Professional Documents

Culture Documents

Top Schemes-03-01-2023-10 - 21 - 09

Uploaded by

Ankit Maheshwari /WealthMitra/Delhi/Dwarka/0 ratings0% found this document useful (0 votes)

18 views27 pagesOriginal Title

Top Schemes-03-01-2023-10_21_09

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views27 pagesTop Schemes-03-01-2023-10 - 21 - 09

Uploaded by

Ankit Maheshwari /WealthMitra/Delhi/Dwarka/Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 27

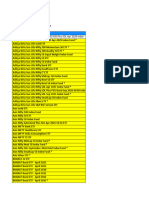

SCHEMES EXPENSE RATIO CATEGORY AUM(CR)

NSE Nifty Next 50 Div Yield Equity: Small Cap

NSE NIFTY 500 Value 50 TRI Equity: Value

NSE Nifty Next 50 P-E Equity: Small Cap

NSE Nifty Next 50 P-B Equity: Small Cap

NSE NIFTY 50 Equal Weight TRI Equity: Large Cap

DSP Nifty 50 Equal Weigh 0.86 Equity: Index 495

HDFC NIFTY 50 Equal wei 1.25 Equity: Index 534

Aditya Birla SL Nifty 50 1.02 Equity: Index 139

NSE Nifty AAA Bond Plus SDL Apr 2026 50:50 IndeDebt: Medium to Long Duration

L&T Nifty 50 Index Fund 0.45 Equity: Index 114

NSE Nifty 50 TRI Equity: Large Cap

NSE Nifty 500 (50),Crisil Short Term Bond Fund Equity: Multi Cap

IDFC Nifty 50 Index Fund 0.6 Equity: Index 575

NSE Nifty 50 Div Yield Hybrid: Arbitrage

UTI Nifty 50 Index Fund ( 0.3 Equity: Index 9503

DSP Nifty 50 Index Fund 0.38 Equity: Index 254

Navi Nifty 50 Index Fund 0.27 Equity: Index 611

HDFC Index Fund-NIFTY 5 0.4 Equity: Index 7551

ICICI Pru Nifty 50 Index 0.4 Equity: Index 3971

NIFTY 50 Total Return (50), CRISIL Liquid (50) Equity: Large Cap

Tata Nifty 50 Index Fund 0.52 Equity: Index 339

Kotak Nifty 50 Index Fun 0.51 Equity: Index 266

Motilal Oswal Nifty 50 I 0.5 Equity: Index 230

Axis Nifty 50 Index Fund 0.42 Equity: Index 190

CRISIL Liquid (70), NIFTY 50 TRI (30) Hybrid: Aggressive

HSBC Nifty 50 Index Fund 0.45 Equity: Index 114

NSE NIFTY 50 Hybrid Composite Debt 70:30 Equity: Large Cap

Aditya Birla SL Nifty 50 0.6 Equity: Index 506

NSE Nifty Dividend Opp 50 TRI Equity: Multi Cap

NSE NIFTY 50 Hybrid Composite Debt 65:35 Equity: Large Cap

NIFTY 50 Total Return (55), CRISIL Composite BondEquity: Large Cap

NIFTY 50 Total Return (50), CRISIL Short-Term BonEquity: Large Cap

CRISIL Liquid (40), NIFTY 50 TRI(30), CRISIL Short Hybrid: Aggressive

NSE NIFTY 50 Hybrid Short Duration Debt 40:60 Equity: Large Cap

NSE NIFTY 50 Hybrid Composite Debt 50:50 Equity: Large Cap

Edelweiss Nifty 50 Index 0.6 Equity: Index 9

S&P BSE Sensex (45), CRISIL Composite Bond (45),Equity: Sectoral

NSE NIFTY Large Midcap 250 TRI Equity: Large Cap

Nifty 50 Arbitrage (75%) + S&P BSE 200 TRI (25%) Equity: Index

NSE NIFTY 50 Hybrid Short Duration Debt 25:75 Debt: Short Duration

NSE Nifty Midcap 50 Equity: Mid Cap

NIFTY 50 Index (35%) + CRISIL Composite Bond FuEquity: Large Cap

NSE Nifty 50 Equity: Large Cap

Nifty 50 TRI (35%),Nifty 50 Arbitrage Index (30%), Equity: Large Cap

NSE Nifty 500 TRI Equity: Multi Cap

NIFTY 50 Arbitrage Index 40%,Crisil Short Term Hybrid: Aggressive

CRISIL Composite Bond (65), S&P BSE Sensex TRI(2Hybrid: Aggressive

NSE Nifty Midcap 150 TRI Equity: Mid Cap

NIFTY 50 Total Return (60), CRISIL Composite BondHybrid: Aggressive

30% S&P BSE 200 TRI + 30% Crisil Short Term BondHybrid: Aggressive

35% Nifty 50 Arbitrage Index + 35% Nifty 50 + 30%Hybrid: Aggressive

NIFTY 100 TRI (50), CRISIL Short-Term Bond (35), Equity: Global

Nifty 50 Arbitrage (75%) + Nifty 50 (25%) Equity: Index

40% of Crisil Liquid Fund Index + 30% of Crisil Sh Hybrid: Aggressive

CRISIL Liquid (70), NIFTY 500 TRI (30) Hybrid: Aggressive

CRISIL Composite Bond (80), NIFTY 50 Total ReturnHybrid: Aggressive

NIFTY 50 (70), CRISIL Composite Bond (30) Hybrid: Aggressive

NSE NIFTY 50 Arbitrage Equity: Large Cap

S&P BSE Sensex (65), CRISIL Composite Bond (20),Equity: Sectoral

50% Nifty 50 + 50% Crisil Composite Bond Fund I Hybrid: Aggressive

NSE NIFTY 50 Hybrid Composite Debt 15:85 Equity: Large Cap

CRISIL Composite Bond (85), NIFTY 50 Total ReturnDebt: Corporate Bond

NSE NIFTY Large Midcap 250 Equity: Large Cap

Edelweiss NIFTY Large Mi 1.03 Equity: Index 46

CRISIL Composite Bond (60), NIFTY 50 (40) Hybrid: Aggressive

