Professional Documents

Culture Documents

RAIBC ENG 022 023 CreazioneValore Affiancate

Uploaded by

Glory TraderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RAIBC ENG 022 023 CreazioneValore Affiancate

Uploaded by

Glory TraderCopyright:

Available Formats

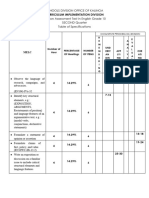

THE VALUE CREATION PROCESS

NFS

NFS

NGE

AT E CHA FARE

We operate in a global context characterized by financial and geopolitical instability, digital Y • CL I M

D N E W WEL

ABILIT G AN

revolution, cybersecurity issues, climate change, demographic aging and new welfare systems as C I A L INST • AGIN

N

D FINA ENTS

well as the pandemic. We are committed to leveraging our capitals, classified according to The I CAL AN ME EV

O L I T R E RITY

International <IR> Framework’s principles. By leveraging our solid and resilient business model, • GE O P

S A N DE X T

C Y B E RSECU

DEMI C AND

we create value in the short, medium and long term for all our stakeholders, from our customers to

L CON TEXT • PAN E V O LUTION

TERNA TAL R

• DIGI

shareholders, employees, agents, distributors, partners and the community, in order to guarantee EX

a safer and sustainable future.

OUR BUSINESS MODEL

We effectively face the challenges of the market context, by leveraging our

FINANCIAL CAPITAL INTELLECTUAL CAPITAL core strengths: a clear strategy, a focus on technical excellence, a strong

HUMAN CAPITAL MANUFACTURED CAPITAL distribution network, the Group’s solid capital position and a diversified

SOCIAL AND RELATIONSHIP CAPITAL NATURAL CAPITAL business model, that proved resilient even in a complex context like the

pandemic one.

We develop simple, integrated, customized and competitive Life and Property&Casualty insurance solutions

for our customers: the offer ranges from savings, individual and family protection policies, unit-linked policies,

as well as motor third-party liability (MTPL), home, accident and health policies, to sophisticated coverage for

EMPL commercial and industrial risks and tailored plans for multinational companies. We expand our offer to asset

OY E

ES management solutions addressed to institutional (such as pension funds and foundations) and retail third-

OUR PURPOSE party customers. We rely on innovation as a key driver for future growth to allow for tailored solutions and

Enable people to shape a safer future quicker product development. We are also committed to high value-added solutions from a social and

by caring for their lives and dreams

environmental perspective. Rigorous criteria for the risk selection are applied in the underwriting process.

AG

EN

VALUES OUR BEHAVIOURS

TS

AN

We distribute our products and we offer our services based on a multi-channel strategy, while also relying

DD

Deliver on the promise Ownership on new technologies: not only through a global network of agents and financial advisors, but also through

ISTR

brokers, bancassurance and direct channels that allow customers to obtain information on alternative

IBUT

Y

products, compare options for the desired product, acquire the preferred product and rely on excellent after-

FINANCIAL COMMUNIT

Value our people Simplification

ORS

sales service and experience. Proprietary networks are a key and valuable asset for our business model.

Their role is to regularly dialogue with and assist customers at their best, striving for customer experience

Live the community Innovation

excellence and promoting the Generali brand.

CONTRACTUAL

Be open Human touch

We receive premiums from our customers to enter into insurance contracts. They are responsibly

invested in high quality assets, with a particular attention to the impact that such assets may have on the

www.generali.com/who-we-are/our-culture BRAND environment and society.

PA RTNE

We pay claims and benefits to our policyholders or their beneficiaries after death, accidents or the

RS

occurrence of the insured event. The payment is guaranteed also through appropriate asset-liability

THE GENERALI 2021 STRATEGY

NT

management policies.

NME

IRO

Being a Lifetime Partner to customers, offering innovative,

NV

personalized solutions thanks to an unmatched distribution network E

Information on STAKEHOLDERS, other than what reported in

the relating chapters, is available in:

Leading the European insurance market for individuals, professionals Y

NIT

and SMEs, while building a focused, global asset management COM

MU

TS

CLIEN

www.generali.com/our-responsibilities/responsible-business/stakeholder-engagement

platform and pursuing opportunities in high potential markets

OUR GOVERNANCE

Within a challenging economic and financial environment, we believe that FINANCIAL CAPITAL INTELLECTUAL CAPITAL

our governance - which complies with the best international practices HUMAN CAPITAL MANUFACTURED CAPITAL

as well as the principles and recommendations of the Corporate SOCIAL AND RELATIONSHIP CAPITAL NATURAL CAPITAL

Governance Code - is adequate for effectively pursuing our strategy and

the sustainable success of the Company.

You might also like

- Archival Studies - Practice and Projects - 2023Document47 pagesArchival Studies - Practice and Projects - 2023froegeNo ratings yet

- Soft Web SolutionsDocument5 pagesSoft Web SolutionsSeomarketerNo ratings yet

- JPortfolio Part IDocument23 pagesJPortfolio Part IJared ShueNo ratings yet

- MBA 530 GROW ModelDocument5 pagesMBA 530 GROW ModelSchool Purposes OnlyNo ratings yet

- Rural Development: Pme NTDocument24 pagesRural Development: Pme NTcool ishanNo ratings yet

- Lesson 7Document14 pagesLesson 7MARI ANGELA LADLAD 李樂安No ratings yet

- StoryLine - 1 TBDocument116 pagesStoryLine - 1 TBFernando Brenca0% (1)

- Accenture The New Delivery Reality HP Post and Parcel Research 2016Document47 pagesAccenture The New Delivery Reality HP Post and Parcel Research 2016Ray deeNo ratings yet

- 5G Perspective PDFDocument394 pages5G Perspective PDFFurqon Fatih AzzamNo ratings yet

- Dokumen - Tips - PNP Patrol Plan 2030 Guidebook 17Document1 pageDokumen - Tips - PNP Patrol Plan 2030 Guidebook 17mogijo11asaffdffdfgdfgNo ratings yet

- Variable Data PublishingDocument15 pagesVariable Data Publishingapi-26016747No ratings yet

- TemplateDocument19 pagesTemplateapi-378540990No ratings yet

- Weaving Stories Into Learning: W We We W AvivivnDocument116 pagesWeaving Stories Into Learning: W We We W AvivivnFlorencia OttavianiNo ratings yet

- Your Paragraph TextDocument1 pageYour Paragraph TextShania Rahma shalshabilaNo ratings yet

- Manufacturing and Operations Plan: Pamantasan NG Lungsod NG MarikinaDocument6 pagesManufacturing and Operations Plan: Pamantasan NG Lungsod NG MarikinaWilma WenceslaoNo ratings yet

- SustainabilityDocument9 pagesSustainabilityMeezan Bank LimitedNo ratings yet

- Dantherm Catalogue Humanitarian Defence ENDocument24 pagesDantherm Catalogue Humanitarian Defence ENКек ЛолNo ratings yet

- GD Storyline3Document122 pagesGD Storyline3Atahualpa DazaNo ratings yet

- Presentation 1Document1 pagePresentation 1NILESHKATENo ratings yet

- Marketing Plan - Aldrich ZubiriDocument7 pagesMarketing Plan - Aldrich ZubiriAlNo ratings yet

- Polypropylene Nonwoven Cover For Fruits & Vegetables: Special FeatureDocument12 pagesPolypropylene Nonwoven Cover For Fruits & Vegetables: Special Featurevb_scribd1234No ratings yet

- SDR hpch2Document8 pagesSDR hpch2MmmmNo ratings yet

- SDR hpch5Document28 pagesSDR hpch5Shubham SharmaNo ratings yet

- MWMusicMethod PracticeTransposingDocument1 pageMWMusicMethod PracticeTransposingelizabeth aliende garciaNo ratings yet

- MWMusicMethod PracticeTransposingDocument1 pageMWMusicMethod PracticeTransposingelizabeth aliende garciaNo ratings yet

- Standard Assessment Test - ENGLISH - 10 - Q2Document11 pagesStandard Assessment Test - ENGLISH - 10 - Q2ahnyacaiaNo ratings yet

- LogRhythm Overview 2009 04Document2 pagesLogRhythm Overview 2009 04testNo ratings yet

- Comlang Learning Itinerary Activities 1Document4 pagesComlang Learning Itinerary Activities 1ცი სიNo ratings yet

- Save Up To 80% On Your BSS Cost by Moving To The Public CloudDocument2 pagesSave Up To 80% On Your BSS Cost by Moving To The Public CloudRuben Rumipamba ZambranoNo ratings yet

