Professional Documents

Culture Documents

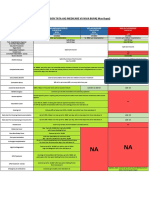

Integrated Shield Plans For Ward Class B1 in Public Hospitals

Integrated Shield Plans For Ward Class B1 in Public Hospitals

Uploaded by

lilian yongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Integrated Shield Plans For Ward Class B1 in Public Hospitals

Integrated Shield Plans For Ward Class B1 in Public Hospitals

Uploaded by

lilian yongCopyright:

Available Formats

Integrated Shield Plans for Ward Class B1 in Public Hospitals

Disclaimer: All material included in our web site is of a general nature. It is intended for education and informational purposes only. The information provided is based on what was provided to us at the date of Publication. We are not responsible for the correctness of the information, or any third party contents which can be accessed

through the web site. You are strongly advised to seek the professional advice of insurance professionals before making any decision on any of the medical insurance schemes.

Integrated Shield Plans: Integrated Shield Plans (IPs) comprise two components: (i) A MediShield Life component run by the Central Provident Fund Board (CPFB) and (ii) additional private insurance coverage run by the private insurer. The MediShield Life component provides coverage targeted at B2/C-wards in public hospitals,

while the additional private insurance coverage provides additional coverage beyond MediShield Life coverage. IPs therefore do not provide duplicate coverage with MediShield Life. This table provides a comparison between IPs for Class B1 wards in public hospitals.

Table: Comparison of Private Integrated Shield Plans for Class B1 in Public Hospitals

Income IncomeShield Plan Income Enhanced AIA HealthShield Gold Max B Great Eastern Great Eastern Prudential Raffles Health Insurance

Benefits AIA HealthShield Gold Max C* Aviva MyShield Plan 3

B* IncomeShield Basic Lite GREAT SupremeHealth B* GREAT SupremeHealth B PLUS PruShield B* Raffles Shield B

Inpatient and Day Surgery:

Daily Ward and Treatment Charges

- Normal Ward 1,000/day 700/day 1,750/day 750/day

As Charged As Charged As Charged As Charged

- Intensive Care Unit Ward 1,400/day 1,200/day 2,950/day 1,250/day

As Charged

1,000/day

As Charged (up to 90 days for Sub-acute Care: 1,000/day

- Community Hospital (up to 45 days for each 450/day - 550/day As Charged As Charged (up to 45 days)

each admission) Rehabilitation Care: 750/day

admission)

3,500/yr 3,500/yr

5,000/yr

(Additional post-hospitalisation (Additional post-hospitalisation 20,000/yr

500/day (Includes post hospitalisation

- Psychiatric 5,000/yr 5,000/yr psychiatric treatment of 500/yr psychiatric treatment of 1,000/yr - (Including pre & post hospitalisation -

(up to 35 days/yr) psychiatric treatment up to 90

within 200 days after within 200 days after benefits)

days)

Confinement) Confinement)

- Inpatient Palliative Care - As Charged - As Charged - 750/day - - -

As Charged in

Governmen/Restructured

Surgery 500 - 8,200 600 - 16,800 600 - 8,500

Hospitals, else subject to pro-

As Charged ration factor As Charged As Charged As Charged As Charged

Surgical Implants and Approved Medical Consumables 9,000/admission 7,000/treatment 10,000/treatment 8,000/treatment

Gamma Knife 9,600/procedure 9,600/procedure 10,000/procedure 10,000/treatment

Outpatient Treatment:

As Charged

(Pro-ration factor waived for

Kidney Dialysis 2,500/mth applicable treatment by 24,000/yr As Charged 36,000/yr As Charged 24,000/yr As Charged As Charged

preferred partners)

(Note (11))

Cancer treatment:

Radiotherapy

(i) External or Superficial: (i) External or Superficial: (i) External or Superficial:

(i) External or Superficial (i) External or Superficial: 550/day

300/session 280/session 600/session

(ii) Brachytherapy (ii) Brachytherapy: 550/day

(ii) Brachytherapy: 500/session (ii) Brachytherapy: 500/session (ii) Brachytherapy: 1,200/session

(iii) Hemi-Body

Chemotherapy 3,000/mth 3,000/mth 25,000/year 36,500/year

As Charged As Charged As Charged As Charged As Charged

Immunotherapy 700/mth 700/mth 8,500/year 8,500/year

Stereotactic Radiotherapy 2,500/session 2,000/session 2,000/course 2,000/treatment

