Professional Documents

Culture Documents

Appicable Financial

Uploaded by

Elvira Mirajul0 ratings0% found this document useful (0 votes)

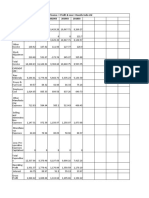

7 views2 pagesThe document presents financial ratios for a company over 6 periods. It includes current ratio, debt ratio, equity ratio, debt to equity ratio, gross profit margin, operating profit margin, cash flow margin, net profit margin, asset turnover, and rate of return on assets. The ratios show increasing current assets, equity, and profits but decreasing debt, assets, and asset turnover over time.

Original Description:

Original Title

APPICABLE FINANCIAL

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document presents financial ratios for a company over 6 periods. It includes current ratio, debt ratio, equity ratio, debt to equity ratio, gross profit margin, operating profit margin, cash flow margin, net profit margin, asset turnover, and rate of return on assets. The ratios show increasing current assets, equity, and profits but decreasing debt, assets, and asset turnover over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesAppicable Financial

Uploaded by

Elvira MirajulThe document presents financial ratios for a company over 6 periods. It includes current ratio, debt ratio, equity ratio, debt to equity ratio, gross profit margin, operating profit margin, cash flow margin, net profit margin, asset turnover, and rate of return on assets. The ratios show increasing current assets, equity, and profits but decreasing debt, assets, and asset turnover over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

APPICABLE FINANCIAL

STATEMENT RATIOS

1. Current Ratio 2.7 3 4 5 6

2 .07 .41 .55 58

Current Assets 51, 143.93 126,786.87 260,811.50 429,418.53 633,278.0

Current Liabilities 18,833.69 41, 300.20 59,097.07 77,429.81 96,184.6

2. Debt Ratio 0.1 0 0 0

8 .24 .20 .17 1

Total Liabilities 18,833.69 41,300.20 59,097.07 77,429.81 96,184.6

Total Assets 104,578.46 173,745.34 301,293.91 463,424.88 660,808.3

3. Equity Ratio 0.5 0 0 0

6 .76 .80 .83 8

Total Equity 58,046.49 132,445.14 242,196.84 385,995.06 564,623.7

Total Assets 104,578.46 173,745.34 301,293.91 463,424.88 660,808.3

4. Debt to Equity Ratio 0.3 0 0 0

2 .31 .34 .20 1

Total Liabilities 18,833.69 41,300.20 59,097.07 77,429.81 96,184.6

Total Equity 58,046.49 132,445.14 242,196.84 385,995.06 564,623.7

5. Gross Profit Margin 0.64 0.65 0.64 0.64 0.6

Gross Profit 225,723.80 301,938.63 365,948.33 432,741.12 502,119.0

Sales 354,540.00 466,085.00 568,292.50 676,692.50 791,332.5

6. Operating Profit Margin 0.15 0.25 0.30 0.33 0.3

Income before Interest 53,810.54 118,000.57 168,848.76 221,228.04 247,813.2

Tax

Sales 354,540.00 466,085.00 568,292.50 676,692.50 791,332.5

7. Cash Flow Margin 0.10 0.17 0.20 0.22 0.2

Cash flow from 35,315.22 80,874.71 116,227.76 150,274.28 185,104.7

operations

Sales 354,540.00 466,085.00 568,292.50 676,692.50 791,332.5

8. Net Profit Margin 0.08 0.16 0.19 0.21 0.2

Net Income 28,839.16 74,398.65 109,751.70 143,798.22 178,628.6

Sales 354,540.00 466,085.00 568,292.50 676,692.50 791,332.5

9. Asset Turnover 3.39 2.68 1.89 1.46 1.2

Net Sales 354,540.00 466,085.00 568,292.50 676,692.50 791,332.5

Ave. Total Assets 104,578.46 173,745.34 301,293.91 463,424.88 660,808.3

10. Rate of Return On 0.28 0.43 0.36 0.31 0.2

Assets

Net Income 28,839.16 74,398.65 109,751.70 143,798.22 178,628.6

Ave. Total Assets 104,578.46 173,745.34 301,293.91 463,424.88 660,808.3

You might also like

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Crossroads, Cosmograms & Sacred SpaceDocument13 pagesCrossroads, Cosmograms & Sacred SpaceMoHagani Magnetek100% (1)

- SMC vs. Laguesma (1997)Document2 pagesSMC vs. Laguesma (1997)Kimberly SendinNo ratings yet

- HW No. 2 - Victoria Planters Vs Victoria MillingDocument2 pagesHW No. 2 - Victoria Planters Vs Victoria MillingAilyn AñanoNo ratings yet

- The Nature of Small BusinessDocument34 pagesThe Nature of Small BusinessRoslinda Bt Abd Razak90% (10)

- A Grammar of Mandarin Chinese Lincom Europa PDFDocument208 pagesA Grammar of Mandarin Chinese Lincom Europa PDFPhuong100% (1)

- Gonzales V HechanovaDocument2 pagesGonzales V HechanovaMicco PesuenaNo ratings yet

- Advertising BudgetDocument12 pagesAdvertising BudgetSurya BathamNo ratings yet

- All MinistryDocument2 pagesAll MinistryManish BodarNo ratings yet

- Balance Sheet ACC Sources of FundsDocument13 pagesBalance Sheet ACC Sources of FundsAshish SinghNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDocument17 pagesHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNo ratings yet

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaNo ratings yet

- Balance Sheet: Year Mar 18 Mar 17Document39 pagesBalance Sheet: Year Mar 18 Mar 17Amit JhaNo ratings yet

- Cho 8Document2 pagesCho 8Usman KulkarniNo ratings yet

- Cho 10Document2 pagesCho 10Usman KulkarniNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- Finance Satyam AnalysisDocument12 pagesFinance Satyam AnalysisNeha AgarwalNo ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- Reported Net Profit 9,607.73 9,844.71 10,200.90 11,223.25 12,464.32Document14 pagesReported Net Profit 9,607.73 9,844.71 10,200.90 11,223.25 12,464.32shubhamNo ratings yet

- Arvind LTD: Balance Sheet Consolidated (Rs in CRS.)Document8 pagesArvind LTD: Balance Sheet Consolidated (Rs in CRS.)Sumit GuptaNo ratings yet

- Allahabad Bank Sep 09Document5 pagesAllahabad Bank Sep 09chetandusejaNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- Ratio Analysis Ratio AnalysisDocument20 pagesRatio Analysis Ratio AnalysisHeena VermaNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNo ratings yet

- Finance Using Excel RJDocument27 pagesFinance Using Excel RJVishal NigamNo ratings yet

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaNo ratings yet

- BAV Final ExamDocument27 pagesBAV Final ExamArrow NagNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsAbhisek SarkarNo ratings yet

- ICICI Bank Is IndiaDocument6 pagesICICI Bank Is IndiaHarinder PalNo ratings yet

- Unit: Million VND: Working CapitalDocument12 pagesUnit: Million VND: Working CapitalThảo LinhNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- Khushboo Tomar Altman Zscore FinalDocument9 pagesKhushboo Tomar Altman Zscore FinalKHUSHBOO TOMARNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- Minda Industries - Forecasted SpreadsheetDocument47 pagesMinda Industries - Forecasted SpreadsheetAmit Kumar SinghNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- Balance Sheet of Grasim Industries LimitedDocument5 pagesBalance Sheet of Grasim Industries LimitedDaniel Mathew VibyNo ratings yet

- SBI Balance SheetDocument1 pageSBI Balance SheetMuralidhar VenkataNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- ParticularsDocument1 pageParticularshariharanpNo ratings yet

- Urc StatementsDocument6 pagesUrc StatementsErvin CabangalNo ratings yet

- Amara Raja BatteriesDocument28 pagesAmara Raja Batteriesgaurav khandelwalNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerNo ratings yet

- Dokumen - Tips Wipro Ratio Analysis 55849d8e50235Document20 pagesDokumen - Tips Wipro Ratio Analysis 55849d8e50235zomaan mirzaNo ratings yet

- Bharti 2Document1 pageBharti 2akhilesh_raj007No ratings yet

- Balance Sheet: Sources of FundsDocument14 pagesBalance Sheet: Sources of FundsJayesh RodeNo ratings yet

- PCBL - Valuation 2Document6 pagesPCBL - Valuation 2Sagar SahaNo ratings yet

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- CocaCola - Financial Statement - FactSet - 2019Document66 pagesCocaCola - Financial Statement - FactSet - 2019Zhichang ZhangNo ratings yet

- MariottDocument6 pagesMariottJunaid SaleemNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- FM Project2Document20 pagesFM Project2Triptasree GhoshNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Balance Sheet of Reliance Industries: - in Rs. Cr.Document2 pagesBalance Sheet of Reliance Industries: - in Rs. Cr.Sara HarishNo ratings yet

- Tata Steel Balance Sheet: AssetsDocument7 pagesTata Steel Balance Sheet: AssetsSahil SawantNo ratings yet

- Draft Consolidated BPCL Financial StatementsDocument18 pagesDraft Consolidated BPCL Financial StatementsMahesh RamamurthyNo ratings yet

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- Balance SheetDocument1 pageBalance SheetswapnaNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Urinary 2Document3 pagesUrinary 2Elvira MirajulNo ratings yet

- Biochem Lesson 2Document3 pagesBiochem Lesson 2Elvira MirajulNo ratings yet

- Assess Yourself As A StudentDocument1 pageAssess Yourself As A StudentElvira MirajulNo ratings yet

- Art Script Amir, Pom, LidoDocument4 pagesArt Script Amir, Pom, LidoElvira MirajulNo ratings yet

- Elvira Mirajul PeDocument9 pagesElvira Mirajul PeElvira MirajulNo ratings yet

- BioSci Lab Quiz 1 To 4Document11 pagesBioSci Lab Quiz 1 To 4Elvira MirajulNo ratings yet

- PATHFIT Unit IDocument2 pagesPATHFIT Unit IElvira MirajulNo ratings yet

- Art AppreciationDocument3 pagesArt AppreciationElvira MirajulNo ratings yet

- BioChem LESSON 1 and 2Document8 pagesBioChem LESSON 1 and 2Elvira MirajulNo ratings yet

- Universidad de Zamboanga School of Liberal Arts and Sciences National Service Training Program Civic Welfare Training ServiceDocument2 pagesUniversidad de Zamboanga School of Liberal Arts and Sciences National Service Training Program Civic Welfare Training ServiceElvira MirajulNo ratings yet

- Activity 4 NSTPDocument4 pagesActivity 4 NSTPElvira MirajulNo ratings yet

- Movie ReflectionDocument5 pagesMovie ReflectionElvira MirajulNo ratings yet

- Art App ScriptDocument1 pageArt App ScriptElvira MirajulNo ratings yet

- The Language of MathematicsDocument3 pagesThe Language of MathematicsElvira MirajulNo ratings yet

- UTS ReviewerDocument3 pagesUTS ReviewerElvira MirajulNo ratings yet

- Math Midterm ReviewerDocument10 pagesMath Midterm ReviewerElvira MirajulNo ratings yet

- Uts-Reviewwer MidtermDocument6 pagesUts-Reviewwer MidtermElvira MirajulNo ratings yet

- History G4 Report FinalDocument14 pagesHistory G4 Report FinalElvira MirajulNo ratings yet

- Purposive Communication ReviewerDocument2 pagesPurposive Communication ReviewerElvira MirajulNo ratings yet

- Math Mod Script G4Document2 pagesMath Mod Script G4Elvira MirajulNo ratings yet

- Purposive Communication ReviewerDocument7 pagesPurposive Communication ReviewerElvira MirajulNo ratings yet

- Physical EducationDocument7 pagesPhysical EducationElvira MirajulNo ratings yet

- Pulse PolioDocument27 pagesPulse PolioAbigail MelendezNo ratings yet

- Unit 15 (Final) PDFDocument12 pagesUnit 15 (Final) PDFआई सी एस इंस्टीट्यूटNo ratings yet

- Principles of Business Sba - Rachael BrownDocument23 pagesPrinciples of Business Sba - Rachael BrownRachael BrownNo ratings yet

- Purchase Request: Supplies and Materials For Organic Agriculture Production NC IiDocument13 pagesPurchase Request: Supplies and Materials For Organic Agriculture Production NC IiKhael Angelo Zheus JaclaNo ratings yet

- Q4 Applied Eco Learning Material Week7Document8 pagesQ4 Applied Eco Learning Material Week7marvi salmingoNo ratings yet

- "Kapit Sa Patalim" Proclivity and Perpetuity of "5-6" Credit Facility Among The Wet Market Micro-EntrepreneursDocument28 pages"Kapit Sa Patalim" Proclivity and Perpetuity of "5-6" Credit Facility Among The Wet Market Micro-Entrepreneurszab1226No ratings yet

- Crossroads of European Histories Multiple Outlooks On Five Key Moments in The History of Europe by Stradling, RobertDocument396 pagesCrossroads of European Histories Multiple Outlooks On Five Key Moments in The History of Europe by Stradling, RobertFarah ZhahirahNo ratings yet

- Reflection Essay 1Document3 pagesReflection Essay 1maria blascosNo ratings yet

- Dtap MM CM Service Request: Ranap CommonidDocument2 pagesDtap MM CM Service Request: Ranap Commonidsunil vermaNo ratings yet

- 00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51Document1 page00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51primousesNo ratings yet

- JB APUSH Unit 1 Topic 1.6Document9 pagesJB APUSH Unit 1 Topic 1.6Graham NicholsNo ratings yet

- Group4 AppecoDocument11 pagesGroup4 AppecoMafu SanNo ratings yet

- Gregg Warburton Canton MADocument6 pagesGregg Warburton Canton MAcharisma12No ratings yet

- New AIDS Law PDFDocument52 pagesNew AIDS Law PDFmille madalogdogNo ratings yet

- Jaime U. Gosiaco, vs. Leticia Ching and Edwin CastaDocument33 pagesJaime U. Gosiaco, vs. Leticia Ching and Edwin CastaClaudia Rina LapazNo ratings yet

- David HockneyDocument12 pagesDavid Hockneyrick27red100% (2)

- Profit MaximizationDocument18 pagesProfit MaximizationMark SantosNo ratings yet

- Health Benefits of Financial Inclusion A Literature ReviewDocument7 pagesHealth Benefits of Financial Inclusion A Literature Reviewl1wot1j1fon3No ratings yet

- Mr. John D'Souza Edward An! DECEMBER 17, 1993 (S. Ratnavel Pandian and P.B. Sawant, JJ.)Document8 pagesMr. John D'Souza Edward An! DECEMBER 17, 1993 (S. Ratnavel Pandian and P.B. Sawant, JJ.)Saket DeshmukhNo ratings yet

- Men Have No Friends and Women Bear The BurdenDocument20 pagesMen Have No Friends and Women Bear The Burdenapi-609142361No ratings yet

- Transnational Religious ActorsDocument16 pagesTransnational Religious ActorsAnnisa HardhanyNo ratings yet

- Fashion Design 6Document7 pagesFashion Design 6RichaNo ratings yet