- MTG 22Document12 pagesMTG 22Sarah AliNo ratings yet

- Scientific American Special Collectors Edition - Fall 2022Document120 pagesScientific American Special Collectors Edition - Fall 2022zexuli33No ratings yet

- Week2 - Incident Response ProcessDocument43 pagesWeek2 - Incident Response Processnathalieedith20No ratings yet

- 18 - 06 - Poultry SpecialDocument24 pages18 - 06 - Poultry SpecialAndreiaAraujoNo ratings yet

- Liberia Report Final 3-6-08Document127 pagesLiberia Report Final 3-6-08Anycyamaya AnycycamayaNo ratings yet

- 188 PDFDocument116 pages188 PDFcalciumblessing100% (1)

- MOTM PresentationDocument19 pagesMOTM Presentationrajarao001No ratings yet

- Kitchen Ventilation - PreliminaryDocument2 pagesKitchen Ventilation - PreliminaryTonyKaren F. LatizaNo ratings yet

- Giving Your Business The Human Factors EdgeDocument19 pagesGiving Your Business The Human Factors EdgeSimony AndradeNo ratings yet

- Creating Videos With Confidence WorkbookDocument29 pagesCreating Videos With Confidence Workbookvero baudensNo ratings yet

- Translation of English Complex SentencesDocument30 pagesTranslation of English Complex SentencesGoranM.MuhammadNo ratings yet

- Generating IdeasDocument8 pagesGenerating IdeasJoemar YubokmeeNo ratings yet

- Jim Tudence Marketing ResumeDocument1 pageJim Tudence Marketing ResumeJim TudenceNo ratings yet

- Subject: CP-Practicum (Sec B) : U O M & TDocument3 pagesSubject: CP-Practicum (Sec B) : U O M & TAqib LatifNo ratings yet

- Circulating Fluidised Bed Boiler Technology Coal Oil Power - PDF (Application PDFDocument16 pagesCirculating Fluidised Bed Boiler Technology Coal Oil Power - PDF (Application PDFGaluh AjengNo ratings yet

- Zuko - Optimizing Financial FormsDocument29 pagesZuko - Optimizing Financial FormsWasim UllahNo ratings yet

- SBG Sayithideitspellit Worksheets 543761Document1 pageSBG Sayithideitspellit Worksheets 543761Belen Abigail SteinleNo ratings yet

- Lenovo Moto C Plus (Lacrosse)Document66 pagesLenovo Moto C Plus (Lacrosse)walterNo ratings yet

- Optical Instruments - 1st Class (21!2!2022)Document28 pagesOptical Instruments - 1st Class (21!2!2022)vladimir.gonzalez.crzNo ratings yet

- IHM 2017 2018 - GenieIndus3Document18 pagesIHM 2017 2018 - GenieIndus3ABLA SENTISSINo ratings yet

- SC PAL - PART I (With Front Page) PDFDocument146 pagesSC PAL - PART I (With Front Page) PDFDS astrology Astrology100% (1)

- Shadow ToolDocument2 pagesShadow ToolRoopali AggarwalNo ratings yet

- AWS Redshift Infographic FinalDocument1 pageAWS Redshift Infographic FinalSiddharth AbbineniNo ratings yet

- Jee August 2021 - July Papers Most Repeated TopicsDocument117 pagesJee August 2021 - July Papers Most Repeated TopicsAbhisek PandaNo ratings yet

- Presentation 1Document4 pagesPresentation 1api-340297439No ratings yet

- Leadership Flywheel by Graham Wilson 1633570343Document2 pagesLeadership Flywheel by Graham Wilson 1633570343Rafael ZerpaNo ratings yet

- Exploring The "New Frontier" For Global Contact Centers: Keith FivesonDocument37 pagesExploring The "New Frontier" For Global Contact Centers: Keith FivesonKeith FivesonNo ratings yet

- WCPC Form 2 VAC Matrix, Detailed ReportDocument7 pagesWCPC Form 2 VAC Matrix, Detailed ReportLuz LabeniaNo ratings yet

- GC Technology 525568Document14 pagesGC Technology 525568sarkhanNo ratings yet

- Mega Projects Saudi ArabiaDocument15 pagesMega Projects Saudi ArabiaAB100% (1)

- Printing in Hong Kong & China 2021Document15 pagesPrinting in Hong Kong & China 2021Publishers WeeklyNo ratings yet

- Students Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityDocument31 pagesStudents Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityAnthony HeartNo ratings yet

- (Product) Construction EquipmentDocument17 pages(Product) Construction EquipmentmustangpipelinesNo ratings yet

- Ballou, R. - Introduction To Business LogisticsDocument48 pagesBallou, R. - Introduction To Business LogisticsGhani RizkyNo ratings yet

- JD Country ManagerDocument2 pagesJD Country ManagerThuyen NguyenNo ratings yet

- 8 D Report FormatDocument9 pages8 D Report FormatLukas LukasNo ratings yet

- Syk ResumeDocument4 pagesSyk ResumeSurendra InnamuriNo ratings yet

- O2 Case StudyDocument20 pagesO2 Case StudyJames LinNo ratings yet

- Chapter 7 InventoriesDocument5 pagesChapter 7 InventoriesJoyce Mae D. FloresNo ratings yet

- Kra Eipl Qa 2020Document36 pagesKra Eipl Qa 2020venkata rami reddyNo ratings yet

- Operation Costing, Just-In-Time System, and Backflush CostingDocument15 pagesOperation Costing, Just-In-Time System, and Backflush CostingJeremy Cyrus TrinidadNo ratings yet

- Shahzad Farrukh - 00704963 - 1535-Qanmos College - IG-1Document11 pagesShahzad Farrukh - 00704963 - 1535-Qanmos College - IG-1Rashid Jamil100% (3)

- CAGR, XIRR, Rolling ReturnDocument9 pagesCAGR, XIRR, Rolling ReturnKarthick AnnamalaiNo ratings yet

- Guide To Data Governance Part2 People and Process WhitepaperDocument28 pagesGuide To Data Governance Part2 People and Process WhitepaperchurchillNo ratings yet

- Just in 10 Minutes: A Case Study On Zepto: Keywords: Zepto, Start-Up, E-Commerce, Business Model, Post-CovidDocument4 pagesJust in 10 Minutes: A Case Study On Zepto: Keywords: Zepto, Start-Up, E-Commerce, Business Model, Post-CovidAlisha ShwetaNo ratings yet

- What Is The Distinctive Competence of The Followin.Document2 pagesWhat Is The Distinctive Competence of The Followin.farel ayengNo ratings yet

- Case Study Presented by Donald CrossDocument13 pagesCase Study Presented by Donald CrossUmeshNo ratings yet

- References of APA FormatDocument8 pagesReferences of APA FormatAK's CreationNo ratings yet

- Impact of Information Technology Integration and Lean/Just-In-Time Practices On Lead-Time PerformanceDocument27 pagesImpact of Information Technology Integration and Lean/Just-In-Time Practices On Lead-Time PerformanceSachen KulandaivelNo ratings yet

- Jadwal Kuliah MM 52 BDocument26 pagesJadwal Kuliah MM 52 BAdietz satyaNo ratings yet

- Raftar Express India PVT LTD Profile.Document8 pagesRaftar Express India PVT LTD Profile.mohdmashaallah5No ratings yet

- LULU ReportDocument4 pagesLULU Reportyovokew738No ratings yet

- Strategic Compensation in Canada Canadian 6th Edition Long Test BankDocument25 pagesStrategic Compensation in Canada Canadian 6th Edition Long Test BankJeffreyWalkerfpqrm100% (26)

- Share Split Sample Problem - StudentDocument3 pagesShare Split Sample Problem - StudentAi MelNo ratings yet

- Agarwal Automobiles: Inventory ManagementDocument10 pagesAgarwal Automobiles: Inventory ManagementAmit Sen50% (2)

- Explain The Difference in Attitude To Risk Between European and US CompaniesDocument3 pagesExplain The Difference in Attitude To Risk Between European and US CompaniesJomer FernandezNo ratings yet

- Management 13th Edition Schermerhorn Test BankDocument48 pagesManagement 13th Edition Schermerhorn Test Bankjohnnavarronpisaoyzcx100% (25)

- Standard Bidding Document KW-4 Road Safety Works: E-Procurement Help Desk No. 080-22485867 E-Mail: Cepramc@kpwd - Gov.inDocument65 pagesStandard Bidding Document KW-4 Road Safety Works: E-Procurement Help Desk No. 080-22485867 E-Mail: Cepramc@kpwd - Gov.inSeshu kvNo ratings yet

- Assessing The Internal Environment of The Firm: EducationDocument50 pagesAssessing The Internal Environment of The Firm: EducationindiraNo ratings yet