Professional Documents

Culture Documents

FT 405 F Iapm at 2 March 2023 Batch 2021-23

Uploaded by

Tithi jainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FT 405 F Iapm at 2 March 2023 Batch 2021-23

Uploaded by

Tithi jainCopyright:

Available Formats

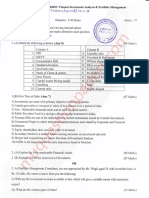

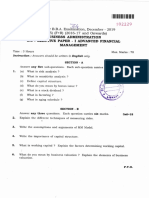

AFMR/ Assignment – AT2 /Investment Analysis and Portfolio Management / FT 405 F

March 2023, Batch 2021-23

MM: 40

Read the case carefully. And answers the questions given below.

Mr. Y, a wealthy businessman, has approached you for professional advice on investment.

He has a surplus of Rs. 20 lakhs which he wishes to invest in share market. Being risk

averse by nature and a first timer to secondary market, he makes it very clear that the risk

should be minimum. Having done some research in this field, you recommend to him a

portfolio of two shares - stocks of an oil exploration company ONGD and an oil marketing

company BPDL. You tell him that both are reputed, government controlled companies.

You have the following market data at your disposal.

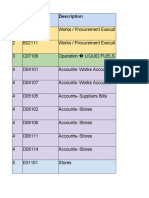

Period Market return (%) Return (%) on

ONGD BPDL

1 10 18 8

2 12 16 10

3 8 12 14

4 -6 (12) 20

5 -4 -7 16

6 10 16 8

The current market price of a share of ONGD is Rs. 1200 and that of BPDL is Rs. 423.

On the future returns of the two stocks and the market, you are able to obtain the

following data from a reputed firm of portfolio managers.

State of the Probability Returns (in percentage) on

Economy Treasury ONGD BPDL Market Index

Bills

Recession 0.3 7 9 15 (2)

Normal 0.4 7 18 10 14

Boom 0.3 7 25 6 20

The firm also informs you that they had very recently made a study of the ONGD stock

and can advise that its beta is 1.65.

Q.1 what do you understand by risk? Explain different aspects of a risk.

Q.2 a) Calculate covariance of the returns on ONGD and BPDL?

b) If the forecasted returns on ONGD and BPDL are perfectly positively correlated (ρ = 1),

what will be expected return from a zero risk portfolio?

Q3 a) Analyse the above case and give your opinion about risk and return of a portfolio

consisting of ONGD and BPDL stocks in equal proportions.

b) Analyse the various risk in the above case. What strategy you suggest for appreciation in

the ONGD and BPD stocks.

Questio Word limit Marks BL C PO PI

n O

1 200-250 2+8 Understanding 1 - -

2a - 8 Applying 2 2 2.2.3

2b - 7 Applying 2 2 2.2.3

3a 200-250 8 Analysing 3 2 2.4.1

3b 200-250 7 Analysing 3 2 2.4.2

You might also like

- TheBigBookOfTeamCulture PDFDocument231 pagesTheBigBookOfTeamCulture PDFavarus100% (1)

- 250 Conversation StartersDocument28 pages250 Conversation StartersmuleNo ratings yet

- Attitude Scale For Mental IllnessDocument6 pagesAttitude Scale For Mental IllnessSyed Faizan100% (7)

- THE PERFECT DAY Compressed 1 PDFDocument218 pagesTHE PERFECT DAY Compressed 1 PDFMariaNo ratings yet

- NBCC 2015 Seismic Design Examples in S-FRAME AnalysisDocument91 pagesNBCC 2015 Seismic Design Examples in S-FRAME AnalysisMike Smith100% (1)

- WTSDA2021 TSDBlack Belt ManualDocument160 pagesWTSDA2021 TSDBlack Belt ManualJesus HernandezNo ratings yet

- Tom Rockmore - Hegel's Circular EpistemologyDocument213 pagesTom Rockmore - Hegel's Circular Epistemologyluiz100% (1)

- MINDSET 1 EXERCISES TEST 1 Pendientes 1º Bach VOCABULARY AND GRAMMARDocument7 pagesMINDSET 1 EXERCISES TEST 1 Pendientes 1º Bach VOCABULARY AND GRAMMARanaNo ratings yet

- Packing List For GermanyDocument2 pagesPacking List For GermanyarjungangadharNo ratings yet

- Recruitment Process Outsourcing PDFDocument4 pagesRecruitment Process Outsourcing PDFDevesh NamdeoNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Case Study On SAPMDocument2 pagesCase Study On SAPMReetaNo ratings yet

- Mini-Case 1: Periods (Years Preceding The Current One) Returns (In %)Document1 pageMini-Case 1: Periods (Years Preceding The Current One) Returns (In %)wolayatkhanNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Tybms Sem5 Iapm Nov18Document3 pagesTybms Sem5 Iapm Nov18kratos42exeNo ratings yet

- Internal Audit-FY 22-23 PH IDocument577 pagesInternal Audit-FY 22-23 PH IanilNo ratings yet

- IDFC First Bank - Initiating Coverage - 311020Document14 pagesIDFC First Bank - Initiating Coverage - 311020Rohit GuptaNo ratings yet

- Fundamentals of Finance and Banking Section A - Compulsory: TH THDocument3 pagesFundamentals of Finance and Banking Section A - Compulsory: TH THShivamNo ratings yet

- Security Analysis and Portfolio Management (Fiba732) Mba 3 SemesterDocument3 pagesSecurity Analysis and Portfolio Management (Fiba732) Mba 3 SemesterAnay BiswasNo ratings yet

- Chinhoyi University of Technology: School of Business Sciences and ManagementDocument8 pagesChinhoyi University of Technology: School of Business Sciences and ManagementDanisa NdhlovuNo ratings yet

- ZuTUyraRFBJJZGiGLn15982462649080 2Document45 pagesZuTUyraRFBJJZGiGLn15982462649080 2Kassa HailuNo ratings yet

- Lycopodium Completes Direct OFS For Arcadia Project: HighlightsDocument93 pagesLycopodium Completes Direct OFS For Arcadia Project: HighlightsE-25 Siddhesh BNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- AlphaIndicator ECOH 20201031Document11 pagesAlphaIndicator ECOH 20201031hajdahNo ratings yet

- Dredging 2017Document62 pagesDredging 2017KartikNo ratings yet

- (ERRATUM II) Trimegah CF 20220918 MEDC - The Real O.GDocument53 pages(ERRATUM II) Trimegah CF 20220918 MEDC - The Real O.Gmery manurungNo ratings yet

- Today's Top Research Idea: Larsen & Toubro: Strong Operating Performance, Balance Sheet StrengthensDocument32 pagesToday's Top Research Idea: Larsen & Toubro: Strong Operating Performance, Balance Sheet StrengthensAshutosh PatidarNo ratings yet

- Market Snapshot: Today's Top Research Idea Health Insurance: Life Insurers To Sell Health Insurance: Lot of Ifs & ButsDocument22 pagesMarket Snapshot: Today's Top Research Idea Health Insurance: Life Insurers To Sell Health Insurance: Lot of Ifs & ButsVinayak ChennuriNo ratings yet

- Oil and Natural Gas CorporationDocument13 pagesOil and Natural Gas CorporationDHEERAJ RAJNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- Amf3872 2020 SumDocument7 pagesAmf3872 2020 SumKatieNo ratings yet

- 2015 Paper BankDocument8 pages2015 Paper BankBrian DhliwayoNo ratings yet

- 1H F2023 Results Presentation Final 09.03Document39 pages1H F2023 Results Presentation Final 09.03JEAN MICHEL ALONZEAUNo ratings yet

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Document9 pagesGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyNo ratings yet

- Economy (2011-22) Prelims QuestionsDocument46 pagesEconomy (2011-22) Prelims QuestionsTarget historyNo ratings yet

- The Influence of Fundamental and Macroeconomic Analysis On Stock PriceDocument13 pagesThe Influence of Fundamental and Macroeconomic Analysis On Stock PriceWiria SalvatoreNo ratings yet

- Singapore Daybreak: What's On The TableDocument8 pagesSingapore Daybreak: What's On The TablephuawlNo ratings yet

