Professional Documents

Culture Documents

Resume - MFM

Uploaded by

Faisal MehmoodCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resume - MFM

Uploaded by

Faisal MehmoodCopyright:

Available Formats

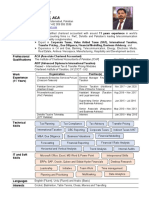

MALIK FAISAL MEHMOOD

RESUME

Malikfaisalmehmood.1989@gmail.com

+966 55 659 1984

(ACA, ADIT) Umm Al Hamam, Riyadh, KSA

Manager (ITS / M&A) / BIG 4 Professional

Profile Summary EDUCATION

▪ BIG 4 experienced professional with more than 12 years of experience in international taxation, inbound / Chartered Accountant, ACA 2016

outbound structuring, restructuring and tax due diligence / M&A. The Institute of Chartered Accountants of Pakistan

▪ Led tax and finance functions for companies in telecommunication and hospitality sectors. International Tax Affiliate, ADIT 2022

▪ Versatile executive with proven competencies in optimizing team dynamics, uniting diverse agenda to common 1.

Chartered Institute of Taxation, UK

goal, and harnessing strategic and operational drivers to deliver results.

▪ Team leader with excellent communication, interpersonal, problem solving and decision-making skills. CORE COMPETENCIES

▪ Proven ability in managing senior relationships. Recognized for commitment, reliability & teamwork.

Due diligence / M&A

Experience Inbound structuring

Outbound structuring

Restructuring

PricewaterhouseCoopers, KSA Zakat / tax planning

Manager (ITS / M&A) – Jun 2022 to present

Domestic advisory

▪ Managing complex projects for local and international clients including but not limited to group restructurings, Tax modelling

structuring inbound / outbound investments, tax due diligence / M&A, permanent establishment (“PE”) risk

assessment, withholding tax implications on cross border transactions and Zakat / tax health check exercises. SKILLS

▪ Obtaining Zakat / tax rulings for contentious issues (both domestic and cross border).

Effective leadership

▪ Managing project outcome through liaison with client’s management, client’s experts / consultants, and PwC

Excellent team player

internal teams (cross functional and cross territory).

Influential communicator

▪ Managing client relationships and expectations from proposal / bid stage to delivery till financial close.

Project management

▪ Conducting internal workshops and carrying out on job training of the staff.

Quality management

Transworld, Pakistan (Orascom Telecom) Data analytics

General Manager (Finance & Taxation) – Jan 2020 to May 2022 Technology

▪ Overseeing Group’s taxation matters (international tax, corporate income tax and VAT) with special focus on MAJOR / RECENT PROJECTS

managing international presence of Group’s employees with regard to submarine cable operations that ranged

from France to China along with landing stations in UAE and Oman. Outbound structuring options paper for an

▪ Supporting Group’s international investments in submarine cables and joint ventures with other consortium education sector group in KSA envisaging to

partners along with local acquisitions of telecommunication assets (long-haul and local loop networks). acquire stake in a network of schools with

▪ Managing Group’s financial / management reporting and operational finance including treasury, procurement / global presence inc. US, UK, and Switzerland.

payables, and revenue / receivables management. Outbound structuring options paper for a

▪ Managing commercial aspects of the Group’s reseller product line including but not limited to appraising capex leading Pharma group in KSA envisaging to

investments and evaluating profitability of long-term customer contracts. acquire business in Switzerland.

▪ Directly working with the Company’s C-level employees and Board of Directors. Outbound structuring options paper for one of

the PIF entities to acquire a minority stake in a

Pakistan Services Limited, Pakistan (Hashoo Group) group engaged in gaming and sports business

Director Taxation (Additional role of Director Finance) – Nov 2017 to Jan 2020 with subsidiaries in Korea, Hong Kong, China,

Singapore, and Malaysia.

▪ In this role, the initial focus remained on the Group’s tax compliance and litigation matters with award of Inbound structuring options paper for a US

additional role to manage Group’s finances towards latter half of my tenure here. Further, the responsibilities

based group in relation to setting up of

under this role were overlapping as have been included in my role with PwC below. manufacturing / distribution operations in KSA.

PricewaterhouseCoopers, Pakistan Inbound structuring options paper for a US

Assistant Manager (TLS) – Sep 2016 to Nov 2017 based electric cars manufacturer (partially PIF

owned) in relation to vehicle assembly

▪ Advising on local and cross border transactions and obtaining advance tax rulings / exemption certificates. operations in KSA.

▪ Reviewing tax computations, tax returns and e-filing with the Federal Board of Revenue. Pre IPO restructuring options paper for a

▪ Reviewing tax accounting and provisioning in accordance with IAS 12 and local tax laws. healthcare client having presence in KSA, UAE

▪ Preparing replies to notices issued by field officers and in case of adverse assessments, preparing appeal and Cyprus.

grounds and arguments and attending related stay / main appeal hearings before concerned appellate forums. Restructuring options paper for a chemicals

manufacturing group having presence in KSA

PricewaterhouseCoopers, Pakistan and Egypt.

Supervising Senior (ABAS) – May 2010 to Aug 2016 Restructuring steps paper for a leading power

(Includes career break from Dec 2013 to May 2015) sector company with presence in KSA, UAE

▪ Preparation of annual internal audit plans for firm’s clients and conducting control design evaluation in the light and Oman.

of COSO integrated framework and stated control objectives. Restructuring paper in relation to carve out of

▪ Identifying design gaps and deviations from best practices and recommending process improvements. business / assets from one of the royal

▪ Documenting business processes and sub-processes using flowcharts. commissions in KSA to a PIF group entity.

▪ Preparing risk registers and accordingly risk-based audit programs. Vendor side due diligence for a health care

▪ Overseeing assignment execution and reviewing of audit work papers. group with presence in KSA, UAE, Qatar,

▪ Preparing internal audit, special audit reports for Board of Directors and senior management. Oman, and Kuwait.

Deloitte, Pakistan LANGUAGES

Intern (TLS) – Jan 2010 to May 2010

English

▪ Assisting in bookkeeping and monthly / annual withholding tax filings for the firm’s clients. Arabic

References can be provided upon request

You might also like

- Abdul Basit Ansari CVDocument2 pagesAbdul Basit Ansari CVmshaheer01No ratings yet

- Batco: Telecom & IT SolutionsDocument27 pagesBatco: Telecom & IT SolutionssamehNo ratings yet

- Muhammad Sajjad CVDocument1 pageMuhammad Sajjad CVAli MuhammadNo ratings yet

- Sohail Malik - CV PDFDocument2 pagesSohail Malik - CV PDFamjad ali khawarNo ratings yet

- PAK - Resume Owais Ahmed - FC FM CFO 17 Yrs Exp - Owais AhmedDocument3 pagesPAK - Resume Owais Ahmed - FC FM CFO 17 Yrs Exp - Owais AhmedFahim FerozNo ratings yet

- Fairoos MohamedDocument3 pagesFairoos MohamedSTC QatarNo ratings yet

- Muhammad Shahid FICO FMDocument3 pagesMuhammad Shahid FICO FMFakhar AbbasNo ratings yet

- Arif Resume1Document3 pagesArif Resume1Asim MalikNo ratings yet

- Rizwan CVDocument2 pagesRizwan CVfattaninaveedNo ratings yet

- Accountant Payable and Controller Abdessamad Essalai Resume CVDocument3 pagesAccountant Payable and Controller Abdessamad Essalai Resume CVmazenabdelbakiNo ratings yet

- Resume YVGRDocument1 pageResume YVGRNiveditha RajNo ratings yet

- Naqash's ResumeDocument1 pageNaqash's ResumeMisbhasaeedaNo ratings yet

- Resume of Professional AcctDocument2 pagesResume of Professional AcctMuhammad ShahzadNo ratings yet

- HarshitBirani5y 1mDocument2 pagesHarshitBirani5y 1mLingesh SNo ratings yet

- CV 2023Document2 pagesCV 2023Nadir KhanNo ratings yet

- Osama Qureshi.01Document2 pagesOsama Qureshi.01MunibNo ratings yet

- Shobhan Dey PDFDocument3 pagesShobhan Dey PDFPulkit KothariNo ratings yet

- KPMGDocument1 pageKPMGvinay narneNo ratings yet

- Muhmmad Ashraf RB - Pdf. (IR & Admin Manager)Document1 pageMuhmmad Ashraf RB - Pdf. (IR & Admin Manager)Engr AhmedNo ratings yet

- Babar Shabir Ver 7.2Document2 pagesBabar Shabir Ver 7.2Babar ShabirNo ratings yet

- Carter: CharlesDocument4 pagesCarter: CharlesC CNo ratings yet

- Nigah E-Nazar - Resume .DocxfinalDocument4 pagesNigah E-Nazar - Resume .DocxfinalnazarfcmaNo ratings yet

- Mastering Construction Cost and CapabilitiesDocument20 pagesMastering Construction Cost and CapabilitiesSedrick NdoforNo ratings yet

- Another Brillant CVDocument2 pagesAnother Brillant CVShahzaib GulzarNo ratings yet

- Seejal TyagiDocument1 pageSeejal TyagiVipul TyagiNo ratings yet

- Resume 202209120255Document4 pagesResume 202209120255Salman AsimNo ratings yet

- Aftab Ahmad CVDocument2 pagesAftab Ahmad CVAhmadNo ratings yet

- Gopal+Banka UpdatedDocument6 pagesGopal+Banka UpdatedCareelogy KolkataNo ratings yet

- Karthikeyan Manivasagam - Exp ResumeDocument2 pagesKarthikeyan Manivasagam - Exp Resumesushmitha17031996No ratings yet

- Kulwinder SikarwarDocument3 pagesKulwinder Sikarwarkulwinder sikarwarNo ratings yet

- Ibrahim Abu Fara - CV - V4Document3 pagesIbrahim Abu Fara - CV - V4mahmoud SakrNo ratings yet

- Ucp 600 PDFDocument2 pagesUcp 600 PDFMamun uddinNo ratings yet

- Seejal TyagiDocument1 pageSeejal TyagiVipul TyagiNo ratings yet

- Rida Sarwar CV Sample1Document1 pageRida Sarwar CV Sample1xaadali1177No ratings yet

- Hassanain Ullah Jan - CV PDFDocument3 pagesHassanain Ullah Jan - CV PDFSaid AliNo ratings yet

- Shahmeen PMP REFX FIDocument2 pagesShahmeen PMP REFX FIShahmeen Ashraf FahadNo ratings yet

- Organisation Restructuring 2023 MGMT TeamDocument9 pagesOrganisation Restructuring 2023 MGMT TeamArul AravindNo ratings yet

- XXXXXXXXXX: - Global Operations - Flexible Solutions - Multi-Cultural Exposure - New Revenue StreamsDocument3 pagesXXXXXXXXXX: - Global Operations - Flexible Solutions - Multi-Cultural Exposure - New Revenue StreamsashaNo ratings yet

- AshishhPassari InbondDocument2 pagesAshishhPassari InbondRahul KunniyoorNo ratings yet

- Mansoor RESUME Updated 09-01-2020Document3 pagesMansoor RESUME Updated 09-01-2020mansoorNo ratings yet

- Tison New CV 2023Document4 pagesTison New CV 2023Tison ThomasNo ratings yet

- CV - Ankit KumarDocument2 pagesCV - Ankit Kumarmintoo123112233No ratings yet

- Sesha Krishna CVDocument3 pagesSesha Krishna CVG Yugandhar Alwaz UniqueNo ratings yet

- Imran QurashiDocument3 pagesImran QurashiVaibhav VermaNo ratings yet

- CV Template 0016Document1 pageCV Template 0016Amr mfaNo ratings yet

- Joe CMA - CV PDFDocument4 pagesJoe CMA - CV PDFAli AyubNo ratings yet

- TONYS - RESUME - Tony GaniDocument2 pagesTONYS - RESUME - Tony GaniDitto Dwi PurnamaNo ratings yet

- Work History - ZetyDocument1 pageWork History - ZetyMathias OnosemuodeNo ratings yet

- SR Accountant ILMDocument1 pageSR Accountant ILMsara osooliNo ratings yet

- Wisdom Akoto: ContactDocument2 pagesWisdom Akoto: Contactasianpipes vaishaliNo ratings yet

- Oracle Cloud - FinancialsDocument19 pagesOracle Cloud - FinancialsAvinash RoutrayNo ratings yet

- Sr. Acc Suroor ResumeDocument2 pagesSr. Acc Suroor ResumeVaibhav VermaNo ratings yet

- CV CA Ankit VatsaDocument1 pageCV CA Ankit Vatsadileep.jcmNo ratings yet

- CV - DoddyRachmatDocument1 pageCV - DoddyRachmatdoddy rachmatNo ratings yet

- Transferable: Muhammad Tariq JavedDocument6 pagesTransferable: Muhammad Tariq Javedabdul waleedNo ratings yet

- Musa Khan: Profile SummaryDocument2 pagesMusa Khan: Profile Summarymusa khanNo ratings yet

- DharmaSastha (11y 0m)Document2 pagesDharmaSastha (11y 0m)Lingesh SNo ratings yet

- Ryznaldi Taufiq Nurahman: Experienced Finance & Project Management ProfessionalDocument2 pagesRyznaldi Taufiq Nurahman: Experienced Finance & Project Management ProfessionalOki SetiawanNo ratings yet

- Tariq Shahzad Acca: Employment History Executive ProfileDocument1 pageTariq Shahzad Acca: Employment History Executive ProfileMurtaza JangdaNo ratings yet

- June 2018 Paper 3.04Document4 pagesJune 2018 Paper 3.04Faisal MehmoodNo ratings yet

- 8 - June 2018 Module 3.04 (Suggested Solutions)Document16 pages8 - June 2018 Module 3.04 (Suggested Solutions)Faisal MehmoodNo ratings yet

- June 2019 Module 3.04Document14 pagesJune 2019 Module 3.04Faisal MehmoodNo ratings yet

- 4 - June 2016 Paper 3.04 (Suggested Solutions)Document11 pages4 - June 2016 Paper 3.04 (Suggested Solutions)Faisal MehmoodNo ratings yet

- Income Tax On Capital Gains From Restructuring EventsDocument11 pagesIncome Tax On Capital Gains From Restructuring EventsFaisal MehmoodNo ratings yet

- 1 - CV - TaxDocument3 pages1 - CV - TaxFaisal MehmoodNo ratings yet

- PWC Oil and Gas Handbook - Final Sept 2013Document171 pagesPWC Oil and Gas Handbook - Final Sept 2013Faisal MehmoodNo ratings yet

- Engineering Management Masters Thesis TopicsDocument5 pagesEngineering Management Masters Thesis Topicsgbtrjrap100% (2)

- F6MWI 2015 Jun ADocument7 pagesF6MWI 2015 Jun AangaNo ratings yet

- Imron Sahid NugrohoDocument7 pagesImron Sahid NugrohoAnanda LukmanNo ratings yet

- Product Costing - COPA (End To End Guide)Document153 pagesProduct Costing - COPA (End To End Guide)rajesh_popatNo ratings yet

- Case Study: From Munich To Mohali: QuestionsDocument3 pagesCase Study: From Munich To Mohali: Questionsshika rai100% (1)

- State of The Game Industry 2021Document29 pagesState of The Game Industry 2021spotNo ratings yet

- HW Chap 6Document4 pagesHW Chap 6uong huonglyNo ratings yet

- Roll 3 - 269128 Class Class 9 - N Name Hamza Abdul RehmanDocument1 pageRoll 3 - 269128 Class Class 9 - N Name Hamza Abdul Rehmanfloppaedits752No ratings yet

- An Overview of Association Rule Mining & Its Application: by Abhinav RaiDocument22 pagesAn Overview of Association Rule Mining & Its Application: by Abhinav RaiBheng AvilaNo ratings yet

- Test Bank For Industrial Relations in Canada 3rd EditionDocument10 pagesTest Bank For Industrial Relations in Canada 3rd EditionLorraine Holcombe100% (32)

- Vertical Pumps Repairs Standards VPRSDocument44 pagesVertical Pumps Repairs Standards VPRSAlvialvarez100% (1)

- Rishita S - ResumeDocument1 pageRishita S - ResumeRishita SukhadiyaNo ratings yet

- The Most Basic Things Your Company Needs To Know About Sales (Fog Creek Software)Document24 pagesThe Most Basic Things Your Company Needs To Know About Sales (Fog Creek Software)alessandraNo ratings yet

- Certified Human Resources Manager Sample MaterialDocument13 pagesCertified Human Resources Manager Sample MaterialAnamika VermaNo ratings yet

- Business and IndustyDocument3 pagesBusiness and IndustysantoshskpurNo ratings yet

- Teaching PowerPoint Slides - Chapter 1Document24 pagesTeaching PowerPoint Slides - Chapter 1famin87No ratings yet

- Whistleblower #1 AffidavitDocument3 pagesWhistleblower #1 AffidavitSteve BirrNo ratings yet

- Steps in Production Planning and ControlDocument2 pagesSteps in Production Planning and ControlImran Ali67% (3)

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument53 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSanaka LogesNo ratings yet

- An Industrial Visit To Jindal AluminiumDocument8 pagesAn Industrial Visit To Jindal AluminiumAnushka SenguptaNo ratings yet

- Business Studies - Class 11 NotesDocument106 pagesBusiness Studies - Class 11 Notessaanvi padhye100% (1)

- Letter of Invitation - DraftDocument3 pagesLetter of Invitation - DraftAidel BelamideNo ratings yet

- Agrre To Sell MR - KrishnaDocument7 pagesAgrre To Sell MR - Krishnapradyu.winner749No ratings yet

- 1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletDocument12 pages1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletKunjunni MashNo ratings yet

- Titan Company - WikipediaDocument74 pagesTitan Company - Wikipediakay617138No ratings yet

- Bhavnath Temple: Case AnalysisDocument2 pagesBhavnath Temple: Case Analysismanvi singhNo ratings yet

- BusplanDocument38 pagesBusplanCrissa MorescaNo ratings yet

- Financial Reporting - Prof. ManojDocument6 pagesFinancial Reporting - Prof. Manojtechna8No ratings yet

- AUE Guide To Outsourcing Governance Procedures PDFDocument20 pagesAUE Guide To Outsourcing Governance Procedures PDFLingua IntlNo ratings yet

- Rajesh Exports: ExportingDocument8 pagesRajesh Exports: ExportingShreepal ParekhNo ratings yet