Professional Documents

Culture Documents

Accounting Adjustments and Financial Statements

Uploaded by

JunkoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Adjustments and Financial Statements

Uploaded by

JunkoCopyright:

Available Formats

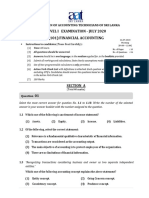

01

Institute :.................................................................. Index No :......................................................

PART 01

01. Which of the following statements given the best definition of the objective of accounting?

(1) To provide useful information to users in making economic decision

(2) To record, categories and summaries financial transactions

(3) To calculate the taxation due to the government

(4) To calculate the amount of dividend to pay to the shareholders

(5) To ensure the safeguard of the business assets (……….)

02. Profits of a business may be calculated by using which one of the following formulas?

(1) Opening capital – Drawings + Capital introduced – Closing capital

(2) Opening capital + Drawings – Capital introduced – Closing capital

(3) Closing capital + Drawings – Capital introduced – opening capital

(4) Closing capital – Drawings + Capital introduced – Opening capital

(5) None of the above (……….)

03. Nimal bought goods from Saman for which the payment was made within two weeks by issuing a

cheque. However, Nimal found that some of the items were defective and returned them to Saman.

The relevant source document respectively to record the transactions in Nimal’s prime entry books

are.

(1) Payment Voucher, Cheque counter foil, Credit note

(2) Invoice, Payment voucher, Credit note

(3) Invoice, cash receipt, Credit note

(4) Invoice, Payment voucher, Debit note

(5) Invoice, Payment voucher, Credit note (……….)

04. Bank statement of Mami Ltd. Shown a debit balance of Rs. 718 500 as at 31 March 2022. The

following additional information is also available for your consideration

• Unpresented cheques as at 31 March 2022 Rs. 595 600.

• Bank charges of Rs. 18 130 and overdraft interest of Rs. 55 000 have not been recorded in the

cash control account.

• A cheque payment amounting to Rs. 108 000 had been recorded twice in the cash control

account.

• Unrealized deposits as at 31 March 2022 Rs. 180 000.

• Bank statement contains Rs. 50 000 worth of cheque which has been issued by other current

account holder.

Pasindu Wijerama EAccounting

nglish Medium

1

What is the amount of bank overdraft that should be shown in the Statement of financial position

as at 31 March 2022, after making the relevant adjustments stated above?

(1) 1,048,100 (2) 1,084,100 (3) 1,184,100

(4) 1,148,100 (5) None of the above (……….)

05. A business has changed its inventory valuation policy two times within last two financial years. This

change violates?

(1) Prudence concept (2) Materiality concept (3) Consistency concept

(4) Separate entity concept (5) Fully discourser concept (……….)

06. Which of the following statement is false relating to sales ledger control account?

(1) Total of the VAT column in the sales journal is debited to sales ledger control account

(2) Provision for expected losses on trade receivable will be credited to sales ledger control

account.

(3) Sales ledger control account is maintained in the general ledger.

(4) Sales ledger control account is mostly updated on monthly basis.

(5) Sales ledger control account may have both debit & credit balances. (……….)

07. Name four (04) output of management accounting.

(1) ………………......................................................................…………………….

(2) ………………......................................................................…………………….

(3) ………………......................................................................…………………….

(4) ………………......................................................................…………………….

08. State the source documents for the following transactions.

Transactions Source Document

(1) Return inwards

(2) Depreciations

(3) Direct deposits by debtors

(4) Cash receipts by petty cashier

09. Would each of the following errors require a use of suspense account to correct. Tick the

appropriate box.

Transaction Suspense No suspense

Account Account

1. The total of the sales book Rs. 25 600 has

been credited to the sales account as 26 500

2. Motor vehicle repair expenses of Rs 15,000, has

been debited to the motor vehicle account

3. Balance of the sales return account Rs 96,000

has not been taken in to the trial balance

4. Total of the discount column in the receipt

journal has been overstated by Rs 2,000

Pasindu Wijerama EAccounting

nglish Medium

2

10. Balance of the trade receivable control account as at 31. 03. 2022 was Rs. 640 000, which was

not agreed to ledger listing balance. Subsequent investigate identify the following errors.

(1) Total of the sales journal was overstated by Rs. 60 000.

(2) Credit note of Rs. 10 000 has been completely omitted from the books of accounts.

(3) A debtor balance of Rs. 20 000 has been omitted from ledger listing.

(4) Interest charged on debtors Rs 15,000 has been updated only in the general ledger

You are required to calculate.

