Professional Documents

Culture Documents

Cat 1 Q2

Uploaded by

caleb0 ratings0% found this document useful (0 votes)

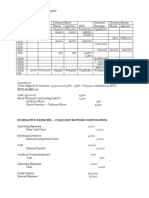

5 views1 page1) The COPA kiboko yao Club had total income of KES 13,940 for the year ended 31 December 2018 from subscriptions, visitors' fees, competition fees, and snack bar profits. Total expenditures were KES 4,800, resulting in a surplus of KES 8,640.

2) As of 31 December 2018, the club's assets included non-current assets valued at KES 44,200 and current assets of KES 3,200. Liabilities were KES 11,760 resulting in accumulated funds of KES 35,640.

3) Key items in the financial statements included depreciation on games equipment of KES 800 and accumulated funds opening balance of KES 27

Original Description:

cat

Original Title

CAT 1 Q2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The COPA kiboko yao Club had total income of KES 13,940 for the year ended 31 December 2018 from subscriptions, visitors' fees, competition fees, and snack bar profits. Total expenditures were KES 4,800, resulting in a surplus of KES 8,640.

2) As of 31 December 2018, the club's assets included non-current assets valued at KES 44,200 and current assets of KES 3,200. Liabilities were KES 11,760 resulting in accumulated funds of KES 35,640.

3) Key items in the financial statements included depreciation on games equipment of KES 800 and accumulated funds opening balance of KES 27

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageCat 1 Q2

Uploaded by

caleb1) The COPA kiboko yao Club had total income of KES 13,940 for the year ended 31 December 2018 from subscriptions, visitors' fees, competition fees, and snack bar profits. Total expenditures were KES 4,800, resulting in a surplus of KES 8,640.

2) As of 31 December 2018, the club's assets included non-current assets valued at KES 44,200 and current assets of KES 3,200. Liabilities were KES 11,760 resulting in accumulated funds of KES 35,640.

3) Key items in the financial statements included depreciation on games equipment of KES 800 and accumulated funds opening balance of KES 27

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

CMFI 2106: FINANCIAL ACCOUNTING II – CAT ANSWER

2) COPA kiboko yao Club KES KES

a) Income & Expenditure Account for the year ended 31 Dec 2018 Workings

KES KES Snack bar profit

Income Income 12,000

Subscriptions 7,000 Cost of sales

Visitors' fees 1,300 Opening inventory 1,600

Competition fees 1,640 add: Purchases 7,500

Snack bar profit (see workings) 3,500 9,100

Rent and business rates 13,440 less: closing inventory 1,800

less Expenditure: 7,300

Rent and rates 3,000 Gross profit 4,700

Secretarial expenses 480 less expenses 1,200

Loan interest 520 3,500

Depreciation on games equipment (see workings) 800 Depreciation on games equipment

4,800 Cost rate KES

Surplus of income over expenditure 8,640 4,000 20% 800

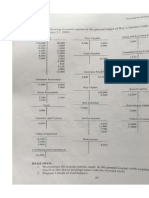

b) Balance Sheet as at 31 December 2018 Workings

Accumulated Net Book

Cost Depreciation Value

KES KES KES

Non-current assets

Clubhouse buildings (25,000 + 16,000) 41,000 - 41,000

Games equipment 4,000 800 3,200 Accumulated fund

45,000 800 44,200 Cash at bank 400

Current assets Snack bar inventory 1,600

Snack bar inventory 1,800 Club house buildings 25,000

Bank 1,400 27,000

3,200

47,400

Current liabilities

Subscriptions received in advance 760

Loan from bank 11,000

11,760

35,640

Financed by:

Accumulated fund

Opening balance (see workings) 27,000

Add: surplus for the year 8,640

35,640

You might also like

- IAS 7 Full Conso Statement of Cash Flows-Akorfa GroupDocument2 pagesIAS 7 Full Conso Statement of Cash Flows-Akorfa GroupeoafriyieNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Activity 1 Finman 1Document6 pagesActivity 1 Finman 1lykaNo ratings yet

- Asset 2017 2018: Total 313.000 295.000Document1 pageAsset 2017 2018: Total 313.000 295.000Agung KartikasariNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- Name: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoDocument2 pagesName: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoRowma Danielle LactaoNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Gross Profit 25,450.00Document6 pagesGross Profit 25,450.00AliNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- Financial Statements (Basic)Document7 pagesFinancial Statements (Basic)Mohamed MubarakNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- Latihan Balance SheetDocument2 pagesLatihan Balance SheetRetno TitisariNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Chap 1Document14 pagesChap 1Nguyen Thi Diem Quynh (K17 HCM)No ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Acc117 - Assessment - Project 2 (Q)Document5 pagesAcc117 - Assessment - Project 2 (Q)SHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Accounting Assignment Q-4Document5 pagesAccounting Assignment Q-4Ueamraan MartNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Haliza Nabila Putri - b1024201030 2021 Jan Introduction To AccountingDocument4 pagesHaliza Nabila Putri - b1024201030 2021 Jan Introduction To AccountingHaliza Nabila PutriNo ratings yet

- Lembar JWB PD ANGKASADocument53 pagesLembar JWB PD ANGKASAernyNo ratings yet

- Financial Statements - BasicDocument5 pagesFinancial Statements - BasicMohamed MubarakNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Assignment in AccountingDocument19 pagesAssignment in AccountingPAU VLOGSNo ratings yet

- Cash-Flow-Statement - Class PracticeDocument7 pagesCash-Flow-Statement - Class PracticeShruti ShivhareNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Quiz 1Document2 pagesQuiz 1Leonie Jhoy Concepcion MillanesNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Nonp 1 SlidesDocument20 pagesNonp 1 SlidesomponyeprimoganeditseNo ratings yet

- Revision Question BAAB1014 May 23-1Document6 pagesRevision Question BAAB1014 May 23-1Hareen JuniorNo ratings yet

- 3.1.cash Flows Class QuestionsDocument3 pages3.1.cash Flows Class Questionsmali CNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsDaniel PeterNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Question Bank Chapter 12Document4 pagesQuestion Bank Chapter 12Giang Thái HươngNo ratings yet

- Answers Part OneDocument25 pagesAnswers Part OneDeul ErNo ratings yet

- Topic 6 Test ISBS 3E4Document5 pagesTopic 6 Test ISBS 3E4LynnHanNo ratings yet

- T1 - ABFA1153 (Extra)Document1 pageT1 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Assignment 9 FARDocument23 pagesAssignment 9 FARcha618717No ratings yet

- LkhgyDocument2 pagesLkhgyDynNo ratings yet

- Answer To RQ1 - Week 6Document1 pageAnswer To RQ1 - Week 6calebNo ratings yet

- FA 2 - Essay QuestionDocument4 pagesFA 2 - Essay QuestioncalebNo ratings yet

- Answer To RQ 3 - Week 6 PDFDocument1 pageAnswer To RQ 3 - Week 6 PDFcalebNo ratings yet

- XYZ LTDDocument1 pageXYZ LTDcalebNo ratings yet

- Answer Q5Document2 pagesAnswer Q5calebNo ratings yet

- Week 5 NotesDocument9 pagesWeek 5 NotescalebNo ratings yet

- Week 6 NotesDocument7 pagesWeek 6 NotescalebNo ratings yet

- Week 2 NotesDocument20 pagesWeek 2 NotescalebNo ratings yet

- Week 3 NotesDocument8 pagesWeek 3 NotescalebNo ratings yet

- Week 8 NotesDocument8 pagesWeek 8 NotescalebNo ratings yet

- Business Law Notes Final - NDocument42 pagesBusiness Law Notes Final - NcalebNo ratings yet

- Accounting For PartnershipsDocument15 pagesAccounting For PartnershipscalebNo ratings yet

- Lesson Eight - Theory of Costs and Profit MaximizationDocument7 pagesLesson Eight - Theory of Costs and Profit MaximizationcalebNo ratings yet

- Course Code and Title: ACED 7Document18 pagesCourse Code and Title: ACED 7maelyn calindongNo ratings yet

- Getting Started With GST Unit 2 8 Mark QuestionsDocument2 pagesGetting Started With GST Unit 2 8 Mark Questionsmanoharchary157No ratings yet

- Account PayableDocument6 pagesAccount PayablenaysarNo ratings yet

- Siddharth Canara 17733213733Document3 pagesSiddharth Canara 17733213733SiddharthNo ratings yet

- Q1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2Document72 pagesQ1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2artemisNo ratings yet

- Final Report KasbDocument70 pagesFinal Report KasbtrueliarerNo ratings yet

- When Are CountryWide Notes Endorsed and Excerpt of Deposition Transcript of SjolanderDocument18 pagesWhen Are CountryWide Notes Endorsed and Excerpt of Deposition Transcript of Sjolander83jjmack100% (8)

- Fedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Document22 pagesFedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Somdutt Gujjar100% (2)

- Bank Version Personal Financial StatementDocument9 pagesBank Version Personal Financial StatementJk McCrea100% (1)

- Understanding GAAP - AccountingDocument9 pagesUnderstanding GAAP - Accountingshanu104100% (1)

- SIC InterpretationsDocument42 pagesSIC InterpretationsJean Fajardo Badillo100% (1)

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- Financial Statement Analysis: 17-5 The Dividend Yield Is TheDocument51 pagesFinancial Statement Analysis: 17-5 The Dividend Yield Is TheMafi De LeonNo ratings yet

- Statement 028201000028352Document6 pagesStatement 028201000028352Saravanan 75No ratings yet

- Last Assignment December 2022Document77 pagesLast Assignment December 2022DavidNo ratings yet

- Bank PerformanceDocument34 pagesBank Performancebr bhandariNo ratings yet

- GO2 BankDocument1 pageGO2 Bank邱建华No ratings yet

- Indian Overseas BankDocument3 pagesIndian Overseas Bankramarm3No ratings yet

- IFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALDocument80 pagesIFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALbaraalqasem100% (1)

- Analysis of The Risk and Return Relationship of Equity Based Mutual Fund in IndiaDocument7 pagesAnalysis of The Risk and Return Relationship of Equity Based Mutual Fund in Indiagau2gauNo ratings yet

- Account STDocument1 pageAccount STSadiq PenahovNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- Bank Name Account NumberDocument4 pagesBank Name Account Numberhemant kangriwalaNo ratings yet

- Cambria Tail Risk ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Tail Risk ETF: Strategy Overview Fund Detailscena1987No ratings yet

- Guideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Document20 pagesGuideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Shaa DidiNo ratings yet

- ExercisesDocument11 pagesExercisesJirlin LncNo ratings yet

- On December 31 2011 Information Inc Completed Its Third YearDocument1 pageOn December 31 2011 Information Inc Completed Its Third YearFreelance WorkerNo ratings yet

- Sr. No. Description Allied Rate of Charges PL Category (T24)Document2 pagesSr. No. Description Allied Rate of Charges PL Category (T24)Textro VertNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet