Professional Documents

Culture Documents

Lowering Mi Cost Plan Fact Sheet Lower MI Costs

Uploaded by

Elizabeth WashingtonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lowering Mi Cost Plan Fact Sheet Lower MI Costs

Uploaded by

Elizabeth WashingtonCopyright:

Available Formats

GOVERNOR WHITMER'S PLAN TO

LOWER MI COSTS

THE CHALLENGE

Michiganders are feeling the pinch right now. They’re seeing rising costs on gas, groceries, and other

essentials. We must lower costs and put money back in people’s pockets so they can pay the bills and put

food on the table.

THE PLAN

Governor Whitmer’s Lowering MI Costs plan would repeal the retirement tax, boost the Working Families

Tax Credit, and deliver pre-K for all so every kid gets a great start. Repealing the retirement tax would save

500,000 households an average of $1,000 a year. That’s money for prescriptions, groceries, gas, or gifts for

grandkids. Boosting the Working Families Tax Credit would deliver a combined refund of at least $3,000 to

700,000 working families. This increase will directly benefit almost 1 million kids—45% of the kids in

Michigan. Delivering pre-K for all would save families $10,000 a year. It will put all 110,00 4-year-olds in

Michigan on a path to a brighter future while helping their parents go back to work knowing their kids are

safe and cared for. Together, these proposals will save millions of Michiganders thousands of dollars and

help us fight inflation head-on.

THE STORIES

THE PLAN

KIMBERLY FROM TRAVERSE CITY

Kimberly, a former teacher, and her husband, a retired UAW member, retired right as this bill was signed

into law. Like many of our families, they didn’t plan for an extra tax in their retirement and are now

scrambling to make sure they have enough. It’s long past time to do something about this and to support

our seniors in Michigan.

MICHIGANDER'S STORIES

MORIAH AND JESSE FROM GRAND HAVEN

Moriah and Jesse are both working full time with a 1st grader at home. With all the price increases we’ve

seen over the last couple of years, it can be a battle to make ends meet, especially when factoring in child

care costs. This year alone, their daughter’s daycare increased prices by $15 per day, which adds up fast.

Families that work this hard deserve a break, not bank-breaking costs. Boosting the Working Families Tax

Credit will benefit working Michiganders like Moriah and Jesse.

JENNI FROM YALE

Jenni is a preschool teacher in a tuition-based room in Yale. Each semester, she watches parents struggle to

afford the tuition at her school. Jenni recognizes that each student deserves to start their educational

journey on a good foot, and that means quality education before kindergarten. Pre-K for all would mean the

parents at Jenni’s school and across our state can rest easy with fewer financial burdens, while their children

get an extra boost in their education. Michigan’s children deserve to be set up for success from day one.

You might also like

- Fitness Action Recognition Based On MediapipeDocument8 pagesFitness Action Recognition Based On MediapipeBouhafs AbdelkaderNo ratings yet

- Richard OkkkDocument69 pagesRichard OkkkTUYISUNGE EmmanuelNo ratings yet

- The Effectiveness of Social MediaDocument14 pagesThe Effectiveness of Social MediaAdiNo ratings yet

- Indonesia - Jakarta - Industrial Warehouse 2Q21Document2 pagesIndonesia - Jakarta - Industrial Warehouse 2Q21Adina R.No ratings yet

- Biostar A520mh SpecDocument5 pagesBiostar A520mh SpecdadaNo ratings yet

- AC2100 (Plus) - Eng Guide - 1.00 - 20161201Document78 pagesAC2100 (Plus) - Eng Guide - 1.00 - 20161201AhmedamerNo ratings yet

- Ecopolitan's Minneapolis Raw Food Restaurant MenuDocument6 pagesEcopolitan's Minneapolis Raw Food Restaurant MenuEcopolitan - your Eco-Health NetworkNo ratings yet

- Needham Bank - A BYOD Case StudyDocument8 pagesNeedham Bank - A BYOD Case StudyMitzi SantosNo ratings yet

- Tanya CDPDocument29 pagesTanya CDPPankaj MahantaNo ratings yet

- MVAA 2021 Annual Report: Lean On UsDocument20 pagesMVAA 2021 Annual Report: Lean On UsDevon Louise KesslerNo ratings yet

- ZeptoDocument31 pagesZeptoSAJAL SRIVASTAVANo ratings yet

- MAML THC Statement 8-22Document3 pagesMAML THC Statement 8-22FluenceMediaNo ratings yet

- CatiaV5 Healing AssistantDocument52 pagesCatiaV5 Healing AssistantMohamed MerinissiNo ratings yet

- Resilience in Heritage Conservation and Heritage Tourism A Dissertation by ... (Pdfdrive)Document217 pagesResilience in Heritage Conservation and Heritage Tourism A Dissertation by ... (Pdfdrive)ristya arintaNo ratings yet

- MBA Project Report: Business Development Opportunities For IDBI Bank Ltd.,Dhamnod BranchDocument29 pagesMBA Project Report: Business Development Opportunities For IDBI Bank Ltd.,Dhamnod BranchVedang Patidar100% (1)