(1) Amended trade receivable control account balance as at 31. 03. 2022

........................................................................................................................................................

(2) Debtors ledger listing balance as at 31. 03. 2022

........................................................................................................................................................

PART 02

Question 01

Lanka Coconut Ltd. Which has been in business since 1990 manufactures and distributes coconuts-based

production. Given below is the trading and profit and losses Account for the period ended March 31, 2023

prepared by a trainee accounts assistant.

Required

You are required to prepare Comprehensive income statement for the year ended 31.03.2023, as per

LKAS 01 (20 Marks)

Pasindu Wijerama EAccounting

nglish Medium

3

Question 02

(a) Prepare journal entries to correct the following errors. (Narrations are required)

(1) Even though a credit sales amounting to Rs. 123,560 had been correctly recorded in the Trade

receivable control account, the sales account had been credited as Rs. 132,560.

(2) Nothing had been recorded relating to the purchase of office furniture amounting to

Rs. 65,000, otherthan recording the cash paid in the cash control account.

(3) A discount received amounting to Rs. 2,860 had been accurately recorded in the Trade payable

control account; however, it has been credited to the discount allowed account.

(4) Motor vehicle repair expense of Rs. 40,000 has been debited to motor vehicle account

(5) Electricity bill received for the month Rs. 32 000 has not been accounted. (05 Marks)

(b) The cash account of Melwin’s Trading Company on 31/01/2022 showed an overdrawn balance of

Rs. 130 700 while the bank statement showed an overdrawn balance of Rs. 91,100.

Comparison of receipt and payment journal entries with entries of the bank statement has revealed

the following:

(i) Bank charges of Rs. 350 was not taken into the business books of Accounts

(ii) A cheque deposit of Rs. 132 100 made on 27/01/2022 was not realized as at 31/01/2021.

(iii) A cheque payment of Rs. 4,271 during the month was erroneously recorded in the receipt

journal

(iv) A standing order payment of Rs. 37 500 being owner’s insurance premium, was not taken into

the cash control account

(v) A cheque to the value of Rs. 132 142 issued during the month had not been presented for

payment up to 31/01/2022.

(vi) A direct deposit of Rs. 85 950 made in the bank by a customer was not taken into the receipt

journal

Required prepare

(a) Amended Cash Control Account as at 31.01.2022 (5 Marks)

(b) Bank Reconciliation Statement as at 31.01.2022

Question 03

Following information relates to a Tile manufactories firm “Siyana” for the year ending 31/03/2023

Rs.

Material Purchase 90 250

Material Purchase return 1 000

Direct Factory Salaries 30 200

Machinery Depreciation 4 000

Factory Electricity 4 000

Factory Sunday expenses 3 000

Payment made to patent holder 5 250

Salaries - Administration & Supervision 12 000

Sales 137 500

Pasindu Wijerama EAccounting

nglish Medium

4

Additional information

(1) Closing Stock of the business, consist with followings

2022/04/01 2023/03/31

Material 3,900 4,850

Work in Progress 550 800

Finished Goods 10,000 ?

(2) 2/3 of the Administration & Supervision Salaries is related to production division.

(3) Finished goods inventory as at 01/04/2022 included 4 000 tiles

(These have been sold during the year)

Total no. of tiles produced during the year and sold during the year was respectively 47 500 and 42 500.

Required:

(1) Prepare the manufacturing account for the year ending 31/03/2023

(2) Calculate the cost of a tile

(3) Calculate the value of the closing finish goods inventory

(4) Calculate the gross profit for the year ending 31/03/2023 (10 Marks)

Pasindu Wijerama EAccounting

nglish Medium

5

You might also like

- 3957CL 2. Accounting MA2021Document3 pages3957CL 2. Accounting MA2021Md SiamNo ratings yet

- Accounting Title for Document on Financial Accounting ExamDocument10 pagesAccounting Title for Document on Financial Accounting ExamjamespotheadNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument22 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDEEPAK ATALNo ratings yet

- 64713bos51933 FND p1Document22 pages64713bos51933 FND p1un627331No ratings yet

- CT 2 BRS & Control Accounts 1Document6 pagesCT 2 BRS & Control Accounts 1sangeeta.jumaniNo ratings yet

- Fall 2009 Past PaperDocument4 pagesFall 2009 Past PaperKhizra AliNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- Accounting for Sole ProprietorshipsDocument23 pagesAccounting for Sole ProprietorshipsjamespotheadNo ratings yet

