Professional Documents

Culture Documents

Case Study On SAPM

Uploaded by

ReetaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study On SAPM

Uploaded by

ReetaCopyright:

Available Formats

CASE STUDY ON SECURITY ANALYSIS & PORTFOLIO MANAGEMENT

MINICASE 1

Mr. Nitin Gupta had invested Rs.8 million each in Ashok Exports and Biswas Industries and Rs.

4 million in Cinderella Fashions, only a week before his untimely demise. As per his will this

portfolio of stocks were to be inherited by his wife alone. As the partition among the family

members had to wait for one year as per the terms of the will, the portfolio of shares had to be

maintained as they were for the time being. The will had stipulated that the job of administering

the estate for the benefit of the beneficiaries and partitioning it in due course was to be done by

the reputed firm of Chartered Accountants, Talwar Brothers. Meanwhile the widow of the

deceased was very eager to know certain details of the securities and had asked the senior partner

of Talwar Brothers to brief her in this regard. For this purpose the senior partner has asked you to

prepare a detailed note to him with calculations using CAPM, to answer the following possible

doubts.

1. What is the expected return and risk (standard deviation) of the portfolio?

2. What is the scope for appreciation in market price of the three stocks-are they overvalued

or undervalued?

You find that out the three stocks, your firm has already been tracking two viz. Ashok

Exports (A) and Biswas Industries (B)-their betas being 1.7 and 0.8 respectively. Further,

you have obtained the following historical data on the returns of Cinderella

Fashions(C):

Period Market return (%) Return on

Cinderella Fashions (%)

------------- ------------------------ ---------------

1 10 14

2 5 8

3 (2) (6)

4 (1) 4

5 5 10

6 8 11

7 10 15

On the future returns of the three stocks, you are able to obtain the following forecast from a

reputed firm of portfolio managers.

-------------------------------------------------------------------------------------------------------

State of the Probability Returns (in percentage)

Economy Treasury Ashok Biswas Cinderella Sensex

Bills Exports Industries Fashions

-------------------------------------------------------------------------------------------------------

Recession 0.3 7 5 15 (10) (2)

Normal 0.4 7 18 8 16 17

Boom 0.3 7 30 12 24 26

Required: Prepare your detailed note to the senior partner.

Prepared by: Mr. R A Khan, Visiting Faculty Page 1

MINICASE 2

Mr. Pawan Garg, a wealthy businessman, has approached you for professional advice on

investment. He has a surplus of Rs. 20 lakhs which he wishes to invest in share market.

Being risk averse by nature and a first timer to secondary market, he makes it very clear

that the risk should be minimum. Having done some research in this field, you recommend

to him a portfolio of two shares - stocks of an oil exploration company ONGD and an oil

marketing company BPDL. You tell him that both are reputed, government controlled

companies.

You have the following market data at your disposal.

Period Market return (%) Return (%) on

ONGD BPDL

-------- ------------- -------------------------------

1 10 18 8

2 12 16 10

3 8 12 14

4 -6 (12) 20

5 -4 -7 16

6 10 16 8

The current market price of a share of ONGD is Rs. 1200 and that of BPDL is Rs. 423.

On the future returns of the two stocks and the market, you are able to obtain the following

forecast from a reputed firm of portfolio managers.

-------------------------------------------------------------------------------------------------------

State of the Probability Returns (in percentage) on

Economy Treasury ONGD BPDL Market Index

Bills

-------------------------------------------------------------------------------------------------------

Recession 0.3 7 9 15 (2)

Normal 0.4 7 18 10 14

Boom 0.3 7 25 6 20

The firm also informs you that they had very recently made a study of the ONGD stock and

can advise that its beta is 1.65.

Mr. Garg requests you to answer the following questions:

a. What is the beta for BPDL stock?

b. What is the covariance of the returns on ONGD and BPDL? Use the forecasted returns to

calculate this.

c. If the forecasted returns on ONGD and BPDL are perfectly negatively correlated (ρ = -1),

what will be expected return from a zero risk portfolio?

d. What will be the risk and return of a portfolio consisting of ONGD and BPDL stocks in

equal proportions?

e. What is the scope for appreciation for the two stocks?

