Professional Documents

Culture Documents

Untitled

Uploaded by

Cece B.Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Cece B.Copyright:

Available Formats

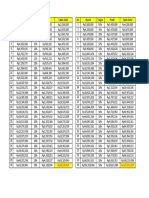

Repayment Schedule

08-Mar-2023

Principal Amount Transaction P 67983.00 Booked on your Credit card

Monthly Installment Due P 5,998.42 at 0.49% Converted Monthly Factor Rate for 12 month(s)

Annual Effective Interest Rate 11.22% per year

Installment Initial Interest and Monthly Principal Component Interest Component

Period Installment Due (Php) (Php) (Php)

0 P 564.81 P 0.00 P 564.81

1 P 5,998.42 P 5,393.26 P 605.16

2 P 5,998.42 P 5,441.27 P 557.15

3 P 5,998.42 P 5,489.71 P 508.71

4 P 5,998.42 P 5,538.58 P 459.84

5 P 5,998.42 P 5,587.88 P 410.54

6 P 5,998.42 P 5,637.62 P 360.80

7 P 5,998.42 P 5,687.80 P 310.62

8 P 5,998.42 P 5,738.43 P 259.99

9 P 5,998.42 P 5,789.51 P 208.91

10 P 5,998.42 P 5,841.05 P 157.37

11 P 5,998.42 P 5,893.04 P 105.38

12 P 5,998.42 P 5,944.85 P 53.57

Your actual repayment schedule will be mailed to you in a few days. The initial interest is computed based on

the actual number of days from the approval date of your Installment Transaction to your statement date, and

will be charged on your first Statement of Account issued following the approval date. The Monthly

Installments Due will be reflected on your second and succeeding Statements of Account after the approval

date.

If you wish to cancel an Installment Transaction before its Term ends, you may do so without a prepayment

penalty. In that case, you agree to pay in full the unpaid portion of the Principal Amount and the cancellation

processing fee equivalent to 4% of the unbilled portion of the Principal Amount for Citi Balance Conversion

and Citi Balance Transfer or P300 for Citi PayLite after purchase, plus accrued Interest Charges on the

cancelled Installment Transaction computed based on the actual number of days from the last Statement Date

until the date of cancellation.

You might also like

- Harley DavidsonDocument40 pagesHarley Davidsonristosk100% (1)

- Premier MDocument44 pagesPremier Mthebetterman0511No ratings yet

- Applichem Case-SCM Sec B Group-2Document11 pagesApplichem Case-SCM Sec B Group-2Ayush RanjanNo ratings yet

- Amortization and Sinking Funds PDFDocument17 pagesAmortization and Sinking Funds PDFLawrence CezarNo ratings yet

- Instrument TechnicianDocument3 pagesInstrument TechnicianMahabula TypingNo ratings yet

- Technical Report Route To IEng GuidanceDocument11 pagesTechnical Report Route To IEng GuidanceECCNo ratings yet

- GSPDocument27 pagesGSPVirgil Titimeaua100% (1)

- Future ValueDocument6 pagesFuture ValueMayankNo ratings yet

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Document2 pagesRevised Withholding Tax Table: Daily 1 2 3 4 5 6Maureen PascualNo ratings yet

- Annex E RR 11-2018Document2 pagesAnnex E RR 11-2018Bernardino PacificAceNo ratings yet

- 2023 WT Table Annex E RR 11-2018Document2 pages2023 WT Table Annex E RR 11-2018Cee MoralesNo ratings yet

- Bulan Pertama Bulan Kedua 1 RP 1,500,000 5% RP 1,575,000 1Document6 pagesBulan Pertama Bulan Kedua 1 RP 1,500,000 5% RP 1,575,000 1ラマダンNo ratings yet

- Business Math GZAS 1-2 Q2Document4 pagesBusiness Math GZAS 1-2 Q2Gherrie Zethrida SingsonNo ratings yet

- FinMan DLSUD Mid-Term Exam April 11 2019Document4 pagesFinMan DLSUD Mid-Term Exam April 11 2019Raquel ManarpiisNo ratings yet

- DraftDocument22 pagesDraftarun.andyNo ratings yet

- SC EX16 RSA CS4-7a TsholofeloModise 2Document17 pagesSC EX16 RSA CS4-7a TsholofeloModise 2modisecharmaine19No ratings yet

- Excel Loan CalculatorDocument11 pagesExcel Loan CalculatorSharad ManjhiNo ratings yet

- Chapter 4 - Financial AspectDocument143 pagesChapter 4 - Financial AspectPiolen NicaNo ratings yet

- Quiz No. 1 - Intermediate AccountingDocument2 pagesQuiz No. 1 - Intermediate AccountingJi BaltazarNo ratings yet

- Mortgage Loan Calculator KPR ISANA GRIYA (FLAT BSI)Document6 pagesMortgage Loan Calculator KPR ISANA GRIYA (FLAT BSI)maliktaufik22No ratings yet

