Professional Documents

Culture Documents

5d2dbd383497c-Home Buying Checklist 2019

Uploaded by

ezzularabOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5d2dbd383497c-Home Buying Checklist 2019

Uploaded by

ezzularabCopyright:

Available Formats

Home-buying:

step-by-step

1 Save for a deposit: use the Which?

mortgage deposit calculator

(which.co.uk/depositcalculator) to

6 View properties in person: it’s

vital that you don’t purely judge

properties on their online listings. Get

11 Hire a removals company:

get at least three quotes. You

can use Which? Trusted Traders

work out how much you’ll need to out and about to get a true sense of (trustedtraders.which.co.uk) to find a

save and how long it’ll take. what you want. reliable firm near you.

If you’re a first-time buyer, a Help Download our property-viewing

to Buy or lifetime Isa could enable

you to claim a 25% top-up from the

government.

checklist (which.co.uk/viewingchecklist)

to make sure you check all the

essentials before making an offer.

12 Arrange home insurance:

you’ll need buildings insurance

in place from the day you exchange.

Find out the best and worst home

2 Find out how much

mortgage you can borrow:

use our calculator (which.co.uk/

7 Make an offer: work out how

much to offer based on recent

selling prices for similar homes in

insurance companies at which.co.uk/

homeinsurancereviews.

mortgagebudget) to get a rough idea,

or speak to a mortgage adviser for an

exact figure.

the same neighbourhood and

whether you’ll need to carry out

repairs to the property.

13 Exchange contracts: your

and the seller’s solicitors

will swap signed contracts and

Make your offer to the estate you’ll pay the deposit (which.co.uk/

3 Research your chosen area:

our area comparison tool (which.

agent, who will pass it on to the

seller. If your first offer is rejected,

exchangecomplete).

co.uk/areacompare) shows you how

your chosen area compares on factors

such as house prices, Ofsted ratings

you may have to negotiate - play it

cool and keep your top budget

private (which.co.uk/makeanoffer).

14 Complete: your mortgage and

deposit will be transferred to

the seller and then you can collect

and happiness. your new house keys from your estate

4 Apply for a mortgage

agreement in principle (AIP):

8 Apply for a mortgage: a whole-

of-market mortgage broker can

recommend the best lenders and deal

agent and celebrate!

this is a confirmation from a lender for you and help you apply.

that they would, in principle, be willing

to lend you a certain amount. It can

make you a more attractive buyer,

as it shows the seller you can afford

9 Find someone to do the legal

work: you’ll need to appoint

a conveyancer or property solicitor

the property. - ask friends or look online for

The AIP doesn’t have to come from recommendations, and don’t make

your bank or building society. An your choice based on price alone.

independent mortgage broker can

help you apply.

10 Get a property survey:

hire a Rics-accredited or

SOLD

5 Start house-hunting: register

with several estate agents in your

chosen area(s) and set up email alerts

RPSA surveyor to check for serious

structural problems before you buy

the property. If it unearths problems,

on online portals such as Rightmove you might want to ask the seller to fix

and Zoopla. them or reduce your offer.

You might also like

- Lease Options: Own A Property For £1!: Property Investor, #5From EverandLease Options: Own A Property For £1!: Property Investor, #5No ratings yet

- How To Be A Landlord Advice GuideDocument30 pagesHow To Be A Landlord Advice GuideAbdul Malik YacobNo ratings yet

- Guide to Getting Started in Buy-to-Let InvestingDocument7 pagesGuide to Getting Started in Buy-to-Let InvestingMrSomnambululNo ratings yet

- DLUHC How To Rent Oct2023Document19 pagesDLUHC How To Rent Oct2023Vali MatauNo ratings yet

- Secrets to Making Money on Distressed Properties: Property Investor, #4From EverandSecrets to Making Money on Distressed Properties: Property Investor, #4No ratings yet

- 23 Biggest Mistakes Landlords MakeDocument6 pages23 Biggest Mistakes Landlords Make2008gandhi100% (1)

- Rent To Own A HomeDocument55 pagesRent To Own A HomeShane BeardNo ratings yet

- How To Rent Guide 2023Document18 pagesHow To Rent Guide 2023tarek.hamid12No ratings yet

- How To Rent in UKDocument11 pagesHow To Rent in UKNaenNo ratings yet

- The Real Estate Law Summit: Negotiating Agency and Commission AgreementsDocument24 pagesThe Real Estate Law Summit: Negotiating Agency and Commission Agreementsskshimla1No ratings yet

