Professional Documents

Culture Documents

Untitled

Uploaded by

Joy BuddiesllcCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Joy BuddiesllcCopyright:

Available Formats

chapter 5

jesse livermore was the greatest trader of his day. around 30

he had about 100 million dollars in his bank account. by 1929

he was well known around the world for his trading, but the

same exact stock market that made him rich and famous

crashed. his legacy was semented in stone. his wife was

scared for him, especcialy after hearing stories of other

wall street speculators commiting suicide. she and her

children greeted livermore while crying, before she ran into

her room, crying horribly. jesse stood completely confused

before realizing what happened. he told his family that he

guessed that the market would crash, and, shorted the market.

on that day he made 3 billion. he became the richest man in

the world, by pure luck.

while they celebrated success, Abraham Germansky, a

multimillionare real estate developer, wandered the streets

woefully. like almost every multimillionare in new york did,

he invested heavily in the stock market.

around the ending of october 1929, the new york times

published an article that portrays a tragic end. an attorney

by the name of bernard h sandler was asked yesterday morning

by ms. abraham germansky to help find her husband, missing

since thursday morning. ms germansky that a friend saw her

husband tearing a strip of sticker tape into bits near wall

street. there is a very noticable contrast: the crash made

jesse livermore the richest man in the world while abraham

germansky’s life was ruined. but, in the next few years,

Jesse Livermore ended up in the exact same situation.

they both shared something very similar: they where both good

at getting rich, and, similarly, both very bad at staying

rich.

40% of companies who become publicly traded losed almost all

there value over time. capitalism is hard because getting

money and keeping money are very contrasting skills. keeping

money requires humility, while getting money means taking

risks.

the head of Sequonia Capitial, michael Mortitz was

interviewed by Charlie Rose about why his company was so

successful. mortitz mentioned longetivity, so Rose asked him

why. mortitz says that “they were almost always terrified of

going out of business.” he cant afford to rest, because he

has no idea what would happen in the next few years, or even

months. survival is success in the economy.

there are two reasons why survival is key with money. one is:

few gains are great enough to destroy everything. the second

is: the counterintuitive math of compounding. compounding

works like a plant: tending to it, nurturing it, and seeing

it grow. getting that growth requires survival. as an

example, lets talk about Rick Guerin.

if you’ve heard of the investing duo (Warren Buffett and

Charile Munger), then it will come as a suprise to some that,

around 40 or so years ago, Rick Guerin was originally apart

of the team. they used to do almost everything together. but

then Guerin disappeared. Buffett said, in a conversation with

investor Mohnish Pabrai, that charlie and warren knew that

they would get incredibly wealthy, and that they both wasnt

really in a hurry to get there, but Rick was.

Nassim Taleb puts it this way: having a head start and

surviving is completely different. both needs the other. you

need to avoid failing at all costs.

applying this mindset in your own life requires 3 things: 1.

be financially unbreakable. this means that keeping your good

returns undisturbed will give you even better returns. 2.

planning is important, but going off the plan is even more

important. a plan is useful when it can survive testing it,

ie surviving everything in life. most of peoples lives are

filled with unsertanty. 3. be optimistic about the future and

paranoid about how your going to reach there. being

optimistic doesnt mean to just “be happy”. it’s about

beliving that you have the odds, and you will win. in the

past 3 years our ecomony has crashed, a near endless amount

of people died of covid, and the stock market crashed twice.

but the economy has been showing great signs all around us.

chapter 6

in 1936, Heinz Berggruen fled Nazi Germany for the United

States, where he studied literature in U.C. Berkeley. around

the 1990s, Heinz Berggruen was one of the most respected art

dealers of all time. but, as a child, he was very plain, and

not very interesting. in 2000 he sold some of his art to the

german government for 100 million euros. the germans

considered it a donation, because it was pretty much a

bargain. almost all of his paintings pretty much costed 1

billion. collecting that much paintings is nearly

unbeleviable. art very much subjective, especially in the eye

of the beholder. how can you tell that the art you own will

become the most sought-after works of the century?