Immunosuppressants for organ transplants 600/mth 5,000/yr 10,000/yr 5,000/year

Erythropoietin 600/mth 5,000/yr 5,500/yr 5,000/year

Long-Term Parenteral Nutrition - As Charged - As Charged - As Charged - - -

Integrated Shield Plans for Ward Class B1 in Public Hospitals pg1

Integrated Shield Plans: Integrated Shield Plans (IPs) comprise two components: (i) A MediShield Life component run by the Central Provident Fund Board (CPFB) and (ii) additional private insurance coverage run by the private insurer. The MediShield Life component provides coverage targeted at B2/C-wards in public hospitals, while the additional private insurance coverage provides additional coverage

beyond MediShield Life coverage. IPs therefore do not provide duplicate coverage with MediShield Life. This table provides a comparison between IPs for Class B1 wards in public hospitals.

Table: Comparison of Private Integrated Shield Plans for Class B1 in Public Hospitals

Income IncomeShield Plan Income Enhanced AIA HealthShield Gold Max B Great Eastern Great Eastern Prudential Raffles Health Insurance

Benefits AIA HealthShield Gold Max C* Aviva MyShield Plan 3

B* IncomeShield Basic Lite GREAT SupremeHealth B* GREAT SupremeHealth B PLUS PruShield B* Raffles Shield B

Additional Benefits Limits:

(i) As Charged (Up to 90 days)

[for non-panel specialist in a

private hospital (without certificate

of pre-authorisation)]

Limited to unused balance Pre-hospital specialist’s

Pre-Hospitalisation Treatment (number of days indicate maximum number of days amount** of room, board and consultation is limited to unused

medical-related services, 500/confinement As Charged As Charged (ii) As Charged (Up to 180 days) As Charged

covered prior admission) balance amount of room, board -

intensive care unit (ICU) and (Up to 100 days) (Up to 100 days) (Up to 120 days) [for Panel specialist in a private (Up to 90 days)

(Note (1)) and medical-related services

medical-related services hospital

benefit.

benefits and staying in a (with certificate of pre-

community hospital (Up to 90 authorisation),

days) restructured hospital or community

** If the inpatient claim is made As Charged hospital]

under a third party plan, Income (up to 100 days) (i) As Charged (i) As Charged (Up to 180 days)

will calculate the unused (Up to 180 days) [for non-panel specialist in a

balance amount after assessing [for non-panel specialist in a Private private hospital (without certificate

the inpatient bill based on Hospital or Panel specialist in a Private of pre-authorisation)]

Income’s IP limits and 1,000/confinement Post-hospitalisation treatment is Hospital (without certificate of pre-

Post-Hospitalisation Treatment (number of days indicate maximum number of days deductibles. For more (Up to 100 days). Additional As Charged limited to unused balance amount authorisation)] (ii) As Charged (Up to 365 days) As Charged

covered after discharge) information, please check with -

1,000 for an additional 100 days (Up to 100 days) of room, board and medical-related [for Panel specialist in a private (Up to 90 days )

(Note (1)) your financial advisor or for 30 critical illnesses) services benefit. (ii) As Charged hospital

Income. (up to 365 days) (with certificate of pre-

[for Panel specialist in a Private Hospital authorisation),

(with certificate of pre-authorisation) or restructured hospital or community

Restructured Hospital] hospital]

Speech Therapy, Occupational Therapy,

Other Post-Hospitalization Treatment (number of days indicate maximum number of

- - - - - Physical Therapy: 1200/yr; 120/session - - -

days covered after discharge)

(Up to 180 days)

As Charged in

Covered under Inpatient and Governmen/Restructured As Charged

Major Organ Transplant As Charged As Charged - As Charged - As Charged

Day surgery limits Hospitals, else subject to pro- (for selected organs only)

ration factor

Living Donor Organ Transplant, coverage for insured donor (after 24 mths waiting Covered up to MediShield Life 20,000/transplant 20,000/lifetime

20,000/transplant 20,000/transplant 20,000/transplant - - 20,000/transplant

period) benefits only (Note (2)) (Note (2))

20,000/transplant 20,000/transplant 20,000 / transplant 20,000/transplant

Living Donor Organ Transplant, coverage for non-insured donor - - - - -

(Note (3)) (Note (3)) (Note (2)) (Note (3))

Pregnancy and Delivery-Related Complications Benefit

3,500/yr As Charged

(after 10 months waiting period) (for selected conditions only - please check with your - As Charged - As Charged - As Charged As Charged

insurer for futher details)

