Professional Documents

Culture Documents

2

2

Uploaded by

Puneet MishraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2

2

Uploaded by

Puneet MishraCopyright:

Available Formats

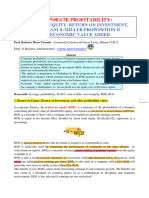

Value of Firms pre-merger was in the ra o 300:240 i.e.

5:4

Value of Firms post-merger is in the ra o 321:299 i.e. 5:4.67

Thus, Nextel shareholders have got a be er share of the value of the combined firm as well as the synergy gains

For a balanced split of value, the exchange ra on should have been 1.2:1 instead of 1.4:1 (i.e. in the ra o of market price of shares of both t

Break-even synergy level

Revised Shares

New Value of Value per

Sprint Nextel Synergy no. of Held by 30

Value Sprint Sh share

Shares Sprint SH

28

300 240 0 540 23.2 12 279 23.28

300 240 10 550 23.2 12 284 23.71

26

300 240 20 560 23.2 12 290 24.14

Share Price

300 240 30 570 23.2 12 295 24.57

24

300 240 40 580 23.2 12 300 25.00

300 240 50 590 23.2 12 305 25.43 22

300 240 60 600 23.2 12 310 25.86

300 240 70 610 23.2 12 316 26.29 20

0 10

300 240 80 620 23.2 12 321 26.72

300 240 90 630 23.2 12 326 27.16

300 240 100 640 23.2 12 331 27.59

300 240 110 650 23.2 12 336 28.02

300 240 120 660 23.2 12 341 28.45

You might also like

- Diskusi Mid Test - Meeting 7Document26 pagesDiskusi Mid Test - Meeting 7Jimmy LimNo ratings yet

- HR ReportKHLTHRDetailDocument4 pagesHR ReportKHLTHRDetailrohmanNo ratings yet

- Heat Transfer Data TemplateDocument2 pagesHeat Transfer Data TemplateNatalie HoNo ratings yet

- Statement 20230707 212204Document1 pageStatement 20230707 212204olibiakos2009No ratings yet

- Heirarchial and KMeansDocument27 pagesHeirarchial and KMeansChandrashekar MuramallaNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web Billrahmanhussain667No ratings yet

- UntitledDocument2 pagesUntitledDinesh RamaNo ratings yet

- Symmetrical Vertical Curve - PVC GivenDocument6 pagesSymmetrical Vertical Curve - PVC GivenSalama ShurrabNo ratings yet

- Book1 Di IjalDocument4 pagesBook1 Di IjalRicky Chandra PamungkasNo ratings yet

- Camden Electronics CaseDocument2 pagesCamden Electronics CaseTăng QuânNo ratings yet

- Beton IndepDocument3 pagesBeton IndepNur Azizah AzmaNo ratings yet

- Solar Data 2019-June To 2020 JuneDocument2 pagesSolar Data 2019-June To 2020 JuneKilaru DivyaNo ratings yet

- Lesco - Web BillDocument1 pageLesco - Web Billshaukat.wattoo786No ratings yet

- Perhitungan Kuat Tekan BetonDocument8 pagesPerhitungan Kuat Tekan BetonPanji K. MangadiNo ratings yet

- Stagii Luna 05-10-2023 01 23Document4 pagesStagii Luna 05-10-2023 01 23Liciu Cristian-MarianNo ratings yet

- Loanchart Aug 30 2023 09 37 08Document1 pageLoanchart Aug 30 2023 09 37 08prabakaran365No ratings yet

- Load ScheduleDocument1 pageLoad ScheduleDibby Mae BrillasNo ratings yet

- PPP Investment StrategyDocument7 pagesPPP Investment StrategyAllur Sai Vijay KumarNo ratings yet

- 3Document14 pages3Ziad GamalNo ratings yet

- 26.6 Fake NumberDocument1 page26.6 Fake NumberSuperXNo ratings yet

- Stocks Real Data and AnalysisDocument14 pagesStocks Real Data and AnalysisTahseen MukhtarNo ratings yet

- Anpel May 2100Document9 pagesAnpel May 2100kusrahman doankNo ratings yet

- Universal - Beam Halaman 4Document1 pageUniversal - Beam Halaman 4GunawanNo ratings yet

- Paket MTF April 2024Document1 pagePaket MTF April 2024dikiebi78No ratings yet

- Tablas CapacidadDocument27 pagesTablas CapacidadRENE CLIMACONo ratings yet

- No TL (CM) TKG: Column1Document6 pagesNo TL (CM) TKG: Column1Saide RodrigoNo ratings yet

- Parcial Braye Rsmith SalinasDocument6 pagesParcial Braye Rsmith SalinasAnonymous Se2tLarNo ratings yet

- 5.4 Current Ratio Current Assset / Current LiablitiesDocument8 pages5.4 Current Ratio Current Assset / Current LiablitiesAdarsh MandhaneNo ratings yet

- Shrinkage % vs. Exposure: LVDT Reading Strain (Micro)Document3 pagesShrinkage % vs. Exposure: LVDT Reading Strain (Micro)Bilal KhattabNo ratings yet

- Calculo VarDocument9 pagesCalculo VarmanuelodicioNo ratings yet

- Findings: Given DataDocument4 pagesFindings: Given DataGhaffar KhanNo ratings yet

- Defectos Week 26Document17 pagesDefectos Week 26Chris VegaNo ratings yet

- Sample HydrologyDocument2 pagesSample HydrologyHarukaNiLauNo ratings yet

- Simpang Ampar Data Cuaca BulananDocument9 pagesSimpang Ampar Data Cuaca BulananAnnisa PujiatiNo ratings yet

- Current Real MW August 2019 2Document1 pageCurrent Real MW August 2019 2Janica LobasNo ratings yet

- Ram U Osi 4Document4 pagesRam U Osi 4Aleksandar MaksimovicNo ratings yet

- Ram U Osi 4Document4 pagesRam U Osi 4Aleksandar MaksimovicNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web Billmumerfatooq886No ratings yet

- Assignment 2Document5 pagesAssignment 2Mr. AceNo ratings yet

- Software Exercise 1Document14 pagesSoftware Exercise 1MeraNo ratings yet

- Assignment 10Document6 pagesAssignment 10018-PRATYA PRATIM KUANRNo ratings yet

- Strains ProjectDocument1 pageStrains ProjectMaxiNo ratings yet

- UM6WG1 Inlet ManifoldDocument7 pagesUM6WG1 Inlet ManifoldBurik8No ratings yet

- Disso 2Document2 pagesDisso 2Susmita GhoshNo ratings yet

- Potraživanje 2023Document222 pagesPotraživanje 2023Jelena JovanovićNo ratings yet

- Pemerintah Provinsi Jawa Barat Dinas Pengelolaan Sumber Daya Air Balai Data Dan Informasi Sumber Daya AirDocument1 pagePemerintah Provinsi Jawa Barat Dinas Pengelolaan Sumber Daya Air Balai Data Dan Informasi Sumber Daya AirIqbal PuhendraNo ratings yet

- RMC Plant Calibration ReportDocument5 pagesRMC Plant Calibration ReportSurendra kumar50% (2)

- Aditya Excel For AgentDocument11 pagesAditya Excel For Agentkalyanisingh7002No ratings yet

- Plan Demisol ModificatDocument1 pagePlan Demisol ModificatSimonaNo ratings yet

- Data For Chem LabDocument4 pagesData For Chem Labmymahmed786No ratings yet

- Pii-2006600-Sf PurDocument2 pagesPii-2006600-Sf PurSayyid AzzamNo ratings yet

- Description: Tags: MaineDocument6 pagesDescription: Tags: Maineanon-497721No ratings yet

- Asset ManagementDocument4 pagesAsset Managementmanasisalvi08No ratings yet

- Vista Explodida Ck-200Document1 pageVista Explodida Ck-200Allison MouraNo ratings yet

- District Wise Target & Achievement Under AWP 2021-22Document6 pagesDistrict Wise Target & Achievement Under AWP 2021-22kartikNo ratings yet

