Professional Documents

Culture Documents

Assignment

Uploaded by

Asif Abdullah KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment

Uploaded by

Asif Abdullah KhanCopyright:

Available Formats

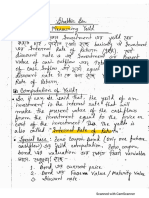

Summary of Information-motivated trading

1. Information-motivated traders (example: bank treasury) trade to profit from information that

they believe allows them to predict future prices.

2. They hope to buy low and sell high, with an additional return from their information.

3. Active investment managers (example: pension fund) are information-motivated traders who

collect and analyze information to identify under/overvalued assets.

4. They aim to obtain a higher return than the unconditional return by using their information

analysis.

5. The distinction between information-motivated traders and pure investors lies in their motives

for trading.

6. Investors trade to move wealth forward in time, while information-motivated traders trade to

profit from superior information.

7. Information-motivated traders trade because they expect prices to change faster than others

would expect.

8. They hope to close positions and realize profits quickly.

9. Investors can also be information-motivated traders if they collect and analyze information to

get greater returns.

10. A consistent failure to produce superior returns means the efforts are futile and the trader

would have been better off buying and holding a diversified portfolio.

You might also like

- A Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketFrom EverandA Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketNo ratings yet

- Summary of Benjamin Graham's The Intelligent InvestorFrom EverandSummary of Benjamin Graham's The Intelligent InvestorRating: 5 out of 5 stars5/5 (1)

- How to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketFrom EverandHow to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketNo ratings yet

- The Advanced Day Trading Guide: Learn Secret Step by Step Strategies on How You Can Day Trade Forex, Options, Stocks, and Futures to Become a Successful Day Trader for a Living!From EverandThe Advanced Day Trading Guide: Learn Secret Step by Step Strategies on How You Can Day Trade Forex, Options, Stocks, and Futures to Become a Successful Day Trader for a Living!Rating: 4.5 out of 5 stars4.5/5 (9)

- I. Executive Summary Virtual Stock Trading Allows Investors To Practice Buying and Selling SecuritiesDocument18 pagesI. Executive Summary Virtual Stock Trading Allows Investors To Practice Buying and Selling SecuritiesMarnelli LagumbayNo ratings yet

- DAY TRADING OPTIONS: Strategies and Techniques for Profiting from Short-Term Options Trading (2024 Guide for Beginners)From EverandDAY TRADING OPTIONS: Strategies and Techniques for Profiting from Short-Term Options Trading (2024 Guide for Beginners)No ratings yet

- Investment Is Putting Money Into Something With The Hope of Profit. More SpecificallyDocument20 pagesInvestment Is Putting Money Into Something With The Hope of Profit. More Specificallyzulfi12345No ratings yet

- Rich Dad's Guide to Investing (Review and Analysis of Kiyosaki and Lechter's Book)From EverandRich Dad's Guide to Investing (Review and Analysis of Kiyosaki and Lechter's Book)No ratings yet

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- Accounting Theory - W3 - Group1Document5 pagesAccounting Theory - W3 - Group1animecrushNo ratings yet

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- Day Trading: A Comprehensive Guide to Making Money with Day TradingFrom EverandDay Trading: A Comprehensive Guide to Making Money with Day TradingNo ratings yet

- Index Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSFrom EverandIndex Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSRating: 5 out of 5 stars5/5 (43)

- Stock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationFrom EverandStock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationNo ratings yet

- Swing Trading: A Beginner's Guide to Highly Profitable Swing Trades - Proven Strategies, Trading Tools, Rules, and Money ManagementFrom EverandSwing Trading: A Beginner's Guide to Highly Profitable Swing Trades - Proven Strategies, Trading Tools, Rules, and Money ManagementRating: 3.5 out of 5 stars3.5/5 (2)

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersFrom EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNo ratings yet

- JOSEDocument5 pagesJOSEWillhem PhillyNo ratings yet

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsFrom EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsRating: 1 out of 5 stars1/5 (1)

- FM 325 Lesson 3Document7 pagesFM 325 Lesson 3Nineth Mariz BintadNo ratings yet

- Stock Market Investing for Beginners: How to Build Wealth and Achieve Financial Freedom with a Diversified Portfolio Using Index Funds, Technical Analysis, Options, Penny Stocks, Dividends, and REITS.From EverandStock Market Investing for Beginners: How to Build Wealth and Achieve Financial Freedom with a Diversified Portfolio Using Index Funds, Technical Analysis, Options, Penny Stocks, Dividends, and REITS.Rating: 5 out of 5 stars5/5 (54)

- Module IIIDocument30 pagesModule IIIabhishek guptaNo ratings yet

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeFrom EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeNo ratings yet

