Professional Documents

Culture Documents

Pacific Bank Seeks P61K from Insurer

Uploaded by

John Mark RevillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pacific Bank Seeks P61K from Insurer

Uploaded by

John Mark RevillaCopyright:

Available Formats

Pacific v CA

G.R. No. L-41014

November 28, 1988

Facts

An open fire insurance policy, was issued to Paramount Shirt

Manufacturing by Oriental Assurance Corporation to indemnify P61,000.00,

caused by fire to the factory’s stocks, materials and supplies. The insured was a

debtor of Pacific Banking in the amount of P800,000.00 and the goods described

in the policy were held in trust by the insured for Pacific Banking under trust

receipts.

The policy was endorsed to Pacific Banking as mortgagee/ trustor of the

properties insured, with the knowledge and consent of private respondent to the

effect that "loss if any under this policy is payable to the

Pacific Banking Corporation".

A fire broke out on the premises destroying the goods contained in the

building. The bank sent a letter of demand to Oriental for indemnity. The

company wasn’t ready to give since it was awaiting the adjuster’s report. The

company then made an excuse that the insured had not filed any claim with it,

nor submitted proof of loss which is a clear violation of Policy Condition No. 11,

as a result, determination of the liability of private respondent could not be

made.

Pacific Banking filed in the trial court an action for a sum of money for

P61,000.00 against Oriental Assurance. At the trial, petitioner presented

communications of the insurance adjuster to Asian Surety revealing undeclared

co-insurances with the following: P30,000 with Wellington Insurance; P25,000

with Empire Surety and P250,000 with Asian Surety undertaken by insured

Paramount on the same property covered by its policy with Oriental whereas the

only co-insurances declared in the subject policy are those of P30,000.00 with

Malayan P50,000.00 with South Sea and P25.000.00 with Victory.

Issue & Ruling

Whether or not the insured violated the condition in the insurance

policy

Yes. The insured failed to reveal before the loss three other insurances.

Had the insurer known that there were many co-insurances, it could have

hesitated or plainly desisted from entering into such contract. Hence, the insured

was guilty of clear fraud.

Concrete evidence of fraud or false declaration by the insured was

furnished by the petitioner itself when the facts alleged in the policy

under clauses "Co-Insurances Declared" and "Other Insurance Clause" are

materially different from the actual number of co-insurances taken over the

subject property. As the insurance policy against fire expressly required that

notice should be given by the insured of other insurance upon the same property,

the total absence of such notice nullifies the policy.

Petitioner points out that Condition No. 3 in the policy in relation to the

"other insurance clause" supposedly to have been violated, cannot certainly

defeat the right of the petitioner to recover the insurance as mortgagee/assignee.

The condition was the exceptions to the general rule that insurance as to the

interest of the mortgagee, cannot be invalidated; namely: fraud, or

misrepresentation or arson. Concealment of the aforecited co-insurances can

easily be fraud, or in the very least, misrepresentation.

You might also like

- Employee Bonus Policy TemplateDocument3 pagesEmployee Bonus Policy TemplateEVANGELINE SAN FELIXNo ratings yet

- Completion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanDocument6 pagesCompletion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanNestor Del PilarNo ratings yet

- Deed of Assignment DraftDocument2 pagesDeed of Assignment Draftanthony menzonNo ratings yet

- 65 Pacific Banking Corp. v. CADocument2 pages65 Pacific Banking Corp. v. CASIPC PSA Applications 2020No ratings yet

- Pacific V CA GDocument3 pagesPacific V CA Gtops videosNo ratings yet

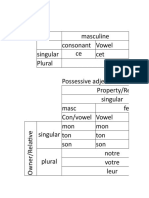

- How to use possessive adjectives in FrenchDocument3 pagesHow to use possessive adjectives in FrenchKumarNo ratings yet

- 03 - Possessive Adjectives-DeterminersDocument2 pages03 - Possessive Adjectives-DeterminersVajresh N.No ratings yet

- CEO Bonus Plan Sample-Product ShippingDocument5 pagesCEO Bonus Plan Sample-Product Shippingexpertceo_productionNo ratings yet

- Mental Health ProgramDocument4 pagesMental Health ProgramMADULI, Marlone G.100% (1)

- 4.4.7.9 Working During Inclement Weather ConditionsDocument6 pages4.4.7.9 Working During Inclement Weather ConditionsAndrewNo ratings yet

- NEW SOP 4.10 Working Under Adverse Weather Condition R6 FinalDocument6 pagesNEW SOP 4.10 Working Under Adverse Weather Condition R6 FinalVUNo ratings yet

- Compliance Monitoring Report (CMR)Document15 pagesCompliance Monitoring Report (CMR)Patrick GoNo ratings yet

- Cathay Insurance v. CA (P Petitioner: RespondentsDocument1 pageCathay Insurance v. CA (P Petitioner: RespondentsAnne Dela CruzNo ratings yet

- Rules in special proceedings may apply where possibleDocument21 pagesRules in special proceedings may apply where possibleAndrew M. AcederaNo ratings yet

- Drug-Free Workplace Policy SummaryDocument2 pagesDrug-Free Workplace Policy SummaryNadine LucenaNo ratings yet

- In Re Bonilla v. AranzaDocument2 pagesIn Re Bonilla v. AranzaJuno GeronimoNo ratings yet

- Fly Me NextDocument5 pagesFly Me NextAyin AhuninNo ratings yet

- Pacific Banking v CA insurance case digestDocument154 pagesPacific Banking v CA insurance case digestviva_3388% (8)

- 3 Pacific V CA FACTS: An Open Fire Insurance Policy, Was Issued To Paramount Shirt Manufacturing by OrientalDocument2 pages3 Pacific V CA FACTS: An Open Fire Insurance Policy, Was Issued To Paramount Shirt Manufacturing by OrientalVedia Genon IINo ratings yet

- Double Insurance Fire InsuranceDocument41 pagesDouble Insurance Fire InsuranceDessa Ruth ReyesNo ratings yet

- Pacific Banking Corp. vs. CADocument1 pagePacific Banking Corp. vs. CAJohn Mark RevillaNo ratings yet

- Insurance dispute over unpaid fire insurance proceedsDocument33 pagesInsurance dispute over unpaid fire insurance proceedsJamie TiuNo ratings yet

- (C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Document8 pages(C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Alexiss Mace JuradoNo ratings yet

- Pacific Banking v. CADocument2 pagesPacific Banking v. CAAndrae Nicolo GeronimoNo ratings yet

- 2 Pacific Banking Corporation V CA and Oriental AssuranceDocument3 pages2 Pacific Banking Corporation V CA and Oriental AssuranceKokoNo ratings yet

- Tai Tong Chuache & Co. vs Insurance CommissionDocument8 pagesTai Tong Chuache & Co. vs Insurance CommissionAaron CariñoNo ratings yet

- Geagonia v. Court of Appeals G.R. No. 114427, 6 February 1995, 241 SCRA 152 FactsDocument5 pagesGeagonia v. Court of Appeals G.R. No. 114427, 6 February 1995, 241 SCRA 152 FactsEdwin VillaNo ratings yet

- Digests Batch 2Document7 pagesDigests Batch 2Miguel SorianoNo ratings yet

- Pacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsDocument6 pagesPacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsJohn Mark RevillaNo ratings yet

- Insurance Cases MidDocument29 pagesInsurance Cases MidRasmirah BeaumNo ratings yet

- Insurance DigestsDocument4 pagesInsurance DigestsLesly BriesNo ratings yet

- Pacific Banking Corporation V CADocument2 pagesPacific Banking Corporation V CAArtemisTzy100% (1)

- InsuranceDocument4 pagesInsuranceYsa SumayaNo ratings yet

- RCBC's Rights as Assignee of Insurance PoliciesDocument8 pagesRCBC's Rights as Assignee of Insurance PoliciesNelson LaurdenNo ratings yet

- Great Pacific V CA G.R. No. L-31845 April 30, 1979Document10 pagesGreat Pacific V CA G.R. No. L-31845 April 30, 1979Zacky ChanNo ratings yet

- Spouses Cha v. Court of Appeals FactsDocument7 pagesSpouses Cha v. Court of Appeals FactsMary Ann IsananNo ratings yet

- Geagonia Vs CADocument1 pageGeagonia Vs CAkamiruhyunNo ratings yet

- 5 - Insurance CasesDocument14 pages5 - Insurance CasesFRANCIS CEDRIC KHONo ratings yet

- Fire Insurance - Pacific Banking Corp Vs CADocument2 pagesFire Insurance - Pacific Banking Corp Vs CAMarioneMaeThiamNo ratings yet

- Malayan Insurance vs PAP Co ruling on fire insurance policy transferDocument9 pagesMalayan Insurance vs PAP Co ruling on fire insurance policy transferJam RxNo ratings yet

- White Gold Marine Services, Inc. vs Pioneer Insurance and Surety Corporation (Insurance license caseDocument26 pagesWhite Gold Marine Services, Inc. vs Pioneer Insurance and Surety Corporation (Insurance license caseHaze Q.No ratings yet

- Fire Insurance and Casualty DigestsDocument8 pagesFire Insurance and Casualty DigestsCarla January OngNo ratings yet

- American vs. Chua, 309 SCRA 250 FactsDocument2 pagesAmerican vs. Chua, 309 SCRA 250 FactsRidz TingkahanNo ratings yet

- Insurance CasesDocument10 pagesInsurance CasesAna RobinNo ratings yet

- G.R. No. L-25317 August 6, 1979 Philippine Phoenix Surety & Insurance Company, Plaintiff-AppelleeDocument39 pagesG.R. No. L-25317 August 6, 1979 Philippine Phoenix Surety & Insurance Company, Plaintiff-AppelleeGlenn PinedaNo ratings yet

- Facts:: WHITE GOLD V PIONEER G.R. NO. 154514. JULY 28, 2005Document7 pagesFacts:: WHITE GOLD V PIONEER G.R. NO. 154514. JULY 28, 2005yannie isananNo ratings yet

- Policy CasesDocument18 pagesPolicy CasesccsollerNo ratings yet

- Insurancecase Digest June 22, 2016Document10 pagesInsurancecase Digest June 22, 2016Albert BantanNo ratings yet

- Insurance Last BatchDocument139 pagesInsurance Last BatchEarl ConcepcionNo ratings yet

- ALPHA INSURANCE AND SURETY CO., Petitioner, vs. ARSENIA SONIA CASTOR, RespondentDocument9 pagesALPHA INSURANCE AND SURETY CO., Petitioner, vs. ARSENIA SONIA CASTOR, RespondentClaudine Mae G. TeodoroNo ratings yet

- 4 - Insurance CasesDocument13 pages4 - Insurance CasesFRANCIS CEDRIC KHONo ratings yet

- General Insurance V NG HuaDocument2 pagesGeneral Insurance V NG HuaMorgana BlackhawkNo ratings yet

- Insurance Dispute Over Burned BuildingDocument2 pagesInsurance Dispute Over Burned BuildingXing Keet LuNo ratings yet

- American Home Ass - Co V ChuaDocument2 pagesAmerican Home Ass - Co V ChuaNiajhan PalattaoNo ratings yet

- Filipino Merchants Insurance Co. v. CA 179 SCRA 638 (1989)Document6 pagesFilipino Merchants Insurance Co. v. CA 179 SCRA 638 (1989)maronillaizelNo ratings yet

- New Life Enterprises v. CADocument3 pagesNew Life Enterprises v. CACourtney TirolNo ratings yet

- 2ND Meeting - INSU CASE DIGESTDocument26 pages2ND Meeting - INSU CASE DIGESTmhickey babonNo ratings yet

- Supreme Court upholds insurer's right to rescind policy for non-disclosure of additional insuranceDocument38 pagesSupreme Court upholds insurer's right to rescind policy for non-disclosure of additional insuranceacesmaelNo ratings yet

- Cathay Insurance Co., Inc. v. Court of AppealsDocument7 pagesCathay Insurance Co., Inc. v. Court of AppealsJico FarinasNo ratings yet

- Development Insurance vs. IACDocument3 pagesDevelopment Insurance vs. IACCourtney TirolNo ratings yet

- Harding vs. Commercial Union AssuranceDocument1 pageHarding vs. Commercial Union AssuranceJohn Mark RevillaNo ratings yet