Prepared by: Mr. R A Khan, Visiting Faculty Page 2

You might also like

- Conflict ResolutionDocument48 pagesConflict ResolutionReeta100% (2)

- Risk Return AnalysisDocument108 pagesRisk Return AnalysisduraiworldNo ratings yet

- Investments Test 3 Study Guide (8-10)Document24 pagesInvestments Test 3 Study Guide (8-10)Lauren100% (2)

- Capital Asset Pricing Model Written ReportDocument7 pagesCapital Asset Pricing Model Written Reportgalilleagalillee0% (1)

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- FT 405 F Iapm at 2 March 2023 Batch 2021-23Document2 pagesFT 405 F Iapm at 2 March 2023 Batch 2021-23Tithi jainNo ratings yet

- 2decision Theory HODocument14 pages2decision Theory HOadesh guliaNo ratings yet

- Practice Questions For OBEDocument16 pagesPractice Questions For OBEJaihindNo ratings yet

- Security Analysis and Portfolio Management (Fiba732) Mba 3 SemesterDocument3 pagesSecurity Analysis and Portfolio Management (Fiba732) Mba 3 SemesterAnay BiswasNo ratings yet

- Mini-Case 1: Periods (Years Preceding The Current One) Returns (In %)Document1 pageMini-Case 1: Periods (Years Preceding The Current One) Returns (In %)wolayatkhanNo ratings yet

- 06april2023 India DailyDocument158 pages06april2023 India Dailyavinashpathak777No ratings yet

- Monthly Test - October 2021 Grade 9 (Cambridge) Business StudiesDocument6 pagesMonthly Test - October 2021 Grade 9 (Cambridge) Business StudiesMohamed MubarakNo ratings yet

- Punj Lloyd Result UpdatedDocument11 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- Yonus Brother GroupeDocument15 pagesYonus Brother Groupeasadkabir23No ratings yet

- Appendix 2 Assessment of Working Capital Requirement:: (A) Justification For Estimated / Projected SalesDocument55 pagesAppendix 2 Assessment of Working Capital Requirement:: (A) Justification For Estimated / Projected SaleskhetaramNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- BFD Test 1 With Solution Jun 2024 Sir Saud Tariq ST AcademyDocument7 pagesBFD Test 1 With Solution Jun 2024 Sir Saud Tariq ST Academyaimanraees10No ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Corporate FinanceDocument7 pagesCorporate Financeseyon sithamparanathanNo ratings yet

- IVRCL, 18th February, 2013Document11 pagesIVRCL, 18th February, 2013Angel BrokingNo ratings yet

- BMSSEM6OTRCENT2Document3 pagesBMSSEM6OTRCENT2Lipun SwainNo ratings yet

- Performance Highlights: NeutralDocument11 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Exide Industries: Running On Low ChargeDocument9 pagesExide Industries: Running On Low ChargeAnonymous y3hYf50mTNo ratings yet

- Business Studies 9 ........... (Cambridge) : Monthlytest October 2020Document7 pagesBusiness Studies 9 ........... (Cambridge) : Monthlytest October 2020Mohamed MubarakNo ratings yet

- Bir Form 1701 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2018Document5 pagesBir Form 1701 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2018lemor xalicaNo ratings yet

- JFM - Quarterly - Result - Preview Apr 18 EDEL 2 PDFDocument78 pagesJFM - Quarterly - Result - Preview Apr 18 EDEL 2 PDFRajesh KumarNo ratings yet

- f9 2010 June QDocument8 pagesf9 2010 June QAbid SiddiquiNo ratings yet

- Risk N ReturnDocument6 pagesRisk N ReturnRakesh Kr RouniyarNo ratings yet

- BKT ReportDocument18 pagesBKT Reportneelakanta srikarNo ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- IDFC First Bank - Initiating Coverage - 311020Document14 pagesIDFC First Bank - Initiating Coverage - 311020Rohit GuptaNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Practice QuestionsDocument10 pagesPractice QuestionsDana El SakkaNo ratings yet

- IVRCL Infrastructure: Performance HighlightsDocument12 pagesIVRCL Infrastructure: Performance HighlightsAngel BrokingNo ratings yet

- Cases Relating To Audit PlanningDocument5 pagesCases Relating To Audit PlanningRazib DasNo ratings yet

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- Market Outlook 18th January 2012Document7 pagesMarket Outlook 18th January 2012Angel BrokingNo ratings yet

- B1 B4 B5 MergedDocument64 pagesB1 B4 B5 MergedHussein AbdallahNo ratings yet

- Bajaj Auto: Uncertainty Priced In, Upgrade To BUYDocument8 pagesBajaj Auto: Uncertainty Priced In, Upgrade To BUYvipin51No ratings yet

