Professional Documents

Culture Documents

Yug Dharma Public School Vs Employees Provident FuMP2022141222164800144COM73697

Uploaded by

Riya Navratan0 ratings0% found this document useful (0 votes)

17 views4 pagesJudgement on overriding effect of special laws over general laws

Original Title

Yug_Dharma_Public_School_vs_Employees_Provident_FuMP2022141222164800144COM73697

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJudgement on overriding effect of special laws over general laws

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesYug Dharma Public School Vs Employees Provident FuMP2022141222164800144COM73697

Uploaded by

Riya NavratanJudgement on overriding effect of special laws over general laws

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

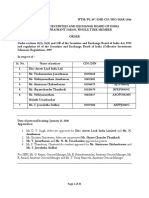

MANU/MP/3384/2022

IN THE HIGH COURT OF MADHYA PRADESH (INDORE BENCH)

Misc. Petition No. 4278 of 2022

Decided On: 01.12.2022

Appellants: Yug Dharma Public School

Vs.

Respondent: Employees Provident Fund Organisation Regional Provident Fund

Commissioner II

Hon'ble Judges/Coram:

Subodh Abhyankar, J.

Counsels:

For Appellant/Petitioner/Plaintiff: Manoj Manav, Advocate

For Respondents/Defendant: Pankaj Kumar Jain, Advocate

Case Category:

LABOUR MATTERS - MATTERS RELATING TO PROVIDENT FUND

ORDER

Subodh Abhyankar, J.

1. This petition has been filed by the petitioner-Yug Dharma Public School under Article

226 r/w 227 of the Constitution of India, against the order dated 28.07.2022, passed by

the Presiding Officer, Central Government Industrial Tribunal (CGIT), Jabalpur wherein,

the petitioner's appeal filed under Rule 7 of the Employees' Provident Fund Appellate

Tribunal (Procedure) Rules, 1997 has been rejected solely on the ground of its

limitation as according to Rule 7, the limitation of 60 days is provided which can be

extended to further 60 days' period, whereas, the appeal has been preferred after a

period of 15 days of the extended period of limitation.

2 . Shri Manoj Manav, counsel appearing for the petitioner has submitted that the

aforesaid provision of the Limitation Act cannot be construed strictly as has been held

by the Calcutta High Court in its decision rendered in the case of C D Steel Pvt. Ltd. and

others Vs. Assistant Provident Fund Commissioner reported as MANU/WB/0989/2022.

(Relevant paras are 19, 20 & 21), and also in the case of Superintending

Engineer/Dehar Power House Circle Bhakra Beas Management Board (PW) Slapper and

Another Vs. Excise and Taxation Officer, Sunder Nagar/Assessing Authority reported as

MANU/SC/1478/2019 : (2020) 17 SCC 692 (Relevant paras are 6, 20, 28 & 29).

3 . The petition has been opposed by the respondent/Employees' Provident Fund

Organization and a reply has also been filed.

4. Shri Pankaj Kumar Jain, learned counsel appearing for the respondent has submitted

that no illegality has been committed by the Appellate Authority in rejecting the

petitioner's appeal on the ground of delay only. It is submitted that under the proviso of

Rule 7 of the Rules, if the appeal is not filed within the original period of limitation of

60 days, the delay cannot be condoned beyond the extended period of 60 further days..

15-03-2023 (Page 1 of 4) www.manupatra.com The Law Desk

5. In support of his contention, Shri Jain has relied upon the decisions rendered by the

Supreme Court in the case of as also a Constitutional Bench Commissioner of Customs

and Central Excise Vs. Hongo India Private Limited and Another reported as(2009) 5

SCC 791 (Relevant paras are 16, 18 & 32).

6. Heard counsel for the parties and perused the record.

7. So far as the Rule 7 of the Rules of 1997 is concerned, the same reads as under:-

"7. Fee, time for filing appeal, deposit of amount due on filing appeal.--

(1) Every appeal filed with the Registrar shall be accompanied by a fee

of Rupees five hundred to be remitted in the form of Crossed Demand

Draft on a nationalized bank in favour of the Registrar of the Tribunal

and payable at the main branch of that Bank at the station where the

seat of the said Tribunal situate.