- Rental AssurancesDocument7 pagesRental AssurancesRobert NixonNo ratings yet

- It's Not All About The Rent: A Tenant's Guide to Cracking The Commercial Real Estate Lease CodeFrom EverandIt's Not All About The Rent: A Tenant's Guide to Cracking The Commercial Real Estate Lease CodeNo ratings yet

- How To Rent July 2019Document13 pagesHow To Rent July 2019Iuliana BerianuNo ratings yet

- Guide To Staircasing Amended Jan 20 V 1Document12 pagesGuide To Staircasing Amended Jan 20 V 1Ollie GreenNo ratings yet

- 10 Costly Mistakes Tenants Make When Negotiating a Commercial Lease or RenewalFrom Everand10 Costly Mistakes Tenants Make When Negotiating a Commercial Lease or RenewalNo ratings yet

- Commercial Landlord-Tenant LawDocument11 pagesCommercial Landlord-Tenant LawVikas ChhabriaNo ratings yet

- Real Estate Investing – Flipping Houses: Complete Beginner’s Guide on How to Buy, Rehab, and Resell Residential Properties the Right Way for Profit. Achieve Financial Freedom with This Proven MethodFrom EverandReal Estate Investing – Flipping Houses: Complete Beginner’s Guide on How to Buy, Rehab, and Resell Residential Properties the Right Way for Profit. Achieve Financial Freedom with This Proven MethodNo ratings yet

- The Landlord Learning Curve: 50 Easy Ways to Improve Your Property Management & Boost Your Rental Property ProfitsFrom EverandThe Landlord Learning Curve: 50 Easy Ways to Improve Your Property Management & Boost Your Rental Property ProfitsRating: 4.5 out of 5 stars4.5/5 (3)

- How To Buy A House in Malaysia in 10 StepsDocument4 pagesHow To Buy A House in Malaysia in 10 StepsJunaidahMubarakAliNo ratings yet

- First-Time Landlords GuideDocument15 pagesFirst-Time Landlords GuideWaseem KhanNo ratings yet

- REMAX Home Buyers GuideDocument14 pagesREMAX Home Buyers GuideGeorgeNo ratings yet

- PLP REVISION VC A&ODocument23 pagesPLP REVISION VC A&OHedley Horler (scribd)No ratings yet

- Your Home Buying GuideDocument13 pagesYour Home Buying Guideapi-182635653No ratings yet

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- The Successful Landlord's Guide to Resolving Disputes and Avoiding Costly MistakesDocument18 pagesThe Successful Landlord's Guide to Resolving Disputes and Avoiding Costly MistakesKnownUnknowns-XNo ratings yet

- PLP Freeholds PDFDocument22 pagesPLP Freeholds PDFHedley Horler (scribd)No ratings yet

- LivingOffYourPaycheck 66WaysToSaveMoney Handout 1Document8 pagesLivingOffYourPaycheck 66WaysToSaveMoney Handout 1Brenda L.No ratings yet

- Commercial Real Estate TermsDocument30 pagesCommercial Real Estate TermsAtul SharmaNo ratings yet

- Rental Property Management for Beginners: The Ultimate Guide to Manage Properties. Start Creating Passive Income Using Successful Real Estate Management Strategies.From EverandRental Property Management for Beginners: The Ultimate Guide to Manage Properties. Start Creating Passive Income Using Successful Real Estate Management Strategies.No ratings yet

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsFrom EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNo ratings yet

- Summary of Brandon Turner and Heather Turner's The Book on Managing Rental PropertiesFrom EverandSummary of Brandon Turner and Heather Turner's The Book on Managing Rental PropertiesNo ratings yet

- First Time Buyers GuideDocument38 pagesFirst Time Buyers GuideJamal AbunahelNo ratings yet

- Step by Step Guide to Taking in a LodgerDocument5 pagesStep by Step Guide to Taking in a LodgersarahjamessbNo ratings yet

- Summary of Sam Liebman's Harvard Can't Teach What You Learn from the StreetsFrom EverandSummary of Sam Liebman's Harvard Can't Teach What You Learn from the StreetsNo ratings yet

- Leases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesFrom EverandLeases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesNo ratings yet

- Focus On Personal Finance 5Th Edition Kapoor Test Bank Full Chapter PDFDocument67 pagesFocus On Personal Finance 5Th Edition Kapoor Test Bank Full Chapter PDFmiguelstone5tt0f100% (12)

- Buying A Property in SwedenDocument12 pagesBuying A Property in SwedenmailprasanaNo ratings yet

- 52 Essential Real Estate Terms You Should Know - OpendoorDocument23 pages52 Essential Real Estate Terms You Should Know - OpendoorAtul SharmaNo ratings yet

- 8 Essential Steps Start Up Dental PracticeDocument10 pages8 Essential Steps Start Up Dental PracticeVasile FlorinNo ratings yet

- Passive Profits: Do It Once And Profit Forever: Financial seriesFrom EverandPassive Profits: Do It Once And Profit Forever: Financial seriesNo ratings yet

- Living in SwitzerlandDocument28 pagesLiving in SwitzerlandbioNo ratings yet

- Summary of Brian Murray & Brandon Turner's The Multifamily Millionaire, Volume IIFrom EverandSummary of Brian Murray & Brandon Turner's The Multifamily Millionaire, Volume IINo ratings yet

- Conveyancing Guide v3Document4 pagesConveyancing Guide v3Mícheál O'DowdNo ratings yet

- First Time Buyer Guide Int PDFDocument18 pagesFirst Time Buyer Guide Int PDFTausifNo ratings yet

- 10 Deadly MistakesDocument2 pages10 Deadly MistakesRoy GarciaNo ratings yet

- How To Rent: The Checklist For Renting in EnglandDocument8 pagesHow To Rent: The Checklist For Renting in EnglandAnonymous BYRr45ENo ratings yet

- Home Owning, Renting, and Home PurchaseDocument5 pagesHome Owning, Renting, and Home PurchaseFeven MezemirNo ratings yet

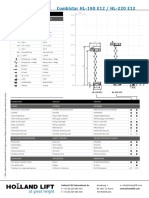

- Technical Characteristics 2020 ENDocument1 pageTechnical Characteristics 2020 ENezzularabNo ratings yet

- Flyer PASCHAL Ident ENDocument2 pagesFlyer PASCHAL Ident ENezzularabNo ratings yet

- Tunnel System DokaCCDocument104 pagesTunnel System DokaCCezzularabNo ratings yet

- Load Capacity of Alkus Sheets Based on Span LengthDocument3 pagesLoad Capacity of Alkus Sheets Based on Span LengthezzularabNo ratings yet

- Holland Lift 220 ElectricDocument3 pagesHolland Lift 220 ElectricezzularabNo ratings yet

- FDP D Euro PropsDocument6 pagesFDP D Euro PropsezzularabNo ratings yet

- Mabey Propping and Jacking Brochure WebDocument27 pagesMabey Propping and Jacking Brochure WebezzularabNo ratings yet

- Doka Circular Formwork enDocument2 pagesDoka Circular Formwork enezzularabNo ratings yet

- Appendix L Temporary Works Coordinator Training Course Aug19Document14 pagesAppendix L Temporary Works Coordinator Training Course Aug19ezzularabNo ratings yet

- Wilts & Berks Canal Trust Temporary Works ProcedureDocument21 pagesWilts & Berks Canal Trust Temporary Works ProcedureezzularabNo ratings yet

- MANAGEMENT OF TEMP WORKSDocument14 pagesMANAGEMENT OF TEMP WORKSezzularab100% (1)

- Section 2: Procedural Control of Temporary Works: 6 ProceduresDocument38 pagesSection 2: Procedural Control of Temporary Works: 6 Proceduresezzularab100% (3)

- 01 Soldier SystemDocument26 pages01 Soldier SystemezzularabNo ratings yet

- EngiLab Frame.2D User ManualDocument234 pagesEngiLab Frame.2D User ManualezzularabNo ratings yet

- Rapid Column ArmDocument4 pagesRapid Column ArmezzularabNo ratings yet

- TWf2019.03 - Temporary Works Procedure - 8 December 2019 - FINAL1Document22 pagesTWf2019.03 - Temporary Works Procedure - 8 December 2019 - FINAL1ezzularabNo ratings yet

- Welding ProcedureDocument2 pagesWelding ProcedurefallalovaldesNo ratings yet

- Firmenflyer Blickle-ENDocument2 pagesFirmenflyer Blickle-ENezzularabNo ratings yet

- RMD Kwikform India: Formwork ServicesDocument10 pagesRMD Kwikform India: Formwork ServicesezzularabNo ratings yet

- Visa Security Infographic 102314 JC v30Document1 pageVisa Security Infographic 102314 JC v30ezzularabNo ratings yet

- Airlines GraphicDocument1 pageAirlines GraphicezzularabNo ratings yet

- Abu Dhabi To Dubai Link Bridges: Case StudyDocument1 pageAbu Dhabi To Dubai Link Bridges: Case StudyezzularabNo ratings yet

- Al Baleed Resort: Case StudyDocument1 pageAl Baleed Resort: Case StudyezzularabNo ratings yet