it could be luck, skill, or something else. Horizon Research,

an investment firm, has a third option. the great art dealers

acted like index funds, buying up any kind of art they found,

then holding on to it for a very long time, waiting for a few

winners. burggruen could be wrong most of the time and still

turn out rich.

steamboat willie put Disney on the map, however his buisness

success wasnt very good, as his first studio went bankrupt.

all his films where monsterably expensive. by the mid 1930’s,

they made over 400 films. most of them was short, some was

very beloved, and some cost a fortune. snow white changed

everything. the 8 million it earned in it first few months in

1938 paid off all of there debts, certain employees got

retention bonuses, and they got a new studio in burbank, CA.

anything that is very profitable and famous is the result of

a tail event - an one-in-a-million event. when we focus on

famous, very profitable works, its very easy to underestimate

it. some of them are very obvious. take NFTs or non-fungible

tokens. most “smart” people who invest in it, they usually

expect to make millions from it, however, they usually dont.

instead of expecting to have some that fail, some that dont,

and some that will fully win the bet, most people invest

without even knowing the drawbacks. (NFTs are already a bad

idea, as they end up helping with climate change, scamming,

and other unsavory things. see Line Goes Up – The Problem With

NFTs for more information)

when you accept that tails drives everything, you realize

that it’s normal for everything to change, wether for good or

bad. one of the greatest investors of our time, peter lynch

said, “if this buisness is good, youll be right 6 out of 10

times.” some jobs need you to be perfect. investing,

buisness, and finance are not those jobs. “nobody makes good

decisions all the time” is one thing youll learn from

buisnessmen and investors. take amazon: when they released

the fire phone, it completely failed. shortly after the

launch, jeff bezos said: if you think that’s a failure, where

working on much bigger failures right now. it’s ok for

companies as big as Amazon (such as disney) to release

failure after failure, because they are too big to fail.

take elon musk’s twitter, as another example: after buying it

he made multiple bad desisions after bad desisions - such as

paying for verification - in order to earn millions. but,

suprisingly, he completely failed. the stock actually fell

because of his bad desisions.

it shows that some billionares can show off power and

richness, but when they are finally found out, almost

everyone hates them.

there are a nearly uncountable amount of galaxys in space,

yet in our tiny speck of the universe, we are the (possibly)

the only life forms on a planet with intelligent life.

chapter 8

one reason for being a valet is driving cool-looking cars

such as Lamborghinis, Rolls-Royces, and all the other “rich

people” cars. the author always had a dream to own one of

those cars because it showed you were rich, had class, and

other pointless things. the irony is that he never really

looked at the drivers. when you see somebody driving a rolls-

royce you think “i wish i had that car so that people think

im cool.” this is a paradox: you might want one of those cars

to look cool, but most people will only look at the car. all

you really want is admiration from other people. does this

apply to people with big homes? expencive jewlery? yes and

yes. if you want respect and admiration, then being kind,

polite, and humble will get you there, not money and cars.

chapter 9

one of the most important ironies in money (yes, seriously)

is that wealth is what you dont see. most people see ferrari

drivers as rich, even though most of them are people who only

got a pretty mediocre success in their jobs, and spent it all

on a “nice” car. some people buy nice cars, but eventually

have to sell it, because they couldnt really afford the cars

cost of maintenance.

there are endless stories of people buying or renting nice

cars, expencive jewlery, and other material wealth and losing

it almost immediately. but weath is not the nice cars it’s

small things. Rihanna nearly went bankrupt after

overspending, and tried sueing her financial advisor. he said

“was it necessary to tell her that if you spend money on

things, you will end up with the things and not any money?”

everybody wants to buy nice things to make themselves feel

better. being rich means you have a very stable income.

