Professional Documents

Culture Documents

Weekly Levels Playing Sheet Commodities & Currencies

Uploaded by

Akshay WaghmareOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Levels Playing Sheet Commodities & Currencies

Uploaded by

Akshay WaghmareCopyright:

Available Formats

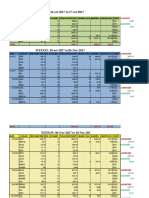

Monday, July 19, 2021

Commodity / Breakdown Critical Intermediate Intermediate Critical Breakout

Direction

Currency level Support Support Resistance Resistance level

MCX GOLD Corrective Rally 46770 47100 47400 48300 48675 49050

SPOT GOLD Corrective Rally 1735 1757 1785 1830 1865 1900

MCX SILVER Corrective Rally 64650 65485 66550 68630 69555 70300

SPOT SILVER Corrective Rally 24.1 24.55 24.9 25.8 26.3 26.7

MCX BULLDEX Corrective Rally 14085 14300 14500 14865 15050 15180

MCX CRUDE OIL Corrective Fall 4960 5050 5165 5455 5595 5650

NYMEX CRUDE OIL Corrective Fall 67 68.25 69.4 71.85 73.05 74.45

MCX NAT. GAS Range Bound 242 251 262 283.5 300 310

NYMEX NAT. GAS Range Bound 3.08 3.3 3.52 3.95 4.12 4.3

MCX METLDEX Corrective Rally 15620 15800 15030 15600 15865 16100

MCX COPPER Range Bound 698 707 716.5 737 746 755

LME COPPER Range Bound 8994 9110 9233 9497 9613 9729

MCX NICKEL Corrective Rally 1310 1340 1390 1446 1500 1550

LME NICKEL Corrective Rally 17395 17794 18458 19201 19918 20582

MCX LEAD Range Bound 168.2 171 174.6 180.65 184.1 186.9

LME LEAD Range Bound 2178 2215 2261 2339 2384 2420

MCX ZINC Corrective Rally 230.8 234.5 237 247 251 255

LME ZINC Corrective Rally 2831 2876 2907 3029 3079 3128

MCX ALUMINIUM Range Bound 188 191.35 194.2 201.15 203.7 207

LME ALUMINIUM Range Bound 2370 2412 2448 2535 2568 2609

USDINR (SPOT) Range Bound 74.05 74.25 74.4 74.7 74.9 74.9

USDINR Range Bound 74.1 74.4 74.55 74.85 75 75.1

EURINR Corrective Fall 87.4 87.7 88 88.55 88.8 88.8

GBPINR Range Bound 102.4 102.4 102.75 103.5 103.8 103.8

JPYINR Corrective Rally 66.8 67.1 67.4 68.25 68.25 68.6

DOLLAR INDEX Corrective Rally 92 92 92.4 92.95 93.2 93.5

EURUSD Corrective Fall 1.172 1.172 1.177 1.187 1.191 1.198

GBPUSD Range Bound 1.366 1.366 1.373 1.381 1.286 1.391

USDJPY Corrective Fall 108.7 109.1 109.6 110.8 111.2 111.2

Please refer to the disclaimer at the end of the report. 1|Page

Monday, July 19, 2021

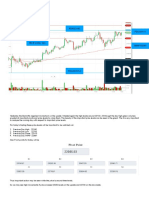

How to interpret levels in this report?

Support – This is a price level observed on a historical chart where buyers become more inclined to

buy and sellers become less inclined to sell. If price breaks below support, then that support level

becomes the new resistance level.

Resistance – This is the opposite of a support level. This is a price level observed on a historical chart

where sellers become more inclined to sell and buyers become less inclined to buy. If price breaks

above resistance, then that resistance level becomes the new support level.

Range Bound –A range bound market is one where the price trades in a range, moving between

support and resistance levels. It is advised to buy near support and sell near resistance in a range

bound market till a clear breakout occurs in either direction. This type of market gives an opportunity

to trade on either side of the range with limited risk.

Uptrend – An uptrend describes the price movement of a commodity/currency pair when the medium-

term as well as the short-term direction is upward. Buying near support or on breach of resistance is

advised in an upward-trending market.

DownTrend – A down trend describes the price movement of a commodity/currency pair when the

medium-term as well as the short-term direction is downward. Selling near resistance or on break of

support is advised in a downward-trending market.