- AA11 FAB en July 2015 PDFDocument10 pagesAA11 FAB en July 2015 PDFNoel Cuthbert MushiNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- NJHZ Ilkhdhw NTSPF Fs Epiyak Elhj JK : Conducted by Field Work Centre, ThondaimanaruDocument12 pagesNJHZ Ilkhdhw NTSPF Fs Epiyak Elhj JK : Conducted by Field Work Centre, ThondaimanaruSharomyNo ratings yet

- Answer The Following Questions: (1×5)Document4 pagesAnswer The Following Questions: (1×5)Zikrur RahmanNo ratings yet

- Intermediate Accounting 1 Receivables DIY ProblemsDocument11 pagesIntermediate Accounting 1 Receivables DIY ProblemsMay Ramos100% (1)

- Foundation Accounts Suggested Jan21Document22 pagesFoundation Accounts Suggested Jan21Himanshu RayNo ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- ACCOUNTANCY XI SAMPLE PAPERDocument13 pagesACCOUNTANCY XI SAMPLE PAPERpriyaNo ratings yet

- Asignacioìn 1 AISDocument5 pagesAsignacioìn 1 AISElia SantanaNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Abfa1164 Pyq0522Document7 pagesAbfa1164 Pyq05220130 CrystalaquariusNo ratings yet

- Control Accounts SummaryDocument19 pagesControl Accounts SummaryDi-Shanae BurnettNo ratings yet

- Paper 03Document8 pagesPaper 03sathini sanvidithaNo ratings yet

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- The Direct and Indirect Taxes Applic: Bank Reconciliation Statement Problems and SolutionsDocument8 pagesThe Direct and Indirect Taxes Applic: Bank Reconciliation Statement Problems and SolutionskoshkoshaNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- EV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20Document13 pagesEV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20minita sharmaNo ratings yet

- ACCA F3 Control Accounts and Incomplete Records Questions2Document6 pagesACCA F3 Control Accounts and Incomplete Records Questions2Amos OkechNo ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Must DoDocument27 pagesMust DoKuldeep SharmaNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- P5 Syl2012 InterDocument27 pagesP5 Syl2012 InterViswanathan SrkNo ratings yet

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocument3 pagesAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediNo ratings yet

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Multiple Choice QuestionsDocument8 pagesMultiple Choice QuestionsPrashant Sagar Gautam100% (1)

- Class No 1 - Chapter 6Document23 pagesClass No 1 - Chapter 6ApuNo ratings yet

- Igcse Accounting Control Accounts - Questions AnswersDocument24 pagesIgcse Accounting Control Accounts - Questions AnswersOmar WaheedNo ratings yet

- Igcse Accounting Control Accounts Questions OnlyDocument18 pagesIgcse Accounting Control Accounts Questions OnlyDonnaNo ratings yet

- Igcse Accounting Control Accounts Practice QuestionsDocument18 pagesIgcse Accounting Control Accounts Practice QuestionsSiddarthNo ratings yet

- IGCSE Control AccountsDocument17 pagesIGCSE Control AccountsNipuni PereraNo ratings yet

- Ev 2Document9 pagesEv 2minita sharmaNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Accountancy: Class: XiDocument8 pagesAccountancy: Class: XiSanskarNo ratings yet

- 11th Accounts Mock Paper-1Document2 pages11th Accounts Mock Paper-1Aliasgar ZaverNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- 54103bos43406 p1Document31 pages54103bos43406 p1Aman GuptaNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- BS Logos & IndiciesDocument11 pagesBS Logos & IndiciesJunkoNo ratings yet

- The EagleDocument4 pagesThe EagleJunkoNo ratings yet

- 2022 (2023) AL - General English (I Part Answers)Document6 pages2022 (2023) AL - General English (I Part Answers)JunkoNo ratings yet

- Ict Predicted Paper Structure 2022 AlDocument6 pagesIct Predicted Paper Structure 2022 AlJunkoNo ratings yet

- A Bird Came Down The WalkDocument4 pagesA Bird Came Down The WalkJunkoNo ratings yet

- Accounting Adjustments and Financial StatementsDocument5 pagesAccounting Adjustments and Financial StatementsJunkoNo ratings yet

- Deed of Donation: Legal Form No. 14Document3 pagesDeed of Donation: Legal Form No. 14Laurie Carr LandichoNo ratings yet

- MpuDocument4 pagesMpuLawrence LingNo ratings yet

- Ehs6 Ehs8 Startup Guide v02Document19 pagesEhs6 Ehs8 Startup Guide v02nicolás_lorréNo ratings yet

