Professional Documents

Culture Documents

Magarao Executive Summary 2021

Magarao Executive Summary 2021

Uploaded by

Yeonjin C. Choi0 ratings0% found this document useful (0 votes)

16 views5 pagesOriginal Title

Magarao Executive Summary 2021 (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views5 pagesMagarao Executive Summary 2021

Magarao Executive Summary 2021

Uploaded by

Yeonjin C. ChoiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

EXECUTIVE SUMMARY

A, INTRODUCTION

The Municipality of Magarao is a 4" class, partially-urban municipality founded in

1570 with a population of 26,742 as of the 2020 census. The Municipality is spread out

over an area of 44,97 square kilometers, yielding a density of around 595 people per square

kilometer. The township is included in the Third Legislative District of the Province of

Camarines Sur and composed of 15 barangays,

Audit Methodology and Scope of Audit

The Financial, Compliance, Project Evaluation and Revenue audit conducted

covered the accounts and operations of the Municipality of Magarao, Camarines Sur for all

funds for the period January 1 to December 31, 2021

The audit was conducted to ascertain the propriety of financial transactions and

compliance of the agency with prescribed rules and regulations. It was also made to

ascertain the accuracy of financial records and reports, as well as the fairness of the

presentation of the financial statements.

‘The audit was focused on the different audit thrusts/areas required by the Local

Government Sector of the Commission.

B, FINANCIAL HIGHLIGHTS

B.1 Financial Position and Performance

Financial Position Highlights

20,000,000.00 s

]

200,000,000.00 _—

150,000,000 97,897.80. 4

100,000,000.00 058.95

50,000,000.00 538.85.

40g

0.00 — - -

Assets Liabilities Government Equity

=CY¥ 2021 CY 2020

Assets increased from P192,197,897.80 to P201,184,122.22 in CY 2021, while

liablity also decreased from PS50,106,838.85 to P40,913,495.38. Moreover, equity

increased from P142,091,058.95 to P160,270,626.84

Financial Performance Highlights

120,000,000,00 eee |

100,000,000.00. |"

'80,000,000,00 jo31,491 |

60,000,000.00 156,921.79.

845

40,000,000.00

20,000,000.00 2

mek ai a 19.89

Total Income Total Expenditures Net Surplus,

mcy2021 mcy 2020

‘On the other hand, income increased from P105,93 1,749.89 to P106, 134,056.91, while

expenses decreased from P87,756,921.70 to P84,544,423,38, Also, Net Surplus increased

from P17,833,719.89 to P21,133,633.53.

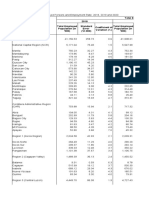

B.2 Sources and Application of Funds

In Philippine Peso | %or

Particulars Increase/ | Increase

CY 2021 CY 2020 (Decrease) (Decrease)

General Fund E

Allotments 73,858,850.40 | _ 74,313,724.00| _(454,873.60)|__(1%)_|

Obligations 69,350,884.03 66,861,777.13 | 2,489.106.90 4%

Balance 4,507,966.37 | __7,451,946.87 | (2,943,980.50) | _ (40%)

Special Education Fund

Allotments 835,805.92 805,092.40[ _30,713.52[ 4%

Obligations 819,514.21 718,146.41 | 101,367.80] 14%

Balance 16,291.71 86,945.99 | (70,654.28) | (81%) _|

B.3 Major Program/Projects/Activities undertaken in CY 2010

Some of the major projects reported as implemented by LGU Magarao during the

year consisted of various infrastructure projects totaling P23,191,099.11

Completed projects of the LGU were not all validated as to existence by the Au

Team due to time constraint. Our audit was limited only to available records and

documents submitted to the Office of the Auditor.

AU

‘OR’S OPINION ON THE FINANCIAL STATEMENTS

We rendered a qualified opinion on the fairness of the presentation of the financial

statements as of December 31, 2021 because the existence, completeness and accuracy of

Property, Plant and Equipment (PPE) accounts could not be ascertained due to

unreconciled balance between the agency books and Report on Physical Count of Property,

Plant and Equipment (RPCPPE) amounting to P158,997,45 1.02.

D. SUMMARY or SIGNIFICANT. OBSERVATIONS AND

RECOMMENDATIONS

For the exception mentioned earlier, we recommended that Management: a) direct

the Property Custodian to maintain individual property card for all PPE owned by the

LGU; b) require the Municipal Accountant to maintain a complete and updated PPELC; c)

instruct the Municipal Engineer to provide the Municipal Accountant the complete

description and cost segregation of road components for road projects, d) instruct the

Inventory Committee to conduct an inventory and submit the complete Report on Physical

Count of Property, Plant and Equipment (RPCPPE); and e) instruct the Muni

Accountant to prepare an updated lapsing schedule.

The Audit Team has communicated the observations and recommendations with

the Auditee through the issuance of Audit Observation Memorandum (AOMs) and

discussed them with agency officials during the exit conference conducted on June 10,

2022. Their comments and explanations were incorporated in the report, where

appropriate.

The following are the significant observations together with the corresponding

recommendations:

1, Government Service Insurance System (GSIS) contributions, loan

amortizations and the employees’s loan amortizations deducted from

employees’ salaries with net amount of 751,440.80 were either

uunreconciled and/or unremitted due to lack of separation of duties

We recommended that management: a) separate the offices in charge of the

preparation of payroll deductions and remittances, b) through Accounting

Office to reconcile the contributions and loan amortizations deductions and

remittances, and c) assign the Head of Office to be in charge in approving

employee requests related to the deferment of employee's salary deduction of

Joan amortizations

iii

2. The Local Development Project on livelihood amounting to P2,691,520.00

was not properly implemented and evaluated

We recommended that management: a) provide the additional supporting

documents for the discrepancy noted between the number of quantity purchased

and distributed and the additional supporting IDs for recipients that did not

submit their ID's; and b) ensure proper planning, implementation and

evaluation of the projects funded by 20% LDF.

3. Several disbursements for COVID-19 related transactions amounting to

P1,260,544.00 were made thru reimbursements.

We recommended that management require the Municipal Accountant, the

Municipal Treasurer and all other officials concerned to ensure that the LGU

official/s discontinue or refrain from the practice of procuring goods without

following the procurement law and to stop the practice of payment through

reimbursements and ensure that taxes are appropriately withheld on all

‘government money payments,

4, Procurement of 670 sacks of rice and other gocds charged against the

DRRM Funds amounting to P2,226,313.08 could not be ascertained if

distributed to disaster related activities due to non-submission of complete

distribution list

We recommended that management require the: a) municipal Accountant

and the LDRRM Officer to strictly adhere to the provision of NDRRMC-DBM-

DILG Joint Memorandum Circular No, 2013-1 and utilize the fund that support

disaster risk management activities such as, disaster prevention and mitigation,

disaster preparedness, disaster response and disaster rehabilitation and

recovery; and b) LDRRM Officer to submit Distribution List for goods and rice

distributed to each recipient with complete details as to name, address, number

of kilos, purpose and date given.

5. The non-application for insurance policy of DRRM vehicle for CY 2020-

2021 resulted in incurrence of unavoidable expenses amounting to

P400,000.00, not in keeping with COA Circular No. 92-390, thus entailing

additional cost for repair of damaged vehicle

We recommend that the Management: a) regularly monitor the expiration of

insurance policy for all properties insured; b) ensure that all documents

submitted to the Team are duly filled out and supporting documents were

attached prior to payments thereof for consideration in audit; and explain why

no insurance was procured for the vehicle herein mentioned

E. SUMMARY OR AUDIT SUSPENSIONS, DISALLOWANCES AND CHARGES

Balance Jan 1, Balance Dee

Particulars 2021 eee 31, 2021

Issued Seitled

Suspensions | _P510.400.00| P 510,400.00

Disallowance | __247,821.22 P46,42032 201,400.90

Charges

Total £758.22122 4642032 711,800.90 |

F. STATUS OF IMPLEMENTATION OF PRIOR YEARS’ AUDIT

RECOMMENDATIONS,

We monitored and verified the implementation of the audit recommendations

contained in CY 2020 Annual Audit Report and noted that out of the 91 audit

recommendations, eight were fully implemented, 29 were partially implemented and $4

were not implemented as of December 31, 2021

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Controlling TaskDocument1 pageControlling TaskYeonjin C. ChoiNo ratings yet

- Micro LectureDocument1 pageMicro LectureYeonjin C. ChoiNo ratings yet

- Guide QuestionsDocument2 pagesGuide QuestionsYeonjin C. ChoiNo ratings yet

- Sample LetterDocument1 pageSample LetterYeonjin C. ChoiNo ratings yet

- MS Waiver - F2F For All ProgramsDocument1 pageMS Waiver - F2F For All ProgramsYeonjin C. ChoiNo ratings yet

- Lesson 11 - Self-EfficacyDocument44 pagesLesson 11 - Self-EfficacyYeonjin C. Choi100% (1)

- DIAGRAMDocument2 pagesDIAGRAMYeonjin C. ChoiNo ratings yet

- Table 1. Provincial Total Employed Persons and Employment Rate 2018, 2019 and 2020may28 - 0Document16 pagesTable 1. Provincial Total Employed Persons and Employment Rate 2018, 2019 and 2020may28 - 0Yeonjin C. ChoiNo ratings yet