CRISIL Composite Bond (60), NIFTY 500 TRI (40) Hybrid: Aggressive

Motilal Oswal Nifty 500 1.05 Equity: Multi Cap 388

NSE Nifty 500 Equity: Multi Cap

Motilal Oswal Nifty Midc 1.02 Equity: Index 660

Nippon India Nifty Midca 0.8 Equity: Index 531

Aditya Birla SL Nifty Mid 1.02 Equity: Index 81

NSE Nifty 500 Multicap 50:25:25 TRI Equity: Multi Cap

NSE Nifty CPSE Bond Plus SDL Sep 2026 50 50 Ind Debt: Medium to Long Duration

Nippon India Nifty 50 Va 0.8 Equity: Index 212

NSE Nifty Next 50 TRI Equity: Small Cap

Kotak Nifty Next 50 Inde 0.83 Equity: Index 106

DSP Nifty Next 50 Index 0.6 Equity: Index 246

UTI Nifty Next 50 Index F 0.79 Equity: Index 2112

ICICI Pru Nifty Next 50 I 0.73 Equity: Index 2610

SBI Nifty Next 50 Index F 0.83 Equity: Index 481

L&T Nifty Next 50 Index 0.8 Equity: Index 61

NSE Nifty Next 50 Equity: Small Cap

Navi Nifty Next 50 Index 0.59 Equity: Index 96

Axis Nifty Next 50 Index 0.83 Equity: Index 80

Aditya Birla SL Nifty Nex 1.03 Equity: Index 37

Navi Nifty Midcap 150 In 1.01 Equity: Index 26

Axis Nifty Smallcap 50 In 1 Equity: Small Cap 41

Axis Nifty Midcap 50 Ind 0.98 Equity: Mid Cap 33

UTI Nifty Midcap 150 Qua 0.87 Equity: Index 118

DSP Nifty Midcap 150 Qua 0.94 Equity: Index 132

Quantum Nifty 50 E T F F 0.18 Equity: Large Cap 15

ICICI Pru Nifty50 Equal 1 Equity: Index 11

SBI Nifty Midcap 150 Ind 0 Equity: Index 125

SBI Nifty Smallcap 250 I 0 Equity: Index 136

Mirae Asset Nifty AAA PS 0.37 Debt: Medium to Long Du 64

Tata Nifty Midcap 150 M 1.01 Equity: Mid Cap 17

Nippon India Nifty AAA P0 Debt: Medium Duration 180

Edelweiss Nifty Midcap150 Momentum 50 Index FEquity: Index

Edelweiss Nifty Next 50 Index Fund Reg (G) Equity: Index

Edelweiss Nifty Smallcap 250 Index Fund Reg (G) Equity: Index

Motilal Oswal Nifty Next 0.98 Equity: Index 139

HDFC NIFTY next 50 Inde 0.8 Equity: Index 388

HSBC Nifty Next 50 Index 0.8 Equity: Index 61

NSE NIFTY 50 Value 20 Equity: Value

NSE NIFTY SMALLCAP 250 TRI Equity: Small Cap

NSE Nifty 50 P-B Hybrid: Arbitrage

Motilal Oswal Nifty Smal 1.03 Equity: Index 334

Nippon India Nifty Small 1.04 Equity: Index 389

NSE Nifty 500 Shariah TRI Equity: Multi Cap

NSE Nifty 500 Shariah Equity: Multi Cap

NSE Nifty 50 USD Equity: Large Cap

NSE Nifty 50 P-E Hybrid: Arbitrage

NSE Nifty 50 Shariah Equity: Large Cap

NSE Nifty Alpha 50 TRI Equity: Large Cap

NSE NIFTY SMALLCAP 50 TRI Equity: Sectoral

Aditya Birla SL Nifty Sma 1.01 Equity: Index 45

1 DAY 7 DAY 15 DAY 30 DAY

-0.564899981021881 -9.28 -12.44 -10.66

1.98020005226135 5.39 1.9 2.63

0.156100004911423 5.77 2.64 0.59

0 5.27 2.13 0

0.377999991178513 1.27 -0.58 -2.61

0.370799988508224 1.24 -0.63 -2.7

0.369599997997284 1.24 -0.63 -2.71

0.366899996995926 1.23 -0.65 -2.72

0 0.06 0.08 -2.05

0 0 0.15 1.94

0.509100019931793 1.02 -0.39 -2.67

0 0.53 -2.09 -0.29

0.500299990177155 1 -0.42 -2.71

-0.787400007247925 -1.56 -2.33 -1.56

0.507000029087067 1.01 -0.41 -2.69

0.506200015544891 1.01 -0.41 -2.7

0.503099977970123 1.01 -0.41 -2.69

0.505400002002716 1.01 -0.41 -2.7

0.505999982357025 1.01 -0.41 -2.7

0 0.52 -1.32 -2.83

0.498199999332428 1 -0.42 -2.7

0.500400006771088 1 -0.42 -2.75

0.505400002002716 1 -0.42 -2.71

0.503799974918366 1 -0.42 -2.71

0 0.44 -1.07 -2.3

0.504400014877319 0.98 -0.43 -2.72

0 0.56 -1.47 -3.12

0.504299998283386 1 -0.42 -2.72

0.662699997425079 1.22 -0.66 -2.66

0 0.55 -1.45 -3.05

0 0.53 -1.38 -2.91

0 0.5 -1.31 -2.78

0 0.43 -1.06 -2.26

0 0.47 -1.2 -2.54

0 0.51 -1.34 -2.81

0.502600014209747 1 -0.45 -2.73

0 0.57 -1.43 -3.02

0.563499987125397 1.86 -0.67 -2.71

0 0.53 -0.51 -0.98

0 0.38 -0.96 -2

0.800400018692017 2.64 -0.11 -1.92

0 0.45 -1.19 -2.43

0.50900000333786 1.01 -0.39 -2.67

0 0.32 -0.66 -1.39

0.484100013971329 1.47 -0.72 -2.75

0 0.29 -0.57 -1.19

0 0.52 -1.31 -2.54

0.711399972438812 2.61 -0.75 -2.6

0 0.42 -1.09 -2.19

0 0.35 -0.83 -1.25

0 0.31 -0.58 -1.28

0 0.45 -1.11 -2.05

0 0.36 -0.22 -0.69

0 0.39 -0.95 -2.02

0 0.67 -1.63 -2.34

0 0.36 -0.93 -1.8

0 0.54 -1.44 -3.03

0 0.07 0.29 0.62

0 0.6 -1.52 -3.22

0 0.49 -1.28 -2.65

0 0.31 -0.8 -1.48

