Professional Documents

Culture Documents

Assignment 5

Uploaded by

Rudr PodderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 5

Uploaded by

Rudr PodderCopyright:

Available Formats

21BSP0139 SAYAN PODDER 21BSP0139

ASSIGNMENT –5

WEALTH MANAGEMENT

RETIREMENT PLANNING

Retirement planning is the process of setting retirement income goals and the actions and decisions

necessary to achieve those goals. Retirement planning includes identifying sources of income,

estimating expenses, implementing a savings program, and managing assets and risk.

Retirement planning is being prepared for life after paid working period ends financially as well as all

other aspects of life. The non-financial aspects include lifestyle choices such as spending time during

retirement, a place to live, designated time to completely quit working, and others. A holistic

retirement planning considers all the areas with equal importance.

The level of emphasis on retirement planning varies throughout different life stages. During the

youth, retirement planning only means setting aside enough funds for retirement. During the middle

of the career, it might change to setting specific income/asset targets and taking the necessary steps

to realise them. Once we reach retirement, decades of savings will pay out.

NEED FOR RETIREMENT PLANNING

Retirement planning doesn’t mean one should only concentrate on their finances. Retirement

planning requires a combination of financial and personal planning. Personal planning determines

one’s satisfaction during their retirement.

On the other hand, financial planning helps in budgeting income and expenses based on the

personal plan.

Primarily personal planning revolves around the question ‘how does one want to spend their

retirement?’ Having an idea of how retirement should be will help in determining financial needs.

For example, some might want to travel the world during their retirement, while others would like

to learn a course or two, or volunteer at an NGO. The retirement options are endless.

However, having an idea about how one would want to spend their retirement is the first step

towards retirement planning.

The lifestyle needs and preferences will help in estimating the finances. Therefore, financial planning

will help in creating a retirement fund.

21BSP0139 SAYAN PODDER 21BSP0139

21BSP0139 SAYAN PODDER 21BSP0139

Following are the reasons why retirement planning is essential:

• One cannot work forever.

• The average life expectancy is increasing.

• Higher complications, e.g., medical emergencies.

• Best time to fulfil life aspirations.

• Relying on one source of income is risky, e.g., pension.

• Do not depend on children.

• Contribute to the family even during retirement.

• Start planning early and diversify investments.

Therefore, to lead a peaceful and uncompromised life during retirement, it is essential to start

planning and investing towards it.

21BSP0139 SAYAN PODDER 21BSP0139

You might also like

- Retirement Planning for Beginners: Financial Planning Essentials, #1From EverandRetirement Planning for Beginners: Financial Planning Essentials, #1No ratings yet

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- Aditya Retirement PlanningDocument49 pagesAditya Retirement PlanningAditya TiwariNo ratings yet

- Retirement PlanningDocument18 pagesRetirement PlanningsuryarathiNo ratings yet

- Retirement ExampleDocument1 pageRetirement ExampleErman DurmazNo ratings yet

- Retirement PlanningDocument4 pagesRetirement Planningakshaygupta55555411No ratings yet

- Retirement PlanningDocument3 pagesRetirement PlanningAarti GuptaNo ratings yet

- Financial PlanningDocument4 pagesFinancial PlanningVarun IyerNo ratings yet

- Ultimate Guide To Financial PlanningDocument9 pagesUltimate Guide To Financial PlanningProlific SolutionsNo ratings yet

- Personal Wealth ManagementDocument33 pagesPersonal Wealth ManagementVaibhav ArwadeNo ratings yet

- Retirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessFrom EverandRetirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessNo ratings yet

- The Priority of Retirement: How to Align Your Financial Future Using the Wisdom of the AgesFrom EverandThe Priority of Retirement: How to Align Your Financial Future Using the Wisdom of the AgesNo ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Group Assignment FIN533 - Group 4Document22 pagesGroup Assignment FIN533 - Group 4Muhammad Atiq100% (1)

- LESSON 20: What Is Personal Finance? TargetDocument8 pagesLESSON 20: What Is Personal Finance? TargetMai RuizNo ratings yet

- Home Financial Consumers Learn Financial Planning BasicsDocument4 pagesHome Financial Consumers Learn Financial Planning BasicsVJ BrajdarNo ratings yet

- Chapter 1: IntroductionDocument20 pagesChapter 1: IntroductionAlyn CheongNo ratings yet

- Wealth ManagementDocument14 pagesWealth Managementnikki karma100% (1)

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Retirement Planning: The Soon-to-be Senior's Guidebook to an Enjoyable and Hassle-Free RetirementFrom EverandRetirement Planning: The Soon-to-be Senior's Guidebook to an Enjoyable and Hassle-Free RetirementNo ratings yet

- Planning RetirmentsDocument5 pagesPlanning Retirmentssavage.ashuNo ratings yet

- 7 Retirement PlanningDocument44 pages7 Retirement PlanningIsmail FaizelNo ratings yet

- Basic Concepts of Retirement PlanningDocument16 pagesBasic Concepts of Retirement PlanningHarsha VardhanNo ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- Art of Early Retirement: Blueprint for Financial Planning,Investment Strategies and Navigating the Important DecisionsFrom EverandArt of Early Retirement: Blueprint for Financial Planning,Investment Strategies and Navigating the Important DecisionsNo ratings yet

- Lovely Professional University: Learning Outcomes: To Get Understanding of Types Retirement/pension Plans Offered byDocument7 pagesLovely Professional University: Learning Outcomes: To Get Understanding of Types Retirement/pension Plans Offered byTushar HalderNo ratings yet

- Unlocking Financial Freedom: A Comprehensive Guide to Retire Early and WealthyFrom EverandUnlocking Financial Freedom: A Comprehensive Guide to Retire Early and WealthyNo ratings yet

- Retirement Planning Guidebook for Couples and Seniors: All You Need to Know to Plan For and Have a Stress-Free RetirementFrom EverandRetirement Planning Guidebook for Couples and Seniors: All You Need to Know to Plan For and Have a Stress-Free RetirementNo ratings yet

- FINAL - PFM - 5 - Steps - Retirement - Guide 2Document11 pagesFINAL - PFM - 5 - Steps - Retirement - Guide 2Jeffrey EmgeNo ratings yet

- RETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeFrom EverandRETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeNo ratings yet

- Personal Financial PlanningDocument10 pagesPersonal Financial PlanningMariesz PleytoNo ratings yet

- Do You Know What to Expect?: A Retirement Adjustment GuideFrom EverandDo You Know What to Expect?: A Retirement Adjustment GuideNo ratings yet

- RETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysFrom EverandRETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysNo ratings yet

- The Retirement Blueprint: A Step-by- Step Guide to Building Your Ideal RetirementFrom EverandThe Retirement Blueprint: A Step-by- Step Guide to Building Your Ideal RetirementNo ratings yet

- CFP EbookDocument81 pagesCFP EbookNikhil parabNo ratings yet

- Personal Finance - PDF RoomDocument144 pagesPersonal Finance - PDF RoomEllie HoangNo ratings yet

- New Rules Of Retirement: What Your Financial Advisor Isn't Telling YouFrom EverandNew Rules Of Retirement: What Your Financial Advisor Isn't Telling YouNo ratings yet

- Financial AccountingDocument221 pagesFinancial AccountingAditya AgnihotriNo ratings yet

- "Smart Money Management: A Comprehensive Guide to Financial Success"From Everand"Smart Money Management: A Comprehensive Guide to Financial Success"No ratings yet

- 5 Financial Stages of LifeDocument9 pages5 Financial Stages of LifeEdward GanNo ratings yet

- Finance: NAME:Hasan Mamudul 卡尔 Student ID:5086180123 Class:1801Document9 pagesFinance: NAME:Hasan Mamudul 卡尔 Student ID:5086180123 Class:1801mamudul hasan100% (1)

- Retirement Planning GuideDocument26 pagesRetirement Planning GuideKalaivani ArunachalamNo ratings yet

- Money Matters 101 - Financial Planning Essentials: Finance 4 Everyone, #1From EverandMoney Matters 101 - Financial Planning Essentials: Finance 4 Everyone, #1No ratings yet

- Retirement PlanningDocument6 pagesRetirement PlanningDRUVA KIRANNo ratings yet

- How to Retire Early: A Guide to Financial Planning and Early RetirementFrom EverandHow to Retire Early: A Guide to Financial Planning and Early RetirementNo ratings yet

- Ifp 23 Estimating Retirement Needs and How Much Do You Need On RetirementDocument9 pagesIfp 23 Estimating Retirement Needs and How Much Do You Need On Retirementsachin_chawlaNo ratings yet

- FP IntroductionDocument4 pagesFP IntroductionStellina JoeshibaNo ratings yet

- The Path to Wealth - Proven Strategies for Achieving Financial SuccessFrom EverandThe Path to Wealth - Proven Strategies for Achieving Financial SuccessNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- Full ReportDocument37 pagesFull ReportXiao TianNo ratings yet

- Your Money Mind: Setting Financial Goals to Manage Money BetterFrom EverandYour Money Mind: Setting Financial Goals to Manage Money BetterNo ratings yet

- Market Research and Content Marketing StrategyDocument5 pagesMarket Research and Content Marketing StrategyRudr PodderNo ratings yet

- CH11 - Search Engine OptimizationDocument7 pagesCH11 - Search Engine OptimizationRudr PodderNo ratings yet

- CH12 - Video MarketingDocument8 pagesCH12 - Video MarketingRudr PodderNo ratings yet

- DH Ahff DT: Implementation of Neural Network Based Control Scheme On The Benchmark Conical Tank Level SystemDocument5 pagesDH Ahff DT: Implementation of Neural Network Based Control Scheme On The Benchmark Conical Tank Level SystemRudr PodderNo ratings yet

- GChandbook2008Document72 pagesGChandbook2008api-19918078No ratings yet

- Hartnell Governor Isochronous Speed Equations - Engineers EdgeDocument1 pageHartnell Governor Isochronous Speed Equations - Engineers Edgestallone21No ratings yet

- 1VuHongDuyen - Portfolio 5Document7 pages1VuHongDuyen - Portfolio 5manhtuan15aNo ratings yet

- MONOLOGUE & DialogueDocument3 pagesMONOLOGUE & DialogueAshish SahuNo ratings yet

- Presentation Rheinmetall Hand GrenadesDocument24 pagesPresentation Rheinmetall Hand Grenadesn0dazeNo ratings yet

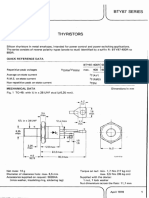

- BTY87 PhilipsDocument8 pagesBTY87 PhilipsmatheuzalexsanderNo ratings yet

- Research Article: Manufacturing of Ecofriendly Bricks Using Microdust Cotton WasteDocument10 pagesResearch Article: Manufacturing of Ecofriendly Bricks Using Microdust Cotton Wasteshinaiya StarNo ratings yet

- Netnumen™ U31 R06: Hardware Installation GuideDocument128 pagesNetnumen™ U31 R06: Hardware Installation GuideRidfa MilisNo ratings yet

- 2 I SEP ?n?i: Memorandum CircutarDocument10 pages2 I SEP ?n?i: Memorandum CircutarMPD Forensic UnitNo ratings yet

- Bending Machine Centurion ModelDocument4 pagesBending Machine Centurion ModelbharathaninNo ratings yet

- 5990 8296enDocument4 pages5990 8296enGiriraj T KulkarniNo ratings yet

- Pepper Jenelle Losely: SummaryDocument4 pagesPepper Jenelle Losely: Summaryapi-532850773No ratings yet

- Auditing Routine Checking and Test Checking: (PART-11) (UNIT-II) (PART-4)Document9 pagesAuditing Routine Checking and Test Checking: (PART-11) (UNIT-II) (PART-4)ŠhříÑůNo ratings yet

- Essay About TechnologyDocument24 pagesEssay About TechnologyTemo Abashidze100% (2)

- Solutions: Homework 2 Biomedical Signal, Systems and Control (BME 580.222)Document5 pagesSolutions: Homework 2 Biomedical Signal, Systems and Control (BME 580.222)JoJa JoJaNo ratings yet

- Lubrication BasicsDocument3 pagesLubrication BasicsVenkatesh RjNo ratings yet

- 2022 05 12 BNEF Pexapark Webinar PresentationDocument43 pages2022 05 12 BNEF Pexapark Webinar PresentationTolga OrkenNo ratings yet

- Family Safety HandbookDocument12 pagesFamily Safety HandbookAdib_dokterNo ratings yet

- Comparison Korea PhilippinesDocument8 pagesComparison Korea PhilippinesChin EscubroNo ratings yet

- Advances in Scanning Force Microscopy For Dimensional MetrologyDocument38 pagesAdvances in Scanning Force Microscopy For Dimensional MetrologyDiana Alejandra Bermudez FajardoNo ratings yet

- maxDPUTools A1Document117 pagesmaxDPUTools A1Deepak GuptaNo ratings yet

- Ohio Tools For Watershed Stewardship in The Chippewa Creek WatershedDocument30 pagesOhio Tools For Watershed Stewardship in The Chippewa Creek WatershedFree Rain Garden ManualsNo ratings yet

- Earlier Times - An Illustrated History of BritainDocument15 pagesEarlier Times - An Illustrated History of BritainMacarena FerreyraNo ratings yet

- Impact of Thermal Aging On The Intermetallic Compound Particle Size andDocument9 pagesImpact of Thermal Aging On The Intermetallic Compound Particle Size andAamir JanNo ratings yet

- Rukmini Devi Institute of Advance Studies: Summer Training Report BBA-311Document7 pagesRukmini Devi Institute of Advance Studies: Summer Training Report BBA-311Shivam NarulaNo ratings yet

- Leadership and FollowershipDocument10 pagesLeadership and FollowershipLawrence ConananNo ratings yet

- Refrigerant Compressor - Remove and Install: Cerrar SIS Pantalla AnteriorDocument7 pagesRefrigerant Compressor - Remove and Install: Cerrar SIS Pantalla AnteriorDiego LiraNo ratings yet

- Consumer Perception Icici Bank SynopsisDocument8 pagesConsumer Perception Icici Bank Synopsisbantu121No ratings yet

- 2 Rajiv Aggarwal Bio CNG A Green Alternate To Fossil FuelsDocument28 pages2 Rajiv Aggarwal Bio CNG A Green Alternate To Fossil FuelsGaneshkumar AmbedkarNo ratings yet

- AMADA Vipros 357 Queen With Fanuc 18P Control Layout Drawings ManualDocument10 pagesAMADA Vipros 357 Queen With Fanuc 18P Control Layout Drawings ManualSv KoNo ratings yet