Professional Documents

Culture Documents

WS 5 SFP

Uploaded by

Ericel MonteverdeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WS 5 SFP

Uploaded by

Ericel MonteverdeCopyright:

Available Formats

Student: Teacher: Pinky F.

Sarmiento-Tacason

Section: Date of

Submission:

Quarter 1 Week 2 Work Sheet No. 5

Statement of Financial Position (SFP)

Objectives: The learner are able to classify accounts under each elements of SFP

Discussion:

The elements of SFP are assets, liabilities and owners equity. This is represented in the

accounting equation

Assets = Liabilities + Owner’s Equity ( A = L + OE )

These elements are grouped into Current Assets, Noncurrent Assets, Current Liabilities,

Noncurrent Liabilities and Owner’s Equity.

Current Assets – Assets that can be realized (collected, sold, used up) one year after year-end

date. Examples include Cash, Accounts Receivable, Merchandise Inventory, Prepaid Expense, etc.

Current Liabilities – Liabilities that fall due (paid, recognized as revenue) within one year after year-

end

date. Examples include Notes Payable, Accounts Payable, Accrued Expenses (example: Utilities

Payable), Unearned Income, etc.

Current Assets are arranged based on which asset can be realized first (liquidity). Current assets and

current liabilities are also called short term assets and shot term liabilities.

Noncurrent Assets – Assets that cannot be realized (collected, sold, used up) one year after yearend

date. Examples include Property, Plant and Equipment (equipment, furniture, building, land),

Long Term investments,Intangible Assets etc.

Noncurrent Liabilities – Liabilities that do not fall due (paid, recognized as revenue) within one year

after year-end date. Examples include Loans Payable, Mortgage Payable, etc.

Noncurrent assets and noncurrent liabilities are also called long term assets and long term

liabilities.

Owner’s Equity is the residual interest of the owner from the business. It can be derived by

deducting liabilities from assets.

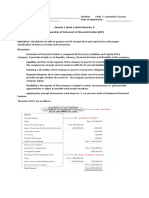

Activity No. 1

Directions: Classify the accounts into the following:

Elements: Assets Classification : Current

Liabilities Non-current

Owner’s Equity No classification

Account Element Classification

Note Payable

Notes Receivable

Prepaid Rent

Property and Equipment

Raw Materials

Salaries Payable

Supplies

Preferred Stock

Utilities Payable

Drawings

Accounts payable

Accounts Receivables

Bonds payable

Cash

Retained Earnings

Interest Payable

Cash on Hand

Additional Paid – In Capital

Cash in Bank

Common Stock

Activity No. 2

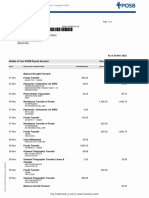

Directions: Below are the accounts of Benedict Services for the year ended December 31, 2015.

Compute for:

1. How much is the total current asset of the entity

2. How much is the total non current assets of the entity

3. How much is the total current liabilities of the entity?

4. How much is the total non current liabilities of the entity?

5. How much is the total assets of the entity?

6. How much is the total liabilities of the entity?

7. How much is the owner’s equity?

Accounts Payable 50,000.00

Accounts Receivable 70,000.00

Capital 920,000.00

Cash 500,000.00

Inventories 225,000.00

Long - Term Debt 150,000.00

Notes Payable 50,000.00

Notes Receivable 50,000.00

Property and Equipment 275,000.00

Supplies and other prepayments 50,000.00

You might also like

- 1 - Fabm2 Pivot Word - LatestDocument48 pages1 - Fabm2 Pivot Word - LatestRoilene MelloriaNo ratings yet

- Current Vs Non CurrentDocument23 pagesCurrent Vs Non CurrentRachelleNo ratings yet

- Module-1 Fabm2Document7 pagesModule-1 Fabm2Kate ArenasNo ratings yet

- Week 2 FABM2 1Document28 pagesWeek 2 FABM2 1Jeremy SolomonNo ratings yet

- Demo Lesson PlanDocument4 pagesDemo Lesson PlanJane Tanams100% (1)

- Fundamentals of Accountancy, Business and Management 2 (Lesson 1)Document21 pagesFundamentals of Accountancy, Business and Management 2 (Lesson 1)Rojane L. Alcantara100% (1)

- Statement of Financial Position BALANCE SHEETDocument28 pagesStatement of Financial Position BALANCE SHEETCleah WaskinNo ratings yet

- 1.statement of Financial Position (SFP)Document29 pages1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- W3 B Statement of FInancial PositionDocument36 pagesW3 B Statement of FInancial PositionKristine DiceNo ratings yet

- Cieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Document10 pagesCieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Venus Frias-Antonio100% (1)

- Fabm2 Week 1 HandoutsDocument6 pagesFabm2 Week 1 HandoutsDane J. CayabyabNo ratings yet

- Module 1: Statement Of: Financial Position (SFP)Document20 pagesModule 1: Statement Of: Financial Position (SFP)Alyssa Nikki VersozaNo ratings yet

- TVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesDocument6 pagesTVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesEunise OprinNo ratings yet

- Fundamentals of ABM 2 SFPDocument34 pagesFundamentals of ABM 2 SFPPrecious chloe DelacruzNo ratings yet

- Lesson 1 Statement of Financial PositionDocument22 pagesLesson 1 Statement of Financial PositionMylene SantiagoNo ratings yet

- Lesson 1 - Statement of Financial PositionDocument23 pagesLesson 1 - Statement of Financial Position12ABM20 MATEO, Roxanne M.No ratings yet

- ACTG 2011 - Midterm Package - 2012-2013Document44 pagesACTG 2011 - Midterm Package - 2012-2013waysNo ratings yet

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- 1 Statement of Financial PositionDocument30 pages1 Statement of Financial PositionAnn Catherine EcitaNo ratings yet

- Fundamentals of Accountancy Business and Management II Module 1Document5 pagesFundamentals of Accountancy Business and Management II Module 1Rafael RetubisNo ratings yet

- Statement of Financial Position 2Document25 pagesStatement of Financial Position 2Daphne Gesto SiaresNo ratings yet

- Fabm 2 ModuleDocument8 pagesFabm 2 ModuleVeinraxzia LlamarNo ratings yet

- Lusterio, Glorielyn-SHS FABM 2-WEEK 1 WLASDocument10 pagesLusterio, Glorielyn-SHS FABM 2-WEEK 1 WLASGlorielyn LusterioNo ratings yet

- Act1module1 (No Template)Document6 pagesAct1module1 (No Template)Miranda S. AlbertNo ratings yet

- FABM2-week1 CshsDocument19 pagesFABM2-week1 Cshsalliyah.edu.phNo ratings yet

- SFP WK 1Document6 pagesSFP WK 1Alma Dimaranan-Acuña0% (1)

- Fundamentals of Accountancy, Business and Management 2Document8 pagesFundamentals of Accountancy, Business and Management 2KING JOSEPHNo ratings yet

- FABM Q3 L4. SLEM - W4 - 2S - Q3 - Five Major AccountDocument16 pagesFABM Q3 L4. SLEM - W4 - 2S - Q3 - Five Major AccountSophia MagdaraogNo ratings yet

- Fabm 2 Week 1Document60 pagesFabm 2 Week 1Camille Cornelio100% (1)

- Fundamentals of Accountancy, Business and Management 2: Statement of Financial PositionDocument18 pagesFundamentals of Accountancy, Business and Management 2: Statement of Financial PositionJemina PocheNo ratings yet

- Ch2 Measuring & Evaluating Financial Position & PerformanceDocument5 pagesCh2 Measuring & Evaluating Financial Position & PerformanceheyNo ratings yet

- Module in Fundamentals of Accountancy 2Document8 pagesModule in Fundamentals of Accountancy 2RoseAnnGatuzNicolas100% (1)

- Chapter 2 - A Further Look at Financial StatementsDocument18 pagesChapter 2 - A Further Look at Financial StatementsCông Hoàng ĐìnhNo ratings yet

- Financial Statement (Balance Sheet, Trading Account, Profit and Loss Account), Ratio AnalysisDocument52 pagesFinancial Statement (Balance Sheet, Trading Account, Profit and Loss Account), Ratio AnalysisRkred237No ratings yet

- Lesson Exemplar: Foundamentals of Accountancy & Business Management 2Document5 pagesLesson Exemplar: Foundamentals of Accountancy & Business Management 2Nancy AtentarNo ratings yet

- SFP WK 1Document6 pagesSFP WK 1Alma Dimaranan-AcuñaNo ratings yet

- Statement of Financial Position (SFP)Document38 pagesStatement of Financial Position (SFP)Jackie100% (2)

- FABM2 Module 1. Statement of Financial PositionDocument10 pagesFABM2 Module 1. Statement of Financial PositionSITTIE RAYMAH ABDULLAHNo ratings yet

- Fabm2-Module 1 - With ActivitiesDocument8 pagesFabm2-Module 1 - With ActivitiesROWENA MARAMBANo ratings yet

- Fundamentals of Accounting, Business AND Management 2Document16 pagesFundamentals of Accounting, Business AND Management 2Mary April Repuela GapoNo ratings yet

- Fundamentals of Accountancy Lesson 1Document6 pagesFundamentals of Accountancy Lesson 1Rojane L. AlcantaraNo ratings yet

- 1.fundamentals of ABM 2Document27 pages1.fundamentals of ABM 2MaraNo ratings yet

- Fundamentals of Abm 2Document61 pagesFundamentals of Abm 2Zandra QuillaNo ratings yet

- Statement of Financial Position (SFP) : Lesson 1Document29 pagesStatement of Financial Position (SFP) : Lesson 1Dianne Saragena100% (1)

- Fundamentals of Accountancy, Business and Management 2Document12 pagesFundamentals of Accountancy, Business and Management 2Julia ConceNo ratings yet

- Assets and Liability ManagementDocument42 pagesAssets and Liability Managementssubha123100% (4)

- Fabm-1, Week-3Document16 pagesFabm-1, Week-3Antonio TanegaNo ratings yet

- Abm 2Document11 pagesAbm 2Kyla Balistoy100% (1)

- Hba Lap1 - SFPDocument42 pagesHba Lap1 - SFPChristian Dave EvangelistaNo ratings yet

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Fundamentals of Abm2: Statement of Financial Position (SFP)Document16 pagesFundamentals of Abm2: Statement of Financial Position (SFP)imeemagdangalNo ratings yet

- Topic I - Statement of Financial PositionDocument6 pagesTopic I - Statement of Financial PositionJianne Ricci GalitNo ratings yet

- Funds Flow StatementDocument40 pagesFunds Flow StatementShalini Kolla100% (1)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- WS 6 Preparation of SFPDocument5 pagesWS 6 Preparation of SFPEricel MonteverdeNo ratings yet

- Q1 Module2 G11 12 MIL Sir NarsDocument10 pagesQ1 Module2 G11 12 MIL Sir NarsEricel MonteverdeNo ratings yet

- Contempo Q1 W2Document4 pagesContempo Q1 W2Ericel MonteverdeNo ratings yet

- G12 Abm WHLP W2Document3 pagesG12 Abm WHLP W2Ericel MonteverdeNo ratings yet

- Fabia Week2 PE WS2Document3 pagesFabia Week2 PE WS2Ericel MonteverdeNo ratings yet

- 21stCenturyLit Week-1 PTDocument1 page21stCenturyLit Week-1 PTEricel MonteverdeNo ratings yet

- BESR 4thQtr - Module1.wk1Document5 pagesBESR 4thQtr - Module1.wk1Ericel MonteverdeNo ratings yet

- BESR 4thQtr - Module2.wk2Document5 pagesBESR 4thQtr - Module2.wk2Ericel MonteverdeNo ratings yet

- Chapter 6 - Parternship Liquidation (Lump-Sum) PDFDocument26 pagesChapter 6 - Parternship Liquidation (Lump-Sum) PDFEricel MonteverdeNo ratings yet

- About Us: WWW - Gupshup.ioDocument2 pagesAbout Us: WWW - Gupshup.ioSwati ChaturvediNo ratings yet

- IESCO ONLINE BILL 1 MarDocument1 pageIESCO ONLINE BILL 1 MarShehzad hasnainiNo ratings yet

- Unit 2: Micro-Economics 2.4 Theory of Production Concept of ProductionDocument14 pagesUnit 2: Micro-Economics 2.4 Theory of Production Concept of ProductionAahana AahanaNo ratings yet

- Er 1-94 Program Issuance Fund Allocation - Doe PDFDocument52 pagesEr 1-94 Program Issuance Fund Allocation - Doe PDFMelvin John CabelinNo ratings yet

- Planning Personal Finances: Unit 1Document28 pagesPlanning Personal Finances: Unit 1Prathamesh KhopkarNo ratings yet

- Report - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaDocument101 pagesReport - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaBongani SaidiNo ratings yet

- Limitations of Market SegmentationDocument6 pagesLimitations of Market SegmentationIQRA YOUSAFNo ratings yet

- Invoice Letter 11 Nov 2021Document8 pagesInvoice Letter 11 Nov 2021Suvi AzkaNo ratings yet

- Microeconomics (Monopoly, CH 10)Document32 pagesMicroeconomics (Monopoly, CH 10)Vikram SharmaNo ratings yet

- Why Diverse Markets Need Diverse Talent Speech by Andrew HauserDocument10 pagesWhy Diverse Markets Need Diverse Talent Speech by Andrew HauserHao WangNo ratings yet

- Shanto-Mariam University of Creative Technology: Report Topic: History of Apparel Industry and RMG in BangladeshDocument21 pagesShanto-Mariam University of Creative Technology: Report Topic: History of Apparel Industry and RMG in BangladeshFarzak Faysal M FarabiNo ratings yet

- IAS 37 - SummaryDocument4 pagesIAS 37 - SummaryRenz Francis LimNo ratings yet

- Global Business EnvironmentDocument15 pagesGlobal Business EnvironmentSANDEEP SINGH63% (8)

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet

- Comparative Vs Absolute AdvantageDocument9 pagesComparative Vs Absolute AdvantageJayesh Kumar YadavNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsAartiNo ratings yet

- HZS120F8Document2 pagesHZS120F8saimunNo ratings yet

- PBA Vs CA, CTA and CIRDocument8 pagesPBA Vs CA, CTA and CIRChrissyNo ratings yet

- Buscom Quiz: Book Value Fair ValueDocument2 pagesBuscom Quiz: Book Value Fair ValueNairah M. TambieNo ratings yet

- Happy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223Document4 pagesHappy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223pkNo ratings yet

- LMM Jjs PPT 2a Basics of LeanDocument116 pagesLMM Jjs PPT 2a Basics of LeanAby Reji ChemmathuNo ratings yet

- Artech Cooling Towers Top Quality Cooling Tower 161202110226Document19 pagesArtech Cooling Towers Top Quality Cooling Tower 161202110226Raouia MaalemNo ratings yet

- Simple Tax Invoice With Billing and ShippingDocument1 pageSimple Tax Invoice With Billing and ShippingerjasdNo ratings yet

- Consumer Information:: Name: Date of Birth: GenderDocument3 pagesConsumer Information:: Name: Date of Birth: GendermohitNo ratings yet

- School Based Assessment: To Assess The Cause and Effects of Inflation On Small Businesses in The Greater Portmore RegionDocument22 pagesSchool Based Assessment: To Assess The Cause and Effects of Inflation On Small Businesses in The Greater Portmore RegionOniel BryanNo ratings yet

- What Are The Features of The IstisnaDocument4 pagesWhat Are The Features of The IstisnaanassaleemNo ratings yet

- Xiaomi Case StudyDocument4 pagesXiaomi Case StudyAyushi KumawatNo ratings yet

- November 2022Document4 pagesNovember 2022NURSAJIDANo ratings yet

- A Contingency View of Porter's "Generic Strategies"Document12 pagesA Contingency View of Porter's "Generic Strategies"Onos Bunny BenjaminNo ratings yet

- Expendable Net AssetsDocument4 pagesExpendable Net AssetsSyed Muhammad Ali SadiqNo ratings yet