Professional Documents

Culture Documents

LTCC Sampe

LTCC Sampe

Uploaded by

Shaina GarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LTCC Sampe

LTCC Sampe

Uploaded by

Shaina GarciaCopyright:

Available Formats

Prob.

1

MM Construction Company was awarded a contract to construct a sewage system for Maynilad for 32,500,000.

The original estimate of the cost to complete the project was 30,000,000. The contract provides for periodic progress

billings. A final billing equal to 25% of the CP is to be made upon final inspection and acceptance by Maynilad. The

record was follows:

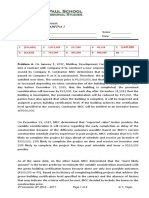

Date Cost incurred to date Est. cost to complete

12/31/2021 10,750,000 16,125,000

12/31/2022 26,250,000 7,500,000

8/15/2023 34,250,000

The construction was inspected on Aug. 15, 2021, Jan. 15, 2022, and Oct. 1, 2022, and PB equal to 25% of the CP were

made on each of these dates. The system was completed, and final inspection and acceptance took place on Aug. 31,

2023. CIP net of PB in 2022 ____________________________

Prob. 2

MM Cons. Company began operation on Jan. 2, 2023. During the year, the company entered into a contract with

TT to construct a manufacturing facility. At that time, MM estimated that it would take 5 years to complete the facility at

a total cost of 18,000,000. The total CP for the construction is 25,000,000. During the year, the company incurred

4,400,000 in construction cost related to the project. The estimated cost to complete the contract is 15,600,000. TT was

billed and paid 30% of the CP. Using POC, how much is the CIP or PB ____________________________

Prob. 3

MM Cons. Inc. entered into a construction contract in 2022 that called for a contract price of 9,600,000. At the

beginning of 2023, a change order increased the initial CP by 480,000. The company uses POC method for completing

the project, the ff. data is available:

2022 2023

Cost incurred to date 4,920,000 8,640,000

Est. cost to complete 4,920,000 2,160,000

RGP/(RGL) to be recognized for 2022 _____________________ and 2023 ______________________

Prob. 4

MM works on a 70 million contract in 2023 to construct a mall. During 2023, MM uses the POC method of

revenue recognition. At Dec. 31, 2023, account balances were:

CIP 24,500,000

AR 2,400,000

Contract billings 12,000,000

Est. cost to complete 31,850,000

Actual cost incurred for 2023 _______________________

Prob. 5

In 2021, MM Builders agreed to construct a commercial building at a price of 10,000,000. MM uses POC method

of recognizing revenue from LTC projects. Data were as follows:

2021 2022 2023

Cost incurred each year 2,800,000 3,200,000 1,850,000

Est. cost to complete 5,200,000 2,000,000 -

Billings to date 1,500,000 4,000,000 10,000,000

Collections 1,200,000 3,200,000 9,400,000

RGP in 2022 _____________________

Balance of CIP net of PB ____________________

If ZPM, balance of CIP over PB _______________________

Prob. 6

MM recognized RGP of 315,000 on its LTC projects that has accumulated cost of 612,500 for the year. To finish

the project, MM estimates that it has to incur additional cost of 1,225,000. Billings were made 40% of the CP. What was

the balance of CIP account net of PB? ______________________

You might also like

- 9006 - LTCC SolutionsDocument9 pages9006 - LTCC SolutionsFrancis Vonn Tapang100% (1)

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- AFAR Self Test - 9002Document7 pagesAFAR Self Test - 9002Jennifer RueloNo ratings yet

- Quiz Long Term ContractsDocument7 pagesQuiz Long Term ContractsDeanna GicaleNo ratings yet

- Long-Term Construction QuizDocument4 pagesLong-Term Construction QuizCattleyaNo ratings yet

- ConstDocument15 pagesConstJemson YandugNo ratings yet

- Managerial Economics (Chapter 6)Document39 pagesManagerial Economics (Chapter 6)api-370372482% (11)

- Demand For Labour in Competitive Labour Markets: Main QuestionsDocument33 pagesDemand For Labour in Competitive Labour Markets: Main Questionsvijay_jeyapalanNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Construction ContractsDocument4 pagesConstruction ContractsAnjelica MarcoNo ratings yet

- LTC ExercisesDocument3 pagesLTC Exercisesjemmaserrano1220No ratings yet

- Problem 1Document8 pagesProblem 1Celine Marie AntonioNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Problems - Construction ContractDocument2 pagesProblems - Construction ContractAbby Gail TiongsonNo ratings yet

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- Activity 5 Long Term Construction ContractsDocument4 pagesActivity 5 Long Term Construction ContractsSharon AnchetaNo ratings yet

- LTCCDocument16 pagesLTCCandzie09876No ratings yet

- LTCC Easy 2Document2 pagesLTCC Easy 2alyNo ratings yet

- Longterm Conat QuizDocument3 pagesLongterm Conat QuizKurtNo ratings yet

- LTCC Easy 1Document1 pageLTCC Easy 1alyNo ratings yet

- 4 Material 4 LTCC For Students 2Document3 pages4 Material 4 LTCC For Students 2Joyce Anne GarduqueNo ratings yet

- Finals 3Document8 pagesFinals 3Patricia Jane CabangNo ratings yet

- 04 Construction ContractsDocument3 pages04 Construction ContractsJoshua HonraNo ratings yet

- Activity 6 - Long-Term Construction ContractsDocument2 pagesActivity 6 - Long-Term Construction ContractsDe Chavez May Ann M.No ratings yet

- 9206 - Long-Term Construction Contracts - Test Bank & ReviewerDocument4 pages9206 - Long-Term Construction Contracts - Test Bank & ReviewerspaynanteNo ratings yet

- Long Term Construction Contract AssignmentDocument2 pagesLong Term Construction Contract Assignmentcali cdNo ratings yet

- 06 Long Term Construction ContractsDocument4 pages06 Long Term Construction ContractsAllegria AlamoNo ratings yet

- FT Specialized IndustryDocument4 pagesFT Specialized IndustryJamie RamosNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Long Term Construction Contract Discussion GuideDocument2 pagesLong Term Construction Contract Discussion GuideLaren KayeNo ratings yet

- Actual Estimated Contract Percent Project No. Cost Total Cost Price CompleteDocument10 pagesActual Estimated Contract Percent Project No. Cost Total Cost Price CompleteRalph Renz CastilloNo ratings yet

- LTCC Part 2Document2 pagesLTCC Part 2Aivan De LeonNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsAnalynNo ratings yet

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsJustine CruzNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- MODULE 5 - Construction AccountingDocument8 pagesMODULE 5 - Construction AccountingEdison Salgado CastigadorNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- LTCC Exam PDF FreeDocument5 pagesLTCC Exam PDF FreeMichael Brian TorresNo ratings yet

- LTCC - ExamDocument5 pagesLTCC - ExamLouise Anciano100% (1)

- Const PDF FreeDocument15 pagesConst PDF FreeMichael Brian TorresNo ratings yet

- UntitledDocument18 pagesUntitledjeralyn juditNo ratings yet

- 20% DevelopmentDocument4 pages20% DevelopmentWilliam A. Chakas Jr.No ratings yet

- Quiz 3 Construction ContractsDocument7 pagesQuiz 3 Construction ContractsMarinel Mae Chica100% (2)

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- LTCC SeatworkDocument2 pagesLTCC SeatworkCaselyn Clyde UyNo ratings yet

- Finance-Case StudyDocument2 pagesFinance-Case StudyTolulope Afuwape TimothyNo ratings yet

- LTCC QuizDocument3 pagesLTCC QuizJamhel MarquezNo ratings yet

- Percentage of Completion 33.33%Document6 pagesPercentage of Completion 33.33%AlexNo ratings yet

- Final ExamDocument3 pagesFinal ExamErica DaprosaNo ratings yet

- Construction Contracts Prac 2 2020 PDFDocument27 pagesConstruction Contracts Prac 2 2020 PDFSharmaineMiranda100% (1)

- Construction ContractDocument17 pagesConstruction ContractYvonne Gam-oyNo ratings yet

- Revenue From LTCCDocument2 pagesRevenue From LTCCMarife RomeroNo ratings yet

- Quiz ConstructionDocument1 pageQuiz ConstructionErjohn PapaNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Policies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionFrom EverandPolicies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionNo ratings yet

- PoemDocument1 pagePoemShaina GarciaNo ratings yet

- INSTALLMENT SALES Part 2Document1 pageINSTALLMENT SALES Part 2Shaina GarciaNo ratings yet

- Instalment Sales Prob. 1Document3 pagesInstalment Sales Prob. 1Shaina GarciaNo ratings yet

- Corliq CheatDocument2 pagesCorliq CheatShaina GarciaNo ratings yet

- Intermediate Accounting 3 ModuleDocument13 pagesIntermediate Accounting 3 ModuleShaina GarciaNo ratings yet

- Module 1 STSDocument6 pagesModule 1 STSShaina GarciaNo ratings yet

- Toaz - Info Quiz1 Set A PR PDFDocument8 pagesToaz - Info Quiz1 Set A PR PDFNah HamzaNo ratings yet

- Quiz 14 - Financial ManagementDocument9 pagesQuiz 14 - Financial ManagementAurelio Delos Santos Macatulad Jr.No ratings yet

- 05 Relevant Costing With Linear ProgrammingDocument9 pages05 Relevant Costing With Linear Programmingrandomlungs121223No ratings yet

- Production Choices and Costs3Document12 pagesProduction Choices and Costs3Johainisah Hadji KamalNo ratings yet

- 4kieso Ch18-Revenue 2019Document55 pages4kieso Ch18-Revenue 2019Peter Arya PrimaNo ratings yet

- Cobb Douglus Production FunctionDocument4 pagesCobb Douglus Production FunctionNishantNo ratings yet

- Competition in The Long-RunDocument28 pagesCompetition in The Long-RunRudjun TapalNo ratings yet

- MCQsDocument3 pagesMCQsVikas guptaNo ratings yet

- ChapterIII Theory of Production and Cost.Document25 pagesChapterIII Theory of Production and Cost.VirencarpediemNo ratings yet

- Clarito, Trisha Bacostmx - Hw7 - Part 1Document4 pagesClarito, Trisha Bacostmx - Hw7 - Part 1Clarito, Trisha Kareen F.No ratings yet

- Production Analysis: E5 Managerial EconomicsDocument27 pagesProduction Analysis: E5 Managerial EconomicsTharshiNo ratings yet

- Chapter 5 - The Demand For LaborDocument8 pagesChapter 5 - The Demand For Laborhui200xNo ratings yet

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- Perfectly Competitive Supply and Monopolies-1Document62 pagesPerfectly Competitive Supply and Monopolies-1Samiur RahmanNo ratings yet

- ConuDocument4 pagesConuPrabhat MishraNo ratings yet

- In-Class 1 SolutionsDocument2 pagesIn-Class 1 SolutionssassNo ratings yet

- The Economic Problem: Scarcity and Choice: Case & Fair: Chapter 2Document42 pagesThe Economic Problem: Scarcity and Choice: Case & Fair: Chapter 2Manepalli YashwinNo ratings yet

- Ibzlz5x7r - Cost Accounting MidtermDocument2 pagesIbzlz5x7r - Cost Accounting MidtermLyra Mae De BotonNo ratings yet

- Solution Manual For Microeconomics 16th Canadian Edition Christopher T S Ragan Christopher RaganDocument14 pagesSolution Manual For Microeconomics 16th Canadian Edition Christopher T S Ragan Christopher RaganElizabethSteelefocgk100% (85)

- Final Exam Review QuestionsDocument9 pagesFinal Exam Review QuestionsSaurav DuttNo ratings yet

- Nabila Indri Yani 2010931037 Tugas AEBDocument4 pagesNabila Indri Yani 2010931037 Tugas AEBInnabilaNo ratings yet

- ProductionCost ProblemsDocument3 pagesProductionCost ProblemsRyanNo ratings yet

- Production Function Returns To ScaleDocument16 pagesProduction Function Returns To Scalejayti desaiNo ratings yet

- F5.1 Lý Thuyết Tiếng ViệtDocument147 pagesF5.1 Lý Thuyết Tiếng ViệtTrần Diễm QuỳnhNo ratings yet

- 8 The Cost of ProductionDocument2 pages8 The Cost of ProductionDaisy Marie A. RoselNo ratings yet

- Cima c04 2013 Class Chapter 6 Cost BehaviourDocument14 pagesCima c04 2013 Class Chapter 6 Cost BehaviourMir Fida NadeemNo ratings yet

- Written Assignment Week 4Document5 pagesWritten Assignment Week 4Shiraz ShafqatNo ratings yet

- Cost Output RelationshipDocument17 pagesCost Output RelationshipAnonymous 1ClGHbiT0JNo ratings yet