dieting - and exersize - is a very useful example: if you

keep exersizing instead of rewarding yourself with a big meal

- if you keep on investing, and not buying useless things -

you can gain that satisfaction. you cant find wealthy role

models - you only find rich ones. there are some wealthy

people who spend a lot of money, of course. but we dont see

the millions of dollars in there bank account, and the

endless investing portfolios. almost everybody wants - at

least at some point in there lives - to be rich. freedom you

dont get if you stay with your 100s of thousands of dollars

in your bank account. people are good at imatating others to

learn. most people cant find wealthy people. i think, as a

good (not example, more of a suggestion) is to stay modest.

not modest as in money, i mean modest as in dont buy what you

want, buy what you need. save your money. dont waste your

“big break” on nice car and fancy jewlery. keep it. put the

big money in the savings.

You might also like

- YourlifeDocument324 pagesYourlifewhitepaladinNo ratings yet

- William Davis - The Rich, A New Study of The SpeciesDocument283 pagesWilliam Davis - The Rich, A New Study of The SpeciescchauNo ratings yet

- The Holy Grail Trading SystemDocument113 pagesThe Holy Grail Trading Systemadma1100% (1)

- Jim Rickards The Big Drop Book p29Document274 pagesJim Rickards The Big Drop Book p29Jorge Pleite GuerraNo ratings yet

- The Real Book of Real Estate - Robert KiyosakiDocument513 pagesThe Real Book of Real Estate - Robert Kiyosakiroti0071558100% (3)

- One Up On Wall Street: How To Use What You Already Know To Make Money InFrom EverandOne Up On Wall Street: How To Use What You Already Know To Make Money InRating: 4.5 out of 5 stars4.5/5 (115)

- The Great DistortionDocument6 pagesThe Great DistortionAlex Senges100% (1)

- Understand Trading in 2 Hours SteveRyanDocument63 pagesUnderstand Trading in 2 Hours SteveRyanAkash Biswal100% (2)

- Rickards BigdropDocument274 pagesRickards Bigdropgneyman100% (2)

- Ebook From Narmer's Kemet To Cleopatra's EgyptDocument108 pagesEbook From Narmer's Kemet To Cleopatra's EgyptJoy BuddiesllcNo ratings yet

- 100 BTC With R&E in Exchange For EURO / USD at Market PriceDocument10 pages100 BTC With R&E in Exchange For EURO / USD at Market Priceerick tafurNo ratings yet

- Clothing Line Business Plan Example PDFDocument27 pagesClothing Line Business Plan Example PDFSimran Singh67% (3)

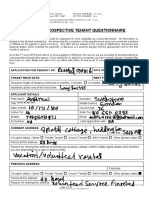

- PROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Document10 pagesPROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Duke Jno100% (1)

- Conversation With Charlie MungerDocument16 pagesConversation With Charlie Mungerbenclaremon92% (12)

- Why Do Smart People Do Stupid Stupid ThingsDocument8 pagesWhy Do Smart People Do Stupid Stupid ThingsPetrescu Mihai100% (1)

- Knowledge Is Power, So Be As Powerful As You Can!Document27 pagesKnowledge Is Power, So Be As Powerful As You Can!Ahemad ShamimNo ratings yet

- The Money Masters July 1993Document4 pagesThe Money Masters July 1993Rajeev KumarNo ratings yet

- Wharton Consulting Club Case Book 2019Document201 pagesWharton Consulting Club Case Book 2019guilhermetrinco62% (13)

- Fraud Larry Williams The True Trading LifeDocument10 pagesFraud Larry Williams The True Trading LifeAlexNo ratings yet

- The Quotable Billionaire: Advice and Reflections From and For the Real, Former, Almost, and Wanna-Be Super-Rich . . . and OthersFrom EverandThe Quotable Billionaire: Advice and Reflections From and For the Real, Former, Almost, and Wanna-Be Super-Rich . . . and OthersNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- The Game: How the World of Finance Really WorksFrom EverandThe Game: How the World of Finance Really WorksRating: 5 out of 5 stars5/5 (2)