(2) Any person aggrieved by a notification issued by the Central

Government or an order passed by the Central Government or any

other authority under the Act, may within 60 days from the date of

issue of the notification/order, prefer an appeal to the Tribunal.

Provided that the Tribunal may if it is satisfied that the appellant was

prevented by sufficient cause from preferring the appeal within the

prescribed period, extend the said period by a further period of 60

days.

Provided further that no appeal by the employer shall be entertained by

the Tribunal unless he has deposited with the Tribunal a Demand Draft

payable in the Fund and bearing 75% of the amount due from him as

determined under Section 7-A. Provided also that the Tribunal may for

reasons to be recorded in writing, waive or reduce the amount to be

deposited under Section 7-O."

(emphasis supplied)

8. A perusal of the aforesaid Rule clearly reveals that the limitation to file an appeal is

60 days which can be extended for a further period of 60 days subject to sufficient

cause being shown.

9 . Counsel for the petitioner has submitted that there is no specific exclusion of

Limitation Act, 1963 in the aforesaid provision and thus, the extended period of 60 days

can still be extended to condone the delay and the application filed under Section 5 of

the Limitation Act would be maintainable. However, so far as the decision rendered in

the case of Commissioner of Customs and Central Excise (supra) is concerned, the

relevant paras 16, 18 & 32 of the same reads as under:-

16) Reliance was placed to Section 5 and Section 29(2) of the Limitation Act

which read as under:

"5. Extension of prescribed period in certain cases.-Any appeal or any

application, other than an application under any of the provisions of

Order XXI of the Code of Civil Procedure, 1908, may be admitted after

the prescribed period, if the appellant or the applicant satisfies the

court that he had sufficient cause for not preferring the appeal or

15-03-2023 (Page 2 of 4) www.manupatra.com The Law Desk

making the application within such period."

xxxxxx

"29. Savings.-(1) Nothing in this Act shall affect Section 25 of the

Indian Contract Act, 1872 (9 of 1872).

(2) Where any special or local law prescribes for any suit, appeal or

application a period of limitation different from the period prescribed

by the Schedule, the provisions of Section 3 apply as if such period

were the period prescribed by the Schedule and for the purpose of

determining any period of limitation prescribed for any suit, appeal or

application by any special or local law, the provisions contained in

Section 4 and Section 24 (inclusive) shall apply only in so far as, and

to the extent to which, they are not expressly excluded by such special

or local law."

xxxxxxxxxxx

1 8 . Learned Additional Solicitor General relying on the judgment of

this Court in Union of India vs. M/s. Popular Construction Co.,

MANU/SC/0613/2001 : (2001) 8 SCC 470 contended that in the

absence of specific exclusion of the Limitation Act in the Central Excise

Act, in lieu of Section 29(2) of the Limitation Act, Section 5 of the

same is applicable even in the case of reference application to the High

Court.

xxxxxxxxxxx

32) As pointed out earlier, the language used in Sections 35, 35-B,

35EE, 35G Sections 35, 35B, 35EE, 35G and 35H makes the position

clear that an appeal and reference to the High Court should be made

within 180 days only from the date of communication of the decision or

order. In other words, the language used in other provisions makes the

position clear that the legislature intended the appellate authority to

entertain the appeal by condoning the delay only up to 30 days after

expiry of 60 days which is the preliminary limitation period for

preferring an appeal. In the absence of any clause condoning the delay

by showing sufficient cause after the prescribed period, there is

complete exclusion of Section 5 of the Limitation Act. The High Court

was, therefore, justified in holding that there was no power to condone

the delay after expiry of the prescribed period of 180 days.

(emphasis supplied)

10. A perusal of the aforesaid decision relied upon by the counsel for the respondents

clearly reveals that when a particular Act itself provides for limitation period and also

the extended period of limitation, the provisions of Limitation Act cannot be invoked as

the applicability of the Limitation Act is barred by the operation of the special Act. In

such circumstances, even if under Rule 7, the provisions of Limitation Act are not

specifically excluded, in the light of the extended period of limitation contained in the

same, it cannot be said that the Limitation Act would be applicable..