- Magsaysay, Inc. vs. AganDocument2 pagesMagsaysay, Inc. vs. AganJohn Mark RevillaNo ratings yet

- Phil. Home Assurance vs. CADocument1 pagePhil. Home Assurance vs. CAJohn Mark RevillaNo ratings yet

- PICP v. CADocument1 pagePICP v. CAJohn Mark RevillaNo ratings yet

- Insurance Subrogation Rights Upheld in Cargo Damage CaseDocument2 pagesInsurance Subrogation Rights Upheld in Cargo Damage CaseJohn Mark RevillaNo ratings yet

- Cathay Insurance vs. CADocument1 pageCathay Insurance vs. CAJohn Mark RevillaNo ratings yet

- Great Pacific Life Assurance vs. CADocument1 pageGreat Pacific Life Assurance vs. CAJohn Mark RevillaNo ratings yet

- Artex Development Co. vs. Wellington Ins. CoDocument2 pagesArtex Development Co. vs. Wellington Ins. CoJohn Mark RevillaNo ratings yet

- Pacific Timber Export vs. CADocument2 pagesPacific Timber Export vs. CALaika CorralNo ratings yet

- NG Gan Zee vs. Asian Crusader Life Assurance G.R. No. L-30685 May 30, 1983 FactsDocument4 pagesNG Gan Zee vs. Asian Crusader Life Assurance G.R. No. L-30685 May 30, 1983 FactsJohn Mark RevillaNo ratings yet

- Fieldman vs. Asian Surety G.R. No. L-23447 July 31, 1970Document2 pagesFieldman vs. Asian Surety G.R. No. L-23447 July 31, 1970John Mark RevillaNo ratings yet

- Jarque vs. Smith Bell & CoDocument2 pagesJarque vs. Smith Bell & CoJohn Mark RevillaNo ratings yet

- Pacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsDocument6 pagesPacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsJohn Mark RevillaNo ratings yet

- 72 - BONGON - Great Pacific V CADocument2 pages72 - BONGON - Great Pacific V CADanna BongonNo ratings yet

- Equitable Insurance vs. Rural InsuranceDocument2 pagesEquitable Insurance vs. Rural InsuranceJohn Mark RevillaNo ratings yet

- Consuegra vs. GSISDocument2 pagesConsuegra vs. GSISJohn Mark RevillaNo ratings yet

- Roque v. Intermediate Appellate CourtDocument2 pagesRoque v. Intermediate Appellate CourtJohn Mark RevillaNo ratings yet

- Keihin-Everett vs. Tokio Marine Malayan InsuranceDocument4 pagesKeihin-Everett vs. Tokio Marine Malayan InsuranceJohn Mark RevillaNo ratings yet

- Insular Life Assurance vs. Heirs of AlvarezDocument2 pagesInsular Life Assurance vs. Heirs of AlvarezJohn Mark RevillaNo ratings yet

- Development Insurance vs. IACDocument2 pagesDevelopment Insurance vs. IACJohn Mark RevillaNo ratings yet

- Lim v Sunlife Insurance Policy Not ConsummatedDocument1 pageLim v Sunlife Insurance Policy Not ConsummatedJohn Mark RevillaNo ratings yet

- Florendo vs. PHILAMDocument1 pageFlorendo vs. PHILAMJohn Mark RevillaNo ratings yet

- Life Insurance Obtained Through FraudDocument1 pageLife Insurance Obtained Through FraudJohn Mark RevillaNo ratings yet

- Great Pacific Life Assurance vs CA Ruling on Concealing Health FactsDocument1 pageGreat Pacific Life Assurance vs CA Ruling on Concealing Health FactsJohn Mark RevillaNo ratings yet

- SSS V DavacDocument1 pageSSS V DavacJohn Mark RevillaNo ratings yet

- Insular vs. EbradoDocument1 pageInsular vs. EbradoJohn Mark RevillaNo ratings yet

- NG Gan Zee vs. Asian Crusader Life AssuranceDocument1 pageNG Gan Zee vs. Asian Crusader Life AssuranceJohn Mark RevillaNo ratings yet

- Young vs. Midland Textile InsuranceDocument1 pageYoung vs. Midland Textile InsuranceJohn Mark RevillaNo ratings yet

