Professional Documents

Culture Documents

Project Acc117

Uploaded by

Afiqah AliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Acc117

Uploaded by

Afiqah AliaCopyright:

Available Formats

ACC117/106/PROJECT2/OCTFEB2022

ACC117/106: GROUP PROJECT 2

CARRY MARK: 15%

TOTAL MARKS: 50

INTRODUCTION:

In this group assignment, a group of students are expected to analyse financial

statements using simple financial ratios for sole proprietorship business.

INSTRUCTIONS:

1. Form a group with a maximum of 4 members.

2. Answer all questions.

QUESTION 1

The following are the final accounts of AKB Enterprise for the year ended 30 June 2020

and 2021:

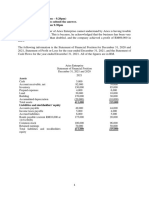

AKB Enterprise

Statement of Profit or Loss for the year ended 30 June 2020 and 2021

2020 2021

Sales 100,000 120,000

Less: Sales Return (3,200) (1,200)

Net Sales 96,800 118,800

Less: Cost of Goods Sold

Opening Inventory 25,200 12,000

Add: Purchases 34,800 24,500

60,000 36,500

Less: Closing Inventory (12,000) (48,000) (12,500) (24,000)

Gross profit 48,800 94,800

Add: other revenues 60,000 36,000

Less: Expenses (14,200) (44,200)

Net Profit 94,600 86,600

ACC117/106/PROJECT2/OCTFEB2022

AKB enterprise

Statement of Financial Position as at 30 June 2020 and 2021

2020 2021

Non-current Assets 169,000 187,000

Current Assets:

Inventory 12,000 12,500

Account Receivable 11,400 33,500

Bank 6,000 9,500

Prepaid expense - 1,000

29,400 56,500

198,400 243,500

Financed by:

Capital 146,400 146,400

Add: Net Profit 94,600 187,000 86,600 233,000

Current Liabilities 11,400 10,500

198,400 243,500

Required:

Based on the financial statements for the year ended on 30 June 2020 and 2021 given,

you are required to:

i) Calculate for both years:

a. Current ratio

b. Acid-test ratio

c. Gross profit margin

d. Net profit margin

e. Return on investment

f. Inventory turnover ratio

g. Average collection period (Assume there are 365 days in a year)

(30 marks)

ii) Interpret each of the ratios for both years.

(14 marks)

iii) Compare and contrast the liquidity ratios, profitability ratios and efficiency ratios

for both years.

(6 marks)

(Total: 50 marks)

END OF QUESTION PAPER

You might also like

- NEC3 ECC Project Manager Form Templates V1-02Document61 pagesNEC3 ECC Project Manager Form Templates V1-02cityren75% (8)

- Schwaaz Rhino AdjustmentsDocument1 pageSchwaaz Rhino AdjustmentssamNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Accruals & Deferrals Errors AuditDocument2 pagesAccruals & Deferrals Errors AuditHaidee Flavier SabidoNo ratings yet

- Working Capital Management and Financial AnalysisDocument9 pagesWorking Capital Management and Financial AnalysisFahmy KfNo ratings yet

- Mezan Oil Company HistoryDocument5 pagesMezan Oil Company Historyshahrukh khanNo ratings yet

- AC3101 PresentationsDocument21 pagesAC3101 PresentationsAngie Koh Ann Ping100% (1)

- BSc Business Finance Exam QuestionsDocument9 pagesBSc Business Finance Exam QuestionsRukshani RefaiNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- ADVANCED ACCOUNTING 2CDocument5 pagesADVANCED ACCOUNTING 2CHarusiNo ratings yet

- VVU School of Business Final Exam Questions on Financial ManagementDocument4 pagesVVU School of Business Final Exam Questions on Financial ManagementNubor RichardNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- PST FR 2015 2023Document109 pagesPST FR 2015 2023PhilipNo ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Skills MARCH... JULY 2020 #IfrsiseasyDocument138 pagesSkills MARCH... JULY 2020 #IfrsiseasyEniola OlakunleNo ratings yet

