Professional Documents

Culture Documents

Comparison Tata Aig Medicare Vs Niva Bupa

Uploaded by

Tikekar ShubhamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison Tata Aig Medicare Vs Niva Bupa

Uploaded by

Tikekar ShubhamCopyright:

Available Formats

COMPARISON TATA AIG MEDICARE VS NIVA BUPA( Max Bupa)

Features TATA AIG MEDICARE PREMIER TATA AIG MEDICARE NIVA BUPA REASSUARE

Sum insured Options 5 Lac to 50 Lac 3 Lac to 20 Lac 3 Lac to 1 Cr

Max Entry Age 65 Yrs 65 Yrs

Policy tenure 1/2/3 Years 1/2/3 Years 1 YR

AYUSH BENEFIT COVERED COVERED COVERED

AMBULANCE COVER Rs. 5000/- per hospitalization Rs. 3000/- per hospitalization Covered upto 2,000 per hospitalization

Pre- Hospitalization Expense Upto 60 days Upto 60 days

Post- hospitalization Expense Upto 90 days Upto 180 days

IN PATIENT TREATMENT

Day Care Procedures

Upto Sum Insured

Organ Donar

Domicialary Treatment Upto Sum Insured

Global Cover NA

IN PATIENT TREATMENT - Dental NA

Restore Benefit UNLIMITED

Upto 1% previous of Sum Insured; Max cappings - 500 FOR 1 Lac SI, 5000 for individual policy,

Health Checkup

max. Rs.10,000 10000 for Family policy

Rs. 20000/- per policy year, for immediate family member of Insured, on incurring travel expenses-round trip,

Compassionate travel economy class air ticket, or first-class railway ticket to meet the insured who is hospitalized for 5 or more NA

consecutive days; Over and above SI

Consumables Benefit Covered consumables items which are related to lnsured's Treatment COVERED

Cumulative Bonus 50% of SI, up to max 100%, on every claim-free year 50% of SI, up to max 100%, on every claim-free year

Accidental Death Benefit 100% of Base SI if Insured meets with an accident-Inbuilt Available as ADD On ADD- ON

Bariatric Surgery Covered up to SI with reasonable and customary expenses.

Second Opinion (once in a policy year) if Insured person suffers from listed illnesses mentioned under Second

Second Opinion

Opinion

NA

Cover Max Rs. 5000/- on taking anti-rabies & typhoid vaccination from day one.

Vaccination Cover

For HPV & Hepatitis B-Vaccination after two years waiting period; Over and above SI

Hearing Aid Will pay 50% of actual cost OR Rs. 10,000/- every third Year; Over and above SI

Daily Cash for Chossing Shared accomodation Up to 0.25% of Base SI or max up to Rs. 2000/- per day, with no max days limit; Over and above SI ADD- ON

Daily Cash For accompanying an insured child Up to 0.25% of Base SI or max up to Rs. 2000/- per day, with no max days limit; Over and above SI ADD- ON

Global Cover Covered up to Base SI and Available Cumulative Bonus NA

Boy : Up to Rs. 50,000; Girl: Up to Rs. 60,000;

Maternity Cover

with 4 years Waiting Period

New Born Bsaby Cover Covered up to Rs. 10,000

First Year Vaccination for new-born child;

First year Vaccination

Boy : Up to Rs. 10,000; Girl: Up to Rs. 15,000

1% of SI, if Insured hospitalized due to diseases/illness/ injury

Prolonged Hospitalization

for more than 10 consecutive days; Over and above SI

High End Diagnostics

Covered up to Rs. 25,000/- per policy, year on listed

High-end Diagnostic test; Over and above SI

NA NA

Coverage of Consultations & Pharmacy, up to Rs. 5000/- per

OPD Treatment

policy year, after two years Waiting Period; Over and above SI

Covered up to Rs. 10,000/- after two years Waiting Period;

OPD Treatment - Dental

Over and above SI

Cashless claim: Covered up to sum insured Reimbursement

Emergency Air Ambulance Covered up to 5 Lakhs, Over and above SI

claim: Covered up to 2.5 Lacs

You might also like

- MediCare One Pager-1Document2 pagesMediCare One Pager-1Himanshu AroraNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Comprehensive Health Insurance PlanDocument21 pagesComprehensive Health Insurance Plansenthil.parkcoll535No ratings yet

- Copression Between Comprhensive & Care PDFDocument1 pageCopression Between Comprhensive & Care PDFsatishlad1288No ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- HS 360 One PagerDocument4 pagesHS 360 One PagerpratheepNo ratings yet

- ReAssure_SSDocument2 pagesReAssure_SSAmit Kumar KandiNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Annual Premium: Apollo Munich Tata Aig Star HealthDocument2 pagesAnnual Premium: Apollo Munich Tata Aig Star HealththirupremaNo ratings yet

- SENIOR FIRST_0 Co Payment_BrDocument2 pagesSENIOR FIRST_0 Co Payment_BriamshonalidixitNo ratings yet

- Optima Restore Brochure 1Document8 pagesOptima Restore Brochure 1abhi_1mehrotaNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- COMPLETE HEALTH INSURANCE WITH COVID COVERAGEDocument2 pagesCOMPLETE HEALTH INSURANCE WITH COVID COVERAGEPRADEEP GUPTANo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Apollo Munich VS Icici LombardDocument12 pagesApollo Munich VS Icici LombardNavendu ShekharNo ratings yet

- Happy Family Floater - Policy NewDocument45 pagesHappy Family Floater - Policy Newpooja singhalNo ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- Bagic Apollo MunichDocument3 pagesBagic Apollo Munichrajkamal rNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Optima Restore plan rewards walkingDocument8 pagesOptima Restore plan rewards walkingrohit22221No ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- PolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayDocument3 pagesPolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayAshish PatelNo ratings yet

- Niva - SENIOR FIRST - SS - v3Document2 pagesNiva - SENIOR FIRST - SS - v3scrikanth03565No ratings yet

- Niva PB ReAssure SS v5Document2 pagesNiva PB ReAssure SS v5samdsozaNo ratings yet

- Care Advantage & Protect Plus BrochureDocument4 pagesCare Advantage & Protect Plus BrochureAnushka UpadhyayNo ratings yet

- Care Senior BrochureDocument4 pagesCare Senior Brochuresatishch27No ratings yet

- Comparision 15-01-2024Document3 pagesComparision 15-01-2024mohammadshakir498No ratings yet

- AIA Travel PA Plus Brochure 030123Document21 pagesAIA Travel PA Plus Brochure 030123Navin IndranNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Health insurance comparison for Mr. PatelDocument1 pageHealth insurance comparison for Mr. PatelHasmukh patelNo ratings yet

- Royal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Document2 pagesRoyal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Abhijit MohantyNo ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- Balsam Leaflet en PDFDocument8 pagesBalsam Leaflet en PDFEng. Waleed AhmedNo ratings yet

- A plan for every health needDocument8 pagesA plan for every health needgouravbhatia200189No ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Health QuotationDocument4 pagesHealth QuotationKasturi SankarNo ratings yet

- GMC Benefit Manual - 22Document28 pagesGMC Benefit Manual - 22SwaNo ratings yet

- GMC Policy Benefits ChartDocument3 pagesGMC Policy Benefits ChartpankajgujjarNo ratings yet

- Star health comprehensive plan summaryDocument26 pagesStar health comprehensive plan summaryMeenu SinghNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- Leaflet PDFDocument9 pagesLeaflet PDFVyshak SamakNo ratings yet

- Group Health Insurance ..Document9 pagesGroup Health Insurance ..Amrita PatraNo ratings yet

- 202301.01 TNC Zomato GMC (New Plan With Dependents) RenewalDocument23 pages202301.01 TNC Zomato GMC (New Plan With Dependents) Renewalajptl92No ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2UserNo ratings yet

- Apollo Munich Optima Restore - Policy BrochureDocument8 pagesApollo Munich Optima Restore - Policy BrochureSivaramkrishnanNo ratings yet

- L2-Care Global-1Document18 pagesL2-Care Global-1Become CreatorNo ratings yet

- Key health insurance plan features comparisonDocument12 pagesKey health insurance plan features comparisonSomil GuptaNo ratings yet

- HealthCompare PDFDocument1 pageHealthCompare PDFHasmukh patelNo ratings yet

- Care Freedom For DiabtiesDocument25 pagesCare Freedom For DiabtiesAgile ServicesNo ratings yet

- Compare Silver and Gold Health Insurance Plans Under 40 CharactersDocument4 pagesCompare Silver and Gold Health Insurance Plans Under 40 CharactersMitra LalNo ratings yet

- Health CompareDocument1 pageHealth CompareHasmukh patelNo ratings yet

- L2-Care Smart SelectDocument12 pagesL2-Care Smart SelectDeepak BansodeNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Health & Dental Handout JUN17Document2 pagesHealth & Dental Handout JUN17Darius YangNo ratings yet

- Medical Inssurance AA+BenefitsDocument2 pagesMedical Inssurance AA+BenefitsCarlo MeNo ratings yet

- 360 Degree Postural Medicine and Diabetes Type 1 & 2From Everand360 Degree Postural Medicine and Diabetes Type 1 & 2No ratings yet

- 19th CenturyDocument25 pages19th CenturynonononowayNo ratings yet

- Jean Anderson For Vermilion MayorDocument2 pagesJean Anderson For Vermilion MayorThe Morning JournalNo ratings yet

- Britains Anthrax Island Known Agents of Biological WarfareDocument237 pagesBritains Anthrax Island Known Agents of Biological WarfareAnonymous 594vnRuMONo ratings yet

- Mines Vocational Training Manual DraftDocument169 pagesMines Vocational Training Manual DraftHimangshu Dutta100% (1)

- Case LawDocument15 pagesCase LawAshutosh PrasadNo ratings yet

- Confirmed Kolkata to Delhi Flight TicketDocument2 pagesConfirmed Kolkata to Delhi Flight Ticketarpita bhattacharyyaNo ratings yet

- The Lakeville Journal - March 5, 2020Document12 pagesThe Lakeville Journal - March 5, 2020Lakeville JournalNo ratings yet

- Emergency Management Disaster Preparedness Manager in Phoenix AZ Resume Don BrazieDocument2 pagesEmergency Management Disaster Preparedness Manager in Phoenix AZ Resume Don BrazieDonBrazieNo ratings yet

- The Cambridge Law Journal Volume 7 Issue 02Document6 pagesThe Cambridge Law Journal Volume 7 Issue 02KkkNo ratings yet

- PDF Alfiler 1999 The Philippine Administrative SystemDocument5 pagesPDF Alfiler 1999 The Philippine Administrative SystemRenz Isidoro100% (1)

- Policy MemoDocument7 pagesPolicy Memoapi-407553737No ratings yet

- Chapter I Socio-Demographic Profile of IDocument77 pagesChapter I Socio-Demographic Profile of IShirley Dela Cueva GolezNo ratings yet

- Et Seq., Et Seq., Et Seq.Document31 pagesEt Seq., Et Seq., Et Seq.Abc FghNo ratings yet

- A BILL For A LAW (Lagos State Health Management Agency)Document26 pagesA BILL For A LAW (Lagos State Health Management Agency)rainmaker1978No ratings yet

- 49 CFR 172 Subpart H PDFDocument5 pages49 CFR 172 Subpart H PDFAlvaro Rojas AnzolaNo ratings yet

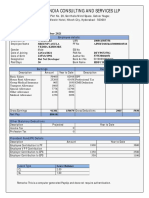

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Conditions of SecondmentDocument3 pagesConditions of SecondmentHenri Severien JuniorNo ratings yet

- As 4607-1999 Personal Response SystemsDocument8 pagesAs 4607-1999 Personal Response SystemsSAI Global - APACNo ratings yet

- Parivar Paramarsh Kendra EnglishDocument43 pagesParivar Paramarsh Kendra Englishdabster7000100% (1)

- Briefer: Department of The Interior and Local GovernmentDocument2 pagesBriefer: Department of The Interior and Local GovernmentBembol MirasolNo ratings yet

- Hilti Screws Drywall SubmittalDocument6 pagesHilti Screws Drywall SubmittalanhnguyenhaiNo ratings yet

- FM 8-230 Medical Specialist PDFDocument720 pagesFM 8-230 Medical Specialist PDFJames100% (1)

- National Policy Forum - NSW CandidatesDocument11 pagesNational Policy Forum - NSW CandidatesNSW LaborNo ratings yet

- Guide To The Workplace Safety and Health (WSHO) Regulations 2007Document4 pagesGuide To The Workplace Safety and Health (WSHO) Regulations 2007Htin Lin AungNo ratings yet

- USDA Profile of SNAP Program Highlights Nutrition, Flexibility, IntegrityDocument48 pagesUSDA Profile of SNAP Program Highlights Nutrition, Flexibility, IntegrityesjacobsenNo ratings yet

- National Human Resources For Health Master Plan 2020-2040 (Updated As of 12 Nov 2021)Document318 pagesNational Human Resources For Health Master Plan 2020-2040 (Updated As of 12 Nov 2021)Renard JaenNo ratings yet

- FIDIC Red and Pink BookDocument6 pagesFIDIC Red and Pink Bookhmd rasika100% (2)

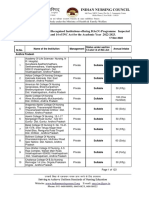

- List of State Nursing Council Recognised Institutions in Andhra PradeshDocument123 pagesList of State Nursing Council Recognised Institutions in Andhra PradeshShubham PushpNo ratings yet

- Wagga City Council Annual Report 2017-18Document104 pagesWagga City Council Annual Report 2017-18Toby VueNo ratings yet

- WWW HSSC Gov inDocument66 pagesWWW HSSC Gov inlifeinnocent172No ratings yet