Professional Documents

Culture Documents

Government Climate Scores1

Uploaded by

Huong Dao MaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Climate Scores1

Uploaded by

Huong Dao MaiCopyright:

Available Formats

A Bloomberg Professional Services Offering

Bloomberg Professional Services

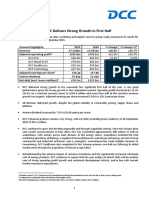

Climate Risk Scores:

Goverments

Assess government preparedness in the transition to a low carbon

world with transparent, data driven scores.

ESG

Countries around the world are racing to align to the Paris Climate Agreement, with goals of limiting warming to 1.5

degrees Celsius by achieving net zero greenhouse gas emissions. Government action can influence markets by setting

out clear, consistent policies, along with strong incentives that enable carbon emissions reduction and the shift towards

a low carbon economy.

But how can you effectively analyze a particular country when it comes to its climate transition performance? The

Bloomberg Government Climate Risk Scores provide meaningful detail and key performance indicators on 135

countries, addressing the many challenges associated with accurate measurement.

Bloomberg’s data-driven measure of country climate performance

The Bloomberg Government Climate Risk Scores are fully transparent, showing the connection between each score and

the country-reported data driving it. Further information on the Government Climate Risk Scores methodology is

available on BESG<GO>.

These scores are composed of three equally-weighted sets of measurements:

• Carbon Transition: Measures a country or region's historical, current and forward looking emissions performance.

• Power Transition: Measures a country or region's progress and future effort towards power sector decarbonization.

The Power Sector Transition score features proprietary BloombergNEF (BNEF) data collected for BNEF's

Climatescope project and other BNEF tools. It includes proprietary capacity country-level capacity and generation

data, wind and solar capacity additions forecast and clean energy investment numbers.

• Climate Policies: Measures a country or region's progress on net zero target pledges, green debt issuance and

renewable energy policy frameworks.

Key Features Use Cases

• Transparent scoring — Investors can view and analyze • Index and Portfolio construction — Government

the underlying data driving each score, making them Climate Risk scores and underlying data can be

useful for a wide range of analyses and reporting. leveraged to construct indices and portfolios by

• Quantitative methodology — Bloomberg’s employing score-based tilts, or by screening

proprietary quantitative model is informed by constituents in terms of explicit emissions

extensive research and analysis to: reduction.

o Normalize data • Government Level Peer Analysis — The

o Address GDP size biases quantitative methodology employed adjusts for

o Assess materiality of specific fields based on economy size biases, as well as investment and

economic indicators and government policies policy materiality, to enable score performance

o Effectively aggregate data comparisons across countries.

Climate Risk Scores

Access Government Climate Risk Scores and identify best and worst performers

BI ESG GOVCLIMATE <GO>> — To view Government Climate Risk Scores open the BI ESG Dashboard and select BBG Scores from the Data Library.

Track detailed performance metrics across pillars

Access and analyze performance at the Issues and Sub-issue level across the three scoring pillars.

Learn more

For more information about Government Climate Risk Scores, contact your account representative.

Take the next step. Beijing Hong Kong New York Singapore

+86 10 6649 7500 +852 2977 6000 +1 212 318 2000 +65 6212 1000

For additional information, Dubai London San Francisco Sydney

press the <HELP> key twice +971 4 364 1000 +44 20 7330 7500 +1 415 912 2960 +61 2 9777 8600

on the Bloomberg Terminal®. Frankfurt Mumbai São Paulo Tokyo

+49 69 9204 1210 +91 22 6120 3600 +55 11 2395 9000 +81 3 4565 8900

bloomberg.com/esg The data included in these materials are for illustrative purposes only. ©2021 Bloomberg

You might also like

- Launching A Digital Tax Administration Transformation: What You Need to KnowFrom EverandLaunching A Digital Tax Administration Transformation: What You Need to KnowNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Governance Scores Fact SheetDocument3 pagesGovernance Scores Fact SheetSekhar aNo ratings yet

- Economics - Economics - Cheat - SheetDocument1 pageEconomics - Economics - Cheat - SheetranaurNo ratings yet

- CDP CC 2020 Final Sans SCDocument101 pagesCDP CC 2020 Final Sans SCJose LopezNo ratings yet

- Business Environment GDP FINAL ReportDocument10 pagesBusiness Environment GDP FINAL ReportLIFO LIFO (Magazine)No ratings yet

- Climate Risk Symposium Part 2:: Managing A Disorderly TransitionDocument42 pagesClimate Risk Symposium Part 2:: Managing A Disorderly TransitionHEINRICH VARDYNo ratings yet

- PORT+ Modules FactsheetDocument1 pagePORT+ Modules FactsheetBing LiNo ratings yet

- White-Paper-Service Providers-Green-It-SustainabilityDocument22 pagesWhite-Paper-Service Providers-Green-It-Sustainability陳鼎元No ratings yet

- DGNB Criteria Set Districts Version 2020Document561 pagesDGNB Criteria Set Districts Version 2020Michał NawrotNo ratings yet

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- DDM Model (Revised)Document5 pagesDDM Model (Revised)Tran UyenNo ratings yet

- Bloomberg Close Price Fact SheetDocument2 pagesBloomberg Close Price Fact Sheetjuan camilo FrancoNo ratings yet

- Lyft 2022 12 31 Press Release (Annual)Document12 pagesLyft 2022 12 31 Press Release (Annual)Rio RahmatNo ratings yet

- Sustainability ReportingDocument29 pagesSustainability ReportingOmkar PednekarNo ratings yet

- 4Q13 Presentation of ResultsDocument24 pages4Q13 Presentation of ResultsMillsRINo ratings yet

- Factsheet Alesund NorwayDocument64 pagesFactsheet Alesund Norwayamin mohNo ratings yet

- Wong Check Ying 04003446 Cheung Siu Wun 04004485 Lee Po Hung 04005856 Leung Yee Ka 04014057Document47 pagesWong Check Ying 04003446 Cheung Siu Wun 04004485 Lee Po Hung 04005856 Leung Yee Ka 04014057jeet_singh_deepNo ratings yet

- TERM 1-Credits 3 (Core) TAPMI, Manipal Session 4: Prof Madhu & Prof RajasulochanaDocument24 pagesTERM 1-Credits 3 (Core) TAPMI, Manipal Session 4: Prof Madhu & Prof RajasulochanaAnishNo ratings yet

- ReportDocument9 pagesReportOrlan GaliyNo ratings yet

- Interim Report 2021Document39 pagesInterim Report 2021Priya ShindeNo ratings yet

- LG 10sr 12-FullenDocument88 pagesLG 10sr 12-FullenAnh Khoa PhạmNo ratings yet

- Bloomberg TPPA - Third Party QuestionnaireDocument4 pagesBloomberg TPPA - Third Party QuestionnaireronistgdrNo ratings yet

- DIscussion Day 1Document20 pagesDIscussion Day 1MANINDER SYAMALANo ratings yet

- United States Debt Ceiling and Impact On Bloomberg Index: Technical NoteDocument3 pagesUnited States Debt Ceiling and Impact On Bloomberg Index: Technical NotehaginileNo ratings yet

- Cost of Living 2020 11Document12 pagesCost of Living 2020 11vae2797No ratings yet

- In The Spotlight How Software Accelerates Sustainability Reporting and Performance Management FINAL CompressedDocument18 pagesIn The Spotlight How Software Accelerates Sustainability Reporting and Performance Management FINAL CompressedDDNo ratings yet

- Financial Analysis of Coca Cola CompanyDocument22 pagesFinancial Analysis of Coca Cola CompanyCedric AjodhiaNo ratings yet

- World - Quality - Report - 2017-18 - Capgemini PDFDocument76 pagesWorld - Quality - Report - 2017-18 - Capgemini PDFPavan VasudevanNo ratings yet

- World Quality Report: 2017-18 Ninth EditionDocument76 pagesWorld Quality Report: 2017-18 Ninth EditionAgastiya S. MohammadNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- Governance Roadshow 2022 LandisGyr May 2022Document30 pagesGovernance Roadshow 2022 LandisGyr May 2022Yu hongNo ratings yet