0 0.31 -0.8 -1.48

0.563399970531464 1.86 -0.67 -2.71

0.554400026798248 1.85 -0.7 -2.77

0 0.44 -1.17 -2.38

0 0.72 -1.83 -2.57

0.476300001144409 1.44 -0.77 -2.84

0.484200000762939 1.47 -0.72 -2.76

0.706300020217896 2.59 -0.79 -2.66

0.703800022602081 2.6 -0.78 -2.66

0.703199982643127 2.6 -0.8 -2.69

0.575299978256226 1.99 -0.95 -2.59

0 0.07 0.05 0.2

0.688799977302551 1.2 -0.37 -2.92

0.143900007009506 1.28 -1.72 -3.81

0.136999994516373 1.26 -1.76 -3.88

0.140900000929832 1.27 -1.74 -3.86

0.138999998569489 1.27 -1.75 -3.86

0.138699993491173 1.26 -1.75 -3.86

0.138300001621246 1.26 -1.76 -3.88

0 0 0.27 -0.86

0.143999993801117 1.28 -1.72 -3.81

0.138699993491173 1.24 -1.78 -3.89

0.139300003647804 1.32 -1.71 -3.82

0.135499998927116 1.27 -1.76 -3.88

0.699599981307983 2.57 -0.82 -2.72

1.0048999786377 2.84 -1.68 -3.01

0.79009997844696 2.6 -0.15 -1.98

0.266699999570847 0.81 -1.64 -4.95

0.265199989080429 0.7 -1.76 -5.08

0.471100002527237 0.93 -0.42 -2.75

0.367700010538101 1.24 -0.64 -2.69

0.702199995517731 2.59 -0.8 -2.68

0.746900022029877 3.1 -1.89 -2.18

0.0176999997347593 0.11 0.16 0.36

0.556500017642975 1.82 -1.67 -6.08

-0.00300000002607703 0.09 0.1 0.3

0.650600016117096 3.02 -0.55 -5.02

0.135299995541573 1.36 -1.66 -3.8

0.743300020694733 3.15 -1.87 -2.18

0.137600004673004 1.25 -1.78 -3.9

0.136500000953674 1.24 -1.78 -3.9

0.137700006365776 1.25 -1.77 -3.89

0.695500016212463 1.26 -0.29 -2.81

0.754700005054474 3.13 -1.84 -2.1

0.470600008964539 0.95 -0.47 -3.39

0.744799971580505 3.1 -1.9 -2.2

0.745199978351593 3.1 -1.89 -2.18

0.291700005531311 1.37 -0.96 -3.97

0.291799992322922 1.37 -0.96 -4.09

0 1.84 -0.73 -5.51

0.504800021648407 1.15 -0.27 -3.14

0.420399993658066 0.85 -0.53 -4.91

-0.0516000017523766 2.94 -2.37 -3.77

1.01530003547668 2.9 -1.64 -2.94

1.00510001182556 2.85 -1.71 -3.07

3 MONTH 6 MONTH 1 YEAR 2 YEAR

-11.56 -22.47 28.47 28.81

19.31 31.75 25.59 39.31

17.64 38.61 11.9 -21.63

3.46 22.19 11.4 4.45

5.12 17.27 8.52 20.76

4.87 16.67 7.49 19.56

4.81 16.51 7.21 0

4.76 16.23 6.99 0

1.81 3.42 6.67 0

3.84 12.8 6.53 18.09

6.6 16.11 6.23 15.33

5.64 8.6 6.02 13.13

6.41 15.72 5.9 14.61

-4.55 -10.64 5.88 5.59

6.52 15.9 5.87 14.96

6.49 15.83 5.75 14.76

6.51 15.87 5.74 0

6.49 15.82 5.72 14.78

6.48 15.83 5.69 14.72

6.93 13.4 5.68 13.47

6.44 15.75 5.68 14.59

6.43 15.7 5.67 0

6.43 15.75 5.59 14.44

6.44 15.69 5.58 0

6.01 11.54 5.57 11.8

6.38 15.68 5.56 14.57

7.43 14.47 5.53 14.21

6.42 15.67 5.49 14.48

7.25 14.73 5.48 18.36

7.32 14.25 5.47 13.96

7.06 13.73 5.44 13.49

6.84 13.22 5.41 13.18

5.96 11.42 5.34 11.6

6.44 12.38 5.26 12.39

6.89 13.42 5.23 13.01

6.33 15.6 5.22 0

7.02 14.14 5.2 13.35

4.02 17.53 5.07 19.52

3.4 7.48 4.93 8.79

5.53 10.55 4.92 10.67

5.87 19.93 4.89 21.57

6.26 12.18 4.88 11.63

6.45 15.52 4.86 13.91

4.53 8.49 4.75 9.03

4.8 16.47 4.75 17.1

4.18 7.78 4.69 8.48

6.08 12.61 4.65 11.89

2.76 19.31 4.65 23.77

5.85 11.38 4.65 10.74

3.5 8.08 4.59 9.16

4.24 7.81 4.53 8.33

4.65 10.32 4.48 10.69

3.45 6.1 4.4 7.1

5.46 10.25 4.38 10.04

4.75 12.41 4.35 13.6

5.21 10.16 4.29 9.41

7.15 13.67 4.22 12.64

1.3 2.34 4.19 4.2

7.18 14.31 4.12 12.9

6.51 12.44 4.01 11.37

4.69 9.16 4 8.34

4.69 9.16 4 8.34

3.92 16.98 3.94 18.28

3.73 16.89 3.94 0

6.06 11.6 3.86 10.5

5.06 13.43 3.81 14.06

4.51 15.78 3.61 15.65

4.68 15.9 3.52 15.78

2.56 18.58 3.51 22.12

2.56 18.76 3.47 0

2.46 18.52 3.46 0

4.32 17.34 3.43 20.12

1.93 3.52 2.26 0

7.17 12.79 1.29 0

-0.25 14.93 1.11 14.56

-0.43 14.86 0.8 0

-0.38 14.51 0.53 13.78

-0.45 14.43 0.24 13.54

-0.43 14.4 0.22 13.46

-0.47 14.35 0.17 0

-3.07 12.51 0.13 16.38

-0.32 14.49 0.07 13.53

-0.46 14.72 0 0

-0.45 14.69 0 0

-0.56 14.26 0 0

2.42 18.61 0 0

2.63 12.9 0 0

5.57 19.26 0 0

-3.69 7.23 0 0

-3.82 0 0 0

6.47 0 0 0

0 0 0 0

3.54 0 0 0

40 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

-0.49 14.33 -0.01 13.16

-0.49 14.23 -0.13 0

-0.49 14.06 -0.13 13.32

7.09 12.27 -0.19 15.23

3.96 18.59 -1.9 25.82

6.22 6.22 -2.29 3.7

3.61 17.6 -3.4 23.63

3.64 17.7 -3.48 23.69

2.52 11.45 -4.08 15.42

2.21 10.71 -5.39 13.83

