Professional Documents

Culture Documents

2023 Value Addition Format

Uploaded by

harsha.dilan4320Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 Value Addition Format

Uploaded by

harsha.dilan4320Copyright:

Available Formats

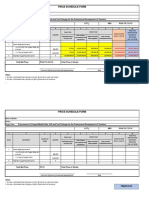

Company Name: ……………………………………………………….

Name of final Product: ………………………………………………..

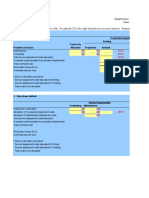

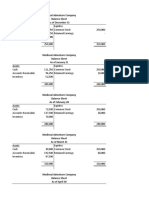

The calculation of Local Value Addition (LVA) of an industrial product (Sample format)

As a % of

the Total

Variable Description of cost Value (Rs) - per unit

Ex-factory

Cost

1 Cost of Raw Materials and Duty

Cost of Imported Materials

CIF Value of Imported Materials (define/ name each materials)

1.

2.

3.

Custom Import Duty

Port and Airport Dev. Levy

All other import charges

Sub Total

Cost of Local Materials

Materials and Parts manufactured locally ( define /name each

materials)

1.

2.

3.

Sub Total

2 Direct labour cost (Salaries and Wages,allowances,Staff welfare and EPF/ETF)

3 Depreciation (Direct)

Total ex factory cost (without profit margin)

Local Value Addition (cost of locally manufactured inputs + Direct Labour cost+ Depreciation (Direct) ) as a percentage of the

Ex-facory cost

The composition of the LVA

Percentage of Local material cost

Percentage of all local costs related to the manufacturing

process

Total

The above cost statement has been checked and verified by us according to the information and records available,

We hereby certify that the calculations are true & correct.

For Company For Charted Accountant

Date: Date:

Signature: Signature:

Name: Name:

Designation: Rubber Stamp:

Company Seal:

You might also like

- Sample Format Cost Statement For The ExportDocument2 pagesSample Format Cost Statement For The Exportummar_2009No ratings yet

- IG5336.9201 ch1 ADocument2 pagesIG5336.9201 ch1 AHnamMahpNo ratings yet

- Chapter 7 (Lecture) : Job Order Costing AccountingDocument19 pagesChapter 7 (Lecture) : Job Order Costing AccountingNurin QistinaNo ratings yet

- Instructions:: Any ExceptionsDocument3 pagesInstructions:: Any ExceptionsAkhmad FathoniNo ratings yet

- Cost and RevenueDocument17 pagesCost and RevenueKalpana MishraNo ratings yet

- Claim Form II B Departmental ExecutionDocument1 pageClaim Form II B Departmental ExecutionChimakurthy NagarapanchayatNo ratings yet

- Sesi 2 - Konsep BiayaDocument14 pagesSesi 2 - Konsep BiayaanindhabackupNo ratings yet

- Ampa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Document26 pagesAmpa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Alireza entNo ratings yet

- Chapter 3 - Job Order Costing-01022021 - GLDocument66 pagesChapter 3 - Job Order Costing-01022021 - GLStavria KalliNo ratings yet

- Bid Form Price Schedule Form 1Document4 pagesBid Form Price Schedule Form 1LGNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument50 pagesProduct Costing and Cost Accumulation in A Batch Production EnvironmentAbdelrahman El-shafaeeNo ratings yet

- Module: Costing (Controlling) As-Is Business Process ListDocument28 pagesModule: Costing (Controlling) As-Is Business Process ListjsphdvdNo ratings yet

- Job-Order Costing: An Overview: Job-Order Costing Systems Are Used When: Job-Order Costing Systems Are Used WhenDocument72 pagesJob-Order Costing: An Overview: Job-Order Costing Systems Are Used When: Job-Order Costing Systems Are Used WhenRifat Tasfia OtriNo ratings yet

- Lesson 2-Manufacturing AccountDocument20 pagesLesson 2-Manufacturing Accountandrewsamuelhernandez1No ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument56 pagesProduct Costing and Cost Accumulation in A Batch Production Environmentsunanda mNo ratings yet

- 4.PC 02 03 G2 (LIDER Budget Proy Grandes Mixed)Document18 pages4.PC 02 03 G2 (LIDER Budget Proy Grandes Mixed)Ricardo Del Pozo MartínNo ratings yet

- Costaccounting IIDocument255 pagesCostaccounting IIAbith MathewNo ratings yet

- AnnexureDocument12 pagesAnnexureyavNo ratings yet

- Commercial Invoice TemplateDocument2 pagesCommercial Invoice TemplatedukuhwaruNo ratings yet

- Garment Costing: Minnie BastinDocument73 pagesGarment Costing: Minnie BastinBastinNo ratings yet

- Commercial Invoice EnglishDocument1 pageCommercial Invoice EnglishPratima ChavanNo ratings yet

- Job-Order Costing: Calculating Unit Product CostsDocument46 pagesJob-Order Costing: Calculating Unit Product CostsGigo Kafare BinoNo ratings yet

- Details of Goods Imported or To Be Imported Into India Section A: Import Licence ParticularsDocument2 pagesDetails of Goods Imported or To Be Imported Into India Section A: Import Licence ParticularsRavindra BabuNo ratings yet

- MA Slide 1Document31 pagesMA Slide 1MahamNo ratings yet

- Ctivity Ased Osting Is As Simple As: A B C ABCDocument32 pagesCtivity Ased Osting Is As Simple As: A B C ABCsaptarshi_majumdar_5No ratings yet

- Department of Public Works and Highways (DPWH) : Name of Procuring Entity AddressDocument1 pageDepartment of Public Works and Highways (DPWH) : Name of Procuring Entity AddressKing BangngayNo ratings yet

- 107-W4-Job order-chp08-STDocument77 pages107-W4-Job order-chp08-STmargaret mariaNo ratings yet

- AWB Légi FuvarlevélDocument1 pageAWB Légi FuvarlevélTamás CsirkovicsNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument58 pagesProduct Costing and Cost Accumulation in A Batch Production EnvironmentWali NoorzadNo ratings yet

- Behavioral Classification of CostDocument22 pagesBehavioral Classification of CostLabib ShahNo ratings yet

- Penawaran ANNEX - 8.1 - Bill - of - Quantities - For - RefractoryDocument6 pagesPenawaran ANNEX - 8.1 - Bill - of - Quantities - For - RefractoryZattya ZattyaNo ratings yet

- Problem 17 26Document4 pagesProblem 17 26saad bin sadaqatNo ratings yet

- Supplier Contact Directory (SCD) : Key Point(s)Document3 pagesSupplier Contact Directory (SCD) : Key Point(s)nicuNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument61 pagesProduct Costing and Cost Accumulation in A Batch Production EnvironmentSaifuddin AfaqNo ratings yet

- Job Cost Tracking SpreadsheetDocument1 pageJob Cost Tracking SpreadsheetsteuryjamesNo ratings yet

- TTK JobsheetDocument1 pageTTK JobsheetShivaNo ratings yet

- Job SheetDocument1 pageJob SheetShivaNo ratings yet

- SPPTChap 002Document25 pagesSPPTChap 002Abdulaziz ObaidNo ratings yet

- UntitledDocument16 pagesUntitledMaria Nena LoretoNo ratings yet

- Import Sample InvDocument8 pagesImport Sample Invmedo hosnyNo ratings yet

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-2Document14 pagesCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-2Tanvir Ahmed ChowdhuryNo ratings yet

- (Revised) Week 13 - ReviewDocument94 pages(Revised) Week 13 - ReviewCheuk Ling SoNo ratings yet

- Stage 1 Template For Detailed Site Assessment ReportDocument15 pagesStage 1 Template For Detailed Site Assessment ReportSakthiNo ratings yet

- Chapter 5 Job Order CostingDocument74 pagesChapter 5 Job Order Costingumar afzalNo ratings yet

- Vendor Master File FormDocument3 pagesVendor Master File FormVince Dones SagarapNo ratings yet

- Chapter 3 - POHRDocument29 pagesChapter 3 - POHRNehal SalemNo ratings yet

- 3 5+Material+or+Equipment+Entry-Exit+Pass+FormDocument1 page3 5+Material+or+Equipment+Entry-Exit+Pass+FormAbey Dessalegn100% (1)

- PMF-007-SCO-006 v1 Spare Parts Record TemplateDocument1 pagePMF-007-SCO-006 v1 Spare Parts Record TemplateAbdelrhman SaidNo ratings yet

- Management Accounting Session 3 Job Order Costing: Indian Institute of Management RohtakDocument52 pagesManagement Accounting Session 3 Job Order Costing: Indian Institute of Management RohtakSiddharthNo ratings yet

- Paint (Good Example: Ingredients After Curing Are Entered For The Paint Bad Example: Ingredients Before Curing Are Entered For The Paint)Document43 pagesPaint (Good Example: Ingredients After Curing Are Entered For The Paint Bad Example: Ingredients Before Curing Are Entered For The Paint)Durai NaiduNo ratings yet

- Cost I Ch. 3Document57 pagesCost I Ch. 3Magarsaa AmaanNo ratings yet

- Daily Work ReportDocument6 pagesDaily Work ReportBander Al–kouhlaniNo ratings yet

- Cost Chapter Three 3Document27 pagesCost Chapter Three 3esmailhuwalo1956No ratings yet

- IT T 89to108Document13 pagesIT T 89to108talha aftabNo ratings yet

- FORM P-3 MANUFACTURERS DATA REPORT FOR WATERTUBE BOILERS SUPERHEATERS WATERWALLS AND ECONOMIZERS Edit2017Document5 pagesFORM P-3 MANUFACTURERS DATA REPORT FOR WATERTUBE BOILERS SUPERHEATERS WATERWALLS AND ECONOMIZERS Edit2017msb_75No ratings yet

- Cost AnalysisDocument36 pagesCost AnalysisHarisagar ThulasiramanNo ratings yet

- Sanat Çanta Kontrat Bütçe KısmıDocument3 pagesSanat Çanta Kontrat Bütçe KısmıÇağlar TürkNo ratings yet

- React.js for A Beginners Guide : From Basics to Advanced - A Comprehensive Guide to Effortless Web Development for Beginners, Intermediates, and ExpertsFrom EverandReact.js for A Beginners Guide : From Basics to Advanced - A Comprehensive Guide to Effortless Web Development for Beginners, Intermediates, and ExpertsNo ratings yet

- Transfer ReceiptDocument1 pageTransfer Receiptharsha.dilan4320No ratings yet

- AOM - Board Resolution - Appt of DirDocument1 pageAOM - Board Resolution - Appt of Dirharsha.dilan4320No ratings yet

- TS ApplicationDocument2 pagesTS Applicationharsha.dilan4320No ratings yet

- Application For Import TS Item v1Document4 pagesApplication For Import TS Item v1harsha.dilan4320No ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument88 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri Lankaharsha.dilan4320No ratings yet

- Form 06Document2 pagesForm 06harsha.dilan4320No ratings yet

- Intrabank Transfer: Cyber ReceiptDocument1 pageIntrabank Transfer: Cyber ReceiptAhmed KamaldeenNo ratings yet

- 2023 Value Addition FormatDocument1 page2023 Value Addition Formatharsha.dilan4320No ratings yet

- Application For Import TS Item v1Document4 pagesApplication For Import TS Item v1harsha.dilan4320No ratings yet

- Transfer ReceiptDocument1 pageTransfer Receiptharsha.dilan4320No ratings yet

- TS ApplicationDocument2 pagesTS Applicationharsha.dilan4320No ratings yet

- Powercommand Modlon Ii Gateway Modbus - Lon Converter: Description FeaturesDocument4 pagesPowercommand Modlon Ii Gateway Modbus - Lon Converter: Description Featuresharsha.dilan4320No ratings yet

- Ezbiz Product Proposal HNBDocument22 pagesEzbiz Product Proposal HNBharsha.dilan4320No ratings yet

- Chinese VISA Invitation Verification LetterDocument1 pageChinese VISA Invitation Verification Letterharsha.dilan4320No ratings yet

- 5 Environmental Threats To Greenhouses-11.20.18Document8 pages5 Environmental Threats To Greenhouses-11.20.18harsha.dilan4320No ratings yet

- Strategic Cost MGTDocument9 pagesStrategic Cost MGThridyansh kainNo ratings yet

- Chapter 7 LeverageDocument21 pagesChapter 7 Leveragemuluken walelgnNo ratings yet

- Declining Balance Depreciation Alpha 0.15 N 10Document2 pagesDeclining Balance Depreciation Alpha 0.15 N 10Ysabela Angela FloresNo ratings yet

- MBA 7214 - Practice Exam With The AnswersDocument9 pagesMBA 7214 - Practice Exam With The AnswersAnkit ChoudharyNo ratings yet

- Pantaloons: Group - 4Document18 pagesPantaloons: Group - 4Simran MehrotraNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- Bending The Curve Tv+Digital VideoDocument8 pagesBending The Curve Tv+Digital VideoCarolina GutierrezNo ratings yet

- Porter SM Ch. 10 - 2ppDocument35 pagesPorter SM Ch. 10 - 2ppmfawzi010No ratings yet

- FIN220 - Time Value of Money Practice QuestionsDocument2 pagesFIN220 - Time Value of Money Practice QuestionsMatt ZaheadNo ratings yet

- Vidhyoday - BCK Revision ChartsDocument21 pagesVidhyoday - BCK Revision Chartsmishrakumkum526No ratings yet

- Role of HR LeadershipDocument2 pagesRole of HR LeadershipAhmed NafeezNo ratings yet

- Operation and Prodn MGMTDocument150 pagesOperation and Prodn MGMTSurafel KebeeeNo ratings yet

- Chapter 4 Managing QualityDocument21 pagesChapter 4 Managing QualityAndrew Pradana PutraNo ratings yet

- Chapter 8 - Merchandising Operations PDFDocument28 pagesChapter 8 - Merchandising Operations PDFCarlos Juliano ImportanteNo ratings yet

- Literature Review AccountingDocument6 pagesLiterature Review Accountingc5qm9s32100% (1)

- Ariel Marketing MixDocument9 pagesAriel Marketing MixIann AcutinaNo ratings yet

- Environment: Kotler and Armstrong Analyzing The MarketingDocument32 pagesEnvironment: Kotler and Armstrong Analyzing The Marketingx xxxNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetGregorian JerahmeelNo ratings yet

- Brand Awareness and Marketing Campaign For NilkamalDocument6 pagesBrand Awareness and Marketing Campaign For NilkamalEditor IJTSRDNo ratings yet

- Answers AuditDocument29 pagesAnswers AuditJayden Galing100% (1)

- Accounting Excel Budget ProjectDocument8 pagesAccounting Excel Budget Projectapi-242531880No ratings yet

- Value Investing and Risk ManagementDocument32 pagesValue Investing and Risk Managementadib_motiwala0% (1)

- Sales DialogueDocument5 pagesSales DialogueDada AlconesNo ratings yet

- Chapter 3 - Adjusting The AccountsDocument49 pagesChapter 3 - Adjusting The AccountsTâm Lê Hồ HồngNo ratings yet

- Project On AmazonDocument30 pagesProject On AmazonFaizan Sir's Tutorials100% (1)

- TM 4 - Earning ManagementDocument27 pagesTM 4 - Earning ManagementRifqa aulia nabylaNo ratings yet

- Chapter 1. Introduction To Cost and ManagementDocument49 pagesChapter 1. Introduction To Cost and ManagementHARYATI SETYORINI100% (1)

- TBChap 010Document42 pagesTBChap 010varun cyw100% (3)

- Special JournalsDocument9 pagesSpecial JournalsnikNo ratings yet