Professional Documents

Culture Documents

Annexure A Hawa Energy

Uploaded by

Kamran RaufOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure A Hawa Energy

Uploaded by

Kamran RaufCopyright:

Available Formats

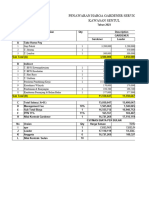

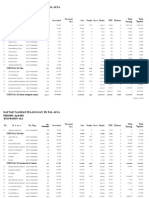

Labels A B C=AxB D E F G H = C+D+E+F+G I J K=H+I+J

Service GST (SRB

Monthly Salary No. Of EOBI @1250

Description Location Gross Salary SESSI @ 6% Edu.CESS GLI Subtotal Charges @13%) On Grand Total

Per Employee Employee Per Employee

(7%) Service Charges

Base Working Sindh 30,000 1 30,000 1,250 1,800 9 250 33,309 2,332 303 35,944

Location 1 Noori Abad 30,000 12 360,000 15,000 21,600 108 3,000 399,708 27,980 3,637 431,325

Location 2 Head-Office 30,000 9 270,000 11,250 16,200 1,296 2,250 300,996 21,070 2,739 324,805

Grand Total 21 630,000 26,250 37,800 1,404 5,250 700,704 49,050 6,377 756,131

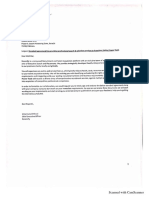

Important Notes:

Labor Laws Provisions

Monthly Wage: Referred to Minimum Wage For Skills Labor Sindh Minimum Wages ACT 2015

Employee Old-Age Benefits (EOBI): Referred to law EOBI ACT 1976

Sindh Employees Social Security (SESSI): 6% applicable on the salary range identified by concern authorities Sindh Employees Social Security Act, 2016

Education CESS : Applicable as per law Workers Children Education Ordinance 1972

Group Life Insurance (GLI): Applicable as per Workmen's Compensation Act 1923

Note:

Compliance cost will be charged to client as per prevailing laws

Tax Law

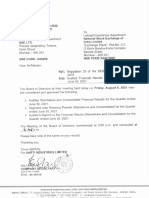

Service Category: Resorsify is the HR Services Provider and fall under the category of Labor and Manpower Outsourcing

Income Tax: Advance Income Tax Under Section 153 1b @ 3% On Services Charges Only Referred (Section 153, First Schedule, Part III, Division III)

Sindh Revenue Board Service Sales Tax (SRB): Applicable as per Law Sindh Sales Tax on Services Act 2011

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- UnAudited Result-Mangalam Cement-Q1 2020Document4 pagesUnAudited Result-Mangalam Cement-Q1 2020Rajeev RsNo ratings yet

- Wages Rate A B C NewDocument3 pagesWages Rate A B C NewpcnishantNo ratings yet

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1No ratings yet

- Contor BQ RSUD Claning Servise .Document2 pagesContor BQ RSUD Claning Servise .Apa BaeNo ratings yet

- Assignment 01, HRM 412Document3 pagesAssignment 01, HRM 412Nur Nahar LimaNo ratings yet

- Selina Solution Concise Maths Class 10 Chapter 1 Exercise 1ADocument7 pagesSelina Solution Concise Maths Class 10 Chapter 1 Exercise 1AAviral KaushalNo ratings yet

- Fm-Ii Assignment Fm-Ii Assignment: Neha Singh Neha SinghDocument62 pagesFm-Ii Assignment Fm-Ii Assignment: Neha Singh Neha SinghNeha SinghNo ratings yet

- Q2FY22 ResultsDocument16 pagesQ2FY22 ResultsrohitnagrajNo ratings yet

- Bonus Akhir Tahun - TKI MalaysiaDocument1 pageBonus Akhir Tahun - TKI Malaysiahardi.saputra27No ratings yet

- Sunny TaxDocument2 pagesSunny TaxImran UllahNo ratings yet

- Ibcp - Open House: 8 April 2023Document8 pagesIbcp - Open House: 8 April 2023ca_charanjitNo ratings yet

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDocument6 pagesPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNo ratings yet

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDocument6 pagesPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNo ratings yet

- MRSD Labour Market Report 4Q 2019Document78 pagesMRSD Labour Market Report 4Q 2019Phú VõNo ratings yet

- Financial Management: Case#0 A-Rod: Signing The Best Player in BaseballDocument8 pagesFinancial Management: Case#0 A-Rod: Signing The Best Player in BaseballSakshiChaturvediNo ratings yet

- Sulit & Persendirian: PayslipDocument1 pageSulit & Persendirian: Paysliplegasijambang 83No ratings yet

- Mahima - Pay Slip SeptemberDocument1 pageMahima - Pay Slip SeptemberMegha DurganNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Darshan Shetty - AnnexureDocument1 pageDarshan Shetty - Annexuredarshan shettyNo ratings yet

- Experience IIFTDocument4 pagesExperience IIFTJayesh JaiswalNo ratings yet

- List Non RT April 2021Document30 pagesList Non RT April 2021rahmawatiNo ratings yet

- REF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00Document1 pageREF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00RajNo ratings yet

- Payslip 10115186 03-2023 2023-04-06 17 23 03 642eb29f0ddb6Document1 pagePayslip 10115186 03-2023 2023-04-06 17 23 03 642eb29f0ddb6krishnasai4222No ratings yet

- Private and Confidential: Payslip For PeriodDocument1 pagePrivate and Confidential: Payslip For PeriodYahya Uso YahyaNo ratings yet

- Closing EntriesDocument1 pageClosing EntriesRania GoujaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- City of Fort St. John - 2023-2027 Operating BudgetDocument30 pagesCity of Fort St. John - 2023-2027 Operating BudgetAlaskaHighwayNewsNo ratings yet

- Nahmias Chapter 3 SolutionsDocument9 pagesNahmias Chapter 3 SolutionsDiego Andres Vasquez100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- CIRP Expenses - BreakupDocument2 pagesCIRP Expenses - BreakupsnigdhabeeNo ratings yet

- Project Report of M/S.Abc CoDocument10 pagesProject Report of M/S.Abc CoRajesh BogulNo ratings yet

- August 11, 2023: 153/LG/SE/AUG/2023/GBSLDocument8 pagesAugust 11, 2023: 153/LG/SE/AUG/2023/GBSLmd zafarNo ratings yet

- Bihar State Electronics Development Corporation: Beltron Bhawan, Shastrinagar, PatnaDocument2 pagesBihar State Electronics Development Corporation: Beltron Bhawan, Shastrinagar, PatnaAbhishek KumarNo ratings yet

- 2012Document133 pages2012MwiAccounts BranchNo ratings yet

- CCLYTICX - Security & HK 2021 2022Document3 pagesCCLYTICX - Security & HK 2021 2022yggdrasiladvisorsNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- Chapter 1Document21 pagesChapter 1tirumalaNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- KA Yagi & Co. 2022-2023Document1 pageKA Yagi & Co. 2022-2023Tania AkterNo ratings yet

- PES Institute of Technology, Bangalore South Campus.: Net Salary Sd/-PrincipalDocument2 pagesPES Institute of Technology, Bangalore South Campus.: Net Salary Sd/-PrincipalHemanth Kumar SNo ratings yet

- Q1FY22 ResultsDocument14 pagesQ1FY22 ResultsrohitnagrajNo ratings yet

- News ICLDocument12 pagesNews ICLAlok DeoriNo ratings yet

- PayslipDocument1 pagePayslipSuyash RaulNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- Ori Salary Telogic Staff IND Feb'17Document14 pagesOri Salary Telogic Staff IND Feb'17Suparjo PranotoNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsKezNo ratings yet

- Sgs India Private Limited Full and Final For The Month of Mar 2021Document2 pagesSgs India Private Limited Full and Final For The Month of Mar 2021Saket JhaNo ratings yet

- Sadbhav Infrastructure ProjectDocument16 pagesSadbhav Infrastructure ProjectbardhanNo ratings yet

- GUNJI ANIL JulyDocument1 pageGUNJI ANIL JulyBhaskar Siva KumarNo ratings yet

- Arfin India LimitedDocument4 pagesArfin India Limitedkumar52No ratings yet

- Aug 2021Document1 pageAug 2021meghaunited2No ratings yet

- Sbi 2022-23qs (Autosaved) Robin and HiteshDocument21 pagesSbi 2022-23qs (Autosaved) Robin and HiteshHitesh GuptaNo ratings yet

- f6vnm 2007 Dec ADocument6 pagesf6vnm 2007 Dec APhạm Hùng DũngNo ratings yet

- IPC-14 Abstract MPL-076 (21 Mar 2023)Document54 pagesIPC-14 Abstract MPL-076 (21 Mar 2023)Adnan IbrahimNo ratings yet

- Project Report On: Saraswati Vidya Mandiram-NarpalaDocument24 pagesProject Report On: Saraswati Vidya Mandiram-NarpalaUsmankhan KhanNo ratings yet

- Chapter 7 Financial Aspect ScheduleDocument13 pagesChapter 7 Financial Aspect ScheduleAleelNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- PAYSLIP Jun-2023Document1 pagePAYSLIP Jun-2023satish vNo ratings yet

- Assignment 2 - AccountsDocument6 pagesAssignment 2 - AccountsKamran RaufNo ratings yet

- TVM Spring 2015Document2 pagesTVM Spring 2015Kamran RaufNo ratings yet

- Excel WorkingDocument5 pagesExcel WorkingKamran RaufNo ratings yet

- Kamran Rauf Application of QuantativeDocument4 pagesKamran Rauf Application of QuantativeKamran RaufNo ratings yet

- 24-5-2023 Shu SfiDocument10 pages24-5-2023 Shu SfiKamran RaufNo ratings yet

- AStudyof Brand Awarenessand Customer SatisfactionDocument12 pagesAStudyof Brand Awarenessand Customer SatisfactionKamran RaufNo ratings yet

- Junaid SiddiqueDocument1 pageJunaid SiddiqueKamran RaufNo ratings yet

- Internship Report - Kamran Rauf - FinalDocument15 pagesInternship Report - Kamran Rauf - FinalKamran RaufNo ratings yet

- Customer Satisfaction TheoriesDocument1 pageCustomer Satisfaction TheoriesKamran RaufNo ratings yet

- Marketing Research - Aamir Ali KhanDocument16 pagesMarketing Research - Aamir Ali KhanKamran RaufNo ratings yet

- Term Project - MergedDocument10 pagesTerm Project - MergedKamran RaufNo ratings yet

- Descriptive SatisDocument7 pagesDescriptive SatisKamran RaufNo ratings yet

- FBMJ Contents Abstracts Volume 4 Issue1Document2 pagesFBMJ Contents Abstracts Volume 4 Issue1Kamran RaufNo ratings yet

- ATT46812Document2 pagesATT46812Kamran RaufNo ratings yet

- Marketing Research Report - Kamran Rauf - F220BBA204 - Fall - 2022Document27 pagesMarketing Research Report - Kamran Rauf - F220BBA204 - Fall - 2022Kamran RaufNo ratings yet

- Ayaz KhosoDocument2 pagesAyaz KhosoKamran RaufNo ratings yet

- AliAhmed KamaliDocument6 pagesAliAhmed KamaliKamran RaufNo ratings yet

- HRPlus - ProfilesDocument21 pagesHRPlus - ProfilesKamran RaufNo ratings yet

- Recruitment ContractDocument5 pagesRecruitment ContractKamran RaufNo ratings yet

- Harunavamwe Kanengoni 2013 AJBMDocument8 pagesHarunavamwe Kanengoni 2013 AJBMKamran RaufNo ratings yet

- Impact of Nonmonetary Factors On Retention of Higher Education Institutes Teachers Through Mediating Role of Motivation1Document18 pagesImpact of Nonmonetary Factors On Retention of Higher Education Institutes Teachers Through Mediating Role of Motivation1Kamran RaufNo ratings yet

- Impact of Supply Chain Management Strategies On Business PerformanceDocument6 pagesImpact of Supply Chain Management Strategies On Business PerformanceKamran RaufNo ratings yet

- 28 6 2022ijbt313115-130Document17 pages28 6 2022ijbt313115-130Kamran RaufNo ratings yet

- Factors Affecting Customer Satisfaction in After-Sales Service of Malaysian Electronic Business MarketDocument10 pagesFactors Affecting Customer Satisfaction in After-Sales Service of Malaysian Electronic Business MarketKamran RaufNo ratings yet

- Questionnaire Form - Kamran Rauf AssignmentDocument3 pagesQuestionnaire Form - Kamran Rauf AssignmentKamran RaufNo ratings yet

- 1650-Article Text-4055-2-10-20220119Document25 pages1650-Article Text-4055-2-10-20220119Kamran RaufNo ratings yet

- How Do Internet Memes Affect Brand Image?: Hsuju TengDocument15 pagesHow Do Internet Memes Affect Brand Image?: Hsuju TengKamran RaufNo ratings yet

- Toll Free: 1-866-512-3861 Fax: 757-952-0119 Tel: 757-952-0118 421 Butler Farm Road Hampton, VA 23666Document3 pagesToll Free: 1-866-512-3861 Fax: 757-952-0119 Tel: 757-952-0118 421 Butler Farm Road Hampton, VA 23666Reynaldo RodríguezNo ratings yet

- Victorias Milling Co. Inc. vs. SSS (4 SCRA 627) Case DigestDocument2 pagesVictorias Milling Co. Inc. vs. SSS (4 SCRA 627) Case DigestCamelle EscaroNo ratings yet

- Social Security and SSI IssuesDocument40 pagesSocial Security and SSI Issuesdave8365-1100% (2)

- RA 7432 - Senior Citizens ActDocument5 pagesRA 7432 - Senior Citizens ActChristian Mark Ramos GodoyNo ratings yet

- Ssa 7162Document2 pagesSsa 7162grijalva100% (1)

- Member Enrollment Application - APEX Plan - FillableDocument1 pageMember Enrollment Application - APEX Plan - Fillableeric.risnerNo ratings yet

- Farm Business Planning and StartupDocument15 pagesFarm Business Planning and Startupdchammer3171No ratings yet

- Excel 2007 Final Practical ExamDocument2 pagesExcel 2007 Final Practical ExamCarol Neng Calupitan100% (1)

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- CA Enrollment FormDocument7 pagesCA Enrollment FormCarolineXiaNo ratings yet

- Midland Valley Monthly - November 2012Document16 pagesMidland Valley Monthly - November 2012Aiken StandardNo ratings yet

- April To June 2020 TransamericaDocument6 pagesApril To June 2020 TransamericaBuckner Napoleon NesheimNo ratings yet

- CH 7 Measuring GrowthDocument15 pagesCH 7 Measuring GrowthAdam XuNo ratings yet

- Senate Hearing, 110TH Congress - The Aging Workforce: What Does It Mean For Businesses and The Economy ?Document204 pagesSenate Hearing, 110TH Congress - The Aging Workforce: What Does It Mean For Businesses and The Economy ?Scribd Government DocsNo ratings yet

- Parkin Econ SM CH30 GeDocument22 pagesParkin Econ SM CH30 GeMuri SetiawanNo ratings yet

- Homestead Credit Refund (For Homeowners) and Renter's Property Tax RefundDocument32 pagesHomestead Credit Refund (For Homeowners) and Renter's Property Tax Refundsundevil2010usa4605No ratings yet

- Work Opportunity Tax Credit Package: Employee InstructionsDocument3 pagesWork Opportunity Tax Credit Package: Employee InstructionsAnonymous K8H1CRR2mNo ratings yet

- US Internal Revenue Service: I1040 - 1999Document117 pagesUS Internal Revenue Service: I1040 - 1999IRSNo ratings yet

- NJ PersDocument58 pagesNJ PersHPAE5094No ratings yet

- Nyambirai V National Social Security Authority and AnotherDocument15 pagesNyambirai V National Social Security Authority and Anotherian_ling_2100% (2)

- Lecture Notes On RetirementDocument51 pagesLecture Notes On RetirementCéline van Essen100% (1)

- CH 2Document71 pagesCH 2Adilene AcostaNo ratings yet

- 2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsDocument12 pages2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsCrystal KleistNo ratings yet

- Pas 24Document7 pagesPas 24angelo vasquezNo ratings yet

- Chap 006Document24 pagesChap 006Fazal WahabNo ratings yet

- 3FLUID - Florida Unemployment Internet Direct ClaimsDocument4 pages3FLUID - Florida Unemployment Internet Direct ClaimsBarbara PomalesNo ratings yet