(i) 10,000/yr (Within 730 days of last

5,000/yr As Charged Covered up to benefit limits of the Covered up to benefit limits of the policy effective date) As Charged As Charged

Congenital Abnormalities Benefit - -

(with 24 mths waiting period) (with 12 mths waiting period) plan plan (ii) As Charged (After 730 days from last (with 12 mths waiting period) (with 24 mths waiting period)

policy effective date)

[Only for insured female] 12,000 / lifetime

Congenital Abnormalities Benefit of Insured's biological child from birth - - - 12,000 per lifetime - Limited to 3,000 / child - - -

Limited to 3,000 per child [with 300 days waiting period]

Prosthesis Benefit 6,000/yr 6,000/yr - - - - - - -

Addtl 30,000 policy yr limit Addtl 50,000 policy yr limit Additional 50,000/yr

Critical Illnesses - - (for 30 Critical Illnesses) (for 30 Critical Illnesses) - - - (for 5 Critical Illnesses) -

(Note (4)) (Note (4)) (Note (4))

Reimburse Eligible Expenses Reimburse Eligible Expenses

incurred for overseas medical or incurred for overseas medical or

Reimburse the actual Expenses

surgical treatment subject to the surgical treatment subject to the

incurred overseas or the

applicable claim limits under AIA applicable claim limits under AIA Reimburse the lower of Hospital

Reasonable and Customary

As Charged but limited to costs HealthShield Gold Max C. Benefit HealthShield Gold Max B Lite. As Charged expenses incurred up to the limits As Charged As Charged

Covered under Inpatient and Charges applicable in

Emergency overseas treatment of ward class B1 in Singapore payable under Emergency Benefit payable under Emergency (But limited to Singapore Restructured covered by PruShield B or the (pegged to costs restructured (limited to Singapore Restructured

Day surgery limits a Class B1 ward of a Restructured

restructured hospitals Overseas (Outside Singapore) Overseas (Outside Singapore) Hospitals, Class B1 Ward charges) actual Reasonable and Cusotmary hospitals in Singapore) Hospital Class B1 Ward charges)

Hospital, whichever

Medical Treatment Benefit limited Medical Treatment Benefit limited Expenses

is the lower, subject to the benefit

to the level of reasonable and to the level of reasonable and

limits of Supreme Health B.

customary charges in a customary charges in a

Singapore Private Hospital. Singapore Private Hospital.

As Charged

(pegged to costs of restructured

Planned overseas treatment - - - - - - - -

hospitals in Singapore)

(Note (5))

Proton Beam Therapy Treatment - 70,000/yr - 70,000/yr - 30,000/yr - 10,000 / yr -

Cell, Tissue and Gene Therapy - 150,000/yr - 100,000/yr - 100,000/yr - 30,000 / yr -

Autologous bone marrow transplant treatment for multiple myeloma - 10,000/yr - As Charged - 20,000/yr - - -

Final Expense Benefit (Note (10)) 3,000 3,000 2,500 2,500 3,600 3,600 3,000 10,000 3,000

In the event of Death/TPD of the

parent (payor), premium will be

Waiver of Premium upon Total Permanent Disability - - Waives 1 yr premium for insured Waives 1 yr premium for insured - - - -

wavied for the Insured until he/she

reaches age 21.

Integrated Shield Plans for Ward Class B1 in Public Hospitals pg2

Integrated Shield Plans: Integrated Shield Plans (IPs) comprise two components: (i) A MediShield Life component run by the Central Provident Fund Board (CPFB) and (ii) additional private insurance coverage run by the private insurer. The MediShield Life component provides coverage targeted at B2/C-wards in public hospitals, while the additional private insurance coverage provides additional coverage

beyond MediShield Life coverage. IPs therefore do not provide duplicate coverage with MediShield Life. This table provides a comparison between IPs for Class B1 wards in public hospitals.