Corrective Rally – A commodity/currency pair is said to be in a corrective rally when the short-term

direction is upward even though the medium term direction is still lower. Buying near support or on

breach of resistance is advised. The only thing to remember is that upside could be limited in such a

market.

Corrective Fall –A commodity/currency pair is said to be in a corrective fall when the short-term

direction is downward even though the medium term direction is still higher. Selling near resistance

or on break of support is advised. The only thing to remember is that downside could be limited in such

a market.

For any details contact:

Commodities Advisory Desk - +91 22 3958 3600

commoditiesresearch@motilaloswal.com

Disclaimers

Please refer to the disclaimer at the end of the report. 2|Page

You might also like

- Hysterical Horror Comic HistoryDocument26 pagesHysterical Horror Comic HistoryColecionadores GO100% (1)

- Tree Plantations in The Caribbean Lowlands of Costa Rica: The Beginnings and EARTH UniversityDocument85 pagesTree Plantations in The Caribbean Lowlands of Costa Rica: The Beginnings and EARTH UniversityRicardo RussoNo ratings yet

- Rose Petal Powder BenefitsDocument7 pagesRose Petal Powder BenefitsABUBAKAR SIDDIQNo ratings yet

- PRAI-M0-YT01-LA-7500 - As-Built - Data Sheet For Feed Water PumpDocument3 pagesPRAI-M0-YT01-LA-7500 - As-Built - Data Sheet For Feed Water PumpSuman GhoshNo ratings yet

- Astro Support ResistanceDocument24 pagesAstro Support ResistanceVinod PatilNo ratings yet

- Tolentino Vs Commission On Elections Case DigestDocument3 pagesTolentino Vs Commission On Elections Case DigestDaf MarianoNo ratings yet

- Bety Garma Niños en Análisis - de La Exp - 20180427153854Document6 pagesBety Garma Niños en Análisis - de La Exp - 20180427153854pamelapsi100% (1)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Isotopes of Pennium LabDocument3 pagesIsotopes of Pennium Labapi-312554801No ratings yet

- Emini SP500 Daily Aug 25 2014Document1 pageEmini SP500 Daily Aug 25 2014Duma DumaiNo ratings yet

- Emini SP500 Daily Sep 01 2014Document1 pageEmini SP500 Daily Sep 01 2014Duma DumaiNo ratings yet

- July 28 2020Document12 pagesJuly 28 2020Varun VasurendranNo ratings yet

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavNo ratings yet

- ResearchDocument1 pageResearchshaalimNo ratings yet

- Commodity Research Report 06 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 06 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Daily Commodity, Currency & Money Market Update - 28th Dec 2023Document4 pagesDaily Commodity, Currency & Money Market Update - 28th Dec 2023S.M Abdulla ShuvoNo ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 25 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 25 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Koersen AEX Na DropDocument15 pagesKoersen AEX Na DropFSAMENNo ratings yet

- RolloverDocument9 pagesRollovermanishmandal1976No ratings yet

- Highnoon Nov 26Document3 pagesHighnoon Nov 26SITU2412No ratings yet

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Document5 pagesStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhNo ratings yet

- Derivative Strategies 11112009Document3 pagesDerivative Strategies 11112009richard8887No ratings yet

- Commodity Research Report 18 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 18 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Exchange Rate 23 October 2022Document2 pagesExchange Rate 23 October 2022JsjsNo ratings yet

- Rollover Report July 2020 - Aug 2020Document7 pagesRollover Report July 2020 - Aug 2020bbaalluuNo ratings yet

- Commodity Research Report 12 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 12 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Exchange Rate 08 September 2022Document2 pagesExchange Rate 08 September 2022Md. Shahriar Mahmud RakibNo ratings yet

- Jiya FileDocument6 pagesJiya FileghazalaNo ratings yet

- Daily CallsDocument18 pagesDaily Callsreesty68_unfearyNo ratings yet

- EMF - ReportDocument9 pagesEMF - Reports.kundraNo ratings yet

- Indian Market Research Daily Market Summary: Paterson Securities PVT LTDDocument3 pagesIndian Market Research Daily Market Summary: Paterson Securities PVT LTDmuthu_theone6943No ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Brosur PC November 2017Document1 pageBrosur PC November 2017RosalindaNo ratings yet

- OMSEC Morning Note 26 09 2022Document6 pagesOMSEC Morning Note 26 09 2022Ropafadzo KwarambaNo ratings yet