11. So far as the decision by the Calcutta High Court in the case of C D Steel Pvt. Ltd.

15-03-2023 (Page 3 of 4) www.manupatra.com The Law Desk

is concerned, that the Act of 1952 is beneficial legislature and should be dealt with

leniently, with due respect to the learned Judge of the Calcutta High Court, this Court

begs to defer with the aforesaid preposition in the light of the decision in the case of

Commissioner of Customs and Central Excise (supra) and even otherwise, as has been

rightly pointed out by the counsel for the respondents that the Act of 1952 is a

beneficial legislation not for the employers but, for the employees and in such

circumstances also, the aforesaid decision in the case of C D Steel Pvt. Ltd. and others

(Supra) cannot be relied upon by this Court.

1 2 . The petitioner has also relied upon the decision in the case of Superintending

Engineer (Supra) but it is found that in the aforesaid case, the question before the

Supreme Court was of the interpretation of Section 48 of Value Added Tax Act, 2005

and on perusal of Section 48 clearly reveals that there is no such extended period of

limitation. In view of the same, the decision relied upon by the petitioner is of no avail.

1 3 . Resultantly, this Court is of the considered opinion that no illegality has been

committed by the learned Judge of the Appellate Court in passing the impugned order

by dismissing the appeal on the ground of delay.

14. Resultantly, the petition being devoid of merits, is hereby dismissed.

© Manupatra Information Solutions Pvt. Ltd.

15-03-2023 (Page 4 of 4) www.manupatra.com The Law Desk

You might also like

- 2019 4 1501 17733 Judgement 25-Oct-2019Document30 pages2019 4 1501 17733 Judgement 25-Oct-2019ShreenidhiBadanahattiNo ratings yet

- Cases - S 29ADocument5 pagesCases - S 29ADeeptangshu KarNo ratings yet

- Simplex Infrastructure LTD Vs Union of India UOI 0SC201810121815285495COM466423Document8 pagesSimplex Infrastructure LTD Vs Union of India UOI 0SC201810121815285495COM466423KANCHAN SEMWALNo ratings yet

- Judgment Cadila Healthcare 488902Document12 pagesJudgment Cadila Healthcare 488902venkatNo ratings yet

- Union of India (Uoi) Vs Tata Engineering & Locomotive Co (1) - ... On 7 February, 1989Document4 pagesUnion of India (Uoi) Vs Tata Engineering & Locomotive Co (1) - ... On 7 February, 1989sangram singhNo ratings yet

- Delhi HC allows filing of written statement beyond 120 days subject to costsDocument15 pagesDelhi HC allows filing of written statement beyond 120 days subject to costskunal jainNo ratings yet

- Alternative Dispute Resolution - 1582Document17 pagesAlternative Dispute Resolution - 1582Maneesh ReddyNo ratings yet

- Pam Developement - Judgment - Court ProceddingsDocument9 pagesPam Developement - Judgment - Court ProceddingsAshok tiwariNo ratings yet

- Prakash Corporates (S) v. Dee Vee Projects Limited (S), 2022, SCDocument35 pagesPrakash Corporates (S) v. Dee Vee Projects Limited (S), 2022, SCshristy prasadNo ratings yet

- Shri Surendra Prasad v. CCI and OrsDocument3 pagesShri Surendra Prasad v. CCI and OrsVinayak GuptaNo ratings yet

- Appealable Orders in ArbitrationDocument49 pagesAppealable Orders in ArbitrationShyam Anandjiwala100% (1)

- 16399_2022_4_1507_43314_Judgement_10-Apr-2023Document44 pages16399_2022_4_1507_43314_Judgement_10-Apr-2023dwipchandnani6No ratings yet

- Rohinton Fali Nariman and Vineet Saran, JJ.: 2019 (4) SC ALE574Document5 pagesRohinton Fali Nariman and Vineet Saran, JJ.: 2019 (4) SC ALE574Ujjwal Malhotra100% (1)

