Professional Documents

Culture Documents

BAU 08101 Test Two

Uploaded by

Cornelio Swai0 ratings0% found this document useful (0 votes)

5 views1 pagepaper

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpaper

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageBAU 08101 Test Two

Uploaded by

Cornelio Swaipaper

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

BAU 08101: Transport Cost and Finance

Test Two Duration: 45’

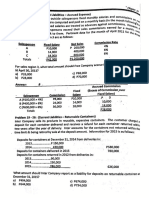

Assume that, UDAT has two alternatives for a new highway project. Alternative 1 addresses all future

demand until year 20 and cost TZS 140,000. Alternative 2 will be built in two stages: the first stage builds

initial capacity and cost TZS 100,000 and the second, if required will require an additional of TZS 120,000

in year N to update to full capacity. Assuming operations and maintenance costs for both alternatives are

equal and interest rate is 8%. The table shows the cash flows for each alternative if the second stage of

alternative 2 is built in year N.

Year (N) Alternative 1 (TZS) Alternative 2 (TZS)

0 140,000 220,000

4 140,000 180,000

8 140,000 165,000

12 140,000 148,000

16 140,000 135,000

20 140,000 126,000

Determine which is the best alternative by using

a) NPV and

b) Payback period

You might also like

- Pinky Dey Batch 17 PM Assignment: (Rs. in 000)Document14 pagesPinky Dey Batch 17 PM Assignment: (Rs. in 000)PINKY DEYNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Solutions Chapter 5Document13 pagesSolutions Chapter 5Laila Al Suwaidi100% (2)

- 7-Risk and Real Options in Capital BudgetingDocument38 pages7-Risk and Real Options in Capital BudgetingSameerbaskarNo ratings yet

- Project Investment TimingDocument3 pagesProject Investment TimingIrene CheronoNo ratings yet

- Memorandum: Analysis of New Centralized Kitchen-Cum Procurement Office Layout AnalysisDocument7 pagesMemorandum: Analysis of New Centralized Kitchen-Cum Procurement Office Layout AnalysisAnonymous aKmI1dNo ratings yet

- Ppe - Intpraa - 03182020 - Part 2Document6 pagesPpe - Intpraa - 03182020 - Part 2Mich ClementeNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarNo ratings yet

- Construction Economy 1Document4 pagesConstruction Economy 1Venessa WahNo ratings yet

- Memorandum: Analysis of New Centralized Kitchen-Cum Procurement Office Layout AnalysisDocument6 pagesMemorandum: Analysis of New Centralized Kitchen-Cum Procurement Office Layout AnalysisAnonymous aKmI1dNo ratings yet

- CA1 (4th) Dec2014Document3 pagesCA1 (4th) Dec2014Kr Ish NaNo ratings yet

- 8318 - Making Investment Decision - Case StudyDocument1 page8318 - Making Investment Decision - Case Studyanon_593009167No ratings yet

- Assignment IiDocument5 pagesAssignment IiusmanjalaliNo ratings yet

- OPM530 Case Study 2 - LocationDocument3 pagesOPM530 Case Study 2 - LocationAisyah AfiqahNo ratings yet

- 02 LCC, WaccDocument20 pages02 LCC, Waccx23siddharthnaNo ratings yet

- Unit Costing Lecture 3Document5 pagesUnit Costing Lecture 3YashaswiNo ratings yet

- II 17.10.2008 Answer All Questions. Assume Missing Data in Case RequiredDocument2 pagesII 17.10.2008 Answer All Questions. Assume Missing Data in Case RequireddonotpanicNo ratings yet

- Ce 867: Urban Transportation System Evalaution Homework 2: Assigned On March 28, 2019 Due On April 4, 2019Document8 pagesCe 867: Urban Transportation System Evalaution Homework 2: Assigned On March 28, 2019 Due On April 4, 2019Jalal Habib KhanNo ratings yet

- Engineering EconomicsDocument32 pagesEngineering EconomicsbibekNo ratings yet

- ME 16801 Engineering Economics: Comparison of AlternativesDocument100 pagesME 16801 Engineering Economics: Comparison of AlternativesraraNo ratings yet

- Capital Budgeting Class AssignmentDocument1 pageCapital Budgeting Class AssignmentAbdul Motaleb SaikiaNo ratings yet

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghNo ratings yet

- Cost and Management Accounting - Ii - HonoursDocument4 pagesCost and Management Accounting - Ii - HonoursAnit LuckyNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- MA NovDocument4 pagesMA NovShajib KhanNo ratings yet

- Evaluation of Mutually Exclusive Part 1Document16 pagesEvaluation of Mutually Exclusive Part 1Dave FortuNo ratings yet

- Asignment Yazid Mwishwa 12Document12 pagesAsignment Yazid Mwishwa 12Baraka KamuhabwaNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Homework No.12Document6 pagesHomework No.12Danna ClaireNo ratings yet

- Budgetary Control AssignmentDocument4 pagesBudgetary Control AssignmentYash AggarwalNo ratings yet

- AnswersDocument3 pagesAnswersAnghelNo ratings yet

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseKhairul Bashar Bhuiyan 1635167090No ratings yet

- BQ Bungalow 2Document2 pagesBQ Bungalow 2remi RahimNo ratings yet

- Practical AccountingDocument9 pagesPractical Accountingestela revillaNo ratings yet

- (Published in Part - III Section 4 of The Gazette of India, Extraordinary) Tariff Authority For Major Ports G No. 143 New Delhi, 4 June 2012Document35 pages(Published in Part - III Section 4 of The Gazette of India, Extraordinary) Tariff Authority For Major Ports G No. 143 New Delhi, 4 June 2012vivekNo ratings yet

- SMU MBA104 FINANCIAL AND MANAGEMENT ACCOUNTING Free Solved AssignmentDocument3 pagesSMU MBA104 FINANCIAL AND MANAGEMENT ACCOUNTING Free Solved AssignmentPrasad HegdeNo ratings yet

- Solution 2 1Document2 pagesSolution 2 1Rhozeiah Leiah100% (1)

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevDocument11 pagesWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TNo ratings yet

- Latihan Soal Akuntansi BiayaDocument5 pagesLatihan Soal Akuntansi Biayaaufa alfayedhaNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- 2 TM C Finance-Task-CalcDocument3 pages2 TM C Finance-Task-Calcvlad vladNo ratings yet

- ECF04 Exam Sem I 2019 SolutionsDocument16 pagesECF04 Exam Sem I 2019 SolutionsZaid DeanNo ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseAurik IshNo ratings yet

- TUGAS EKOTEK (Adesita N)Document21 pagesTUGAS EKOTEK (Adesita N)AdeSitaNursabaniahNo ratings yet

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocument2 pagesLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- Sensitivity Scenario Analysis 1711549320367Document18 pagesSensitivity Scenario Analysis 1711549320367pre.meh21No ratings yet

- Investment Decision - Techniques.Document4 pagesInvestment Decision - Techniques.Ashutosh AgrawalNo ratings yet

- Expected Return On A One-Year Bond With An Adjustment For Default ProbabilityDocument83 pagesExpected Return On A One-Year Bond With An Adjustment For Default ProbabilitySyed Ameer Ali ShahNo ratings yet

- Unit III-B PMDocument45 pagesUnit III-B PMAbdul AleemNo ratings yet

- Khairul Haque RA-1Document8 pagesKhairul Haque RA-1Jandu Construction AndamanNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- Solution To Pri: Ociobe 2018Document4 pagesSolution To Pri: Ociobe 2018maria ronoraNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Accounting For Decision Making IIIDocument16 pagesAccounting For Decision Making IIICornelio SwaiNo ratings yet

- Standard Costing and Variance AnalysisDocument37 pagesStandard Costing and Variance AnalysisCornelio SwaiNo ratings yet

- Airline Finance 5th EdnDocument48 pagesAirline Finance 5th EdnCornelio SwaiNo ratings yet

- Transport Cost and BenefitsDocument49 pagesTransport Cost and BenefitsCornelio SwaiNo ratings yet

- Marine CostsDocument20 pagesMarine CostsCornelio SwaiNo ratings yet

- BAU 07311 Test TwoDocument1 pageBAU 07311 Test TwoCornelio SwaiNo ratings yet

- MPRDocument1 pageMPRCornelio SwaiNo ratings yet

- BMU 07312 Test TwoDocument2 pagesBMU 07312 Test TwoCornelio SwaiNo ratings yet

- SpecialDocument2 pagesSpecialCornelio SwaiNo ratings yet