Professional Documents

Culture Documents

Lecture # 07 - Business

Uploaded by

Ramjan Ali SiamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture # 07 - Business

Uploaded by

Ramjan Ali SiamCopyright:

Available Formats

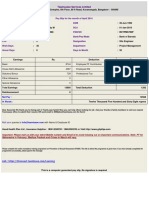

DHAKA UNIVERSITY OF ENGINEERING AND TECHNOLOGY

CITY UNIVERSITY

DEPARTMENT OF MECHANICAL ENGINEERING

ME 473 ENGINEERING MANAGEMENT

ME 4203 INDUSTRIAL MANAGEMENT

_______________________________________________________________________

BUSINESS

REFERENCE

O. P. Khanna (1995) Industrial Engineering and Management, Dhanpat Rai & Sons

Arun Kumar Sen and Jitendra Kumar Mitra (1998) Commercial and Industrial Law, The

World Press Private Limited, Calcutta

M. C. Shukla (1994) Business Organization and Management, S. Chand & Company

Limited, Ramnagar, New Delhi

K. K. Dewett and Adarsh Chand (2001) Modern Economic Theory, Shyamlal Charitable

Trust, Ram Nagar, New Delhi

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 1

Introduction

- ‘Industrial Ownership’, ‘Business organization’, ‘Forms of Ownership of Industry’,

‘Types of organization in Industry’, ‘Business Enterprises’, ‘Types of Ownership’,

etc., all convey the same meaning.

- To start a business enterprise the most important thing required is the capital.

- If the capital is provided by single individual, it is known as Individual ownership,

Individual entrepreneur organization, Single ownership or Individual proprietorship,

etc.

- If the capital is supplied by two or more persons, it refers to partnership organization.

- If the capital is provided by many persons in the form of shares to an institute with a

legal entity, it is called a Joint Stock Company.

- There are other forms of ownership also, but they are merely outgrowths of the three

types mentioned above.

Types of Ownership

The different types of ownership are

1. Single ownership (Private Undertaking).

2. Partnership.

3. Joint Stock Companies.

4. Cooperative organization.

5. State and central Government owned.

1. Single Ownership

Concept

- Ownership when applied to an industrial enterprise means title to and possession of

the assets of the enterprise, the power to determine the policies of operation, and the

right to receive and dispose of the proceeds.

- It is called a single ownership when an individual exercise and enjoys these rights in

his own interest.

- Single ownership does well for those enterprises which require little capital and lend

themselves readily to control by one person

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 2

- In single ownership, one person contributes the original assets to start the business,

maintains and controls business operations, reaps full benefit in terms of profit and is

fully liable for all debts associated with the business.

Advantages

1. Easy to establish as it does not require to complete and legal formality.

2. Simplicity of organization.

3. The expenses in starting the business are minimal.

4. Owner is free to make all decisions.

5. This type of ownership is simple, easy to operate and extremely flexible.

6. The owner enjoys all the profits

7. There is a great deal of personal motivation and incentive to succeed.

8. Minimum legal restrictions are associated with this form of ownership.

Disadvantages

1. The owner is liable for all obligations and debts of the business.

2. The business may not be successful if the owner has limited money, lacks ability and

necessary experience to run the business.

3. Because of relatively unstable nature of the business, it is difficult to raise capital for

expanding the business.

4. If the business fails, creditors can take the personal property as well as the business

property of the (single) owner to settle their claims. This means single ownership

involves unlimited liability for debts and losses.

5. There is limited opportunity for employees as regards monetary rewards (e.g., profit

sharing, bonuses, etc.) and promotions.

6. Generally, single ownership firm has limited life, i.e. the firm may cease to exist with

the death of the proprietor. This is the cause of unstable nature of the firm (refer 3

above).

Applications. Single ownership is suitable

1. For retail trades, service concerns and small engineering firms which require

relatively small capital to start with and to run.

2. For those businesses which do not involve high risks of failure.

3. When the business can be taken care by one person.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 3

2. Partnership

Concept

- A single owner becomes inadequate as the size of the business enterprise grows. He

may not be in a position to do away with all the duties and responsibilities of the

grown business.

- At this stage, the individual owner may wish to associate with him more persons who

have either capital to invest, or possess special skill and knowledge to make the

existing business still more profitable

- Such a combination of individual traders is called partnership.

- Individuals with common purposes join as partners and they put together their

property, ability, skill, knowledge, etc., for the purpose of making profits.

- In brief, partnership is an association of two or more (up to 20) persons to carry on as

co-owners of a business for profit.

