Professional Documents

Culture Documents

Sol2 Receivables 1 9

Uploaded by

Shaira CastorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sol2 Receivables 1 9

Uploaded by

Shaira CastorCopyright:

Available Formats

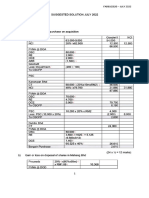

PROBLEM 1

I. Allowance for Doubtful Accounts, beg. P 143,000

Provision (P 15M x 2%) 300, 000

Write- off(P 140 000 + 120 000) (260, 000)

Recoveiy ofpreviously written off 43. 000

Balanc€, before adjustment L--226J0O0

2.

Balan.elRatelemount

November - December 2010 2,160,000 $,24C

luly - October 2010 1,300,000 7A% 130,00c

840,000 25% 210,000

Priortolanuary l" 2010

{300,000 - 120,000 w te off) 130,000 10% 126 000

Required allowance balance, Dec. 31, 2010 509,200

Le$: Allowance balance before adjustment

226,W0

_____ 31?!9

Jourial entry:

Bad debts expense 283,200

Allowance for bad delrts 283,200

(P s09 200 - 226 000)

3. Provision P 300,000

Adjustmeni 283.200

Total Bad debts expense P 583-A0

4. Balance ofaccounts receivable (P 4 600 000

- 120 000) P 4,480, 000

Allowance for bad debts ( 509.200)

Net Realizable value Pl,9ZLl0r0

5.D

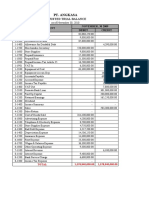

PROBLI]M 2

l

Required

1 - X5 days 64% 2,880,000 1% 28,800

11- 30 days 1a% 810,000 25% 20,250

Past due 31- 60 d6ys a% 360,000 18,000

Past due 61- 120 days 225,OOO 20% 45,000

Pan due 121- 1aO days 3% i35,000 35% 47,250

Past due over 180 days 2% 45,000 ao% 36_dr)

Required allowance

____l9E9q

2. Adjusted balance ofAllowance for Doubtful Accounts P 195,300

Balance ofAllowance:

ADA, beg P 81,900

Provision (24M*4%) 960, 000

write off ( 868, 500)

Additional write off (4,50q000't2%*50o/o) ( 45.000) r 128- 400r

AdjustmeDt for Allowance P ____66.100

PROBLEM 3

1. Control account balance P 1, 270, 000

Subsidiary Ledger balance ( 1.260. 000)

Unlocated Difference P-10J0q)

Joumal Entry:

Sales 10,000

Accounts Receiyable 10,000

2. Unde. I month P 540,000

I to6 months (552,000-21,000) 531,000

Over 6 months (228,000-72,000)

Adjust€d accorrnts receiyalrle PL22tum0

3. Aging of accounts rec€ivablei

Under 1 month (540,000*1%) P 5,400

One to 6 months (531,000*2%) 10, 620

Over 6 months (3 6000* 50o/o,\ + {120,000* 1O%) 30.000

Required Allowance for bad debts L4nlJzA

4. Journal entry:

Bad debts expense 40,020

Allowance for doubtft accoEnts 40, a0

Required allowance for bad debs P 46,020

Write off of rmcollectible accounts 12,000

Recorded Allowance for bad debts (78^000)

Net adjustment L- __4UD0

.PROBLEM 4

1. Accounts Receivable under "6l 90 days,, category:

MOA Corp. ( lnvoice d are 10/25/20t0 ) P 10,600

Centerpoinr Corp. ( Invoice date 10/9/2010 ) 22.000 P 32..6100

Accounts Receivable under "9l - 120 days,, category:

Mega Corp. ( Invoice d ate 9/27 /2010 ) P 12,000

Fairview Corp. ( Invoice date 9/12/2010 ) t7. 400 P.- 4.4N

1 Aging of Accounts Receivables:

0 - 30 days [ ( P 14,000 + 19, 200+20,000 + 12,400) x 1%1 P 6s6

31 60 days [ ( p 21, 180 + 23, t4O) x r5% I 665

61 - 90 days (P 32, 600 x3r/o ) 978

91 - l2C days ( P 29, 400 x 10yo ) 2,940

Over I20 days ( P 8, 920 x 50% ) 4. 460

Required bal&[ce of AllowaDce for Bad Debts P I 6qS

4. EnFy:

Bad Debts Expense 15, 199

Allowance for Bad Debts

(5,500rr,699)

P 15, r99

5. TotalAccountsReceivables

( P 65, 600 + 44, 32A + 32, 600 + 29 , 1OO + 8, 920 P 180,840

)

Allowance for Bad Debts ( 9.699 \

Net Realizable Value of Accounts Receivabl€s

B_17L"!41

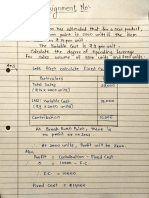

PROBIIM 5

1. Unadjusted balance ofAccounts Receivable P 558,600

Uncollectible accolmls ( P6, 300 + 4, 110 ) ( 10,410 )

Credit balance in Accounts Rec€ivable 7.26u

Adjusted baleEce of Accounts Receivable L555.4s0

2. Aging ofAccounts Receivables:

60 days and under ( p 258, 513 x 1% ) P 2,58s

6l to 90 days [ ( p 204, 73s + 7,260 ) x3%] 6,360

91 to 120 days [ ( p 59, Bt6 - 4,110) x 6%] 3,347

Over 120 days [ ( P 35, 466 - 6,300 ) x25o/r ] '1.291

Adjusted balance ofAllowarce for Bad I)ebts P p.5e3

3. Allowance for Bad Debrs, Dec. 31,2010 P 19,583

Write-offofAccounts Receivables ( p 4, l lO + 6, 300 ) 10,410

Allowance for Bad Debts, Jan. 1, 2010 ( 13. 125 )

Doubtful Accounts Expense, 2010 P 16.t68

4. Recorded Doubtful Accounts Expense(P27,930-4,110) p 23,820

Corect Doubtful Accounts Expense ( 16. 868 )

Adjustment to Doubtful Accounts ExpeNe ( credit ) p 6.952

PROBLEM 6

1 Othertrade accounts receivable unassiened 750,000.00

Trade accounts receivable - assigned 375,000.00

Trade installment receivabledue 1-18 months, net of u nea rned flnance charge ofp30,0OO 300,000.00

Trade receivables from offi.ers due currently 22,500.00

Trade accounts on which post dated checks are held 75,000.00

Trade accounts receivable L,522,5OO.OO

2 Trade accounts receivable (1) 7,s22,500.O0

Advance paymentsto creditorss on PO 150,00c.00

hlerei rereivables on bonds 1s0,000.00

Subscriptions receivable, due i.30 days 825,000.00

Current trade and other receivables

-3447_,5oo.oo

3 Advancesto affiliated companies 375,000.00

PROBLf,M 7

AR, unadjusted 1,300,000.00

Adjustments:

Goods shipped io customer) 12.30.10, FOB shipping point 50,000.00

Customer's NSF check returned by the bank on 12.29.10 5.000.00

AR, adjusted 1,355,000.00

2 AR, adjusted 1,355,000.00

Rate 1.50%

Required balance ofADA 20,325.00

3 ADA, endine 20,325.OO

ADA, beginning (debit balance) 8,000.00

Provision for bad debts 28,325,00

PROBLEM 8

1 Trade receivables (current) 3,440,000.00

Past due trade accounts 640,000.00

Notes receivable dishonored 240,000.00

Consigned goods already sold (p160,000*90%) 144,00C.00

Adjusted trade receivables 4,464,OO0.OO

Adjusted trade receivables 4,464,000.oo

Less due from consignee 144,000.00

Easis ofallowance for bad debts 4,320,000.00

Rate

Required balance of bad debts 215,000.o0

3 Required balance of bad debts 216,000.00

Add write off of bad debts 128,000.00

Less aliowance for bad debts, before adjustments 80,000.00

Bad debts expense 26+000.00

PROBLEM 9

L AR, beg

480,000.00

Add: Sales on account 2,400,ooo.oo

Recovery ofaccounts previously written off 4,400.oo 2,404,aoo.oo

less: Collections,includingrecovery 2,560,000.00

Sales dis€ount (2%) 28,800.00

Sales discount (1%) 8,000.00

Accounts written off 17,600.00 2,614,400.00

AR, enc!