- Emini SP500 Daily Aug 20 2014Document3 pagesEmini SP500 Daily Aug 20 2014Duma DumaiNo ratings yet

- Stock Market Reports For The Week (21st - 25th March - 2011)Document6 pagesStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1No ratings yet

- Daily Market Coverage 8th Dec 2017Document1 pageDaily Market Coverage 8th Dec 2017Riya ShrivastavNo ratings yet

- Commodity Research Report 16 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateZabed HossainNo ratings yet

- July 24 2020Document12 pagesJuly 24 2020Varun VasurendranNo ratings yet

- STEP 1: Tick Pada Enable DDE Server Di MT4 STEP 2: Right Pada Market Watch Dan Klik Show AllDocument9 pagesSTEP 1: Tick Pada Enable DDE Server Di MT4 STEP 2: Right Pada Market Watch Dan Klik Show AllMthunzi MthunziNo ratings yet

- Output 10609Document1 pageOutput 10609Ajith Chand BhandaariNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateKhandaker Shefat NoorNo ratings yet

- Derivative Report 6march2017Document6 pagesDerivative Report 6march2017ram sahuNo ratings yet

- Spyder Sports: Ashutosh DashDocument34 pagesSpyder Sports: Ashutosh DashSaurabh ChhabraNo ratings yet

- Stock Market Reports For The Week (16th - 20th May '11)Document6 pagesStock Market Reports For The Week (16th - 20th May '11)Dasher_No_1No ratings yet

- Equity Research Report 14 August 2018 Ways2CapitalDocument17 pagesEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- CMP HR S/R Day Week Mo Vedanta 90 116 126 144 170 26 36 54 80 Gain 28.89% 40% 60% 89% r2r 0.8125 1.125 1.6875 2.5 Heiken Ashi Rsi 14 MfiDocument9 pagesCMP HR S/R Day Week Mo Vedanta 90 116 126 144 170 26 36 54 80 Gain 28.89% 40% 60% 89% r2r 0.8125 1.125 1.6875 2.5 Heiken Ashi Rsi 14 Mfisoumya chatterjeeNo ratings yet

- Stock MarketDocument9 pagesStock Marketsoumya chatterjeeNo ratings yet

- Eagleeye - e (2) - 7Document7 pagesEagleeye - e (2) - 7Harry AndersonNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateMAHMUDUR RAHMANNo ratings yet

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateshuvoNo ratings yet

- Equity Reports For The Week (25th - 29th April '11)Document6 pagesEquity Reports For The Week (25th - 29th April '11)Dasher_No_1No ratings yet

- Ashika Morning Report - 28.02.2024Document11 pagesAshika Morning Report - 28.02.2024Tirthankar DasNo ratings yet

- Commodity Research Report 27november 2018 Ways2CapitalDocument13 pagesCommodity Research Report 27november 2018 Ways2CapitalWays2CapitalNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Sunrise Market Pulse: Technical OverviewDocument4 pagesSunrise Market Pulse: Technical OverviewSana LaganikartaNo ratings yet

- Technical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDocument3 pagesTechnical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDIVYA PANJWANINo ratings yet

- Finm Ca 1Document44 pagesFinm Ca 1Muskan ChawlaNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateJeetNo ratings yet

- Bill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupDocument1 pageBill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupFaizanNo ratings yet

- Week 5 - Tutorial SolutionsDocument5 pagesWeek 5 - Tutorial SolutionsDivya chandNo ratings yet

- Stock Market Reports For The Week (9th - 13th May '11)Document6 pagesStock Market Reports For The Week (9th - 13th May '11)Dasher_No_1No ratings yet

- Ashika Morning Report - 05.03.2024Document10 pagesAshika Morning Report - 05.03.2024Tirthankar DasNo ratings yet

- Weekly Technical Report: 28 March 2022 Volume: 52Document7 pagesWeekly Technical Report: 28 March 2022 Volume: 52Akshay WaghmareNo ratings yet

- Pacifica Hamilton IM NAV December 20 2022Document16 pagesPacifica Hamilton IM NAV December 20 2022Akshay WaghmareNo ratings yet

- BA Super Achiever Oct-22 - 221129 - 143229Document1 pageBA Super Achiever Oct-22 - 221129 - 143229Akshay WaghmareNo ratings yet