- Ls - Confidentiality and Nondisclosure Agreement For ClientsDocument2 pagesLs - Confidentiality and Nondisclosure Agreement For ClientsHeinz MilitarNo ratings yet

- WHD20162022a Pérez Vs Puerto Rico Police Department DemandaDocument8 pagesWHD20162022a Pérez Vs Puerto Rico Police Department DemandaEmily RamosNo ratings yet

- CIR vs San Roque Power Corp., 690 SCRA 336: CTA upholds claim for VAT refundDocument84 pagesCIR vs San Roque Power Corp., 690 SCRA 336: CTA upholds claim for VAT refundRonnie Garcia Del RosarioNo ratings yet

- Introduction To Labor RelationsDocument16 pagesIntroduction To Labor RelationsA&D Forever (Ashraf Hasan)No ratings yet

- Conspiracy Theories: Secrecy and Power in American Culture. by Mark Fenster. MinDocument4 pagesConspiracy Theories: Secrecy and Power in American Culture. by Mark Fenster. MinMano RatyiNo ratings yet

- Quarter 1 - Module 6: Applied EconomicsDocument8 pagesQuarter 1 - Module 6: Applied EconomicsYannah LongalongNo ratings yet

- Report TechnopreneurshipDocument20 pagesReport TechnopreneurshipMabz Buan100% (1)

- Deloitte Title VII ViolationsDocument71 pagesDeloitte Title VII ViolationsDeloitte LawsuitNo ratings yet

- Kalahi-Cidss Additional Financing Briefer: Project Component 1: Capacity Building and Implementation Support. Under ThisDocument4 pagesKalahi-Cidss Additional Financing Briefer: Project Component 1: Capacity Building and Implementation Support. Under ThisNolan GaraNo ratings yet

- Nixon v Fitzgerald 1982 Supreme Court dissent favors qualified immunityDocument2 pagesNixon v Fitzgerald 1982 Supreme Court dissent favors qualified immunityNamu BwakaNo ratings yet

- SC upholds hierarchy of courts in dismissing directly filed certiorari petitionDocument277 pagesSC upholds hierarchy of courts in dismissing directly filed certiorari petitionKris NageraNo ratings yet

- 1.canon Kabushiki Kaisha v. CA DigestDocument2 pages1.canon Kabushiki Kaisha v. CA Digestclandestine2684100% (1)

- Summary of The Competition Commission of India Order No. 022023 Dt. 190723Document2 pagesSummary of The Competition Commission of India Order No. 022023 Dt. 190723Siddheesh YadavNo ratings yet

- Fuel Injector Reference For 3500Document9 pagesFuel Injector Reference For 3500ingcalderonNo ratings yet

- For Land & JusticeDocument23 pagesFor Land & JusticeUMAPilipinasNo ratings yet

- Gmail - FW - Separation For Kuppili, ShashiDocument1 pageGmail - FW - Separation For Kuppili, Shashishashi kiranNo ratings yet

- Rule 108 Presentation RevisedDocument35 pagesRule 108 Presentation RevisedGillian Alexis ColegadoNo ratings yet

- Assignment On InsuranceDocument10 pagesAssignment On InsuranceMD.Thariqul Islam 1411347630No ratings yet

- Diocese of Bacolod v. COMELEC, G.R. No. 205728, January 21, 2015Document34 pagesDiocese of Bacolod v. COMELEC, G.R. No. 205728, January 21, 2015Alan Vincent FontanosaNo ratings yet

- Aerosus TrainingDocument101 pagesAerosus TrainingMladen RadojevicNo ratings yet

- 30 Ways Drunk DrivingDocument1 page30 Ways Drunk DrivingMaunish UpadhyayNo ratings yet

- Ligot Vs RepublicDocument5 pagesLigot Vs RepublicPaolo MendioroNo ratings yet

- و البترولDocument50 pagesو البترولnimmodragomelo123No ratings yet

- Banna Leisure Limited financial analysisDocument2 pagesBanna Leisure Limited financial analysisravinyseNo ratings yet

- Accounting Paper For First Year O LevelDocument6 pagesAccounting Paper For First Year O LevelhbuzdarNo ratings yet

- 4th Year RecitationDocument3 pages4th Year RecitationEmmanuel BuanNo ratings yet

- International Relations Theories ExplainedDocument13 pagesInternational Relations Theories ExplainedRashmi100% (1)