Professional Documents

Culture Documents

Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDF

Uploaded by

Sarah Nicole S. LagrimasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDF

Uploaded by

Sarah Nicole S. LagrimasCopyright:

Available Formats

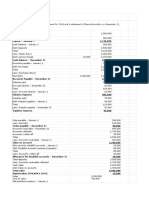

NAME: LAGRIMAS, SARAH NICOLE S.

PROVISIONS, CONTINGENCIES AND OTHER LIABILITIES

PROBLEM 1-1

a, c, e, g, h, i, m, n, o, p

PROBLEM 1-2

Case 1- None

Case 2 - P800,000

Case 3 - P400,000

Case 4 - P350,000

Case 5 - P100,000 = (1M × 10%) + (200,000 × 30%) - 60,000

Case 6 -None

PROBLEM 1-3

a.) B= 8.000.000 × 8%= ₱640,000 d.) B= .08 /8.000.000- B- T \

b.) B= 8% (8000,000 - B ) T - .30 (8,000,000 - B)

B= 640.000 - 08B B = .08{8,000,000 - B- .30 (8,000,000 - B)}

B = 640,000/1.08 = ₱592,593 B = .08 {8,000,000 - B - 2,400,000 + 30B}

c.) B = .08 (8.000.000- T ) B = 448,000 - .056B

Т = .30 (8,000,000 - B) B= 448,000/1.056 = ₱424,242

B = .08 {8,000,000 - .30 (8,000,000- B) }

B = .08 {8,000,000 - 2,400,000 + .30B}

B= 448.000 + .024B

B = 448,000/0.976 = ₱459,016

PROBLEM 1-4

a.) Bonus to sales manager = .08 × 3,000,000 = B = ₱240,000

Bonus to each sales agent = .06 × 3,000,000 = B = ₱180,000

b.) Total Bonus = .36 {3,000,000 - B - T )

T = .30 {3,000,000 -B }

B= .363,000,000-B-.30(3,000,000-B)}

B = .36 {3,000,000 - B- 900,000 + .30B}

B = 756,000 - .252B

B= 756.000/1.252 = 603,834 (total)

B (Each): 603,834 / 3 B = ₱201,278

c.) B=.32{3,000,000-B}

B = 960,000 - .32B

B = 960,000/1.32 = 727,273 (total)

B (Sales Manager): 727,273 × 12/32 B = ₱272,727

B (Each Sales Agent): 727,273 × 10/32 B = ₱227,273

PROBLEM 1-5

B= .06{9,000,000-B-T}

Т = .30 (9,000,000 - B)

B = .06 (9,000,000- B- .30 (9,000,000 - B) }

B= .06 {9,000,000- B- 2,700,000 + .30B }

B = 378,000 - .042B

B = 378,000 / 1.042 = 362,764

T = .30 (9.000.000 - 362.764) T = ₱2,591,171

PROBLEM 1-6

2019 2020 2021

Sale of Product 1,000,000 2,500,000 3,500,000

Cash/ Accounts Receivables 1,000,000 2,500,000 3,500,000

Sales

Accrual of Repairs

Warranty Expense 60,000 150,000 210,000

Warranty Liability 60,000 150,000 210,000

Actual Repairs

Warranty Liability 8,000 38,000 112,500

Cash/ Accounts Payable 8,000 38,000 112,500

PROBLEM 1-7

a.) 2019 2020

Warranty Liability, January 1 ₱0 ₱187,200

Warranty expense (8% × 4,200,000)/(8% × 6,960,000) 336,000 556,800

Actual repair costs incurred -148,800 -180,000

Warranty liability, December 31 ₱187,200 ₱564,000

b.)

On 2019 sales (4,200,000 × 5% × ⁄ )

On 2020 sales [(1/2 of 3%) + 5%] × 6,960,000 ₱105,000

Predicted warranty liability at December 31, 2020 452,400

₱557,400

PROBLEM 1-8

a.) 2019 2020

Cash 720,000 864,000

Unearned Revenue from Warranty Contracts 720,000 864,000

Cost of Warranty Contracts 25,000 100,000

Cash, Materials, etc. 25,000 100,000

Unearned Revenue from Warranty Contracts 72,000 266,400

Revenue from Warranty Contracts 72,000 266,400

b.)

From 2019 contracts 720,000 × 65% 468,000

From 2020 contracts 864,000 × 90% 777,600

Total ₱1,245,600

c.) 2019 2020

Revenue from warranty contracts 72,000 266,400

Cost of Warranty Contracts 25,000 100,000

Profit from warranty contracts ₱47,000 ₱166,400

PROBLEM 1-9

a.)

Premium Inventory 25,000

Cash/Accounts Payable 25,000

b.)

Cash/ Accounts Receivable 15,000,000

Sales 14,062,500

Unearned Revenue for Premium Claims 937,500

c.)

Cash 50,000

Unearned Revenue for Premium Claims 234,375

Sales 284,375

PROBLEM 1-10

a.)

Basis of allocation of sales price of main product

Selling price of main product 300,000 × 30 9,000,000

Selling price of premium (300,000 × 30%)/20 = 4,500 x 40 180,000

₱9,180,000

Allocation of sales price

To main product 9,000,000 × (9M/9.180M 8,823,529

To premium 9,000,000 × (180,000/9,180,000) Total 176,471

Total ₱9,000,000

Unearned revenue for unredeemed coupons before redemption 176,471

Reduction resulting from redemption 176,471 × (4,000/4,500) 158,963

Unearned revenue for unredeemed coupons, December 31 ₱19,608

b.)

Additional Sales [176,471 × (4,000/4,500)] ₱158,963

You might also like

- Robinhood Case StudyDocument3 pagesRobinhood Case StudyXnort G. XwestNo ratings yet

- Assignment 2 Taxation AtxDocument17 pagesAssignment 2 Taxation Atxiknowu250No ratings yet

- Week 2 Output-KingDocument4 pagesWeek 2 Output-KingAlexis KingNo ratings yet

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Nhóm 4 - In-Class Exercise BOP - 2020Document36 pagesNhóm 4 - In-Class Exercise BOP - 2020Thảo Hoàng PhươngNo ratings yet

- PSDA (SM) - PatanjaliDocument11 pagesPSDA (SM) - PatanjalinancyNo ratings yet

- Pitch - Investor Pitch ToolkitDocument35 pagesPitch - Investor Pitch Toolkitapritul3539100% (2)

- Word DiorDocument3 pagesWord Diorlethiphuong15031999100% (1)

- Tesco 14 FullDocument4 pagesTesco 14 FullBilal SolangiNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- Discussion Problems and SolutionsDocument33 pagesDiscussion Problems and SolutionsBella De LiañoNo ratings yet

- Intacc 3 Ans To Chap 1 ProbsDocument4 pagesIntacc 3 Ans To Chap 1 ProbsMhico MateoNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- Warranty Liability Empleo Robles SolManDocument2 pagesWarranty Liability Empleo Robles SolManJohanna Raissa CapadaNo ratings yet

- Problem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductDocument15 pagesProblem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductJPNo ratings yet

- Assignment#2Document5 pagesAssignment#2Kristine Esplana ToraldeNo ratings yet

- ASSIGNMENT#2Document5 pagesASSIGNMENT#2Kristine Esplana ToraldeNo ratings yet

- Intermediate Accounting 2 Chapter 3Document8 pagesIntermediate Accounting 2 Chapter 3Mau Dela CruzNo ratings yet

- Module 3 DepreciationDocument4 pagesModule 3 DepreciationLouie Jay JadraqueNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Pauline Kisha CastroNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Joana MagtuboNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)HohohoNo ratings yet

- Audit Probs 4 (Final Exam)Document6 pagesAudit Probs 4 (Final Exam)YameteKudasaiNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Assignment FARDocument2 pagesAssignment FARCykee Hanna Quizo LumongsodNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Document34 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Makoy BixenmanNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Ch3Warranty LiabilityDocument24 pagesCh3Warranty LiabilityCrysta LeeNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- Assignment#1Document4 pagesAssignment#1Kristine Esplana ToraldeNo ratings yet