- 5 Little Guys That Got Rich in Bad Times: by Joshua BoswellDocument5 pages5 Little Guys That Got Rich in Bad Times: by Joshua BoswellElle-MaiNo ratings yet

- 12 Month Real Estate MillionaireDocument27 pages12 Month Real Estate Millionairetestnation0% (1)

- Investing Principles - Financial UDocument80 pagesInvesting Principles - Financial UK4NO100% (1)

- Michael Price Lecture Notes - 1292015Document4 pagesMichael Price Lecture Notes - 1292015brett_gardner_3No ratings yet

- 13 Steps to Investing WiselyDocument33 pages13 Steps to Investing WiselyadikesaNo ratings yet

- You Got Screwed!: Why Wall Street Tanked and How You Can ProsperFrom EverandYou Got Screwed!: Why Wall Street Tanked and How You Can ProsperRating: 3.5 out of 5 stars3.5/5 (14)

- Wall Street Self Defense Manual PreviewDocument18 pagesWall Street Self Defense Manual PreviewCharlene Dabon100% (1)

- (David Dreman) Contrarian Investment Strategies - OrgDocument34 pages(David Dreman) Contrarian Investment Strategies - Orgarunpdn80% (5)

- RPT Short Sale SecretsDocument16 pagesRPT Short Sale SecretsJoshelle B. BanciloNo ratings yet

- The Almighty Dollar: Follow the Incredible Journey of Single Dollar to See How the Global Economy Really WorksFrom EverandThe Almighty Dollar: Follow the Incredible Journey of Single Dollar to See How the Global Economy Really WorksNo ratings yet

- Man vs. Markets: Economics Explained (Plain and Simple)From EverandMan vs. Markets: Economics Explained (Plain and Simple)Rating: 4 out of 5 stars4/5 (3)

- The Holy Grail Trading SystemDocument113 pagesThe Holy Grail Trading SystemAtef Albooq100% (2)

- Geshe Michael Roach - Fearless Success in Work and LifeDocument21 pagesGeshe Michael Roach - Fearless Success in Work and LifeShreekanth Holla100% (5)

- Don't Blame the Shorts: Why Short Sellers Are Always Blamed for Market Crashes and How History Is Repeating ItselfFrom EverandDon't Blame the Shorts: Why Short Sellers Are Always Blamed for Market Crashes and How History Is Repeating ItselfRating: 3 out of 5 stars3/5 (1)

- Proven Strategies of The Worlds Greatest Investors 2012 PDFDocument6 pagesProven Strategies of The Worlds Greatest Investors 2012 PDFcreat1No ratings yet

- The Practical Magic of The 5 Hour Workday by Trevor BlakeDocument29 pagesThe Practical Magic of The 5 Hour Workday by Trevor BlaketracyNo ratings yet

- Pay your Greentech Services LPG bill online or by chequeDocument1 pagePay your Greentech Services LPG bill online or by chequeAbhishek NigamNo ratings yet

- The Very, Very Rich and How They Got That Way (Harriman Classics): The spectacular success stories of 15 men who made it to the very very topFrom EverandThe Very, Very Rich and How They Got That Way (Harriman Classics): The spectacular success stories of 15 men who made it to the very very topNo ratings yet

- World Maker V 2.0Document8 pagesWorld Maker V 2.0Joy Buddiesllc100% (1)

- Best Practices S4HANA 2022Document153 pagesBest Practices S4HANA 2022venkataravin100% (1)

- Polaroid - Process and Quality Control Case Study: Preparation by Presentation byDocument6 pagesPolaroid - Process and Quality Control Case Study: Preparation by Presentation byVinit Vijay SankheNo ratings yet

- The Bond King: How One Man Made a Market, Built an Empire, and Lost It AllFrom EverandThe Bond King: How One Man Made a Market, Built an Empire, and Lost It AllRating: 3.5 out of 5 stars3.5/5 (10)

