Professional Documents

Culture Documents

Chapter 6

Uploaded by

Moti BekeleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6

Uploaded by

Moti BekeleCopyright:

Available Formats

Chapter 6: Security analysis

The aim of the analysis is to determine what stock to buy and at what price, there are two basic analysis

methods; i.e. fundamental analysis and technical analysis. Fundamental analysis is the cornerstone of

investing. In fact, some would say that you are not really investing if you aren't performing fundamental

analysis. Because the subject is so broad, however, it's tough to know where to start. There are an endless

number of investment strategies that are very different from each other, yet almost all use the

fundamentals. Fundamental analysis maintains that markets may misprice a security in the short run but

that the "correct" price will eventually be reached. Profits can be made by trading the mispriced security

and then waiting for the market to recognize its "mistake" and re-price the security.

Technical analysis maintains that all information is reflected already in the stock price. It considers the

trends that are your friend' and sentiment changes predate and predict trend changes. Investors' emotional

responses to price movements lead to recognizable price chart patterns. Technical analysis does not care

what the 'value' of a stock is. Their price predictions are only extrapolations from historical price patterns.

Investors can use any or all of these different but somewhat complementary methods for stock picking.

For example many fundamental investors use technical’s for deciding entry and exit points. Many

technical investors use fundamentals to limit their universe of possible stock to 'good' companies. The

choice of stock analysis is determined by the investor's belief in the different paradigms for "how the

stock market works".

6.1. Fundamental analysis

Fundamental analysis of a business/investment involves analyzing its financial statements, its

management, competitive advantages, and its competitors and markets. When applied to futures and

foreign exchange, it focuses on the overall state of the economy, interest rates, production, earnings, and

management.

Fundamental analysis is performed on historical and present data, but with the goal of making financial

forecasts. There are several possible objectives of fundamental analysis. These are:

i) To conduct a company stock valuation and predict its probable price evolution,

ii) To make a projection on its business performance,

iii) To evaluate its management and make internal business decisions,

iv) To calculate its credit risk.

Components of Fundamental Analysis:

Economic analysis;

Industry analysis and

Company analysis

6.1.1 Economic analysis

The economy is study to determine if overall conditions are good for the stock market. Is inflation a

concern? Are interest rates likely to rise or fall? Are consumers spending? Is the trade balance favorable?

Is the money supply expanding or contracting? These are just some of the questions that the fundamental

analyst would ask to determine if economic conditions are right for the stock market.

The macro-economy is the overall economy environment in which all firms operate. The key

variables/factors commonly used to describe the state of the macro-economy are:

Growth rate of gross domestic product

Industrial growth rate

Agriculture and monsoons

Savings and investments

Government budget and deficit

Price level and inflation

Security Analysis Page 1

Interest rate

Balance of payment, foreign exchange reserves, and exchange rate

Infrastructure facilities and arrangements sentiments

6.1.2 Industry analysis

Industry analysis is a market assessment tool designed to provide a business with an idea of the

complexity of a particular industry. Industry analysis involves reviewing the economic, political and

market factors that influence the way the industry develops. Major factors can include the power wielded

by suppliers and buyers, the condition of competitors, and the likelihood of new market entrants.

Industry analysis is a market strategy tool used by businesses to determine if they want to enter a product

or service market. Company management must carefully analyze several aspects of the industry to

determine if they can make a profit selling goods and services in the market. Analyzing economic factors,

supply and demand, competitors, future conditions and government regulations will help management

decide whether to enter an industry or invest money elsewhere.

a) Economic Factors: Economic factors of industry analysis include raw materials, expected profit

margins and the interference of substitute goods. The cost of raw materials is an important factor in

industry analysis because over-priced goods will not sell in an established market. Profit margins are

closely linked to materials costs because offering discounts or sales prices will shrink company

profits and lessen cash inflows for future production activity. Substitute goods allow consumers to

purchase a cheaper good that performs relatively like the original item.

b) Supply and Demand: A supply and demand analysis helps management understand if enough

consumers are willing to purchase more goods in an industry. If demand is high and supply is low, a

company may be willing to enter the market and offer goods near the market price to gain a

competitive advantage in the industry. A trend of declining demand indicates an industry that is

oversold, and any new competitors will likely lose money because consumers are not interested in

current goods or services.

c) Competitors: The number of competitors is an important factor for proper industry analysis. If few

competitors exist in a market, they may be charging consumers higher prices because of limited

availability of products or services. As new competitors enter the market, existing companies can

lower prices to maintain their current market share; newer competitors may not be able to match these

price cuts if their products costs are too high. As industries contract, inefficient producers are forced

out.

d) Future Conditions: While no company managers can predict the future of an industry, they can try

to determine where the industry is in the business cycle. If the industry is in an emerging market

stage, companies can enter an industry and expect to earn a profit from rising consumer demand. If

the industry is in a plateau stage, then only the most efficient producers with the lowest costs can

continue to earn profits. At the end of a business cycle, demand is declining and producers leave the

industry for more profitable markets.

e) Government Regulations: Some industries have heavier regulations or taxes than others, which

must be considered by companies looking to enter new markets. Taxes and other government fees

add to the cost of doing business, which eats into profits earned by companies. Properly

understanding the amount of government regulation in an industry helps management to determine if

expected profit margins will earn a high enough return to cover these costs.

Techniques for evaluating relevant Industry Factors

Each industry has differences in terms of its customer base, market share among firms, industry-wide

growth, competition, regulation and business cycles. Learning about how the industry works will give an

investor a deeper understanding of a company's financial soundness.

i) Customers Base: Some companies serve only a handful of customers, while others serve millions. In

general, it's a red flag (a negative) if a business relies on a small number of customers for a large

portion of its sales because the loss of each customer could dramatically affect revenues.

Security Analysis Page 2

ii) Market Share: Understanding a company's present market share can tell volumes about the

company's business. The fact that a company possesses an 85% market share tells you that it is the

largest player in its market by far. Furthermore, this could also suggest that the company possesses

some sort of "economic moat," in other words, a competitive barrier serving to protect its current and

future earnings, along with its market share. Market share is important because of economies of scale.

When the firm is bigger than the rest of its rivals, it is in a better position to absorb the high fixed

costs of a capital-intensive industry.

iii) Industry Growth: One way of examining a company's growth potential is to first examine whether

the amount of customers in the overall market will grow. This is crucial because without new

customers, a company has to steal market share in order to grow. In some markets, there is zero or

negative growth, a factor demanding careful consideration. For example, a manufacturing company

dedicated solely to creating audio compact cassettes might have been very successful in the '70s, '80s

and early '90s. However, that same company would probably have a rough time now due to the

advent of newer technologies, such as CDs and MP3s. The current market for audio compact

cassettes is only a fraction of what it was during the peak of its popularity.

iv) Competitions: Simply looking at the number of competitors goes a long way in understanding the

competitive landscape for a company. Industries that have limited barriers to entry and a large

number of competing firms create a difficult operating environment for firms. One of the biggest

risks within a highly competitive industry is pricing power. This refers to the ability of a supplier to

increase prices and pass those costs on to customers. Companies operating in industries with few

alternatives have the ability to pass on costs to their customers. A great example of this is Wal-Mart.

They are so dominant in the retailing business, that Wal-Mart practically sets the price for any of the

suppliers wanting to do business with them. If you want to sell to Wal-Mart, you have little, if any,

pricing power.

v) Regulation: Certain industries are heavily regulated due to the importance or severity of the

industry's products and/or services. As important as some of these regulations are to the public, they

can drastically affect the attractiveness of a company for investment purposes.

In industries where one or two companies represent the entire industry for a region (such as utility

companies), governments usually specify how much profit each company can make. In these instances,

while there is the potential for sizable profits, they are limited due to regulation.

In other industries, regulation can play a less direct role in affecting industry pricing. For example, the

drug industry is one of most regulated industries. And for good reason no one wants an ineffective drug

that causes deaths to reach the market.

6.1.3 Company analysis

At the final stage of fundamental analysis, the investor analyzes the company. The Company is one's

perception of the state of a company - it cannot necessarily be supported by hard facts and figures. A

company may have made losses consecutively for two years or more and one may not wish to touch its

shares - yet it may be a good company and worth purchasing into. There are several factors one should

look at this analysis:

Which company has performed well in comparison with other similar companies?

Which company is performing well in comparison to earlier years?

Which company is better by its management, policies, location and labor relations?

Which company is the market leader by its productions and segment?

6.1.3.1. Objectives of Company analysis

Company analysis focuses on finding attractive firms by:

a) Analyzing individual firms.

b) Understanding each firm's strengths and risks.

c) Identifying attractive firms with superior management and strong performance (measured by

sales and earnings growth).

Stock selection focuses on finding attractive stocks by:

Security Analysis Page 3

a) Computing each stock’s intrinsic value.

b) Comparing the intrinsic value to the stock’s market price.

c) Identifying attractive stocks, which are substantially undervalued.

6.1.3.2. Significant Factors to be Considered for Company Analysis

It is imperative that one completes the politico economic analysis and the industry analysis before a

company is analyzed because the company's performance at a period of time is to an extent a reflection of

the economy, the political situation and the industry. The different issues regarding a company that

should be examined are:

1. The Management: The single most important factor one should consider when investing in a

company and one often never considered is its management. It is upon the quality, competence and

vision of the management that the future of company rests. A good, competent management can

make a company grow while a weak, inefficient management can destroy a successful company.

2. The Annual Report: The primary and most important source of information about a company is its

Annual Report. By law, this is prepared every year and distributed to the shareholders. The Annual

Report is broken down into the following specific parts:

a) The Director's Report: The Director’s Report is a report submitted by the directors of a company

to its shareholders, advising them of the performance of the company under their stewardship

b) The Auditor's Report: The auditor represents the shareholders and it is his duty to report to the

shareholders and the general public on the stewardship of the company by its directors. Auditors

are required to report whether the financial statements presented do, in fact, present a true and fair

view of the state of the company.

c) The Financial Statements: The published financial statements of a company in an Annual Report

consist of its Balance Sheet and other statements.

3. Ratios: No person should invest in a company until he has analyzed its financial statements and

compared its performance in the previous years, and with that of other companies. This can be

difficult at times because:

(a) The size of the companies may be different.

(b) The composition of a company's balance sheet may have changed significantly.

Ratios can be broken down into four broad categories:

a) Profit and Loss Ratios: These show the relationship between two items or groups of items in a profit

and loss account or income statement. The more common of these ratios are:

1. Sales to cost of goods sold.

2. Selling expenses to sales.

3. Net profit to sales and

4. Gross profit to sales.

b) Balance Sheet Ratios: these deals with the relationship in the balance sheet such as:

(i) Shareholders’ equity to borrowed funds.

(ii) Current assets to current liabilities.

(iii)Liabilities to net worth.

(iv) Debt to assets and

(v) Liabilities to assets

c) Balance Sheet and Profit and Loss Account Ratios: These relate an item on the balance sheet to

another in the profit and loss account such as:

1. Earnings to shareholder's funds.

2. Net income to assets employed.

3. Sales to stock.

4. Sales to debtors and

Security Analysis Page 4

5. Cost of goods sold to creditors.

d) Financial Statements and Market Ratios: These are normally known as market ratios and are

arrived at by relation financial figures to market prices:

1. Market value to earnings and

2. Book value to market value.

These ratios have been grouped into eight categories that will enable an investor to easily determine the

strengths or weaknesses of a company. Market value, Earnings, Profitability, Liquidity, Leverage, Debt

Service Capacity, Asset-Management/Efficiency, and Margin

It must be ensured that the ratios being measured are consistent and valid. The length of the periods being

compared should be similar. Large non-recurring income or expenditure should be omitted when

calculating ratios calculated for earnings or profitability, otherwise the conclusions will be incorrect.

Ratios do not provide answers. They suggest possibilities. Investors must examine these possibilities

along with general factors that would affect the company such as its management, management policy,

government policy, the state of the economy and the industry to arrive at a logical conclusion and he

must act on such conclusions.

4. Cash flow Analysis: In cash flow analysis, investors must always checks; how much is the

company's cash earnings? How is the company being financed and using it? The answers to these

questions can be determined by preparing a statement of sources and uses of funds. A statement of

sources and uses begins with the profit for the year to which are added the increases in liability

accounts (sources) and from which are reduced the increases in asset accounts (uses). The net result

shows whether there has been an excess or deficit of funds and how this was financed.

6.1.3.3. Company Analysis using the Relative Valuation Approach

The relative valuation approach of company analysis involves three steps:

i. Estimate future earnings per share (EPS) for the company.

ii. Estimate an earnings multiplier (P/E ratio) for the company.

iii. Therefore the future stock value is estimated as EPS x P/E ratio.

i. Estimate the EPS

Expected earnings per share are a function of the sales forecast and the estimated profit margin. Time-

series analysis is often used here.

Company sales forecast: It includes an analysis of the relationship of company sales to various

relevant economic series and to the company's industry series.

Profit margin estimate: You need to identify and evaluate the firm's Specific competitive strategy -

e.g. low-cost (the firm seeks to become the low-cost producer in the industry)? Differentiation (the firm

seeks to identify itself as unique in some attributes that are important to the customers)?

Internal performance: Relationship with its industry, which should indicate whether the company's

past performance is attributable to its industry or if it is unique to the firm.

EPS = (Sales x Net Profit Margin)/Number of Outstanding Shares

ii. Estimate the P/E

Assuming a firm has constant dividend growth rate, the value of its stock is determined by P = D 1/(k-g).

Therefore the firm's P/E ratio is: P/E = Payout ratio / (k - g), where the payout ratio is D1/EPS.

Analysts can use two approaches here, as in the industry analysis:

a) Macro analysis: Estimate a P/E ratio from the relationship among the firm, its industry and the

market.

Identify the projected P/E multiples of the market and the industry.

Security Analysis Page 5

Use time-series analysis to examine the relationship among the P/E ratios for the firm, the

industry and the market.

Estimate the firm’s P/E ratio by adjusting the market or industry P/E multiple upwards or

downwards.

b) Micro analysis: estimate a multiplier based on three components:

The dividend payout ratio (based on the firm’s dividend payout history, investment plans,

industry trend and current economic events).

The required rate of return: consider fundamental factors and market-determined risk (beta) based

on CAPM.

The rate of growth: use DuPont model.

6.2. Technical analysis

While fundamental analysis helps you decide what companies you may want to invest in; i.e. based on

the company's management, products and services, financial records, and other information. And it won't

always help you figure out when to buy, sell or hold. There will be times when the stock of a solid

company falters and times when a riskier company performs well. As a result, although fundamental

analysis is important, it's not always sufficient to make investment decisions. Technical analysis, the

study of price movements and trends, can help you figure out when to enter and exit the market.

Technical analysts base trading decisions on examinations of prior price and volume data to determine

past market trends from which they predict future behavior for the market as a whole and for individual

securities. Several assumptions lead to this view of price movements. In technical analysis, charts are

similar to the charts that you see in any business setting. I.e. The foundation of technical analysis is the

chart. A chart is simply a graphical representation of a series of prices over a set time frame.

Technical analysis is one of the oldest techniques used to make market decisions. Based on the ideas of

Charles Dow, technical analysts use a variety of technical indicators, or series of data points plotted on a

price chart that has been formed using price or price & volume statistics for a particular security over a

particular time period. The goal is to spot market trends and manage risks associated with price

movements.

While some indicators use complex formulas and others are simpler, all of them seek to establish visual

patterns that make sometimes confusing price data easier to understand and interpret. Indicators can be

applied to stock, indexes, futures contracts and any other tradable instruments whose prices move in

response to supply and demand.

While each indicator depicts patterns made by the price movements of securities, studying just one may

not give you a complete picture of the direction the price is likely to head. For example, an indicator may

make false signals, called whipsaws, where prices move in one direction and quickly revert to an original

trajectory. Examining more than one study makes it easier to spot true signals.

6.2.1. Assumptions of Technical analysts

Technical analysts base trading decisions on examinations of prior price and volume data to determine

past market trends from which they predict future behavior for the market as a whole and for individual

securities. Several assumptions lead to this view of price movements:

i) The market value of any good or service is determined solely by the interaction of supply and

demand.

ii) Supply and demand are governed by numerous rational and irrational factors. Included in these

factors are those economic variables relied on by the fundamental analyst as well as opinions,

moods, and guesses. The market weighs all these factors continually and automatically.

Security Analysis Page 6

iii) Disregarding minor fluctuations, the prices for individual securities and the overall value of the

market tend to move in trends, which persist for appreciable lengths of time.

iv) Prevailing trends change in reaction to shifts in supply and demand relationships. These shifts, no

matter why they occur, can be detected sooner or later in the action of the market itself.

6.2.2. The Top Five Strengths of Technical Analysis

Technical analysis involves the use of charts and technical indicators to predict the price movement of a

currency. Many people (called technicians) swear by this approach to price forecasting while others

(called fundamentalists) won’t touch it. Most traders know that technical analysis has its advantages and

strong points, but that it also has limitations. Many foreign exchange (Forex) traders use charting

methods alone while others use a combination of approaches. Let’s examine the benefits of technical

analysis.

i) Technical analysis focuses on price movement. .

ii) Trends are easily found.

iii) Patterns are easily identified.

iv) Charting is quick and inexpensive.

v) Charts provide a plenty of information

6.2.3. Limitations of Technical Analysis

The same tools for everyone:-With the democratization of information, most market players use

technical analysis software that relies on the same mathematical models.

Lack of hindsight and reflection: - Monitoring the trend is an imperative, it follows a succession of

phases of increase or decrease manic, totally disconnected with the underlying reality.

The classical figures do not work: - The sense of the individual manager is an afterthought because

"the market is always right" one is always wrong all cons.

The volatility has taken over:-The volatility, the most senior-and-down of each session, has exploded

since January. It induces changes daily to a breadth of 5 to 8 times higher than the average.

6.2.4. Technical Indicator

Technical indicators, collectively called "technicals", are distinguished by the fact that they do not

analyze any part of the fundamental business, like earnings, revenue and profit margins. Technical

indicators are used most extensively by active traders in the market, as they are designed primarily for

analyzing short-term price movements. To a long-term investor, most technical indicators are of little

value, as they do nothing to shed light on the underlying business. The most effective uses of technical

for a long-term investor are to help identify good entry and exit points for the stock by analyzing the

long-term trend. In the context of technical analysis, an indicator is a mathematical calculation based on a

securities price and/or volume. The result is used to predict future prices. Common technical analysis

indicators are the moving average convergence-divergence (MACD) indicator and the relative strength

index (RSI).

In an economic context, an indicator could be a measure such as the unemployment rate, which can be

used to predict future economic trends. Common general economic indicators are the unemployment rate,

new housing starts and the consumer price index (CPI).

6.2.4.1.Moving Average Convergence

The moving average convergence divergence (MACD) is one of the most well known and used indicators

in technical analysis. This indicator is comprised of two exponential moving averages, which help to

measure momentum in the security. The MACD is simply the difference between these two moving

averages plotted against a centerline. The centerline is the point at which the two moving averages are

Security Analysis Page 7

equal. Along with the MACD and the centerline, an exponential moving average of the MACD itself is

plotted on the chart. The idea behind this momentum indicator is to measure short-term momentum

compared to longer term momentum to help signal the current direction of momentum.

MACD= (Shorter-term Moving Average) – (Longer Term Moving Average)

When the MACD is positive, it signals that the shorter term moving average is above the longer-term

moving average and suggests upward momentum. The opposite holds true when the MACD is negative -

this signals that the shorter term is below the longer and suggest downward momentum. When the

MACD line crosses over the centerline, it signals a crossing in the moving averages. The most common

moving average values used in the calculation are the 26-day and 12-day exponential moving averages.

The signal line is commonly created by using a nine-day exponential moving average of the MACD

values. These values can be adjusted to meet the needs of the technician and the security. For more

volatile securities, shorter term averages are used while less volatile securities should have longer

averages.

Another aspect to the MACD indicator that is often found on charts is the MACD histogram. The

histogram is plotted on the centerline and represented by bars. Each bar is the difference between the

MACD and the signal line or, in most cases, the nine-day exponential moving average. The higher the

bars are in either direction, the more momentum behind the direction in which the bars point.

6.2.4.2.Relative Strength Index

The relative strength index (RSI) is another one of the most used and well-known momentum indicators

in technical analysis. RSI helps to signal overbought and oversold conditions in a security. The indicator

is plotted in a range between zero and 100. A reading above 70 is used to suggest that a security is

overbought, while a reading below 30 is used to suggest that it is oversold. This indicator helps traders to

identify whether a security’s price has been unreasonably pushed to current levels and whether a reversal

may be on the way.

Figure: RSI Values

The standard calculation for RSI uses 14 trading days as the basis, which can be adjusted to meet the

needs of the user. If the trading period is adjusted to use fewer days, the RSI will be more volatile and

will be used for shorter term trades

Security Analysis Page 8

6.2.5. Evaluation of Technical Analysis

While there are several ways those Forex traders to predict price movement, they belong to one of three

kinds of traders. They are either from the school of Technical analysis, fundamental analysis or they

make apply of both disciplines. While Forex trading can be carried out successfully with the utilization of

just one type of analysis, those that have a basic comprehend of both technical in addition to fundamental

analysis tend to be better equipped.

The foundation of technical analysis is based on volume, price along with past market data to establish

currency along with future price movements. Strict technical traders put their faith purely on these factors

with no consideration to external factors.

Yet, the way the charts are viewed and the Forex indicators employed for such an analysis are very

extensive. Technical analysis also includes support along with resistance, daily pivots, trend lines in

addition to pattern formations.

External factors such as economic data plus political news are not factored in. Trend lines in addition to

the methods employed to spot them play a huge part in technical analysis. A lot of effort as well as Forex

indicators in addition to tools are used to verify the continuation or reversal of the current trend. Because

technical traders respond to any change in the trend line, they generally open more trades than long term

fundamental traders do. They are usually composed of midterm along with short term traders. Having

said that scalpers can make use of both disciplines plus end up opening huge amounts of trades every

week. Scalping is a topic for another day however.

Technical analysis is employed by the vast majority of traders in any financial market today. The reasons

for this are straightforward. This is the case simply because technical analysis is easier to comprehend in

addition to employ that fundamental analysis. The trader does not need a good understanding of

economics.

Technical analysis appears to be a highly controversial approach to security analysis. It has its ardent

votaries; it has its severe critics. The advocates of technical analysis offer the following interrelated

arguments in support of their position.

1. Under the influence of crowd psychology, trends persist for quite some time. Tools of technical

analysis that help in identifying these trends early are helpful aids in investment decision

making.

2. Shifts in demand and supply are gradual rather than instantaneous. Technical analysis helps in

detecting these shifts rather early and hence provides clues to future price movements.

3. Fundamental information about a company is absorbed and assimilated by the market over a

period of time. Hence, the price movement tends to continue in more or less the same direction

till the information is fully assimilated in the stock price.

4. Charts provide a picture of what has happened in the past and hence give a sense of volatility

that can be expected from the stock. Further, the information on trading volume which is

ordinarily provided at the bottom of a bar chart gives a fair idea of the extent of public interest

in the stock.

The detractor of technical analysis believes that technical analysis is a useless exercise. Their arguments

run as follows:

1. Most technical analysts are not able to offer convincing explanations for the tools employed by

them.

2. Empirical evidence in support of the random walk hypothesis cast its shadow over the usefulness

of technical analysis.

Security Analysis Page 9

3. By the time an uptrend or downtrend may have been signaled by technical analysis, it may

already have taken place.

4. Ultimately, technical analysis must be a self defeating proposition. As more and more people

employ it, the value of such analysis tends to decline.

5. The numerous claims that have been made for different chart patterns are simply untested

assertions.

6. There is a great deal of ambiguity in the identification of configurations as well as trend lines and

channels on the charts. The same can be interpreted differently.

To sum up, we are in a state where the market is either poised to recover, or go into a long term decline (a

change in the major trend). A failure of the head-and-shoulders formation in the National Index, which

could occur if the index clambers over 1,400 would be a good signal to suggest a market recovery, while

a breakdown below the support levels given for the leading Sensex stocks would suggest harsher times

ahead.

Despite these limitations charting is very popular. Why? It appears that charting appeals to a certain type

of personality; the collector. Listening to a chart list describe the satisfaction he derives from sitting down

after dinner with his charts for a few hours, one is reminded of the philatelist or lepidopterist. Finding a

certain pattern gives chart lists satisfaction that transcends the possibilities of turning the patterns into

money. John Magee, the guru of chart lists writes, ecstatically about the wonderful world of the

logarithmic spirals (which) contains so much of beauty and so much of the sheer wonder of pattern and

rhythm.

A pure chartist is almost monk-like in dedication, believing the essential truth about the market is to be

found in squiggles and figures on graph paper. He is unmoved by a plant explosion or a profit explosion.

A pure chartist believes what is my position on the practical utility of technical analysis? I believe that in

a rational well-ordered and efficient market, technical analysis is a worthless exercise. However, given

the imperfections, inefficiencies and irrationalities that characterize real world markets, technical analysis

can be helpful. But I do not believe it can be of great value. Hence, it may be used, albeit to a limited

extent, in conjunction with fundamental analysis to guide investment decision making.

6.2.6. General Steps to Technical Evaluation

Many technicians employ a top-down approach that begins with broad-based macro analysis. The larger

parts are then broken down to base the final step on a more focused/micro perspective. Such an analysis

might involve three steps:

i) Broad market analysis through the major indices; such as the S&P 500, Dow Industrials, NASDAQ

and NYSE Composite.

ii) Sector analysis to identify the strongest and weakest groups within the broader market.

iii) Individual stock analysis to identify the strongest and weakest stocks within select groups.

The beauty of technical analysis lies in its versatility. Because the principles of technical analysis are

universally applicable, each of the analysis steps above can be performed using the same theoretical

background. You don't need an economics degree to analyze a market index chart. You don't need to be a

CPA to analyze a stock chart. Charts are charts. It does not matter if the time frame is 2 days or 2 years. It

does not matter if it is a stock, market index or commodity. The technical principles of support,

resistance, trend, trading range and other aspects can be applied to any chart. While this may sound easy,

technical analysis is by no means easy. Success requires serious study, dedication and an open mind.

Security Analysis Page 10

You might also like

- Consulting Interview Case Preparation: Frameworks and Practice CasesFrom EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNo ratings yet

- Midland Energy Resources (Final)Document4 pagesMidland Energy Resources (Final)satherbd21100% (3)

- Different Principles, Tools, and Techniques in Creating A BusinessDocument5 pagesDifferent Principles, Tools, and Techniques in Creating A Businesskaren bulauan100% (1)

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- Chapter Four IvestmetDocument9 pagesChapter Four IvestmetMoti BekeleNo ratings yet

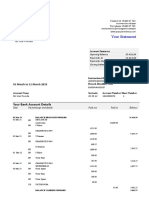

- Banco Popular StatementDocument2 pagesBanco Popular StatementLong Home ProductsNo ratings yet

- Competitor AnalysisDocument10 pagesCompetitor AnalysissajanmarianNo ratings yet

- Fundamental vs Technical Analysis Key DifferencesDocument12 pagesFundamental vs Technical Analysis Key DifferencesShakti ShuklaNo ratings yet

- Market Need Analysis Define The Market Need For The New BusinessDocument2 pagesMarket Need Analysis Define The Market Need For The New BusinessCarmela De Juan100% (3)

- Macro-Economic and Industry AnalysisDocument33 pagesMacro-Economic and Industry AnalysisPraveen Kumar SinhaNo ratings yet

- Unit 3Document21 pagesUnit 3InduSaran AttadaNo ratings yet

- Monetary Standards ExplainedDocument35 pagesMonetary Standards Explained莎侬呂63% (8)

- Forex MarketDocument64 pagesForex MarketGaurab KumarNo ratings yet

- Cash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsDocument13 pagesCash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsRapitse Boitumelo Rapitse0% (1)

- PMT 8-K Acquires $140M Non-Performing Mortgage AssetsDocument2 pagesPMT 8-K Acquires $140M Non-Performing Mortgage Assetsank333No ratings yet

- Morgan Stanley - Market ShareDocument57 pagesMorgan Stanley - Market ShareelvisgonzalesarceNo ratings yet

- Economic Value AddedDocument14 pagesEconomic Value Addedmanish singh rana0% (1)

- 006 Fundamental AnalysisDocument8 pages006 Fundamental AnalysisDavid RiveraNo ratings yet

- Fundamental Analysis of PETROLEUM SectorDocument31 pagesFundamental Analysis of PETROLEUM SectorAbhay Kapkoti0% (1)

- Security Analysis and Portfolio ManagementDocument25 pagesSecurity Analysis and Portfolio ManagementKomal Shujaat0% (1)

- Fundamental Analysis Project On BemlDocument71 pagesFundamental Analysis Project On Bemlthilaknavi7_37807777100% (2)

- Chapter Five Security Analysis and ValuationDocument66 pagesChapter Five Security Analysis and ValuationKume MezgebuNo ratings yet

- What Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current PriceDocument9 pagesWhat Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current Pricedhwani100% (1)

- Industry AnalysisDocument4 pagesIndustry Analysissnehachandan91No ratings yet

- SAPM - Security AnalysisDocument7 pagesSAPM - Security AnalysisTyson Texeira100% (1)

- Security Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Document17 pagesSecurity Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Sukanya ShridharNo ratings yet

- BD Job Traning Session 4Document58 pagesBD Job Traning Session 4Mamun ReturnNo ratings yet

- Investment CH 05Document10 pagesInvestment CH 05tesfaNo ratings yet

- Business Analysis and Valuation Ifrs 4th Edition Peek Solutions ManualDocument22 pagesBusiness Analysis and Valuation Ifrs 4th Edition Peek Solutions ManualMichaelJohnstonipwd100% (53)

- Full Download Business Analysis and Valuation Ifrs 4th Edition Peek Solutions ManualDocument12 pagesFull Download Business Analysis and Valuation Ifrs 4th Edition Peek Solutions Manualbaydayenory6100% (19)

- Dwnload Full Business Analysis and Valuation Ifrs 4th Edition Peek Solutions Manual PDFDocument35 pagesDwnload Full Business Analysis and Valuation Ifrs 4th Edition Peek Solutions Manual PDFeustacegabrenas100% (12)

- MDI GDPI Prep - StrategyDocument10 pagesMDI GDPI Prep - StrategyDevavrat SinghNo ratings yet

- CHAPTER 5-InvestmentDocument12 pagesCHAPTER 5-InvestmentMelody LisaNo ratings yet

- Analyzing Fundamental Factors for Investment DecisionsDocument13 pagesAnalyzing Fundamental Factors for Investment Decisionsvivek badhanNo ratings yet

- GST301: Human and Financial Resources Planning in EntrepreneurshipDocument25 pagesGST301: Human and Financial Resources Planning in EntrepreneurshipOkeja Faith MiracleNo ratings yet

- Porter's Five Forces That Shape IndustryDocument8 pagesPorter's Five Forces That Shape IndustryLaong laanNo ratings yet

- Marketing Management AssignmentDocument32 pagesMarketing Management Assignmentwerksew tsegayeNo ratings yet

- SYBFM Equity Market II Session II Ver 1.2Document94 pagesSYBFM Equity Market II Session II Ver 1.2KarlosNo ratings yet

- Chapter 7Document63 pagesChapter 7KalkayeNo ratings yet

- Industry Analysis: Charles P. Jones, Investments: Analysis and Management, Eighth Edition, John Wiley & SonsDocument35 pagesIndustry Analysis: Charles P. Jones, Investments: Analysis and Management, Eighth Edition, John Wiley & SonsWafaa NasserNo ratings yet

- The Industry AnalysisDocument6 pagesThe Industry AnalysisNicoleNo ratings yet

- Chapter Ii - Review of Literature: Equity AnalysisDocument82 pagesChapter Ii - Review of Literature: Equity AnalysisChannabasava Kavital0% (1)

- We TubeDocument38 pagesWe TubeGaurav ChikhalikarNo ratings yet

- Reviewer Compre 1Document30 pagesReviewer Compre 1Dexter AlcantaraNo ratings yet

- The Strategic Planning ProcessDocument39 pagesThe Strategic Planning Processakash0chattoorNo ratings yet

- A study on Equity Analysis at India-InfolineDocument21 pagesA study on Equity Analysis at India-Infolinearjunmba119624No ratings yet

- 1 - Basics of FundamentalDocument2 pages1 - Basics of FundamentalBhaskarjit DekaNo ratings yet

- Fundamentals of Valuation: Chapter One: IntroductionDocument16 pagesFundamentals of Valuation: Chapter One: IntroductionAhmed RedaNo ratings yet

- Group 1 Equity Research ReportDocument45 pagesGroup 1 Equity Research ReportKuldip DixitNo ratings yet

- Global Wide Moat ListDocument67 pagesGlobal Wide Moat Listd9r5fhnfmrNo ratings yet

- Industry Analysis and Evolution StrategiesDocument6 pagesIndustry Analysis and Evolution StrategiesSo PaNo ratings yet

- Market Analysis Chapter 5 Key FactorsDocument23 pagesMarket Analysis Chapter 5 Key FactorsSaron GebreNo ratings yet

- CH 5 FIIM ClassDocument32 pagesCH 5 FIIM ClassFikreslasie LemaNo ratings yet

- Boston Consulting GroupDocument11 pagesBoston Consulting GroupMehereen AubdoollahNo ratings yet

- Final Project Guidelines1Document3 pagesFinal Project Guidelines1Đạt TrầnNo ratings yet

- Role of A Managerial Economist: Internal. These External Factors Lie Outside The Control of Management Because TheyDocument3 pagesRole of A Managerial Economist: Internal. These External Factors Lie Outside The Control of Management Because Theykkv_phani_varma5396No ratings yet

- 4 PIMS AnalysisDocument19 pages4 PIMS AnalysisamendonzaNo ratings yet

- Industry and Competitive AnalysisDocument39 pagesIndustry and Competitive AnalysisNahian HasanNo ratings yet

- Investment MGTDocument82 pagesInvestment MGThams2010No ratings yet

- BCG Matrix 11Document18 pagesBCG Matrix 11Ambrose Tumuhimbise MuhumuzaNo ratings yet

- ACC311 Week 1 NotesDocument8 pagesACC311 Week 1 NotesCynthia LautaruNo ratings yet

- Sales ForecastingDocument13 pagesSales ForecastingNadeem AslamNo ratings yet

- 1614501324_Fundamental AnalysisDocument7 pages1614501324_Fundamental AnalysisAdarsh KumarNo ratings yet

- BCG MATRIX AND PORTER'S FIVE FORCES MODELDocument16 pagesBCG MATRIX AND PORTER'S FIVE FORCES MODELDana DrNo ratings yet

- BBA5 Fundamental Analysis of Investment ManagementDocument7 pagesBBA5 Fundamental Analysis of Investment Managementgorang GehaniNo ratings yet

- Fundamental & Technical Analysis: by Anup K. SuchakDocument53 pagesFundamental & Technical Analysis: by Anup K. SuchakanupsuchakNo ratings yet

- Macro-Economic, Industry & Company AnalysisDocument4 pagesMacro-Economic, Industry & Company Analysissamuel debebeNo ratings yet

- How to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesFrom EverandHow to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesNo ratings yet

- Audit Planning and ConductDocument17 pagesAudit Planning and ConductMoti BekeleNo ratings yet

- Chapter 7Document17 pagesChapter 7Moti BekeleNo ratings yet

- Stock Valuation MethodsDocument7 pagesStock Valuation MethodsMoti BekeleNo ratings yet

- Chapter 1audi 2015 DUDocument10 pagesChapter 1audi 2015 DUMoti BekeleNo ratings yet

- Understanding Internal Control ComponentsDocument10 pagesUnderstanding Internal Control ComponentsMoti BekeleNo ratings yet

- Chapter 6Document15 pagesChapter 6Moti Bekele100% (1)

- Chapter 5 AudDocument14 pagesChapter 5 AudMoti BekeleNo ratings yet

- Auditing Chapter 1: Integral to EconomyDocument37 pagesAuditing Chapter 1: Integral to EconomyMoti BekeleNo ratings yet

- Chapter 2 Aud 2015 DUDocument12 pagesChapter 2 Aud 2015 DUMoti BekeleNo ratings yet

- Cost & Pricing StrategiesDocument5 pagesCost & Pricing StrategiesMoti BekeleNo ratings yet

- Chapter TwoDocument52 pagesChapter TwoMoti BekeleNo ratings yet

- NNNNNNNDocument30 pagesNNNNNNNMoti Bekele100% (1)

- Financial Management II WorksheetDocument3 pagesFinancial Management II WorksheetMoti BekeleNo ratings yet

- Auditing Principles IntroductionDocument8 pagesAuditing Principles IntroductionMoti BekeleNo ratings yet

- INTERNSHIP REPORT ON CUSTOMER SERVICE AT OROMIA BANKDocument29 pagesINTERNSHIP REPORT ON CUSTOMER SERVICE AT OROMIA BANKMoti BekeleNo ratings yet

- Ais CH 1, 2022Document17 pagesAis CH 1, 2022Moti BekeleNo ratings yet

- Tsagge NewDocument30 pagesTsagge NewMoti BekeleNo ratings yet

- Abdul Edit-1Document17 pagesAbdul Edit-1Moti BekeleNo ratings yet

- Analyzing CBE's PerformanceDocument18 pagesAnalyzing CBE's PerformanceMoti BekeleNo ratings yet

- Managing Working CapitalDocument17 pagesManaging Working CapitalMoti BekeleNo ratings yet

- Bdo Loan FormDocument4 pagesBdo Loan FormChristineNo ratings yet

- Problems-Chapter 3Document4 pagesProblems-Chapter 3An VyNo ratings yet

- Chapter 8 SolutionsDocument4 pagesChapter 8 SolutionsNikulNo ratings yet

- Jonathan Cummings: MSR/New Accounts/Loans/ Membership Officer, ELGA Credit Union (April 2013 To Present)Document3 pagesJonathan Cummings: MSR/New Accounts/Loans/ Membership Officer, ELGA Credit Union (April 2013 To Present)api-300840567No ratings yet

- Goldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument3 pagesGoldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVIgnat FrangyanNo ratings yet

- Factors Influencing Adoption of Agency Banking in EthiopiaDocument43 pagesFactors Influencing Adoption of Agency Banking in EthiopiaHenok AsemahugnNo ratings yet

- Muthoot Annual Report For Fy 2018-19Document332 pagesMuthoot Annual Report For Fy 2018-19Salman SalmanNo ratings yet

- Comparative Analysis Between Unicon Investment and Its Competitors-2010Document102 pagesComparative Analysis Between Unicon Investment and Its Competitors-2010Vasudev GuptaNo ratings yet

- Calculating Cash Flow from OperationsDocument11 pagesCalculating Cash Flow from OperationsRaman SachdevaNo ratings yet

- Accounting For ReceivablesDocument16 pagesAccounting For ReceivablesAnna RoseNo ratings yet

- Tata BAF - 6%Document1 pageTata BAF - 6%Samrat FuriaNo ratings yet

- Economics McqsDocument56 pagesEconomics McqsAtif KhanNo ratings yet

- General Terms and ConditionsDocument8 pagesGeneral Terms and ConditionsSudhanshu JainNo ratings yet

- Accounting For Non-Profit Making Org-1Document14 pagesAccounting For Non-Profit Making Org-1Amelia Bailey100% (1)

- Wolfe Wave BookDocument3 pagesWolfe Wave BookmrvalybNo ratings yet

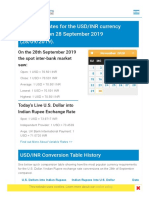

- U.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdDocument6 pagesU.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdAnish KumarNo ratings yet

- Financial ServicesDocument6 pagesFinancial ServicesSukh Gill100% (1)

- Acts of Sri LankaDocument1 pageActs of Sri LankaChalithaNo ratings yet

- New Table of ContentsDocument4 pagesNew Table of ContentsSuvro AvroNo ratings yet

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Persona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowDocument2 pagesPersona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowAndika WidriantamaNo ratings yet

- My CoursesDocument23 pagesMy CoursesCasper John Nanas MuñozNo ratings yet

- RMGB Statement Kakndwala PDFDocument5 pagesRMGB Statement Kakndwala PDFRny buriaNo ratings yet