- Partnerships are based upon a partnership agreement, which is generally reduced to

writing. It should cover all areas of disagreement among the partners. It should define

the authority, rights and duties of each partner. It should specify-how profits and

losses will be divided among the partners, etc.

Kinds of Partners

(i) Active Partners who take active part in the management of the business enterprise.

(ii) Sleeping Partners who do not take any active part in the conduct of the business.

Both Active and Sleeping partners are responsible for the debts of the Partnership.

General Duties of Partners. Partners should

(i) Be faithful to one another.

(ii) Render true accounts and full information about every thing that affects any

partner.

(iii) Cooperate and accommodate each other.

(iv) Have confidence in each other and better mutual understanding.

(v) Respect the views of one-another.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 4

Types of Partnership

(i) General Partnership.

(ii) Limited Partnership.

(i) General Partnership

- In a general partnership, each partner has full agency powers and may bind the

partnership by any act, i.e, each partner may act as though he were an individual

proprietor. General partnership differs from single ownership in that the actions of

any partner not only affect himself but they affect other partners also.

- As the partnership grows or personnel changes occur, additional partners can be had

with the consent of all old partners.

Advantages

(i) Large capital is available to the firm.

(ii) The firm possesses much better talents, judgment and skills.

(iii) General partnership is easy to form and is relatively inexpensive in terms of

organization cost.

(iv) Incentive for success is high.

(v) There is a definite legal status of the firm.

(vi) Partners have full control of the business and possess full rights to all profits.

(vii) Partnership firms can borrow money quite easily form banks.

(viii) For all losses, there are more than one person to share them.

Disadvantages

(i) Each partner has unlimited liability for the debts of the firm.

(ii) Danger of disagreement and distrust among the partners.

(iii) Authority being divided among partners.

(iv) Partnership lacks permanence and stability; it has limited life. Partnership may

dissolve if a partner dies.

(v) Investors and lenders hesitate to provide money because of the lack of stability of

a partnership firm.

(vi) All partners suffer because of the wrong steps taken by one partner.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 5

Applications. General Partnership does very well in

1. Law firms

2. Retail trade organization

3. Medical clinics

4. Small engineering firms, etc.

(ii) Limited Partnership

- Limited partnership type of ownership overcomes the two main disadvantages [e.g.

number (i) and (v) mentioned above] of general partnership.

- Limited partnership is an association of one or more general partners who manage the

business and one or more limited partners whose liability is limited to the capital they

have invested in the business.

- Limited partners share the profit but they do not participate or interfere with the

control or management of the firm. Moreover limited partners have their liabilities

limited to the amount of their investment.

- Thus, those investors and lenders who used to hesitate investing in the venture can do

so without much risk.

- Limited partnership type of ownership is easy and less costly to form, and personal

incentive to succeed is retained.

- A disadvantage associated with limited partnership is that the limited partner, though

he invests in the business, has no voice in the management.

3. Joint Stock Company

Concept

- Joint Stock Company overcomes many of the disadvantages associated with

Partnership types of industrial ownership, such as (i) difficulties in raising capital, (ii)

easy disruption, (iii) lack of facility for centralized management, and (iv) unlimited

liability, etc.

- A joint stock company is an Association of individuals, called shareholders, who join

together for profit and agree to supply capital divided into shares that are transferable

for carrying on a specific business.

- Death, insolvency, disablement or lunacy of the shareholders does not affect the joint

stock company.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 6

- A joint stock company consists of more than twenty persons for carrying any business

other than the banking business.

- These persons give a name to the company, mention the purpose for which it is

formed, and state the nature and the amount of capital (shares) to be issued, etc., and

submit the proposal to the Registrar of Companies. As the registrar issues a certificate

in this connection, the company starts operating.

- The managing body of a joint stock company is the Board of Directors elected by the

shareholders. The Board of Directors (i) makes policies, (ii) takes decisions; and (iii)

runs the company efficiently

- The liability of the members (or shareholders) of a joint stock company is limited to

that capital only of which they hold the shares.

- Finance is raised by issuing shares, debentures, bank loans, loans from industrial and

finance corporations.

Types of Joint Stock Company. There are two types of joint stock companies

(a) Private limited company,

(b) Public limited company.

(a) Private limited company

- The capital is collected from the private partners; some of them may be active while

others being sleeping.

- Private limited company restricts the right to transfer shares, avoids public to take up

shares or debentures.

- The number of members is between 2 and 50, excluding employee and ex-employee

shareholders.

- The company need not file documents such as consent of directors, list of directors,

etc., with the Registrar of Joint Stock Companies.

- The company need not obtain from the Registrar, a certificate of commencement of

business.

- The company need not circulate the Balance Sheet, Profit and Loss Account, etc.,

among its members; but it should hold its annual general meeting and place such

financial statements in the meeting.