- Bill MillerDocument6 pagesBill Millerfrans leonard100% (1)

- Swing Trading: Simplified - The Fundamentals, Psychology, Trading Tools, Risk Control, Money Management, And Proven Strategies: Stock Market Investing for Beginners Book, #2From EverandSwing Trading: Simplified - The Fundamentals, Psychology, Trading Tools, Risk Control, Money Management, And Proven Strategies: Stock Market Investing for Beginners Book, #2Rating: 4.5 out of 5 stars4.5/5 (2)

- Stock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayFrom EverandStock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayNo ratings yet

- Day Trading Kills: A Must-Read for ANYONE Considering Day Trading Forex, Futures, Stocks, Options, and CryptocurrenciesFrom EverandDay Trading Kills: A Must-Read for ANYONE Considering Day Trading Forex, Futures, Stocks, Options, and CryptocurrenciesRating: 5 out of 5 stars5/5 (1)

- All That Glitters: The Effect of Attention and News On The Buying Behavior of Individual and Institutional InvestorsDocument47 pagesAll That Glitters: The Effect of Attention and News On The Buying Behavior of Individual and Institutional InvestorsSpencer MainsNo ratings yet

- Summary of Freeman Publications's The 8-Step Beginner’s Guide to Value InvestingFrom EverandSummary of Freeman Publications's The 8-Step Beginner’s Guide to Value InvestingNo ratings yet

- Summary of Howard Marks, Paul Johnson & Bruce Greenwald's The Most Important Thing IlluminatedFrom EverandSummary of Howard Marks, Paul Johnson & Bruce Greenwald's The Most Important Thing IlluminatedNo ratings yet

- Day Trading the Ultimate Guide the Best Beginner’s Guide to Learn How to Use the Best Money Management Tools and Advanced Techniques to Make Money on 2022: WARREN MEYERS, #4From EverandDay Trading the Ultimate Guide the Best Beginner’s Guide to Learn How to Use the Best Money Management Tools and Advanced Techniques to Make Money on 2022: WARREN MEYERS, #4No ratings yet

- Stock Market Simplified: A Beginner's Guide to Investing Stocks, Growing Your Money and Securing Your Financial Future: Personal Finance and Stock Investment StrategiesFrom EverandStock Market Simplified: A Beginner's Guide to Investing Stocks, Growing Your Money and Securing Your Financial Future: Personal Finance and Stock Investment StrategiesRating: 5 out of 5 stars5/5 (1)

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Export ChatDocument3 pagesExport ChatENOCH ACQUAH BAIDENNo ratings yet

- Behavioral Finance Topic 6Document16 pagesBehavioral Finance Topic 6Tolfu FutolNo ratings yet

- Financial Market TradingDocument20 pagesFinancial Market TradingSheila Mae BenedictoNo ratings yet

- Business SolutionDocument7 pagesBusiness SolutionYogesh PanwarNo ratings yet

- Day Trading for Beginners: Proven Strategies to Succeed and Create Passive Income in the Stock Market - Introduction to Forex Swing Trading, Options, Futures & ETFs: Stock Market Investing for Beginners Book, #3From EverandDay Trading for Beginners: Proven Strategies to Succeed and Create Passive Income in the Stock Market - Introduction to Forex Swing Trading, Options, Futures & ETFs: Stock Market Investing for Beginners Book, #3No ratings yet

- Day Trading: The Complete Day Trading Success Guide - How To Day Trade For Consistent Profits DailyFrom EverandDay Trading: The Complete Day Trading Success Guide - How To Day Trade For Consistent Profits DailyNo ratings yet

- Stock Market: InvestmentDocument3 pagesStock Market: InvestmentJHON DERIC BATANGNo ratings yet

- Efficient Market Hypothesis and Stock Market TermsDocument3 pagesEfficient Market Hypothesis and Stock Market TermsJen RicafortNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- Chapter 13 Market EfficiencyDocument2 pagesChapter 13 Market EfficiencySajib KarNo ratings yet

- Trading Strategy: The Algorithmic Strategies for Investing in Stocks Like a Genius; Understanding the Trade Forecasting System of the Stock MarketFrom EverandTrading Strategy: The Algorithmic Strategies for Investing in Stocks Like a Genius; Understanding the Trade Forecasting System of the Stock MarketRating: 4.5 out of 5 stars4.5/5 (50)

- Index Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortFrom EverandIndex Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortRating: 5 out of 5 stars5/5 (38)

- Dividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementFrom EverandDividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementNo ratings yet

- Options Trading: Take Your Trading to the Next Level With Winning Strategies and Precise Technical Analysis Used by Top Traders to Beat the Odds and Achieve Consistent Profits in the Options Market.From EverandOptions Trading: Take Your Trading to the Next Level With Winning Strategies and Precise Technical Analysis Used by Top Traders to Beat the Odds and Achieve Consistent Profits in the Options Market.Rating: 5 out of 5 stars5/5 (26)

- BSEC (Public Issue) Rules, 2015 (31.12.2015) - Published in The GazetteDocument53 pagesBSEC (Public Issue) Rules, 2015 (31.12.2015) - Published in The GazetteAsif Abdullah KhanNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- On Market Regulation and PresentationDocument56 pagesOn Market Regulation and PresentationAsif Abdullah KhanNo ratings yet

- Bangladesh Securities Commission Rules 2015 PresentationDocument51 pagesBangladesh Securities Commission Rules 2015 PresentationAsif Abdullah KhanNo ratings yet

- Bangladesh Securities Commission Rules 2015 PresentationDocument51 pagesBangladesh Securities Commission Rules 2015 PresentationAsif Abdullah KhanNo ratings yet

- What is a make-whole call provisionDocument1 pageWhat is a make-whole call provisionAsif Abdullah KhanNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- SEC Rules on Rights IssuesDocument22 pagesSEC Rules on Rights IssuesAsif Abdullah KhanNo ratings yet

- Calculate Current Yield for Bonds Given Price and Coupon RateDocument14 pagesCalculate Current Yield for Bonds Given Price and Coupon RateAsif Abdullah KhanNo ratings yet

- Company Analysis and ValuationDocument13 pagesCompany Analysis and ValuationAsif Abdullah KhanNo ratings yet

- CH 4Document22 pagesCH 4Asif Abdullah KhanNo ratings yet

- Fixed-Income SecuritiesDocument15 pagesFixed-Income SecuritiesAsif Abdullah KhanNo ratings yet

- FIS NoteDocument34 pagesFIS NoteAsif Abdullah KhanNo ratings yet

- FIS 1st Mid NoteDocument28 pagesFIS 1st Mid NoteAsif Abdullah KhanNo ratings yet

- Capital Investment Decision - DUDocument50 pagesCapital Investment Decision - DUAsif Abdullah KhanNo ratings yet

- Project AnalysisDocument28 pagesProject AnalysisShayakh Ahmed RezoanNo ratings yet

- Chapter 18Document25 pagesChapter 18fyoonNo ratings yet

- Golden Harvest Agro Industries Limited: A Brief Financial AnalysisDocument33 pagesGolden Harvest Agro Industries Limited: A Brief Financial AnalysisAsif Abdullah KhanNo ratings yet

- Chapter 6: Making Capital Investment Decisions: Corporate FinanceDocument36 pagesChapter 6: Making Capital Investment Decisions: Corporate FinanceAsif Abdullah KhanNo ratings yet

- Statistical Breakdown On Odi Career of Shakib Al Hasan and Angelo MathewsDocument24 pagesStatistical Breakdown On Odi Career of Shakib Al Hasan and Angelo MathewsAsif Abdullah KhanNo ratings yet

- Anti-Dumping Investigation: Prepared ForDocument30 pagesAnti-Dumping Investigation: Prepared ForAsif Abdullah KhanNo ratings yet

- Pharmaceutical Industry of Bangladesh: An Overview of the Multi-Billion Dollar IndustryDocument44 pagesPharmaceutical Industry of Bangladesh: An Overview of the Multi-Billion Dollar IndustryTanzir HasanNo ratings yet

- Anti-Dumping Investigation: Prepared ForDocument30 pagesAnti-Dumping Investigation: Prepared ForAsif Abdullah KhanNo ratings yet

- Golden Harvest Agro Industries Limited: A Brief Financial AnalysisDocument31 pagesGolden Harvest Agro Industries Limited: A Brief Financial AnalysisAsif Abdullah KhanNo ratings yet

- Business Letter About MeetingDocument1 pageBusiness Letter About MeetingCharuNo ratings yet

- Statistical Breakdown On Odi Career of Shakib Al Hasan and Angelo MathewsDocument24 pagesStatistical Breakdown On Odi Career of Shakib Al Hasan and Angelo MathewsAsif Abdullah KhanNo ratings yet

- Business Letter About ShipmentDocument1 pageBusiness Letter About ShipmentAsif Abdullah KhanNo ratings yet

- Business Letter About Dissolving PartnershipDocument1 pageBusiness Letter About Dissolving Partnershipnet6351No ratings yet

- Business Letter About Dissolving PartnershipDocument1 pageBusiness Letter About Dissolving Partnershipnet6351No ratings yet