Professional Documents

Culture Documents

Illustration

Uploaded by

shaan.sangram190Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Uploaded by

shaan.sangram190Copyright:

Available Formats

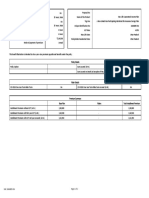

08-11-2023

Quote No : qbxczkk13suqv

Benefit Illustration for HDFC Life Guaranteed Pension Plan

This illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Guaranteed Pension Plan

Age is taken as on last birthday

Name of the Prospect /Policy holder: S Swain Proposal No:

Age: 64* Name of the Product: HDFC Life Guaranteed Pension Plan

A Non linked, Non-Participating Pension

Name of the Life Assured: S Swain Tag Line:

Plan

Age: 64* Unique Identification No: 101N092V12

Policy Term 10 year(s) GST Rate: 4.5%* for first year

Premium Payment Term: 5 year(s) 2.25%* second year onwards

Amount of Installment Premium (Without

Rs.100000 1.08 % on vesting benefits

GST):

Mode of Premium Payment Annual Vesting Age: 74

*0% if qualifies as zero-rated supply under GST law

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

This benefit illustration is intended to show year wise premiums payable and benefits under the policy.

Policy Details

Policy Option HDFC Life Guaranteed Pension Plan Sum Assured Rs. 4,25,135

Sum Assured on Death (at inception

1,05,000

of the policy) Rs.

Premium Summary

Base Plan Riders Total Installment Premium

Instalment Premium without GST 1,00,000 0 1,00,000

Instalment Premium with First Year GST 1,04,500 0 1,04,500

Instalment Premium with GST 2nd Year Onwards 1,02,250 0 1,02,250

(Amounts in Rupees.)

Guaranteed Benefits Non Guaranteed Benefits

Single /

Policy Year Survival Benefits / Other Benefits Maturity /

Annualized Premium Death Benefit Min Guaranteed Surrender Value Special Surrender Value

Loyalty Additions if any Vesting Benefit

1 1,00,000 0 0 0 1,06,000 0 0

2 1,00,000 0 0 0 2,18,360 68,341 1,21,563

3 1,00,000 0 0 0 3,37,462 1,19,387 1,98,989

4 1,00,000 0 0 0 4,63,709 2,22,039 2,89,976

5 1,00,000 0 0 0 5,97,532 2,81,694 3,96,375

6 0 0 0 0 6,33,384 2,93,772 4,41,698

7 0 0 0 0 6,71,387 3,08,745 4,92,379

8 0 0 0 0 7,11,670 4,27,136 5,48,645

9 0 0 0 0 7,54,370 5,49,864 6,10,728

10 0 0 0 6,80,216 7,99,632 0 0

Annuity Payable p.a. based on prevailing annuity rates(Rs) 68255

Annuity Options Selected(the option can be changes anytime before vesting) Life Option

Notes:

1. The values shown above are for illustration purpose only. The actual annuity amount receivable depends on the prevailing annuity rates at the time of vesting.

2. Annualised premium excludes underwriting extra premium, frequency loadingon premiums, the premium paid towards rider, if any and Goods & Service Tax

3. Refer Sales literature for explanation of terms used in this illustration.

I , have explained the premiums, charges and benefits under the product fully to I S Swain,having received the information with respect to the above, have

the prospect / policy holder. understood the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- C42135AA Beckman Coulter ClearLLab 10C Casebook PDFDocument586 pagesC42135AA Beckman Coulter ClearLLab 10C Casebook PDFHam Bone100% (1)

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Exide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022Document3 pagesExide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022lakshmee262No ratings yet

- HDFC Life Sanchay Par Advantage benefit illustrationDocument3 pagesHDFC Life Sanchay Par Advantage benefit illustrationShruti SrivastavaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration LIC's Amrit BaalDocument3 pagesBenefit Illustration LIC's Amrit BaalVENKATESHNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- 70014883867Document4 pages70014883867Manish YadavNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- HDFC Life Sanchay Par Advantage Benefit IllustrationDocument3 pagesHDFC Life Sanchay Par Advantage Benefit IllustrationRajaNo ratings yet

- Exide Life Smart Term Pro-Thu Feb 11 19 - 50 - 37 IST 2021Document3 pagesExide Life Smart Term Pro-Thu Feb 11 19 - 50 - 37 IST 2021Pramod DwivediNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- Aditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04Document4 pagesAditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04kunjal mistryNo ratings yet

- HDFC Life Sanchay Par Advantage Benefit IllustrationDocument3 pagesHDFC Life Sanchay Par Advantage Benefit IllustrationBLOODY ASHHERNo ratings yet

- HDFC Life Sanchay Par Advantage benefit illustrationDocument3 pagesHDFC Life Sanchay Par Advantage benefit illustrationBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- BenefitIllustrations 1Document2 pagesBenefitIllustrations 1vonamal985No ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationsarthakNo ratings yet

- IllustrationDocument3 pagesIllustrationsukh37949No ratings yet

- How To Read and Understand This Benefit Illustration?: Policy DetailsDocument3 pagesHow To Read and Understand This Benefit Illustration?: Policy DetailsBLOODY ASHHERNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Exide Life Guaranteed Income Insurance Plan1633941626957Document2 pagesExide Life Guaranteed Income Insurance Plan1633941626957Prashant PrinceNo ratings yet

- HDFC Life Sanchay Par Advantage benefit illustrationDocument3 pagesHDFC Life Sanchay Par Advantage benefit illustrationBLOODY ASHHERNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- Benefit Illustration for HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration for HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- 70002886268Document4 pages70002886268acme financialNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationVamsi Krishna BNo ratings yet

- HDFC Life Smart Term Edge Plan-Mon Feb 13 16 - 57 - 14 IST 2023Document3 pagesHDFC Life Smart Term Edge Plan-Mon Feb 13 16 - 57 - 14 IST 2023NamanNo ratings yet

- S A 2 X 25032024191816Document2 pagesS A 2 X 25032024191816Kiran JohnNo ratings yet

- Insured Benefits for PNB MetLife Century PlanDocument4 pagesInsured Benefits for PNB MetLife Century PlanManager Pnb LucknowNo ratings yet

- Illustration Qbxt9qkqiyoe8Document3 pagesIllustration Qbxt9qkqiyoe8mr copy xeroxNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- Exide Life Assured Gain Plus1599746714499 PDFDocument5 pagesExide Life Assured Gain Plus1599746714499 PDFDarshan HNNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- LIC's Jeevan Utsav (Plan No. 871) : Benefit IllustrationDocument5 pagesLIC's Jeevan Utsav (Plan No. 871) : Benefit Illustrationmohan730463No ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Benefit Illustration For HDFC Life Guaranteed Pension PlanDocument2 pagesBenefit Illustration For HDFC Life Guaranteed Pension PlannrameshecmNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- 4 Operation of Design Review in Small Irrigation Projects inDocument20 pages4 Operation of Design Review in Small Irrigation Projects inJoseph Rana SangpangNo ratings yet

- Measure Science AccuratelyDocument41 pagesMeasure Science AccuratelyAnthony QuanNo ratings yet

- Lesson 2: Weaving A Mannahatta Muir WebDocument2 pagesLesson 2: Weaving A Mannahatta Muir WebTamas SzamosfalvyNo ratings yet

- Student quiz answer sheetsDocument26 pagesStudent quiz answer sheetsSeverus S PotterNo ratings yet

- WEEK 7 ICPS - and - ICSSDocument31 pagesWEEK 7 ICPS - and - ICSScikguhafidzuddinNo ratings yet

- SAP ABAP Interview Questions and AnswersDocument8 pagesSAP ABAP Interview Questions and AnswersKarthi ThirumalaisamyNo ratings yet

- Burkert General Catalogue Rev2Document44 pagesBurkert General Catalogue Rev2cuongNo ratings yet

- PIRA - 2022 - ESTIMATED FMV As of October 2022Document48 pagesPIRA - 2022 - ESTIMATED FMV As of October 2022Aggy ReynadoNo ratings yet

- Tugas 3vDocument4 pagesTugas 3vRomie SyafitraNo ratings yet

- Solution SellingDocument18 pagesSolution Sellingvikramgulati13090% (1)

- Investigation of Nursing Students Knowledge of and Attitudes About Problem Based LearningDocument4 pagesInvestigation of Nursing Students Knowledge of and Attitudes About Problem Based LearningasdasdasdasNo ratings yet

- Ejc-M13 - FN953205Document203 pagesEjc-M13 - FN953205JoséNo ratings yet

- Weap - ModflowDocument20 pagesWeap - Modflowguive3No ratings yet

- Apparent Dip PDFDocument2 pagesApparent Dip PDFanon_114803412No ratings yet

- Sample Resume For HRDocument2 pagesSample Resume For HRnapinnvoNo ratings yet

- CAPS LESSON PLAN, KAHOOT QUIZ, PPT VIDEODocument3 pagesCAPS LESSON PLAN, KAHOOT QUIZ, PPT VIDEOMandisa MselekuNo ratings yet

- Vernacular Terms in Philippine ConstructionDocument3 pagesVernacular Terms in Philippine ConstructionFelix Albit Ogabang IiiNo ratings yet

- Online test series analysis reportDocument17 pagesOnline test series analysis reportchetan kapoorNo ratings yet

- Inv 069 1701757527Document1 pageInv 069 1701757527neetu9414576916No ratings yet

- PV380 Operations ManualDocument20 pagesPV380 Operations ManualCarlosNo ratings yet

- Belotero Intense LidocaineDocument7 pagesBelotero Intense LidocaineAnnaNo ratings yet

- Age Hardening Gold Alloys For JewelryDocument4 pagesAge Hardening Gold Alloys For JewelryReinol Eko SianturiNo ratings yet

- Listening 2 - Log 4 - Answer. SheetDocument3 pagesListening 2 - Log 4 - Answer. SheetNguyen LeeNo ratings yet

- Hatsun Supplier Registration RequestDocument4 pagesHatsun Supplier Registration Requestsan dipNo ratings yet

- Arts and Crafts of Basey SamarDocument28 pagesArts and Crafts of Basey SamarTrisha MenesesNo ratings yet

- Bartending and Catering: Agenda: Basics of Bartending Bar Tools and EquipmentDocument146 pagesBartending and Catering: Agenda: Basics of Bartending Bar Tools and EquipmentMars Mar100% (1)

- Chapter 5 Perfect CompetitionDocument20 pagesChapter 5 Perfect Competition刘文雨杰No ratings yet

- Lesson 2 - Procedures in Cleaning Utensils and EquipmentDocument26 pagesLesson 2 - Procedures in Cleaning Utensils and EquipmentReizel TulauanNo ratings yet

- Taco Bell - Re EngineeringDocument6 pagesTaco Bell - Re Engineeringabcxyz2811100% (6)