Professional Documents

Culture Documents

Manju PDF

Uploaded by

harshit gargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manju PDF

Uploaded by

harshit gargCopyright:

Available Formats

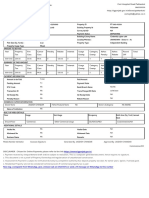

Form 26QB

Your E-tax Acknowledgement Number is BI6108023

The Acknowledgement No. generated will be valid only if the taxpayer makes a payment at Bank's site. Taxpayers are advised to save above

Acknowledgement No. for downloading Form 16B from TRACES website.

As communicated by Income Tax Department, TDS certificate (Form 16B) will be available for download from the TRACES website after atleast 2

days of deposit of tax amount at the respective Bank.

The TDS amount as per Form 26QB should be entered in the field 'Basic Tax' (Income Tax) on the Bank's web-portal as TDS certificate (Form 16B)

will be based on 'Basic Tax' (Income Tax) only.

If Date of deduction is greater than Date of Payment/Credit, the same may result in Demand Notice for late deduction.

If Date of deduction is less than Date of Payment/Credit, the same may result in Demand Notice for late deduction.

If Date of furnishing Form 26QB is beyond prescribed due date, the same may attract late filing fee u/s 234E.

Tax Applicable 0021 Assessment Year 2022-23

Minor Head Code 800 Financial Year 2021-22

Permanent Account No. (PAN) of

AYTPK4374Q Permanent Account No. (PAN) of Transferor (Payee/Seller)BKWPM0703R

Transferee(Payer/Buyer)

RAKXXX

Full Name (Masked) of the Transferee Full Name (Masked) of the Transferor MANXX

XUMAR

Category of Transferee on the basis of PAN Individual Category of Transferor on the basis of PAN Individual

Status of PAN as per ITD PAN Master Active PAN Status of PAN as per ITD PAN Master Active PAN

Complete Address of the Pro Complete Address of the Pro

perty Transferee perty Transferor

Name of premises/Building/ Village27 Name of premises/Building/ Village172

Flat/Door/Block No. Flat/Door/Block No.

Road/Street/Lane ROJA JALAPUR Road/Street/Lane BADALPUR, DADRI

City/District GAUTAM BUDDHA NAGAR City/District GAUTAM BUDDHA NAGAR

State UTTAR PRADESH State UTTAR PRADESH

Pin Code 201307 Pin Code 201307

Email ID apx.builder@gmail.com Email ID

Mobile No. 8851666269 Mobile No.

Whether more than one

Date of Agreement/Booking 14/01/2022 No

Transferee/Buyer

Whether more than one

Date of Payment/Credit 14/01/2022 Yes

Transferor/Seller

Whether TDS is deducted at Higher

Date of Tax Deduction 14/01/2022 No

rate as per Section 206AB

Payment Type Lumpsum

Complete Address of the Pro Tax Deposit

perty Transferred Details

Type of Property Land Rate of TDS (in %) 1

Name of premises/Building/ VillageKHASRA NO 29 & 51 Total Amount Paid/Credited 5548000

Flat/Door/Block No. TDS Amount to be paid 55480

Road/Street/Lane SADDLAPUR Interest 9154

City/District GAUTAM BUDDHA NAGAR Fee 55480

State UTTAR PRADESH Total payment 120114.00

Pin Code 201307 One Lakhs Twenty Thousand One

Value in words Hundred and Fourteen Rupees and

paise

Total Value of Consideration (Property Value)11096000 Stamp Duty Value For Property 555000

Mode of Payment Online (Net-Banking)

Bank Name Union Bank of India

Note

This Acknowledgement is only for the information regarding TDS on sale of property submitted to Tax Information Network (TIN). This cannot be construed as

proof of payment of taxes.

You might also like

- Master Sub-Fee Protection Agreement With Participants' Full DetailsDocument8 pagesMaster Sub-Fee Protection Agreement With Participants' Full DetailsAlexandre Poignant-spalikowski100% (7)

- EpaymentPrintCommonAction DoDocument1 pageEpaymentPrintCommonAction DoDHANU DANGINo ratings yet

- New Property TDSDocument2 pagesNew Property TDSHariKrishnaNo ratings yet

- Untuk Interview XenditDocument5 pagesUntuk Interview XenditDinda BazliahNo ratings yet

- Complete Address of The Prope Rty Transferee Complete Address of The Prope Rty TransferorDocument1 pageComplete Address of The Prope Rty Transferee Complete Address of The Prope Rty TransferorDevu GautamNo ratings yet

- Your E-tax Acknowledgement Form 26QBDocument2 pagesYour E-tax Acknowledgement Form 26QBClient 1No ratings yet

- Form 26QCDocument2 pagesForm 26QCPrashant Garg100% (1)

- Ghisulalji JainDocument2 pagesGhisulalji JainManish HedaNo ratings yet

- Form 26QB: Your E-Tax Acknowledgement Number Is AG5312381Document2 pagesForm 26QB: Your E-Tax Acknowledgement Number Is AG5312381anon_275845789No ratings yet

- Form 26QB E-tax Acknowledgement for Property Sale TDSDocument2 pagesForm 26QB E-tax Acknowledgement for Property Sale TDSPATAN ELAKATHNo ratings yet

- E-tax Acknowledgement for Form 26QB TDS SubmissionDocument1 pageE-tax Acknowledgement for Form 26QB TDS SubmissionVyapar NitiNo ratings yet

- Form 26QB: Your E-Tax Acknowledgement Number Is BI3180855Document2 pagesForm 26QB: Your E-Tax Acknowledgement Number Is BI3180855hari prasadNo ratings yet

- PRABHAVATHI Form26QBDocument2 pagesPRABHAVATHI Form26QBPrakash BattalaNo ratings yet

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDocument2 pagesForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghNo ratings yet

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDocument2 pagesForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghNo ratings yet

- 1654672632867property Receipt 1654672632617Document1 page1654672632867property Receipt 1654672632617Sehaj Edu infotech PathankotNo ratings yet

- It 000147087361 2024 12Document1 pageIt 000147087361 2024 12Revenue sectionNo ratings yet

- TAHIR HUSSAIN SHAH 236 K 12000Document1 pageTAHIR HUSSAIN SHAH 236 K 12000mazharehsan08No ratings yet

- Parking Pass For Canteen Internal 123Document2 pagesParking Pass For Canteen Internal 123Rabindra SinghNo ratings yet

- It 000147087234 2024 12Document1 pageIt 000147087234 2024 12Revenue sectionNo ratings yet

- Screenshot 2022-08-24 at 8.11.05 PMDocument2 pagesScreenshot 2022-08-24 at 8.11.05 PMutkarshNo ratings yet

- ST 000146704836 2023 11Document1 pageST 000146704836 2023 11Waqas AtharNo ratings yet

- It 000144628237 2024 10Document1 pageIt 000144628237 2024 10hizbullahjantankNo ratings yet

- Bit Mesra GST230001 DT 050418Document3 pagesBit Mesra GST230001 DT 050418Dharmendra KumarNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanSyed Tahir ImamNo ratings yet

- Bzipr4121f 2021Document4 pagesBzipr4121f 2021arahangdale156No ratings yet

- Income Tax Payment Challan: PSID #: 171894732Document1 pageIncome Tax Payment Challan: PSID #: 171894732moxykho109No ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- Abgpi5760g 2022Document4 pagesAbgpi5760g 2022JAGDISH KUMARNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- It 000147370507 2024 12Document1 pageIt 000147370507 2024 12Revenue sectionNo ratings yet

- It 000147370616 2024 12Document1 pageIt 000147370616 2024 12Revenue sectionNo ratings yet

- IT-000132223866-2023-01Document1 pageIT-000132223866-2023-01mazharehsan08No ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- It 000147370452 2024 12Document1 pageIt 000147370452 2024 12Revenue sectionNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- It 000147296140 2022 00Document1 pageIt 000147296140 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- Acope8800c 2020Document4 pagesAcope8800c 2020Asif EbrahimNo ratings yet

- Property Tax (PD) E-Receipt For 2021-2022: Page 1 of 1Document1 pageProperty Tax (PD) E-Receipt For 2021-2022: Page 1 of 1India TreadingNo ratings yet

- Income Tax Payment Challan: PSID #: 171709428Document1 pageIncome Tax Payment Challan: PSID #: 171709428fast fbrNo ratings yet

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- Income Tax Payment Challan: PSID #: 172780977Document1 pageIncome Tax Payment Challan: PSID #: 172780977fast fbrNo ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsSyed Tahir ImamNo ratings yet

- It 000147370701 2024 12Document1 pageIt 000147370701 2024 12Revenue sectionNo ratings yet

- Income Tax Payment Challan: PSID #: 48977809Document1 pageIncome Tax Payment Challan: PSID #: 48977809Abdul SattarNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000144586598 2022 00Document1 pageIt 000144586598 2022 00hizbullahjantankNo ratings yet

- Installation ChargesVDocument1 pageInstallation ChargesVbaby yodaNo ratings yet

- Coepk8062c 2022Document4 pagesCoepk8062c 2022Mohan ChandraNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanMuhammad Asif BashirNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- It 000147370561 2024 12Document1 pageIt 000147370561 2024 12Revenue sectionNo ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- MUMTAZ KHAN 236 K 6000Document1 pageMUMTAZ KHAN 236 K 6000mazharehsan08No ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanWasimNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Finance Department PresentationDocument12 pagesFinance Department PresentationKMI7769% (13)

- Fuji Invoice 110131998 - February 2020 Rental ChargesDocument1 pageFuji Invoice 110131998 - February 2020 Rental ChargesPius Canta100% (1)

- Invoice: Attention Of: Mr. Mohammed GhazalDocument3 pagesInvoice: Attention Of: Mr. Mohammed Ghazalhassan husseinNo ratings yet

- Bank Gurantee FormatDocument3 pagesBank Gurantee FormatAnkit LakshyaNo ratings yet

- Mcs QDocument52 pagesMcs QNabeel GondalNo ratings yet

- 2012 Payee Disclosure Report - Saskatchewan GovernmentDocument252 pages2012 Payee Disclosure Report - Saskatchewan GovernmentAnishinabe100% (1)

- Suspense Accounts ExplainedDocument41 pagesSuspense Accounts ExplainedMuhammad RiazNo ratings yet

- 98.) Enriquez vs. People, 331 SCRA 538, May 09, 2000Document28 pages98.) Enriquez vs. People, 331 SCRA 538, May 09, 2000GioNo ratings yet

- Sanjay Dhande Vs ICICI and Ors Landmark Order in Sim Swap Fraud CaseDocument24 pagesSanjay Dhande Vs ICICI and Ors Landmark Order in Sim Swap Fraud CaseAdv (Dr.) Prashant MaliNo ratings yet

- Oracle Banking Payments: India Unified Payment Interface (UPI) User Guide Release 14. 5.0.0.0 F42401-01Document30 pagesOracle Banking Payments: India Unified Payment Interface (UPI) User Guide Release 14. 5.0.0.0 F42401-01Kaustubh VaradeNo ratings yet

- Cash Payment in FinacleDocument32 pagesCash Payment in FinacleAristaioslug Bhram40% (5)

- General terms for loansDocument2 pagesGeneral terms for loansRoyNo ratings yet

- Tender Document JSSDocument58 pagesTender Document JSSSunilkumar CeNo ratings yet

- Ap - Ar PDFDocument500 pagesAp - Ar PDFRoop Talari100% (1)

- CIR vs. Algue, Inc.Document2 pagesCIR vs. Algue, Inc.Leyard100% (1)

- Fabm2 Elements of SFPDocument30 pagesFabm2 Elements of SFPMylene SantiagoNo ratings yet

- Tax invoices for Sugam Park maintenance chargesDocument62 pagesTax invoices for Sugam Park maintenance chargesKaran VermaNo ratings yet

- Vadodara Mahanagar Seva Sadan VadodaraDocument62 pagesVadodara Mahanagar Seva Sadan Vadodararvmehta18No ratings yet

- Front OfficeDocument55 pagesFront OfficeTowhid R. SouravNo ratings yet

- Catalogue of components for fuel, heavy oil and gas systemsDocument116 pagesCatalogue of components for fuel, heavy oil and gas systemskhabbab hussainNo ratings yet

- LGU NGAS - Forms24 51vol2Document30 pagesLGU NGAS - Forms24 51vol2Lloyd BaulNo ratings yet

- Evolution of Payments from Commodity to Digital MoneyDocument5 pagesEvolution of Payments from Commodity to Digital Moneyrabia liaqatNo ratings yet

- Instructions To Applicant: City Planning Division - CMCDocument4 pagesInstructions To Applicant: City Planning Division - CMCanasNo ratings yet

- Quiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsDocument6 pagesQuiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsKyle EspinozaNo ratings yet

- A.Y. 2021-22Document4 pagesA.Y. 2021-22LAXMI FINANCENo ratings yet

- Order Management O2CDocument210 pagesOrder Management O2Cramprabu ganesanNo ratings yet

- LANDBANK iAccess FAQs: Everything You Need to Know About LANDBANK's Online Banking ServiceDocument13 pagesLANDBANK iAccess FAQs: Everything You Need to Know About LANDBANK's Online Banking ServiceallanjulesNo ratings yet

- HW 1 List of ProblemsDocument4 pagesHW 1 List of ProblemsMai Xiao50% (2)