- GX Deloitte 2019 Global Impact Report Basis of ReportingDocument6 pagesGX Deloitte 2019 Global Impact Report Basis of ReportingEsteban MartinNo ratings yet

- CTI 2.0 Report - Metrics For Business by Business Final v2Document74 pagesCTI 2.0 Report - Metrics For Business by Business Final v2carbononeutralNo ratings yet

- Global Trends in Renewable Energy Investment 2015Document2 pagesGlobal Trends in Renewable Energy Investment 2015YounesNo ratings yet

- Blackrock 2021 GHG Emissions ReportDocument7 pagesBlackrock 2021 GHG Emissions Reportaquaboi924No ratings yet

- 23 034 Programme Advanced-Transfer Pricing Global Transformation FinalDocument5 pages23 034 Programme Advanced-Transfer Pricing Global Transformation Final79569zdqtwNo ratings yet

- Dell Technologies IncDocument8 pagesDell Technologies IncBrute1989No ratings yet

- Annual ReportDocument100 pagesAnnual Reportkim007No ratings yet

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- 2021 Integrated Report - enDocument49 pages2021 Integrated Report - enhuyphanNo ratings yet

- Joyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingDocument20 pagesJoyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingInternational Consortium on Governmental Financial ManagementNo ratings yet

- Annual Report 2014 KSB Group DataDocument176 pagesAnnual Report 2014 KSB Group DataRicardo BarrosNo ratings yet

- Consooo2 Final Submission Himanshu Gupta (z5454806)Document13 pagesConsooo2 Final Submission Himanshu Gupta (z5454806)himanshu guptaNo ratings yet

- Samsung Analyst Day Finances 1 PDFDocument34 pagesSamsung Analyst Day Finances 1 PDFJason MickNo ratings yet

- Globe: Analyst Briefing MaterialsDocument11 pagesGlobe: Analyst Briefing MaterialsBusinessWorldNo ratings yet

- Tisa Esg Briefing Slide Deck 1Document78 pagesTisa Esg Briefing Slide Deck 1Giang VuNo ratings yet

- Assignment 3 EconomicssDocument11 pagesAssignment 3 EconomicssRanvir SinghNo ratings yet

- Uob Sustainability Report 2022Document170 pagesUob Sustainability Report 2022kangjunze403No ratings yet

- 2023-05-30 Staff Report - 2022 Climate Emergency Action PlanDocument201 pages2023-05-30 Staff Report - 2022 Climate Emergency Action PlanBobNo ratings yet

- Carbon Footprint Report 2022 enDocument48 pagesCarbon Footprint Report 2022 enTojo harivola germain ANDRIAMIHANTANo ratings yet

- Green Mark NRB 2015 CriteriaDocument209 pagesGreen Mark NRB 2015 CriteriaMa joue Est venuNo ratings yet

- Leading IndicatorDocument26 pagesLeading IndicatoralexanderNo ratings yet

- Atos Annual Results 2021Document28 pagesAtos Annual Results 2021Anand TajneNo ratings yet

- BSC (Hons) Accounting Minor: Business InformaticsDocument31 pagesBSC (Hons) Accounting Minor: Business InformaticsKavish BhandoyNo ratings yet

- Carbon Reduction Plan Nov 22Document8 pagesCarbon Reduction Plan Nov 22goutam suryadeveraNo ratings yet

- LG Annual Report 2022Document24 pagesLG Annual Report 2022Linh Hong PhamNo ratings yet

- Mondelēz International: CAGNY ConferenceDocument66 pagesMondelēz International: CAGNY ConferenceAnkit WindlasNo ratings yet

- A Bengoa 2011Document50 pagesA Bengoa 2011pocholoshop7No ratings yet

- 2.2 Materi CCRDocument9 pages2.2 Materi CCRfadhlyjheNo ratings yet

- Review of Research Based Literature (Brm917)Document8 pagesReview of Research Based Literature (Brm917)Azrin Kun KidzStudiosNo ratings yet

- ESG Syllabus V3 16062021finalDocument13 pagesESG Syllabus V3 16062021finalsaabiraNo ratings yet

- Man CH 3 MCQDocument65 pagesMan CH 3 MCQAbhishek57% (44)

- Employee PerformaceDocument15 pagesEmployee PerformaceMalik AwanNo ratings yet

- Qualman Quiz 3Document4 pagesQualman Quiz 3Laurence Ibay PalileoNo ratings yet

- The Role of Transparency in School AdministrationDocument10 pagesThe Role of Transparency in School Administrationsanjuanwest districtNo ratings yet

- Penalties For Success: Reactions To Women Who Succeed at Male Gender-Typed TasksDocument12 pagesPenalties For Success: Reactions To Women Who Succeed at Male Gender-Typed TasksHeloisaNo ratings yet

- MArketing ResearchDocument19 pagesMArketing Researcharnabjyoti dasNo ratings yet

- The Impact of Entrepreneurial Climate On Youth Unemployment: A Study of This Relationship in Swedish MunicipalitiesDocument49 pagesThe Impact of Entrepreneurial Climate On Youth Unemployment: A Study of This Relationship in Swedish MunicipalitiesHeaven SentNo ratings yet

- Business Environment Unit 1: 1.1 Concepts of Business Environment 1.1.1 Defination of BEDocument12 pagesBusiness Environment Unit 1: 1.1 Concepts of Business Environment 1.1.1 Defination of BEVamshi KrishnaNo ratings yet

- Inferential StatisticsDocument6 pagesInferential StatisticsRomdy LictaoNo ratings yet

- Otago MuseumDocument19 pagesOtago MuseumFoamdomeNo ratings yet

- Exploring Research Methodology: Review Article International Journal of Research & Reviewed by KELDocument5 pagesExploring Research Methodology: Review Article International Journal of Research & Reviewed by KELkel zewedeNo ratings yet

- 2001-003-C-01 Framework For Measuring SuccessDocument21 pages2001-003-C-01 Framework For Measuring SuccessironclawNo ratings yet

- Questionnaire Example 3Document6 pagesQuestionnaire Example 3Muhammad Sajid Saeed0% (1)

- Ref Om McDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteDocument4 pagesRef Om McDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteJing CruzNo ratings yet

- Research Methods in Tourism: By. Kimberly Bunquin Mialyn CustodioDocument20 pagesResearch Methods in Tourism: By. Kimberly Bunquin Mialyn CustodiorhyzeneNo ratings yet

- 1 Introduction To Bridge EngineeringDocument18 pages1 Introduction To Bridge EngineeringUsman RafiqNo ratings yet

- SEA Technology Feb 2022Document45 pagesSEA Technology Feb 2022skr20100% (1)

- Folio ThinkingDocument4 pagesFolio Thinkingapi-677280872No ratings yet

- Rhetorical AnalysisDocument6 pagesRhetorical Analysisapi-299723979100% (1)

- Web QuestsDocument4 pagesWeb Questsapi-689855542No ratings yet

- Validity and ReliabilityDocument96 pagesValidity and ReliabilitysylarynxNo ratings yet

- Critical To Customer RequirementsDocument29 pagesCritical To Customer RequirementsVaibhav SinghNo ratings yet

- Yield Curve Analysis Using Principal ComponentsDocument6 pagesYield Curve Analysis Using Principal ComponentssoumyakumarNo ratings yet

- A Comparative Study of Culinary Practices of Homegrown Cooks and Chefs in Contemporary Philippine Cuisine of Heirloom Recipes of CalabarzonDocument4 pagesA Comparative Study of Culinary Practices of Homegrown Cooks and Chefs in Contemporary Philippine Cuisine of Heirloom Recipes of CalabarzonGwreyneth Kate MiroNo ratings yet

- Quantitative Analysis: Dianna May C. MacapulayDocument19 pagesQuantitative Analysis: Dianna May C. MacapulayDianna May Combate MacapulayNo ratings yet

- Transcript P3-4 (Test 1)Document5 pagesTranscript P3-4 (Test 1)Đỗ NguyênNo ratings yet

- Gizi-Nutrisional MarasmusDocument11 pagesGizi-Nutrisional MarasmusAndrewNo ratings yet