Professional Documents

Culture Documents

Brochure With Policy

Uploaded by

santhoshreddyb986Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brochure With Policy

Uploaded by

santhoshreddyb986Copyright:

Available Formats

How Can You Benefit From This Insurance?

If You Don’t Have Insurance:

Obtaining the coverage that’s “always enough for you” has never been easier.

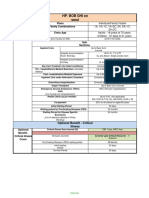

If You Have Health insurance with Low Cover:

Considering your insurance plan's range, we recommend extending coverage based on the following table.

Existing Health Insurance Plan

Recommended Health Insurance Cover Price (Starting @/annum)*

(Deductible#)

₹3L ₹10 Lakh / ₹15 Lakh ₹1441

₹5L ₹10 Lakh / ₹15 Lakh/ ₹962

₹25 Lakh / ₹50 Lakh

₹10L ₹75 Lakh / ₹1 Crore ₹863

₹20L ₹1 Crore ₹345

Prices inclusive of tax for a 25 years old

*

Exploring the Niva Bupa Smart Health Insurance Policy

Insurance Coverage

Policy Tenure 1 Year

Adult: 18 Yrs To 70 Yrs

Entry Age Child: 91 Days To 18 Years

1 Adult, 2 Adult, 2 Adult & 2 Children,

Plans

1 Adult+1 Child, 1 Adult + 2 Children

Relationship Self, Spouse, Daughter, Son, Mother, Father

Base Sum Base 10L - Deductible: ₹25,000, 3 Lakh, 5 Lakh

Insured/Deductible Base 15L - Deductible: 3 Lakh, 5 Lakh

Base 25L - Deductible: 5 Lakh, 10 Lakh

Base 50L - Deductible: 5 Lakh, 10 Lakh, 20 Lakh

Base 75L - Deductible: 10 Lakh, 20 Lakh

Base 1Cr - Deductible: 10 Lakh, 20 Lakh

Hospitalization Coverage

Inpatient Care Up to Base Sum Insured

Single Private Room � Deluxe

Hospital Accommodation- Room Rent/Day

Suite and Above � 30% Co-Pay

Hospital Accommodation- Icu/Day Up to Base Sum Insured

Day Care Treatment All

Pre-Hospitalization Medical Expenses 90 Days

Post-Hospitalization Medical Expenses 180 Days

Domiciliary Hospitalization Up to Base Sum Insured

Organ Transplant Up to Base Sum Insured

Modern Treatment Up to Base Sum Insured As Per T&C

Alternative Treatments Up to Base Sum Insured

Emergency Ground Ambulance- Within

INR 2000 Per Hospitalization

India (One Transfer Per Hospitalization)

Critical Illness Multiplier Indemnity Cover 2X Of Base Sum Insured

Personal Accident 2X Of Base Sum Insured

Re-Assure Benefit Unlimited reinstatement up to base Sum

Insured. �Applicable for both same & different illness)

Waiting Periods

Waiting Period For Pre-Existing Diseases (PED) 12 Months

Initial Waiting Period 30 Days

Specific Disease Waiting Period 12 Months

How to Get Started?

Follow these 4 simple steps to secure your coverage:

01 02 03 04

Get Started

#

Deductible: It's the amount of money you have to pay from your own pocket before your insurance helps with your medical bills. For example, if your deductible is 25,000 INR

and you have a medical bill of 10,00,000 INR, you'll need to pay the first 25,000 INR yourself (that's your deductible). After that, your insurance will cover the remaining 9,75,000

INR of the bill. So, the deductible is what you pay upfront, and then your insurance takes care of the rest.

Disclaimer: Insurance is a subject matter of solicitation. Niva Bupa Health Insurance Company Limited (formerly known as Max Bupa Health Insurance Company Limited) (IRDAI

Registration No. 145). 'Bupa' and 'HEARTBEAT ' logo are registered trademarks of their respective owners and arebeing used by Niva Bupa Heaith Insurance Company Limited

under license. Registered office: C-98, First Floor, Lajpat Nagar, Part 1, New Delhi-110024.; "For more details on risk factors, termsand conditions please read sales brochure

carefully before concluding a sale". CIN NO.U66000DL2008PLC182918. Product Name: Smart Health |Product UIN:MAXHLGP21223V012021. UIN No. : NB/BR/CA/2023-24/587.

Website: www.nivabupa.com. Fax:+ 91 1141743397. Customer Helpline No.: 1860-500-8888

You might also like

- Cigna Global GOP ProviderDocument2 pagesCigna Global GOP ProviderRoyer HyacintheNo ratings yet

- Health Consumer Cot LaraDocument70 pagesHealth Consumer Cot LaraMYLYN JULIONo ratings yet

- Bandhan Bank Health Plus Portability 050723Document2 pagesBandhan Bank Health Plus Portability 050723goelrajivgNo ratings yet

- Niva Axis CASA SS v8Document2 pagesNiva Axis CASA SS v8jar070888No ratings yet

- Super Top Up - 211130 - 094009Document3 pagesSuper Top Up - 211130 - 094009Venkatesh SharmaNo ratings yet

- Activ One Max Product Benefit TableDocument11 pagesActiv One Max Product Benefit Tablesaisuraj.arNo ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- Chi - Health Elite Plus CoveragesDocument1 pageChi - Health Elite Plus CoveragesVikram VermaNo ratings yet

- ReAssure SSDocument2 pagesReAssure SSAmit Kumar KandiNo ratings yet

- Niva - SENIOR FIRST - SS - v3Document2 pagesNiva - SENIOR FIRST - SS - v3scrikanth03565No ratings yet

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- Health - Pulse Single SheeterDocument2 pagesHealth - Pulse Single SheeterAnupam JainNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Activ Health - Platinum Enhanced - One PagerDocument2 pagesActiv Health - Platinum Enhanced - One PagerYashNo ratings yet

- Health Companion V2022 SSDocument2 pagesHealth Companion V2022 SSKarthik ViswanathanNo ratings yet

- GhonjiDocument3 pagesGhonjiaraban datesNo ratings yet

- Niva PB ReAssure SS v5Document2 pagesNiva PB ReAssure SS v5samdsozaNo ratings yet

- BARODAHEALTHDocument1 pageBARODAHEALTHSejal KumariNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Health PulseDocument2 pagesHealth PulseAcma Renu SinghaniaNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Lifetime GlobalLeaflet Feb21 P2Document4 pagesLifetime GlobalLeaflet Feb21 P2sanjay4u4allNo ratings yet

- 202301.01 TNC Zomato GMC (New Plan With Dependents) RenewalDocument23 pages202301.01 TNC Zomato GMC (New Plan With Dependents) Renewalajptl92No ratings yet

- Star Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Document1 pageStar Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Viki for gmail GmailNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3PRADEEP GUPTANo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- HC - Brochure - (Mob) - 11may17Document11 pagesHC - Brochure - (Mob) - 11may17Ksl VajralaNo ratings yet

- Top Up INSUDocument1 pageTop Up INSUStar HealthNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2UserNo ratings yet

- HFFP-2015 Revised ProspectusDocument25 pagesHFFP-2015 Revised Prospectuspooja singhalNo ratings yet

- Benefits ManualDocument34 pagesBenefits ManualRupayan DuttaNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- SENIOR FIRST - 0 Co Payment - BRDocument2 pagesSENIOR FIRST - 0 Co Payment - BRiamshonalidixitNo ratings yet

- Care Freedom One Pager-1Document2 pagesCare Freedom One Pager-1kkNo ratings yet

- CHI - One Pager - Version 1.0 - Feb 20Document2 pagesCHI - One Pager - Version 1.0 - Feb 20Prasad.MNo ratings yet

- Apollo Munich VS Icici LombardDocument12 pagesApollo Munich VS Icici LombardNavendu ShekharNo ratings yet

- GMC Benefit Manual - 22Document28 pagesGMC Benefit Manual - 22SwaNo ratings yet

- Category B FlyerDocument8 pagesCategory B FlyerHarishNo ratings yet

- Aspire BrochureDocument3 pagesAspire BrochureUJJAL KUMAR MANNANo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- Care Advantage & Protect Plus BrochureDocument4 pagesCare Advantage & Protect Plus BrochureAnushka UpadhyayNo ratings yet

- Copression Between Comprhensive & Care PDFDocument1 pageCopression Between Comprhensive & Care PDFsatishlad1288No ratings yet

- Product One PagerDocument1 pageProduct One PagervamsiklNo ratings yet

- Sbi General'S Arogya Plus Policy: Assure Your Health For A Fixed PremiumDocument9 pagesSbi General'S Arogya Plus Policy: Assure Your Health For A Fixed Premiumdinesh banaNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- Optima Restore Brochure 1Document8 pagesOptima Restore Brochure 1abhi_1mehrotaNo ratings yet

- Young Star PolicyDocument1 pageYoung Star PolicyStar HealthNo ratings yet

- Young Star - One Pager - Version 1.4 - September 2021Document1 pageYoung Star - One Pager - Version 1.4 - September 2021ShihbNo ratings yet

- Corona Kavach STAR One PagerDocument1 pageCorona Kavach STAR One PagerRajat GuptaNo ratings yet

- Corona Kavach - One Pager - Version 1.0 - July - 2020 PDFDocument1 pageCorona Kavach - One Pager - Version 1.0 - July - 2020 PDFRanjeeta BhanjNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- One Pager For YOUNG STARDocument1 pageOne Pager For YOUNG STARVivek Sharma100% (1)

- AV Comment Letter - CY 2025 MA Proposed Rule - 1.4 - FinalDocument14 pagesAV Comment Letter - CY 2025 MA Proposed Rule - 1.4 - FinalArnold VenturesNo ratings yet

- 12 Basic Yoga PosesDocument1 page12 Basic Yoga PosessearchhistorycollectionNo ratings yet

- Aging in The PhilippinesDocument23 pagesAging in The PhilippinesKyro Luigi LaureaNo ratings yet

- 100 AdvancedCtrlDocument7 pages100 AdvancedCtrlLuis EspinosaNo ratings yet

- Public Health Laws: Romeo R. Andaya, MD, MSCPD, PHD, Fpafp Chair, DPMCH Uph-DjgtmuDocument8 pagesPublic Health Laws: Romeo R. Andaya, MD, MSCPD, PHD, Fpafp Chair, DPMCH Uph-DjgtmuKatNo ratings yet

- ECHS ClaimingDocument2 pagesECHS ClaimingIndraneel NamuduriNo ratings yet

- RHI-FWMI-brochure-English (Revised) 04-Nov-2022Document2 pagesRHI-FWMI-brochure-English (Revised) 04-Nov-2022Casey JeffersonNo ratings yet

- Health Insurance Benefits Verification Phone ScriptDocument2 pagesHealth Insurance Benefits Verification Phone ScriptDiana JaneNo ratings yet

- Module 7 Health Insurance Types and ImportanceDocument10 pagesModule 7 Health Insurance Types and ImportanceKAH' CHISMISSNo ratings yet

- Information Sheet For Application For Assistance: MedicaidDocument27 pagesInformation Sheet For Application For Assistance: Medicaidmsweed womanNo ratings yet

- Investors Attitude Towards Investment in Private Insurance Companies in Madurai City, Tamil Nadu StateDocument6 pagesInvestors Attitude Towards Investment in Private Insurance Companies in Madurai City, Tamil Nadu StatekomalNo ratings yet

- Gail Carlson, MPH PH.D, State Health Education Specialist, University of Missouri ExtensionDocument9 pagesGail Carlson, MPH PH.D, State Health Education Specialist, University of Missouri ExtensionRahmat ShahNo ratings yet

- Clover Healthcare Plan HipaaDocument19 pagesClover Healthcare Plan HipaaJoey Cintrón-MarquesNo ratings yet

- Ready For Better NDP 2021 CommitmentsDocument115 pagesReady For Better NDP 2021 CommitmentsstephenmtaylorNo ratings yet

- AW CarriersDocument35 pagesAW CarriersHari HaranNo ratings yet

- Max Bupa Reimb Claim Form (1604v1)Document4 pagesMax Bupa Reimb Claim Form (1604v1)Arun Kumar PNo ratings yet

- The Positive Effects of A Particular Health-Related Law in Our SocietyDocument2 pagesThe Positive Effects of A Particular Health-Related Law in Our SocietyKyle OrlanesNo ratings yet

- HCF & LCMDocument78 pagesHCF & LCMhariniNo ratings yet

- Being A Nursing Assistant: Francie WolginDocument19 pagesBeing A Nursing Assistant: Francie Wolginraquelita1970No ratings yet

- DILG R8 BP 204 - October 20202Document2 pagesDILG R8 BP 204 - October 20202Region PersonnelNo ratings yet

- Project ReportDocument68 pagesProject ReportNazim UmarNo ratings yet

- Utilization of Primary Health Care Services in Rural and Urban Areas in ShirazDocument10 pagesUtilization of Primary Health Care Services in Rural and Urban Areas in ShirazNamarig IzzaldinNo ratings yet

- Eligibility Audit Report June 2023Document58 pagesEligibility Audit Report June 2023Matthew SelfNo ratings yet

- Network Relations Representatives: Behavioral Health Physical HealthDocument1 pageNetwork Relations Representatives: Behavioral Health Physical HealthData hi DataNo ratings yet

- Robert Half BenefitsDocument30 pagesRobert Half BenefitsGiorgos MeleasNo ratings yet

- FDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115Document4 pagesFDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115arjunNo ratings yet

- Community Health Nursing Services in The Philippines PDFDocument2 pagesCommunity Health Nursing Services in The Philippines PDFHilario. Hayascent.Reign.M.No ratings yet

- Local San Antonio Businesses Who Applied For PPP LoansDocument150 pagesLocal San Antonio Businesses Who Applied For PPP LoansMaritza NunezNo ratings yet