Table: Comparison of Private Integrated Shield Plans for Class B1 in Public Hospitals

Income IncomeShield Plan Income Enhanced AIA HealthShield Gold Max B Great Eastern Great Eastern Prudential Raffles Health Insurance

Benefits AIA HealthShield Gold Max C* Aviva MyShield Plan 3

B* IncomeShield Basic Lite GREAT SupremeHealth B* GREAT SupremeHealth B PLUS PruShield B* Raffles Shield B

Other Policy Features

Raffles Hospital - 60%

Private Hospital - 50%

Proration factors for Private Hospital & Private Outpatient Clinics (Note (6)) 80% 50%

- 50% 50% Private Outpatient - 65% - 35%

(Please check with your insurer for more information on other applicable factors) (Note (7)) (Note (7)) Private Hospitals (except Raffles

Private Day Surgery - 65%

Hospital) - 50%

80% 80% 80%

Proration factors for Class A Wards - 85% - - 85% 80%

(Note (8)) (Note (7)) (Note (7))

Proration factors for Non-Subsidised Short-Stay Ward / Day Surgery / Outpatient 80% 80%

- - - - - 85% -

Treatment (Note (7)) (Note (7))

Deductibles (Per Policy Year) (Note (9))

Class C 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500

Class B2 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000

Class B1 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500

Class A and Private Hospital 2,500 2,500 2,500 3,500 3,500 3,500 3,500 3,500

Restructured hospital

Subsidised Day Surgery/ Short Stay Wards 2,000 2,000 2,000 2,000 2,500 1,500 (short stay) 1,500 2,000

2,000 (day surgery)

2,000 (day surgery)

Restructured hospital: 2,000 (subsidised short stay ward)

2,000 (short stay) 3,500 (unsubsidised short stay

Unsubsidised Day Surgery/ Short Stay Wards 2,500 2,500 2,000 2,000 2,500 (day surgery) 2,000 ward) 3,000

Private Hospital:

3,500 (short stay & day surgery)

10%

Co-insurance 10% 10% 10% 10% 10% 10% 10% 10%

(max $25,500/yr)

Policy Year Limit 150,000 250,000 150,000 300,000 180,000 500,000 120,000 500,000 300,000

Lifetime Limit Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited

Last Entry Age 75 75 75 75 75 75 75 75 75

Maximum Coverage Age Lifetime Lifetime Lifetime Lifetime Lifetime Lifetime Lifetime Lifetime Lifetime

Integrated Shield Plans for Ward Class B1 in Public Hospitals pg3

Information on Premiums: Integrated Shield Plans (IPs) comprise two components: (i) A MediShield Life component run by the Central Provident Fund Board (CPFB) and (ii) additional private insurance coverage run by the private insurer. The MediShield Life component provides coverage targeted at B2/C-wards in public hospitals, while the additional private insurance coverage provides additional

coverage beyond MediShield Life coverage. Premiums for IPs shown below is the total premiums comprising both premiums for MediShield Life and the additional private insurance coverage component for IPs for Class B1 wards in public hospitals.

Integrated Shield Plan Premiums for Singapore Citizen (SC) and Permanent Resident (PR) Policyholder (Rounded to nearest $)

Income IncomeShield Plan Income Enhanced AIA HealthShield Gold Max B Great Eastern Great Eastern Prudential Raffles Health Insurance

AIA HealthShield Gold Max C* Aviva MyShield Plan 3 Raffles Shield B

B* IncomeShield Basic Lite GREAT SupremeHealth B* GREAT SupremeHealth B PLUS PruShield B*

Age Next Birthday: SC + PR

1 to 20 167 - 193 169 - 183 205 213 182 - 190 193 - 202 184 215 201

21 to 30 280 282 320 320 295 308 - 326 289 323 309

31 to 40 434 - 443 453 - 463 492 492 454 467 - 489 442 490 473

41 to 50 603 638 - 655 650 687 - 724 643 665 - 681 602 705 - 721 651

51 to 60 878 - 888 946 - 958 955 - 988 1,015 - 1,038 965 1,025 - 1,112 880 - 890 1,078 - 1,086 1,024 - 1,033

61 to 65 1,196 1,317 1,288 1,380 1,323 1,366 - 1,547 1,196 1,500 1,398

66 to 70 1,473 1,569 1,485 1,680 1,626 1,685 - 1,989 1,448 1,819 1,712

71 to 73 1,716 1,910 1,854 2,055 2,038 2,145 - 2,279 1,829 2,346 2,105

74 to 75 1,914 2,168 2,088 2,330 2,303 2,479 - 2,558 2,056 2,661 2,383

76 to 78 2,246 2,545 2,440 2,899 2,601 2,853 - 3,039 2,665 3,442 2,753

79 to 80 2,320 2,745 2,593 2,959 2,839 3,203 - 3,317 2,655 3,514 2,997

81 to 83 2,168 2,942 2,711 3,093 2,948 3,454 - 3,563 2,488 4,225 3,117

84 to 85 2,633 3,428 2,975 3,402 3,321 3,879 - 3,938 2,782 4,506 3,743

86 to 90 2,800 - 2,937 3,672 - 3,944 3,119 3,655 - 3,920 3,942 - 3,995 4,088 - 4,347 2,949 5,045 - 5,172 4,051 - 4,361

Premiums above age 90 3,162 - 3,962 4,351 - 5,435 3,149 - 3,500 4,126 - 4,817 4,025 - 4,786 4,447 - 5,178 4,005 - 4,417 5,462 - 5,890 4,733 - 5,154

* This plan is no longer offered to new members. Existing members may continue to renew their policies.

Note (1): Pre & Post hospital treatment may not be available for: accident inpatient dental treatment, inpatient congenital anomalies, inpatient pregnancy complications, living donor organ transplant, inpatient psychiatric treatment and emergency overseas treatment. Please check with your insurer for more information.

Note (2): (a) For Great Eastern plans, the living donor organ transplant applies for kidney, liver and pancreas transplants only. When Life Insured is the donor, the recipient must be a family member (parents, siblings, children or spouse) of the Life Insured.

(b) For Aviva plans, the living donor organ transplant applies for kidney and liver transplants only, where the recipient must be a family member (parents, siblings, children or spouse) of the Life Insured.

(c) For Raffles Shield B, the recipient of the organ must be a family member (parents, siblings, spouse and children) of the Life Insured.

Note (3): Expenses incurred by the non-insured living donor shall only be reimbursed under the Living Donor Organ Transplant (coverage for non-insured donor) if the organ recipient is the Life Assured and the living donor is not eligible to be reimbursed under MediShield Life, Medisave-approved

Integrated Shield Plans or any other insurance plans for the organ donation.

Note (4): Aviva and AIA's Critical Illness Benefit is provided over and above the Overall Policy Year Limit and the Overall Lifetime Limit.

Note (5): Expenses incurred under Planned overseas treatment shall only be reimbursed if the inpatient treatment or day surgery was received at an overseas hospital that has an approved working arrangement with a Medisave-accredited institution/referral centre in Singapore .

Note (6): Treatment in the following private dialysis centres will not be pro-rated: National Kidney Foundation, Kidney Dialysis Foundation and People's Dialysis Centre.

Note (7): A pro-ration factor of 90% and 80% will apply to Singapore Permanent Residents and Foreigners respectively, for expenses incurred in: 1) Class B1 or lower in restructured hospital/government-funded Community Hospital and/or government-funded Inpatient Palliative Care Institution, or 2)

Subsidised short-stay ward, day surgery and/or restructured hospitals.

Note (8): A pro-ration factor of 90% will apply to Singapore Permanent Residents for expenses incurred in Class B1 ward in restructured hospital.

Note (9): (a) For Great Eastern's SupremeHealth B Plus plan, the deductible applicable for policyholders after the age of 85 will be raised by $1,000 of the above listed deductible.

(b) For Income's IncomeShield Plan B and Enhanced IncomeShield Basic, the deductible applicable for policyholders after the age of 80 is as follows: Class C - $2,250, Class B2/B2+ - $3,000, Class B1/A/pte hospital - $3,750,

(c) For Aviva's MyShield Plan, the deductible applicable for policyholders after the age of 80 will be 150% of the listed deductibles.

(d) For AIA HSG Max B Lite, the deductible applicable for Insured ages of 81 is as follows: Class C - $1,500, Class B2 - $2,250, Class B1 - $3,000, Class A / Private - $4,500

(e) For Raffles Shield B, the deductibles applicable for Insureds with Age Next Birthday of 81 and above will be 150% of the listed deductibles.

Note (10): Final Expense Benefit refers to the waiver of the deductible and co-insurance up to the stipulated amounts in the event of the insured's death during hospitalisation or within a stipulated period after discharge from hospital subject to the conditions as stipulated by the insurer.

Note (11): Panel or preferred partner means a registered medical practitioner, specialist, hospital or medical institution on our approved list. Please refer to www.income.com.sg for the approved list. The list may be updated from time to time.

The premiums payable are based on your age next birthday and may increase as you enter into the next age band

The annual Additional Withdrawal Limits for the Additional Private Insurance Premiums of Medisave-approved Integrated Shield Plan policies are:

(a) $300 per policy year, where the insured person is aged 40 or less at his/her next birthday on date of policy commencement/renewal

(b) $600 per policy year, where the insured person is aged between 41 to 70 years at his/her next birthday on date of policy commencement/renewal

(c) $900 per policy year, where the insured person is aged 71 or more years at his/her next birthday on date of policy commencement/renewal

Integrated Shield Plans for Ward Class B1 in Public Hospitals pg4

You might also like

- 20230117032741premier Brochure Full - 2023-01 (January 17)Document8 pages20230117032741premier Brochure Full - 2023-01 (January 17)jadetorresNo ratings yet

- Comparison of Private Hospital IpsDocument4 pagesComparison of Private Hospital IpsTerrence LiNo ratings yet

- v8 Comparison of A Ips - Sep 2022Document4 pagesv8 Comparison of A Ips - Sep 2022Wenwei ChionhNo ratings yet

- Integrated Shield Plans For Ward Class B2/C in Public Hospitals pg1Document4 pagesIntegrated Shield Plans For Ward Class B2/C in Public Hospitals pg1pervinder singhNo ratings yet

- Singlife Shield Singlife Health Plus Product SummaryDocument22 pagesSinglife Shield Singlife Health Plus Product SummaryKevin FongNo ratings yet

- ReyForBusiness (Group) - Plan & Price Sampling - 2023Document7 pagesReyForBusiness (Group) - Plan & Price Sampling - 2023Nadhifah Nur HafshahNo ratings yet

- SOB - 01 Oct 2022Document14 pagesSOB - 01 Oct 2022Chi Wai NgNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- Brochure Health Foundation A4Document4 pagesBrochure Health Foundation A4BartoszNo ratings yet

- Medical Inssurance AA+BenefitsDocument2 pagesMedical Inssurance AA+BenefitsCarlo MeNo ratings yet

- SOB - 01 Sep 2019 PDFDocument9 pagesSOB - 01 Sep 2019 PDFJacky_LEOLEONo ratings yet

- Daniza Tolentino - Option 2Document1 pageDaniza Tolentino - Option 2Josquine DíazNo ratings yet

- Group Health Insurance ..Document9 pagesGroup Health Insurance ..Amrita PatraNo ratings yet

- Balsam Leaflet en PDFDocument8 pagesBalsam Leaflet en PDFEng. Waleed AhmedNo ratings yet

- A-Plus Total Health BrochureDocument2 pagesA-Plus Total Health BrochureAIA Sunnie YapNo ratings yet

- AIA HS Gold Elite BrochureDocument12 pagesAIA HS Gold Elite BrochureBensam JoysonNo ratings yet

- AIA Travel PA Plus Brochure 030123Document21 pagesAIA Travel PA Plus Brochure 030123Navin IndranNo ratings yet

- Proposed ADV (Sea) LTD 2018Document3 pagesProposed ADV (Sea) LTD 2018Syaiful ZulfahriNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Prudential - Medical Insurance Benefits - 22112022Document29 pagesPrudential - Medical Insurance Benefits - 22112022Amatsiko PrimahNo ratings yet

- Member Certificate 70749421 1Document2 pagesMember Certificate 70749421 1abadir.abdiNo ratings yet

- MOH Schedule of BenefitDocument18 pagesMOH Schedule of BenefitHihiNo ratings yet

- ReAssure SSDocument2 pagesReAssure SSAmit Kumar KandiNo ratings yet

- HLA MediShield ENG - Updated AUG 18Document16 pagesHLA MediShield ENG - Updated AUG 18Chan SCNo ratings yet

- Niva PB ReAssure SS v5Document2 pagesNiva PB ReAssure SS v5samdsozaNo ratings yet

- Top Up INSUDocument1 pageTop Up INSUStar HealthNo ratings yet

- ReportDocument19 pagesReportGambar GambarNo ratings yet

- Happy Family Floater - Policy NewDocument45 pagesHappy Family Floater - Policy Newpooja singhalNo ratings yet

- Health 360 PPT 5 Dec 2022Document30 pagesHealth 360 PPT 5 Dec 2022Movies JunctionNo ratings yet

- General Product Summary of ZTI SCHEN enDocument8 pagesGeneral Product Summary of ZTI SCHEN enArif Nur CahyoNo ratings yet

- I Great Evo PDFDocument32 pagesI Great Evo PDFshafik jabbarNo ratings yet

- HFF-2015 Pol PDFDocument31 pagesHFF-2015 Pol PDFAmit RajNo ratings yet

- Daleel E PDFDocument44 pagesDaleel E PDFNumair AshrafNo ratings yet

- AXA Shield BrochureDocument13 pagesAXA Shield BrochureWilliamNo ratings yet

- TripCare 360 Insurance BrochureDocument8 pagesTripCare 360 Insurance BrochureStri LokaNo ratings yet

- Health Insurance Quotation: Insurer Coverage Room Limit Plane Name PremiumDocument4 pagesHealth Insurance Quotation: Insurer Coverage Room Limit Plane Name PremiumAijaz AhmedNo ratings yet

- AXAShield Brochure 10feb2020Document13 pagesAXAShield Brochure 10feb2020Nelly HNo ratings yet

- HS 360 One PagerDocument4 pagesHS 360 One PagerpratheepNo ratings yet

- 2018 Benefit IP-OPDocument1 page2018 Benefit IP-OPaerqukadafraeNo ratings yet

- PRUlife Ready Audrey Valeria 2015aug28 1440740115072 PDFDocument21 pagesPRUlife Ready Audrey Valeria 2015aug28 1440740115072 PDFPhilip JuniorNo ratings yet

- Principles of Economics 6th Edition Frank Solutions ManualDocument7 pagesPrinciples of Economics 6th Edition Frank Solutions Manualbeckhamkhanhrkjxsk100% (26)

- Travel Insurance BrochureDocument7 pagesTravel Insurance BrochureArunava SahaNo ratings yet

- Student Outbound KFB 2022-11Document3 pagesStudent Outbound KFB 2022-11caroline liuNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3PRADEEP GUPTANo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Apollo Munich VS Icici LombardDocument12 pagesApollo Munich VS Icici LombardNavendu ShekharNo ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- Insurance Policy: Star CareDocument2 pagesInsurance Policy: Star CareShivaRamaKrishnaPatelNo ratings yet

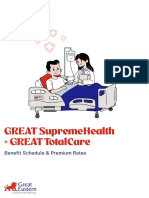

- Supreme Health - 2021Document2 pagesSupreme Health - 2021raeshawn1980No ratings yet

- Live2Play Working Holiday Insurance PlanDocument6 pagesLive2Play Working Holiday Insurance PlanmbbcatNo ratings yet

- Copy of 2020 ID List of Benefits and Allowances ARZxlsx - 2. Medical Insurance UpdDocument1 pageCopy of 2020 ID List of Benefits and Allowances ARZxlsx - 2. Medical Insurance Updfrututu.smoothiesNo ratings yet

- 202301.01 TNC Zomato GMC (New Plan With Dependents) RenewalDocument23 pages202301.01 TNC Zomato GMC (New Plan With Dependents) Renewalajptl92No ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- GSH GTC Benefit Schedule and Premium RatesDocument19 pagesGSH GTC Benefit Schedule and Premium RatesChin Mui LanNo ratings yet

- The Marsh Medicare Flyer-Generic - ClicDocument1 pageThe Marsh Medicare Flyer-Generic - ClicLeslie AtaemboNo ratings yet

- The Enabling Environment for Disaster Risk Financing in Fiji: Country Diagnostics AssessmentFrom EverandThe Enabling Environment for Disaster Risk Financing in Fiji: Country Diagnostics AssessmentNo ratings yet

- Healthcerts-Clinics 240322Document68 pagesHealthcerts-Clinics 240322lilian yongNo ratings yet

- Annex I - HPV Vaccination Schedule For Cervarix Age at The Time of First Dose Number of Doses and Interval 2 DosesDocument1 pageAnnex I - HPV Vaccination Schedule For Cervarix Age at The Time of First Dose Number of Doses and Interval 2 Doseslilian yongNo ratings yet

- UntitledDocument31 pagesUntitledlilian yongNo ratings yet

- You Are My Sunshine Singapore Youaremysunshine - SG Scan Here For Our Daily Promotions!Document15 pagesYou Are My Sunshine Singapore Youaremysunshine - SG Scan Here For Our Daily Promotions!lilian yongNo ratings yet

- UntitledDocument1 pageUntitledlilian yongNo ratings yet

- Maris Stella High School: 1) Updates On AchievementsDocument11 pagesMaris Stella High School: 1) Updates On Achievementslilian yongNo ratings yet

- AMA MoneySense For Your ChildDocument1 pageAMA MoneySense For Your Childlilian yongNo ratings yet

- Allotment Gardens FAQs - Mar 2022Document9 pagesAllotment Gardens FAQs - Mar 2022lilian yongNo ratings yet

- (Parent Kit) Holiday Activities With Our Children-3Document1 page(Parent Kit) Holiday Activities With Our Children-3lilian yongNo ratings yet

- Acquisition TNC NewDocument5 pagesAcquisition TNC Newlilian yongNo ratings yet

- Tncs Uob Cash Rebate PromoDocument4 pagesTncs Uob Cash Rebate Promolilian yongNo ratings yet

- Peningkatan Komunikasi Efektif Antar Profesional Pemberi AsuhanDocument7 pagesPeningkatan Komunikasi Efektif Antar Profesional Pemberi AsuhanFauziyah AuliaNo ratings yet

- NURS-FPX4020 - MuaClaude - Assessment 1-1Document6 pagesNURS-FPX4020 - MuaClaude - Assessment 1-1marvinNo ratings yet

- AI HealthcareDocument2 pagesAI HealthcareStormbornNo ratings yet

- Flow and TableDocument7 pagesFlow and TableRainbow DashieNo ratings yet

- CV CanadienDocument4 pagesCV CanadienmedNo ratings yet

- Resume 2Document2 pagesResume 2api-576574115No ratings yet

- Doh Circular 2019-0225Document1 pageDoh Circular 2019-0225Jas PerNo ratings yet

- PEER GROUP TEACHING Independent PractionerDocument6 pagesPEER GROUP TEACHING Independent Practionerparushni dab100% (1)

- Hospital Accreditation Process GuideDocument131 pagesHospital Accreditation Process GuiderazeyalmrzNo ratings yet

- HINAI® 5.9.15 - SR05 LiveDocument1 pageHINAI® 5.9.15 - SR05 LiveRismandara NabilaNo ratings yet

- List Merit Broad SPL Other 2023 10102023Document11 pagesList Merit Broad SPL Other 2023 10102023komal sharmaNo ratings yet

- American Well - Case StudyDocument13 pagesAmerican Well - Case StudySumitNo ratings yet

- En 05 10095Document24 pagesEn 05 10095Suleiman Opeyemi AbdulmuheezNo ratings yet

- Semba TDocument3 pagesSemba Tsembakarani thevagumaranNo ratings yet

- Role of Hospitals in AMSDocument27 pagesRole of Hospitals in AMSRockson Ohene AsanteNo ratings yet

- Nothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeDocument2 pagesNothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeSJ WealthNo ratings yet

- C 1 ExamDocument10 pagesC 1 ExamAshiq KNo ratings yet

- Rec Letter From ZhylkybaevaDocument2 pagesRec Letter From ZhylkybaevaГулнара УмурзаковаNo ratings yet

- Management Principles For Health Professionals 7th Edition Ebook PDFDocument61 pagesManagement Principles For Health Professionals 7th Edition Ebook PDFmaria.bowman208100% (47)

- 890999f0-1223-473f-932a-abb34964d566 (1)Document3 pages890999f0-1223-473f-932a-abb34964d566 (1)cayade9530No ratings yet

- AR Follow Up QuestionsDocument4 pagesAR Follow Up QuestionsMahesh PallintiNo ratings yet

- Health Care Services in IndiaDocument53 pagesHealth Care Services in Indiasasmita nayak100% (1)

- Ayushman Bharat YojanaDocument28 pagesAyushman Bharat YojanaParth VasaveNo ratings yet

- Form DGHSDocument4 pagesForm DGHSVIKAS KOCHARNo ratings yet

- UAE Healthcare Market (Nephrology and Dialysis) : InvestmentDocument6 pagesUAE Healthcare Market (Nephrology and Dialysis) : InvestmentMuhammad Usman AsgherNo ratings yet

- Formulary Addition Request FormDocument2 pagesFormulary Addition Request Formرعد الشمريNo ratings yet

- Reading Comprehension For Students SoetDocument2 pagesReading Comprehension For Students SoetAnusha ReddyNo ratings yet

- Capella RN To BN - NURS-FPX4900 - Spring 2023 - Capstone Assessment 4 - Scoring GuideDocument1 pageCapella RN To BN - NURS-FPX4900 - Spring 2023 - Capstone Assessment 4 - Scoring GuideAngela Hernandez-PrinceNo ratings yet

- 366-Article Text-1258-1-10-20220824Document7 pages366-Article Text-1258-1-10-20220824YunitafazaksNo ratings yet

- Career ProgressionDocument64 pagesCareer ProgressionAillaMarieRafolsBasbasNo ratings yet