- Growth of Corporate FarmingDocument22 pagesGrowth of Corporate FarmingNiraj PatilNo ratings yet

- JD Logistics H1 2022 ResultsDocument38 pagesJD Logistics H1 2022 ResultsKit WooNo ratings yet

- OD126164812918973000Document1 pageOD126164812918973000Manoj SirsatNo ratings yet

- Analysis and Evaluation of Article "The Tale of Two Teams"Document16 pagesAnalysis and Evaluation of Article "The Tale of Two Teams"Maida AvdicNo ratings yet

- Aegis Ar 2018-19 (Final)Document194 pagesAegis Ar 2018-19 (Final)Jatin SankarNo ratings yet

- In A Frictionless Incompressible Flow The Veloci...Document1 pageIn A Frictionless Incompressible Flow The Veloci...Mergen KhanNo ratings yet

- Thematic Session - AgricultureDocument39 pagesThematic Session - AgricultureHavi JoshiNo ratings yet

- Moxa Nport W2150a W2250a Series Manual v10.2Document142 pagesMoxa Nport W2150a W2250a Series Manual v10.2gfdgfNo ratings yet

- Bond Overview 1 PDFDocument6 pagesBond Overview 1 PDFAkash SinghNo ratings yet

- Iwa Final DraftDocument10 pagesIwa Final Draftapi-606231768No ratings yet

- BU620 - Final Exam Case 1 and Case 2Document13 pagesBU620 - Final Exam Case 1 and Case 2Sigma SCSNo ratings yet

- First Announcement COE - 70 - MedanDocument23 pagesFirst Announcement COE - 70 - MedanHeru HermantrieNo ratings yet

- 5 6100332991869879402Document487 pages5 6100332991869879402abhinav agrawalNo ratings yet

- st4 l2 26aug PDFDocument24 pagesst4 l2 26aug PDFsankarcsharpNo ratings yet

- MetLife Bangladesh Recruitment and Selection ReportDocument23 pagesMetLife Bangladesh Recruitment and Selection Reportfahim shahriyarNo ratings yet

- PS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyDocument1 pagePS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyJhansi RokatiNo ratings yet

- Niall - Chiang Festival-1Document12 pagesNiall - Chiang Festival-1api-538408600No ratings yet

- GST Supply Incidence and Taxable EventsDocument56 pagesGST Supply Incidence and Taxable EventsniveditaNo ratings yet

- Bosch Sensortec Product OverviewDocument16 pagesBosch Sensortec Product OverviewAmador Garcia III100% (1)

- MD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDocument602 pagesMD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDonNo ratings yet

- ARK-Pearl Residency BrochureDocument4 pagesARK-Pearl Residency BrochureRaja SheikNo ratings yet

- Moody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableDocument4 pagesMoody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableChris SwamNo ratings yet

- Resilience360 Annual Risk Report 2018Document45 pagesResilience360 Annual Risk Report 2018M QasimNo ratings yet

- Managing Stress Through SportsDocument24 pagesManaging Stress Through Sportsanthony jizzNo ratings yet

- ARD Pool DrowningsDocument6 pagesARD Pool DrowningsJoe TrustyNo ratings yet

- Orca Share Media1672898478819 7016644781308336021Document4 pagesOrca Share Media1672898478819 7016644781308336021Vanessa Karikitan EstorNo ratings yet

- Affiliated To Dr. A.P.J Abdul Kalam Technical University, LucknowDocument11 pagesAffiliated To Dr. A.P.J Abdul Kalam Technical University, LucknowHimanshu DarganNo ratings yet

- 424 PDFDocument24 pages424 PDFSakshi JagdaleNo ratings yet

- Truong-Quoc-Khang BM01 209011039Document11 pagesTruong-Quoc-Khang BM01 209011039David YungNo ratings yet

- Satyendra TiwariDocument4 pagesSatyendra Tiwarihr mancomNo ratings yet

- Mil Amelia Reyes Module1-30Document25 pagesMil Amelia Reyes Module1-30Gab ReyesNo ratings yet

- L21 - Grey Shades of Sugar Policies in IndiaDocument9 pagesL21 - Grey Shades of Sugar Policies in IndiaYATHARTH AGARWALNo ratings yet

- Mental Health First Aid Training Information Flyer FinalDocument1 pageMental Health First Aid Training Information Flyer FinalT RNo ratings yet

- UntitledDocument3 pagesUntitledK A R A N M A L H O T R ANo ratings yet

- CFC - Inclusive Econ ReportDocument71 pagesCFC - Inclusive Econ ReportKelly KenoyerNo ratings yet

- Firm Culture and Leadership as Predictors of Firm PerformanceDocument6 pagesFirm Culture and Leadership as Predictors of Firm Performancechernet kebedeNo ratings yet

- Big Basket PPT 8.19Document1 pageBig Basket PPT 8.19RekhaNo ratings yet

- PDF Srs Zomato CompressDocument6 pagesPDF Srs Zomato CompressiggiguhouhNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- ESCAP RP 2021 Achieving SDGs South AsiaDocument168 pagesESCAP RP 2021 Achieving SDGs South AsiapalomiNo ratings yet

- Date: 11 March 2021 MR Rahul Sharma Rze2 Mahavi Enclave New Delhi New Delhi 110045 Delhi Policy No.: 16811926 Mobile No.: Xxxxxx3693Document6 pagesDate: 11 March 2021 MR Rahul Sharma Rze2 Mahavi Enclave New Delhi New Delhi 110045 Delhi Policy No.: 16811926 Mobile No.: Xxxxxx3693Rahul SharmaNo ratings yet

- Employment Newspaper Third Week of July 2019 PDFDocument40 pagesEmployment Newspaper Third Week of July 2019 PDFrajneeshmmmecNo ratings yet

- Princy Thomas Singh - Compliance Case Specialist - RemoteDocument3 pagesPrincy Thomas Singh - Compliance Case Specialist - RemoteSAURABH1004No ratings yet

- V-Doped NiFeDocument9 pagesV-Doped NiFeCB Dong SuwonNo ratings yet

- Gov. Tim Walz Kids and Families Budget ProposalDocument10 pagesGov. Tim Walz Kids and Families Budget ProposalPatch MinnesotaNo ratings yet

- 2020-2025 DGA Healthcare Professionals Presentation Children, AdolescentsDocument21 pages2020-2025 DGA Healthcare Professionals Presentation Children, AdolescentsElizabeth WashingtonNo ratings yet

- Motion For A Preliminary Injunction Pro-VDocument31 pagesMotion For A Preliminary Injunction Pro-VElizabeth WashingtonNo ratings yet

- Lawsuit Against Dearborn Heights Landlord Who Sexually Harassed Several Women Looking For Rental HomesDocument9 pagesLawsuit Against Dearborn Heights Landlord Who Sexually Harassed Several Women Looking For Rental HomesElizabeth WashingtonNo ratings yet

- Porcupine Mountains Wilderness State ParkDocument1 pagePorcupine Mountains Wilderness State ParkElizabeth WashingtonNo ratings yet

- Michigan House Bill No. 4328Document13 pagesMichigan House Bill No. 4328Elizabeth WashingtonNo ratings yet

- Turkey Tracts Info SheetDocument1 pageTurkey Tracts Info SheetElizabeth WashingtonNo ratings yet

- House Bill No. 4001Document13 pagesHouse Bill No. 4001Elizabeth WashingtonNo ratings yet

- Talking To Children About Violence June 2022Document2 pagesTalking To Children About Violence June 2022Elizabeth WashingtonNo ratings yet

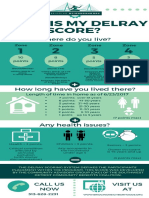

- Whats My Delray ScoreDocument1 pageWhats My Delray ScoreElizabeth WashingtonNo ratings yet

- State of The Region ReportDocument36 pagesState of The Region ReportWXYZ-TV Channel 7 DetroitNo ratings yet

- Oakland Community Health Network BrochureDocument4 pagesOakland Community Health Network BrochureElizabeth WashingtonNo ratings yet

- Bridging Neighborhoods Program AreaDocument1 pageBridging Neighborhoods Program AreaElizabeth WashingtonNo ratings yet

- House Bill 4001Document7 pagesHouse Bill 4001Elizabeth WashingtonNo ratings yet

- Tips For Teachers ParentsDocument2 pagesTips For Teachers Parentsapi-268684269No ratings yet

- 18 0711 USSS NTAC Enhancing School Safety GuideDocument32 pages18 0711 USSS NTAC Enhancing School Safety GuideJulio Cesar BalderramaNo ratings yet

- Threat Assessment Policies 2022Document13 pagesThreat Assessment Policies 2022Elizabeth WashingtonNo ratings yet

- Pontiac Youth Rec Flyer - Winter 2023Document2 pagesPontiac Youth Rec Flyer - Winter 2023Elizabeth WashingtonNo ratings yet

- Current MI Rabies Map in MichiganDocument1 pageCurrent MI Rabies Map in MichiganElizabeth WashingtonNo ratings yet

- My New Book! Coming Jan 4, 2022: Sign Up For My Mailing List Follow Me On InstagramDocument90 pagesMy New Book! Coming Jan 4, 2022: Sign Up For My Mailing List Follow Me On InstagramИлья ШишконаковNo ratings yet

- SAEBRS Teacher Rating SheetDocument2 pagesSAEBRS Teacher Rating SheetElizabeth Washington100% (1)

- Emoji DecodedDocument1 pageEmoji DecodedWXMI50% (2)

- Boil Water Advisory Recovery Checklist BusinessesDocument3 pagesBoil Water Advisory Recovery Checklist BusinessesElizabeth WashingtonNo ratings yet

- Boil Water Advisory Recovery Checklist ResidentsDocument2 pagesBoil Water Advisory Recovery Checklist ResidentsElizabeth WashingtonNo ratings yet