- M.B.A (2021 Pattern)Document63 pagesM.B.A (2021 Pattern)Sahil DhumalNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- MAS12-FS-ANALYSISDocument10 pagesMAS12-FS-ANALYSIShatdognamaycheese123No ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- ACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationDocument17 pagesACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationTavakoli MehranNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

- MODULE 3-Short ProblemsDocument5 pagesMODULE 3-Short ProblemsJaimell LimNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- ADVANCED ACCOUNTING 2EDocument3 pagesADVANCED ACCOUNTING 2EHarusiNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Acf 211 M 2018Document6 pagesAcf 211 M 2018Bulelwa HarrisNo ratings yet

- Installment Sales and Long Term Construction ContractDocument13 pagesInstallment Sales and Long Term Construction ContractPaupauNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Maf605 - Final Exam 24.09.2022Document6 pagesMaf605 - Final Exam 24.09.2022sanjuladasanNo ratings yet

- 1 - 4-1Document11 pages1 - 4-1sandeshjhanbia021No ratings yet

- Financial Ratios 2017Document5 pagesFinancial Ratios 2017Marian PajarNo ratings yet

- MBA731 Class Activity Question 2 CashflowDocument5 pagesMBA731 Class Activity Question 2 CashflowWisdom MandazaNo ratings yet

- Bac 101 Fundamentals of Accounting IiDocument8 pagesBac 101 Fundamentals of Accounting IiShadddie SnrNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Group Assignment B - Amni - Merc - LioniDocument5 pagesGroup Assignment B - Amni - Merc - LioniAmniNo ratings yet

- SEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Document5 pagesSEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Aaysha AgrawalNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- MBA Managerial Accounting TestDocument3 pagesMBA Managerial Accounting TestasdeNo ratings yet

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocument2 pagesCapital Intensive Labor Intensive: Required: Determine The FollowingMahediNo ratings yet

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- Financial Statements AnalysisDocument3 pagesFinancial Statements AnalysisGing freexNo ratings yet

- Jul22 Osa Supp Accounting and Financial Management Question PaperDocument9 pagesJul22 Osa Supp Accounting and Financial Management Question PaperMelokuhle MhlongoNo ratings yet

- COMPARATIVE INCOME STATEMENTDocument12 pagesCOMPARATIVE INCOME STATEMENTBISHAL ROYNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Financial Accounting AOLDocument7 pagesFinancial Accounting AOLNatasha HerlianaNo ratings yet

- Cash Flow Statement for K BarrettDocument4 pagesCash Flow Statement for K BarrettRajay BramwellNo ratings yet

- GP 2 Far 620Document17 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Faculty of Accountancy Bachelor of Accountancy (Hons.)Document8 pagesFaculty of Accountancy Bachelor of Accountancy (Hons.)Syafahani SafieNo ratings yet

- L18.12 UTS 1718 v3Document11 pagesL18.12 UTS 1718 v3AnggiNo ratings yet

- BCOE-142 December 2022Document12 pagesBCOE-142 December 2022SanjeetNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Organizing Fundamentals for ManagementDocument27 pagesOrganizing Fundamentals for ManagementizzahkjNo ratings yet

- The Fundamentals of Decision Making Process and TechniquesDocument9 pagesThe Fundamentals of Decision Making Process and TechniquesAfiqah AliaNo ratings yet

- MGT Chapter 1-IntroductionDocument12 pagesMGT Chapter 1-IntroductionAfiqah AliaNo ratings yet

- 4.3 Trial BalanceDocument5 pages4.3 Trial BalanceAfiqah AliaNo ratings yet

- Planning Fundamentals for Organizational SuccessDocument15 pagesPlanning Fundamentals for Organizational SuccessAfiqah AliaNo ratings yet

- 3ii. ACCOUNTING Effects On TransactionNDocument15 pages3ii. ACCOUNTING Effects On TransactionNAfiqah AliaNo ratings yet

