Professional Documents

Culture Documents

Tax Assignment-1 PDF

Uploaded by

firdous0 ratings0% found this document useful (0 votes)

123 views2 pagesOriginal Title

tax assignment-1.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

123 views2 pagesTax Assignment-1 PDF

Uploaded by

firdousCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

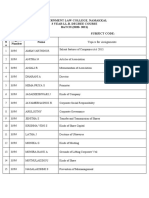

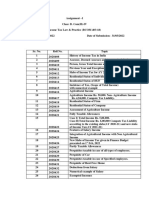

MARKAZ LAW COLLEGE

9TH SEMETSER BBA LLB

ASSINGMENT OF DIRECT TAX

DATE OF SUBMISSION-13/02/2023

Roll No NAME OF THE STUDENT TOPICS

1 ABDULLA FUHAD K History of income tax act

2 ABDULLA SAHID Previous year and assessment year

3 ABDUL MUHAIMIN O Assessee under income tax act

4 ABDUL VAHAB C Income and deemed income under income tax act

5 ABUASIL A K Chargeability under income tax act

6 ADEEBA AMEEN Constitutional provisions and taxation

7 ADITHYA M P Residential statuts under income tax act

8 ADITHYA PRAKASH Income from salary

9 AFNAS E Income from house property

10 AHMED MIDLAJ T V Profit or gain from business or profession

11 AMEENA BEEGAM P V Income from capital gain

12 ANAGHA A C Income from other sources

13 ASHIDA ISMAYIL Statutory exemptions under sec 10 of IT Act 1961

14 ASNIYA P P Perquisites under income tax act

15 ASWATHI K B Clubbing of income

16 AYANA M Calculation of gross total income

17 DILNA P T Liability under special cases

18 FADHIYA NAZARIN T M Set off and carryforward of losses

19 FIRDOUS Return under income tax act

20 JOSMI JOSEPH Income tax authorities and their powers

21 JUNAID Types of assessment

22 MIHJA Procedur for assessment

23 MIRSAD A U Appeals under IT Act 1961

24 MOHAMMED ALI DILSHAN MK

Revision

25 MOHAMMED ISMAYIL Settlement commission

26 MOHAMMED RASHID T K TDS and TCS

27 MOHAMMED SHIFAN M Advance payment of Tax

28 MOHAMMED SHIHAB Z Advance ruling under incometax act

29 MUFEEDA V K Refund

30 MUHAMMAD AJEER Collection and recovery

31 MUHAMMED FAIZ N Penalties,offences and prosecution

32 MUHAMMED RAEES Search and seizure

33 MUHAMMED RIYAS M Assest and deemed assest under wealth tax

34 MUHAMMED SALIH T K Tax planning and management

35 MUHAMMED SALIM P V Assessee under income tax act

36 MUHAMMED SALMAN T A Deductions under income tax act

37 MUHAMMED SHAFEEQ M K Rebate and relief

38 MUHAMMED SHAMEEL V Capital reciept and revenue reciept and its differences

39 MUHAMMED SHIBIL

VADAKKENGARA Income tax authorities and their powers

40 MUHAMMED UKKASHA V House rent allowences

41 MUHAMMED ZENIN FEROZ Exempted assesst under wealth tax act

42 NABEEL A P Liability under special cases

43 NASEEM SUHAIL AL SHAHIR Tax incentives

44 RAHUL RAJU Income of non profit organaisation

45 REEHA FATHIMA M Taxation of companies

46 RISHAL Wealth tax authorities

47 SAFIYA K A Maitance of account

48 SAHADUDHEEN M Special provision to prevent tax evasion

49 SHAJAHAN SHEIKH ABDULLAH

Depriciation under income tax act

50 SHIFNA K Powers of income tax authorities

51 SUHAIB N Assessment procudre of HUF after parition

52 SUHAIL SULAIMAN Fringe benefit tax

53 SUNAILATH K S Minimum alternative tax

54 SUNITHA M K Residential status

55 SYED NIHAL P M Types of returns under IT Act 1961

56 THAKYUDHEEN P Agricultural income under IT Act 1961

57 THASNI SALIM Offences and prosecution under IT Act 1961

58 UMAR SALIM M Characteristics of Tax

You might also like

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Section B Project Topics.Document2 pagesSection B Project Topics.aditya pariharNo ratings yet

- Wa0015.Document1 pageWa0015.73 ShivagangaNo ratings yet

- ZIMBABWE INCOME TAX ACT Chapter 23 06Document336 pagesZIMBABWE INCOME TAX ACT Chapter 23 06Riana Theron MossNo ratings yet

- Government Law College Company Law AssignmentsDocument5 pagesGovernment Law College Company Law AssignmentsshivaNo ratings yet

- Pita Law FullDocument93 pagesPita Law Fullay odNo ratings yet

- TNGST ACT 2017 (With Amendments)Document168 pagesTNGST ACT 2017 (With Amendments)Darshni 18No ratings yet

- Taxation - 6 SemesterDocument28 pagesTaxation - 6 SemesterKhalid123No ratings yet

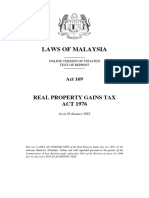

- REAL PROPERTY GAINS TAX ACT 1976 As at 30 January 2022Document109 pagesREAL PROPERTY GAINS TAX ACT 1976 As at 30 January 2022sk tanNo ratings yet

- Current Taxation Laws Projects. Section ADocument3 pagesCurrent Taxation Laws Projects. Section APrasidhi AgrawalNo ratings yet

- List of Topics GST - IDocument7 pagesList of Topics GST - IArnav GargNo ratings yet

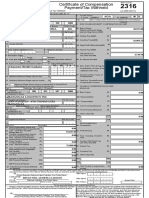

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Real Property Gains Tax Act 1976 - Oct2015Document92 pagesReal Property Gains Tax Act 1976 - Oct2015Kevin PohNo ratings yet

- Income Tax Act of The Kingdom of Bhutan 2001english VersionDocument48 pagesIncome Tax Act of The Kingdom of Bhutan 2001english VersionRinchen DorjiNo ratings yet

- Laws of Malaysia: Real Property Gains Tax ACT 1976Document109 pagesLaws of Malaysia: Real Property Gains Tax ACT 1976Kim Hock GohNo ratings yet

- Law of Taxation Important Questions 6th SemDocument29 pagesLaw of Taxation Important Questions 6th SemGulshan RaiNo ratings yet

- The Nigerian PitaDocument93 pagesThe Nigerian PitaKevinNo ratings yet

- TPC - List of The Regulations Under The Tax Procedure Code ActDocument65 pagesTPC - List of The Regulations Under The Tax Procedure Code ActEdward BiryetegaNo ratings yet

- Term Paper (Individual Presentation) Section - B SL Roll Number Name TopicsDocument3 pagesTerm Paper (Individual Presentation) Section - B SL Roll Number Name TopicsMd Anik HasanNo ratings yet

- Sections of CGST Act effective from 22-6-2017 and 1-7-2017Document9 pagesSections of CGST Act effective from 22-6-2017 and 1-7-2017JK Lights TradingNo ratings yet

- Income TaxDocument9 pagesIncome Taxlegendstillalive4826No ratings yet

- RPGT Act 169Document77 pagesRPGT Act 169naimahderaniNo ratings yet

- DT Revision Cum Marathon Dec 22Document164 pagesDT Revision Cum Marathon Dec 22Suraj PawarNo ratings yet

- IncometaxproperdocDocument10 pagesIncometaxproperdocYuki JameloNo ratings yet

- 17Document2 pages17PATRICIA MAE CABANANo ratings yet

- Cir V Itogon-Suyoc MinESDocument2 pagesCir V Itogon-Suyoc MinESkeloNo ratings yet

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- The Income Tax Act 2022 VersionDocument195 pagesThe Income Tax Act 2022 VersionMalama BwaleNo ratings yet

- Subject Codes for Legal DocumentsDocument14 pagesSubject Codes for Legal Documentsramesh upadeNo ratings yet

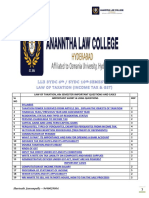

- LAW OF TAXATION-AnanthaDocument27 pagesLAW OF TAXATION-AnanthaG Vinoda100% (1)

- Labor Law Compliance Registers GuideDocument3 pagesLabor Law Compliance Registers GuidevsnaveenkNo ratings yet

- UntitledDocument99 pagesUntitledola mideNo ratings yet

- CTA Orders Refund of Overpaid Interest to Esso for 1960 Tax DeficiencyDocument2 pagesCTA Orders Refund of Overpaid Interest to Esso for 1960 Tax DeficiencyJohnnyPenafloridaNo ratings yet

- IncomeTax Ordinance, 1984 (English)Document277 pagesIncomeTax Ordinance, 1984 (English)enamulNo ratings yet

- Income Tax Ordinance 2001Document4 pagesIncome Tax Ordinance 2001QadirNo ratings yet

- Constancia de Situación FiscalDocument3 pagesConstancia de Situación FiscalRicardo GuerraNo ratings yet

- RPGT ACT 1976 (As at 1 February 2019)Document104 pagesRPGT ACT 1976 (As at 1 February 2019)ILMINo ratings yet

- Bir 2013Document1 pageBir 2013karlycoreNo ratings yet

- Section A Project Topics. Current Batch.Document2 pagesSection A Project Topics. Current Batch.Anupam JainNo ratings yet

- CIR vs. Esso Standard EasternDocument4 pagesCIR vs. Esso Standard EasternCharish DanaoNo ratings yet

- CIT (1994) 207 ITR 252 (Bom) - With Regard To The Clubing of IncomeDocument13 pagesCIT (1994) 207 ITR 252 (Bom) - With Regard To The Clubing of IncomeShimran ZamanNo ratings yet

- The Income Tax Rules 1984 Updated Up To July 2021Document196 pagesThe Income Tax Rules 1984 Updated Up To July 2021Masum Gazi100% (1)

- TAXATION LAW - Hernando CDD 2023Document43 pagesTAXATION LAW - Hernando CDD 2023Hadjie LimNo ratings yet

- Air Gateway Bank Statements - AIBDocument8 pagesAir Gateway Bank Statements - AIBIdrees ShinwaryNo ratings yet

- Zambia Income Tax Act 1967 (As Amended 2006)Document100 pagesZambia Income Tax Act 1967 (As Amended 2006)siva chidambaramNo ratings yet

- 17 City of Lapu V PEZADocument31 pages17 City of Lapu V PEZAJCapskyNo ratings yet

- B-BACD002 Summative 1 Part 1Document2 pagesB-BACD002 Summative 1 Part 1Lhulaan OrdanozoNo ratings yet

- Anderson Vs Posadas, GR 44100, 22 Sept 1938Document5 pagesAnderson Vs Posadas, GR 44100, 22 Sept 1938Nor-Alissa M DisoNo ratings yet

- Bacha F Guzdar V CIT Ag IncomeDocument6 pagesBacha F Guzdar V CIT Ag Incomekannisha1904No ratings yet

- Bir Form 0605Document2 pagesBir Form 0605John Louise Tan100% (1)

- Anderson V PosadasDocument2 pagesAnderson V PosadasJerico GodoyNo ratings yet

- Assignment I (ITLP) B.com (H) IVDocument2 pagesAssignment I (ITLP) B.com (H) IVHarpreet SinghNo ratings yet

- Petitioner vs. vs. Respondents: First DivisionDocument5 pagesPetitioner vs. vs. Respondents: First DivisionShanen LimNo ratings yet

- The IncomeTax Ordinance - 1984Document277 pagesThe IncomeTax Ordinance - 1984নাকিব ভূঁইয়াNo ratings yet

- Tax Review DoctrinesDocument18 pagesTax Review DoctrinesGrace Robes HicbanNo ratings yet

- SB 76 - Property Tax Independence ActDocument138 pagesSB 76 - Property Tax Independence ActJim CoxNo ratings yet

- Tax 2 DigestsDocument9 pagesTax 2 DigestsCid Benedict PabalanNo ratings yet

- Human Rights of Vulnerable Groups in India, Aged and Disbled 1 PDFDocument33 pagesHuman Rights of Vulnerable Groups in India, Aged and Disbled 1 PDFfirdousNo ratings yet

- Notice For Essay Competition2021Document5 pagesNotice For Essay Competition2021firdousNo ratings yet

- International Conference BrochureDocument9 pagesInternational Conference BrochurefirdousNo ratings yet

- School of Indian Legal Thought Kottayam PDFDocument5 pagesSchool of Indian Legal Thought Kottayam PDFfirdousNo ratings yet

- Casihr Journal On Human Rights Practice: Volume 5, Issue 2Document7 pagesCasihr Journal On Human Rights Practice: Volume 5, Issue 2firdousNo ratings yet

- The National Academies Press: Purposeful Jettison of Petroleum Cargo (1994)Document216 pagesThe National Academies Press: Purposeful Jettison of Petroleum Cargo (1994)firdousNo ratings yet

- A2017 22Document8 pagesA2017 22kevinNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Preferred Time SlotfirdousNo ratings yet

- Competitions Call ListDocument12 pagesCompetitions Call ListfirdousNo ratings yet

- Team PointsDocument1 pageTeam PointsfirdousNo ratings yet

- 1st, 2nd, 3rd Place Winners: Mappilappattu Upper PrimaryDocument2 pages1st, 2nd, 3rd Place Winners: Mappilappattu Upper PrimaryfirdousNo ratings yet

- 1st, 2nd, 3rd Place Winners: Elocution Malayalam Upper PrimaryDocument4 pages1st, 2nd, 3rd Place Winners: Elocution Malayalam Upper PrimaryfirdousNo ratings yet

- A2017 22Document8 pagesA2017 22kevinNo ratings yet

- The Arbitration Act SummaryDocument10 pagesThe Arbitration Act SummaryfirdousNo ratings yet

- Shariah Law and Cyber-Sectarian Conflict: How Can Islamic Criminal Law Respond To Cyber Crime?Document9 pagesShariah Law and Cyber-Sectarian Conflict: How Can Islamic Criminal Law Respond To Cyber Crime?firdousNo ratings yet

- Participant Total Score - Stage WiseDocument1 pageParticipant Total Score - Stage WisefirdousNo ratings yet

- Civil Administration of Islamic CriminalDocument14 pagesCivil Administration of Islamic CriminalfirdousNo ratings yet

- Final Assignment Crime and Criminology IDocument6 pagesFinal Assignment Crime and Criminology IfirdousNo ratings yet

- Adultery in The Perspective of Islamic LDocument5 pagesAdultery in The Perspective of Islamic LfirdousNo ratings yet

- Judges SheeetDocument2 pagesJudges SheeetfirdousNo ratings yet

- Behnam Darabi PHD Candidate of Islamic CDocument11 pagesBehnam Darabi PHD Candidate of Islamic CfirdousNo ratings yet

- Judges SheeetDocument2 pagesJudges SheeetfirdousNo ratings yet

- 10 - Chapter 6Document67 pages10 - Chapter 6firdousNo ratings yet

- Programme ListingDocument6 pagesProgramme ListingfirdousNo ratings yet

- Team ListDocument2 pagesTeam ListfirdousNo ratings yet

- Off-Stage Items General Category: Programme ListDocument8 pagesOff-Stage Items General Category: Programme ListfirdousNo ratings yet

- Elasticity of Islamic Criinal LawDocument18 pagesElasticity of Islamic Criinal LawfirdousNo ratings yet

- Group C: Ug 3 Stage ItemsDocument4 pagesGroup C: Ug 3 Stage ItemsfirdousNo ratings yet

- Markaz Sharia City Seminar on Islamic Finance & Economic CrisisDocument1 pageMarkaz Sharia City Seminar on Islamic Finance & Economic CrisisfirdousNo ratings yet

- Baruch College Monetary Economics SyllabusDocument4 pagesBaruch College Monetary Economics SyllabusAhsan RiazNo ratings yet

- Fintech A Game Changer For Financial Inclusion April 2019 PDFDocument18 pagesFintech A Game Changer For Financial Inclusion April 2019 PDFSumeer BeriNo ratings yet

- Macro LMS - Chapter 25&26Document14 pagesMacro LMS - Chapter 25&26Bảo Vy TrươngNo ratings yet

- Pile cp12Document46 pagesPile cp12casarokarNo ratings yet

- 2020 06b FI Core-Concepts IPSAS 29 PPDocument27 pages2020 06b FI Core-Concepts IPSAS 29 PPFebby Grace SabinoNo ratings yet

- Non Performing Assets of BanksDocument109 pagesNon Performing Assets of BanksJIGAR87% (23)

- Oliver Wyman 2019 - The Brazilian Investment Landscape A New Era For Brazilian InvestorsDocument22 pagesOliver Wyman 2019 - The Brazilian Investment Landscape A New Era For Brazilian InvestorsThomaz FragaNo ratings yet

- Payment GatewaysDocument11 pagesPayment GatewaysAnmol Agarwal100% (1)

- Name of Work: Town Municipal CouncilDocument38 pagesName of Work: Town Municipal CouncilmaniannanNo ratings yet

- ACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFDocument19 pagesACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFPiyal HossainNo ratings yet

- Aminul Islam 2016209690 EMB-660-Assignment-2Document35 pagesAminul Islam 2016209690 EMB-660-Assignment-2Aminul Islam 2016209690No ratings yet

- Entrepreneurship: Financing The New Venture and BeyondDocument31 pagesEntrepreneurship: Financing The New Venture and BeyondSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- HRP-HLIS Housing Loan Interest Subsidy PolicyDocument3 pagesHRP-HLIS Housing Loan Interest Subsidy PolicyBHUVANESH KUMAR0% (1)

- State Bank of India savings account statement from 11 Aug to 26 Oct 2019Document12 pagesState Bank of India savings account statement from 11 Aug to 26 Oct 2019Shalini SinghNo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan SrivastavaNo ratings yet

- VC Case Study SaaS Valuation MultiplesDocument17 pagesVC Case Study SaaS Valuation MultiplesJohn SmithNo ratings yet

- Listening Skill Unit 3: History of MoneyDocument5 pagesListening Skill Unit 3: History of MoneyMinh LêNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Cuir, Angelie Fei C. Case Digest in Negotiable Instruments Judge Edmar CastilloDocument8 pagesCuir, Angelie Fei C. Case Digest in Negotiable Instruments Judge Edmar CastilloAngelie Fei CuirNo ratings yet

- Business World (Jan. 12, 2016)Document25 pagesBusiness World (Jan. 12, 2016)Peter RojasNo ratings yet

- PAS 21 EFFECTS OF FOREIGN EXCHANGE RATESDocument7 pagesPAS 21 EFFECTS OF FOREIGN EXCHANGE RATESElizabeth DumawalNo ratings yet

- Argenti A ScoreDocument1 pageArgenti A Scoremd1586100% (1)

- Hanson Ski Products - Projected Quarterly Balance Sheets (In $ Thousand)Document5 pagesHanson Ski Products - Projected Quarterly Balance Sheets (In $ Thousand)Farhad KabirNo ratings yet

- Financial Management: Study TextDocument10 pagesFinancial Management: Study TextTimo Paul100% (1)

- Cannon Ball Review Part 2 Cash and ReceivablesDocument30 pagesCannon Ball Review Part 2 Cash and ReceivablesLayNo ratings yet

- Bank 1Document14 pagesBank 1Anand CorreiaNo ratings yet

- Class XII - AccountancyDocument11 pagesClass XII - Accountancyumangchh2306No ratings yet

- Qurr-03/2024: Föföl FüfälDocument7 pagesQurr-03/2024: Föföl Füfälsandeep kumarNo ratings yet

- Checklist of Documentary Requirements - Issuance by BIR of CARDocument1 pageChecklist of Documentary Requirements - Issuance by BIR of CARLRMNo ratings yet

- Bank statement details for Ganesh NDocument4 pagesBank statement details for Ganesh NGanesanNo ratings yet