- GTPL - Channel Mumber ListDocument22 pagesGTPL - Channel Mumber ListAkshay Waghmare100% (1)

- MO Commodities Daily ReportDocument4 pagesMO Commodities Daily ReportAkshay WaghmareNo ratings yet

- Agri Technical WeeklyDocument4 pagesAgri Technical WeeklyAkshay WaghmareNo ratings yet

- भारताचा अर्थसंकल्पDocument18 pagesभारताचा अर्थसंकल्पAkshay WaghmareNo ratings yet

- International BusinessDocument13 pagesInternational BusinessShifna MohamedNo ratings yet

- Jenny Kate Tome: Rob-B-HoodDocument5 pagesJenny Kate Tome: Rob-B-HoodDarcy Mae SanchezNo ratings yet

- Òey©Gvjvó: WMG Cövwßi WB '©WKKVDocument8 pagesÒey©Gvjvó: WMG Cövwßi WB '©WKKVRAJIBNo ratings yet

- Mid QuestionsDocument4 pagesMid QuestionsMAMA LALANo ratings yet

- Law 6 Court Attention at All CostDocument6 pagesLaw 6 Court Attention at All CoststevensonaguinaldoNo ratings yet

- APUSH Chapter 20 Study GuideDocument3 pagesAPUSH Chapter 20 Study Guidekevinaguilera100% (1)

- This Dashain, Sacrifice Your Inner Demons, Not Animals Stop Temples Turning Into SlaughterhousesDocument6 pagesThis Dashain, Sacrifice Your Inner Demons, Not Animals Stop Temples Turning Into SlaughterhousesMamta ShahNo ratings yet

- Rizwan CVDocument8 pagesRizwan CVAnonymous UlojE8No ratings yet

- Perancangan Mesin Pengurai Sabut Kelapa PDFDocument7 pagesPerancangan Mesin Pengurai Sabut Kelapa PDFRoni100% (1)

- Hazrat Adam (AS)Document7 pagesHazrat Adam (AS)Faizan75% (4)

- Bash Shell On MAC and LinuxDocument13 pagesBash Shell On MAC and LinuxSenthil NathanNo ratings yet

- Cbs Esp 001 Notes PDFDocument8 pagesCbs Esp 001 Notes PDFمحمد عبد الحليم شعراويNo ratings yet

- Linux MCQ Fot InterviewDocument2 pagesLinux MCQ Fot InterviewHromit ProdigyNo ratings yet

- H. B. Green (auth.), J. T. Fraser, N. Lawrence (eds.) - The Study of Time II_ Proceedings of the Second Conference of the International Society for the Study of Time Lake Yamanaka-Japan (1975, Springer-Verlag Berli.pdfDocument491 pagesH. B. Green (auth.), J. T. Fraser, N. Lawrence (eds.) - The Study of Time II_ Proceedings of the Second Conference of the International Society for the Study of Time Lake Yamanaka-Japan (1975, Springer-Verlag Berli.pdfEduardo GuedesNo ratings yet

- MSDS - Alkyd Enamel Paint (Cat Avian) PDFDocument11 pagesMSDS - Alkyd Enamel Paint (Cat Avian) PDFbumisetraNo ratings yet

- Teaching StrategiesDocument65 pagesTeaching StrategiessheenaNo ratings yet

- Descriptive Research: Definition, Characteristics, Methods, Examples and AdvantagesDocument17 pagesDescriptive Research: Definition, Characteristics, Methods, Examples and AdvantagessamuelNo ratings yet

- PROJECT WORK For Class 12-B Subject-COMMERCEDocument2 pagesPROJECT WORK For Class 12-B Subject-COMMERCEMariamNo ratings yet

- Literacy Narrative On Music PDFDocument8 pagesLiteracy Narrative On Music PDFapi-315815192No ratings yet

- PEN 33 Individual and Dual Sport - Table Tennis: PrefaceDocument25 pagesPEN 33 Individual and Dual Sport - Table Tennis: PrefaceBSN CMUNo ratings yet

- Architectural CompetitionsDocument15 pagesArchitectural CompetitionsShailendra PrasadNo ratings yet

- TerminDocument5 pagesTerminAnonymous DA8iQzNo ratings yet

- Battle of Hunayn (نـيـنـ ُح ةوزـَغ)Document5 pagesBattle of Hunayn (نـيـنـ ُح ةوزـَغ)Syed Mohsin Mehdi TaqviNo ratings yet