Professional Documents

Culture Documents

Solutions - CH 5

Uploaded by

Khánh AnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions - CH 5

Uploaded by

Khánh AnCopyright:

Available Formats

CH ( 5 )

BRIEF EXERCISE 5-1

Sales Revenue – Cost of Goods Sold = Gross Profit – Operating expenses = Net income

(a) Cost of goods sold = $45,000 ($75,000 – $30,000).

Operating expenses = $19,200 ($30,000 – $10,800).

(b) Gross profit = $38,000 ($108,000 – $70,000).

Operating expenses = $8,500 ($38,000 – $29,500).

(c) Sales Revenue = $163,500 ($83,900 + $79,600).

Net income = $40,100 ($79,600 – $39,500).

EXERCISE 5-4

(a) June 10 Inventory................................................... 8,000

Accounts Payable............................ 8,000

11 Inventory................................................... 400

Cash.................................................. 400

12 Accounts Payable.................................... 300

Inventory........................................... 300

19 Accounts Payable ($8,000 – $300).......... 7,700

Inventory ($7,700 X 2%)................... 154

Cash ($7,700 – $154)........................ 7,546

(b) June 10 Accounts Receivable.............................. 8,000

Sales Revenue................................. 8,000

Cost of Goods Sold................................ 4,800

Inventory.......................................... 4,800

12 Sales Returns and Allowances.............. 300

Accounts Receivable...................... 300

Inventory................................................. 70

Cost of Goods Sold........................ 70

19 Cash ($7,700 – $154)............................... 7,546

Sales Discounts ($7,700 X 2%).............. 154

Accounts Receivable ($8,000 – $300) 7,700

EXERCISE 5-8

(a) Cost of Goods Sold................................................ 600

Inventory......................................................... 600

(b) Sales Revenue........................................................ 380,000

Income Summary........................................... 380,000

Income Summary................................................... 335,600

Cost of Goods Sold ($218,000 + $600)......... 218,600

Freight-Out...................................................... 7,000

Insurance Expense......................................... 12,000

Rent Expense.................................................. 20,000

Salaries and Wages Expense........................ 55,000

Sales Discounts.............................................. 10,000

Sales Returns and Allowances..................... 13,000

Income Summary ($380,000 – $335,600).............. 44,400

Owner’s Capital.............................................. 44,400

EXERCISE 5-9

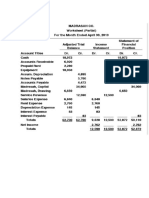

(a) FURLOW COMPANY

Income Statement

For the Month Ended March 31, 2014

Sales revenues

Sales revenue.................................................... $380,000

Less: Sales returns and allowances.............. $13,000

Sales discounts..................................... 8,000 21,000

Net sales............................................................ 359,000

Cost of goods sold................................................ 212,000

Gross profit............................................................ 147,000

Operating expenses

Salaries and wages expense............................ 58,000

Rent expense..................................................... 32,000

Freight-out......................................................... 7,000

Insurance expense............................................ 6,000

Total operating expenses..................... 103,000

Net income......................................................... $ 44,000

(b) Gross profit rate = $147,000 ÷ $359,000 = 40.95%.

EXERCISE 5-10

(a) LEMERE COMPANY

Income Statement

For the Year Ended December 31, 2014

Net sales............................................... $2,200,000

Cost of goods sold.............................. 1,289,000

Gross profit.......................................... 911,000

Operating expenses............................ 725,000

Income from operations...................... 186,000

Other revenues and gains

Interest revenue........................... $28,000

Other expenses and losses

Interest expense........................... $70,000

Loss on disposal of plant assets 17,000 87,000 (59,000)

Net income........................................... $ 127,000

(b) LEMERE COMPANY

Income Statement

For the Year Ended December 31, 2014

Revenues

Net sales............................................... $2,200,000

Interest revenue................................... 28,000

Total revenues.............................. 2,228,000

Expenses

Cost of goods sold.............................. $1,289,000

Operating expenses............................ 725,000

Interest expense.................................. 70,000

Loss on disposal of plant assets....... 17,000

Total expenses............................. 2,101,000

Net income................................................... $ 127,000

PROBLEM 5-1A :

(a) June 1 Inventory....................................................... 1,600

Accounts Payable................................. 1,600

3 Accounts Receivable................................... 2,500

Sales Revenue...................................... 2,500

Cost of Goods Sold...................................... 1,440

Inventory............................................... 1,440

6 Accounts Payable........................................ 100

Inventory............................................... 100

9 Accounts Payable ($1,600 – $100).............. 1,500

Inventory ($1,500 X .02)........................ 30

Cash....................................................... 1,470

15 Cash............................................................... 2,500

Accounts Receivable............................ 2,500

17 Accounts Receivable................................... 1,800

Sales Revenue...................................... 1,800

Cost of Goods Sold...................................... 1,080

Inventory............................................... 1,080

20 Inventory....................................................... 1,500

Accounts Payable................................. 1,500

24 Cash (1,800 – 36 ) ........................................ 1,764

Sales Discounts ($1,800 X .02).................... 36

Accounts Receivable............................ 1,800

26 Accounts Payable........................................ 1,500

Inventory ($1,500 X .02)........................ 30

Cash ( 1500 – 30 ) ................................ 1,470

28 Accounts Receivable................................... 1,400

Sales Revenue...................................... 1,400

Cost of Goods Sold...................................... 850

Inventory............................................... 850

30 Sales Returns and Allowances................... 120

Accounts Receivable............................ 120

Inventory....................................................... 72

Cost of Goods Sold.............................. 72

You might also like

- Chapter 5Document4 pagesChapter 5Ngô Hoàng Bích KhaNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- Business English Writing: Effective Business Writing Tips and Will Help You Write Better and More Effectively at WorkFrom EverandBusiness English Writing: Effective Business Writing Tips and Will Help You Write Better and More Effectively at WorkNo ratings yet

- gr12 Chapter 5 SolutionsDocument14 pagesgr12 Chapter 5 SolutionsMrinmoy SahaNo ratings yet

- CH5 Accounting QuizDocument7 pagesCH5 Accounting QuizTarun ImandiNo ratings yet

- ISCF - Income Statements and Cash FlowsDocument17 pagesISCF - Income Statements and Cash FlowsSen Ho Ng100% (1)

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Merchandising Exercises Answers PDFDocument4 pagesMerchandising Exercises Answers PDFHamzaFathi100% (3)

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Accounting For Merchandising Businesses: Problems Prob. 5-1ADocument22 pagesAccounting For Merchandising Businesses: Problems Prob. 5-1ARheino WahyuNo ratings yet

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Assign 1 FA2 SP 23Document2 pagesAssign 1 FA2 SP 23AbdulNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- Jawaban Webster CompanyDocument4 pagesJawaban Webster CompanyHans WakhidaNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- Assignment No 1Document15 pagesAssignment No 1M Naveed SultanNo ratings yet

- Basic Acc ReviewerDocument7 pagesBasic Acc ReviewerReign PangilinanNo ratings yet

- Module 2 Homework Answer KeyDocument5 pagesModule 2 Homework Answer KeyMrinmay kunduNo ratings yet

- Module 4 Homework Answer KeyDocument9 pagesModule 4 Homework Answer KeyMrinmay kunduNo ratings yet

- AC213 Ch04 ExerciseSolutionsDocument28 pagesAC213 Ch04 ExerciseSolutionsRezzan Joy Camara MejiaNo ratings yet

- Questions On Chapter FourDocument2 pagesQuestions On Chapter Fourbrook butaNo ratings yet

- Fa AssignmentDocument6 pagesFa AssignmentemnagrichiNo ratings yet

- Jawaban Laporan Arus Kas Dan Laba Rugi KomprehensifDocument4 pagesJawaban Laporan Arus Kas Dan Laba Rugi KomprehensifAksit RistiyaningsihNo ratings yet

- ch05 ExercisesDocument13 pagesch05 ExercisesTowkirNo ratings yet

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- Intermedite AccountingDocument1 pageIntermedite AccountingNicolas ErnestoNo ratings yet

- 10.18 SamDocument1 page10.18 SamSAMUEL SILALAHI 200503147No ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- App DDocument15 pagesApp DTino HartonoNo ratings yet

- Financial MGTDocument2 pagesFinancial MGTSohail Liaqat AliNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- CH 4 In-Class Exercise SOLUTIONSDocument7 pagesCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- FA 2 CH 1 Accounting For InventoriesDocument16 pagesFA 2 CH 1 Accounting For InventoriesYasinNo ratings yet

- FIN 220, Ch3, Selected Problems 2Document3 pagesFIN 220, Ch3, Selected Problems 23ooobd1234No ratings yet

- Jawaban S 3-2Document4 pagesJawaban S 3-2Lamtiur LidiaqNo ratings yet

- Solutions To ProblemsDocument2 pagesSolutions To ProblemsPonleu KinNo ratings yet

- NKLT - PR1-3B-GR8Document1 pageNKLT - PR1-3B-GR8kimphuc3819No ratings yet

- CH 5 - HomeworkDocument4 pagesCH 5 - HomeworkAxel OngNo ratings yet

- Exhibit 7.1: Financial Statement AnalysisDocument2 pagesExhibit 7.1: Financial Statement AnalysisYean SoramyNo ratings yet

- Income Statement Problems With AnswersDocument6 pagesIncome Statement Problems With AnswerskoftaNo ratings yet

- PR Week 10Document8 pagesPR Week 10Rifda AmaliaNo ratings yet

- Balance Sheet and Cash Flow AnalysisDocument8 pagesBalance Sheet and Cash Flow AnalysisAntonios FahedNo ratings yet

- Case 8 23Document5 pagesCase 8 23Thinh VuNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- Chapter 4Document28 pagesChapter 4Shibly SadikNo ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- Credit Terms and Inventory CalculationsDocument7 pagesCredit Terms and Inventory CalculationsMUHAMMAD ARIF BASHIRNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Variable Costing and Absorption Costing Income StatementsDocument6 pagesVariable Costing and Absorption Costing Income StatementsSid Chaudhary100% (1)

- 111Document7 pages111haerudinsaniNo ratings yet

- Solutions To Exercises - Chapter 17Document6 pagesSolutions To Exercises - Chapter 17Ng. Minh ThảoNo ratings yet

- Dickinson Company 2014 Income StatementDocument2 pagesDickinson Company 2014 Income StatementSp MagdalenaNo ratings yet

- Calculate Cash Collections for University BudgetDocument15 pagesCalculate Cash Collections for University BudgetIsra' I. SweilehNo ratings yet

- TOPIC 5 - Time Value of Money ApplicationDocument38 pagesTOPIC 5 - Time Value of Money ApplicationKhánh AnNo ratings yet

- Ask Chuck - ITM Case StudyDocument3 pagesAsk Chuck - ITM Case StudyKhánh AnNo ratings yet

- TOPIC 4 - Time Value of Money ConceptDocument28 pagesTOPIC 4 - Time Value of Money ConceptKhánh AnNo ratings yet

- 2023 - Tutorial 1 - FMADocument1 page2023 - Tutorial 1 - FMAKhánh AnNo ratings yet

- TOPIC 1 - Overview of Financial ManagementDocument32 pagesTOPIC 1 - Overview of Financial ManagementKhánh AnNo ratings yet

- Unit 2 Vitamins - Essence of HealthDocument7 pagesUnit 2 Vitamins - Essence of HealthKhánh AnNo ratings yet

- Mushroom Storage and ProcessingDocument5 pagesMushroom Storage and ProcessingKho Siong Thong80% (5)

- Athlete WaiverDocument1 pageAthlete WaiverRonan MurphyNo ratings yet

- Case Wheel Loaders 667ta Engine Service ManualDocument10 pagesCase Wheel Loaders 667ta Engine Service Manuallinda100% (34)

- (GUIDE) Advanced Interactive Governor Tweaks Buttery Smooth and Insane Battery Life! - Page 519 - Xda-DevelopersDocument3 pages(GUIDE) Advanced Interactive Governor Tweaks Buttery Smooth and Insane Battery Life! - Page 519 - Xda-Developersdadme010% (2)

- Samahan NG Manggagawa NG Hanjin Vs BLRDocument11 pagesSamahan NG Manggagawa NG Hanjin Vs BLRPhrexilyn PajarilloNo ratings yet

- Bloodborne Pathogens Program: Western Oklahoma State College Employee Training HandbookDocument35 pagesBloodborne Pathogens Program: Western Oklahoma State College Employee Training HandbookKashaNo ratings yet

- Del Monte Golf Club in BukidnonDocument1 pageDel Monte Golf Club in BukidnonJackieNo ratings yet

- SolidWorks Motion Tutorial 2010Document31 pagesSolidWorks Motion Tutorial 2010Hector Adan Lopez GarciaNo ratings yet

- Uti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)Document8 pagesUti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)bharath289No ratings yet

- Maputo Port Approach Passage PlanDocument1 pageMaputo Port Approach Passage PlanRitesh ChandraNo ratings yet

- Law On Sales: Perfection Stage Forms of Sale When Sale Is SimulatedDocument21 pagesLaw On Sales: Perfection Stage Forms of Sale When Sale Is SimulatedRalph ManuelNo ratings yet

- Operating Instructions MA 42 - Maico Diagnostics PDFDocument28 pagesOperating Instructions MA 42 - Maico Diagnostics PDFJuan PáezNo ratings yet

- OM B - Basic PDFDocument114 pagesOM B - Basic PDFTodor ToshkovNo ratings yet

- Cameron VBR-II (Variable Bore Ram) PackerDocument2 pagesCameron VBR-II (Variable Bore Ram) Packerjuan olarteNo ratings yet

- Llave de Impacto PDFDocument21 pagesLlave de Impacto PDFmasterfiera1No ratings yet

- Compound Sentences FANBOYS WorksheetDocument7 pagesCompound Sentences FANBOYS WorksheetVerenice SuarezNo ratings yet

- DNV Casualty Info 2011 #3Document2 pagesDNV Casualty Info 2011 #3Sureen NarangNo ratings yet

- Mechanical Engineering Semester SchemeDocument35 pagesMechanical Engineering Semester Schemesantvan jagtapNo ratings yet

- Business Plan For Mobile Food CourtDocument13 pagesBusiness Plan For Mobile Food CourtMd. Al- AminNo ratings yet

- Haukongo Nursing 2020Document86 pagesHaukongo Nursing 2020Vicky Torina ShilohNo ratings yet

- COVID-19 Impact on Philippine ExportsDocument5 pagesCOVID-19 Impact on Philippine ExportsHazel BorboNo ratings yet

- Advance Corporate StrategyDocument2 pagesAdvance Corporate StrategyPassionate_to_LearnNo ratings yet

- Accounting Basics: Recording TransactionsDocument8 pagesAccounting Basics: Recording TransactionsRegina Bengado100% (1)

- 2015 Idmp Employee Intentions Final PDFDocument19 pages2015 Idmp Employee Intentions Final PDFAstridNo ratings yet

- IsotopesDocument35 pagesIsotopesAddisu Amare Zena 18BML0104No ratings yet

- Irrigation Management and Development PlanDocument5 pagesIrrigation Management and Development PlanRTL JRNo ratings yet

- BROC Mackam Dab en v1.0Document2 pagesBROC Mackam Dab en v1.0jangri1098No ratings yet

- Report On Indian Education SystemDocument7 pagesReport On Indian Education SystemYashvardhanNo ratings yet

- Group Assignment For Quantitative: Analysis For Decisions MakingDocument45 pagesGroup Assignment For Quantitative: Analysis For Decisions Makingsemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- Analysis Report PDFDocument4 pagesAnalysis Report PDFJever BorjaNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)