- Lycopodium Completes Direct OFS For Arcadia Project: HighlightsDocument93 pagesLycopodium Completes Direct OFS For Arcadia Project: HighlightsE-25 Siddhesh BNo ratings yet

- Copra Questionnaire-2017Document17 pagesCopra Questionnaire-2017Addy BachillerNo ratings yet

- Market Outlook 19th January 2012Document8 pagesMarket Outlook 19th January 2012Angel BrokingNo ratings yet

- Projected Cash Flow Statements and Balance SheetDocument15 pagesProjected Cash Flow Statements and Balance Sheetcabbage_donNo ratings yet

- Disclosure Document For Portfolio Management ServicesDocument13 pagesDisclosure Document For Portfolio Management ServicesimjoycoolNo ratings yet

- Questions For Project Management Subject: Question 1 Case Study - CompulsoryDocument13 pagesQuestions For Project Management Subject: Question 1 Case Study - CompulsorySomnath KhandagaleNo ratings yet

- Peregrine CNC Decision CaseDocument6 pagesPeregrine CNC Decision CaseAsadMughalNo ratings yet

- Accountancy and Auditing-2007Document10 pagesAccountancy and Auditing-2007BabarNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- IL&FS Transportation Networks: Performance HighlightsDocument14 pagesIL&FS Transportation Networks: Performance HighlightsAngel BrokingNo ratings yet

- Kiri Industries Report With ValuationDocument6 pagesKiri Industries Report With ValuationDishant ShahNo ratings yet

- PM Quiz 1Document7 pagesPM Quiz 1Daniyal NasirNo ratings yet

- Market Outlook 4th April 2012Document4 pagesMarket Outlook 4th April 2012Angel BrokingNo ratings yet

- Investment Banking & Financial Services: An Event Study On Impact of Mergers and Acquisitions in Indian Banking SectorDocument29 pagesInvestment Banking & Financial Services: An Event Study On Impact of Mergers and Acquisitions in Indian Banking SectorAbhishek SinghNo ratings yet

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocument10 pagesAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarNo ratings yet

- Lecture ProfitabilityDocument42 pagesLecture ProfitabilityGLORIA GUINDOS BRETONESNo ratings yet

- Initiating Coverage - Sandhar Technologies - 26072021Document18 pagesInitiating Coverage - Sandhar Technologies - 26072021Chandrakumar KumarNo ratings yet

- Bir Form 1702 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2018Document5 pagesBir Form 1702 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2018Agnez FernandezNo ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- Cover Sheet: 1 3 5 J - P. Rizal S T - P Roject 4 QUE ZON CityDocument49 pagesCover Sheet: 1 3 5 J - P. Rizal S T - P Roject 4 QUE ZON CityDaniel ManalacNo ratings yet

- Sharekhan Top Picks: October 26, 2012Document7 pagesSharekhan Top Picks: October 26, 2012Soumik DasNo ratings yet

- A Profile of Banks 2005-06: Reserve Bank of IndiaDocument96 pagesA Profile of Banks 2005-06: Reserve Bank of IndialakshmimanipalNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Hostel InfoDocument1 pageHostel InfoReetaNo ratings yet

- MAT 070 Word Probs-AveragesDocument45 pagesMAT 070 Word Probs-AveragesReetaNo ratings yet

- Home SccinceDocument4 pagesHome SccinceReetaNo ratings yet

- MADocument2 pagesMAReetaNo ratings yet

- Img 20221230 151706Document1 pageImg 20221230 151706ReetaNo ratings yet

- OkCredit - CustomerStatement - 27 12 2022 - 12 01 2023Document2 pagesOkCredit - CustomerStatement - 27 12 2022 - 12 01 2023ReetaNo ratings yet

- CH 10Document19 pagesCH 10ReetaNo ratings yet

- Forwading ShiftingDocument1 pageForwading ShiftingReetaNo ratings yet

- Academic Calender For Session 2022-23 UPDATEDDocument3 pagesAcademic Calender For Session 2022-23 UPDATEDReetaNo ratings yet

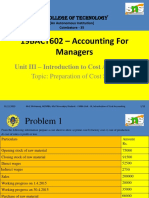

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDocument12 pages19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaNo ratings yet