- Accounting Duality ConceptDocument23 pagesAccounting Duality ConceptAfiqah AliaNo ratings yet

- Mr. Gatti's - Restaurant Trade Dress Complaint PDFDocument12 pagesMr. Gatti's - Restaurant Trade Dress Complaint PDFMark JaffeNo ratings yet

- SRADocument14 pagesSRAHarshada SinghNo ratings yet

- Cao 1 - 1996Document3 pagesCao 1 - 1996Jorelyn Rose OrlinNo ratings yet

- Company LawDocument15 pagesCompany Lawpreetibajaj100% (2)

- Chapter 3 Strategic Management Concepts and Cases 12th EditionDocument17 pagesChapter 3 Strategic Management Concepts and Cases 12th EditionOkaahlikeuangan100% (1)

- Hidden Costs of AccidentsDocument10 pagesHidden Costs of AccidentsNaga RajanNo ratings yet

- GROUP - E - Himalaya Bath SoapDocument6 pagesGROUP - E - Himalaya Bath SoapSK Sabbir AhmedNo ratings yet

- OpTransactionHistory02 04 2023 PDFDocument3 pagesOpTransactionHistory02 04 2023 PDFPranav TiwariNo ratings yet

- Google Analytics Study GuideDocument142 pagesGoogle Analytics Study Guiderahulmantri00No ratings yet

- 50 Best Sales Management Articles of The DecadeDocument23 pages50 Best Sales Management Articles of The DecadejairojcsfNo ratings yet

- SolidWorks Simulation Student Guide-CHTDocument42 pagesSolidWorks Simulation Student Guide-CHTdeity003No ratings yet

- Public Transportation: Introduction Current StatusDocument7 pagesPublic Transportation: Introduction Current Statusmerlin 1No ratings yet

- Ticket Ability PrechecksDocument3 pagesTicket Ability PrechecksDipesh Raj TuladharNo ratings yet

- SPP PRE-DESIGN SERVICES SCOPE AND COMPENSATIONDocument32 pagesSPP PRE-DESIGN SERVICES SCOPE AND COMPENSATIONJediDiah PogiNo ratings yet

- EE 481 - Research Paper Finalized)Document12 pagesEE 481 - Research Paper Finalized)Boom Phattaraphon HongsrisookNo ratings yet

- Revised Coursework 1-2015Document7 pagesRevised Coursework 1-2015RayNo ratings yet

- الحمار القارئ KutubDocument18 pagesالحمار القارئ KutubBet BetNo ratings yet

- Regular Time Table For Oct 2016 ExamDocument6 pagesRegular Time Table For Oct 2016 ExamAnurag SinghNo ratings yet

- Strategy Mapping ToolDocument15 pagesStrategy Mapping ToolXuan Hung100% (2)

- AFA Animal Production 9 Quarter 4 Module 4Document13 pagesAFA Animal Production 9 Quarter 4 Module 4Claes TrinioNo ratings yet

- APO LearningsDocument8 pagesAPO LearningsAnonymous aYTA0AgrNo ratings yet

- The Impact of Product Factors On The Consumer Satisfaction "Document111 pagesThe Impact of Product Factors On The Consumer Satisfaction "Mohammed LubNo ratings yet

- Business English For AccountingDocument7 pagesBusiness English For AccountingAnonymous 9phe9IbtNo ratings yet

- HRMagazine Jul 2011Document76 pagesHRMagazine Jul 2011Rajan DhandayudhapaniNo ratings yet

- Chapter - I Inroduction and Design of The Study: 1.1. Introduction To Online-BankingDocument65 pagesChapter - I Inroduction and Design of The Study: 1.1. Introduction To Online-BankingyuvashankarNo ratings yet

- OPERATIONS RESEARCH Assignment 1 Formulation of LPPDocument5 pagesOPERATIONS RESEARCH Assignment 1 Formulation of LPPManeesh K ChaudharyNo ratings yet