270,400.o0

2 AR, end

270 400.aa

Rate

5%

Required allowance for bad debts

13,520.00

Add accounts written off

17,600.00

less: Recovery ofaccounts previously written off

4800.o0

ADA, beg 19,200.00 24,000.00

Provision for bad debts

,-,l2o.oo

You might also like

- AYAR-07: TotalDocument1 pageAYAR-07: TotalJohn Francis Raspado AnchetaNo ratings yet

- Quiz No. 2 Multiple Choice and Problem Solving QuestionsDocument6 pagesQuiz No. 2 Multiple Choice and Problem Solving QuestionsNonami AbicoNo ratings yet

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranNo ratings yet

- Consolidated Profits and Non-Controlling InterestsDocument4 pagesConsolidated Profits and Non-Controlling InterestsAlayka LorzanoNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Calculating adjustments for Pacers Company inventory, payables, and salesDocument13 pagesCalculating adjustments for Pacers Company inventory, payables, and salesShiela Mae BautistaNo ratings yet

- Grade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233Document11 pagesGrade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233hobyanevisionNo ratings yet

- Cash Flow File No.1Document8 pagesCash Flow File No.1tomNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- FAR210 Aug 2023 S PDFDocument10 pagesFAR210 Aug 2023 S PDFNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Audit of Receivables and Sales SolutionsDocument16 pagesAudit of Receivables and Sales SolutionsNICELLE TAGLENo ratings yet

- P9-2 Consolidation Workpaper EntriesDocument13 pagesP9-2 Consolidation Workpaper EntriesAlfatih 1453No ratings yet

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMNo ratings yet

- This Study Resource Was: Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesThis Study Resource Was: Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeChelle HullezaNo ratings yet

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- PT. Cahaya Cash Flow StatementDocument1 pagePT. Cahaya Cash Flow StatementKatrin8No ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Tugas2 Elriska Tiffani 142200111 EA-DDocument4 pagesTugas2 Elriska Tiffani 142200111 EA-DElriska TiffaniNo ratings yet

- 01 Act 1Document1 page01 Act 1dimayugadesiree5No ratings yet

- Chapter 12 FAR Millan Chapter 12 FAR MillanDocument4 pagesChapter 12 FAR Millan Chapter 12 FAR MillanJoanah AquinoNo ratings yet

- Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesChapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeAnna TaylorNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- Audit of Accounts Receivable and Related Accounts ComDocument3 pagesAudit of Accounts Receivable and Related Accounts ComCJ alandyNo ratings yet

- Chapter 2 Partnership Operations 2021 EditionDocument17 pagesChapter 2 Partnership Operations 2021 Editionregine bacabagNo ratings yet

- AE 111 Midterm Summative Assessment 3 SolutionsDocument12 pagesAE 111 Midterm Summative Assessment 3 SolutionsDjunah ArellanoNo ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Ga2 - Far460 - Equity - Note On PpeDocument2 pagesGa2 - Far460 - Equity - Note On PpeAmniNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument11 pagesSol. Man. - Chapter 12 - Partnership OperationspehikNo ratings yet

- Solution Manual Special Transactions Millan 2021 Chapter 1Document14 pagesSolution Manual Special Transactions Millan 2021 Chapter 1Jester LimNo ratings yet

- Current Liabilities ChapterDocument8 pagesCurrent Liabilities ChapterJonathan Villazon Rosales67% (3)

- Calculating Partner Capital Balances and Distribution AmountsDocument1 pageCalculating Partner Capital Balances and Distribution AmountsCristal KayeNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Kerja Kelompok PT Angkasa BDocument28 pagesKerja Kelompok PT Angkasa BElisa EndrianiiNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- National College partnership operations and profit distributionDocument6 pagesNational College partnership operations and profit distributionRosmar AbanerraNo ratings yet

- FAR Diagnostic Exam PDFDocument9 pagesFAR Diagnostic Exam PDFReach Moon DaddyNo ratings yet

- Financial Reporting in HyperinflationDocument12 pagesFinancial Reporting in HyperinflationShane KimNo ratings yet

- Intac QuizDocument4 pagesIntac QuizPamela Joy AlvarezNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Group FinancialDocument8 pagesGroup FinancialNever GonondoNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Chapter 3 Problem 1, 2 and 5 SolutionsDocument30 pagesChapter 3 Problem 1, 2 and 5 SolutionseiaNo ratings yet

- Cost Method Amortization Chapter 3 ConsolidationDocument39 pagesCost Method Amortization Chapter 3 ConsolidationJane DizonNo ratings yet

- Chapter 3 3-1. The Solution To ThisDocument13 pagesChapter 3 3-1. The Solution To Thisericle8750% (2)

- Example - Tax ComputationDocument10 pagesExample - Tax ComputationAminul Islam RubelNo ratings yet