- Republic of The Philippines Nueva Ecija University of Science and Technology College of Engineering Department of Electrical EngineeringDocument8 pagesRepublic of The Philippines Nueva Ecija University of Science and Technology College of Engineering Department of Electrical EngineeringAbdifatah mohamedNo ratings yet

- TX Loading CharactDocument8 pagesTX Loading CharactAbdifatah mohamedNo ratings yet

- Data Hujan Nariewati FebruariDocument1 pageData Hujan Nariewati FebruariIqbal PuhendraNo ratings yet

- Weight of Sieves Echantillon Nom MK2Document3 pagesWeight of Sieves Echantillon Nom MK2elNo ratings yet

- A Comparative Financial Analysis of Commercial Banks in NepalDocument122 pagesA Comparative Financial Analysis of Commercial Banks in NepalPushpa Shree PandeyNo ratings yet

- Financial Management PPT FinalDocument16 pagesFinancial Management PPT FinalGalinNo ratings yet

- Accounting and Finance Unit 6Document45 pagesAccounting and Finance Unit 6vasudhaNo ratings yet

- Hester Bank StatementDocument4 pagesHester Bank Statementjohn yorkNo ratings yet

- Financial Management R. KitDocument241 pagesFinancial Management R. KitDamaris100% (1)

- Midterm RFBTDocument25 pagesMidterm RFBTPamela PerezNo ratings yet

- 3rd Periodical Summative Test - FABM2Document3 pages3rd Periodical Summative Test - FABM2eddahamorlagosNo ratings yet

- Concrete Parade SDN BHD V Apex Equity Holdings BHD & OrsDocument32 pagesConcrete Parade SDN BHD V Apex Equity Holdings BHD & OrsAiman Zarith ZahrullailNo ratings yet

- SlidesGPT - AI PowerPoint Presentations, Powered by ChatGPT API 1Document12 pagesSlidesGPT - AI PowerPoint Presentations, Powered by ChatGPT API 1pranayvanjare200No ratings yet

- Lesson Four Financial Management Functions - 1Document5 pagesLesson Four Financial Management Functions - 1RafikNo ratings yet

- Ch. 6 - Wiley PowerPointDocument60 pagesCh. 6 - Wiley PowerPointazargalaxykustagiNo ratings yet

- Intermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadDocument109 pagesIntermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadEdna Nunez100% (18)

- Chapter 5Document25 pagesChapter 5Ephrem ChernetNo ratings yet

- Assessment (Journ Unadjusted)Document12 pagesAssessment (Journ Unadjusted)REYES, Hannah Marie, A. BSA-1BNo ratings yet

- Chapter 1 Textbook NotesDocument16 pagesChapter 1 Textbook NotesAhmed SohailNo ratings yet

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- Consolidation Question PaperDocument42 pagesConsolidation Question PaperNick VincikNo ratings yet

- Verka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - inDocument7 pagesVerka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - insharmaanita7761No ratings yet

- Ia Multiple ChoiceDocument3 pagesIa Multiple Choicecamilleescote562No ratings yet

- Nov2018 Paper1 Part2 OlevelDocument6 pagesNov2018 Paper1 Part2 OlevelAbid faisal AhmedNo ratings yet

- Sources of Long Term FinanceDocument308 pagesSources of Long Term FinanceVrinda BansalNo ratings yet

- SEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)Document3 pagesSEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)judy jace thaddeus AlejoNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- TECHNOR CaseDocument4 pagesTECHNOR CaseДенис ЗаславскийNo ratings yet

- Akuntansi ManajerialDocument5 pagesAkuntansi Manajerialdinda ardiyaniNo ratings yet

- Corporate Profitability 2022Document22 pagesCorporate Profitability 2022Valerie RogatskinaNo ratings yet

- Financial and Managerial Accounting 18Th Edition Williams Test Bank Full Chapter PDFDocument59 pagesFinancial and Managerial Accounting 18Th Edition Williams Test Bank Full Chapter PDFclitusarielbeehax100% (10)

- Answer of AptiDocument10 pagesAnswer of Aptimanishbhoir345No ratings yet

- Goodwill & PSR Final Revision SPCCDocument43 pagesGoodwill & PSR Final Revision SPCCHeer SirwaniNo ratings yet