Professional Documents

Culture Documents

Xyz Abslinishchitaayush 24153 1678626707467

Uploaded by

LISHA AVTANIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Xyz Abslinishchitaayush 24153 1678626707467

Uploaded by

LISHA AVTANICopyright:

Available Formats

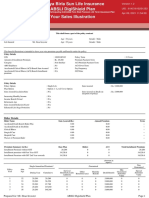

Aditya Birla Sun Life Insurance Version 1

ABSLI Nishchit Aayush Plan UID : 3078704171082

A non-linked non-participating individual savings life insurance plan Mar 12, 2023 18:41:47

Your Benefit Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

This shall form a part of the policy contract

Proposer Mr. Xyz Age : 22 years Gender : Male

Life Insured Mr. Xyz Age : 22 years Gender : Male

This benefit illustration is intended to show year wise premiums payable and benefits under the policy:

Policy Details

UIN : 109N137V02

Annualized Premium : Rs. 100,000 Premium Paying Term : 12 years

GST Rate Year 1 : 4.5% Policy Term : 40 years

GST Rate Year 2 onwards : 2.25% Deferment Period : 0 year

Premium Payment Frequency : Annual

Policy Details

Benefit Option : Long Term Income Sum Assured : Rs. 1,000,000

Income Variant : Level Income with Lumpsum Benefit Sum Assured on Death (at inception : Rs. 1,000,000

of policy)

Benefit Payout Frequency : Annual Income Benefit Factor : 41.8%

Rider Details

Rider Name Sum Assured Rider Term Annualized Premium

ABSLI Accidental Death Benefit Rider Plus -- -- --

ABSLI Critical Illness Rider -- -- --

ABSLI Surgical Care Rider -- -- --

ABSLI Hospital Care Rider -- -- --

ABSLI Waiver of Premium Rider -- -- --

Premium Summary (in Rs.) Base Plan Riders Total

Annualized Premium 100,000 0 100,000

Installment Premium before Modal Loading (A) 100,000 0 100,000

Modal Loading Factor (B) 0% 0% 0%

Installment Premium without GST after Modal Loading 100,000 0 100,000

{(A*B) + A}

First year's GST 4,500 0 4,500

Installment Premium with First Year GST 104,500 0 104,500

Installment Premium with GST 2nd Year onwards 102,250 0 102,250

Prepared for: Mr. Xyz ABSLI Nishchit Aayush Plan Page 1

Aditya Birla Sun Life Insurance Version 1

ABSLI Nishchit Aayush Plan UID : 3078704171082

A non-linked non-participating individual savings life insurance plan Mar 12, 2023 18:41:47

Your Benefit Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

(Amount in rupees)

Non

Guaranteed Guaranteed

Policy

Year Cumulative Special

Annualized Survival Maturity Total Benefits Death Minimum Guaranteed

Annualized Surrender

Premium(1) Benefit (A) Benefit (B) (A) + (B) Benefit(2) Surrender Value*

Premium Value

BOY EOY* EOY EOY* EOY EOY EOY

1 100,000 100,000 41,800 0 41,800 1,000,000 0 0

2 100,000 200,000 41,800 0 41,800 1,000,000 18,200 18,200

3 100,000 300,000 41,800 0 41,800 1,000,000 21,400 21,400

4 100,000 400,000 41,800 0 41,800 1,000,000 74,600 74,600

5 100,000 500,000 41,800 0 41,800 1,000,000 82,800 39,080

6 100,000 600,000 41,800 0 41,800 1,000,000 91,000 46,060

7 100,000 700,000 41,800 0 41,800 1,000,000 99,200 65,952

8 100,000 800,000 41,800 0 41,800 1,000,000 115,400 73,980

9 100,000 900,000 41,800 0 41,800 1,000,000 133,600 81,660

10 100,000 1,000,000 41,800 0 41,800 1,050,000 163,800 106,790

11 100,000 1,100,000 41,800 0 41,800 1,155,000 187,000 134,365

12 100,000 1,200,000 41,800 0 41,800 1,260,000 212,200 202,454

13 0 0 41,800 0 41,800 1,260,000 182,400 228,032

14 0 0 41,800 0 41,800 1,260,000 152,600 252,774

15 0 0 41,800 0 41,800 1,260,000 134,800 276,680

16 0 0 41,800 0 41,800 1,260,000 105,000 272,500

17 0 0 41,800 0 41,800 1,260,000 75,200 321,984

18 0 0 41,800 0 41,800 1,260,000 45,400 343,382

19 0 0 41,800 0 41,800 1,260,000 27,600 363,944

20 0 0 41,800 0 41,800 1,260,000 0 383,670

21 0 0 41,800 0 41,800 1,260,000 0 427,720

22 0 0 41,800 0 41,800 1,260,000 0 445,356

23 0 0 41,800 0 41,800 1,260,000 0 486,480

24 0 0 41,800 0 41,800 1,260,000 0 525,932

25 0 0 41,800 0 41,800 1,260,000 0 563,712

26 0 0 41,800 0 41,800 1,260,000 0 622,890

27 0 0 41,800 0 41,800 1,260,000 0 656,908

28 0 0 41,800 0 41,800 1,260,000 0 711,488

29 0 0 41,800 0 41,800 1,260,000 0 763,560

30 0 0 41,800 0 41,800 1,260,000 0 834,522

31 0 0 41,800 0 41,800 1,260,000 0 902,140

32 0 0 41,800 0 41,800 1,260,000 0 966,414

33 0 0 41,800 0 41,800 1,260,000 0 1,047,488

34 0 0 41,800 0 41,800 1,260,000 0 1,124,382

35 0 0 41,800 0 41,800 1,260,000 0 1,197,096

36 0 0 41,800 0 41,800 1,284,520 0 1,284,520

37 0 0 41,800 0 41,800 1,385,400 0 1,385,400

38 0 0 41,800 0 41,800 1,480,428 0 1,480,428

39 0 0 41,800 0 41,800 1,587,240 0 1,587,240

40 0 0 41,800 1,680,000 1,721,800 1,704,582 0 0

"BOY" = refers to cash flows payable at the "Beginning of the Year", "EOY" = refers to cash flows payable at the "End of the Year", "EOY*" = refers to

cashflows payable in arrears as per the Benefit Payout Frequency chosen

Notes:

(1) Annualized Premium means Premium amount payable during a Policy Year, excluding underwriting extra premiums, loadings for modal premiums, rider

premiums, first year discounts and applicable taxes, cesses and levies, if any.

(2) In the event of death of the Life Insured during the Policy Term, the benefit shall be, Higher of :

- Sum Assured on Death

Prepared for: Mr. Xyz ABSLI Nishchit Aayush Plan Page 2

Aditya Birla Sun Life Insurance Version 1

ABSLI Nishchit Aayush Plan UID : 3078704171082

A non-linked non-participating individual savings life insurance plan Mar 12, 2023 18:41:47

Your Benefit Illustration

LIFE INSURANCE

Aditya Birla Sun Life Insurance Company Limited

- Surrender Benefit

The Sum Assured on Death is the highest of:

• Sum Assured

• 105% of the Total Premiums Paid up to the date of death

Where,

• "Total Premiums Paid" means total of all the premiums received, excluding underwriting extra premium, loadings for modal premium, any rider premium, first

year discounts and applicable taxes, cesses and levies, if any.

• "Sum Assured" is the absolute amount equal to a 10 times of the Annualized Premium.

*Income Benefit/s paid till date are deducted from the Surrender Values indicated above.

-

Please refer the Product Brochure for more details on the terms used in this illustration.

The rider benefit(s), if any, shall not be payable if the policy is in reduced paid-up mode.

I,................................................................, have explained the premiums, I,................................................................, having received the information

and benefits under the policy fully to the prospect/policyholder.. with respect to the above, have understood the above statement before

entering into the contract.

Place :

Date :12/3/2023 Date :12/3/2023

____________________________________ ____________________________________

Signature of Agent/Intermediary/ Official Signature of Prospect/Policyholder

V02 - 12/3/2023

For further details please refer to the product brochure.

Aditya Birla Sun Life Insurance Company Limited Reg. No. 109

Prepared for: Mr. Xyz ABSLI Nishchit Aayush Plan Page 3

You might also like

- Investor Abslinishchitaayush 04585 1687152283310Document3 pagesInvestor Abslinishchitaayush 04585 1687152283310Prabhat GuptaNo ratings yet

- Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance PlanDocument3 pagesLife Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plannita davidNo ratings yet

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance Plannita davidNo ratings yet

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanPavan Kumar TripurariNo ratings yet

- Shankar M Lifeshield 16197 1628753881844Document3 pagesShankar M Lifeshield 16197 1628753881844mohammed hussainNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- Pending 1692863217 IllustrationDocument2 pagesPending 1692863217 IllustrationDishani MaityNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- Sanchay Fix 15-15Document3 pagesSanchay Fix 15-15Ravi KumarNo ratings yet

- SMP 20 Years 1 LAKHDocument3 pagesSMP 20 Years 1 LAKHTamil Vanan NNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- SMP 25 Years 1 LakhDocument3 pagesSMP 25 Years 1 LakhTamil Vanan NNo ratings yet

- IllustrationDocument2 pagesIllustrationshaan.sangram190No ratings yet

- Sukhwinder Fortuneelite 24527 1671441783110Document6 pagesSukhwinder Fortuneelite 24527 1671441783110Harish SharmaNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- 15 Pay 1cr Cover Till 70Document5 pages15 Pay 1cr Cover Till 70venkyNo ratings yet

- Illustration Qbyuu7muxf1cvDocument3 pagesIllustration Qbyuu7muxf1cvajayNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- SMP 15 Year 1 LAKHDocument3 pagesSMP 15 Year 1 LAKHTamil Vanan NNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- IllustrationDocument3 pagesIllustrationsukh37949No ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Hdfc-Illustration - 2022-09-09T113844.627Document3 pagesHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaNo ratings yet

- Illustration - 2022-08-31T152151.383Document3 pagesIllustration - 2022-08-31T152151.383Soumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Illustr NewDocument2 pagesIllustr NewHar DonNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Rithushana S GuaranteedMilestone 17.12.2019 16.41.47Document3 pagesRithushana S GuaranteedMilestone 17.12.2019 16.41.47remo jeeNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- Exide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022Document3 pagesExide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022lakshmee262No ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- LIC's Jeevan Utsav (Plan No. 871) : Benefit IllustrationDocument5 pagesLIC's Jeevan Utsav (Plan No. 871) : Benefit Illustrationmohan730463No ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationlosssssssssNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- Policy Contract - 009049662 - 113959Document1 pagePolicy Contract - 009049662 - 113959ayushigoon1234No ratings yet

- 70012752332Document5 pages70012752332Hitesh KumarNo ratings yet

- Sanchay ParDocument2 pagesSanchay ParAkshay ChaudhryNo ratings yet

- Aditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04Document4 pagesAditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04kunjal mistryNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- Policy DetailsDocument2 pagesPolicy DetailsMyeduniya MEDNo ratings yet