- Trading Plan 100jtDocument12 pagesTrading Plan 100jtabu jahalNo ratings yet

- Akt784 (Apbd)Document5 pagesAkt784 (Apbd)agiswitdiatiNo ratings yet

- Create A Debt Amortization Schedule For The Following Loan CaseDocument11 pagesCreate A Debt Amortization Schedule For The Following Loan CaseShivamKhareNo ratings yet

- Mortgage Loan Calculator KPR 10% TREVISTA PARK Coba 2Document6 pagesMortgage Loan Calculator KPR 10% TREVISTA PARK Coba 2maliktaufik22No ratings yet

- Status IPV-1Document1 pageStatus IPV-1ronal putraNo ratings yet

- Activa Flex Computation v2019.08.01Document2 pagesActiva Flex Computation v2019.08.01rhineheart romanNo ratings yet

- VASAVI GP TRENDS, Nanakramguda: PRICE SHEET For 1st Floor To 7th FloorDocument1 pageVASAVI GP TRENDS, Nanakramguda: PRICE SHEET For 1st Floor To 7th FloorHEMANTH BATTULANo ratings yet

- Flexible LoanDocument5 pagesFlexible LoanDicksonNo ratings yet

- Amendment To Application For Takaful/Acceptance Letter: Revised Certificate StructureDocument2 pagesAmendment To Application For Takaful/Acceptance Letter: Revised Certificate StructureMuhammad TahirNo ratings yet

- Target!!!Document15 pagesTarget!!!Dave DarkNo ratings yet

- Kelompok 5 DK - SSDocument2 pagesKelompok 5 DK - SSFebriati RusydaNo ratings yet

- TVM Practice SheetDocument5 pagesTVM Practice SheetHurmat AhmedNo ratings yet

- Loan and LeasingDocument67 pagesLoan and LeasingKnishka KhandelwalNo ratings yet

- Awmun III ProposalDocument19 pagesAwmun III Proposalhusnaini dwi wanriNo ratings yet

- Santiago Villas: Gloria House ModelDocument4 pagesSantiago Villas: Gloria House ModelJoel ReyesNo ratings yet

- B. Finance - Q1-Week 6-8 - AssignmentDocument6 pagesB. Finance - Q1-Week 6-8 - AssignmentBrix AguasonNo ratings yet

- PDF DocumentDocument32 pagesPDF DocumentNasya NapitupuluNo ratings yet

- Lap - Angsuran Pinjaman LIADocument7 pagesLap - Angsuran Pinjaman LIAlula laiveNo ratings yet

- Simulasi 001Document2 pagesSimulasi 001Rizka Mustakim 99No ratings yet

- Week 10 Business Research Financial StatementsDocument51 pagesWeek 10 Business Research Financial StatementsJamie HaravataNo ratings yet

- Forecast Cost OperationDocument1 pageForecast Cost OperationElgi Zacky ZachryNo ratings yet

- Few Minutes To ChaosDocument1 pageFew Minutes To ChaosFerdian YudistiroNo ratings yet

- BackyardTrends CBAIRRDocument2 pagesBackyardTrends CBAIRRmanoranjan838241No ratings yet

- Engineering Economy For Video 5Document18 pagesEngineering Economy For Video 5jerromecymouno.garciaNo ratings yet

- Cristian Maita H LeasingDocument4 pagesCristian Maita H LeasingCristian MaitaNo ratings yet

- AnnuityDocument1 pageAnnuityAnonymous LC5kFdtcNo ratings yet

- Annex D RR 11-2018 PDFDocument1 pageAnnex D RR 11-2018 PDFKarl Anthony MargateNo ratings yet

- RR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFDocument1 pageRR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFRiña Lizte AlteradoNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Document1 pageRevised Withholding Tax Table: Daily 1 2 3 4 5 6Renzo Ross Certeza SarteNo ratings yet

- Annex D RR 11-2018Document1 pageAnnex D RR 11-2018Maureen PascualNo ratings yet

- 10 Chapter 8 Financial Plan 4Document12 pages10 Chapter 8 Financial Plan 4moniquemagsanay5No ratings yet

- Gambar KpaDocument4 pagesGambar KpafazatiaNo ratings yet

- Your CFO Guy - Board Reporting - PortraitDocument6 pagesYour CFO Guy - Board Reporting - PortraitAli KhanNo ratings yet

- Working Paper Example (Hand Out To PAX)Document1 pageWorking Paper Example (Hand Out To PAX)popla poplaNo ratings yet

- Calculadora Crédito PersonalDocument1 pageCalculadora Crédito PersonalorionpechNo ratings yet

- L1f19bsaf0065 Sec B Assign 2 2 1Document7 pagesL1f19bsaf0065 Sec B Assign 2 2 1mistayia brunettaNo ratings yet

- KPR BTN SYARIAH Cluser 2Document1 pageKPR BTN SYARIAH Cluser 2saepul ikhsanNo ratings yet

- 12 Abm 2 SGBM - Module No. 4 Business FinanceDocument5 pages12 Abm 2 SGBM - Module No. 4 Business FinanceAlzen FlorescaNo ratings yet

- SAMPLE - Depreciation Problems AnswersDocument2 pagesSAMPLE - Depreciation Problems AnswersSheinna Mae Von CalupigNo ratings yet

- Your Current Account TermsDocument28 pagesYour Current Account Termswilliamsmith1404No ratings yet

- HaramDocument1 pageHaramFerdian YudistiroNo ratings yet

- Amortization Table (Unionbank)Document10 pagesAmortization Table (Unionbank)Charmaine Jhun AndalizaNo ratings yet

- Interest Rate Structure Up To January 2021Document8 pagesInterest Rate Structure Up To January 2021Rogérs Rizzy MugangaNo ratings yet

- UntitledDocument1 pageUntitledCece B.No ratings yet

- MNL ILO: E-Boarding Pass QR Code For Bag TagsDocument1 pageMNL ILO: E-Boarding Pass QR Code For Bag TagsCece B.No ratings yet

- Covid-19 Vaccination Certificate: Janine Anjenette Relanes SibayanDocument1 pageCovid-19 Vaccination Certificate: Janine Anjenette Relanes SibayanCece B.No ratings yet

- Guidelines On How To Guidelines On How To Schedule Your Appointment Schedule Your AppointmentDocument14 pagesGuidelines On How To Guidelines On How To Schedule Your Appointment Schedule Your AppointmentCece B.No ratings yet

- NewaaDocument2 pagesNewaaCece B.No ratings yet

- Subdivision Sto Domingo Cainta Rizal Effective June 15, 2022Document1 pageSubdivision Sto Domingo Cainta Rizal Effective June 15, 2022Cece B.No ratings yet

- The 'X' Chronicles Newspaper - August 2010Document50 pagesThe 'X' Chronicles Newspaper - August 2010Rob McConnell100% (1)

- Unit 49 Installing and Commissioning Engineering EquipmentDocument13 pagesUnit 49 Installing and Commissioning Engineering EquipmentSaifuddinHidayat100% (1)

- Incredible IndiaDocument13 pagesIncredible IndiaShradha DiwanNo ratings yet

- Week 11b ViewsDocument26 pagesWeek 11b ViewsKenanNo ratings yet

- ISO9001 2008certDocument2 pagesISO9001 2008certGina Moron MoronNo ratings yet

- The Butt Joint Tool: Product InformationDocument8 pagesThe Butt Joint Tool: Product InformationElias de Souza RezendeNo ratings yet

- Trumpf TruSystem 7500 Service ManualDocument424 pagesTrumpf TruSystem 7500 Service ManualVitor FilipeNo ratings yet

- Acord and IAADocument4 pagesAcord and IAABHASKARA_20080% (1)

- SC-HM910 - HM810 (sm-RQZM0167) PDFDocument104 pagesSC-HM910 - HM810 (sm-RQZM0167) PDFJory2005No ratings yet

- Mode ReversionsDocument15 pagesMode ReversionsISHAANNo ratings yet

- Rainwater Harvesting - A Reliable Alternative in The San Juan IslandsDocument103 pagesRainwater Harvesting - A Reliable Alternative in The San Juan IslandsGreen Action Sustainable Technology Group100% (1)

- 6CS6.2 Unit 5 LearningDocument41 pages6CS6.2 Unit 5 LearningAayush AgarwalNo ratings yet

- 1z0 062Document274 pages1z0 062Dang Huu AnhNo ratings yet

- Literature Study Nift ChennaiDocument5 pagesLiterature Study Nift ChennaiAnkur SrivastavaNo ratings yet

- DCTN Lsqmdocu63774Document21 pagesDCTN Lsqmdocu63774Bharani KumarNo ratings yet

- Tyco SprinklerDocument3 pagesTyco SprinklerVitor BrandaoNo ratings yet

- Bubble Point Temperature - Ideal Gas - Ideal Liquid: TrialDocument4 pagesBubble Point Temperature - Ideal Gas - Ideal Liquid: TrialNur Dewi PusporiniNo ratings yet

- Guidelines For Hall IC SubassemblyDocument9 pagesGuidelines For Hall IC SubassemblyvkmsNo ratings yet

- Marrantz Service Manual Using CS493263 09122113454050Document63 pagesMarrantz Service Manual Using CS493263 09122113454050Lars AnderssonNo ratings yet

- GSM RF Interview QuestionsDocument26 pagesGSM RF Interview QuestionsmohammedelrabeiNo ratings yet

- Vatan Katalog 2014Document98 pagesVatan Katalog 2014rasko65No ratings yet

- Fax 283Document3 pagesFax 283gary476No ratings yet

- MIL-W-22759 Rev E - Part34Document1 pageMIL-W-22759 Rev E - Part34David WongNo ratings yet

- Articles On Organic Agriculture Act of 2010Document6 pagesArticles On Organic Agriculture Act of 2010APRIL ROSE YOSORESNo ratings yet