- Singh Group Versus State of U.P. and 2 Others - 2022 (8) Tmi 97 - Allahabad High CourtDocument6 pagesSingh Group Versus State of U.P. and 2 Others - 2022 (8) Tmi 97 - Allahabad High CourtSrichNo ratings yet

- Article On Condonation of Delay, Restoration of Suit, and Seetting Aside Exparte Orders - YSRDocument16 pagesArticle On Condonation of Delay, Restoration of Suit, and Seetting Aside Exparte Orders - YSRY.Srinivasa RaoNo ratings yet

- Arguments Against Condonation ApplicationDocument2 pagesArguments Against Condonation ApplicationKartikey singhNo ratings yet

- Supreme Court clarifies key issues under IBCDocument4 pagesSupreme Court clarifies key issues under IBCRitesh kumarNo ratings yet

- Union of India Vs Chenab Construction Company RegdDE201924101917360063COM341167Document14 pagesUnion of India Vs Chenab Construction Company RegdDE201924101917360063COM341167Pranav KaushikNo ratings yet

- 195 2021 33 1501 27050 Judgement 19-Mar-2021Document74 pages195 2021 33 1501 27050 Judgement 19-Mar-2021VasumankNo ratings yet

- Fertilisers And Chemicals vs Union Of India on damages claimDocument2 pagesFertilisers And Chemicals vs Union Of India on damages claimsangram singhNo ratings yet

- Cable Corp vs. AP MSE Facilitation Council - Telangana HC Page 5Document15 pagesCable Corp vs. AP MSE Facilitation Council - Telangana HC Page 5Pragalbh BhardwajNo ratings yet

- Everest Review 529824Document11 pagesEverest Review 529824Prasad VaidyaNo ratings yet

- Limitation Period W/R To IBCDocument16 pagesLimitation Period W/R To IBCRagesh KarimbilNo ratings yet

- 026d5f931a8be SeptemberDocument9 pages026d5f931a8be SeptemberAbhijitNo ratings yet

- Case Law Condonation of Delay Not Allowed Government PDFDocument3 pagesCase Law Condonation of Delay Not Allowed Government PDFmuhammad_awan_49No ratings yet

- Indian Bank Vs Maharashtra State Cooperative Marke0827s980450COM441873Document4 pagesIndian Bank Vs Maharashtra State Cooperative Marke0827s980450COM441873Bhuvneshwari RathoreNo ratings yet

- 29.03.2023 - NCLTDocument11 pages29.03.2023 - NCLTSREEMANTINI MUKHERJEENo ratings yet

- Rajiv Sahai Endlaw, J.: Equiv Alent Citation: 2009 (3) ARBLR494 (Delhi)Document9 pagesRajiv Sahai Endlaw, J.: Equiv Alent Citation: 2009 (3) ARBLR494 (Delhi)aridaman raghuvanshiNo ratings yet

- QLJHLQKNFDocument15 pagesQLJHLQKNFnishit gokhruNo ratings yet

- High Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 14/04/2021 at 09:16:33 PM)Document8 pagesHigh Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 14/04/2021 at 09:16:33 PM)ApoorvnujsNo ratings yet

- ADR ProjectDocument11 pagesADR ProjectMADHURI ARJILLI 122033201029No ratings yet

- Indian Farmers Fertilizer CoOperative Limited Vs BSC20182901181739401COM374811Document16 pagesIndian Farmers Fertilizer CoOperative Limited Vs BSC20182901181739401COM374811mohitpaliwalNo ratings yet

- Case Law 2021 51 G S T L 187 Bom 22 12 2020Document10 pagesCase Law 2021 51 G S T L 187 Bom 22 12 2020Ashwini ChandrasekaranNo ratings yet

- (2021, AP HC) - RINlDocument65 pages(2021, AP HC) - RINlAbhinay ReddyNo ratings yet

- Uttarakhand Purv Sainik Kalyan Nigam Limited Vs NoSC20192811191650382COM886007Document7 pagesUttarakhand Purv Sainik Kalyan Nigam Limited Vs NoSC20192811191650382COM886007Sidhant WadhawanNo ratings yet

- K.K. Pushpakaran vs Union of India (2008Document4 pagesK.K. Pushpakaran vs Union of India (2008devNo ratings yet

