Professional Documents

Culture Documents

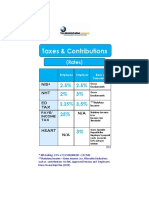

Mandatory Contributions

Uploaded by

LAWRENCE DE LEON0 ratings0% found this document useful (0 votes)

10 views1 pageThis document outlines the mandatory contributions and income tax computation for an employee with a basic monthly salary of 35,000 pesos. The total monthly mandatory contributions are 2,237.50 pesos, consisting of contributions to SSS, PhilHealth, and Pag-IBIG. The annual taxable compensation is 393,150 pesos after deducting annual contributions of 26,850 pesos from the gross annual income of 420,000 pesos. The income tax due is calculated as 21,472.50 pesos based on a tax rate of 15% for taxable income over 250,000 pesos but below 400,000 pesos.

Original Description:

Original Title

MANDATORY CONTRIBUTIONS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the mandatory contributions and income tax computation for an employee with a basic monthly salary of 35,000 pesos. The total monthly mandatory contributions are 2,237.50 pesos, consisting of contributions to SSS, PhilHealth, and Pag-IBIG. The annual taxable compensation is 393,150 pesos after deducting annual contributions of 26,850 pesos from the gross annual income of 420,000 pesos. The income tax due is calculated as 21,472.50 pesos based on a tax rate of 15% for taxable income over 250,000 pesos but below 400,000 pesos.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageMandatory Contributions

Uploaded by

LAWRENCE DE LEONThis document outlines the mandatory contributions and income tax computation for an employee with a basic monthly salary of 35,000 pesos. The total monthly mandatory contributions are 2,237.50 pesos, consisting of contributions to SSS, PhilHealth, and Pag-IBIG. The annual taxable compensation is 393,150 pesos after deducting annual contributions of 26,850 pesos from the gross annual income of 420,000 pesos. The income tax due is calculated as 21,472.50 pesos based on a tax rate of 15% for taxable income over 250,000 pesos but below 400,000 pesos.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

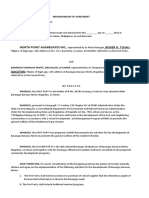

MANDATORY CONTRIBUTIONS

Basic Salary 35,000.00

SSS Contribution 1,350.00 (Base on the SSS Table)

Philhealth 787.50 (35,000 x 4.5%/2-employee share 50%, employer share 50%)

Pag-IBIG 100.00 (Mandatory Contribution- 100 Employee Share)

Total Monthly Contribution Php 2,237.50

Computation for Annual Income Tax

Gross Annual Income (35,000 x 12) 420,000.00

Annual Contributions (2,237.50 x 12) 26,850.00

Taxable Compensation Income 393,150.00

Tax Due

Over 250,000 but not over 400,000- 15% of the excess over 250,000

= [(393,150-250,000) x 15%]

= 143,150 x .15

Tax Due= 21,472.50

You might also like

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument5 pagesSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847No ratings yet

- Graphical Representation of The SalaryDocument25 pagesGraphical Representation of The SalaryNica Jane Macapinig100% (3)

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- Salary Breakup Calculator in Excel 2021: Gross Salary Per Month 25000 Components in Salary Percentage Per Month Per AnnumDocument2 pagesSalary Breakup Calculator in Excel 2021: Gross Salary Per Month 25000 Components in Salary Percentage Per Month Per AnnumFaraz Danish KhanNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- Tax Slabs: Ca. Dipayan DasDocument4 pagesTax Slabs: Ca. Dipayan DasNoob GamerNo ratings yet

- Computation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009Document1 pageComputation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009Nazim ChowdhuryNo ratings yet

- Computation of Income Under The Head "Profits and Gains of Business or Profession"Document14 pagesComputation of Income Under The Head "Profits and Gains of Business or Profession"Shubham KumarNo ratings yet

- (Q2) BS MATH Mod 3Document3 pages(Q2) BS MATH Mod 3Duhreen Kate CastroNo ratings yet

- FINAL G#5 Elaborate 3.4 Cases On RITDocument9 pagesFINAL G#5 Elaborate 3.4 Cases On RITGwyn Lopez100% (1)

- RTP NOV 2022 Important PointsDocument4 pagesRTP NOV 2022 Important PointsDaniel TerstegenNo ratings yet

- Tugas Akmen (Nurfuadi - A031181511)Document2 pagesTugas Akmen (Nurfuadi - A031181511)Budiman BudiNo ratings yet

- Salary Breakup Calculator Excel 1Document2 pagesSalary Breakup Calculator Excel 1Pavan ChetluriNo ratings yet

- Financial Management Assignment: Guided byDocument5 pagesFinancial Management Assignment: Guided byJeeshan IdrisiNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Group 1 HUMSS PT in Gen Math by CalvinDocument6 pagesGroup 1 HUMSS PT in Gen Math by CalvinCalvin Carl D. Delos ReyesNo ratings yet

- BM-PT CagapeDocument5 pagesBM-PT CagapePrincess Sophia CagapeNo ratings yet

- Additional Examples of Income Tax For IndividualsDocument8 pagesAdditional Examples of Income Tax For IndividualsMary Rose BuaronNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Quizzer On Withholding of Monthly Tax Compensation IncomeDocument10 pagesQuizzer On Withholding of Monthly Tax Compensation IncomeRyDNo ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- Entity Tax ExamDocument7 pagesEntity Tax ExamWesley JacksonNo ratings yet

- Group 3 - Compensation Budget Report - Midterm PT GenMathDocument2 pagesGroup 3 - Compensation Budget Report - Midterm PT GenMathShaff LeighNo ratings yet

- SULITASDocument3 pagesSULITASAlvin LuisaNo ratings yet

- BM Module 3 4 Q2W3 4 For PDFDocument5 pagesBM Module 3 4 Q2W3 4 For PDFDanica De veraNo ratings yet

- Payroll and Contribution Rates Employers PDFDocument2 pagesPayroll and Contribution Rates Employers PDFNicquainCTNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Jan To Jul 2022 Tax TablesDocument1 pageJan To Jul 2022 Tax Tablesgracia murevanemweNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Tax CalculationDocument8 pagesTax CalculationvinayNo ratings yet

- Case 3 SalaryDocument3 pagesCase 3 SalaryKritika ChoudharyNo ratings yet

- Taxation Full Test 1 Unscheduled May 2023 Solution 1677483923Document38 pagesTaxation Full Test 1 Unscheduled May 2023 Solution 1677483923Vinayak PoddarNo ratings yet

- Income Tax Slab CalculationDocument2 pagesIncome Tax Slab CalculationRaunak DaryananiNo ratings yet

- Employee Welfare and Benefits (Raul C. Cruz)Document16 pagesEmployee Welfare and Benefits (Raul C. Cruz)Bhenjhan AbbilaniNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Answers To Students Problems From Chapter 6Document2 pagesAnswers To Students Problems From Chapter 6Mi PhoneNo ratings yet

- Principles of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryDocument7 pagesPrinciples of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryWarriach WarriachNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- c12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDocument4 pagesc12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDuongHaNo ratings yet

- The Progressive Tax On Employment Between The President of Nepal and His/her Secretary Will Compared Through The Tax CalculationDocument3 pagesThe Progressive Tax On Employment Between The President of Nepal and His/her Secretary Will Compared Through The Tax CalculationAdolf HittlerNo ratings yet

- Compensation TableDocument1 pageCompensation TableJoy VillaruelNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- PGFB1943 - Sanjana Jasmine SinghDocument4 pagesPGFB1943 - Sanjana Jasmine SinghSanjana SinghNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Yohanes Sihdanardi 201712037 Tugas Analisis LeverageDocument10 pagesYohanes Sihdanardi 201712037 Tugas Analisis LeverageFebri Jkw 1No ratings yet

- Business Finance (ACC 501) Assignment NO.2 Question No.1Document2 pagesBusiness Finance (ACC 501) Assignment NO.2 Question No.1safarashNo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Susquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6Document6 pagesSusquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6EdTan RagadioNo ratings yet

- CompensationDocument1 pageCompensationDandyNo ratings yet

- 02 RebatesDocument53 pages02 RebatesughaniNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- A Guide To Tax Saving Through NPS (National Pension System)Document4 pagesA Guide To Tax Saving Through NPS (National Pension System)alankar2050No ratings yet

- Group 3 - Excel Report - Midterm PT GenMathDocument2 pagesGroup 3 - Excel Report - Midterm PT GenMathShaff LeighNo ratings yet

- Amended & Updated CHP# 4,14Document11 pagesAmended & Updated CHP# 4,14hijab zaidiNo ratings yet

- Taxable Income CalculationsDocument1 pageTaxable Income CalculationsMartin SandersonNo ratings yet

- Brooks Problem SolutionsDocument25 pagesBrooks Problem Solutionsimperdible0No ratings yet

- Aug - Dec 2020 Tax Tables RTGSDocument1 pageAug - Dec 2020 Tax Tables RTGSTanaka MachanaNo ratings yet

- Secretary's Certificate - Lease AgreementDocument4 pagesSecretary's Certificate - Lease AgreementLAWRENCE DE LEONNo ratings yet

- Lease AgreementDocument3 pagesLease AgreementLAWRENCE DE LEONNo ratings yet

- Memorandum of AgreementDocument3 pagesMemorandum of AgreementLAWRENCE DE LEONNo ratings yet

- Brngy ResoDocument2 pagesBrngy ResoLAWRENCE DE LEONNo ratings yet