Professional Documents

Culture Documents

Blue and White Creative Resume

Uploaded by

Format BookOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue and White Creative Resume

Uploaded by

Format BookCopyright:

Available Formats

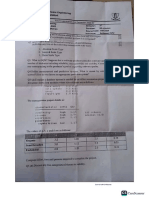

OPERATION MANAGER

UMER SHAHID

OBJECTIVES

To Work for dynamic and Progressive

EDUCATION

Organization. Offering sample

opportunities for Experience and Growth.

B.Com 2nd Div.

Islamia University Committed to Perform Quality Work by

Bahawalpur

applying professional Knowledge.

D.B.A

Board of Intermediate &

Secondary Education EXPERIENCE

Bahawalpur

Matric 2nd Div. ●OG I Branch Operations Manger in United Bank

Board of Intermediate & Limited Since 06 Jan 2014 to Dated

Secondary Education (Working as a BOM in F7,F6,E11,F10,G13 and G8

Bahawalpur

Branch)

Job Description

CONTACT ■Ensuring delivery of best possible customer

services, controlling TAT. Preparing branch for

Mystery shopping by providing continuous coaching

House # 416/3 Street No

14 Sector III and guidance of bank products/Rules

Airport Housing Society

Regulations/Policies & procedures to staff.

Rawalpindi

0333-5441174

■Ensuring the working of branch as per

haierumer4@gmail.com internal/external/SBP audit and compliance of audit

report.

31304-1236643-5

■Ensuring cash on hand in branch as per HO/SBP

requirements including its disposal. Controlling

expenses and ensuring no instance of leakage of

income.

PERSONAL DETAILS

EXPERIENCE

●Father name : Shahid Tufail ■Ensuring dash board exceptions are properly

●Date of Birth : 22-09-1983 closed as per bank requirement.

■Responsible for overall administration of the

●Nationality : Pakistani branch including staff matters, staff leave,

branch environment etc.

●Marital Status : Married ●OG III in MCB Bank Ltd Since 09 Jan 2012 to

Dated 20 Dec 2013.

●CNIC No : 31304-1236643-5 ●Working Experience in Silk Bank Ltd Since 10

Aug 2010 to Dated 07 Jan 2012.

LANGUAGES ●3 & half Years Working Experience in MCB

Bank Ltd. Since Oct 2006 to Dated 09 Aug 2010.

●Urdu

●Punjabi OPERATIONS DEPARTMENT

●English Accounts Department

Job Description : Preparation of Tax returns

& Major Contribution : Checking of daily

SKILLS activity of the Branch

●Operating System. ■HR Management

●MS Office. ■Reconciliation report with other banks & with

●Internet & E-mal. Head Office

■Preparation of the budget of the Branch

■Expense vouchering

REFERENCES

●Will be gladly provided on Remittances Departments

■Issuance of DD, P.O, CDR

demand

■Clearing, Online

Account Opening

■Account Opening

■Customer Due Diligence

■Monitoring of Customer Accounts according

to KYC

Information Technology

■ ATM Balancing

■ Day End and Day Start

You might also like

- Internship Report On Soneri Bank LimitedDocument78 pagesInternship Report On Soneri Bank LimitedZubair Khan50% (2)

- NN IP Guidebook To Alternative CreditDocument140 pagesNN IP Guidebook To Alternative CreditBernardNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Ernst Bloch Principle of Hope PDFDocument2 pagesErnst Bloch Principle of Hope PDFAdamNo ratings yet

- Shoaib Tariq Operation Manager: MCB Bank LTDDocument1 pageShoaib Tariq Operation Manager: MCB Bank LTDShoaib TariqNo ratings yet

- CELL: +971-52-2840529: Bachelor's DiplomaDocument3 pagesCELL: +971-52-2840529: Bachelor's DiplomaSarita ChaudharyNo ratings yet

- Cv-Anita Amir AliDocument2 pagesCv-Anita Amir AliNASEER ULLAHNo ratings yet

- Syed Sajjad HaiderDocument3 pagesSyed Sajjad HaiderMuntaha SyedNo ratings yet

- Imran Ali (CV)Document2 pagesImran Ali (CV)Ammara BajwaNo ratings yet

- An Evaluation of Deposit Schemes of United Commercial Bank LimitedDocument51 pagesAn Evaluation of Deposit Schemes of United Commercial Bank LimitedHarunur RashidNo ratings yet

- M.saqib, Accounts& Finance, 6 Yrs Experience.Document3 pagesM.saqib, Accounts& Finance, 6 Yrs Experience.Nisar AhmedNo ratings yet

- Pranay ResumeDocument2 pagesPranay ResumePranay BansodNo ratings yet

- Md. Imtiaz Ahmed Nayeem: Contact Work ExperienceDocument3 pagesMd. Imtiaz Ahmed Nayeem: Contact Work ExperienceImtiazNo ratings yet

- AccountantDocument2 pagesAccountantAung ThantNo ratings yet

- CV of Khawaja BabarDocument3 pagesCV of Khawaja Babarsikander.lentraxNo ratings yet

- CV - Ali ShahDocument3 pagesCV - Ali ShahAlishah AslamNo ratings yet

- Additional ProfilingDocument33 pagesAdditional ProfilingKushal SainNo ratings yet

- Sandeep CDocument5 pagesSandeep CKushal SainNo ratings yet

- Riddhi Dedhia ResumeDocument2 pagesRiddhi Dedhia Resumemahekpurohit1800No ratings yet

- Fasih Ur Rehman CVDocument3 pagesFasih Ur Rehman CVAnonymous a2NRDXNo ratings yet

- Down Load CVDocument2 pagesDown Load CVRai Babar AdeelNo ratings yet

- Edojariogba Joshua CVDocument3 pagesEdojariogba Joshua CVjoshuaNo ratings yet

- AZIFAIRDocument3 pagesAZIFAIRAZIFAIR_GFMNo ratings yet

- CV (Satya. Panda)Document3 pagesCV (Satya. Panda)satya gyaneswar pandaNo ratings yet

- Deborshi RoyDocument2 pagesDeborshi RoyDeborshi RoyNo ratings yet

- B. Hafiz MazharDocument3 pagesB. Hafiz MazharJenniferNo ratings yet

- Adel M Tayyem CVDocument9 pagesAdel M Tayyem CVAlaa JamoosNo ratings yet

- Doc-20220414-Wa0005 221118 170521Document3 pagesDoc-20220414-Wa0005 221118 170521yogesh padilkarNo ratings yet

- An Internship Report ON General Banking Activities of Southeast Bank LimitedDocument12 pagesAn Internship Report ON General Banking Activities of Southeast Bank Limitedcric6688No ratings yet

- Advertisement No.: IPPB/CO/HR/RECT./2023-24/03Document8 pagesAdvertisement No.: IPPB/CO/HR/RECT./2023-24/03animeshtechnosNo ratings yet

- Rahmat Ullah Rahmat Ullah: Siddique Abad Colony Near Railway Station D G KHAN. Abad Colony Near Railway Station D G KHANDocument4 pagesRahmat Ullah Rahmat Ullah: Siddique Abad Colony Near Railway Station D G KHAN. Abad Colony Near Railway Station D G KHANTALHA KHANNo ratings yet

- Sakherhijazi1 New CV 2022Document2 pagesSakherhijazi1 New CV 2022sakherhijazi21No ratings yet

- Ali Afzal Qureshi - OriginalDocument2 pagesAli Afzal Qureshi - OriginalJenniferNo ratings yet

- Parag Arun Dhande NewDocument3 pagesParag Arun Dhande NewparasdhandeNo ratings yet

- Resume AtiqDocument3 pagesResume AtiqShabbirNo ratings yet

- AMAN UL ALAHA - Assistant Manager - ChenoneDocument2 pagesAMAN UL ALAHA - Assistant Manager - Chenoneusmansss_606776863No ratings yet

- Rizwan's ResumeDocument1 pageRizwan's Resumerizwan saleemNo ratings yet

- Foreign Exchange Operations of Southeast Bank Limited: Internship ReportDocument74 pagesForeign Exchange Operations of Southeast Bank Limited: Internship ReportudenbranNo ratings yet

- Muhammad Asif Siddiqui: Cell #: 0333-7931205Document4 pagesMuhammad Asif Siddiqui: Cell #: 0333-7931205Akram KhanNo ratings yet

- ShijoDocument2 pagesShijoRahul Kunniyoor100% (1)

- Ghulam Mohammad Soomro-1Document2 pagesGhulam Mohammad Soomro-1Ghulam SoomroNo ratings yet

- Modus Operandi of Foreign Exchange DivisDocument133 pagesModus Operandi of Foreign Exchange DivisTARIQNo ratings yet

- Internship Report On Foreign Exchange Operation at Standard Bank LimitedDocument53 pagesInternship Report On Foreign Exchange Operation at Standard Bank LimitedArifulIslamArifNo ratings yet

- Syed Raza Muhammad Naqvi: Key CompetnceDocument3 pagesSyed Raza Muhammad Naqvi: Key CompetnceSyedMushavAliNaqviNo ratings yet

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahDocument28 pagesRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- Waseem Shahzad: F O M O S /E S H / A ADocument2 pagesWaseem Shahzad: F O M O S /E S H / A AWaqaar Ali VirkNo ratings yet

- The Bank of PunjabDocument45 pagesThe Bank of Punjabmankera90% (10)

- A Project Report On Financing Working Capital at PNBDocument52 pagesA Project Report On Financing Working Capital at PNBMudit GuptaNo ratings yet

- 1600635818028resume SDocument4 pages1600635818028resume SSuneel KumarNo ratings yet

- Sonali Resume.Document3 pagesSonali Resume.kysydsNo ratings yet

- Foreign ExchangeDocument18 pagesForeign ExchangeSabbir AhmmedNo ratings yet

- Rajalakshmi Resume PDFDocument3 pagesRajalakshmi Resume PDFReena JaiNo ratings yet

- Rana Amir ShahzadDocument2 pagesRana Amir ShahzadAmir ShahzadNo ratings yet

- Resume - Sunilkumar Manharbhai Rana - AccountantDocument3 pagesResume - Sunilkumar Manharbhai Rana - AccountantpiyushNo ratings yet

- Madhan Ashok Kumar - OriginalDocument4 pagesMadhan Ashok Kumar - Originallakshmi dharmavaramNo ratings yet

- Template Curriculum VitaeDocument3 pagesTemplate Curriculum VitaeJohnny MulambaNo ratings yet

- Naukri SurekhaN 6232576 - 05 10 - 1Document4 pagesNaukri SurekhaN 6232576 - 05 10 - 1TriptiNo ratings yet

- Zohaib Saif (CV)Document2 pagesZohaib Saif (CV)atif.saifNo ratings yet

- Sonali Bank PDFDocument72 pagesSonali Bank PDFkazi Md. yasin ullahNo ratings yet

- Internal Advert Credit Controller Global Grade 07 - MiddelburgDocument1 pageInternal Advert Credit Controller Global Grade 07 - MiddelburgTyronneNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Understanding Principles of Accounting: A High School Student’S Companion.From EverandUnderstanding Principles of Accounting: A High School Student’S Companion.No ratings yet

- Pak Study Notes...Document23 pagesPak Study Notes...Format BookNo ratings yet

- Pakistan Studies-1Document8 pagesPakistan Studies-1Format BookNo ratings yet

- CS Past Papers (GCUF Main Campus) - 5Document104 pagesCS Past Papers (GCUF Main Campus) - 5Format BookNo ratings yet

- Lecture 2-1Document10 pagesLecture 2-1Format BookNo ratings yet

- (Slideshare Downloader La) 63c8d73f6879bDocument31 pages(Slideshare Downloader La) 63c8d73f6879bFormat BookNo ratings yet

- BS Eng 3Document13 pagesBS Eng 3Format BookNo ratings yet

- 3 - DDA AlgorithmDocument9 pages3 - DDA AlgorithmFormat BookNo ratings yet

- 6 - MidPoint AlgorithmDocument8 pages6 - MidPoint AlgorithmFormat BookNo ratings yet

- BSCS 3Document15 pagesBSCS 3Format BookNo ratings yet

- 6 FragmentsDocument4 pages6 FragmentsFormat BookNo ratings yet

- 2 Lecture2Document31 pages2 Lecture2Format BookNo ratings yet

- Irfani NotesDocument385 pagesIrfani NotesFormat BookNo ratings yet

- 3 Parts of A Science Fair ProjectDocument5 pages3 Parts of A Science Fair ProjectGeorge Oswald Junior CarringtonNo ratings yet

- A321 DIFFERENCE GUIDE From A320Document72 pagesA321 DIFFERENCE GUIDE From A320NigelNo ratings yet

- (R) Nelson JB (2017) - Mindful Eating - The Art of Presence While You EatDocument4 pages(R) Nelson JB (2017) - Mindful Eating - The Art of Presence While You EatAnonymous CuPAgQQNo ratings yet

- Control Grupos Electrogenos LobatoDocument20 pagesControl Grupos Electrogenos LobatoEdwin Santiago Villegas AuquesNo ratings yet

- The Enemy Within - v18Document8 pagesThe Enemy Within - v18Matt WillisNo ratings yet

- Pride&PrejudiceDocument88 pagesPride&PrejudiceMà Ř YãmNo ratings yet

- Facilities 2013 SG - Full Time, 2nd YearDocument49 pagesFacilities 2013 SG - Full Time, 2nd Yearsaifasad100% (2)

- Coastal Suite For Tuba SoloDocument7 pagesCoastal Suite For Tuba SoloSusanna Payne-Passmore100% (1)

- Formalismo Geométrico de La Mecánica Cuántica y Sus Aplicaciones A Modelos MolecularesDocument51 pagesFormalismo Geométrico de La Mecánica Cuántica y Sus Aplicaciones A Modelos Moleculareshugo_valles_2No ratings yet

- Unit - 5 SelectionDocument7 pagesUnit - 5 SelectionEhtesam khanNo ratings yet

- Exercises - PronounsDocument3 pagesExercises - PronounsTerritório PBNo ratings yet

- Cybersecurity in Operational Technology: Special ReportDocument15 pagesCybersecurity in Operational Technology: Special ReportAdrian ReyesNo ratings yet

- Metal Gear Solid - Characters Profile and TimelineDocument65 pagesMetal Gear Solid - Characters Profile and Timelinekrevorkian1653100% (1)

- Advanced Concepts of GD&TDocument3 pagesAdvanced Concepts of GD&TPalani Trainer33% (3)

- Phys172 S20 Lab07 FinalDocument8 pagesPhys172 S20 Lab07 FinalZhuowen YaoNo ratings yet

- Cedarwood ChromatographyDocument6 pagesCedarwood ChromatographyMartinaNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- Imran Index 1Document11 pagesImran Index 1api-387022302No ratings yet

- Wilkins Excel SheetDocument9 pagesWilkins Excel SheetYuvraj Aayush Sisodia100% (1)

- AlerTox Sticks Soy PLUS ManualDocument8 pagesAlerTox Sticks Soy PLUS ManualLuis Miguel Matos OteroNo ratings yet

- Geometry Sparkcharts Geometry Sparkcharts: Book Review Book ReviewDocument3 pagesGeometry Sparkcharts Geometry Sparkcharts: Book Review Book ReviewAyman BantuasNo ratings yet

- HECKMAN, J. James - Schools, Skills and SynapsesDocument36 pagesHECKMAN, J. James - Schools, Skills and SynapsesAndré Gonçalves OliveiraNo ratings yet

- Management of Developing DentitionDocument51 pagesManagement of Developing Dentitionahmed alshaariNo ratings yet

- BDU-BIT-Electromechanical Engineering Curriculum (Regular Program)Document187 pagesBDU-BIT-Electromechanical Engineering Curriculum (Regular Program)beselamu75% (4)

- Final Programme EtmmDocument13 pagesFinal Programme EtmmJNo ratings yet

- Clamp Selection Guide - Rev.12 - 3.24.2016 PDFDocument32 pagesClamp Selection Guide - Rev.12 - 3.24.2016 PDFgoran muhamdNo ratings yet

- Radhu's Recipes - 230310 - 180152 PDFDocument123 pagesRadhu's Recipes - 230310 - 180152 PDFl1a2v3 C4No ratings yet

- Economics Key WordsDocument30 pagesEconomics Key WordsJanetNo ratings yet