Professional Documents

Culture Documents

ASU323 - Assignment 2 - Spring 2023

ASU323 - Assignment 2 - Spring 2023

Uploaded by

Yosef Eladawy0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document provides two accounting assignment questions involving journal entries, general ledger, income statement, statement of owner's equity, and balance sheet for transactions of a factory over one month.

The first question details 10 transactions including investing cash, rent payment, materials and supplies purchases, equipment purchase, production costs, sales, and billing. Students are asked to record journal entries, post to accounts, and prepare financial statements.

The second question gives additional transactions for a factory owned by two partners, including investment, loan, rent, equipment purchase, materials purchase, wages, production costs, sales, and billing. Students are asked to calculate 10 account balances and totals based on the transactions.

Original Description:

..

Original Title

ASU323_Assignment 2_Spring 2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides two accounting assignment questions involving journal entries, general ledger, income statement, statement of owner's equity, and balance sheet for transactions of a factory over one month.

The first question details 10 transactions including investing cash, rent payment, materials and supplies purchases, equipment purchase, production costs, sales, and billing. Students are asked to record journal entries, post to accounts, and prepare financial statements.

The second question gives additional transactions for a factory owned by two partners, including investment, loan, rent, equipment purchase, materials purchase, wages, production costs, sales, and billing. Students are asked to calculate 10 account balances and totals based on the transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesASU323 - Assignment 2 - Spring 2023

ASU323 - Assignment 2 - Spring 2023

Uploaded by

Yosef EladawyThe document provides two accounting assignment questions involving journal entries, general ledger, income statement, statement of owner's equity, and balance sheet for transactions of a factory over one month.

The first question details 10 transactions including investing cash, rent payment, materials and supplies purchases, equipment purchase, production costs, sales, and billing. Students are asked to record journal entries, post to accounts, and prepare financial statements.

The second question gives additional transactions for a factory owned by two partners, including investment, loan, rent, equipment purchase, materials purchase, wages, production costs, sales, and billing. Students are asked to calculate 10 account balances and totals based on the transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

AIN SHAMS UNIVERSITY

FACULTY OF ENGINEERING

CREDIT HOURS ENGINEERING PROGRAMS

Basic Science

Spring 2023

ASU323: Introduction to Accounting

Assignment 2

Answer the following question:

Question 1:

• Prepare journal entries for the transactions

• Post transactions to the accounts in the general ledger

• Prepare Income Statement, Statement of Owner’s Equity, and Balance Sheet

• Adjust all the accounts for one month period, then prepare the adjusted Income

Statement, Statement of Owner’s Equity, and Balance Sheet

Given the following transactions for a factory:

1. Dec. 1st: The owner invested $150,000 to start the business

2. Dec. 1st: Paid $50,000 to rent the factory building for one year

3. Dec. 3rd: Buy a stock of raw material for $90,000 cash

4. Dec. 5th: Borrowed $350,000 from a bank (with 13% interest)

5. Dec. 5th: Purchased office supplies for $300 to be paid Jan. 1st

6. Dec. 7th: Buy $300,000 worth of machines to start production. Paid $100,000 cash and

$200,000 to be paid on 5 years (assume the lifetime = 10 years with $15,000 salvage value)

7. Dec. 18th: Used $30,000 worth of material for the production

8. Dec. 18th: Used $50 of the supplies

9. Dec. 21st: Sell products for $55,000 cash

10. Dec. 22nd: Billed $25,000 for products to be paid

11. Dec. 25th: Paid $10,000 wages

AIN SHAMS UNIVERSITY, FACULTY OF ENGINEERING

Basic Science, i-Credit Hours Engineering Programs

Spring 2023 Assignment 2

ASU323: Introduction to Accounting

Assignment 2 2/2

Question 2:

Given the following transactions for a Factory:

• Two Partners invested total $500,000, to start the business.

• They get $1,000,000 loan from a bank with yearly interest of 24%

• They paid $300,000 for one year of rent.

• They paid $900,000 cash to buy Machines (the machines have no salvage value after 15

years)

• Get $2,000,000 worth raw materials. With paying only $100,000 Cash.

• For the first month, they paid $40,000 in wages.

• For the first month, the factory consumes $200,000 worth raw materials.

• The factory sells products with $300,000 in cash.

• The factory delivers products with $150,000 without receiving the money yet.

If the Owners want to check on the business after the first month, answer the following questions

for them:

1 The “Cash” account is balanced at …….

a) $40,000 b) $610,000 c) $460,000 d) None of them

2 The “Rent Expense” account is adjusted to …….

a) $25,000 b) $300,000 c) $250,000 d) None of them

3 The “Machine Depreciation” is …….

a) $75,000 b) $5,000 c) $60,000 d) None of them

4 The “Loan interest” for this month is …….

a) $240,000 b) $83,333 c) $20,000 d) None of them

5 The total “Revenues” are equal …….

a) $300,000 b) $450,000 c) $150,000 d) None of them

6 The total “Expenses” are equal …….

a) $290,000 b) $90,000 c) $250,000 d) None of them

7 Net Income is equal …….

a) $10,000 b) $360,000 c) $165,000 d) None of them

8 The Owners’ equity is equal …….

a) $500,000 b) $665,000 c) $1,665,000 d) None of them

9 The total “Assets” are equal …….

a) $3,580,000 b) $3,780,000 c) $1,800,000 d) None of them

10 The total “Liabilities” are equal …….

a) $1,000,000 b) $2,920,000 c) $1,920,000 d) None of them

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Aids To TradeDocument24 pagesAids To TradeVivek Shaw86% (14)

- HSBC London Corporate Refund Undertaking LetterDocument1 pageHSBC London Corporate Refund Undertaking LetterHelge Sandoy100% (3)

- Cost Accounting SeatworkDocument2 pagesCost Accounting SeatworkLorena TuazonNo ratings yet

- Exam Revision QuestionsDocument5 pagesExam Revision Questionsfreddy kwakwalaNo ratings yet

- 2006 Business CalculationsDocument13 pages2006 Business CalculationsthatasianpersonNo ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- ASU323 - Major Task - Summer 2023Document4 pagesASU323 - Major Task - Summer 2023yara mohamedNo ratings yet

- Midterm Fall 22 AnswersDocument2 pagesMidterm Fall 22 Answerskarenalber2000No ratings yet

- Final Exam - Fall 2007Document9 pagesFinal Exam - Fall 2007jhouvanNo ratings yet

- BUSI 2001 Intermediate Accounting I, Test 1 Sample ProblemsDocument6 pagesBUSI 2001 Intermediate Accounting I, Test 1 Sample Problemsmrhockey2442No ratings yet

- Midterm Solved 2Document9 pagesMidterm Solved 2hamna wahabNo ratings yet

- (ACMR 216) Budgeting Practices Mid-ExamDocument4 pages(ACMR 216) Budgeting Practices Mid-ExamJosuaNo ratings yet

- Chapter 2 Problems Part BDocument4 pagesChapter 2 Problems Part BAbdisalan AliNo ratings yet

- AMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDocument3 pagesAMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDan Andrei Bongo100% (1)

- De 3.2Document6 pagesDe 3.2minh trungNo ratings yet

- Review Questions Financial Accounting 1 StudentsDocument5 pagesReview Questions Financial Accounting 1 StudentsNancy VõNo ratings yet

- Sha1 ACT 201 Final Exam-Fall 2021Document4 pagesSha1 ACT 201 Final Exam-Fall 2021Ifaz Mohammed IslamNo ratings yet

- Tutorial 01-Balance Sheet PDFDocument3 pagesTutorial 01-Balance Sheet PDFKhiren MenonNo ratings yet

- Instructions:: Introduction To Financial Accounting B.Sc. 2 HrsDocument4 pagesInstructions:: Introduction To Financial Accounting B.Sc. 2 HrsPearl LawrenceNo ratings yet

- Accounts ExamDocument5 pagesAccounts Examsoulvloggers321No ratings yet

- Mastering Depreciation TestbankDocument18 pagesMastering Depreciation TestbankLade PalkanNo ratings yet

- CAPE AccountingDocument35 pagesCAPE Accountingget thosebooksNo ratings yet

- PAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamDocument8 pagesPAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamJack PayneNo ratings yet

- 3 Midterm A - AnswerDocument12 pages3 Midterm A - AnswerAllison0% (1)

- Chegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsDocument7 pagesChegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsJoel Christian MascariñaNo ratings yet

- (Question) Take Home Exercise No 1 - Accounting Equation ApplicationsDocument3 pages(Question) Take Home Exercise No 1 - Accounting Equation Applications蛋卷 PsyvidNo ratings yet

- Exam2505 2012Document8 pagesExam2505 2012Gemeda GirmaNo ratings yet

- Latihan Soal Materi Final TestDocument24 pagesLatihan Soal Materi Final TestCarissaNo ratings yet

- Tutorial Chapter 10-11 Part ADocument47 pagesTutorial Chapter 10-11 Part AKate BNo ratings yet

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocument17 pagesDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNo ratings yet

- Standard Quantity Standard Price Standard or Rate CostDocument4 pagesStandard Quantity Standard Price Standard or Rate CostRabie HarounNo ratings yet

- Budgeting - A LevelDocument2 pagesBudgeting - A LevelMUSTHARI KHANNo ratings yet

- MCQ Accounting DoneDocument7 pagesMCQ Accounting DonebinalamitNo ratings yet

- 2 AssingmentDocument3 pages2 AssingmentABM MOZAHIDNo ratings yet

- Finman Practice QuestionsDocument2 pagesFinman Practice QuestionsMaitet CarandangNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- Tutorial Chpater 10-11 Part BDocument32 pagesTutorial Chpater 10-11 Part BKate BNo ratings yet

- ACCT 6301 Quiz 4 Review F23Document15 pagesACCT 6301 Quiz 4 Review F23Utsav JhaNo ratings yet

- Lecture Engineering Economics FE Review ProblemsDocument23 pagesLecture Engineering Economics FE Review ProblemsLee Song HanNo ratings yet

- F 3 BLQNSPDFDocument21 pagesF 3 BLQNSPDFAngie NguyenNo ratings yet

- Practice Exam - QuestionsDocument5 pagesPractice Exam - QuestionsHoàng Võ Như QuỳnhNo ratings yet

- Finance and AccountingDocument2 pagesFinance and AccountingSujon M Jahid HasanNo ratings yet

- P1 - Performance OperationsDocument20 pagesP1 - Performance OperationsshibluNo ratings yet

- Exam176 10Document5 pagesExam176 10Rabah ElmasriNo ratings yet

- Final 20151Document13 pagesFinal 20151Giner Mabale StevenNo ratings yet

- Reveiw For MondayDocument8 pagesReveiw For MondayRehab ElsamnyNo ratings yet

- The 2009 Winter Accounting TribeDocument15 pagesThe 2009 Winter Accounting TribeMara Shaira SiegaNo ratings yet

- Jimma University Construction Economics (CEGN 6108)Document7 pagesJimma University Construction Economics (CEGN 6108)TesfuNo ratings yet

- Problems and SolutionsDocument7 pagesProblems and SolutionsMohitAhuja0% (1)

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Student Name: Class: Student No.: .Document5 pagesStudent Name: Class: Student No.: .Thao LeNo ratings yet

- 2016 SLC Business CalculationsDocument12 pages2016 SLC Business Calculationssslaa82No ratings yet

- A03 Principles of Accounting IIDocument40 pagesA03 Principles of Accounting IIG JhaNo ratings yet

- Ma1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockDocument9 pagesMa1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockMino MinaNo ratings yet

- Contoh Soal Quiz MankeuDocument11 pagesContoh Soal Quiz MankeuGregoriusAdityaNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Quiz CH 9-11 SchoologyDocument8 pagesQuiz CH 9-11 SchoologyperasadanpemerhatiNo ratings yet

- Basic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFDocument40 pagesBasic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFTaylorHarveyawde100% (14)

- Accrual AccountingDocument7 pagesAccrual AccountingMUHAMMAD ARIF BASHIRNo ratings yet

- Accountancy QP XiDocument4 pagesAccountancy QP XiMohammedNo ratings yet

- 01 - Principles of AccountingDocument16 pages01 - Principles of AccountingYosef EladawyNo ratings yet

- ASU323 - Tutorial 1Document9 pagesASU323 - Tutorial 1Yosef EladawyNo ratings yet

- ASU323 - Major Task - Spring 2023Document7 pagesASU323 - Major Task - Spring 2023Yosef EladawyNo ratings yet

- ASU323 - Assignment 1 - Spring 2023Document1 pageASU323 - Assignment 1 - Spring 2023Yosef EladawyNo ratings yet

- Accounting Manager, Financial Services Platform: About The JobDocument2 pagesAccounting Manager, Financial Services Platform: About The Jobsitepu1223No ratings yet

- Ucm6510 UsermanualDocument488 pagesUcm6510 UsermanualkzoliNo ratings yet

- Franchise Your Concept - A One-Stop-ShopDocument4 pagesFranchise Your Concept - A One-Stop-ShopSalim HajjeNo ratings yet

- Kalinga University Faculty of LawDocument10 pagesKalinga University Faculty of LawAradhana SinghNo ratings yet

- Airport System PlanningDocument14 pagesAirport System PlanningKazu YamutaNo ratings yet

- Emea Ros Pos Program Presentation KitDocument19 pagesEmea Ros Pos Program Presentation Kitapi-441633669No ratings yet

- Christian Laurent Launched New Online Store Offering Worldwide DeliveryDocument3 pagesChristian Laurent Launched New Online Store Offering Worldwide DeliveryPR.comNo ratings yet

- Isaac Shields RBC Bank StatementDocument4 pagesIsaac Shields RBC Bank StatementContactus100% (2)

- Book Building ProcessDocument4 pagesBook Building ProcessAshish KaviNo ratings yet

- Peningkatan Pelayanan Angkutan Umum Orang Melalui Angkutan Kereta API Joglokerto (Jogja - Solo - Purwokerto)Document20 pagesPeningkatan Pelayanan Angkutan Umum Orang Melalui Angkutan Kereta API Joglokerto (Jogja - Solo - Purwokerto)Rahmat FNo ratings yet

- Audit Solution - Chapter 1Document13 pagesAudit Solution - Chapter 1Hoài NamNo ratings yet

- Application LetterDocument3 pagesApplication LetterElisya KharuniawatiNo ratings yet

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- 1616749391-11 Working Capital AppraisalDocument24 pages1616749391-11 Working Capital AppraisalAshishku DashNo ratings yet

- CH 3Document48 pagesCH 3m7tarefNo ratings yet

- Ca Foundation: Introducing Best Faculties Together at One Platform (COC Education) ForDocument43 pagesCa Foundation: Introducing Best Faculties Together at One Platform (COC Education) ForTarunNo ratings yet

- Onecard Statement (20 Jul 2022 - 19 Aug 2022) : Firoz AlamDocument3 pagesOnecard Statement (20 Jul 2022 - 19 Aug 2022) : Firoz AlamFiroz KhanNo ratings yet

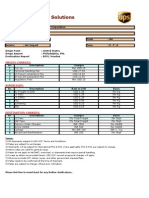

- UPS QuoteDocument1 pageUPS QuoteSwarup DoshiNo ratings yet

- Fastag Maintenence FormDocument1 pageFastag Maintenence FormMukesh K MalviyaNo ratings yet

- Audit of The Sales and Collection Cycle: Tests of Controls and Substantive Tests of TransactionsDocument38 pagesAudit of The Sales and Collection Cycle: Tests of Controls and Substantive Tests of TransactionsLouis ValentinoNo ratings yet

- English CV - Paulina KalfayanDocument1 pageEnglish CV - Paulina KalfayanShalab sharmaNo ratings yet

- AUDITDocument25 pagesAUDITSimon100% (1)

- 3.1 Lecturer1.Chapter3.Balancing Off and Trail BalanceDocument33 pages3.1 Lecturer1.Chapter3.Balancing Off and Trail BalanceTrịnh HoànNo ratings yet

- Class 12 Accountancy Part 1Document268 pagesClass 12 Accountancy Part 1Pyngs Ronra ShimrayNo ratings yet

- Exhibitor FormDocument1 pageExhibitor FormalfonsoNo ratings yet

- Hcia RS Dumps Ver Augus 5051Document305 pagesHcia RS Dumps Ver Augus 5051Sina NeouNo ratings yet

- Basic Elements of Communication SystemDocument4 pagesBasic Elements of Communication SystemArunangshu PalNo ratings yet

- Sr. No. Account NameDocument9 pagesSr. No. Account NameAbhishek MishraNo ratings yet