- Pioneer vs. YapDocument1 pagePioneer vs. YapJohn Mark RevillaNo ratings yet

- RCBC Wins Insurance Proceeds Over Burned PropertyDocument2 pagesRCBC Wins Insurance Proceeds Over Burned PropertyJohn Mark RevillaNo ratings yet

- Admirality Jurisdiction Post ElizabethDocument22 pagesAdmirality Jurisdiction Post ElizabethKaran BhardwajNo ratings yet

- PB Indictment June 2022Document18 pagesPB Indictment June 2022The Post MillennialNo ratings yet

- People vs. Reloj, G.R. No. L-31335, 29 February 1972Document3 pagesPeople vs. Reloj, G.R. No. L-31335, 29 February 1972LASNo ratings yet

- Constitution Law - Unit 1 Topic BDocument8 pagesConstitution Law - Unit 1 Topic BLûv Kûmár ThákûrNo ratings yet

- Housekeeping Ncii: Can I ?Document3 pagesHousekeeping Ncii: Can I ?mary ann tabuyanNo ratings yet

- State, Societyand EnvironmentDocument6 pagesState, Societyand EnvironmentDoreen SamuelNo ratings yet

- Indian Penal Code (IPC) Detailed Notes and Study Material - LexFortiDocument46 pagesIndian Penal Code (IPC) Detailed Notes and Study Material - LexFortiQasim Sher HaiderNo ratings yet

- Philippine Police Position PaperDocument2 pagesPhilippine Police Position PaperreasonNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Constitutional Law Notes 1st 2nd SemesterDocument134 pagesConstitutional Law Notes 1st 2nd SemesterKenn Ade100% (2)

- 230 Criminal Psychology Essay 10579391Document12 pages230 Criminal Psychology Essay 10579391Luc AlanNo ratings yet

- ADR Case Digest 1 5Document3 pagesADR Case Digest 1 5ROSASENIA “ROSASENIA, Sweet Angela” Sweet AngelaNo ratings yet

- Sexual Harrassment at WorkplaceDocument22 pagesSexual Harrassment at Workplaceriv's aquariumNo ratings yet

- Professional EthicsDocument38 pagesProfessional EthicsTroeeta BhuniyaNo ratings yet

- Requirements for valid search warrants and proper implementationDocument5 pagesRequirements for valid search warrants and proper implementationjakeangalaNo ratings yet

- Special Power of Attorney Know All Men by These PresentsDocument2 pagesSpecial Power of Attorney Know All Men by These PresentsMartin SantiagoNo ratings yet

- Animal Abuse Paper ThesisDocument6 pagesAnimal Abuse Paper Thesiskualxkiig100% (2)

- Montelibano v. Bacolod DigestDocument2 pagesMontelibano v. Bacolod DigestJaymee Andomang Os-agNo ratings yet

- Pierce V Lewis, Lewis V PierceDocument119 pagesPierce V Lewis, Lewis V PierceJ RohrlichNo ratings yet

- VOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionDocument15 pagesVOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionMichelle Joy ItableNo ratings yet

- Title 8. PersonsDocument21 pagesTitle 8. Personsmichelle jane reyesNo ratings yet

- APC Obligations 1179-1192Document6 pagesAPC Obligations 1179-1192AP CruzNo ratings yet

- 2003-People v. TudtudDocument38 pages2003-People v. TudtudJames PabonitaNo ratings yet

- Matthew Carter Criminal ChargesDocument13 pagesMatthew Carter Criminal ChargesKim BurrowsNo ratings yet

- People V Octa GR 195196 CDDocument2 pagesPeople V Octa GR 195196 CDLester Fiel PanopioNo ratings yet

- Criminal LawDocument402 pagesCriminal LawBar Examinee 2023 MarcosNoHeroNo ratings yet

- Civilian Immunity in WarDocument276 pagesCivilian Immunity in WarNattaphol NirutnapaphanNo ratings yet

- 15 BibliographyDocument10 pages15 BibliographyBR CLOTHINGNo ratings yet

- 05RM Risk-TreatmentDocument10 pages05RM Risk-TreatmentDarren TanNo ratings yet