Professional Documents

Culture Documents

Statement - 2021 - 1616 N Hillcrest Ave

Uploaded by

JAMIE SCHADEL0 ratings0% found this document useful (0 votes)

16 views2 pagesOriginal Title

1309410023_Statement_2021_1616 N Hillcrest Ave

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesStatement - 2021 - 1616 N Hillcrest Ave

Uploaded by

JAMIE SCHADELCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

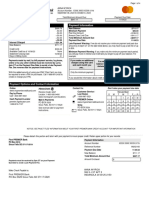

GREENE COUNTY REAL ESTATE TAX STATEMENT TAX YEAR: 2021

Collector of Revenue, Allen Icet

940 Boonville Rm 107 Pay Online! CountyCollector.com

Springfield, MO 65802 We accept credit and debit cards!

417-868-4036

OZARKS HOUSE

DILBECK, BUYERS

MICHAEL L LLC

Legal Description (0.2135 acres)

TAX ID Number: 88-13-09-410-023

PIN Number: 165586 (For Internet Payments)

HOMELAND ADD N1/2 LOT 117 & ALL LOT 118

Location Address: 1616 N HILLCREST AVE

Where Your Taxes Go

Springfield R12 Schools 4.0740% $656.32 Residential Assessed Value 16,110.00

City of Springfield 0.6196% $ 99.82

Library 0.2400% $ 38.66 Total Assessed Value $16,110.00

OTC College 0.1875% $ 30.21

Road 0.1075% $ 17.32 Total Appraised Value $84,800.00

County General Revenue 0.1075% $ 17.32

CO Senior Citizens' Services 0.0486% $ 7.83

CO Dev Disability Programs 0.0461% $ 7.43

State of Missouri 0.0300% $ 4.83

Total Levy 5.4608%

On Time Amount Due $879.74

Total Tax Amount (see box at bottom left) $879.74

Credit For Tax Portion of Previous Payment $879.74

If your previous payment included late fees, the late fee

portion of your payment is not included in the payment figure.

The above calculation is to determine taxes only.

Please return bottom portion of this statement with your payment

Fri Sep 16 2022 09:39:08 AM

GREENE COUNTY REAL ESTATE TAX TAX YEAR: 2021

Collector of Revenue, Allen Icet

940 Boonville Rm 107 If Paid On Time (by Dec 31, 2021) $0.00

Springfield, MO 65802 Make check payable to: Collector of Revenue, Allen Icet

Tax ID Number: 88-13-09-410-023 If Paid Late (after Dec 31, 2021)

PIN Number: 165586 (For Internet Payments) If Paid in Sep 2022 $0.00

If Paid in Oct 2022 $0.00

Location: 1616 N HILLCREST AVE If Paid in Nov 2022 $0.00

If Paid in Dec 2022 $0.00

If Paid in Jan 2023 $0.00

If Paid in Feb 2023 $0.00

DILBECK, MICHAEL

OZARKS HOUSE L

BUYERS LLC

If Paid in Mar 2023 $0.00

759 LOGAN ST

If Paid in Apr 2023 $0.00

ROGERSVILLE MO 65742

If Paid in May 2023 $0.00

If Paid in Jun 2023 $0.00

If Paid in Jul 2023 $0.00

If Paid in Aug 2023 $0.00

We accept debit and credit cards in our office and online.

Bank fees are 1.50% for debit and 2.00% for credit.

Pay with an e-check online with no fee!

Assessor’s Phone: 417-868-4101 FAQ’s

Contact the Assessor’s Office if you:

- Suspect your tax amount is

incorrect Personal Property Questions:

- Have questions about the

Q: Why am I being taxed for a vehicle that I no longer own?

assessed value

A: Your tax bill is based on the vehicles that you owned on January 1st of the

- Notice any incorrect

tax year. Even if you no longer own the vehicles, you still pay the tax based on

information on your bill, i.e.

what you owned on the first day of the year.

name, address, vehicle, etc.

Q: I am no longer a Missouri resident. Do I still owe this tax?

Collector’s Phone: 417-868-4036 A: Yes. According to state law, your tax obligation is established on January 1st.

Email: collectorhelp@greenecountymo.gov Even if you move to a different state on January 2nd, you still owe the tax for the

Monday-Friday 8:00 AM-4:30 PM year. The opposite is true too – if you move to Missouri on January 2nd or after,

you will not owe personal property taxes for that year.

MO License Bureaus Real Estate Questions:

http://dor.mo.gov/offloc

Q: What if my loan company is supposed to pay the bill?

Park Central Office

A: If your loan company is supposed to pay your taxes, please don’t get

149 Park Central Sq Rm 252

anxious and pay the bill yourself. Doing so will result in two payments. Your

417-869-5100 loan company will contact us directly for the bill.

South Springfield Office

319 E Battlefield Rd Ste P Q: I bought my property mid-year. Why have I received a bill for the full year?

417-319-1005 A: At the closing, you should have received a credit for the amount of the tax

Glenstone Office the seller owed for the year. You are now responsible for the payment of all

1002 S Glenstone Ave the taxes when they are due. If you believe that this does not apply in your

417-831-2600 case, contact the title company or real estate company who sold you the

Republic Office property and have them look at the closing papers with you.

243 US Hwy 60

417-732-7557

Still have questions? Find more answers at www.CountyCollector.com

Other Helpful Information:

Sales Tax: 573-751-2836 Look what you can do at CountyCollector.com!

MO Income Tax: 573-751-3505

Dept of Revenue: www.dor.mo.gov

IRS Tax: 800-829-1040

• Make Payments • Print Merchant License Applications

Office on Aging: 417-862-0762 • Print Receipts • Print Tax Sale Forms

• Print Statements • Find Answers to your Questions

Contact Information

Email: ____________________________________________________

Phone: ____________________ Cell Phone: ____________________ Avoid Late Fees

• Be sure your payment is

Permanent Change of Address postmarked on or before Dec 31st

• Pay online at

Name: ___________________________________________________ www.countycollector.com

before midnight on Dec 31st

Street Address: ___________________________________________ (Technical difficulties does NOT

extend the deadline to pay

City, State, Zip: ___________________________________________ with no interest/penalty) .

Date Moved: _____________________________________________

You might also like

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptCHRISNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account Activityluz rodriguezNo ratings yet

- Pay Taxes Pay Taxes Online Subscribe/Unsubscribe To EbillingDocument2 pagesPay Taxes Pay Taxes Online Subscribe/Unsubscribe To EbillingEb SmithNo ratings yet

- ViewFile (1) TDocument2 pagesViewFile (1) TIanNo ratings yet

- Dozier Lili Monthly Statement 2021-06Document2 pagesDozier Lili Monthly Statement 2021-06Sharon Jones100% (3)

- Bart Lili Monthly Statement 2021-05Document2 pagesBart Lili Monthly Statement 2021-05Sharon Jones33% (3)

- 001jan172020 3 PDFDocument4 pages001jan172020 3 PDFSteven EnglishNo ratings yet

- XXXX XXXX XXXX 5026: Han Cai Account Number: XXXX XXXX XXXX 5026 Closing Date: September 2, 2023Document4 pagesXXXX XXXX XXXX 5026: Han Cai Account Number: XXXX XXXX XXXX 5026 Closing Date: September 2, 2023finape6897No ratings yet

- Spark BillDocument3 pagesSpark BillStudy INo ratings yet

- Statement Chase PDFDocument4 pagesStatement Chase PDFN N100% (1)

- Statement 3Document4 pagesStatement 3Martha AurichNo ratings yet

- Travis Card StatementDocument4 pagesTravis Card StatementPapa BoolioNo ratings yet

- Canada ScotiabankDocument2 pagesCanada Scotiabankj2zk4fpvfnNo ratings yet

- Rental IncomeDocument2 pagesRental IncomeAlex SirgiovanniNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityAndreina VillalobosNo ratings yet

- Lili Account Bank StatementDocument2 pagesLili Account Bank StatementAlex NeziNo ratings yet

- GetbillpdfDocument4 pagesGetbillpdfBreezie100% (1)

- Casnetusa StatementDocument4 pagesCasnetusa StatementAresNo ratings yet

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- Documento de Propiedad en Texas, Estados UnidosDocument1 pageDocumento de Propiedad en Texas, Estados UnidosArmandoInfoNo ratings yet

- Chase BusinessDocument4 pagesChase Businessanastasiya DubininaNo ratings yet

- Payment Statement PDFDocument1 pagePayment Statement PDFEmran miahNo ratings yet

- Statement 34Document6 pagesStatement 34Doris AgeeNo ratings yet

- ANZ BankDocument6 pagesANZ BankВлад АнгелNo ratings yet

- Account Number 598110689: Questions?Document2 pagesAccount Number 598110689: Questions?Rich BarcelonaNo ratings yet

- MR Jerry Dimeo Property and Financial deedNJDocument4 pagesMR Jerry Dimeo Property and Financial deedNJPhilip RussellNo ratings yet

- Hello Carlos Perez,: Your Bill at A GlanceDocument5 pagesHello Carlos Perez,: Your Bill at A GlancePedro Kim0% (1)

- Get Statement PDFDocument4 pagesGet Statement PDFThomas SheffieldNo ratings yet

- November 2019Document4 pagesNovember 2019Astrid MeloNo ratings yet

- S Alyssa 2021Document6 pagesS Alyssa 2021aamir hayatNo ratings yet

- B2B Streamlined Bill SampleDocument9 pagesB2B Streamlined Bill SampleCarlos GutierrezNo ratings yet

- Account Summary Contact UsDocument1 pageAccount Summary Contact UsUmairNo ratings yet

- Invoice 220800067820Document8 pagesInvoice 220800067820immanuel1111No ratings yet

- ATTBill 5075 Jan2023Document6 pagesATTBill 5075 Jan2023marvbeats1555No ratings yet

- Xfinity - Statement - 2023-05-13Document5 pagesXfinity - Statement - 2023-05-13scelso100% (2)

- StatementDocument7 pagesStatementMuhammad MubeenNo ratings yet

- Capital One Statement 211043021Document5 pagesCapital One Statement 211043021quannbui95No ratings yet

- 415 Baldwin Ave, APT 7, Jersey City, NJ 07306Document5 pages415 Baldwin Ave, APT 7, Jersey City, NJ 07306Estrada Pence HoseaNo ratings yet

- B2B Streamlined Bill Sample - Phone Bill Template FormDocument9 pagesB2B Streamlined Bill Sample - Phone Bill Template FormBrendon DrewNo ratings yet

- Please Detach Coupon and Return Payment Using The Enclosed Envelope - Allow 5 Days For Mail DeliveryDocument4 pagesPlease Detach Coupon and Return Payment Using The Enclosed Envelope - Allow 5 Days For Mail DeliveryAnatoliy PopikNo ratings yet

- Payment Information Summary of Account Activity: SeptemberDocument3 pagesPayment Information Summary of Account Activity: SeptemberSarah BledsoeNo ratings yet

- Att Final BillDocument4 pagesAtt Final BillJohn Montognese75% (4)

- Town of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd QuarterDocument1 pageTown of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd Quarterharsha.kNo ratings yet

- Account Summary Contact UsDocument1 pageAccount Summary Contact Usorgy11No ratings yet

- 747956694Document2 pages747956694andrimulyaNo ratings yet

- Lili Monthly Statement 2021-11Document2 pagesLili Monthly Statement 2021-11Clifton WilsonNo ratings yet

- ParcelReport 070931104172Document1 pageParcelReport 070931104172Ana Gemma Arcival BacarisasNo ratings yet

- Go BankDocument1 pageGo Bankjeremyreys8No ratings yet

- Varo Bank Account Statement: AmountDocument14 pagesVaro Bank Account Statement: AmountCourtney BrownNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account Activitycory100% (1)

- Chithra Baskar: Account StatementDocument8 pagesChithra Baskar: Account StatementSarath KumarNo ratings yet

- Horace Property Property Tax StatementDocument2 pagesHorace Property Property Tax StatementRob PortNo ratings yet

- Chase BankDocument2 pagesChase BankyomexNo ratings yet

- Attachment 1Document5 pagesAttachment 1sandral.baltazar17No ratings yet

- Amount EnclosedDocument4 pagesAmount EnclosedVicki HillNo ratings yet

- March XfinityDocument11 pagesMarch Xfinityeleggua03No ratings yet

- SAF Direct Deposit Form: Please Use This Form To Provide Updated Banking Information For SA Rental DepositsDocument1 pageSAF Direct Deposit Form: Please Use This Form To Provide Updated Banking Information For SA Rental DepositsJAMIE SCHADELNo ratings yet

- General Warranty Deed: Prepared byDocument3 pagesGeneral Warranty Deed: Prepared byJAMIE SCHADELNo ratings yet

- Greene County Real Estate Receipt Tax Year 2021Document1 pageGreene County Real Estate Receipt Tax Year 2021JAMIE SCHADELNo ratings yet

- Residential Lease AgreementDocument13 pagesResidential Lease AgreementJAMIE SCHADELNo ratings yet

- State of Georgia Rental Assistance Program Income Documentation Waiver FormDocument2 pagesState of Georgia Rental Assistance Program Income Documentation Waiver FormJAMIE SCHADELNo ratings yet

- Statement of Delinquent Rent: Patricia Beltz 3010 Luckie STDocument1 pageStatement of Delinquent Rent: Patricia Beltz 3010 Luckie STJAMIE SCHADELNo ratings yet

- Accounting Equation AmityDocument6 pagesAccounting Equation AmityOdirile MasogoNo ratings yet

- Cash Dividends Received by Resident Foreign CorporationDocument7 pagesCash Dividends Received by Resident Foreign CorporationW-304-Bautista,PreciousNo ratings yet

- Multiple Choice Questions (Choose The Best Answer) 3 Points Each: 15 Points TotalDocument7 pagesMultiple Choice Questions (Choose The Best Answer) 3 Points Each: 15 Points TotalKenny BrownNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- Chapter 7 Business and Financial Aspects of Heritage Tourism - 20231122 - 123328 - 0000Document52 pagesChapter 7 Business and Financial Aspects of Heritage Tourism - 20231122 - 123328 - 0000aslongasshortNo ratings yet

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdNo ratings yet

- Additional Topics - Business CombinationDocument39 pagesAdditional Topics - Business CombinationIan Pol FiestaNo ratings yet

- CCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Test Bank DownloadDocument27 pagesCCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Test Bank DownloadCecelia Taylor100% (23)

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Affidavit of Assets and LiabilitiesDocument5 pagesAffidavit of Assets and LiabilitiesRishabh YadavNo ratings yet

- Chapter 9 Financial Forecasting For Strategic GrowthDocument18 pagesChapter 9 Financial Forecasting For Strategic GrowthMa. Jhoan DailyNo ratings yet

- Part 5Document154 pagesPart 5Han Ny PhamNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- Financial Statements and RatiosDocument27 pagesFinancial Statements and RatiosIoana MariucaNo ratings yet

- Proforma Entries:: NPO (Nonprofit Organization)Document3 pagesProforma Entries:: NPO (Nonprofit Organization)Marie GarpiaNo ratings yet

- Responsibility Accounting and Transfer PricingDocument25 pagesResponsibility Accounting and Transfer Pricingjustine reine cornicoNo ratings yet

- Withholding TaxDocument3 pagesWithholding TaxAnkit Jung RayamajhiNo ratings yet

- Course 2 Sample Exam Questions: y Units of BroccoliDocument47 pagesCourse 2 Sample Exam Questions: y Units of BroccoliEden ZapicoNo ratings yet

- Finance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Document25 pagesFinance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Oyeleye TofunmiNo ratings yet

- Tax 1 ReviewerDocument52 pagesTax 1 ReviewerDrean TubislloNo ratings yet

- 1600-PT 0322Document3 pages1600-PT 0322Mishelle RamosNo ratings yet

- Ratio Anaylsis With Excel (Hypothetical)Document7 pagesRatio Anaylsis With Excel (Hypothetical)awhan sarangiNo ratings yet

- 2021 PDFDocument9 pages2021 PDFNekhavhambe MartinNo ratings yet

- Intermediate Accounting 1 Final ExaminationDocument9 pagesIntermediate Accounting 1 Final ExaminationPearlyn Villarin100% (1)

- Who Benefits From The Child Tax Credit?Document26 pagesWho Benefits From The Child Tax Credit?Katie CrolleyNo ratings yet

- Afm 2810001 Dec 2019Document4 pagesAfm 2810001 Dec 2019PILLO PATELNo ratings yet

- Individual Illustration and Activity No. 2Document22 pagesIndividual Illustration and Activity No. 2Angela CanayaNo ratings yet

- G.R. No. 103379Document1 pageG.R. No. 103379Raffy AmosNo ratings yet

- ME Engg Economy FORMULAS AND REVIEW MANUALDocument10 pagesME Engg Economy FORMULAS AND REVIEW MANUALMashuNo ratings yet

- SECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignDocument13 pagesSECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignCarloAysonNo ratings yet