Professional Documents

Culture Documents

HealthCompare PDF

Uploaded by

Hasmukh patelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HealthCompare PDF

Uploaded by

Hasmukh patelCopyright:

Available Formats

Mr.

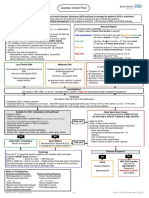

hasmukh patel 8128152287 Mumbai-400001 Self (36 Yrs) , Spouse (33 Yrs) , Son (3-6 Months Yrs) , Daughter (4 Yrs)

ManipalCigna ProHealth Protect Active Assure Diamond CARE-With NCB Super

Sum Insured ₹10,00,000 ₹10,00,000 ₹10,00,000

Premium ₹24,532 ₹24,735 ₹26,085

ADDON BENEFITS

Regular Medical Expenses ( OPD ) Maximum upto Rs.500 covered under "Health Maintenance Benefit" Not Available Covered (Optional)

Daily Hospitalization Allowance Rs.1000 per day max up to 30 Days (Optional) For SI up to 4 Lacs : Rs.500 per day up to max 5 days SI: 3 & 4 Lacs: Rs.500 per day upto max 5 days

for SI 2 - 4 lacs : 15,000 for SI 5 - 10 lacs : 20,000 for SI 15 - 40

lacs : 30,000 for SI 50 - 75 lacs : 40,000 for SI 1 Crore - 2 Crores :

Ayurveda/Homeopathy In-hospital treatment covered upto SI 50,000 Covered

Critical Illness Benefit Covered (Optional) Not Available Only on Hospitalization

Second E-Opinion On Critical Illness Available Available on 15 CI Available, Once a year on 15 CI

Bariatric Surgery Not Available Not Available Not Available

COVERAGE TERM

Pre-Existing Diseases After completion of 4 years of policy term After completion of 4 years of policy term After completion of 4 years of policy term

10% of SI every claim free years, subject to maximum 50% of SI

(Optional Cover - Super NCB is available on extra premium 60% of

SI for 1st and 2nd claim free year; 10% of SI for 3rd, 4th & 5th 60% of SI for 1st and 2nd claim free year; 10% of SI for 3rd, 4th &

Bonus On Claim-Free-Year 5% of SI irrespective of claim, subject to maximum 200% of SI claim free year, subject to maximum 150% of SI) 5th claim free year, subject to maximum 150% of SI

Multiple Times in a policy year for unrelated illness in addition to the Recharge Available - Once in a policy year for unrelated illness in

Reload of Sum Insured Sum Insured Upto 150% of SI, Max up to 50 Lacs addition to the Sum Insured

(Optional) Recharge Available - UNLIMITED in a policy year for

Unlimited Restoration Covered (Optional) on paying extra premium unrelated illness in addtion to the Sum Insured

Day Care Treatments 540+ Day Care Treatments 586 Day Care Treatments 540+ Day Care Treatments

Mandatory Co-payment 20% of claim by customer if age is above 65 years Mandatory 20% Co-Payment : For age of entry at 61 yrs and above 20% of claims by customer; if age is above 60 years at first policy

Waiver Of Mandatory Co-payment Covered (Optional) Not Available Not Available

SI: 3 & 4 Lacs: upto Rs.50,000; SI: 5 - 10 Lacs: upto Rs.1,00,000;

SI: 15 - 40 Lacs: upto Rs.2,00,000; SI: 50 - 75 Lacs: upto

Organ Donor Coverage Covered Covered up to SI Rs.3,00,000

EMERGENCY COVERAGE

SI: 3 & 4 Lacs: upto Rs.1,500; SI: 5 - 10 Lacs: upto Rs.2,000; SI: 15

for SI 2 - 4 lacs : 1,500 for SI 5 - 10 lacs : 2,000 for SI 15 - 40 lacs : - 40 Lacs: upto Rs.2,500; SI: 50 - 75 Lacs: upto Rs.3,000 per

Ambulance Charges Covered upto Rs.2,000 2,500 for SI 50 - 75 lacs : 3,000 for SI 1 Crore - 2 Crores : 5,000 hospitalisation

