Professional Documents

Culture Documents

ReAssure SS

Uploaded by

Amit Kumar KandiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ReAssure SS

Uploaded by

Amit Kumar KandiCopyright:

Available Formats

PRESENTING

Keeps giving you more!

E

M PLET CE

CO URAN

SS

REA WITH

V ID-19 E˜

CO ERAG

COV

ReAssurance at every step

ReAssure# - ReAssure Benefit will trigger after Safeguard features$$ – Go truly

the 1st claim itself. It is unlimited. Each claim will cashless with coverage even for

be up to the base sum insured. non-payable items like gloves etc.^^

Live healthy benefit – get up to 30%

Booster benefit** - Doubles the sum discount on renewal premium basis

insured in 2 claim free years step count in Niva Bupa Health App

Health check-up – starting from day 1

3 30 min. cashless claims processing$

For your family’s health insurance, Call: 1860-500-8888 or visit www.nivabupa.com

Product Name: ReAssure | Product UIN: NBHHLIP23107V022223

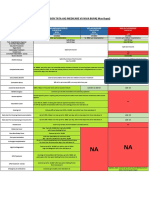

Product Benefit Table (all limits in ` unless defined as percentage)

Base sum insured 3 Lacs, 4 Lacs, 5 Lacs, 7.5 Lacs, 10 Lacs, 12.5 Lacs, 15 Lacs, 20 Lacs, 25 Lacs, 50 Lacs, 75 Lacs, 1 Crore

Inpatient care (without any

Home care treatment

room rent capping)

Pre and post

Benefits covered upto hospitalization

sum insured Day care treatment Domiciliary hospitalization expenses - 60 and 180 days

respectively

Alternative treatments Living organ donor transplant

Unlimited reinstatement of sum insured applicable for any illness or anyone insured (Single claim

ReAssure

under this benefit will be payable up to base sum insured)

In case of claim free year, increase of 50% of base sum insured in a policy year; maximum up to

Booster benefit

100% (In case of a claim, reduction of accumulated Cumulative Bonus by 50% of Base Sum Insured)

Annual (From Day 1); For defined list of tests; up to 500 for every 1 Lac sum insured

Health check-up

(Individual policy: maximum 5,000 per Insured; Family Floater policy: maximum 10,000 per policy)

Collect health points by taking steps counted on our Niva Bupa Health App and get discount

Live healthy benefit(1) up tp 30% on renewal premium

Modern treatments Covered up to sum insured with sub-limit of 1 Lac on few robotic surgeries

Second medical opinion Once for any condition for which hospitalization is triggered

Emergency ambulance Covered upto 2,000 per hospitalization

Cashless claim: Covered up to sum insured

Air ambulance

Reimbursement claim: Covered up to 2.5 Lacs

Shared accommodation Up to 15 Lacs base sum insured: 800 per day (maximum 4,800)

cash benefit Above 15 Lacs base sum insured: 1,000 per day; (maximum 6,000)

Optional Benefits

a. Claim safeguard: Non-payable items paid up to sum insured

Safeguard b. Booster benefit safeguard: No impact on Booster benefit if claims in a policy year is up to 50,000

c. Sum insured safeguard: CPI (Consumer Price Index) linked increase in base sum insured

Up to 5 Lacs base sum insured: 1,000/day

Hospital cash(2) 7.5 Lacs to 15 Lacs base sum insured: 2,000/day

Above 15 Lacs base sum insured: 4,000/day

Personal accident cover

(for insured aged 18 5 times of base sum insured; subject to maximum of 1 Crore

years & above)

Eligible insured person for this benefit will be: a. All members except son/daughter under a Family Floater policy

(1)

b. Any member of age at least 18 years under an Individual policy

Hospital cash - Minimum 48 hrs of continuous hospitalization required. Maximum coverage offered for 30 days/policy

(2)

year/insured person. Payment made from day one subject to hospitalization claim being admissible.

Disclaimer: Insurance is a subject matter of solicitation. Niva Bupa Health Insurance Company Limited (formerly known as Max Bupa Health Insurance Company

Limited) (IRDAI Registration No. 145). ‘Bupa’ and ‘HEARTBEAT’ logo are registered trademarks of their respective owners and are being used by Niva Bupa

Health Insurance Company Limited under license. $Niva Bupa processes pre-authorisation requests within 30 minutes for all active policies, subject to receiving

all documents and information(s) upto Niva Bupa’s satisfaction. The above commitment does not include pre-authorisation settlement at the time of discharge

or system outage. #Single claim under this benefit will be payable up to base sum insured. $$Safeguard is an optional benefit and is available on payment of extra

premium. ^^As per the list I under Annexure II of policy Terms and conditions. **In case of a claim, Booster Benefit will be reduced by 50% of Sum Insured.

~ReAssure plan covers COVID-19 related hospitalization. For more details on risk factors, terms and conditions please read the sales brochure carefully before

concluding a sale. Registered Office Address: C-98, First Floor, Lajpat Nagar, Part 1, New Delhi-110024, Customer Helpline No.: 1860-500-8888. Fax: +91 11

41743397. Website: www.nivabupa.com. CIN: U66000DL2008PLC182918, Product Name: ReAssure. Product UIN: NBHHLIP23107V022223. UIN:

NB/SS/CA/2022-23/424.

You might also like

- Sample 1 PDFDocument45 pagesSample 1 PDFChicagoCitizens EmpowermentGroupNo ratings yet

- A To Z of Shipping TermsDocument82 pagesA To Z of Shipping Termsmanayani52No ratings yet

- Philippine American General Insurance V PKS ShippingDocument2 pagesPhilippine American General Insurance V PKS Shippinganj26a50% (2)

- Midterm ExamDocument3 pagesMidterm Examfitz garlitosNo ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- HDFC Bank Deposit Online Receipt FormatDocument1 pageHDFC Bank Deposit Online Receipt FormatAjay Ajay67% (6)

- Schedule CDocument22 pagesSchedule Cwangrui67% (3)

- 1990 Commercial Bar Exam - CatindigDocument6 pages1990 Commercial Bar Exam - CatindigmailguzmanNo ratings yet

- General Insurance Black Book ProjectDocument45 pagesGeneral Insurance Black Book Projectprasad pawle50% (10)

- Px40 Error Codes InOrder2Document28 pagesPx40 Error Codes InOrder2nassarki100% (2)

- SFBC 2005-Conditions of Building Contract (W Q)Document114 pagesSFBC 2005-Conditions of Building Contract (W Q)Chloe Lam100% (1)

- Choa Tiek Seng Vs CADocument2 pagesChoa Tiek Seng Vs CAReg Yu0% (1)

- 7 Day Indian Keto Diet Plan PDF For Weight Loss PDFDocument33 pages7 Day Indian Keto Diet Plan PDF For Weight Loss PDFMohsin KhanNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3PRADEEP GUPTANo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Niva PB ReAssure SS v5Document2 pagesNiva PB ReAssure SS v5samdsozaNo ratings yet

- Health Companion V2022 SSDocument2 pagesHealth Companion V2022 SSKarthik ViswanathanNo ratings yet

- Niva - SENIOR FIRST - SS - v3Document2 pagesNiva - SENIOR FIRST - SS - v3scrikanth03565No ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2UserNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- Care Senior BrochureDocument4 pagesCare Senior Brochuresatishch27No ratings yet

- ICAI HS360 WithoutDuductibleDocument52 pagesICAI HS360 WithoutDuductiblepadiNo ratings yet

- Health PulseDocument2 pagesHealth PulseAcma Renu SinghaniaNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Health - Pulse Single SheeterDocument2 pagesHealth - Pulse Single SheeterAnupam JainNo ratings yet

- Arogya Rakshak WebDocument44 pagesArogya Rakshak WebkarlNo ratings yet

- Arogya Rakshak - WebDocument44 pagesArogya Rakshak - WebSreenath GopalakrishnanNo ratings yet

- SENIOR FIRST - 0 Co Payment - BRDocument2 pagesSENIOR FIRST - 0 Co Payment - BRiamshonalidixitNo ratings yet

- Short Walks Big Benefits: Optima Restore With Stay Active BenefitDocument8 pagesShort Walks Big Benefits: Optima Restore With Stay Active Benefitrohit22221No ratings yet

- Complete Health Insurance-Brochure PDFDocument16 pagesComplete Health Insurance-Brochure PDFRishi AroraNo ratings yet

- CompleteHealthInsuranceBrochure PDFDocument16 pagesCompleteHealthInsuranceBrochure PDFRishi AroraNo ratings yet

- Complete Health Insurance (Health Elite)Document21 pagesComplete Health Insurance (Health Elite)Chetan RandhawaNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document6 pagesReassurance at Every Step: Keeps Giving You More!Anonymous RRTE5WbNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document33 pagesReassurance at Every Step: Keeps Giving You More!ansanthoshanNo ratings yet

- Health QuotationDocument4 pagesHealth QuotationKasturi SankarNo ratings yet

- Brochure With PolicyDocument2 pagesBrochure With Policysanthoshreddyb986No ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- Complete Health Insurance (Health Elite) 1Document1 pageComplete Health Insurance (Health Elite) 1arajendermcomNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2arijit mukhkerjeeNo ratings yet

- Apollo Munich Health OnDocument5 pagesApollo Munich Health OnKeshu sambitNo ratings yet

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- Complete Health Insurance BrochureDocument21 pagesComplete Health Insurance BrochurePankaj GuptaNo ratings yet

- Optima Restore Brochure 1Document8 pagesOptima Restore Brochure 1abhi_1mehrotaNo ratings yet

- Family Health Optima Insurance Plan NewDocument8 pagesFamily Health Optima Insurance Plan NewNeeraj NemaNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- A Heart Surgery Will Not Stop You From Getting A Health InsuranceDocument8 pagesA Heart Surgery Will Not Stop You From Getting A Health Insurancepriyanka shahNo ratings yet

- Care HeartDocument8 pagesCare HeartrahulbihaniNo ratings yet

- HFF-2015 Pol PDFDocument31 pagesHFF-2015 Pol PDFAmit RajNo ratings yet

- L2-Care Global-1Document18 pagesL2-Care Global-1Become CreatorNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- Arogya Sanjeevani SingleSheeterDocument2 pagesArogya Sanjeevani SingleSheeterKali Prasad MohantyNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- Key Information SheetDocument16 pagesKey Information SheetSwati ShuklaNo ratings yet

- POS Family Health Optima Insurance Plan PDFDocument5 pagesPOS Family Health Optima Insurance Plan PDFDeb Kumar BeraNo ratings yet

- Aspire BrochureDocument3 pagesAspire BrochureUJJAL KUMAR MANNANo ratings yet

- Happy Family Floater - Policy NewDocument45 pagesHappy Family Floater - Policy Newpooja singhalNo ratings yet

- Optima Restore BrochureDocument6 pagesOptima Restore BrochureSubashiniNo ratings yet

- Max Bupa Health InsuranceDocument31 pagesMax Bupa Health InsuranceRAVI MYCALNo ratings yet

- Care Vs Star ComprehnsiveDocument2 pagesCare Vs Star ComprehnsiveAMMIT JAISWALNo ratings yet

- HS 360 One PagerDocument4 pagesHS 360 One PagerpratheepNo ratings yet

- Health-Booster BrochureDocument10 pagesHealth-Booster BrochureParasaram SrinivasNo ratings yet

- Bandhan Bank Health Plus Portability 050723Document2 pagesBandhan Bank Health Plus Portability 050723goelrajivgNo ratings yet

- Copy PrintedDocument5 pagesCopy Printedkiran BawadkarNo ratings yet

- Health Insurance 360 BaseDocument2 pagesHealth Insurance 360 BasepadiNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Leaflet PDFDocument9 pagesLeaflet PDFVyshak SamakNo ratings yet

- PGDPMDocument13 pagesPGDPMAmit Kumar KandiNo ratings yet

- Megger-Mjolner-600 Ds enDocument5 pagesMegger-Mjolner-600 Ds enAmit Kumar KandiNo ratings yet

- Cashback TNC EkitDocument49 pagesCashback TNC EkitParth MakwanaNo ratings yet

- PGDPMDocument13 pagesPGDPMAmit Kumar KandiNo ratings yet

- Galaxy S24ultra Bumpedup 6000 03apr24Document13 pagesGalaxy S24ultra Bumpedup 6000 03apr24Amit Kumar KandiNo ratings yet

- Faqs On ICICI Bank Announces Relief Package For Loans/ Credit FacilitiesDocument10 pagesFaqs On ICICI Bank Announces Relief Package For Loans/ Credit Facilitiesvamshi krishnaNo ratings yet

- SportsquotaodishafgfgfgfgDocument6 pagesSportsquotaodishafgfgfgfgHindustani OnlineNo ratings yet

- BMI Girl TableDocument7 pagesBMI Girl TableVienny Widhyanti RosaryaNo ratings yet

- GRAB DEALS Fest-Terms & Conditions: ValidityDocument2 pagesGRAB DEALS Fest-Terms & Conditions: ValidityAmit Kumar KandiNo ratings yet

- Welcome Benefit: Flipkart Voucher Worth Rs. 500: Detailed Terms and Condition For The Flipkart Vouchers Are As BelowDocument2 pagesWelcome Benefit: Flipkart Voucher Worth Rs. 500: Detailed Terms and Condition For The Flipkart Vouchers Are As BelowShashank JhajhariaNo ratings yet

- Railway Lounge ProgrammeDocument2 pagesRailway Lounge ProgrammeAmit Kumar KandiNo ratings yet

- Tips For Energy ConservationDocument22 pagesTips For Energy ConservationAnuragNo ratings yet

- Routh PDFDocument6 pagesRouth PDFChristinne HerreraNo ratings yet

- 55K760 User ManualDocument16 pages55K760 User ManualsCoRPion_trNo ratings yet

- DummyDocument1 pageDummyAmit Kumar KandiNo ratings yet

- Apex 100Document2 pagesApex 100Swarup NayakNo ratings yet

- ANSI Codes PDFDocument3 pagesANSI Codes PDFelectrical_1012000100% (2)

- Smi 128Document4 pagesSmi 128Amit Kumar KandiNo ratings yet

- Third Harmonic Monitoring PDFDocument6 pagesThird Harmonic Monitoring PDFSoham MukherjeeNo ratings yet

- L 42 Bonus 2020Document4 pagesL 42 Bonus 2020Amit Kumar KandiNo ratings yet

- Is2099 1986 PDFDocument38 pagesIs2099 1986 PDFAnthonyNo ratings yet

- Live Tank Circuit Breakers: Primary PlusDocument20 pagesLive Tank Circuit Breakers: Primary PlusXuân Huy Nguyễn0% (1)

- Three Phase HTCT Multi Port Meter Er300pDocument3 pagesThree Phase HTCT Multi Port Meter Er300pD RAJANNo ratings yet

- Technical Specification of 245Kv Single Pole Live Tank Sf6 Circuit BreakerDocument41 pagesTechnical Specification of 245Kv Single Pole Live Tank Sf6 Circuit BreakerkaaisNo ratings yet

- Electrical Engineering: Preliminary ExaminationDocument16 pagesElectrical Engineering: Preliminary ExaminationAmit Kumar KandiNo ratings yet

- Interruptor GL 314Document2 pagesInterruptor GL 314JosferbaNo ratings yet

- Live Tank Circuit Breakers: Primary PlusDocument20 pagesLive Tank Circuit Breakers: Primary PlusXuân Huy Nguyễn0% (1)

- EMI Calculator MoratoriumDocument3 pagesEMI Calculator MoratoriumVinay VinaykumarNo ratings yet

- Final Appendix UberDocument18 pagesFinal Appendix UberMark Faderguya0% (1)

- First Integrated Bonding and Insurance Vs HernandoDocument1 pageFirst Integrated Bonding and Insurance Vs HernandodelbertcruzNo ratings yet

- Special Conditions of Contract (SCC) : Section - VDocument16 pagesSpecial Conditions of Contract (SCC) : Section - VAnonymous 7ZYHilDNo ratings yet

- Camp Hill School District Superintendent ContractDocument16 pagesCamp Hill School District Superintendent ContractBarbara MillerNo ratings yet

- Accounting For LeassesDocument122 pagesAccounting For LeassesIntan ParamithaNo ratings yet

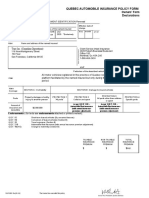

- Quebec Automobile Insurance Policy Form Declarations: Turo Inc. (Canadian Operations)Document1 pageQuebec Automobile Insurance Policy Form Declarations: Turo Inc. (Canadian Operations)Dan VovanNo ratings yet

- Tongko V Manufacturer's Life - GR 167622 - Jun 29 2010Document23 pagesTongko V Manufacturer's Life - GR 167622 - Jun 29 2010Jeremiah ReynaldoNo ratings yet

- Insurance CasesDocument4 pagesInsurance CasesJillen SuanNo ratings yet

- IndemnityDocument1 pageIndemnityapi-262602215No ratings yet

- PhilippinesDocument75 pagesPhilippinesRichel AbelidaNo ratings yet

- Vice President Finance in San Francisco Bay CA Resume Linda WrightDocument3 pagesVice President Finance in San Francisco Bay CA Resume Linda WrightLindaWright1No ratings yet

- Segmentation in The Healthcare Insurance Industry: WhitepaperDocument8 pagesSegmentation in The Healthcare Insurance Industry: WhitepaperMerhan FoudaNo ratings yet

- Concrete Finishing Tools & EquipmentDocument23 pagesConcrete Finishing Tools & EquipmentdantranzNo ratings yet

- Charges and BIMA Cover:: MILVIK Mobile Pakistan Alfalah InsuranceDocument10 pagesCharges and BIMA Cover:: MILVIK Mobile Pakistan Alfalah InsuranceQuraishi SahbNo ratings yet

- Bcom PPT Feb 18 2019Document17 pagesBcom PPT Feb 18 2019Deepan KumarNo ratings yet

- PLI RPLI BookletDocument19 pagesPLI RPLI BookletChinth thimma reddyNo ratings yet

- Project On Investment Planning and FundraisingDocument85 pagesProject On Investment Planning and FundraisingVikram Vrm0% (1)

- National Law University Odisha: A P L, NluoDocument15 pagesNational Law University Odisha: A P L, NluoAnanyaSinghalNo ratings yet