Professional Documents

Culture Documents

ITC - 04 Issue

ITC - 04 Issue

Uploaded by

SUMIT PODDAR0 ratings0% found this document useful (0 votes)

41 views1 pageThe ITC-04 report has several issues that require manual corrections before the JSON file can be generated, including special characters in item descriptions, a lack of bifurcation of input and capital goods, and some returns not being shown. The ERP system also does not allow for easy tracking of returns by challan number or generate error-free reports. Several fields like job worker state must be manually corrected as well.

Original Description:

ITC-04

Original Title

ITC -04 issue

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe ITC-04 report has several issues that require manual corrections before the JSON file can be generated, including special characters in item descriptions, a lack of bifurcation of input and capital goods, and some returns not being shown. The ERP system also does not allow for easy tracking of returns by challan number or generate error-free reports. Several fields like job worker state must be manually corrected as well.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views1 pageITC - 04 Issue

ITC - 04 Issue

Uploaded by

SUMIT PODDARThe ITC-04 report has several issues that require manual corrections before the JSON file can be generated, including special characters in item descriptions, a lack of bifurcation of input and capital goods, and some returns not being shown. The ERP system also does not allow for easy tracking of returns by challan number or generate error-free reports. Several fields like job worker state must be manually corrected as well.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

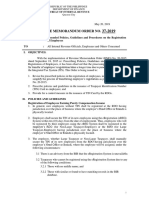

ITC -04 Status/ issue

01 Description of Goods include special character which is not allowed on

GST portal. So we have to manually correct each and every special

character for generation JASON file.

02 Bifurcation of input/ capital Goods not done at the time of Generation of

challan.

03 For some challans which is received back in same date or within same

Quarter. But in ITC-04 it is not shown that said challan is received back.

04 For verification of whether any challan received back or not we have to

find it from GRN summary through Job Work number. For that we have

to firstly find Job work number through challan number and then find

when such challan material received back. All such activities done one to

one for individual challan which is more time consuming.

05 ERP system does not have facility for generating report through challan

number. From which we can easily find it when particular challan issue

or received back.

06 ITC -04 Pending for Two years F.Y 2020-21 & F.Y 2021-22 out of which

ITC-04 of F.Y 2021-22 is already prepared and it is error free for

generation of JASON file.

07 In ERP system we are facing issues for some challans , Stating State of

Job workers not correctly shown in ITC-04 report & for that we have to

manually correct it for generation JASON file.

08 Direct sales of scrap from job worker places or losses incurred in process

not properly maintained in system.

You might also like

- SAP SuccessFactors EC Payroll Configuration WorkbookDocument161 pagesSAP SuccessFactors EC Payroll Configuration WorkbookSalma Basha0% (1)

- Warnings ErrorsDocument3 pagesWarnings ErrorsjmesminNo ratings yet

- Official Document Numbering (ODN) Configuration Sd/Mm/Fi For GSTDocument15 pagesOfficial Document Numbering (ODN) Configuration Sd/Mm/Fi For GSTPRATAP SAPMM100% (1)

- Prop. Solution For India Asset and Tax DepreciationDocument8 pagesProp. Solution For India Asset and Tax DepreciationJit Ghosh100% (2)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- IncidentsDocument3 pagesIncidentsTeja SaiNo ratings yet

- Cheatsheet For Oracle Financials For IndiaDocument8 pagesCheatsheet For Oracle Financials For IndiaKishore BellamNo ratings yet

- SOP-Handling of COD CasesDocument3 pagesSOP-Handling of COD Casespsannakki001No ratings yet

- SAP Tickets-999 FicoDocument198 pagesSAP Tickets-999 FicoKingpinNo ratings yet

- Employees' Old-Age Benefits InstitutionDocument20 pagesEmployees' Old-Age Benefits InstitutionSAWERA TEXTILES PVT LTDNo ratings yet

- Aug AdvisoryDocument1 pageAug Advisoryprakash_sasikalaNo ratings yet

- Out of 34 Tickets Raised in CRMDocument4 pagesOut of 34 Tickets Raised in CRMRahul JagdaleNo ratings yet

- GST - ITC 04 - Guidelines - GSTN Official - 10-04-2018Document36 pagesGST - ITC 04 - Guidelines - GSTN Official - 10-04-2018kumar45caNo ratings yet

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitNo ratings yet

- 2Document3 pages2hidden heroNo ratings yet

- ItrDocument5 pagesItrdgdhandeNo ratings yet

- Challan Recon 190911Document5 pagesChallan Recon 190911chandra shekharNo ratings yet

- EPFO Mumbai 1raDocument64 pagesEPFO Mumbai 1raRitesh AroraNo ratings yet

- SAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuDocument3 pagesSAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuNethaji GurramNo ratings yet

- Tcs DocDocument8 pagesTcs DocSelvaRajNo ratings yet

- Tds Automation FunctionalityDocument3 pagesTds Automation FunctionalitySurya GudipatiNo ratings yet

- 5 Steps For Filing E-TDS ReturnDocument6 pages5 Steps For Filing E-TDS Returnk gowtham kumar100% (1)

- Tax Codes in SDDocument2 pagesTax Codes in SDPrashanth ReddyNo ratings yet

- Direct Cross CC Goods Issues To Work Order PDFDocument5 pagesDirect Cross CC Goods Issues To Work Order PDFVijay ChowdaryNo ratings yet

- National Scholarships Portal (Nsp2.0) Ministry of Electronics & Information TechnologyDocument9 pagesNational Scholarships Portal (Nsp2.0) Ministry of Electronics & Information Technologypal_frndzNo ratings yet

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewNo ratings yet

- Issue Description Issue ReportedDocument10 pagesIssue Description Issue ReportedParth DesaiNo ratings yet

- Itmanuals 030950699Document14 pagesItmanuals 030950699GOURAV KUMARNo ratings yet

- Frequently Asked Questions On IT-Proofs Submission (FY 2021-22)Document17 pagesFrequently Asked Questions On IT-Proofs Submission (FY 2021-22)Krishnanw KingNo ratings yet

- Naya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andDocument6 pagesNaya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andrakeshca1No ratings yet

- Readfile FmsCircularsDocument3 pagesReadfile FmsCircularsArun PNo ratings yet

- Interview QuestionsDocument20 pagesInterview Questionsjay koshtiNo ratings yet

- Bir Rmo No. 37-2019Document6 pagesBir Rmo No. 37-2019Grace BitarraNo ratings yet

- DRC-07 AdvisoryDocument4 pagesDRC-07 AdvisoryGaurav KapriNo ratings yet

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Nikhil KumarNo ratings yet

- ITR BasicDocument13 pagesITR BasicChandrashekar BNo ratings yet

- Project Class Day 11Document6 pagesProject Class Day 11phogatNo ratings yet

- FRS & FM of ERP PDFDocument405 pagesFRS & FM of ERP PDFDebasis BasaNo ratings yet

- FICO Assignment-10-Handling Issues With Types of Issues-16.08.2016Document34 pagesFICO Assignment-10-Handling Issues With Types of Issues-16.08.2016Kolusu GopirajuNo ratings yet

- SD Tax ConfigDocument13 pagesSD Tax ConfigRahul DholeNo ratings yet

- RMO No. 37-2019 PDFDocument6 pagesRMO No. 37-2019 PDFSid CandelariaNo ratings yet

- Revenue Memorandum Order NoDocument6 pagesRevenue Memorandum Order NoMaria Luisa FusileroNo ratings yet

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Partha Pratim BiswasNo ratings yet

- Cross Financial Retro RunDocument7 pagesCross Financial Retro RuniwillmakeufeelgoodNo ratings yet

- What Is A Lockbox?Document7 pagesWhat Is A Lockbox?sureshyadamNo ratings yet

- FNF GuidelinesDocument2 pagesFNF GuidelinesGautam BindlishNo ratings yet

- Instructions For Filling Out FORM ITR 3Document231 pagesInstructions For Filling Out FORM ITR 3Samantha JNo ratings yet

- IT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideDocument39 pagesIT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideOyama MosianeNo ratings yet

- Sap ErrorDocument3 pagesSap ErrorKundan PatilNo ratings yet

- Issues - ManaliDocument4 pagesIssues - ManaliAbhi AbhiNo ratings yet

- Real TimeDocument25 pagesReal TimeNikhatFarooqKhanNo ratings yet

- To-Be ProcessDocument12 pagesTo-Be ProcessSudhakar PatnamNo ratings yet

- 2020-12 Circular Attachment 1Document18 pages2020-12 Circular Attachment 1Mohsin AliNo ratings yet

- Queries Related To ITR FilingDocument3 pagesQueries Related To ITR FilingRajesh KashyapNo ratings yet

- INC-22A: On Companies Incorporated On or Before 31 December 2017Document6 pagesINC-22A: On Companies Incorporated On or Before 31 December 2017MrityunjayNo ratings yet

- Nota Detalle Registros LSDDocument9 pagesNota Detalle Registros LSDClara SackNo ratings yet

- S1 Paper BTDocument2 pagesS1 Paper BTKhadija ShabbirNo ratings yet

- MY 401k BestDocument10 pagesMY 401k BestManepali TejNo ratings yet

- Siebel Incentive Compensation Management ( ICM ) GuideFrom EverandSiebel Incentive Compensation Management ( ICM ) GuideNo ratings yet

- Annexure-5 (Benefits (A) )Document3 pagesAnnexure-5 (Benefits (A) )SUMIT PODDARNo ratings yet

- CDBS70 Process CostingDocument4 pagesCDBS70 Process CostingSUMIT PODDARNo ratings yet

- Forex Risk Management Services WriteUp CA Rajiv D KhatlawalaDocument1 pageForex Risk Management Services WriteUp CA Rajiv D KhatlawalaSUMIT PODDARNo ratings yet

- Schedule of Charges Eff From 15.12.2022Document5 pagesSchedule of Charges Eff From 15.12.2022SUMIT PODDARNo ratings yet

- OIP Flow Chart PDFDocument1 pageOIP Flow Chart PDFSUMIT PODDARNo ratings yet

- Industry Policy 2020Document26 pagesIndustry Policy 2020SUMIT PODDARNo ratings yet

- Seminar On Hedging & Delivery On Base Metals Futures - 17-02-2023 at FGI VadodaraDocument32 pagesSeminar On Hedging & Delivery On Base Metals Futures - 17-02-2023 at FGI VadodaraSUMIT PODDARNo ratings yet

- Indian Electrical Equip Ind Overview - Q1 - FY23Document9 pagesIndian Electrical Equip Ind Overview - Q1 - FY23SUMIT PODDARNo ratings yet

- AatmaNirbhar Gujarat - Industrial Policy Brochure - 051021 - Single PageDocument12 pagesAatmaNirbhar Gujarat - Industrial Policy Brochure - 051021 - Single PageSUMIT PODDARNo ratings yet