Only for 12 Critical Illness (as mentioned in policy wordings) SI: 50,

Worldwide Emergency Available, Once in a policy Year Available as Emergency Assistance Services only 60 & 75 Lacs

Air Ambulance Not Available Available as Emergency Assistance Services only Covered (Optional on Extra premium)

HEALTH MAINTENANCE PROGRAM

Health Checkup Available after 3 years Once every year; starting first year Once every year

HOSPITALISATION CARE

For SI up to 5.5 Lacs : Single Private Room; For SI 7.5 Lacs and for SI 2 - 4 lacs : 1% of SI per day; for SI 5 : Single Private A/C

Hospital Room Eligibility Above : Any Room Category except Suite or higher category Room; for SI 7 lacs and above : No Sublimit (Any Room) SI: 4 Lacs: 1% of SI per Day; SI: 5-75 Lacs: Single Private Room

Pre-Hospitalization Medical Expenses 60 days 30 days 30 days

Post-Hospitalization Medical Expenses 90 days 60 days 60 days

for SI 2 - 4 lacs : 2% of SI per day; for SI 5 lacs and above : Up to

ICU Charges No Sublimits SI SI:3 & 4 Lacs: 2% of SI; 5 Lacs & above: No Limit

Domiciliary(Home) Hospitalisation No Sublimits Up to 10% of SI 10% of SI covered for treatment exceeding 3 days

INFORMATION

Waiting Period 30 Days from Policy Issuance Date 30 Days from Policy Issuance Date 30 Days from Policy Issuance Date

Pre-Medical Checkup (Age) 55 years and above 50 years and above or 25 lacs & above SI 61 years and above or 50 lacs & above SI

MATERNITY COVERAGE

Maternity Expenses Not Available Not Available Covered for SI 50 Lacs and above

New Born Baby Expenses Not Available Not Available Not Available

Vaccination Expenses Not Available Not Available Not Available

Note : This feature comparison is indicative please refer to policy wording for proper understanding

You might also like

- HealthCompare PDFDocument1 pageHealthCompare PDFHasmukh patelNo ratings yet

- Health CompareDocument1 pageHealth CompareHasmukh patelNo ratings yet

- Activ Care PBTDocument4 pagesActiv Care PBTAnkita KalaniNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- PolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayDocument3 pagesPolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayAshish PatelNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2arijit mukhkerjeeNo ratings yet

- Annual Premium: Apollo Munich Tata Aig Star HealthDocument2 pagesAnnual Premium: Apollo Munich Tata Aig Star HealththirupremaNo ratings yet

- L2-Care Global-1Document18 pagesL2-Care Global-1Become CreatorNo ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- ProHealth Accordion NewDocument8 pagesProHealth Accordion Newgouravbhatia200189No ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- N MP Brochure NewDocument4 pagesN MP Brochure Newraj27385No ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- Virtusa Policy Benefit1Document1 pageVirtusa Policy Benefit1Venkatesh KumarNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2UserNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- Digit BrochureDocument24 pagesDigit Brochureinsurance advisorNo ratings yet

- FHO One Pager Version 1.0 Oct 2020Document2 pagesFHO One Pager Version 1.0 Oct 2020Darsh TalwadiaNo ratings yet

- Care Advantage & Protect Plus BrochureDocument4 pagesCare Advantage & Protect Plus BrochureAnushka UpadhyayNo ratings yet

- Short Walks Big Benefits: Optima Restore With Stay Active BenefitDocument8 pagesShort Walks Big Benefits: Optima Restore With Stay Active Benefitrohit22221No ratings yet

- FHO - One Pager - Version 1.0 - Oct 2020Document2 pagesFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- View Benefit DetailsDocument2 pagesView Benefit DetailsSeema Bande JainNo ratings yet

- HFFP-2015 Revised ProspectusDocument25 pagesHFFP-2015 Revised Prospectuspooja singhalNo ratings yet