- Appeal First Appeleate AuthorityDocument11 pagesAppeal First Appeleate AuthorityThe Ultra IndiaNo ratings yet

- Commissioner Of Sales Tax, U.P vs Madan Lal Dass & Sons, 1977 SCR (1) 683Document2 pagesCommissioner Of Sales Tax, U.P vs Madan Lal Dass & Sons, 1977 SCR (1) 683RenuNo ratings yet

- Bharat Barrel and Drum MFG Company Private LTD ands710502COM177090Document11 pagesBharat Barrel and Drum MFG Company Private LTD ands710502COM177090Aman BajajNo ratings yet

- 2021-Zmca-114 Execution of JudgmentDocument12 pages2021-Zmca-114 Execution of JudgmentSMOOVE MARGONo ratings yet

- Jharkhand HC: Tax liability barred if not claimed during CIRPDocument10 pagesJharkhand HC: Tax liability barred if not claimed during CIRPnidhidaveNo ratings yet

- Godrej Judgment Interprets Statute Tax ProvisionsDocument11 pagesGodrej Judgment Interprets Statute Tax ProvisionsGurjot Singh KalraNo ratings yet

- LIMITATION-c.a. 24 K 2019Document17 pagesLIMITATION-c.a. 24 K 2019FAROOQNo ratings yet

- Court analyzes provisions of Sections 29A, 30, 31 of Arbitration ActDocument8 pagesCourt analyzes provisions of Sections 29A, 30, 31 of Arbitration ActmrunalpanchalNo ratings yet

- Supreme Court of India: Hindustan Construction vs. JammuDocument5 pagesSupreme Court of India: Hindustan Construction vs. JammuRahul AggarwalNo ratings yet

- SECTION 37 APPEALSDocument10 pagesSECTION 37 APPEALSsakshi mehtaNo ratings yet

- M - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTDocument3 pagesM - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTSrichNo ratings yet

- Impact of Moratorium on Criminal ProceedingsDocument2 pagesImpact of Moratorium on Criminal ProceedingsAkshara RajratnamNo ratings yet

- Court ProcedureDocument8 pagesCourt ProcedureAE PWD BolpurNo ratings yet

- 2022 1 1503 48065 Judgement 06-Nov-2023Document88 pages2022 1 1503 48065 Judgement 06-Nov-2023rayadurgam bharatNo ratings yet

- L. Nageswara Rao and B.R. Gavai, JJDocument11 pagesL. Nageswara Rao and B.R. Gavai, JJmunir HussainNo ratings yet

- Bank v Co-op Marketing FederationDocument4 pagesBank v Co-op Marketing FederationAyushman SinghNo ratings yet

- M.Y. Eqbal and Kurian Joseph, JJDocument5 pagesM.Y. Eqbal and Kurian Joseph, JJBhola PrasadNo ratings yet

- 558-Devraj Singh Vs Babli DeviDocument14 pages558-Devraj Singh Vs Babli DeviAyush RajNo ratings yet

- 417 Shree Vishnu Constructions V Engineer in Chief Military Engineering Service 9 May 2023 472061Document14 pages417 Shree Vishnu Constructions V Engineer in Chief Military Engineering Service 9 May 2023 472061Pranav KaushikNo ratings yet

- Bharat Coking Coal LTD Vs LK Ahuja 12042004 SCs040333COM179853Document8 pagesBharat Coking Coal LTD Vs LK Ahuja 12042004 SCs040333COM179853deepaNo ratings yet

- The Supreme Court Judgements On ArbitrationDocument12 pagesThe Supreme Court Judgements On ArbitrationAfreenNo ratings yet

- Delhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934Document7 pagesDelhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934KANCHAN SEMWALNo ratings yet

- Dwaraka Das Vs State of Madhya Pradesh and Ors 101122s990714COM865207Document5 pagesDwaraka Das Vs State of Madhya Pradesh and Ors 101122s990714COM865207deepaNo ratings yet

- Establishment of ChaptersDocument16 pagesEstablishment of ChaptersMeterion SocietyNo ratings yet

- Bro Form Advt No 04 2022 by Sarkari Result ComDocument4 pagesBro Form Advt No 04 2022 by Sarkari Result ComMahipal MeenaNo ratings yet

- 2017 Republic - v. - Spouses - Llamas20211014 12 149yqfcDocument10 pages2017 Republic - v. - Spouses - Llamas20211014 12 149yqfcDeanne ViNo ratings yet

- Republic Act No. 11222Document6 pagesRepublic Act No. 11222annarrrrrrrrrrNo ratings yet

- Sample - Addendum To EJSDocument2 pagesSample - Addendum To EJSTricia Maria M. Castro100% (5)

- Parliament of The Democratic Socialist Republic of Sri LankaDocument19 pagesParliament of The Democratic Socialist Republic of Sri LankaImesh SachinthaNo ratings yet

- All Cases ListDocument20 pagesAll Cases ListAnujNo ratings yet

- RTO-Application NumberDocument1 pageRTO-Application NumberKuldeep JatNo ratings yet

- 1st Conflicts of Law Case Pool (Full Text)Document262 pages1st Conflicts of Law Case Pool (Full Text)Jubelle AngeliNo ratings yet

- 89 - Pascual vs. OrozcoDocument2 pages89 - Pascual vs. Orozcomimiyuki_No ratings yet

- Bighorn Company Final ContractDocument29 pagesBighorn Company Final ContractspeifNo ratings yet

- Obligation and Contracts Document AnalyzedDocument5 pagesObligation and Contracts Document Analyzedsora cabreraNo ratings yet

- Neilson VS LepantoDocument26 pagesNeilson VS LepantoJaphet C. VillaruelNo ratings yet

- Tejus-Shadow en BookDash-FKBDocument18 pagesTejus-Shadow en BookDash-FKBsoniaNo ratings yet

- Boracay Closure Upheld as Valid Exercise of Police PowerDocument3 pagesBoracay Closure Upheld as Valid Exercise of Police PowerAna Solito100% (1)

- GeM Bidding 2588256Document4 pagesGeM Bidding 2588256ManishNo ratings yet

- Instant Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF ScribdDocument15 pagesInstant Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF ScribdDanielle Goff100% (14)

- Personal Data SheetDocument5 pagesPersonal Data SheetCarmela SalvadorNo ratings yet

- Exemption Clause Exemption Clause: Contract I (Universiti Malaya) Contract I (Universiti Malaya)Document4 pagesExemption Clause Exemption Clause: Contract I (Universiti Malaya) Contract I (Universiti Malaya)Bella SallehNo ratings yet

- SEC 1 PURE & CONDITIONAL OBLIGATIONSDocument2 pagesSEC 1 PURE & CONDITIONAL OBLIGATIONSAlmineNo ratings yet

- 2 Banas-Nograles v. Comelec - G.R. No. 246328, 10 September 2019Document15 pages2 Banas-Nograles v. Comelec - G.R. No. 246328, 10 September 2019Bee CGNo ratings yet

- Moot Proposition FinalDocument6 pagesMoot Proposition FinalVaishnavi MurkuteNo ratings yet

- Procurement Form of TenderDocument2 pagesProcurement Form of TenderMekuannint DemekeNo ratings yet

- (Midterm) Aap - Module 4 Psa-200 - 210 - 240Document7 pages(Midterm) Aap - Module 4 Psa-200 - 210 - 24025 CUNTAPAY, FRENCHIE VENICE B.No ratings yet

- Zoning and Private Land RestrictionsDocument23 pagesZoning and Private Land RestrictionsPhillip DoughtieNo ratings yet

- Exinity LTD ALPARI Client Agreement V8 PDFDocument43 pagesExinity LTD ALPARI Client Agreement V8 PDFMuhammad AliNo ratings yet

- Partnership Agreement for Crypto Marketing ServicesDocument2 pagesPartnership Agreement for Crypto Marketing ServicesAdzharussyukri 26No ratings yet

- Valet Service ContractDocument3 pagesValet Service ContractRocketLawyer100% (3)

- Release Deed - MambalamDocument6 pagesRelease Deed - MambalamKarthi KeyanNo ratings yet

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderNo ratings yet