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- CHAPTER6Document24 pagesCHAPTER6Lhica EsterasNo ratings yet

- CHAPTER 9 For Cost Con de LeonDocument5 pagesCHAPTER 9 For Cost Con de LeonRose Ann GarciaNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- CF Assignment 2Document8 pagesCF Assignment 2Pranav JoshiNo ratings yet

- PREBOARD AFAR SOLUTIONSDocument4 pagesPREBOARD AFAR SOLUTIONSEphraimNo ratings yet

- IA-2 FINAL EXAM ANSWER KEYDocument4 pagesIA-2 FINAL EXAM ANSWER KEYCarlos arnaldo lavadoNo ratings yet

- Wealth Management and Alternate Investments: End Term Project ReportDocument36 pagesWealth Management and Alternate Investments: End Term Project ReportSakshee SinghNo ratings yet

- Foreclosure0815 PDFDocument8 pagesForeclosure0815 PDFNick ReismanNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Drills Exercises 18-Jan-2020Document2 pagesDrills Exercises 18-Jan-2020MCPS Operations BranchNo ratings yet

- Types of MergersDocument13 pagesTypes of MergersJebin JamesNo ratings yet

- N.B.P FinalDocument47 pagesN.B.P Finalammar_acca100% (1)

- Partnership AgreementDocument6 pagesPartnership AgreementChe'gu JamalNo ratings yet

- Supreme Court Validates Homebuyers as Financial Creditors Under IBCDocument8 pagesSupreme Court Validates Homebuyers as Financial Creditors Under IBCNishant KrNo ratings yet

- Marriott CaseDocument6 pagesMarriott CaseBeibei31475% (4)

- Hospital X-Ray Equipment QuoteDocument2 pagesHospital X-Ray Equipment QuoteMarkson LewaNo ratings yet

- Financial Accounts of The United States: First Quarter 2022Document205 pagesFinancial Accounts of The United States: First Quarter 2022AchmAd AlimNo ratings yet

- Math0301 Review Exercise Set 15Document5 pagesMath0301 Review Exercise Set 15Ever DaleNo ratings yet

- Source of Finance For BusinessDocument26 pagesSource of Finance For BusinessJooooooooNo ratings yet

- Debt Securitization in IndiaDocument16 pagesDebt Securitization in Indiasaurabhm590No ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

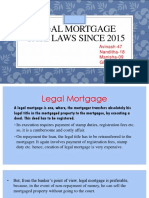

- LEGAL MORTGAGE CASE LAWS SINCE 2015Document10 pagesLEGAL MORTGAGE CASE LAWS SINCE 2015Avinash ManyamNo ratings yet

- 52211CA Commercial Banking in Canada Industry ReportDocument34 pages52211CA Commercial Banking in Canada Industry ReportAnshul Sharma100% (1)

- Anuj Project ReportDocument84 pagesAnuj Project Reportanuj singhNo ratings yet

- Compound InterestDocument33 pagesCompound InterestbhunkriNo ratings yet

- Memory Aid for Credit Transactions in Civil LawDocument34 pagesMemory Aid for Credit Transactions in Civil LawWinona Marie Borla100% (2)

- Topic 4 Mathematics of FinanceDocument66 pagesTopic 4 Mathematics of FinanceAndrew PillayNo ratings yet

- Management in Action On Shree Bhavani GranitesDocument2 pagesManagement in Action On Shree Bhavani GranitesAkshayNo ratings yet

- Responding To A Divorce, Legal Separation or NullityDocument41 pagesResponding To A Divorce, Legal Separation or NullityMarcNo ratings yet

- Debt RestructureDocument7 pagesDebt RestructureYuan basNo ratings yet

- Personal Loan Application FormDocument25 pagesPersonal Loan Application FormMahaveer Jain100% (2)

- The Evolution of Credit and Money SystemsDocument4 pagesThe Evolution of Credit and Money SystemsChantelle IshiNo ratings yet

- Student Loan Debt Research PaperDocument10 pagesStudent Loan Debt Research Paperapi-406088275No ratings yet

- Garuda Indonesia Case AnalysisDocument8 pagesGaruda Indonesia Case AnalysisPatDabz67% (3)

- Olino vs Medina land dispute caseDocument2 pagesOlino vs Medina land dispute caseOyi Lorenzo-Liban0% (1)

- Insolvency WorksheetDocument1 pageInsolvency WorksheetKelly Phillips ErbNo ratings yet