- A private company must get its accounts audited.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 7

- A private company has to send a certificate along with the annual return to the

Registrar of Joint Stock Companies stating that it does not have shareholders more

than fifty excluding the employee and ex-employee shareholders.

Actually, a private joint stock company resembles much with partnership and has the

advantage that big capital can be collected, than could be done so in partnership.

(b) Public Limited Company

- In Public limited company, the capital is collected form the public by issuing shares

having small face value ($ 50, 20, 10)

- The number of shareholders should not be less than seven, but there is no limit to their

maximum number.

- A public company has to file with the Registrar of Joint Stock Companies, documents

such as consent of the directors, list of directors, director’s contract, etc., along with

the memorandum of association and articles of association.

- A public company has to issue a prospectus to the public.

- It has to allot shares within 180 days from the date of prospectus.

- It can start only after receiving the certificate to commence business.

- It has to hold a Statutory Meeting and to issue a Statutory Report to all members and

also to the Registrar within a certain period.

- There is no restriction on the transfer of shares.

- Directors of the company are subject to rotation.

- The public company must get its account audited every year by registered auditors.

- It has to send financial statements to all members and to the Registrar.

- It has to hold a general meeting every year.

- The Managing Agent gets a fixed percentage of net profit as remuneration.

Advantages of Joint Stock Companies

(i) A huge sum of money can be raised.

(ii) It associates limited liability with it.

(iii) Shares are transferable.

(iv) Company’s life is not affected by the life (death) of shareholders.

(v) Services of specialists can be obtained

(vi) Risk of loss is divided among many shareholders.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 8

Disadvantages of Joint Stock Companies

(i) A good deal of legal formalities is required for the formation of a joint stock

company.

(ii) Company is managed by big shareholders only.

(iii) High paid officials manage the whole shows; they cannot have as high interests in

the company as the proprietors can have.

(iv) People can commit frauds with the company.

(v) Board of directors and managers who remain familiar with the financial position

of the company may sell or purchase shares for their personal profits.

(vi) It is difficult to maintain secrecy as in partnership.

Applications of Joint Stock Companies

(i) Steel mills,

(ii) Fertiliser factories, and

(iii) Engineering concerns, etc.

4. Cooperative Organization

Concept

- It is a form of private ownership, which contains features of large partnership as well

as some features of the corporation.

- The main aim of the cooperative is to eliminate profit and provide goods and services

to the members of the cooperative at cost.

- Members pay fees or buy shares of the cooperative, and profits are periodically

redistributed to them.

- Since each member has only one vote (unlike in joint stock companies), this avoids

the concentration of control in a few hands.

- In a cooperative, there are shareholders, a board of directors and the elected officers

similar to the corporation.

- There are periodic meetings of shareholders, also.

- Cooperative organization is a kind of voluntary, democratic ownership formed by

some motivated individuals for obtaining necessities of everyday life at rates less than

those of the market. The principle behind the cooperative is that of cooperation and

self-help.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 9

Forms of Cooperative Enterprises

(i) Consumer’s Cooperatives, in retail trade and services.

(ii) Producer Cooperatives, for group buying and selling such items as dairy products,

grain, fruit, etc.

(iii) Cooperative farming for more and good quality yield from the farms.

(iv) Cooperative housing for constructing and providing houses to the members of the

association at relatively lesser rates.

(v) Cooperative credit society, to provide loans to the needy individuals.

Advantages

(i) Daily necessities of life can be made available at lower rates.

(ii) It is the democratic form of ownership.

(iii) Overheads are reduced as members of the cooperative may render honorary

services.

(iv) It promotes cooperation, mutual assistance and the idea of self-help.

(v) No one person can make huge profits.

(vi) Monetary help can be secured from government.

(vii) Goods required can be purchased directly from the manufacturers and therefore can

be sold at less rates.

Disadvantages

(i) Since the members of the cooperative manage the whole show, they may not be

competent enough to make it a good success.

(ii) Finance being limited, specialist’s services cannot be taken.

(iii) Conflict may arise among the members on the issue of sharing responsibility and

enjoying authorities.

(iv) Members who are in position may try to take personal advantages.

(v) Members being in services may not be able to devote necessary attention and

adequate time for supervising the works of the cooperative enterprise.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 10

5. State and central Government owned

(a) Public Sector

Concept

- A public enterprise is one that is (i) owned by the state, (ii) managed by the state, or

(iii) owned and managed by the state.

- The sector of public enterprises is popularly known as the Public Sector.

- Public enterprises are controlled and operated by the Government either solely or in

association with private enterprises.

- Public enterprises are controlled and operated by the Government to produce and

supply goods and services required by the society.

- Ultimate control of public enterprises remains with the state and the state runs it with

a service motto.

- There is no lack of capital in public sector and business expansion is not difficult.

- Public sector prevents concentration and unbalanced growth of industries.

- Public sectors are accountable in terms of their results to Parliament and State

Legislature.

- A public enterprise is seldom as efficient as a private enterprise; wastage and

inefficiency can seldom be reduced to a minimum.

Objectives of Public Sector

(1) To provide basic infrastructure facilities for the growth of economy.

(2) To promote rapid economic development.

(3) To undertake economic activity strategically important for the growth of the

country, which if left to private initiative would distort the national objective.

(4) To have balanced regional development and even dispersal of economic activity

throughout the country.

(5) To avoid concentration of economic power in a few hands.

(6) To create employment opportunities on an increasing scale.

(7) To earn foreign exchange in order to export commodities not available in the

country e.g., petroleum oil, sophisticated weapon systems etc.

(8) To look after well-being and welfare of public.

(9) To minimize exploitation of workers and consumers.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 11

Merits of Public Sector

(i) Public sector helps in the growth of those industries which require huge amount of

capital and which cannot flourish under the private sector.

(ii) Public sector helps in the implementation of the economic plans and enables them to

reach the target of achievement within a prescribed period by taking initiative in the

establishment of industries of its own accord.

(iii) Due to the absence of project motive in the public sector, the consumers are

benefited by greater, better and cheaper products.

(iv) Public enterprise prevents the concentration of wealth in the hands of a few and

paves the way for equitable distribution of wealth among different sections of

community.

(v) Public enterprise encourages industrial growth of under-developed regions in the

country.

(vi) Public sector offers equitable employment opportunities to all; there is no

discrimination, as may be in a private sector.

Demerits of Public Sector

(i) Public sector can rarely attain the efficiency of a private enterprise; wastage and

inefficiency can seldom be reduced to a minimum.

(ii) Due to heavy administrative expense, state enterprises are mostly run at a loss

leading to additional burden of taxation on the people.

(iii) There is too much interference by the Government and Politicians in the internal

affairs of the public enterprises. As a result inefficiency increases.

(iv) Delay in decisions is a very common phenomenon in public enterprises.

(v) Incompetent persons may occupy high levels.

(b) Private Sector

Concept

- Private sector serves personal interests and is a non-government sector.

- Profit (rather than service) is the main objective.

- Private sector constitutes mainly consumer’s goods industries where profit

possibilities are high.

- Private sector does not undertake risky ventures or those having low-profit margin.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 12

- Private enterprises are run by businessmen, capital is collected from the private

partners.

Merits of Private Sector

(i) The magnitude of profits incurred is high

(ii) The efficiency of the private enterprise is high

(iii) Wastage of material and labour is minimum.

(iv) Decision-making is very prompt.

(v) There is no interference in its internal affairs by politicians of Government.

(vi) Competent persons occupy high levels.

Demerits of Private Sector

(i) There is exploitation motive, the workers and the consumers may not receive fair

deal.

(ii) There is dearth of capital to expand the business.

(iii) Private enterprise leads to concentration of wealth in the hands of a few.

(iv) Private enterprises lead to unbalanced growth of industries.

Short Notes

1. Bond

Bond is a kind of security by which management can borrow money by selling it to the public

directly. The bond holders get interest on the face value of the bond every year. The face

value is the price or the written value on the bond. However, the value in exchange (or the

selling price) of the bond in the market may be different from the face value of the bond. The

use of bond financing offers a distinct tax advantage to the management since interest

payments to the bond holders are legally considered to be costs.

2. Mortgage

When a specific immovable property is made the security for the payment of money or the

performance of an obligation, the transaction is called a Mortgage.

The Transfer of Property Act defines mortgage as, “transfer of an interest in specific

immovable property for the purpose of securing the payment of money advanced or to be

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 13

advanced by way of loan, an existing or future debt or the performance of an engagement

which may give rise to pecuniary liability”.

The person transferring the interest (the debtor) is called the “Mortgagor”. The person to

whom the interest is transferred (the creditor) is called “Mortgagee”. The amount of secured

money is called the “Mortgage Money”. The document in which the transaction is recorded

and by which the transfer of interest is made is called “Mortgage Deed”.

The characteristics of Mortgage are,

1. In a mortgage there is a transfer of an interest in some specific immovable property.

2. The interest is transferred by way of security

3. The security is for the due repayment of a loan or a debt, incurred or to be incurred

for any purpose

4. If the money due or the pecuniary liability is not meet within the agreed time, the

interest transferred (i.e. the security) can be sold through the court and the dues

recovered.

5. A valid mortgage can be effected only by a written document, signed by the

mortgagor and two attesting witnesses, and registered.

6. A mortgage is a contract. Therefore, it must satisfy all the essential element of

contract, e.g., capacity of parties, free consent etc.

3. Loan

The amount of money that a firm borrows directly from banks or insurance companies or

federal agencies is known as loan. Depending on the duration of the loan, a commercial bank

can provide a short-term, medium-term or a long-term loan. Generally, a loan that is

repayable within one year is known as short-term loan. Medium-term loan is given for one to

five years, and the loan that is given for more than five years is known as the long-term loan.

There is no time limitation to pay back the short-term loan. However, the lender is bound

legalistically to repay the loan if the bank asks for it. For this reason, the short-term loan is

also known as demand loan. The cash credit, overdraft etc. are the examples of short-term

loan. The medium-term loan is a kind of loan that is in between short-term and long-term

loans. Many types of consumer credit are the medium-term loan. On the other hand, the long-

term loan is given to build a new industry or a building etc. The amount of the long-term loan

is bigger, and the bank takes security from the lender against this kind of loan.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 14

4. Liquidity and profitability

A bank exists to make profit. Its investment policy is, therefore, mainly governed by the

profit motive. But a bank is a very sensitive institution and must always keep in view its own

security. “Safety first” is the rule and subject to this, the bank must try to make maximum

profit. Thus profitability and safety (i.e., liquidity) are the two considerations governing a

bank’s investment, although it is not easy to reconcile them.

The secret of sound banking consists in the maintenance of adequate reserves, while at the

same time making profits. A bank deals with other peoples’ money (i.e., deposits) and the

money can be withdrawn with or without notice. They must, therefore, maintain adequate

reserves to meet this demand and make profit by lending the rest. A wise banker must

maintain a proper balance between liquidity and profitability. Too much caution will mean

too little profit, while reckless lending may endanger the safety of the bank itself.

The liquidity and profitability are opposing considerations. There has to be a compromise,

but it is uneasy compromise. Because whatever the form and quantity in which the banks

keep their reserve, they are found to be unnecessary in normal times and insufficient when

the depositor’s confidence is shaken.

In order to ensure liquidity for their own safety, a bank must keep adequate reserve. The

amount of reserve kept by a bank is governed, among others, by three factors: (i) day-to-day

fluctuation in the amount of bank’s deposits; (ii) the variability of the customers’ borrowing

needs; and (iii) the nature of secondary reserves, and the character of reserve organization in

the banking system.

5. Share

A company’s capital, or “owned capital” as it is sometimes called, is divided into equal

portions which are bought by persons, called the shareholders, who wish to acquire an

interest in the company. Stated differently shares represent equal portions into which the

capital of a company is divided, each shareholder being entitled to a portion of a company’s

profits corresponding to the number of shares he holds. For example, the capital of a

company may be $50,00,000 divided into $50,000 equal portions or shares of $100 each. If a

person holds 100 shares and a 10% dividend (bonus) is declared by the company, he will get

$1,000 as his share of the profit being 10% of $10,000, the value of shares. The aggregate

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 15

ownership interest in the company is $50,00,000 and his interest in it, as measured by the

sum of money, amounts to $10,000. Share capital is most suitable for meeting long-term

requirements of a company, in particular fixed capital needs, as it is not paid back to the

shareholders as long the company is a going concern.

6. Debenture

A company may wish to borrow money from persons who are willing to lend instead of

buying shares. The money lent to the company must be recorded and acknowledged. The

document which lender receives is called a debenture or “creditorship security”.

A debenture is an acknowledgement under seal of a debt by a company. It is also an

instrument executed by a company under its common seal acknowledging indebtedness to

some person or persons to secure the sum advanced. As shares are the equal parts of share

capital, debentures are equal parts of a loan raised by a company. Like shares, they are also

offered to public by means of a prospectus. The terms and conditions on which they are

issued are endorsed on the back of the instrument. As in the case of the issue of shares,

certain formalities required by the law must be carried out.

Distinction between shareholder and debenture-holder. (i) a debenture-holder is a creditor

of the company, while the shareholder is one of the proprietors of the capital of the company

and so responsible for its liabilities. The debenture-holder is one of the liabilities for which

the shareholder is responsible as a proprietor. For this reason, a debenture is called a

creditorship security and a share is known as “ownership security”. (ii) as a creditor, a

debenture-holder is entitled to receive the interest due to him whether the company makes

any profit or not. A shareholder, on the other hand, can get dividend only if the company

makes profit.

7. Stock Exchange (Share Market)

The stock exchange is concerned with the sale and purchase of second-hand securities. It is in

simple terms a highly organized market for the purchase and sale of shares and debentures as

well as financial securities. It is a market through which shareholders in public companies,

for example, can be bought and sold. Such a market enables an investor to dispose of his

shares easily and conveniently, as he will find a buyer readily when his shares are admitted

on the official list of a stock exchange.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 16

The Securities Contracts (Regulation) Act, (1956) defines a stock exchange as “an

association, organization or body of individuals, whether incorporate or not, established for

the purposes of assisting, regulating and controlling business in buying, selling and dealing in

securities.” This means that a stock exchange is a market which provides necessary facilities

for the transfer of all kinds of securities at competitive rates and without undue delay. To

repeat, a stock exchange is an open market for the sale and purchase of securities.

ME 4203 Industrial Management Professor Dr. Md. Arefin Kowser 17

You might also like

- Chapter 02, BusinessDocument20 pagesChapter 02, BusinessAnna ShanonNo ratings yet

- Unit - 3Document22 pagesUnit - 3naveennanni988No ratings yet

- The Sole Trading Firm Is The Oldest and The Simplest Form of Business OrganisationDocument6 pagesThe Sole Trading Firm Is The Oldest and The Simplest Form of Business OrganisationPankaj MehtaNo ratings yet

- BusinessDocument37 pagesBusinessXumonNo ratings yet

- Chapter 4 Legal Issues For EntrepreneurshipDocument24 pagesChapter 4 Legal Issues For EntrepreneurshipKariuki CharlesNo ratings yet

- 4 Forms of Business Organizations 5 PagesDocument5 pages4 Forms of Business Organizations 5 PagesSujd HesjjfgsNo ratings yet

- Forms of Business OrganisationDocument28 pagesForms of Business OrganisationPembaLama100% (1)

- Forms of BusinessDocument10 pagesForms of BusinessInarjit RayNo ratings yet

- Contingency PlanDocument5 pagesContingency PlanShikha AhlawatNo ratings yet

- Unit Ii Forms of Business OrgDocument40 pagesUnit Ii Forms of Business OrgKainos GreyNo ratings yet

- Finance and Budgetting DestinyDocument9 pagesFinance and Budgetting DestinyEdeh chikamma DestinyNo ratings yet

- BFN 111 - Week 3Document60 pagesBFN 111 - Week 3Gift AnosiNo ratings yet

- Unit V Notes (Part I)Document15 pagesUnit V Notes (Part I)21EBKCS074PARULNo ratings yet

- Forms of Business - Proprietorship, Partnership and CorporationsDocument9 pagesForms of Business - Proprietorship, Partnership and CorporationsNanshal BajajNo ratings yet

- Man MP Forms of OwnershipDocument11 pagesMan MP Forms of OwnershipDipesh BaviskarNo ratings yet

- Types of Business OrganizationDocument7 pagesTypes of Business OrganizationChikanma OkoisorNo ratings yet

- Business Studies Notes F2Document188 pagesBusiness Studies Notes F2Joe KamashNo ratings yet

- BUSINESS NOTES (July Monthly Test)Document18 pagesBUSINESS NOTES (July Monthly Test)siddhieieichawrijalNo ratings yet

- POB - Lesson 6 - Types of BusinessesDocument5 pagesPOB - Lesson 6 - Types of BusinessesAudrey RolandNo ratings yet

- Soc Sci 4A: Philippine Industrial EconomyDocument8 pagesSoc Sci 4A: Philippine Industrial EconomyCzarina Faye MolinaNo ratings yet

- FBM 1 9Document29 pagesFBM 1 9alexandercpanganibanNo ratings yet

- BEFA Chapter 1Document31 pagesBEFA Chapter 1Tarun BoyaNo ratings yet

- ch3 EntreDocument60 pagesch3 EntreeyoyoNo ratings yet

- IndustrailDocument8 pagesIndustrailashish.nigam120893No ratings yet

- Besr ReviewerDocument25 pagesBesr ReviewerJAVIER, KISSIE CZARINNENo ratings yet

- Introduction To Financial ManagementDocument12 pagesIntroduction To Financial ManagementRyzza Yvonne MedalleNo ratings yet

- A Student Guide For ABM124 Students: Introduction To Financial ManagementDocument12 pagesA Student Guide For ABM124 Students: Introduction To Financial ManagementRyzza Yvonne MedalleNo ratings yet

- Business Organisation: BBA I SemDocument49 pagesBusiness Organisation: BBA I SemAnchal LuthraNo ratings yet

- IGCSE Business Studies RevisionDocument27 pagesIGCSE Business Studies Revisionvyaskush80% (5)

- UCU 104 Lesson 6Document19 pagesUCU 104 Lesson 6Matt HeavenNo ratings yet

- Topic Five-Forms of Business OrganizationsDocument33 pagesTopic Five-Forms of Business OrganizationsAlvin KoechNo ratings yet

- Chapter Five Forms of Business Organizations Expected Learning OutcomesDocument33 pagesChapter Five Forms of Business Organizations Expected Learning OutcomesAlvin KoechNo ratings yet

- Forms of Business: Sole Proprietorship and PartnershipDocument17 pagesForms of Business: Sole Proprietorship and PartnershipTavleen KaurNo ratings yet

- Unit 3 - Steps Involved in Establishing BusinessDocument17 pagesUnit 3 - Steps Involved in Establishing BusinessMR PRONo ratings yet

- Corporate Law AnswerDocument22 pagesCorporate Law AnswerAmir KhanNo ratings yet

- TMA 1 Functions of Business Enterprise - Mesfin Zeleke - Dec 2022Document7 pagesTMA 1 Functions of Business Enterprise - Mesfin Zeleke - Dec 2022Dereje ZelekeNo ratings yet

- Revision NotesDocument60 pagesRevision NotesxalishaxpxNo ratings yet

- ZICA T6 - ManagementDocument91 pagesZICA T6 - ManagementMongu Rice100% (7)

- Business Organizations Grade 8: Private SectorDocument16 pagesBusiness Organizations Grade 8: Private SectorCherryl Mae AlmojuelaNo ratings yet

- Abm 1 Lesson 4 Form of Business OrganizationDocument61 pagesAbm 1 Lesson 4 Form of Business OrganizationWarren ErrojoNo ratings yet

- Unit-1 Ieed PPTDocument41 pagesUnit-1 Ieed PPTPriti DhekneNo ratings yet

- Screenshot 2023-12-10 at 5.37.56 PMDocument40 pagesScreenshot 2023-12-10 at 5.37.56 PMswajihulhassanNo ratings yet

- Forms of Business OrganizationsDocument49 pagesForms of Business OrganizationsJooooooooNo ratings yet

- SG 7 - EntrepDocument7 pagesSG 7 - EntrepLovemir LimacoNo ratings yet

- Economics 11Document27 pagesEconomics 11Ernie EnokelaNo ratings yet

- Form of Business OwnershipDocument31 pagesForm of Business OwnershipLandrito Armie Uri0% (1)

- Module 12 Form of Business OwnershipDocument7 pagesModule 12 Form of Business OwnershiphikunanaNo ratings yet

- Unit 3 Introduction To The Business OrganizationDocument8 pagesUnit 3 Introduction To The Business OrganizationZaya SapkotaNo ratings yet

- 1st Year Commerce NotesDocument48 pages1st Year Commerce NotesDivya Chowdary AdusumilliNo ratings yet

- Organization and Management 1 Quarter Lesson 4: The Firm and Its Environment (Continuation of Lesson 3)Document4 pagesOrganization and Management 1 Quarter Lesson 4: The Firm and Its Environment (Continuation of Lesson 3)Sayno, Samantha Jade C.No ratings yet

- Forms of Business OrganizationsDocument31 pagesForms of Business OrganizationsCrystal MaynardNo ratings yet

- Business - Associations - by - Ssozi RajjabuDocument82 pagesBusiness - Associations - by - Ssozi RajjabuNAYIGA DEMITNo ratings yet

- Business Organizations Grade 8: Private SectorDocument14 pagesBusiness Organizations Grade 8: Private SectorPrinceyoon22No ratings yet

- Chapter 2 II Forms of BusinessDocument6 pagesChapter 2 II Forms of BusinessRNo ratings yet

- Business Organisation and Structure Unit 2Document59 pagesBusiness Organisation and Structure Unit 2pragnesh dholakiaNo ratings yet

- Chpater 3 - Sole Trader, Partnership, Franchisee and Social EnterprisesDocument10 pagesChpater 3 - Sole Trader, Partnership, Franchisee and Social EnterprisesHashan SiriwardaneNo ratings yet

- Forms of Business Organizations: Prepared By: Prof. Jonah C. PardilloDocument52 pagesForms of Business Organizations: Prepared By: Prof. Jonah C. PardilloShaneil MatulaNo ratings yet

- Top Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomFrom EverandTop Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomNo ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Cupola FurnaceDocument33 pagesCupola FurnaceRamjan Ali SiamNo ratings yet

- Cast IronDocument52 pagesCast IronRamjan Ali SiamNo ratings yet

- Composite Materials - TribologyDocument38 pagesComposite Materials - TribologyRamjan Ali SiamNo ratings yet

- ME - 2801 - 3 - Second Law of ThermodynamicsDocument70 pagesME - 2801 - 3 - Second Law of ThermodynamicsRamjan Ali SiamNo ratings yet

- ME - 2801 - 4 - Properties of Pure SubstanceDocument37 pagesME - 2801 - 4 - Properties of Pure SubstanceRamjan Ali SiamNo ratings yet

- Lecture # 03 - R&DDocument19 pagesLecture # 03 - R&DRamjan Ali SiamNo ratings yet

- ME 2801 2 First Law of ThermodynamicsDocument79 pagesME 2801 2 First Law of ThermodynamicsRamjan Ali SiamNo ratings yet

- Lecture # 04 - Financial PlanningDocument33 pagesLecture # 04 - Financial PlanningRamjan Ali SiamNo ratings yet

- Lecture # 05 - Purchase & SalesDocument19 pagesLecture # 05 - Purchase & SalesRamjan Ali SiamNo ratings yet

- Lecture # 06 - PerformanceDocument10 pagesLecture # 06 - PerformanceRamjan Ali SiamNo ratings yet

- Agr VisaNet РТ 200М 200424docx - 1Document14 pagesAgr VisaNet РТ 200М 200424docx - 1Ира КацNo ratings yet

- Private Equity Valuation: FintreeDocument46 pagesPrivate Equity Valuation: FintreeAniket JainNo ratings yet

- Company AccountsDocument105 pagesCompany AccountsKaustubh BasuNo ratings yet

- Activity No. 2 (Moredo) : Problem 1Document3 pagesActivity No. 2 (Moredo) : Problem 1Eloisa Joy MoredoNo ratings yet

- Assemble Smartphone Case SolutionDocument3 pagesAssemble Smartphone Case SolutionPravin Mandora50% (2)

- Reporte Dibella Group Alineada A #Iso26000Document32 pagesReporte Dibella Group Alineada A #Iso26000ALBERTO GUAJARDO MENESESNo ratings yet

- Understanding Vietnam: The Rising Star: Economics & StrategyDocument11 pagesUnderstanding Vietnam: The Rising Star: Economics & StrategyHandy HarisNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5cjNo ratings yet

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraNo ratings yet

- RC&G Transcript 2018Document28 pagesRC&G Transcript 2018YashNo ratings yet

- Approved List of ValuersDocument7 pagesApproved List of ValuersTim Tom100% (1)

- Chapter1 SolutionsDocument3 pagesChapter1 SolutionsJosé Del Angel Sánchez BurgosNo ratings yet

- Philippine Accounting StandardsDocument4 pagesPhilippine Accounting StandardsElyssa100% (1)

- Development Project ProposalDocument8 pagesDevelopment Project Proposalnickdash09100% (1)

- Liquidity Management in Banks Treasury Risk ManagementDocument11 pagesLiquidity Management in Banks Treasury Risk Managementashoo khoslaNo ratings yet

- April 2016 - PaySlipDocument1 pageApril 2016 - PaySlipMedi Srikanth NethaNo ratings yet

- Richest Man in Babylon AnnotationDocument10 pagesRichest Man in Babylon Annotationmark jukicNo ratings yet

- Using Historical Probabilities To Trade The Opening Gap: Scott AndrewsDocument32 pagesUsing Historical Probabilities To Trade The Opening Gap: Scott Andrewsjosecsantos83No ratings yet

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesNo ratings yet

- Sol2 Receivables 1 9Document5 pagesSol2 Receivables 1 9Shaira CastorNo ratings yet

- PrepmateDocument69 pagesPrepmatevishal pathaniaNo ratings yet

- BirlasoftDocument3 pagesBirlasoftlubna ghazalNo ratings yet

- Summary List of Filers Statement of Assets, Liabilities and NetworthDocument2 pagesSummary List of Filers Statement of Assets, Liabilities and Networthhans arber lasolaNo ratings yet

- Gambling Inside StoryDocument18 pagesGambling Inside StoryDaryl TanNo ratings yet

- Analysis of PELDocument3 pagesAnalysis of PELHasham NaveedNo ratings yet

- Entrepreneurial Ecosystem Assessment VNDocument54 pagesEntrepreneurial Ecosystem Assessment VNYongtong OuNo ratings yet

- AG Office AccountingDocument165 pagesAG Office AccountingabadeshNo ratings yet

- Surya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Document3 pagesSurya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Halim RachmatNo ratings yet

- Class NotesDocument5 pagesClass NotesAcads LangNo ratings yet

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightNo ratings yet