF Masa Amended PPP Moa Lgu Malapatan MTCDC 101723 Word 2Document14 pagesPDF Masa Amended PPP Moa Lgu Malapatan MTCDC 101723 Word 2dexterbautistadecember161985No ratings yet

- Revised BP Form 202 - InstructionsDocument5 pagesRevised BP Form 202 - InstructionsEmelyn Ventura SantosNo ratings yet

- Sabong Committe ReportDocument3 pagesSabong Committe Reportjojo50166No ratings yet

- EO 79 Revitalizing The Palawan Campaign Against MiningDocument12 pagesEO 79 Revitalizing The Palawan Campaign Against MiningFarah Joshua SevillaNo ratings yet

- Katarungang Pambarangay For PresentationDocument97 pagesKatarungang Pambarangay For PresentationAlma GrandeNo ratings yet

- DND Circular 15Document20 pagesDND Circular 15Phyme PhymeNo ratings yet

- Respondent: Section 2, REPUBLIC ACT NO. 10627: "Bullying"Document2 pagesRespondent: Section 2, REPUBLIC ACT NO. 10627: "Bullying"Anna Pereña Mercene-PulmonesNo ratings yet

- Affidavit: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 18th DayDocument2 pagesAffidavit: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 18th DayFeEdithOronicoNo ratings yet

- Existence of PogoDocument2 pagesExistence of PogoKimberly Sheen Quisado Tabada100% (1)

- Philippine Amusement and Gaming Corporation (PAGCOR)Document8 pagesPhilippine Amusement and Gaming Corporation (PAGCOR)Nald AlmazarNo ratings yet

- Senior ProjectDocument65 pagesSenior ProjectJesa ArindaNo ratings yet

- 21-00382 CRP.18 Resilient Institutions WEB (16727)Document116 pages21-00382 CRP.18 Resilient Institutions WEB (16727)WellesMatiasNo ratings yet

- Risk and Risk Management 2020Document7 pagesRisk and Risk Management 2020Dance on floorNo ratings yet

- J of App Behav Analysis - 2020 - Jess - Increasing Handwashing in Young Children A Brief ReviewDocument6 pagesJ of App Behav Analysis - 2020 - Jess - Increasing Handwashing in Young Children A Brief ReviewdindasaviraNo ratings yet

- KPMG - Top-Risks-Bottom-Line-For-BusinessDocument10 pagesKPMG - Top-Risks-Bottom-Line-For-BusinessOpeyemi AkinkugbeNo ratings yet

- LONG QUIZ # 1 IN ENGLISH 8 (4th Grading PeriodDocument2 pagesLONG QUIZ # 1 IN ENGLISH 8 (4th Grading PeriodAnthony Gio L. AndayaNo ratings yet

- Factors Associated To Decision-Making Behavior For COVID-19 Vaccination Among Factory Workers in Navanakorn Industrial Estate of ThailandDocument5 pagesFactors Associated To Decision-Making Behavior For COVID-19 Vaccination Among Factory Workers in Navanakorn Industrial Estate of ThailandInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Outdoor Stadium Guidance For Michigan StadiumsDocument4 pagesOutdoor Stadium Guidance For Michigan StadiumsWXYZ-TV Channel 7 DetroitNo ratings yet

- Razmerita Et Al.Document819 pagesRazmerita Et Al.Nouman AamirNo ratings yet

- English9 - q3 - CLAS1 - Determining The Relevance and Truthfulness of The Ideas Presented - v4 Eva Joyce PrestoDocument14 pagesEnglish9 - q3 - CLAS1 - Determining The Relevance and Truthfulness of The Ideas Presented - v4 Eva Joyce PrestoHarlene Dela Cruz OzarNo ratings yet

- Capstone Project Draft 4Document10 pagesCapstone Project Draft 4api-540888060No ratings yet

- Effects of COVID-19 On Trade FlowsDocument18 pagesEffects of COVID-19 On Trade FlowsVia GiovanaNo ratings yet

- Ajcp Panao RyeDocument25 pagesAjcp Panao RyeAlicor PanaoNo ratings yet

- Final Project Report On "The Impact of COVID-19 in The Human Resource Management Practices of Private Organizations Operating in Bangladesh"Document56 pagesFinal Project Report On "The Impact of COVID-19 in The Human Resource Management Practices of Private Organizations Operating in Bangladesh"Parvez pialNo ratings yet

- Wimwian Oct 2020Document80 pagesWimwian Oct 2020Raghavendra UdayagiriNo ratings yet

- Peacebuilding Project Quarterly Report Highlights COVID ResponseDocument41 pagesPeacebuilding Project Quarterly Report Highlights COVID ResponseHermione Granger100% (1)

- Indoor Air Quality Rethinking Rules of Building Design Strategies inDocument9 pagesIndoor Air Quality Rethinking Rules of Building Design Strategies inGabriel ClaudeNo ratings yet

- Title Summary of The Coronavirus Situation in Pakistan: DescriptionDocument2 pagesTitle Summary of The Coronavirus Situation in Pakistan: DescriptionfaheemNo ratings yet

- Brand Finance Global 500 2022 PreviewDocument110 pagesBrand Finance Global 500 2022 PreviewGustavo KahilNo ratings yet

- Assignment Ecs555 - Ec2205a1bDocument12 pagesAssignment Ecs555 - Ec2205a1bNabilah.MoktarNo ratings yet

- Gojek Case Study Group 4Document2 pagesGojek Case Study Group 4michelle beyonceNo ratings yet

- Vaccine FormDocument56 pagesVaccine FormPamela PatawaranNo ratings yet

- Moderna COVID-19 Vaccine Distribution Records for Wonosobo District Health OfficeDocument10 pagesModerna COVID-19 Vaccine Distribution Records for Wonosobo District Health OfficePuskesmas Kejajar 2No ratings yet

- Passenger Covid 19 CharterDocument15 pagesPassenger Covid 19 CharterTatianaNo ratings yet

- Deloitte Uk Annual Review of Football Finance 2021Document64 pagesDeloitte Uk Annual Review of Football Finance 2021Sushil Kumar JangirNo ratings yet

- Structure Fitter ResumeDocument8 pagesStructure Fitter Resumeseraj ansariNo ratings yet

- Newscasting Script LinesDocument6 pagesNewscasting Script LinesaleksNo ratings yet

- Pfizer Killed 92% of COVID VictimsDocument7 pagesPfizer Killed 92% of COVID VictimsmikeNo ratings yet

- Irtad Road Safety Annual Report 2020 0Document65 pagesIrtad Road Safety Annual Report 2020 0Oskar InNo ratings yet

- Certificate for COVID-19 Vaccination in IndiaDocument1 pageCertificate for COVID-19 Vaccination in IndiaRam Sumer TiwariNo ratings yet

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Becoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysFrom EverandBecoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysRating: 4.5 out of 5 stars4.5/5 (18)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewFrom EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewRating: 4.5 out of 5 stars4.5/5 (26)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Run It Like a Business: Strategies for Arts Organizations to Increase Audiences, Remain Relevant, and Multiply Money--Without Losing the ArtFrom EverandRun It Like a Business: Strategies for Arts Organizations to Increase Audiences, Remain Relevant, and Multiply Money--Without Losing the ArtNo ratings yet

- Blood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeFrom EverandBlood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeRating: 4.5 out of 5 stars4.5/5 (335)

- Women's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesFrom EverandWomen's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesRating: 4.5 out of 5 stars4.5/5 (190)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceFrom EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceRating: 4.5 out of 5 stars4.5/5 (38)

- Ringmaster: Vince McMahon and the Unmaking of AmericaFrom EverandRingmaster: Vince McMahon and the Unmaking of AmericaRating: 4 out of 5 stars4/5 (31)

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (82)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet