Professional Documents

Culture Documents

Bus Com Acq Date Illustration

Uploaded by

Jhona May Golilao QuiamcoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bus Com Acq Date Illustration

Uploaded by

Jhona May Golilao QuiamcoCopyright:

Available Formats

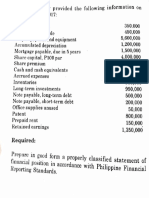

1. Prince Charming Corporation acquired all the assets and assume all liabilities of Princess Corporation.

The

information below summarizes the financial position of Princess Corp and Prince Charming Corp

Princess Prince Charming

Carrying Amount Fair Value Carrying Amount Fair Value

Cash 2,500,000 10,000,000

Inventory 2,800,000 2,500,000 4,000,000 3,800,000

Equipment 3,000,000 2,900,000 5,000,000 4,000,000

Building 4,300,000 4,000,000 3,000,000 2,600,000

Land 5,000,000 6,000,000 10,000,000 12,000,000

Goodwill 1,000,000 500,000

Patent 500,000 600,000 300,000 500,000

Accounts payable 2,300,000 2,300,000 2,800,000 2,800,000

Bonds Payable 3,100,000 3,500,000 1,000,000 1,200,000

Shareholder’s Equity 13,700,000 29,000,000

The purchase price is composed of Cash 8,000,000, Ordinary Shares with a fair value of 2,800,000, and a 3-year

Bonds Payable with a face amount of 5,000,000. The bonds payable was discounted to earn 12% annual interest.

Prince Charming incurred the following cost in completing the acquisition:

Cost of issuing bonds 50,000

Legal fees 100,000

Finder’s fees 50,000

Professional Fees 100,000

Cost of issuing shares 80,000

a. Compute for the Fair Value of the Net Assets Acquired (FVNA).

b. Compute for the total Consideration Transferred.

c. Compute for the goodwill/gain on bargain purchase on the said transaction.

d. Determine the amount of assets and liabilities after the business combination.

2. On January 1, 2023, P Corp. acquired 70% ordinary shares of S Corp. the Fair Value of the Net Assets acquired is

500,000. Compute for the Goodwill/Gain on Bargain Purchase under the following cases:

a. The consideration transferred is 400,000 cash. The fair value of the Non-controlling interest is 200,000.

b. The consideration transferred is 400,000 cash. The NCI is measured using the implied Fair Value method.

c. The consideration transferred is 400,000 cash. The NCI is measured using the proportionate share in FVNA.

d. The consideration transferred is 200,000 and the Fair value of the NCI is 130,000.

e. The consideration transferred is 200,000 and the NCI is measured using the implied Fair Value method.

f. The consideration transferred is 300,000 cash plus a control premium of 100,000. The NCI is measured using the

implied FV method.

3. On January 1, 2023 Daddy Shark acquired Mommy Shark Corp’s 40% ordinary shares for 600,000 which is the fair

value at that time. The investment does not result to control hence, the investment is classified as investment

through FVPL. On June 30,2023, Daddy Shark acquired an additional 30% interest in Mommy Shark for 500,000 the

fair value at that time. The Fair Value of the net assets acquired is 1,000,000 while the NCI is measured at Fair Value

for 400,000. Cost incurred related to business combination is 30,000.

a. Compute the goodwill/gain from business combination.

b. Compute for the net amount to be recognized in profit or loss.

“Success is achieved not by doing only what is comfortable and convenient. Success is built by doing what must be

done to reach it”

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Cash Flow Online April 6 2024 For StudentsDocument5 pagesCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNo ratings yet

- ABC Company DEF Company: Book Fair Book FairDocument15 pagesABC Company DEF Company: Book Fair Book FairJonas Avanzado TianiaNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Corporate Liquidation Pproblems AfarDocument8 pagesCorporate Liquidation Pproblems AfarJhernel SuaverdezNo ratings yet

- Multiple Choice 2019 2020Document9 pagesMultiple Choice 2019 2020Chi IuvianamoNo ratings yet

- Conceptual Frameworks and Accounting Standard - ProblemsDocument3 pagesConceptual Frameworks and Accounting Standard - ProblemsIris Mnemosyne100% (1)

- 1GGJ42AOFPKHYIMZCONI4A0IGQQB7ADocument3 pages1GGJ42AOFPKHYIMZCONI4A0IGQQB7Ajaymark canayaNo ratings yet

- Debt Restructuring Group ActDocument8 pagesDebt Restructuring Group ActYaka Waka100% (1)

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Intangible AssetsDocument7 pagesIntangible Assetssammeracobre-7155No ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- DocxDocument12 pagesDocxAimee DyingNo ratings yet

- P1 QuestionsDocument31 pagesP1 QuestionsWillen Christia M. MadulidNo ratings yet

- Lyceum of Alabang: Partnership AccountingDocument4 pagesLyceum of Alabang: Partnership AccountingJoshua UmaliNo ratings yet

- Solution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Document3 pagesSolution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Christian Clyde Zacal ChingNo ratings yet

- Acctg For Business Combination - Second Evaluation PDFDocument2 pagesAcctg For Business Combination - Second Evaluation PDFDebbie Grace Latiban Linaza100% (1)

- Intermediate Accounting 2 AnswersDocument18 pagesIntermediate Accounting 2 AnswersFery AnnNo ratings yet

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- Chapter 31Document6 pagesChapter 31LorraineMartinNo ratings yet

- AFAR Summative Assessment Problems (Kay Jared)Document75 pagesAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- Notes On Partnership FormationDocument11 pagesNotes On Partnership FormationSarah Mae EscutonNo ratings yet

- Corporation Multiple ChoiceDocument18 pagesCorporation Multiple ChoiceDexell Mar MotasNo ratings yet

- Assessment 4 2024 FARDocument7 pagesAssessment 4 2024 FARmarinel pioquidNo ratings yet

- Financing Equity ProblemsDocument14 pagesFinancing Equity ProblemsIris MnemosyneNo ratings yet

- An-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmDocument4 pagesAn-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmHiba ShalbeNo ratings yet

- Seth Harvey Hendeve IPPPE ME QuizDocument4 pagesSeth Harvey Hendeve IPPPE ME Quizjeams vidalNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- 7160 - FAR Preweek ProblemDocument14 pages7160 - FAR Preweek ProblemMAS CPAR 93No ratings yet

- Dissolution1 PDFDocument7 pagesDissolution1 PDFceidris MartinezNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- FAR-01 Contributed CapitalDocument3 pagesFAR-01 Contributed CapitalKim Cristian MaañoNo ratings yet

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Finals Answer KeyDocument11 pagesFinals Answer Keymarx marolinaNo ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- CH 02 PDFDocument24 pagesCH 02 PDFAurcus JumskieNo ratings yet

- AFAR04-10 Business Combination Date of AcquisitionDocument3 pagesAFAR04-10 Business Combination Date of AcquisitioneildeeNo ratings yet

- Entrepreneurship22 PDFDocument3 pagesEntrepreneurship22 PDFSean DineverrNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- The Supektibol Intangibles: Multiple ChoiceDocument70 pagesThe Supektibol Intangibles: Multiple ChoiceErica PortesNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- Batch 93 FAR First Preboard February 2023Document15 pagesBatch 93 FAR First Preboard February 2023Ameroden AbdullahNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionClaire CadornaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- Book Value Fair Value Book Value Fair ValueDocument18 pagesBook Value Fair Value Book Value Fair ValueCharla SuanNo ratings yet

- Far - First Preboard QuestionnaireDocument14 pagesFar - First Preboard QuestionnairewithyouidkNo ratings yet

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse SiocoNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Tucao - Case DigestDocument3 pagesTucao - Case DigestJhona May Golilao QuiamcoNo ratings yet

- Ortega - Case DigestDocument2 pagesOrtega - Case DigestJhona May Golilao QuiamcoNo ratings yet

- FULLTEXT01Document81 pagesFULLTEXT01Jhona May Golilao QuiamcoNo ratings yet

- Quiz 1Document2 pagesQuiz 1Jhona May Golilao QuiamcoNo ratings yet

- Project Finance Question PaperDocument3 pagesProject Finance Question PaperBhavna0% (1)

- WORKSHEET Business FinanceDocument3 pagesWORKSHEET Business FinanceLuvnica VermaNo ratings yet

- Accounting Standards ProjectDocument6 pagesAccounting Standards ProjectPuneet ChawlaNo ratings yet

- DR Reddys Laboratories: PrintDocument2 pagesDR Reddys Laboratories: PrintSiddharth VermaNo ratings yet

- Chap 4 Stock and Equity Valuation RevisedDocument49 pagesChap 4 Stock and Equity Valuation RevisedHABTAMU TULU100% (1)

- TestBank - Partnership Dissolution and LiquidationDocument3 pagesTestBank - Partnership Dissolution and LiquidationRyan Christian BalanquitNo ratings yet

- The Acquisition of Consolidated Rail Corporation (A)Document15 pagesThe Acquisition of Consolidated Rail Corporation (A)Neetesh ThakurNo ratings yet

- 1 Profit Prior To Incorporate Extra QuestionsDocument3 pages1 Profit Prior To Incorporate Extra QuestionsMahima tiwariNo ratings yet

- Financial Statement Analysis Project - Fall 2012-1Document9 pagesFinancial Statement Analysis Project - Fall 2012-1rajesh934No ratings yet

- Handout Investment in Debt SecuritiesDocument28 pagesHandout Investment in Debt SecuritiesTsukishima KeiNo ratings yet

- Quiz Test-2 Financial Derivatives (KMB-FM-05) : MBA (SEM 4) (Groups 41,42)Document1 pageQuiz Test-2 Financial Derivatives (KMB-FM-05) : MBA (SEM 4) (Groups 41,42)Vivek Singh RanaNo ratings yet

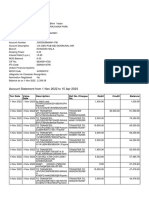

- Account Statement From 1 Nov 2022 To 15 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Nov 2022 To 15 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAyush yadavNo ratings yet

- Audit FirmsDocument5 pagesAudit FirmsJoel ChikomaNo ratings yet

- BLD 416 Budgeting and Financial Control 1 Lecture Note 2Document9 pagesBLD 416 Budgeting and Financial Control 1 Lecture Note 2Oluwayomi MalomoNo ratings yet

- Naveen State Bank of India Acc StatementDocument26 pagesNaveen State Bank of India Acc StatementSRV MOTORSSNo ratings yet

- Final Exam Set A MafDocument6 pagesFinal Exam Set A MafZeyad Tareq Al SaroriNo ratings yet

- GR 11 Accounting P2 (English) November 2022 Question PaperDocument14 pagesGR 11 Accounting P2 (English) November 2022 Question Paperphafane2020No ratings yet

- Open OfferDocument9 pagesOpen OfferraghuNo ratings yet

- Financial Statement Analysis Chapter One ExamplesDocument4 pagesFinancial Statement Analysis Chapter One ExamplesRichard ScripterNo ratings yet

- Cash Flow Valuation MethodsDocument5 pagesCash Flow Valuation Methodssan_lookNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- The Singapore Variable Capital Companies (VCC) at A GlanceDocument8 pagesThe Singapore Variable Capital Companies (VCC) at A GlanceMinal SequeiraNo ratings yet

- BFC5935 - Sample Exam PDFDocument5 pagesBFC5935 - Sample Exam PDFXue XuNo ratings yet

- Ijasr - Financial Performance of Coconut Oil Mills in Western PDFDocument6 pagesIjasr - Financial Performance of Coconut Oil Mills in Western PDFAnonymous dbnms1yNo ratings yet

- Taxpayers Account Management Program (Tamp)Document8 pagesTaxpayers Account Management Program (Tamp)mark liezerNo ratings yet

- H What Is ProrationDocument2 pagesH What Is ProrationDanica BalinasNo ratings yet

- Comparison of Mutual Funds With Other Investment OptionsDocument56 pagesComparison of Mutual Funds With Other Investment OptionsDiiivya86% (14)

- Screenshot 2022-10-06 at 9.42.46 AMDocument20 pagesScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNo ratings yet

- Exercise WorkDocument2 pagesExercise WorkELIZABETH MARGARETHANo ratings yet