Professional Documents

Culture Documents

Perpetual - Unadjusted Trial Balance

Perpetual - Unadjusted Trial Balance

Uploaded by

Jeon Cyrone Cuachon0 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

PERPETUAL - UNADJUSTED TRIAL BALANCE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesPerpetual - Unadjusted Trial Balance

Perpetual - Unadjusted Trial Balance

Uploaded by

Jeon Cyrone CuachonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

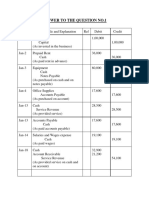

ACCOUNT TITLE: CASH ACCOUNT NUMBER: 1000

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 1 1 The owner invested on her business 200,000 200,000

July 1 2 Purchased office equipment, cash basis 45,000 155,000

July 2 3 Paid advance rental 30,000 125,000

July 8 4 Paid Benigno Corp. for July 4 transaction 24,500 100,500

July 15 5 Paid salary of employees 7,000 93,500

July 16 6 Received payment from Lacdang Company 40,425 133,925

July 19 7 Received inventory from Salinas Inc. 25,000 108,925

July 22 8 Sold Merchandise, cash basis 22,000 130,925

July 25 9 Paid electricity bill 7,400 123,525

July 31 10 Cash withdrawal of owner for personal use 10,000 113,525

ACCOUNT TITLE: ACCOUNTS RECEIVABLES ACCOUNT NUMBER: 1200

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 7 1 Sold Merchandise on credit 41,250 41,250

July 16 2 Received payment from Lacdang Company 41,250 0

July 18 3 Sold Merchandise on credit 5,500 5,500

July 24 4 Sold Merchandise on credit 3,960 9,460

July 26 5 Return of 2 defective calculators from 1,320 8,140

Emmanuel Company.

ACCOUNT TITLE: MERCHANDISE INVENTORY ACCOUNT NUMBER: 1300

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 4 1 Received inventory from Benigno Corp. 25,000 25,000

July 7 2 Cost of item/s sold P 18,750 18,750 6,250

July 8 3 Purchase Discount for July 4 transaction 500 5,750

July 18 4 Cost of item/s sold P 2,500 2,500 3,250

July 19 5 Received inventory from Salinas Inc. 25,000 28,250

July 22 6 Cost of item/s sold P 10,000 10,000 18,250

July 23 7 Received inventory from Francia Corp. 3,000 21,250

July 24 8 Cost of item/s sold P 1,800 1,800 19,450

July 26 9 Cost of item/s returned P 600 600 20,050

ACCOUNT TITLE: PREPAID RENT ACCOUNT NUMBER: 1400

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 2 1 Paid advance rental 30,000 30,000

ACCOUNT TITLE: OFFICE EQUIPMENT ACCOUNT NUMBER: 1600

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 1 1 Purchased office equipment, cash basis 45,000 45,000

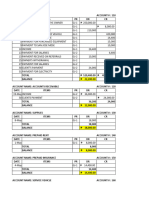

ACCOUNT TITLE: ACCOUNTS PAYABLE ACCOUNT NUMBER: 2000

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 4 1 Received inventory, on account basis 25,000 25,000

July 8 2 Paid Benigno Corp. for July 4 transaction 25,000 0

July 23 3 Received inventory on account 3,000 3,000

ACCOUNT TITLE: DE GUZMAN, CAPITAL ACCOUNT NUMBER: 3000

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 1 1 The owner invested on her business 200,000 200,000

ACCOUNT TITLE: DE GUZMAN, DRAWINGS ACCOUNT NUMBER: 3001

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 31 1 Cash withdrawal of owner for personal use 10,000 10,000

ACCOUNT TITLE: SALES ACCOUNT NUMBER: 4100

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 7 1 Sold Merchandise on credit 41,250 41,250

July 18 2 Sold Merchandise on credit 5,500 46,750

July 22 3 Sold Merchandise, cash basis 22,000 68,750

July 24 4 Sold Merchandise on credit 3,960 72,710

ACCOUNT TITLE: SALES RETURN & ACCOUNT NUMBER: 4101

ALLOWANCES

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 26 1 Return of 2 defective calculators 1,320 1,320

ACCOUNT TITLE: SALES DISCOUNT ACCOUNT NUMBER: 4102

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 16 1 Received payment from Lacdang Company 825 825

ACCOUNT TITLE: COST OF SALES ACCOUNT NUMBER: 5100

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 7 1 Cost of item/s sold P 18,750 18,750

July 18 2 Cost of item/s sold P 2,500 2,500 21,250

July 22 3 Cost of item/s sold P 10,000 10,000 31,250

July 24 4 Cost of item/s sold P 1,800 1,800 33,050

July 26 5 Cost of item/s returned P 600 600 32,450

ACCOUNT TITLE: SALARIES EXPENSE ACCOUNT NUMBER: 5150

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 15 1 Paid salary of employees 7,000 7,000

ACCOUNT TITLE: UTILITIES EXPENSE ACCOUNT NUMBER: 5200

DATE ITEM NO. EXPLANATION DEBIT CREDIT BALANCE

July 25 1 Paid electricity bill 7,400 7,400

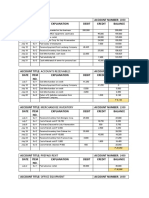

Tin-tin Tindahan Co.

Unadjusted Trial Balance

For the Month Ended July, 2021.

ACCOUNT NO. ACCOUNT TITLE DEBIT CREDIT

1000 Cash 113,525

1200 Accounts Receivables 8,140

1300 Merchandise Inventory 20,050

1400 Prepaid Rent 30,000

1600 Office Equipment 45,000

2000 Accounts Payable 3,000

3000 De Guzman, Capital 200,000

3001 De Guzman, Drawings 10,000

4100 Sales 72,710

4101 Sales Return and Allowances 1,320

4102 Sales Discount 825

5100 Cost of Sales 32,450

5150 Salaries Expense 7,000

5200 Utilities Expense 7,400

275,710 275,710

You might also like

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerNo ratings yet

- Case Problem 1Document8 pagesCase Problem 1Fanny MainNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Abuegmidterm Activity 1 Edgar DetoyaDocument21 pagesAbuegmidterm Activity 1 Edgar DetoyaAnonn78% (9)

- ACT Assignment FullDocument16 pagesACT Assignment Fullsadif sayeed100% (3)

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Periodic - General LedgerDocument5 pagesPeriodic - General LedgerJeon Cyrone CuachonNo ratings yet

- Ledger 4Document5 pagesLedger 4lindzy.amurao01No ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Sample Acctg CycleDocument27 pagesSample Acctg CycleJonabed PobadoraNo ratings yet

- Module 4 Key To CorrectionsDocument4 pagesModule 4 Key To CorrectionsPlame GaseroNo ratings yet

- Fabm 1 Lesson 6Document17 pagesFabm 1 Lesson 6Dionel RizoNo ratings yet

- Date Account Titles and Explanation P.R. Debit Credit: General JournalDocument42 pagesDate Account Titles and Explanation P.R. Debit Credit: General JournalThanh UyênNo ratings yet

- Information Sheet For Trainee # 2Document10 pagesInformation Sheet For Trainee # 2Sharon galabinNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- Book Keeping EXAMPLEDocument4 pagesBook Keeping EXAMPLE12-GOLD AGDON, EARLNo ratings yet

- G3 Posting Guidelines For Merchandising BusinessDocument8 pagesG3 Posting Guidelines For Merchandising Businesschrystineetiu1322No ratings yet

- Detoya Tax ConsultantDocument12 pagesDetoya Tax ConsultantLIMOS JR. ROMEO P.No ratings yet

- Republic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorDocument7 pagesRepublic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorJessie Mark AnapadaNo ratings yet

- Weirdo Beauty Salon Problem Date Account Title and Explanation P.R Debit CreditDocument3 pagesWeirdo Beauty Salon Problem Date Account Title and Explanation P.R Debit CreditEllen Joy PenieroNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- ScoresDocument3 pagesScoresTrisha mae latayanNo ratings yet

- Quiz - Periodic Acctg CycleDocument7 pagesQuiz - Periodic Acctg CycleGalang, Princess T.No ratings yet

- Subsidiary Ledger (Final)Document25 pagesSubsidiary Ledger (Final)Escalo Alvin M.No ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- Final General Ledger of Stellar 1Document12 pagesFinal General Ledger of Stellar 1April MagandaNo ratings yet

- Accounting 12 LedgerDocument2 pagesAccounting 12 LedgerAnwar SerinoNo ratings yet

- Faith D Nakpil Day Care CenterDocument11 pagesFaith D Nakpil Day Care CenterjeromebatoonNo ratings yet

- 1 - CPAR - Audit of Inventory - Theo×ProbDocument5 pages1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaNo ratings yet

- Tiger Corporation (Contributed by Oliver C. Bucao)Document4 pagesTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaNo ratings yet

- The Four Types of Special JournalsDocument18 pagesThe Four Types of Special JournalsJob Castones100% (1)

- FABM - L-10Document16 pagesFABM - L-10Seve HanesNo ratings yet

- Perpetual Journal EntriesDocument31 pagesPerpetual Journal EntriesbaldeNo ratings yet

- FEU HO1 Audit of Inventories 2017 PDFDocument4 pagesFEU HO1 Audit of Inventories 2017 PDFJoshuaNo ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Fabm Module 10 Quarter 1Document8 pagesFabm Module 10 Quarter 1Rhea Alipio SadorraNo ratings yet

- General Journal - Howard's Travel AgencyDocument10 pagesGeneral Journal - Howard's Travel Agencytristan ignatiusNo ratings yet

- Chart of AccountsDocument9 pagesChart of AccountsVincent MadridNo ratings yet

- General Journal: Date Details Folio DR$ CR$ August 1Document2 pagesGeneral Journal: Date Details Folio DR$ CR$ August 1Andy PersaudNo ratings yet

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- Audit of InventoriesDocument4 pagesAudit of InventoriesMc Gavriel VillenaNo ratings yet

- Date Account Title P.R. Debit 2015Document24 pagesDate Account Title P.R. Debit 2015ARABELLA CLARICE JIMENEZNo ratings yet

- Subsidiary BooksDocument6 pagesSubsidiary BooksOshene TaylorNo ratings yet

- Finacre Assignment2Document4 pagesFinacre Assignment2Krizchan Deyb De LeonNo ratings yet

- Solutionsheet - Milk Orange StoreDocument10 pagesSolutionsheet - Milk Orange StorePrincess EscaranNo ratings yet

- Merchandising ProblemsDocument2 pagesMerchandising Problemsjay classroomNo ratings yet

- Bookkeeping Cycle, Leonor Creations and Wash&clean LaundryDocument18 pagesBookkeeping Cycle, Leonor Creations and Wash&clean LaundryNadzma Pawaki Hashim100% (1)

- Acctg Quiz MerchDocument7 pagesAcctg Quiz MerchGalang, Princess T.No ratings yet

- P2 2A Financial AccountingDocument12 pagesP2 2A Financial AccountingFerris126GTNo ratings yet

- Fabm1 q3 Mod9 TrialbalanceDocument11 pagesFabm1 q3 Mod9 TrialbalanceXedric JuantaNo ratings yet

- Special JournalDocument38 pagesSpecial JournalSally Ubando Delos Reyes100% (1)

- November, 2018: Xyz Supply Chain Trial BalanceDocument2 pagesNovember, 2018: Xyz Supply Chain Trial BalanceLeah BausinNo ratings yet

- Royal Laundry ServicesDocument34 pagesRoyal Laundry ServicesRian Atienza EclarNo ratings yet

- 2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsDocument4 pages2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsKrisha TevesNo ratings yet

- October 5 Review PDFDocument5 pagesOctober 5 Review PDFLeah Mae NolascoNo ratings yet

- Financial Statement - BookkeepingDocument8 pagesFinancial Statement - BookkeepingFlorinda GagasaNo ratings yet

- Answer To The Question No. 1 (A) General JournalDocument16 pagesAnswer To The Question No. 1 (A) General JournalSurmaNo ratings yet

- Accounting Cycle of A Service Business-Step 4-Trial BalanceDocument30 pagesAccounting Cycle of A Service Business-Step 4-Trial BalancedelgadojudithNo ratings yet

- UntitledDocument1 pageUntitledJeon Cyrone CuachonNo ratings yet

- PERIODICDocument9 pagesPERIODICJeon Cyrone CuachonNo ratings yet

- Perpetual - General LedgerDocument4 pagesPerpetual - General LedgerJeon Cyrone CuachonNo ratings yet

- Periodic - General LedgerDocument5 pagesPeriodic - General LedgerJeon Cyrone CuachonNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- Analysis and Interpretation of Financial Statements 1Document61 pagesAnalysis and Interpretation of Financial Statements 1Jeon Cyrone CuachonNo ratings yet

- Periodic - Financial StatementsDocument3 pagesPeriodic - Financial StatementsJeon Cyrone CuachonNo ratings yet

- Cpar Week 4 - CuachonDocument11 pagesCpar Week 4 - CuachonJeon Cyrone CuachonNo ratings yet

- Perpetual - Financial StatementsDocument4 pagesPerpetual - Financial StatementsJeon Cyrone CuachonNo ratings yet