- Optima Restore Brochure 1Document8 pagesOptima Restore Brochure 1abhi_1mehrotaNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Bagic Apollo MunichDocument3 pagesBagic Apollo Munichrajkamal rNo ratings yet

- Care Senior BrochureDocument4 pagesCare Senior Brochuresatishch27No ratings yet

- Family Health Optima Insurance PlanDocument1 pageFamily Health Optima Insurance PlanChetan tripathiNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Health Insurance.Document26 pagesHealth Insurance.Meenu SinghNo ratings yet

- Apollo Munich Health OnDocument5 pagesApollo Munich Health OnKeshu sambitNo ratings yet

- CHI - One Pager - Version 1.3 - September 2021Document1 pageCHI - One Pager - Version 1.3 - September 2021ShihbNo ratings yet

- Youngstar - One Pager PDFDocument1 pageYoungstar - One Pager PDFRickyNo ratings yet

- Copression Between Comprhensive & Care PDFDocument1 pageCopression Between Comprhensive & Care PDFsatishlad1288No ratings yet

- HEALTH INFINITY Plan ONE PagerDocument3 pagesHEALTH INFINITY Plan ONE PagerVikas SharmaNo ratings yet

- L2 - Care BasicDocument21 pagesL2 - Care Basicsenthil.parkcoll535No ratings yet

- Edelweiss BrochureDocument6 pagesEdelweiss BrochureHLSNo ratings yet

- L2-Care Smart SelectDocument12 pagesL2-Care Smart SelectDeepak BansodeNo ratings yet

- Apollo Munich Optima Restore - Policy BrochureDocument8 pagesApollo Munich Optima Restore - Policy BrochureSivaramkrishnanNo ratings yet

- Benefits ManualDocument34 pagesBenefits ManualRupayan DuttaNo ratings yet

- Care ClassicDocument4 pagesCare ClassicrahulbihaniNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- One Pager For YOUNG STARDocument1 pageOne Pager For YOUNG STARVivek Sharma100% (1)

- Mr. Manjunath & Family: Features At-A-GlanceDocument3 pagesMr. Manjunath & Family: Features At-A-GlanceRavindra SimpiNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- CignaTTK ProHealth Vs ICICI Lombard CHIDocument9 pagesCignaTTK ProHealth Vs ICICI Lombard CHImaakabhawan26No ratings yet

- Youngstar - One PagerDocument1 pageYoungstar - One Pagersahilbajaj12No ratings yet

- Benefits Silver GoldDocument4 pagesBenefits Silver GoldMitra LalNo ratings yet

- FHO - One Pager - Version 1.1 - MayDocument2 pagesFHO - One Pager - Version 1.1 - MaySakshi Jain50% (2)

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Optima Super Secure BrochureDocument20 pagesOptima Super Secure Brochurekamble.samiksha1309No ratings yet

- Arogya Sanjeevani - One PagerDocument1 pageArogya Sanjeevani - One Pagernaval730107No ratings yet

- Arogya Sanjeevani - One PagerDocument1 pageArogya Sanjeevani - One Pagernaval7301070% (1)

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- 360 Degree Postural Medicine and Diabetes Type 1 & 2From Everand360 Degree Postural Medicine and Diabetes Type 1 & 2No ratings yet

- Gender Support Plan PDFDocument4 pagesGender Support Plan PDFGender SpectrumNo ratings yet

- Brigada Narrative Report 2021Document2 pagesBrigada Narrative Report 2021KIARA CAMILLE RIBANONo ratings yet

- 7 Ways To Treat Chronic Back Pain Without Surgery - Johns Hopkins MedicineDocument3 pages7 Ways To Treat Chronic Back Pain Without Surgery - Johns Hopkins MedicinechhavishNo ratings yet

- Bing Kls 8Document5 pagesBing Kls 8Soni DwinugrohoNo ratings yet

- 12.1 Guided ReadingDocument2 pages12.1 Guided ReadingGrant HasletonNo ratings yet

- PST Inspection Report MS Leisure Company IncDocument6 pagesPST Inspection Report MS Leisure Company IncChris Gothner100% (1)

- Semidetailed Lesson Plan (: Effects of Online Gaming On Mental Health)Document9 pagesSemidetailed Lesson Plan (: Effects of Online Gaming On Mental Health)NALICA, Kristale Nicole A.No ratings yet

- SK San Ramon Accomplishment Report 2021-LydoDocument13 pagesSK San Ramon Accomplishment Report 2021-Lydoherbert.villanuevaNo ratings yet

- Fetal DevelopmentDocument15 pagesFetal DevelopmentOmar HammadNo ratings yet

- 299 - Cardiovascular Collapse, Cardiac Arrest, and Sudden Cardiac DeathDocument10 pages299 - Cardiovascular Collapse, Cardiac Arrest, and Sudden Cardiac Death4g8psyr2qfNo ratings yet

- 6-Year-Follo Up. 3 Steps Techniques. Francesca Valati-1 PDFDocument25 pages6-Year-Follo Up. 3 Steps Techniques. Francesca Valati-1 PDFAdriana CoronadoNo ratings yet

- Chest PainDocument5 pagesChest PainAndrei MurariuNo ratings yet

- Special Power of Attorney Chavez 1Document2 pagesSpecial Power of Attorney Chavez 1Atty. R. PerezNo ratings yet

- PreviewpdfDocument88 pagesPreviewpdfHeidy Montes Galarza100% (1)

- CPAP Vs NIV BiPAPDocument8 pagesCPAP Vs NIV BiPAPcharlyn206No ratings yet

- Uterine Fibroid-IzzatDocument20 pagesUterine Fibroid-IzzatcopperNo ratings yet

- Whats New in GINA 2021 FinalDocument47 pagesWhats New in GINA 2021 FinalHeriestian eriesNo ratings yet

- Ceylon Beverage Can (PVT) LTD: Certificate of AnalysisDocument2 pagesCeylon Beverage Can (PVT) LTD: Certificate of AnalysisCssNo ratings yet

- Specific Groups EssayDocument1 pageSpecific Groups Essaysunilvajshi2873No ratings yet

- 2019-20-ELE-Field Technician Air Conditioning-Q3102-L4-Class-11-12Document34 pages2019-20-ELE-Field Technician Air Conditioning-Q3102-L4-Class-11-12Parag ShrivastavaNo ratings yet

- CHCHCS001 Home Community SupportDocument32 pagesCHCHCS001 Home Community SupportSandip Paudel0% (1)

- UntitledDocument28 pagesUntitledapi-248038645No ratings yet

- Fear of Public SpeakingDocument11 pagesFear of Public SpeakingMustanser GhiasNo ratings yet

- Pre-Birth Waiting Rooms - Proposal TemplateDocument8 pagesPre-Birth Waiting Rooms - Proposal TemplateKisslay AnandNo ratings yet

- The Ultimate Push Pull Legs System - 6xDocument241 pagesThe Ultimate Push Pull Legs System - 6xYash SachdevaNo ratings yet

- Group - 10 - Annotated Bibliography (Worksheet) 1Document16 pagesGroup - 10 - Annotated Bibliography (Worksheet) 1Hazel Ann VitugNo ratings yet

- Digital Workflow For CAD-CAM Custom Abutments of Immediate Implants Based On Natural Emergence Profile of The Tooth To Be ExtractedDocument23 pagesDigital Workflow For CAD-CAM Custom Abutments of Immediate Implants Based On Natural Emergence Profile of The Tooth To Be ExtractedRAEDNo ratings yet

- Crying-And-Feeding-Issues - CCG LeafletDocument16 pagesCrying-And-Feeding-Issues - CCG LeafletWaleed AsadNo ratings yet

- Queenie Amigale K To 12 Nail Care Learning ModuleDocument126 pagesQueenie Amigale K To 12 Nail Care Learning Modulemagtakaanamarie100% (2)

- Social Immersive Learning (Distribution V1)Document15 pagesSocial Immersive Learning (Distribution V1)Aman ChaudharyNo ratings yet