- Property, Plant, & Equipment Problem SetDocument3 pagesProperty, Plant, & Equipment Problem SetSarah Nicole S. LagrimasNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1Sharmaine JoyceNo ratings yet

- R&L Company: Assignment 1 Premium Liability, Warranty LiabilityDocument6 pagesR&L Company: Assignment 1 Premium Liability, Warranty Liabilityangelian bagadiongNo ratings yet

- Aud315 - Quizzes Solution PaperDocument6 pagesAud315 - Quizzes Solution PaperLorraineMartinNo ratings yet

- CH 2 Answers PDFDocument5 pagesCH 2 Answers PDFLian Blakely CousinNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Q3a. Capital Budget AssignmentDocument1 pageQ3a. Capital Budget AssignmentMorgan MunyoroNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- INSTALLMENT SALES UpdatedDocument26 pagesINSTALLMENT SALES UpdatedMichael BongalontaNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Ch2Premium LiabilityDocument20 pagesCh2Premium LiabilityCrysta Lee100% (1)

- PROBLEM 1. (Current and Non-Current Liabilities) : To Record The Purchase of Knives As PremiumsDocument2 pagesPROBLEM 1. (Current and Non-Current Liabilities) : To Record The Purchase of Knives As PremiumsDanica RamosNo ratings yet

- 2.1, 2.2, 2.3, 2.4, 2.9, 2.10, 2.12 KTQTDocument6 pages2.1, 2.2, 2.3, 2.4, 2.9, 2.10, 2.12 KTQTThùy LinhhNo ratings yet

- Ass.1 Acctng. For Special TransactionDocument17 pagesAss.1 Acctng. For Special TransactionJea Ann CariñozaNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- 1860788077acct3006 T06a PDFDocument4 pages1860788077acct3006 T06a PDF徐滢No ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Partnership Opration Do It YourselfDocument4 pagesPartnership Opration Do It YourselfBC qpLAN CrOwNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Income Taxes SolutionsDocument1 pageIncome Taxes SolutionsSleepy marshmallowNo ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- IA2 Quiz1 (ANTIDO)Document4 pagesIA2 Quiz1 (ANTIDO)Claire Magbunag AntidoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- Accounting For Labor & Manufacturing OverheadDocument10 pagesAccounting For Labor & Manufacturing OverheadSarah Nicole S. LagrimasNo ratings yet

- Lagrimas, Sarah Nicole S. - InventoriesDocument3 pagesLagrimas, Sarah Nicole S. - InventoriesSarah Nicole S. LagrimasNo ratings yet

- Process CostingDocument8 pagesProcess CostingSarah Nicole S. LagrimasNo ratings yet

- Assessment 3Document4 pagesAssessment 3Sarah Nicole S. LagrimasNo ratings yet

- Process CostingDocument2 pagesProcess CostingSarah Nicole S. LagrimasNo ratings yet

- LAGRIMAS - Activity 2Document4 pagesLAGRIMAS - Activity 2Sarah Nicole S. LagrimasNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- Lagrimas - Leases Multiple ChoicesDocument4 pagesLagrimas - Leases Multiple ChoicesSarah Nicole S. LagrimasNo ratings yet

- Lagrimas Activity 4Document10 pagesLagrimas Activity 4Sarah Nicole S. LagrimasNo ratings yet

- Lagrimas Activity 1Document3 pagesLagrimas Activity 1Sarah Nicole S. LagrimasNo ratings yet

- Lagrimas, Sarah Nicole S. - Single Entry PDFDocument4 pagesLagrimas, Sarah Nicole S. - Single Entry PDFSarah Nicole S. LagrimasNo ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- The Communist ManifestoDocument4 pagesThe Communist ManifestoSarah Nicole S. LagrimasNo ratings yet

- Business LogicsDocument2 pagesBusiness LogicsSarah Nicole S. LagrimasNo ratings yet

- Lagrimas, Sarah Nicole S. - Bio Assets PDFDocument9 pagesLagrimas, Sarah Nicole S. - Bio Assets PDFSarah Nicole S. LagrimasNo ratings yet

- Property, Plant, & Equipment Problem SetDocument3 pagesProperty, Plant, & Equipment Problem SetSarah Nicole S. LagrimasNo ratings yet

- Chapter 9 - Operations, Dividends, BVPS, & EPSDocument6 pagesChapter 9 - Operations, Dividends, BVPS, & EPSSarah Nicole S. LagrimasNo ratings yet

- SWOT& Financial Data Pakistan Petroleum LimitedDocument13 pagesSWOT& Financial Data Pakistan Petroleum LimitedFarah Nawaz QabulioNo ratings yet

- E3 Operating AuditingDocument21 pagesE3 Operating AuditingPaupauNo ratings yet

- Fort Erie Customs BrokersDocument2 pagesFort Erie Customs BrokersdaverobNo ratings yet

- Affect of Branding On Consumer Purchase Decision: Research ProjectDocument7 pagesAffect of Branding On Consumer Purchase Decision: Research ProjectPooja RawatNo ratings yet

- Bam 200 Strat Man - Module 1 4Document25 pagesBam 200 Strat Man - Module 1 4April Jochebed MadriagaNo ratings yet

- 4global Capital Market 2Document11 pages4global Capital Market 2roseNo ratings yet

- Chapter 1 EnterprDocument11 pagesChapter 1 EnterprSundas FareedNo ratings yet

- Hundred IslandsDocument11 pagesHundred IslandsJeremhia Mhay100% (1)

- FDI in The Indian Retail SectorDocument4 pagesFDI in The Indian Retail SectorE D Melinsani ManaluNo ratings yet

- Fintech and The Transformation of The Financial IndustryDocument9 pagesFintech and The Transformation of The Financial Industryrealgirl14No ratings yet

- Request For Redemption or Fund Switch - DES VersionDocument2 pagesRequest For Redemption or Fund Switch - DES VersionAvillz Mar LeeNo ratings yet

- Understanding Process Change Management in Electronic Health Record ImplementationsDocument35 pagesUnderstanding Process Change Management in Electronic Health Record ImplementationsssimukNo ratings yet

- Building The Resilience of Small Coastal BusinessesDocument60 pagesBuilding The Resilience of Small Coastal BusinessesMona PorterNo ratings yet

- Seeing The World Differently Litigation AriDocument4 pagesSeeing The World Differently Litigation AriTC 15 SPEAKER 2No ratings yet

- Swiggy Refine - AswathyUdhayDocument6 pagesSwiggy Refine - AswathyUdhayAswathy UdhayakumarNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewRohan SharmaNo ratings yet

- Assistant Manager - CSR (Mumbai)Document2 pagesAssistant Manager - CSR (Mumbai)Kumar GauravNo ratings yet

- The Future of FinanceDocument30 pagesThe Future of FinanceRenuka SharmaNo ratings yet

- Mankiw10e Lecture Slides Ch04Document43 pagesMankiw10e Lecture Slides Ch04Anggi YudhaNo ratings yet

- Customer Satisfaction and Promotional Activity of NexaDocument63 pagesCustomer Satisfaction and Promotional Activity of NexaRaghunath AgarwallaNo ratings yet

- Ikea Presentation PDFDocument21 pagesIkea Presentation PDFBharat Gourav DashNo ratings yet

- DHFL Pramerica Deep Value Strategy PMSDocument4 pagesDHFL Pramerica Deep Value Strategy PMSAnkurNo ratings yet

- 09 Ratio AnalysisDocument16 pages09 Ratio AnalysisHimanshu VermaNo ratings yet

- Eldenburg 4e PPT Ch06Document6 pagesEldenburg 4e PPT Ch06StaygoldNo ratings yet