- 3r ChapterDocument1 page3r ChapterReetaNo ratings yet

- January MessDocument1 pageJanuary MessReetaNo ratings yet

- TenseDocument1 pageTenseReetaNo ratings yet

- SSRN Id2820276Document11 pagesSSRN Id2820276ReetaNo ratings yet

- APU3141 OBT Paper 2016-2017 - 20170628104440Document1 pageAPU3141 OBT Paper 2016-2017 - 20170628104440ReetaNo ratings yet

- 17 PointDocument40 pages17 PointReetaNo ratings yet

- Class NotesDocument1 pageClass NotesReetaNo ratings yet

- NotesDocument1 pageNotesReetaNo ratings yet

- McqsDocument4 pagesMcqsaashir ch0% (1)

- State Bank & National Bank McqsDocument26 pagesState Bank & National Bank McqsNazim Shahzad100% (1)

- Market Efficiency and Empirical EvidenceDocument86 pagesMarket Efficiency and Empirical EvidenceVaidyanathan RavichandranNo ratings yet

- FIN450 - Portfolio Analysis: Suggested MaterialsDocument3 pagesFIN450 - Portfolio Analysis: Suggested MaterialsGia MinhNo ratings yet

- SFM Formula BookDocument29 pagesSFM Formula BookAstikNo ratings yet

- CAPM Numerical - With FormulaDocument8 pagesCAPM Numerical - With FormulaJaya RoyNo ratings yet

- Fra Merged PDFDocument336 pagesFra Merged PDFSubhadip SinhaNo ratings yet

- CH5 Tutorial ManagementDocument18 pagesCH5 Tutorial ManagementSam Sa100% (1)

- Dividend Discount Model in Valuation of Common StockDocument15 pagesDividend Discount Model in Valuation of Common Stockcaptain_bkx0% (1)

- BetaDocument4 pagesBetaDebashish SarangiNo ratings yet

- Corporate Finance and Investment Decisions and Strategies 9Th Edition Full ChapterDocument41 pagesCorporate Finance and Investment Decisions and Strategies 9Th Edition Full Chapterharriett.murphy498100% (24)

- Reillych08 10th Edition SMDocument14 pagesReillych08 10th Edition SMUYEN NGUYEN LE THUNo ratings yet

- Investments Global Edition 10Th Edition Bodie Test Bank Full Chapter PDFDocument68 pagesInvestments Global Edition 10Th Edition Bodie Test Bank Full Chapter PDFcurtisnathanvjyr100% (11)

- 10 Risk and Return - Student VersionDocument59 pages10 Risk and Return - Student VersionKalyani GogoiNo ratings yet

- CA SFM Chapter 6 CompilationDocument57 pagesCA SFM Chapter 6 CompilationRaul KarkyNo ratings yet

- Udemy Python Financial Analysis SlidesDocument35 pagesUdemy Python Financial Analysis SlidesWang ShenghaoNo ratings yet

- MK 1 Kuliah 2 Financial EnvironmentDocument80 pagesMK 1 Kuliah 2 Financial EnvironmentRizkyka Waluyo PutriNo ratings yet

- Solutions. Chapter. 9Document6 pagesSolutions. Chapter. 9asih359No ratings yet

- MID-TERM EXAM 1 Sem 1, 2023 24 - ValuationDocument2 pagesMID-TERM EXAM 1 Sem 1, 2023 24 - Valuationphamvi44552002No ratings yet

- Workshop Equity Securities STAFFDocument42 pagesWorkshop Equity Securities STAFFIshan MalakarNo ratings yet

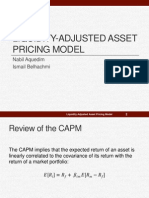

- Liquidity-Adjusted Asset Pricing ModelDocument16 pagesLiquidity-Adjusted Asset Pricing ModelismaelovNo ratings yet

- Chapter 12 Capital Market ResearchDocument28 pagesChapter 12 Capital Market Researchuci ratna wulandariNo ratings yet

- Portfolio Theory FormulasDocument6 pagesPortfolio Theory FormulasNuno LouriselaNo ratings yet

- CFA I QBank, Cost of CapitalDocument15 pagesCFA I QBank, Cost of CapitalGasimovskyNo ratings yet

- 2nd Exam FinmanDocument17 pages2nd Exam FinmanKate AngNo ratings yet

- Ch-10 (Return and Risk-The Capital Asset Pricing Model)Document29 pagesCh-10 (Return and Risk-The Capital Asset Pricing Model)Ahmed ShaanNo ratings yet

- Session 3 Notes and FormulaDocument14 pagesSession 3 Notes and Formulassg2No ratings yet