- EFFICIENCY+FOR+ALL+by+HERBERT+N +CASSONDocument109 pagesEFFICIENCY+FOR+ALL+by+HERBERT+N +CASSONYohanes Nes100% (1)

- AWS Prescriptive Guidance: Migration Readiness GuideDocument17 pagesAWS Prescriptive Guidance: Migration Readiness Guidechandra100% (1)

- PhrasesDocument38 pagesPhrasesarmagedeonNo ratings yet

- Apple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FailDocument3 pagesApple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FaildenisNo ratings yet

- Substituted 'Whorehouse' With 'Harem' When They Printed The Story - A Sign of The Times.)Document3 pagesSubstituted 'Whorehouse' With 'Harem' When They Printed The Story - A Sign of The Times.)arianashokNo ratings yet

- Great Gold BonanzaDocument29 pagesGreat Gold BonanzaAjNo ratings yet

- 7 Mega Trades That Could Hand You A 7 Figure PayouDocument30 pages7 Mega Trades That Could Hand You A 7 Figure Payouyeahitsme604No ratings yet

- Indian Market ManipulationDocument5 pagesIndian Market Manipulationmonu.gaurav100% (1)

- AK 12min (Freelance Writer)Document7 pagesAK 12min (Freelance Writer)Ananda KrishnanNo ratings yet

- Mem Chapter 6 - Rational InsanityDocument18 pagesMem Chapter 6 - Rational InsanityHarleen queenzelNo ratings yet

- (Riqueza) The Next Trillion - Paul Zane PilzerDocument7 pages(Riqueza) The Next Trillion - Paul Zane PilzerJuan Carlos Envejece JovenNo ratings yet

- Magic of Compounding-1Document13 pagesMagic of Compounding-1AshutoshNo ratings yet

- Anglais L3.S2Document36 pagesAnglais L3.S2Romain MizrahiNo ratings yet

- Financial Cataclysm Now!: Why Global Stock And Property Markets Are Now Going To Fall Faster And Further Than Ever Before – And How To Survive ItFrom EverandFinancial Cataclysm Now!: Why Global Stock And Property Markets Are Now Going To Fall Faster And Further Than Ever Before – And How To Survive ItNo ratings yet

- Once Bullish, Contrarian Jim Grant Likes Cash Now: AdchoicesDocument4 pagesOnce Bullish, Contrarian Jim Grant Likes Cash Now: AdchoicesBrandywine84No ratings yet

- Book Summary: Boomerang - The Meltdown Tour - Written by Michael LewisDocument2 pagesBook Summary: Boomerang - The Meltdown Tour - Written by Michael LewisUday JoshiNo ratings yet

- The Book A Series of Talks On Advertising: J. Walter Thompson CoDocument47 pagesThe Book A Series of Talks On Advertising: J. Walter Thompson CoDJ&Music channelNo ratings yet

- Fucking DrawDocument1 pageFucking DrawJoy BuddiesllcNo ratings yet

- UntitledDocument6 pagesUntitledJoy BuddiesllcNo ratings yet

- Keep ExperimentingDocument1 pageKeep ExperimentingJoy BuddiesllcNo ratings yet

- 7 Music TipsDocument1 page7 Music TipsJoy BuddiesllcNo ratings yet

- CookiesDocument1 pageCookiesJoy BuddiesllcNo ratings yet

- GAMEDEVELOPMENTCHEATSHEETS: UI/UXDESIGNERDocument1 pageGAMEDEVELOPMENTCHEATSHEETS: UI/UXDESIGNERJoy BuddiesllcNo ratings yet

- UntitledDocument1 pageUntitledJoy BuddiesllcNo ratings yet

- Foxes Grow On Trees All The Kittens Pick Them For FoodDocument1 pageFoxes Grow On Trees All The Kittens Pick Them For FoodJoy BuddiesllcNo ratings yet

- False Representation of African Culture and the Media's RoleDocument5 pagesFalse Representation of African Culture and the Media's RoleJoy BuddiesllcNo ratings yet

- Essay For SchoolDocument2 pagesEssay For SchoolJoy BuddiesllcNo ratings yet

- DeerdreamsDocument2 pagesDeerdreamsJoy BuddiesllcNo ratings yet

- TOS20221510 enDocument2 pagesTOS20221510 enJoy BuddiesllcNo ratings yet

- Manual enDocument16 pagesManual enJoy BuddiesllcNo ratings yet

- IJSOM - Volume 8 - Issue 2 - Pages 134-164Document31 pagesIJSOM - Volume 8 - Issue 2 - Pages 134-164Jabir ArifNo ratings yet

- List of Attorneys March 2018Document21 pagesList of Attorneys March 2018LOVETH KONNIANo ratings yet

- GBO Placement Report 2023Document11 pagesGBO Placement Report 2023adiranjan1112No ratings yet

- Quality System Risk Assessment ProcedureDocument3 pagesQuality System Risk Assessment ProcedureHarits As Siddiq100% (1)

- Chapter 10Document31 pagesChapter 10winkko ucsmNo ratings yet

- Model For IMC Planning PDFDocument6 pagesModel For IMC Planning PDFApurva SharmaNo ratings yet

- PDF Year Book 2021-22-EnglishDocument180 pagesPDF Year Book 2021-22-EnglishATUL SONINo ratings yet

- Module 3 - ABC Lecture S23Document26 pagesModule 3 - ABC Lecture S23Prachi YadavNo ratings yet

- Adigrat UnversityDocument32 pagesAdigrat UnversityAmir sabirNo ratings yet

- HCC P 15 17 01 Rev. 2 - Braz ProcedureDocument5 pagesHCC P 15 17 01 Rev. 2 - Braz ProcedureAnasNo ratings yet

- Trading Agreement 2018 - SolidmarkDocument2 pagesTrading Agreement 2018 - SolidmarkPhillip James TabiqueNo ratings yet

- Google Slides - Cheat Sheet - Learning Center - G SuiteDocument3 pagesGoogle Slides - Cheat Sheet - Learning Center - G SuitebumfromjerseyNo ratings yet

- Prebisch Singer Hypothesis ExplainDocument8 pagesPrebisch Singer Hypothesis Explainafcmayfzq100% (2)

- Business Strategy: An Introduction To Market Driven StrategyDocument19 pagesBusiness Strategy: An Introduction To Market Driven StrategyAkki vaidNo ratings yet

- Class 7 - Social Science - C6. Understanding Media - NotesDocument3 pagesClass 7 - Social Science - C6. Understanding Media - NotesDiya shivNo ratings yet

- Engineering Management Assignment 2 (UE16EC451D) : NAME: Abhinav Kumar Class: 8th Sem Sec.: A USN/SRN: 01FB16EEC007Document55 pagesEngineering Management Assignment 2 (UE16EC451D) : NAME: Abhinav Kumar Class: 8th Sem Sec.: A USN/SRN: 01FB16EEC007abhinav kumarNo ratings yet

- MBA 231 Marketing Management PDFDocument16 pagesMBA 231 Marketing Management PDFSNEHA SIVAKUMAR 1730152No ratings yet

- Fayol's 14 Principles of Management ExplainedDocument31 pagesFayol's 14 Principles of Management ExplainedmuskanNo ratings yet

- SAP FICO Training Videos - Materials Folder Screenshots PDFDocument8 pagesSAP FICO Training Videos - Materials Folder Screenshots PDFSajanAndyNo ratings yet

- Improve Grammar and Build Vocabulary with TENSES PracticeDocument51 pagesImprove Grammar and Build Vocabulary with TENSES PracticeNguyen DreyNo ratings yet