- 435 Problem Set 1Document3 pages435 Problem Set 1Md. Mehedi Hasan100% (1)

- Notes+ +12+june+2008Document13 pagesNotes+ +12+june+2008api-3862995No ratings yet

- VSA Prelim 2016 AnsDocument28 pagesVSA Prelim 2016 AnsPrisilia Trivita WijayaNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Analysis of Stocks of Small Companies: Amit V. Kanneshwar, F2, SS 08 - 10, IIPM BangaloreDocument17 pagesAnalysis of Stocks of Small Companies: Amit V. Kanneshwar, F2, SS 08 - 10, IIPM BangalorekanneamitNo ratings yet

- Take Home Pack GR 8 EMS T4Document14 pagesTake Home Pack GR 8 EMS T4emmanuelmutemba919No ratings yet

- Morning India 20210330 Mosl Mi Pg018 2021-03-30Document18 pagesMorning India 20210330 Mosl Mi Pg018 2021-03-30vikalp123123No ratings yet

- ECF1100 Individual Assignment 2 Sem 1 2022Document4 pagesECF1100 Individual Assignment 2 Sem 1 2022wesley hudsonNo ratings yet

- India Daily: October 21, 2011Document70 pagesIndia Daily: October 21, 2011nisargstarNo ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- Trimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainDocument8 pagesTrimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainHeryadi IndrakusumaNo ratings yet

- Man Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedDocument5 pagesMan Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedshahavNo ratings yet

- For Filing - Emp 1h 2022 Complete SetDocument45 pagesFor Filing - Emp 1h 2022 Complete SetBORDALLO JAYMHARKNo ratings yet

- 06april2023 India DailyDocument158 pages06april2023 India Dailyavinashpathak777No ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversitySaR aSNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityGrishma BhindoraNo ratings yet

- Presentasi-Distribution Requirement PlanningDocument19 pagesPresentasi-Distribution Requirement PlanningvanielysNo ratings yet

- DECISION ANALYSIS ProblemsDocument10 pagesDECISION ANALYSIS ProblemsSoumendra RoyNo ratings yet

- Sd16 Hybrid p4 QDocument12 pagesSd16 Hybrid p4 QQasim AliNo ratings yet

- December 2016 QDocument7 pagesDecember 2016 QNirmal ShresthaNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- Morning - India 20230410 Mosl Mi PG038Document38 pagesMorning - India 20230410 Mosl Mi PG038Aditya HalwasiyaNo ratings yet

- Punj Lloyd Result UpdatedDocument11 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- LG Balakrishnan Bros - HSL - 180923 - EBRDocument11 pagesLG Balakrishnan Bros - HSL - 180923 - EBRSriram RanganathanNo ratings yet

- IPO ExpensesDocument5 pagesIPO ExpensesPallavi GargNo ratings yet

- Economy (2011-21) Prelims QuestionsDocument36 pagesEconomy (2011-21) Prelims QuestionsChinmay JenaNo ratings yet

- Morning News 2019-05-16-1Document3 pagesMorning News 2019-05-16-1Don HanjarNo ratings yet

- Analysis of DLF (FINAL)Document31 pagesAnalysis of DLF (FINAL)Sumit SharmaNo ratings yet

- Market Outlook 26th July 2011Document7 pagesMarket Outlook 26th July 2011Angel BrokingNo ratings yet

- Investor Digest: Equity Research - 20 March 2024Document5 pagesInvestor Digest: Equity Research - 20 March 2024brian butarNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Futures 0Document10 pagesFutures 0Tithi jainNo ratings yet

- FT 405 H OD AT2 MARCH 2023 Batch 2021-23Document2 pagesFT 405 H OD AT2 MARCH 2023 Batch 2021-23Tithi jainNo ratings yet

- 160 P16MC42 2020061304365276Document11 pages160 P16MC42 2020061304365276Tithi jainNo ratings yet

- FT 401 C BL AT2 MARCH 2023 Batch 2021-23Document2 pagesFT 401 C BL AT2 MARCH 2023 Batch 2021-23Tithi jainNo ratings yet

- FT 405 H OD AT3 MARCH 2023 Batch 2021-23Document2 pagesFT 405 H OD AT3 MARCH 2023 Batch 2021-23Tithi jainNo ratings yet

- FT 401 C BL AT3 MARCH 2023 Batch 2021-23Document1 pageFT 401 C BL AT3 MARCH 2023 Batch 2021-23Tithi jainNo ratings yet

- SCM AT2 and AT3 December 2022Document9 pagesSCM AT2 and AT3 December 2022Tithi jainNo ratings yet

- Hrda At2..at3Document5 pagesHrda At2..at3Tithi jainNo ratings yet

- IrlDocument1 pageIrlTithi jainNo ratings yet

- Broad-Based Growth VitalDocument3 pagesBroad-Based Growth VitalTithi jainNo ratings yet

- HrdaDocument5 pagesHrdaTithi jainNo ratings yet

- Course Information2009 2010Document4 pagesCourse Information2009 2010shihabnittNo ratings yet

- Pamphlet On Arrangement of Springs in Various Casnub Trolleys Fitted On Air Brake Wagon PDFDocument9 pagesPamphlet On Arrangement of Springs in Various Casnub Trolleys Fitted On Air Brake Wagon PDFNiKhil GuPtaNo ratings yet

- Masters Thesis Benyam 2011Document156 pagesMasters Thesis Benyam 2011TechBoy65No ratings yet

- RS577 - Civil Engineering Curriculum 2073Document90 pagesRS577 - Civil Engineering Curriculum 2073mahesh bhattaraiNo ratings yet

- VRF-SLB013-EN - 0805115 - Catalogo Ingles 2015 PDFDocument50 pagesVRF-SLB013-EN - 0805115 - Catalogo Ingles 2015 PDFJhon Lewis PinoNo ratings yet

- Compal Confidential: Ziwb2/Ziwb3/Ziwe1 DIS M/B Schematics DocumentDocument56 pagesCompal Confidential: Ziwb2/Ziwb3/Ziwe1 DIS M/B Schematics DocumentSuhpreetNo ratings yet

- User Manual PocketBookDocument74 pagesUser Manual PocketBookmisu2001No ratings yet

- Ageing World ReportDocument4 pagesAgeing World Reporttheresia anggitaNo ratings yet

- Transformational Leadership in The UmcDocument17 pagesTransformational Leadership in The Umcapi-202352366No ratings yet

- Ip TunnelingDocument15 pagesIp TunnelingBon Tran HongNo ratings yet

- Contents of HvacDocument2 pagesContents of Hvaclijo johnNo ratings yet

- Introduction of Woman Role in SocietyDocument12 pagesIntroduction of Woman Role in SocietyApple DogNo ratings yet

- Et Iso 12543 4 2011Document16 pagesEt Iso 12543 4 2011freddyguzman3471No ratings yet

- Guru ShishyaDocument3 pagesGuru ShishyacktacsNo ratings yet

- Jo - Mc.Donough. ESP in Perspective A Practical Guide. London. Collin ELT. 1984. p.3Document6 pagesJo - Mc.Donough. ESP in Perspective A Practical Guide. London. Collin ELT. 1984. p.3Falihatul Kholidiyah100% (1)

- Spring Newsletter 2014-LockedDocument4 pagesSpring Newsletter 2014-Lockedapi-244488788No ratings yet

- Ashfaque Ahmed-The SAP Materials Management Handbook-Auerbach Publications, CRC Press (2014)Document36 pagesAshfaque Ahmed-The SAP Materials Management Handbook-Auerbach Publications, CRC Press (2014)surajnayak77No ratings yet

- 12.3 What Is The Nomenclature System For CFCS/HCFCS/HFCS? (Chemistry)Document3 pages12.3 What Is The Nomenclature System For CFCS/HCFCS/HFCS? (Chemistry)Riska IndriyaniNo ratings yet

- BraunDocument69 pagesBraunLouise Alyssa SazonNo ratings yet

- My LH Cover LetterDocument3 pagesMy LH Cover LetterAkinde FisayoNo ratings yet