- Alcoa Insert 5052and6061 FINALDocument2 pagesAlcoa Insert 5052and6061 FINALezzularabNo ratings yet

- Bringing Luxury Residential Complex to Life with FormworkDocument1 pageBringing Luxury Residential Complex to Life with FormworkezzularabNo ratings yet

- Lafarge Handbook PDFDocument92 pagesLafarge Handbook PDFezzularabNo ratings yet

- Construction FormworkDocument60 pagesConstruction FormworkDev Bhangui100% (5)

- Lafarge Handbook PDFDocument92 pagesLafarge Handbook PDFezzularabNo ratings yet

- Welding ProcedureDocument2 pagesWelding ProcedurefallalovaldesNo ratings yet

- Dynacon Systems Ar 2017 5323650317Document101 pagesDynacon Systems Ar 2017 5323650317murali_pmp1766No ratings yet

- Allied Banking Corporation v. MacamDocument2 pagesAllied Banking Corporation v. MacamJay jogs100% (2)

- IRDA Project - Akanksha - LLMDocument9 pagesIRDA Project - Akanksha - LLMPULKIT KHANDELWALNo ratings yet

- Financial Ratios Topic (MFP 1) PDFDocument9 pagesFinancial Ratios Topic (MFP 1) PDFsrinivasa annamayyaNo ratings yet

- Final PPT of IndusInd BankDocument14 pagesFinal PPT of IndusInd BanktruptiNo ratings yet

- Hever AnsDocument4 pagesHever AnsJohn WickNo ratings yet

- Major and Minor Programmes 2022-23Document11 pagesMajor and Minor Programmes 2022-23Kelly lamNo ratings yet

- CGPA 3.36/4 Indian School of Business GMAT 710 Strategy and FinanceDocument1 pageCGPA 3.36/4 Indian School of Business GMAT 710 Strategy and FinanceBhawika ChhawchhariaNo ratings yet

- BB 3 Futures & Options Hull Chap 3Document31 pagesBB 3 Futures & Options Hull Chap 3winfldNo ratings yet

- Bond ValuationDocument22 pagesBond Valuationganesh pNo ratings yet

- Strategy Note - Must-Own Stocks For Long-Term InvestingDocument139 pagesStrategy Note - Must-Own Stocks For Long-Term InvestingtenglumlowNo ratings yet

- World Country Indicator Data ListDocument161 pagesWorld Country Indicator Data ListPrzemysław BanaśNo ratings yet

- Chapter 2 The Accounting EquationDocument15 pagesChapter 2 The Accounting EquationDahlia Fernandez Bt Mohd Farid FernandezNo ratings yet

- First Draft 001Document44 pagesFirst Draft 001robbymalcolm18No ratings yet

- Assignment 3Document3 pagesAssignment 3Nurul FitriNo ratings yet

- IS-LM (Session 6, 7 & 8)Document23 pagesIS-LM (Session 6, 7 & 8)fdjuNo ratings yet

- Akl Resume CH.5Document3 pagesAkl Resume CH.5cindy vica azizahNo ratings yet

- Rural Consumer Perceptions of Insurance Companies in LudhianaDocument92 pagesRural Consumer Perceptions of Insurance Companies in Ludhianarachitgoyal20No ratings yet

- Muzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Document25 pagesMuzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Muzammil QureshiiNo ratings yet

- How to Redeem Savings Bonds or NotesDocument3 pagesHow to Redeem Savings Bonds or NotesShevis Singleton Sr.100% (2)

- Balance Sheet and Income Statement AnalysisDocument9 pagesBalance Sheet and Income Statement AnalysisHarshit MalviyaNo ratings yet

- Dax PDFDocument64 pagesDax PDFpiyushNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasMHILET BasanNo ratings yet

- LDI Explained - 2017 FinalDocument44 pagesLDI Explained - 2017 Finaladonettos4008No ratings yet

- Uganda Implementing An IFMSDocument6 pagesUganda Implementing An IFMSkhan_sadi100% (1)

- Optional Riders Provide Critical Illness and Disability CoverageDocument2 pagesOptional Riders Provide Critical Illness and Disability Coverageemaraty khNo ratings yet

- Volatility Contraction Pattern (VCP)Document5 pagesVolatility Contraction Pattern (VCP)Steve HatolNo ratings yet

- ATEINO BSPlanDocument35 pagesATEINO BSPlanSnev EvansNo ratings yet

- Partnership Accounting ReviewerDocument10 pagesPartnership Accounting ReviewerJEFFERSON CUTENo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet