Professional Documents

Culture Documents

Takaful Myclick MediCare PDS - v10

Uploaded by

Wan RuschdeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Takaful Myclick MediCare PDS - v10

Uploaded by

Wan RuschdeyCopyright:

Available Formats

Product Disclosure Sheet

Takaful myClick MediCare

Read this Product Disclosure Sheet before you decide to participate in Takaful myClick MediCare.

Please be sure to also read the general terms and conditions.

1. What is this plan about?

This is an individual medical plan that pays the eligible medical expenses up to the overall annual limit.

2. What are the Shariah concepts applicable?

This plan applies the following Shariah concepts:

a. T

abarru’ means donation for charitable purposes. Under this plan, the participant donates a portion of the

contribution to the Group Family Takaful Account (“GFTA”) to help other participants.

b. W

akalah refers to a contract where a party, as principal authorizes another party as his agent to perform a

particular task on matters that may be delegated, with or without the imposition of a fee. Under this plan,

the participant authorizes Syarikat Takaful Malaysia Keluarga Berhad (“Takaful Malaysia”) to manage the

GFTA and in return, Takaful Malaysia will receive a Wakalah fee.

c. Q

ard refers to a contract of lending money by a lender to a borrower where the latter is bound to repay

an equivalent replacement amount to the lender. Under this plan, Takaful Malaysia will lend an amount of

money to the GFTA without interest if the GFTA is in deficit.

3. What are the covers / benefits provided?

This plan comes with three (3) plan options as below:

Plan Bronze Silver Gold

Section A: In-Patient and Daycare Surgical Benefits

Daily Hospital Room and Board

RM100 RM150 RM200

(No limit on number of days)

Intensive Care Unit

(Maximum 60 days per any one disability)

Surgical Fees

Anaesthetist Fees

Operating Theatre As charged

Hospital Supplies and Services

In-Hospital Physician's and Specialist's Visit

Ambulance Fees

Day Surgery

Daily Cash Allowance at Malaysian Government Hospital

RM100 RM100 RM100

(No limit on number of days)

Section B: Out-Patient Benefits

Pre-Hospitalisation Benefit

(Within 60 days before hospitalisation)

Post-Hospitalisation Benefits

(Within 90 days after discharged)

As charged

Emergency Accidental Out-patient Treatment

Out-patient Cancer Treatment

Out-patient Kidney Dialysis Treatment

Overall Annual Limit (for Sections A & B) RM 50,000 RM 75,000 RM 100,000

Notes:

a. All the benefits are as charged based on reasonable and customary charges in Malaysia, subject to

overall annual limit. No lifetime limit applies.

b. Coverage is provided up to eighty five years (85) next birthday.

PDS(Eng)/Takaful myClick MediCare/V10/03-2022 1/5

Product Disclosure Sheet

Takaful myClick MediCare

c. The participant has an option to choose the deductible limit to enjoy lower contributions as

per table below:

Deductible Limit Per Admission (RM) Contribution Discount (%)

1,000 10

2,000 20

3,000 30

The deductible limit shall not be applicable if the person covered is admitted to a Government Hospital in

Malaysia.

4. How much contribution do I have to pay?

The contribution amount varies by plan option, contribution payment mode, gender and attained age of the

person covered at renewal. Please refer to the following table of annual contributions:

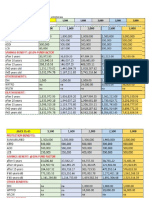

Attained Male Female

Age

(Next

Birthday) Bronze (RM) Silver (RM) Gold (RM) Bronze (RM) Silver (RM) Gold (RM)

1–5 942 952 1,128 771 780 923

6 – 10 579 584 693 553 559 619

11 – 15 463 468 556 433 439 507

16 – 20 559 563 651 532 538 621

21 – 25 536 594 659 500 556 646

26 – 30 537 598 659 504 560 651

31 – 35 545 605 757 586 651 780

36 – 40 655 727 788 658 731 878

41 – 45 761 846 1,019 849 943 1,130

46 – 50 1,081 1,202 1,301 1,107 1,230 1,469

51– 55 1,261 1,401 1,564 1,316 1,463 1,795

56 – 59 1,697 1,887 2,055 1,773 1,970 2,317

60 – 64 2,762 3,069 3,524 2,970 3,301 3,612

65 – 69 4,505 5,300 6,078 4,341 5,107 6,274

70 – 74* 5,353 6,690 8,113 5,767 7,209 8,327

75 – 79* 6,856 9,793 11,603 6,710 9,584 11,348

80 – 85* 9,455 11,819 14,334 9,254 11,569 14,019

*

for renewal only

Notes:

a. The contributions above are applicable to standard lives and if you choose to make a yearly payment.

b. Additional contribution loadings may apply depending on the occupation and health conditions of the

person covered.

c. If the deductible limit is selected, the contribution discount (%) shall apply on the total contribution paid.

d. Please refer to your online quotation for the actual contribution payable under this plan based on the

contribution payment mode that you have selected.

e. The contributions are not guaranteed. Contributions may be adjusted on a portfolio basis in consideration

of medical inflation and any other factors which may materially affect the sustainability of the portfolio.

We will notify you at least thirty (30) days before any revision of the contribution.

PDS(Eng)/Takaful myClick MediCare/V10/03-2022 2/5

Product Disclosure Sheet

Takaful myClick MediCare

5. What are the fees and charges that I have to pay?

Type Amount

Wakalah Fee / Administration Fee 38% of the contribution (includes marketing and administration expenses)

Note:

This plan is developed for online distribution, and may involve marketing collaboration with our business

partners / intermediaries.

6. What are some of the key terms and conditions that I should be aware of?

Some of the key terms and conditions that you should be aware of are:

a. Duty of Disclosure – Pursuant to Paragraph 5 of Schedule 9 of the Islamic Financial Services Act 2013,

you have a duty to take reasonable care not to provide false or inaccurate information when you apply

for this plan. Failure to do so may result in voidance of your contract of Takaful, refusal or reduction

of your claim(s), change of the terms or termination of your contract of Takaful. The above duty of

disclosure shall continue until the time your contract of Takaful is entered into, varied or renewed with

us. You also have a duty to tell us immediately if at any time after your contract of Takaful has been

entered into, varied or renewed with us any of the information provided is inaccurate or has changed.

b. Deductible Limit – You will have to pay the applicable amount per admission before we can pay the

benefits under this plan. You can request to change the deductible limit, subject to the terms and

conditions of your certificate.

c. Waiting Period – The eligibility for benefits under this plan will only start thirty (30) days from the

effective date or the reinstatement date, whichever is the later, for illness other than specified illnesses.

For specified illnesses, the waiting period is one hundred and twenty (120) days.

d. Grace Period – You will have thirty (30) days from the contribution due date (inclusive) to pay each

contribution due. If the contribution is not paid at the end of the grace period, your certificate will lapse

and the person(s) covered will not have any takaful cover, benefit or value.

e. Free-Look Period – There is a free-look period of fifteen (15) calendar days from the date of delivery of

the e-certificate for you to review and decide whether you want to continue with the plan. If you wish to

discontinue, you may request to cancel the certificate and get a full refund of your contributions paid.

f. Portfolio Withdrawal Condition – We reserve the right to cancel this plan portfolio as a whole if we

decide to discontinue this plan. We will provide a prior notice to the participant and we will run off all

certificates to expiry of the current period of cover within the portfolio.

g. Upgrade Room and Board – If the person covered is hospitalised at a room and board which is higher

than his/her room and board benefit limit, then he/she will need to pay the difference in the room and

board charge and the limit.

h. You must nominate a nominee(s) and ensure that your nominee(s) is/are aware of your participation

in this plan.

i. You can choose to make a yearly, half-yearly, quarterly, or monthly payment. However, the total amount

payable with contribution payment mode other than yearly will be higher than the total amount payable

with yearly contribution payment mode.

j. In order to ensure continuous protection under the plan, your contribution will be automatically

deducted from your chosen debit / credit card based on the contribution payment mode that you have

selected.

k. You can only be covered by one (1) Takaful myClick MediCare plan.

l. If an incident occurs which gives rise to a claim, you shall notify Takaful Malaysia immediately. You

may refer to the claims procedures in the Certificate Wording.

Note:

The above list is non-exhaustive. Please refer to the Certificate Wording for the full list of terms and conditions

under this plan.

PDS(Eng)/Takaful myClick MediCare/V10/03-2022 3/5

Product Disclosure Sheet

Takaful myClick MediCare

7. What are the major exclusions under this plan?

This plan does not cover the following:

a. Any claim caused by pre-existing illness;

b. Any claim due to specified illnesses occurring during the first one hundred and twenty (120) days of

continuous cover;

c. Private nursing care or house calls, rest cures or sanitaria care, illegal drugs, intoxication, sterilisation,

venereal Disease and its sequelae, Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex

(ARC) and Human Immunodeficiency Virus (HIV) related Diseases, and any communicable diseases

requiring quarantine by law. Diseases such as the Hand, Foot and Mouth Disease (HFMD), dengue fever and

measles are not considered as communicable diseases requiring quarantine by law; or

d. Any out-patient treatment unless specifically provided under this plan.

Note:

The above list is non-exhaustive. Please refer to the Certificate Wording for the full list of exclusions under this

plan.

8. Can I cancel my certificate?

You may request to cancel your certificate within the fifteen (15) calendar days of the free-look period.

Under such circumstance, you may get a full refund of your contributions paid. If you choose to surrender

your certificate after the fifteen (15) calendar days of the free-look period, you will be entitled to a portion of

contribution refund as determined by us provided that you did not make any claims for the current certificate

year.

9. What do I need to do if there are changes to my contact details?

It is important that you update in the myTakaful Customer portal or inform us of any changes in your contact

details to ensure that all correspondences reach you in a timely manner.

10. Where can I get further information?

Should you require additional information about medical & health takaful, please refer to the insuranceinfo

booklet on ‘Medical & Health Takaful’ available at all our branches or visit insuranceinfo.com.my/.

If you would like to know more about Takaful myClick MediCare, please contact us at:

Customer Service Unit (CSU)

Syarikat Takaful Malaysia Keluarga Berhad [198401019089 (131646-K)]

14th Floor, Annexe Block,

Menara Takaful Malaysia,

No. 4, Jalan Sultan Sulaiman,

50000 Kuala Lumpur

P.O. Box 11483, 50746 Kuala Lumpur.

Tel: 1-300 88 252 385

Email: csu@takaful-malaysia.com.my

11. Other types of similar takaful cover available:

Please refer to our website at https://online.takaful-malaysia.com.my/.

PDS(Eng)/Takaful myClick MediCare/V10/03-2022 4/5

Product Disclosure Sheet

Takaful myClick MediCare

IMPORTANT NOTE:

PARTICIPATING IN A FAMILY TAKAFUL PLAN IS A LONG-TERM FINANCIAL COMMITMENT. YOU

SHOULD SATISFY YOURSELF THAT THIS PLAN WILL BEST SERVE YOUR NEEDS. YOU SHOULD READ

AND UNDERSTAND THIS PLAN AND CONTACT US DIRECTLY FOR MORE INFORMATION.

Syarikat Takaful Malaysia Keluarga Berhad is licensed under the Islamic Financial Services Act 2013 and regulated

by Bank Negara Malaysia.

The information provided in this disclosure sheet is valid as at March 2022.

PDS(Eng)/Takaful myClick MediCare/V10/03-2022 5/5

You might also like

- 35183192-Pdm Med Ext OfferDocument4 pages35183192-Pdm Med Ext OfferNg Siaw LanNo ratings yet

- 32877310-Pdm Med Ext OfferDocument4 pages32877310-Pdm Med Ext OfferShermin NgNo ratings yet

- TATA Medicare 997f212ecbDocument8 pagesTATA Medicare 997f212ecbetyala maniNo ratings yet

- ICan Brochure DigitalDocument16 pagesICan Brochure DigitalAnkush JainNo ratings yet

- Medical Repricing RevisionDocument6 pagesMedical Repricing RevisionSarveshrau SarveshNo ratings yet

- R10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Document10 pagesR10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Nirranjan JNo ratings yet

- Family Sehat Takaful Plan BenefitsDocument1 pageFamily Sehat Takaful Plan BenefitsRaheel KhanNo ratings yet

- Brochure TuneprotectDocument6 pagesBrochure TuneprotectShadishwaren ParameswaranNo ratings yet

- AIA HealthShield Gold MaxDocument11 pagesAIA HealthShield Gold Maxdaniel7tayNo ratings yet

- Features Group Medicare For Canara Bank CustomersDocument3 pagesFeatures Group Medicare For Canara Bank CustomersHarshal JoshiNo ratings yet

- Combination of Umang & AnandDocument3 pagesCombination of Umang & AnandsatyakamNo ratings yet

- Arogya Sanjeevni Policy 1 PDFDocument9 pagesArogya Sanjeevni Policy 1 PDFkrishna-almightyNo ratings yet

- Young India Digi Heath BrochureDocument4 pagesYoung India Digi Heath BrochureAvijit HazraNo ratings yet

- 5 AXA Emedic - Fact Sheet Age49 - v0919Document4 pages5 AXA Emedic - Fact Sheet Age49 - v0919Chan SCNo ratings yet

- Sales Brochure 91Document3 pagesSales Brochure 91prudhvi rajNo ratings yet

- AXA Emedic - PDS - Deductible (Family)Document4 pagesAXA Emedic - PDS - Deductible (Family)PROSURVEY STUDIONo ratings yet

- AIA HealthShield Gold Max For ForeignersDocument11 pagesAIA HealthShield Gold Max For Foreignersdaniel7tayNo ratings yet

- Sun Life Hospital IncomeDocument4 pagesSun Life Hospital IncomeHihiNo ratings yet

- Enjoy Up To 7.3% Yearly Premium DiscountDocument2 pagesEnjoy Up To 7.3% Yearly Premium DiscountAlvin WangNo ratings yet

- Wapic Smart LifeSavers PlanDocument8 pagesWapic Smart LifeSavers PlanSalifu AbdulNo ratings yet

- Renewal Quotation: Quotation Reference No: CP/CORE BRONZE - 50/GRP/002022Document6 pagesRenewal Quotation: Quotation Reference No: CP/CORE BRONZE - 50/GRP/002022Mohit MarwahNo ratings yet

- Brochure Family Sehat StandaloneDocument2 pagesBrochure Family Sehat Standaloneimran_javed_16No ratings yet

- Presentation on Medi-Classic Insurance CoverageDocument24 pagesPresentation on Medi-Classic Insurance CoverageS S Biradar LicNo ratings yet

- Corona Kavach Policy-Oriental Insurance - Rate Chart - RRDocument2 pagesCorona Kavach Policy-Oriental Insurance - Rate Chart - RRNagaraj BVNo ratings yet

- Corona Kavach Policy SummaryDocument2 pagesCorona Kavach Policy SummarykouijNo ratings yet

- ReportDocument5 pagesReportvinaykumar333777No ratings yet

- RkriDocument19 pagesRkriKalai Vani KarthiNo ratings yet

- IFFCO-Tokio Critical Illness Benefit Policy Sales LiteratureDocument4 pagesIFFCO-Tokio Critical Illness Benefit Policy Sales LiteratureMagix MoviesNo ratings yet

- Ican BrochureDocument16 pagesIcan BrochureAbhishek ShatagopachariNo ratings yet

- Energy Brochure OnlineDocument8 pagesEnergy Brochure Onlinenirajthacker93620No ratings yet

- P XXJNTDocument8 pagesP XXJNTmrusamanali1No ratings yet

- ProposalDocument7 pagesProposalroseannesocorinNo ratings yet

- QuoteDocument4 pagesQuotealmas.hossainNo ratings yet

- Ultimav2 Brochure161005 FinalDocument12 pagesUltimav2 Brochure161005 FinalAjNo ratings yet

- World Compass Destinations Inc. Sme Luxe 5-19Document20 pagesWorld Compass Destinations Inc. Sme Luxe 5-19Marjorie UnicareNo ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument2 pagesNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNo ratings yet

- Medicare BrochureDocument8 pagesMedicare Brochuresudhanshu RanjanNo ratings yet

- Mr. Bhatta: An Innovative Retirement Solution ForDocument8 pagesMr. Bhatta: An Innovative Retirement Solution ForTapan DuttaNo ratings yet

- Jamil InsuranceDocument5 pagesJamil InsuranceAli HamzaNo ratings yet

- En PdsDocument6 pagesEn PdsMohd SukriNo ratings yet

- SBI General Arogya Top Up Policy ProspectusDocument64 pagesSBI General Arogya Top Up Policy Prospectusyashmpanchal333No ratings yet

- Updated SME Luxe Proposal For Triforce GlobalDocument21 pagesUpdated SME Luxe Proposal For Triforce GlobalallangreslyNo ratings yet

- Aspire - Rate Cards - v3Document83 pagesAspire - Rate Cards - v3Ronak RanaNo ratings yet

- Prominence Max - Peso Global Technology FundDocument2 pagesProminence Max - Peso Global Technology FundDarrenfel SantizoNo ratings yet

- Combo IllustrationDocument5 pagesCombo IllustrationInvest Aaj for kal Life insuranceNo ratings yet

- MediSaversVIP Takaful Product Disclosure SheetDocument12 pagesMediSaversVIP Takaful Product Disclosure Sheetesh ktasNo ratings yet

- Product Summary - ECIDocument7 pagesProduct Summary - ECIEugene LimNo ratings yet

- Jeevan Kishore T - 102Document3 pagesJeevan Kishore T - 102lalithmohan100% (2)

- Let's Uncomplicate: DiabetesDocument8 pagesLet's Uncomplicate: Diabetesdeepak7837No ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument20 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationAmirul UmarNo ratings yet

- InsuranceDocument8 pagesInsurancerobiulhasan53bdNo ratings yet

- E-Medical Pass Takaful PDSDocument3 pagesE-Medical Pass Takaful PDSGolden ChainNo ratings yet

- AXA eMedic Medical Plan SummaryDocument4 pagesAXA eMedic Medical Plan SummaryAfiq de WinnerNo ratings yet

- Ultra Medic Rider We Have A Plan To Find A Healthier YouDocument2 pagesUltra Medic Rider We Have A Plan To Find A Healthier Youhafiz azmanNo ratings yet

- HDFC Life Crest IllustrationDocument0 pagesHDFC Life Crest IllustrationAnkur SrivastavNo ratings yet

- Super Top Up Features - 2019-20Document4 pagesSuper Top Up Features - 2019-20Shubham JainNo ratings yet

- Living Care Plus Product SummaryDocument6 pagesLiving Care Plus Product SummaryAng KhengNo ratings yet

- Complete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceDocument2 pagesComplete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceChiranjit SahaNo ratings yet

- PSPR210116124918Document5 pagesPSPR210116124918Manikandan ManoharNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- ISFIRE Dec'22 (Web Version)Document100 pagesISFIRE Dec'22 (Web Version)Wan RuschdeyNo ratings yet

- Presentation Group Project DPD40093Document1 pagePresentation Group Project DPD40093Wan RuschdeyNo ratings yet

- Embracing The New Norms in Research and EducationDocument11 pagesEmbracing The New Norms in Research and EducationWan RuschdeyNo ratings yet

- Takaful Myclick MediCare Certificate Wording - v13.1Document17 pagesTakaful Myclick MediCare Certificate Wording - v13.1Wan RuschdeyNo ratings yet

- Presentation Group Project DPD40093Document1 pagePresentation Group Project DPD40093Wan RuschdeyNo ratings yet

- Project and Presentation DPD50122 TakafulDocument2 pagesProject and Presentation DPD50122 TakafulWan RuschdeyNo ratings yet

- IPO EconframeDocument1 pageIPO EconframeWan RuschdeyNo ratings yet

- My Most Precious Investing LessonsDocument9 pagesMy Most Precious Investing LessonsWan RuschdeyNo ratings yet

- The Sun 26012021Document24 pagesThe Sun 26012021Wan RuschdeyNo ratings yet

- Morning: Top Glove Makes The Highest Quarterly ProfitDocument22 pagesMorning: Top Glove Makes The Highest Quarterly ProfitWan RuschdeyNo ratings yet

- Application of Islamic Contracts in Islamic BankingDocument16 pagesApplication of Islamic Contracts in Islamic BankingWan RuschdeyNo ratings yet

- Chapter 13 Malaysian Stock Index Futures Market Hedging Effectiveness: Symmetric and Asymmetric ModelDocument12 pagesChapter 13 Malaysian Stock Index Futures Market Hedging Effectiveness: Symmetric and Asymmetric ModelWan RuschdeyNo ratings yet

- A Conceptual Paper On Factors Affecting Investment Decision of Malaysian InvestorDocument5 pagesA Conceptual Paper On Factors Affecting Investment Decision of Malaysian InvestorWan RuschdeyNo ratings yet

- Individual Assignement UWC BerhadDocument6 pagesIndividual Assignement UWC BerhadWan RuschdeyNo ratings yet

- Robust Framework Diagnostics of BlockchainDocument8 pagesRobust Framework Diagnostics of BlockchainWan RuschdeyNo ratings yet

- Shariah Governance System in Islamic Financial InsDocument17 pagesShariah Governance System in Islamic Financial InsWan RuschdeyNo ratings yet

- A Comparative Analysis of Financial Affordability in Islamic Home Financing Instruments in MalaysiaDocument22 pagesA Comparative Analysis of Financial Affordability in Islamic Home Financing Instruments in MalaysiaWan RuschdeyNo ratings yet

- Chapter 6 Investors' Confidence in The Malaysian Stock Market and Religiosity During Investment DecisionsDocument21 pagesChapter 6 Investors' Confidence in The Malaysian Stock Market and Religiosity During Investment DecisionsWan RuschdeyNo ratings yet

- Factors Explaining The Market Discipline of Sharia Mutual Funds From A Behavioural Finance Perspective - A Theoretical ApproachDocument15 pagesFactors Explaining The Market Discipline of Sharia Mutual Funds From A Behavioural Finance Perspective - A Theoretical ApproachWan RuschdeyNo ratings yet

- Methodological Approaches To Documenting Usul FiqhDocument3 pagesMethodological Approaches To Documenting Usul FiqhWan RuschdeyNo ratings yet

- Annual General Meeting ResolutionsDocument134 pagesAnnual General Meeting ResolutionsWan RuschdeyNo ratings yet

- Challenging The Current Shariah Screening MethodologyDocument16 pagesChallenging The Current Shariah Screening MethodologyWan RuschdeyNo ratings yet

- M4 Legal Aspects and Governance in Islamic Finance - HandbookDocument72 pagesM4 Legal Aspects and Governance in Islamic Finance - HandbookWan RuschdeyNo ratings yet

- Problems Related To Capital Structure and Leverage PDFDocument9 pagesProblems Related To Capital Structure and Leverage PDFrameessalam852569No ratings yet

- Weekly Newsletter 26112020Document17 pagesWeekly Newsletter 26112020Wan RuschdeyNo ratings yet

- 20 Jewels 2020 PDFDocument54 pages20 Jewels 2020 PDFWan RuschdeyNo ratings yet

- Workbook Answers PDFDocument91 pagesWorkbook Answers PDFVy TrầnNo ratings yet

- 20 Jewels 2020 PDFDocument54 pages20 Jewels 2020 PDFWan RuschdeyNo ratings yet

- Notice of ProspectusDocument1 pageNotice of ProspectusWan RuschdeyNo ratings yet

- VIEWMASTER CONSTRUCTION CORPORATION v. MAULITDocument1 pageVIEWMASTER CONSTRUCTION CORPORATION v. MAULITrhodz 88No ratings yet

- Customer Number: CyprusDocument2 pagesCustomer Number: CyprusΕμμανουήλ ΚακαβελάκηςNo ratings yet

- MD HafizurDocument2 pagesMD HafizurMd Shemul Hoshen DulalNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoCentralised NumberNo ratings yet

- Quiño Essay PDFDocument2 pagesQuiño Essay PDFRyuusukeNo ratings yet

- Leader Ship & ManagementDocument2 pagesLeader Ship & ManagementVishnu KompellaNo ratings yet

- Certi Ed Anti-Money Laundering Specialist (CAMS)Document2 pagesCerti Ed Anti-Money Laundering Specialist (CAMS)Alex ThomasNo ratings yet

- CISI Capital Markets Programme: DerivativesDocument9 pagesCISI Capital Markets Programme: DerivativesShilpi JainNo ratings yet

- Final Fresno County GP LetterDocument10 pagesFinal Fresno County GP LetterMelissa MontalvoNo ratings yet

- Runbeti's Violation of International Law Regarding Its Wind Farm ProjectDocument117 pagesRunbeti's Violation of International Law Regarding Its Wind Farm ProjectMichaela PortarcosNo ratings yet

- Global Marketing Management: Chapter 8 Entry and Expansion Strategies: Marketing and SourcingDocument42 pagesGlobal Marketing Management: Chapter 8 Entry and Expansion Strategies: Marketing and SourcingSrishti ShresthaNo ratings yet

- Federal Mortgage Bank of Nigeria: (National Housing Fund Decree 3, 1992) Individual Registration FormDocument1 pageFederal Mortgage Bank of Nigeria: (National Housing Fund Decree 3, 1992) Individual Registration FormumarsaboNo ratings yet

- VN - PT Bill - Ob2320231212233739ylwDocument4 pagesVN - PT Bill - Ob2320231212233739ylwTina LimNo ratings yet

- UntitledDocument266 pagesUntitledHarshith ChinniNo ratings yet

- (II) Ibn KhaldunDocument17 pages(II) Ibn KhaldunAdnan RaheemNo ratings yet

- Surveillance Audit PlanDocument3 pagesSurveillance Audit PlanJessa VillanuevaNo ratings yet

- UNESCO. General Conference 14th Records of The General Conference, 14th Session, Paris, 1966, V. 1 - Resolutions 1967Document389 pagesUNESCO. General Conference 14th Records of The General Conference, 14th Session, Paris, 1966, V. 1 - Resolutions 1967Joplin28No ratings yet

- 168048-2013-Tadeja v. PeopleDocument10 pages168048-2013-Tadeja v. PeopleTintin SumawayNo ratings yet

- Xi-Biden Summit: US Statement in FullDocument3 pagesXi-Biden Summit: US Statement in FullscmpNo ratings yet

- How Does Felix Abt, North Korea's Most Famous Foreign Businessman, Read The Inner Workings of The Hermit Kingdom ?Document7 pagesHow Does Felix Abt, North Korea's Most Famous Foreign Businessman, Read The Inner Workings of The Hermit Kingdom ?thoughtleader001100% (1)

- Gypsy GuitarDocument2 pagesGypsy Guitarkhaled El CheikhNo ratings yet

- Project Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From VirusDocument7 pagesProject Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From Virusmel laguinlinNo ratings yet

- Adcb - Faq - CrsDocument5 pagesAdcb - Faq - CrsAndrea FuentesNo ratings yet

- Shaykh Murabtal HaajDocument7 pagesShaykh Murabtal HaajAbdullah ZakiNo ratings yet

- Indo-Russian Relations in Recent Times: - Manali JainDocument6 pagesIndo-Russian Relations in Recent Times: - Manali JainGautya JajoNo ratings yet

- 3.history Civics and Geography PDFDocument64 pages3.history Civics and Geography PDFloose manusyaNo ratings yet

- gpujpthjp rk;kd; - Notice of Hearing in a Summary SuitDocument25 pagesgpujpthjp rk;kd; - Notice of Hearing in a Summary Suitsharanmit6630No ratings yet

- Checklist NON SDSDocument8 pagesChecklist NON SDSM.S. Johal0% (1)

- Test Bank For Advertising and Promotion: An Integrated Marketing Communications Perspective, 12th Edition, George Belch Michael BelchDocument28 pagesTest Bank For Advertising and Promotion: An Integrated Marketing Communications Perspective, 12th Edition, George Belch Michael BelchPauline Chavez100% (12)

- Ethnicity and Family Therapy Mcgoldrick PDFDocument2 pagesEthnicity and Family Therapy Mcgoldrick PDFJessica0% (4)