4.15 9.8 -6.26 6.82

6.1 12.54 -9.17 -24.6

4.74 6.58 -10.49 7.52

0.31 14.59 -13.52 22.31

2.93 14.22 -16.81 11.74

2.59 13.38 -17.84 0

3 YEAR 5 YEAR 10 YEAR SINCE INCEPTION RETUR

15.56 12.19 3.39650011062622 -0.02

27.74 6.37 13.2819995880127 14.83

-26.97 -7.35 3.54250001907349 3.17

7.18 5.87 7.37650012969971 3.75

20.1 11.9 11.9463996887207 13.91

18.11 10.35 0 10.03

0 0 0 10.04

0 0 0 9.88

0 0 0 3.81

0 0 0 31.87

15.34 13.15 13.1229000091553 13.83

0 0 0 17.34

14.89 12.72 12.6448001861572 11.2

0.81 2.94 -0.905099987983704 -1.54

14.88 12.75 12.5687999725342 15.9

14.59 0 0 15.1

0 0 0 10.4

14.64 12.56 12.5622997283936 14.58

14.63 12.33 12.3683004379272 14.93

13.36 11.76 11.8828001022339 12.93

14.4 12.35 11.9947996139526 14.94

0 0 0 10.06

14.71 0 0 14.6

0 0 0 5.83

11.68 10.58 10.8517999649048 11.14

0 0 0 29.64

14.42 12.55 12.5806999206543 14.33

14.47 12.09 11.9338998794556 15.34

17.53 10.98 10.9549999237061 12

14.23 12.42 12.4646997451782 14.03

13.74 12.07 12.15149974823 13.35

13.51 11.92 11.9962997436523 13.04

11.82 10.72 10.9540004730225 11.23

12.87 11.48 11.6020002365112 12.26

13.52 11.95 12.0340003967285 13.01

0 0 0 1.77

27.07 19.55 15.3492002487183 14.53

19.77 12.04 15.4278001785278 15.49

8.24 7.26 8.24530029296875 7.86

11.46 10.53 10.7644996643066 10.84

22.5 9.99 13.777099609375 12.13

12.47 11.26 11.4160995483398 11.78

13.99 11.74 11.7398996353149 13.71

9.57 8.94 9.37419986724854 8.8

17.13 11.79 13.6978998184204 16.45

8.86 8.4 8.91230010986328 8.44

12.94 11.48 11.8407001495361 12.37

24.18 11.57 17.2632007598877 16.45

11.79 0 0 12.4

9.45 8.29 9.19050025939941 8.63

8.16 7.7 8.36110019683838 7.91

11.31 9.77 10.58899974823 9.73

6.6 0 0 7.05

10.38 9.46 9.84060001373291 10.2

13.36 9.99 11.5106000900269 12.04

10.78 10.16 10.4527997970581 10.21

12.99 11.15 11.2489995956421 12.88

3.54 4.36 5.69890022277832 5.94

13.5 11.75 11.7531003952026 13.96

12.06 10.61 10.7809000015259 11.73

9.97 9.62 9.99909973144531 9.56

9.97 9.62 9.99909973144531 9.56

18.53 10.86 14.0368003845215 13.96

0 0 0 3.61

11.42 10.23 10.4651002883911 11.05

14.55 10.7 12.2735996246338 13.21

15.71 0 0 17.63

15.85 10.51 12.4026002883911 12.54

22.99 0 0 24.39

0 0 0 17.92

0 0 0 16.81

20.2 10.94 14.7896003723145 15.47

0 0 0 2.28

0 0 0 14.36

15 7.62 14.2286996841431 20.6

0 0 0 10.87

13.89 0 0 13.45

13.96 0 0 9.49

13.72 6.47 12.9181995391846 11.01

0 0 0 8.35

0 0 0 25.73

13.96 6.52 12.8796997070313 13.86

0 0 0 -1.11

0 0 0 2.99

0 0 0 3.74

0 0 0 15.35

0 0 0 -7.61

0 0 0 8.24

0 0 0 -8.65

0 0 0 -8.41

0 0 0 11.86

0 0 0 25.9

0 0 0 13.11

0 0 0 14.9

0 0 0 7.47

0 0 0 -12.98

0 0 0 8.6

0 0 0 -32.44

0 0 0 -29.06

0 0 0 -12.6

13.34 0 0 13.36

0 0 0 -1.34

0 0 0 23.99

18.57 14.35 13.2416000366211 17.12

25.54 6.81 14.5752000808716 14.97

4.05 3.94 2.98950004577637 3.06

23.65 0 0 24.19

0 0 0 32.75

21.95 11.81 15.9989995956421 12.29

20.19 10.16 14.4555997848511 10.84

8.65 5.87 7.10869979858398 7.76

-8.46 -3.88 1.45120000839233 2.67

16.62 9.12 12.2700996398926 8.97

31.56 16.84 20.8363990783691 20.64

16.19 -0.33 8.83990001678467 9.91

0 0 0 3.68

FUND RATING R SQUARED SHARPE RATIO SORTINO RATIO

0

0

0

0

0

3 0.73 0.83

0 0

0 0

0

0 0

0

0

5 0.66 0.8

0

5 0.65 0.78

3 0.64 0.78

0 0

4 0.64 0.77

4 0.64 0.78

0

4 0.64 0.77

0 0

0 0

0 0

0

0 0

0

4 0.64 0.78

0

0

0

0

0

0

0

1 -0.29 -0.2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0 0

0

0

3 0.68 0.77

0

3 0.85 0.95

0 0

0 0

0

0

0 0

0

0 0

3 0.6 0.74

3 0.6 0.75

2 0.59 0.73

0 0

0 0

0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0

0

0

0 0

0 0

0 0

0

0

0

2 0.81 0.84

0 0

0

0

0

0

0

0

0

0 0

AVERAGE MATURITY MODIFIED DURATION STANDARD DEV YIELD TO MATURITY

0 0

0 0

0 0

0 0

0 0

0 0 23.58 0

0 0 0 0

0 0 0 0

0 0

0 0 0 0

0 0

0 0

0 0 22.1 0

0 0

0 0 22.45 0

0 0 22.2 0

0 0 0 0

0 0 22.42 0

0 0 22.36 0

0 0

0 0 21.9 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0

0 0 0 0

0 0

0 0 22.1 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0 60.01 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0 0 0

0 0

0 0

0 0 22.28 0

0 0

0 0 25.28 0

0 0 0 0

0 0 0 0

0 0

0 0

0 0 0 0

0 0

0 0 0 0

0 0 21.38 0

0 0 21.61 0

0 0 21.64 0

0 0 0 0

0 0 0 0

0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

3.04 2.56 0 7.29

0 0 0 0

3.6 3.02 0 7.48

0 0

0 0

0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0

0 0

0 0

0 0 29.47 0

0 0 0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0 0 0

MEAN ALPHA BETA LAUNCH DATE

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

20.88 1.21 1.04 2017-10-23 00:00:00

0 0 0 2021-08-18 00:00:00

0 0 0 2021-06-08 00:00:00

0 0 0

0 0 0 2020-04-16 00:00:00

0 0 0

0 0 0

18.11 -0.8 0.99 2010-04-30 00:00:00

0 0 0

18.2 -0.95 1.01 2000-03-06 00:00:00

17.87 -1.1 0.99 2019-02-21 00:00:00

0 0 0 2021-07-15 00:00:00

17.97 -1.15 1 2002-07-17 00:00:00

17.94 -1.14 1 2002-02-26 00:00:00

0 0 0

17.63 -1.13 0.98 2003-02-25 00:00:00

0 0 0 2021-06-21 00:00:00

0 0 0 2019-12-23 00:00:00

0 0 0 2021-12-03 00:00:00

0 0 0

0 0 0 2020-04-16 00:00:00

0 0 0

17.75 -1.16 0.99 2002-09-18 00:00:00

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

-13.78 -34.21 1.09 2015-05-08 00:00:00

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0 2021-12-03 00:00:00

0 0 0

0 0 0

18.73 -1.4 0.98 2019-09-06 00:00:00

0 0 0

25.08 -1.43 1.01 2019-09-06 00:00:00

0 0 0 2021-02-19 00:00:00

0 0 0 2021-04-01 00:00:00

0 0 0

0 0 0

0 0 0 2021-02-19 00:00:00

0 0 0

0 0 0 2021-03-03 00:00:00

16.5 -1.12 0.91 2019-02-21 00:00:00

16.61 -1.17 0.92 2018-06-28 00:00:00

16.4 -1.4 0.92 2010-06-25 00:00:00

0 0 0 2021-05-19 00:00:00

0 0 0 2020-04-16 00:00:00

0 0 0

0 0 0 2022-01-14 00:00:00

0 0 0 2022-01-28 00:00:00

0 0 0 2022-02-18 00:00:00

0 0 0 2022-03-11 00:00:00

0 0 0 2022-03-10 00:00:00

0 0 0 2022-03-28 00:00:00

0 0 0 2022-04-11 00:00:00

0 0 0 2022-08-04 00:00:00

0 0 0 2022-08-05 00:00:00

0 0 0 2022-10-03 00:00:00

0 0 0 2022-10-03 00:00:00

0 0 0 2022-10-03 00:00:00

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0 2019-12-23 00:00:00

0 0 0 2021-11-03 00:00:00

0 0 0 2020-04-16 00:00:00

0 0 0

0 0 0

0 0 0

27.44 -1.25 0.98 2019-09-06 00:00:00

0 0 0 2020-10-16 00:00:00

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0 2021-04-01 00:00:00

SCHEME BENCHMARK LARGECAP RATIO MIDCAP RATIO SMALLCAP RATIO

NIFTY 50 Equal Weight TR 98.08 0 1.79

NIFTY 50 Equal Weight TR 97.94 0 1.78

NIFTY 50 Equal Weight TR 97.93 0 1.78

NIFTY 50 TRI 89.14 0 1.07

NIFTY 50 TRI 98.67 0 1.18

NIFTY 50 TRI 98.81 0 1.19

NIFTY 50 TRI 98.82 0 1.18

NIFTY 50 TRI 98.81 0 1.19

NIFTY 50 TRI 98.8 0 1.19

NIFTY 50 TRI 98.46 0 1.18

NIFTY 50 TRI 98.62 0 1.19

NIFTY 50 TRI 98.18 0 1.18

NIFTY 50 TRI 98.81 0 1.19

NIFTY 50 TRI 98.63 0 1.17

NIFTY 50 TRI 89.14 0 1.07

NIFTY 50 TRI 98.71 0 1.19

NIFTY 50 TRI 98.6 0 1.18

NIFTY Large Midcap 250 50.46 46.87 2.1

NIFTY 500 TRI 76.85 14.8 8.33

NIFTY Midcap 150 TRI 2.17 94.45 3.25

NIFTY Midcap 150 TRI 2.17 94.32 3.26

NIFTY Midcap 150 TRI 2.17 94.46 3.26

NIFTY 50 Value 20 TRI 99.77 0 0

NIFTY Next 50 TRI 89.63 10.37 0

NIFTY Next 50 TRI 89.56 10.35 0

NIFTY Next 50 TRI 89.43 10.34 0

NIFTY Next 50 TRI 89.56 10.35 0

NIFTY Next 50 TRI 89.51 10.34 0

NIFTY Next 50 TRI 89.43 10.35 0

NIFTY Next 50 TRI 89.64 10.36 0

NIFTY Next 50 TRI 89.53 10.33 0

NIFTY Next 50 TRI 89.43 10.34 0

NIFTY Midcap 150 TRI 2.18 94.55 3.27

NIFTY Smallcap 50 TRI 0 2.02 97.46

NIFTY Midcap 50 TRI 0 99.82 0

NIFTY Midcap150 Quality 10.35 79.38 10.11

NIFTY Midcap150 Quality 10.36 79.53 10.11

NIFTY 50 TRI 0 0 99.93

NIFTY 50 Equal Weight TR 97.8 0 1.78

NIFTY Midcap 150 TRI 2.17 94.33 3.25

NIFTY Smallcap 250 TRI 0 1.88 98.02

Nifty AAA PSU Bond Plus 0 0 0

NIFTY Midcap 150 Momen 24.25 75.21 0.54

Nifty AAA PSU Bond Plus 0 0 0

NIFTY Next 50 TRI 89.55 10.33 0

NIFTY Next 50 TRI 89.43 10.34 0

NIFTY Next 50 TRI 89.43 10.35 0

NIFTY Smallcap 250 TRI 0 1.88 97.93

NIFTY Smallcap 250 TRI 0 1.88 97.91

NIFTY Smallcap 50 TRI 0 2.03 97.91

CURRENT NAV IS RECOMMENDED

1.76 0

11675.46 0

25.67 0

4.79 0

34458.88 0

16.5371 0

11.4066 0

11.6541 0

1067.56 0

20.9686 0

26460.41 0

14.4115 0

38.6488 0

1.26 0

122.2878 0

17.2132 0

11.5459 0

169.0599 0

179.3873 0

124.7648 0

111.4934 0

11.648 0

15.1136 0

10.6319 0

89.6099 0

20.5837 0

161.1012 0

180.9832 0

5639.21 0

152.5094 0

134.7351 0

127.2795 0

91.1187 0

110.205 0

126.7342 0

10.2188 0

167.1997 0

12910.84 0

26.2621 0

84.5933 0

8821.8 0

100.9589 0

18197.45 0

29.2887 0

24083.14 0

28.0869 0

112.5454 0

14958.43 0

16.0815 0

28.7157 0

26.3924 0

32.6813 0

13.1922 0

75.0579 0

105.8967 0

75.1835 0

123.626 0

2090.4 0

150.7248 0

99.9661 0

66.5917 0

66.5917 0

10200.7 0

10.3932 0

88.1361 0

131.2663 0

17.2992 0

15523.65 0

20.8873 0

13.6075 0

13.232 0

12881.95 0

1023.59 0

12.8488 0

59392.09 0

12.0615 0

16.2803 0

15.0598 0

37.1818 0

11.4436 0

18.4576 0

42248.4 0

9.8938 0

10.2774 0

10.3438 0

11.2121 0

9.3366 0

10.6265 0

9.3621 0

9.6036 0

10.4713 0

10.591 0

10.3537 0

10.3997 0

10.1472 0

9.722 0

10.1526 0

9.6517 0

9.6944 0

9.879 0

14.6235 0

9.8333 0

18.1823 0

9156.85 0

11921.56 0

4.27 0

20.777 0

18.723 0

6409.36 0

5200.29 0

7621.68 0

21.9 0

3958.41 0

35447.5 0

5357.91 0

10.6723 0

You might also like

- Weightage: S.no Fund Name AUM Size Expense RatioDocument16 pagesWeightage: S.no Fund Name AUM Size Expense RatioAgastyaNo ratings yet

- List of Index Funds in India 2024 Download ExcelDocument8 pagesList of Index Funds in India 2024 Download ExcelMana PlanetNo ratings yet

- Fund Tracking Errors and Differences 22 Dec 2022 2319Document35 pagesFund Tracking Errors and Differences 22 Dec 2022 2319chiragchhillar9711No ratings yet

- NIFTY Consists of 50 Companies Factors Sensex Is For Bse: N IftyDocument1 pageNIFTY Consists of 50 Companies Factors Sensex Is For Bse: N Iftygruntt87No ratings yet

- ETF Daily Earning Mahesh Kaushik Shop of ETF's Version 2 - PKRDocument9 pagesETF Daily Earning Mahesh Kaushik Shop of ETF's Version 2 - PKRrathodprashnt100% (1)

- INOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial ExpressDocument1 pageINOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial Expressravi kumarNo ratings yet

- Index Funds SchemsDocument2 pagesIndex Funds Schemsmanan.maheshwari298No ratings yet

- Weightage: S.no Fund Name AUM Size Expense Ratio Tracking ErrorDocument6 pagesWeightage: S.no Fund Name AUM Size Expense Ratio Tracking ErrorManoj ANo ratings yet

- TE&TD - 02 Mar - 0Document4 pagesTE&TD - 02 Mar - 0Revathi PNo ratings yet

- ETF Daily Earning Mahesh Kaushik Shop of ETF'sDocument2 pagesETF Daily Earning Mahesh Kaushik Shop of ETF'sim6002643No ratings yet

- Nifty 50 - Google SearchDocument1 pageNifty 50 - Google Searchvqsykdb8mvNo ratings yet

- Hdfcsml250 - Google SearchDocument1 pageHdfcsml250 - Google Searchzmstkn1No ratings yet

- Nov 2020 Tracking Error DatasheetDocument7 pagesNov 2020 Tracking Error DatasheetskkkNo ratings yet

- Index DashboardDocument3 pagesIndex DashboardWealth Maker BuddyNo ratings yet

- Icici Prudential Nifty50 Value 20 Index Fund - Investor v2Document18 pagesIcici Prudential Nifty50 Value 20 Index Fund - Investor v2namharidwarNo ratings yet

- Nippon India Nifty Smallcap 250 Index FundDocument19 pagesNippon India Nifty Smallcap 250 Index FundBabli Lovely NickyNo ratings yet

- Mini Project On NseDocument19 pagesMini Project On Nsecharan tejaNo ratings yet

- 11 March 15 DailycallsDocument15 pages11 March 15 DailycallsdineshganNo ratings yet

- Historic Returns - Index Fundsetfs, Index Fundsetfs Fund Performance Tracker Mutual Funds With Highest ReturnsDocument12 pagesHistoric Returns - Index Fundsetfs, Index Fundsetfs Fund Performance Tracker Mutual Funds With Highest Returnsakash bangaNo ratings yet

- Passive Fund Factsheet September 2022Document79 pagesPassive Fund Factsheet September 2022BISWAJITNo ratings yet

- Mutual Fund Screener India - Real Time MF Analysis Tool - TickertapeDocument1 pageMutual Fund Screener India - Real Time MF Analysis Tool - TickertapePrasanna GowriNo ratings yet

- 10 Ijamtes 2015Document7 pages10 Ijamtes 2015KRISHNAM RAJU JANAMALANo ratings yet

- Nifty: S.No. Company NameDocument5 pagesNifty: S.No. Company NameDurgesh AgnihotriNo ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Stock 2Document1 pageStock 2Pradeep BhankarNo ratings yet

- Metho123d Nifty 50Document17 pagesMetho123d Nifty 50praNo ratings yet

- Nifty Alpha Low Volatility 30 Index Whitepaper FinalDocument12 pagesNifty Alpha Low Volatility 30 Index Whitepaper FinalDark HoundNo ratings yet

- Share Price Index IndiaDocument16 pagesShare Price Index IndiaRakesh MalusareNo ratings yet

- Weekly Technical Report 23 September - 2011Document9 pagesWeekly Technical Report 23 September - 2011crypticbirdNo ratings yet

- NinftyDocument16 pagesNinftysonalliNo ratings yet

- Passive Fund Factsheet January 2024Document97 pagesPassive Fund Factsheet January 2024asaultpraveenNo ratings yet

- Commission DisclosureDocument6 pagesCommission DisclosureAbhikSKunduriNo ratings yet

- Edelweiss Factsheet March MF 2023 Revised01 16032023 022236 PMDocument75 pagesEdelweiss Factsheet March MF 2023 Revised01 16032023 022236 PMDiksha DuttaNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatednikhilNo ratings yet

- Project Report Abstract: Domain - Specialization: Finance Name of The Student: Roll Number: Supervisor NameDocument1 pageProject Report Abstract: Domain - Specialization: Finance Name of The Student: Roll Number: Supervisor NameMechWindNaniNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatedUrvashi SharmaNo ratings yet

- Method Nifty 50 ArbitrageDocument8 pagesMethod Nifty 50 ArbitrageTesthdjNo ratings yet

- Weekly Review of India Stock MarketDocument5 pagesWeekly Review of India Stock MarketMark Fidelman100% (1)

- Stock Market Indices: & Its FluctuationDocument11 pagesStock Market Indices: & Its Fluctuationvinodvarghese123No ratings yet

- SENSEXDocument10 pagesSENSEXMohamed ImranNo ratings yet

- Premarket Technical&Derivative Ashika 18.11.16Document4 pagesPremarket Technical&Derivative Ashika 18.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Nifty Bees (N) 1Document14 pagesNifty Bees (N) 1ankushishwarNo ratings yet

- MHBJHBDocument3 pagesMHBJHBShashank DoveriyalNo ratings yet

- Doubts About ProjectDocument2 pagesDoubts About ProjectSudhakara GowdNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- Nifty Broad Market Indices MethodologyDocument17 pagesNifty Broad Market Indices MethodologyArup GhoshNo ratings yet

- JM Daily - 23 Aug - EquityDocument183 pagesJM Daily - 23 Aug - EquityPravin SinghNo ratings yet

- Derivatives Report 30th September 2011Document3 pagesDerivatives Report 30th September 2011Angel BrokingNo ratings yet

- Calculation of Sensex and NiftyDocument5 pagesCalculation of Sensex and Niftykirang gandhi67% (3)

- Derivatives Report 26th December 2011Document3 pagesDerivatives Report 26th December 2011Angel BrokingNo ratings yet

- Astha Credit & Securities Pvt. LTD: Client Welcome Letter For The Day: Sep 26 2020Document2 pagesAstha Credit & Securities Pvt. LTD: Client Welcome Letter For The Day: Sep 26 2020Prabhu GoyalNo ratings yet

- Derivatives Report 25th November 2011Document3 pagesDerivatives Report 25th November 2011Angel BrokingNo ratings yet

- Financial Management: Report On Nifty50Document4 pagesFinancial Management: Report On Nifty50Alen AugustineNo ratings yet

- Comparison of Home Loan & FD RatesDocument1 pageComparison of Home Loan & FD RatesSukhdeep Singh BrarNo ratings yet

- Grievance ProcedureDocument2 pagesGrievance ProcedureAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Schemes Expense Ratio Category Aum (CR) Tata Digital India Fund R 2.17 Equity: Sectoral 2768 Aditya Birla SL Digital in 2.23 Equity: Sectoral 2288Document9 pagesSchemes Expense Ratio Category Aum (CR) Tata Digital India Fund R 2.17 Equity: Sectoral 2768 Aditya Birla SL Digital in 2.23 Equity: Sectoral 2288Ankit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Dear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingDocument5 pagesDear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- AFL CoApplicant V23082021Document2 pagesAFL CoApplicant V23082021Ankit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- West Grievance Officers Jan'21Document4 pagesWest Grievance Officers Jan'21Ankit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Mah Chat Scrub BaseDocument350 pagesMah Chat Scrub BaseAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- S.No. MNDL - Name School Name List of Aide and Unaided High Schools in Krishna DistrictDocument5 pagesS.No. MNDL - Name School Name List of Aide and Unaided High Schools in Krishna DistrictAnkit Maheshwari /WealthMitra/Delhi/Dwarka/100% (1)

- Mah Chat Scrub Base1Document350 pagesMah Chat Scrub Base1Ankit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- List of Private Un-Aided Schools in Anantaur DistrictDocument3 pagesList of Private Un-Aided Schools in Anantaur DistrictAnkit Maheshwari /WealthMitra/Delhi/Dwarka/100% (1)

- Agent Not CreatedDocument220 pagesAgent Not CreatedAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- S.No. MNDL - Name School Name List of Aide and Unaided High Schools in Krishna DistrictDocument5 pagesS.No. MNDL - Name School Name List of Aide and Unaided High Schools in Krishna DistrictAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Omt IdDocument34 pagesOmt IdAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- 1Document7 pages1Ankit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Facilitation CenterDocument30 pagesFacilitation CenterAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Active Irctc AgentsDocument312 pagesActive Irctc AgentsAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- SsddfaldfssDocument36 pagesSsddfaldfssAnkit Maheshwari /WealthMitra/Delhi/Dwarka/0% (1)

- Project ProposalDocument22 pagesProject ProposalFahmie PAGAYAWANNo ratings yet

- QRsTShirtWhiteHalfSleeves 29012021Document23 pagesQRsTShirtWhiteHalfSleeves 29012021Abraham yeshua familyNo ratings yet

- International Parity Conditions: Multinational Business Finance (2 Edition)Document61 pagesInternational Parity Conditions: Multinational Business Finance (2 Edition)Cong Chinh NguyenNo ratings yet

- 公 共 啟 事 Public Notices: AIA GROUP LIMITED (Company No.: 1366053)Document2 pages公 共 啟 事 Public Notices: AIA GROUP LIMITED (Company No.: 1366053)misc miscNo ratings yet

- Tentative Schedule For Green Field 50m and 60m TowerDocument2 pagesTentative Schedule For Green Field 50m and 60m TowertewodrosNo ratings yet

- Invoice 1Document1 pageInvoice 1vibhorNo ratings yet

- Lesson 5 Part 1 Review, Geometric Design of HighwayDocument45 pagesLesson 5 Part 1 Review, Geometric Design of Highwayangel loroNo ratings yet

- "Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDDocument2 pages"Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDANKITNo ratings yet

- 05 - Network Design in Supply ChainDocument21 pages05 - Network Design in Supply ChainAfnanNo ratings yet

- Solution Decision Making ProblemDocument8 pagesSolution Decision Making ProblemSAYAK DAS100% (2)

- Practice AccountingDocument10 pagesPractice AccountingRossmery RosasNo ratings yet

- Abel & Bernanke Macroeconomics Study Guide QuestionsDocument13 pagesAbel & Bernanke Macroeconomics Study Guide Questionskranium2391% (11)

- DEFENCE Account CODE PDFDocument12 pagesDEFENCE Account CODE PDFkhaja1988No ratings yet

- 1st Semester SyllabusDocument7 pages1st Semester SyllabusManvi AroraNo ratings yet

- Mrs. Margaret Is in Her Kitchen. She's Making A Shopping ListDocument6 pagesMrs. Margaret Is in Her Kitchen. She's Making A Shopping ListAndreea PatruNo ratings yet

- Lecture (Week 11) - Chapter 15 (Part II)Document11 pagesLecture (Week 11) - Chapter 15 (Part II)Tasneem MohamedNo ratings yet

- Microeconomics Texas University PDFDocument457 pagesMicroeconomics Texas University PDFAnonymous k24jaLNo ratings yet

- Teori Akuntansi: (Accounting Theory Construction - Chapter 2)Document13 pagesTeori Akuntansi: (Accounting Theory Construction - Chapter 2)Sarah Laras WitaNo ratings yet

- These Are The Top 12 Richest Business Owners of PakistanDocument15 pagesThese Are The Top 12 Richest Business Owners of PakistanApna VeerNo ratings yet

- Anatomy of A Cup-with-Handle Chart PatternDocument3 pagesAnatomy of A Cup-with-Handle Chart PatternbengaltigerNo ratings yet

- QUESTIONNAIRE On ChocolatesDocument4 pagesQUESTIONNAIRE On ChocolatesRavish Sharma85% (27)

- Solved XAT 2021 Paper With SolutionsDocument44 pagesSolved XAT 2021 Paper With SolutionsRaunak RayNo ratings yet

- Business Economics AssignmentDocument7 pagesBusiness Economics AssignmentDEAN JASPERNo ratings yet

- TH E PL Ofit Grai H: Graph 1Document13 pagesTH E PL Ofit Grai H: Graph 1aprilNo ratings yet

- Handout 1 Economy - The Basic Economic Problem & Opportunity CostDocument5 pagesHandout 1 Economy - The Basic Economic Problem & Opportunity CostAndriani GraceNo ratings yet

- Assume The Same Information For The Pacific Boat Company As in Problem 10Document2 pagesAssume The Same Information For The Pacific Boat Company As in Problem 10Elliot RichardNo ratings yet

- Macro Qch1Document13 pagesMacro Qch1Kiều AnhNo ratings yet

- 5 MulticolinearityDocument26 pages5 Multicolinearitysaadullah98.sk.skNo ratings yet

- Curriculum Vitae: DebabratamaityDocument2 pagesCurriculum Vitae: Debabratamaitypuri16No ratings yet

- Microeconomics. Introduction To MicroeconomicsDocument2 pagesMicroeconomics. Introduction To MicroeconomicsEmily GNo ratings yet